- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 07-10-2016.

The research results presented by the Association of purchasing managers in Canada and the Richard Ivey School of Business, have shown that the index of business activity rose sharply, exceeding average forecasts.

According to the report, the September business activity index rose to 58.4 points from 52.3 points in the previous month. Analysts had expected the figure at 53.0 points. Recall, the indicator shows the level of business activity of the industrial sector. More than 150 managers from different regions and sectors are invited to assess the level of purchases compared to the previous month (above, below or at the same level). A reading above 50 indicates an increase in purchases, and a value below 50 indicates a decrease in their volume.

In addition:

-

employment sub-index rose to 54.0 in September from 46.9 in August

-

stocks fell in September to 46.7 against 61.2 in August

-

The index of price fell to 56.8 against 56.7 in August

-

delivery time index rose to 51.7 from 46.1 in August

The unadjusted index of business activity of purchasing managers in September amounted to 68.1 points compared to 53.8 points in August.

U.S. wholesale inventories in August fell more than previously reported as businesses ran down their stocks of farm goods and clothes, the Commerce Department reported on Friday.

Inventories dropped 0.2 percent during the month, the department said.

A drop in inventory investment weighed heavily on economic growth in the second quarter, and some economists believe the inventory correction is close to running its course.

But stocks have edged lower in the first two months of the third quarter, which could drag on economic growth during the period.

EURUSD: 1.1000 (EUR 335m) 1.1100 (685m) 1.1120-25 (675m) 1.1135 (1.52bln)1.1150 (274m) 1.1175-80 (1.17bln) 1.1200 (446m) 1.1225 (686m) 1.1250 (690m) 1.1260 (316m) 1.1270 (373m) 1.1300 (333m) 1.1355 (224m) 1.1400 (1.12bln)

USDJPY: 101.00 (USD 811m) 101.50 (880m) 102.30-35 (730m) 102.75 (300m) 103.25(590m) 103.50 (634m) 103.75 (420m) 104.45-50 (483m) 105.00 (250m)

GBPUSD: 1.1730 (GBP 221m) 1.2290-1.2300 (GBP 623m) 1.2500 (1.18bln) 1.2700 (290m) 1.2900 (1.23bln) 1.3000 (582m)

EURGBP 0.8800 (EUR 200m) 0.8865 (236m)

USDCHF 0.9625 (USD 220m) 0.9705 (200m) 1.0000 (390m)

AUDUSD: 0.7300 (AUD 443m) 0.7390 (300m) 0.7400 (715m) 0.7475 (297m) 0.7560 (201m) 0.7595-0.7600 (670m) 0.7635 (318m)

USDCAD: 1.3025 ((USD 260m) 1.3100 (441m) 1.3120-25 (358m) 1.3170 (717m) 1.3200 (815m) 1.3245-50 (346m) 1.3275 (350m) 1.3300 (440m)

NZD/USD: 0.7100 (NZD 517m) 0.7150 (239m)

EURJPY 113.00 (EUR 300m)

Our monthly estimates of GDP suggest that output grew by 0.4 per cent in the three months ending in September 2016 after growth of 0.5 per cent in the three months ending in August 2016. Our estimates suggest that economic growth slowed in 2016Q3 to 0.4 per cent, from 0.7 per cent in 2016Q2 .

James Warren, Research Fellow at NIESR, said "Our estimates suggest that economic growth slowed in 2016Q3 to 0.4 per cent, from 0.7 per cent in 2016Q2. While retail sales have been buoyant in recent months, the production sector has acted as a drag on economic growth. We estimate that output from the production sector declined by 0.2 per cent in the third quarter of this year."

Employment rose by 67,000 (+0.4%) in September, with most of the increase in part-time work. The unemployment rate was unchanged at 7.0%, as more people participated in the labour market.

In the third quarter of 2016, employment gains totalled 62,000 (+0.3%). This followed little change in employment in the second quarter and a slight increase of 33,000 (+0.2%) in the first quarter.

Compared with 12 months earlier, employment rose by 139,000 (+0.8%), with most of the gains in part-time work. Over the same period, the total number of hours worked edged up 0.2%.

In September, there were more employed people aged 55 and older. At the same time, there was little change in employment among both the 15-to-24 and 25-to-54 age groups.

Provincially, employment rose in Quebec, Alberta and New Brunswick. There was little change in the other provinces.

In September, more people worked in public administration, educational services, and transportation and warehousing. At the same time, employment declined in health care and social assistance.

Self-employment increased in September, while there was little change in the number of private and public sector employees.

Total nonfarm payroll employment increased by 156,000 in September, and the unemployment rate was little changed at 5.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in professional and business services and in health care.

The unemployment rate, at 5.0 percent, and the number of unemployed persons, at 7.9 million, changed little in September. Both measures have shown little movement, on net, since August of last year.

In September, both the labor force participation rate, at 62.9 percent, and the employment-population ratio, at 59.8 percent, changed little.

The average workweek for all employees on private nonfarm payrolls increased by 0.1 hour to 34.4 hours in September. In manufacturing, the workweek increased by 0.1 hour to 40.7 hours, while overtime was unchanged at 3.3 hours. The average workweek for production and nonsupervisory

employees on private nonfarm payrolls was unchanged at 33.5 hours.

In September, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $25.79. Over the year, average hourly earnings have risen by 2.6 percent. Average hourly earnings of private-sector production and nonsupervisory employees increased by 5 cents to $21.68

in September.

-

Our Policies Create Unique Window of Opportunity for

-

We'll go further than March 2017 if we need to

EUR/USD

Offers 1.1220 1.1235 1.1250 1.1280 1.1300 1.1320 1.1350

Bids 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers 1.2480 1.2500 1.2550 1.2600 1.2630 1.2650 1.2700

Bids 1.2400-10 1.2350 1.2300 1.2250 1.2200

EUR/GBP

Offers 0.8930 0.8950 0.9000 0.9030 0.9050 0.9100

Bids 0.8900 0.8850-55 0.8835 0.8800 0.8785 0.8750

EUR/JPY

Offers 115.80 116.00 116.25-30 116.50 117.00 117.30 117.50

Bids 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers 104.00-05 104.20 104.30 104.50 104.80 105.00

Bids 103.50 103.25-30 103.00 102.85 102.70 102.50

AUD/USD

Offers 0.7585 0.7600 0.7630 0.7650 0.7685 0.7700 0.7720

Bids 0.7550 0.7530 0.7500 0.7485 0.7450

-

DB faces enormous challenges with fines from US

-

the fact that the DB head wants to change the business model is a sign that they are reacting to risks

-

declines to comment on speculation that listed German companies want to help DB

-

Germany has an interest in ensuring DB has a successful future

-

The country can not be both in and outside the EU

-

France and Germany has a special responsibility for the future of Europe

European stocks traded mostly in the red zone, as investors await US labor market data, which may affect the likelihood and timing of the Fed interest rates hike. Meanwhile, the British markets approaching all-time highs, receiving support from a renewed collapse of the pound.

According to analysts, today's NFP may provide additional arguments in favor of raising rates. According to the futures market, the likelihood of a Fed hike in December is 63.4% versus 59.8% the previous day. The median forecast for payrolls report is 175 thousand vs 151 thousand prior .. add the average value of the index over the past 12 months amounted to 204 ths.,

If the Fed will take such a step, the ECB may find itself in an even more precarious position. Earlier it was reported that the ECB may begin to gradually reduce the amount QE as the end date draws nearer (March 2017).

"There is a limit to what central banks can do to help the economy and the markets should start to take into account the growth in prices" - said Guillermo Samper expert at MPPM EK.

Little impact on markets had data for Germany and the UK. The Statistical Office Destatis reported that the volume of industrial production in Germany increased in August by 2.5 percent, after falling 1.5 percent in July (the index was not revised). Analysts, on average, had expected production to grow by only 0.8 percent. Last rate of increase was the fastest since January, when the volume of production increased by 2.8 percent. Excluding energy and construction, production increased by 3.3 percent compared to July.

Meanwhile, the Office for National Statistics reported that industrial production in the UK unexpectedly decreased in August, offsetting the previous two months of growth. The volume of industrial production fell by 0.4 percent on a monthly basis, which followed an increase of 0,1 percent in July and June. Economists had forecast that industrial production will increase again by 0.1 percent.

At the same time, the volume of production in the manufacturing industry rose by 0.2 percent after declined by 0.9 percent in July. Nevertheless, the pace of recent growth has been significantly lower than expected (+0.5 percent). The decline was seen in two of the four major sectors, led by mining and quarrying, where output fell by 3.7 per cent.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.8 percent.

Creditors shares rises fot the fourth day, moving counter to the common market dynamics. Cost of Deutsche Bank AG rose 1.3 percent after people familiar with the matter, said that the bank holds informal talks with firms involved in securities, to explore various options, including raising capital.

Shares of mining companies rose after Bank of America analysts recommended buying shares of the sector.

Capitalization of Delta Lloyd NV increased by 2.1 per cent following the rejection of an unsolicited offer from the NN Group NV, referring to the very low valuation. It is worth emphasizing, NN Group NV offered 2.4 bln. Euro.

The cost of EON rose 2.4 percent after reports that Cevian Capital AB is considering the purchase of 10 percent stake in the German company.

At the moment:

FTSE 100 +75.06 7075.02 + 1.07%

DAX -59.93 10508.87 -0.57%

CAC 40 4457.85 -22.25 -0.50%

"We take the opportunity this week to cut our 3m EURUSD forecast to 1.10 from 1.15, leaving the 12m target unchanged at 1.05.

We have long feared that the UK vs EU tensions could become a problem in 2017, not least if they highlight divisions within the rest of the EU going into key elections in France and Germany next year. As GBP is suffering through its divorce, EUR cannot deny its own failings that helped end the marriage.

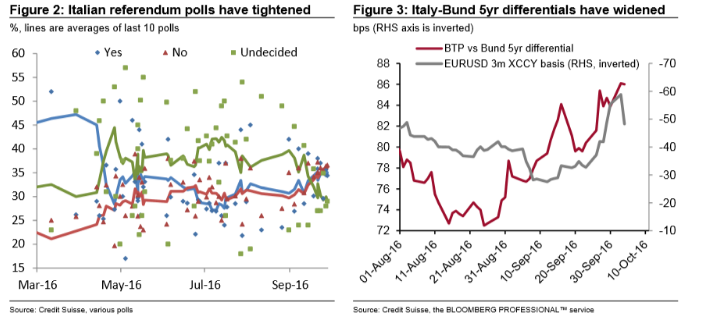

Italy's December 4 constitutional referendum is another key factor consider, with latest polls showing the "No" note in the lead. As Figure 3 shows, Italy - Germany yield differentials are widening again despite the ever-present ECB balance sheet support for European bond markets. And while European banking problems have taken a back seat this week, they are not off the agenda to the degree needed to tighten up the EUR basis again.

In light of and in addition to the discussion above, we see a number of scenarios that could lead to a sudden shift lower in EURUSD:

1. Article 50 being triggered before end-March 2017 in an acrimonious environment.

2. A related or separate pickup in euro area political and / or financial risk.

3. A rise in US inflation expectations / resumption of Fed rate hike cycle (not one and done).

4. The ECB introducing new easing measures even as the market now focuses on tapering.

5. The passage of USD political risk leads to a renewed bid for USD as the global currency of choice".

Copyright © 2016 Credit Suisse, eFXnews™

The UK's deficit on trade in goods and services was estimated to have been £4.7 billion in August 2016, a widening of £2.5 billion from July 2016. Exports increased by £0.1 billion and imports increased by £2.6 billion.

The deficit on trade in goods was £12.1 billion in August 2016, widening by £2.6 billion from July 2016. This widening reflected an increase in exports of £0.1 billion to £25.8 billion and an increase in imports of £2.7 billion to £37.9 billion.

Between the 3 months to May 2016 and the 3 months to August 2016, the total trade deficit for goods and services widened by £3.6 billion to £12.6 billion.

Between the 3 months to May 2016 and the 3 months to August 2016, the deficit on trade in goods widened by £3.3 billion to £34.5 billion. Exports increased by £0.9 billion (1.2%) and imports increased by £4.2 billion (4.0%).

This is the second release of Index of Production covering data post EU referendum. This release shows production decreased month-on-month in August 2016, with a fall in mining and quarrying partially offset by a rise in manufacturing. Users should note that ONS always warns against overly interpreting one month's figures.

In August 2016, total production output was estimated to have increased by 0.7% compared with August 2015. There were increases in 2 of the 4 main sectors, with the largest contribution coming from water supply, sewerage and waste management output, which increased by 7.0%.

Manufacturing was estimated to have increased by 0.5% on a year ago. Other manufacturing and repair provided the largest contribution to growth, increasing by 5.9%.

EUR/USD: 1.1000 (EUR 335m) 1.1100 (685m) 1.1120-25 (675m) 1.1135 (1.52bln) 1.1150 (274m) 1.1175-80 (1.17bln) 1.1200 (446m) 1.1225 (686m) 1.1250 (690m) 1.1260 (316m) 1.1270 (373m) 1.1300 (333m) 1.1355 (224m) 1.1400 (1.12bln)

USD/JPY: 101.00 (USD 811m) 101.50 (880m) 102.30-35 (730m) 102.75 (300m) 103.25(590m) 103.50 (634m) 103.75 (420m) 104.45-50 (483m) 105.00 (250m)

GBP/USD: 1.1730 (GBP 221m) 1.2290-1.2300 (GBP 623m) 1.2500 (1.18bln) 1.2700 (290m) 1.2900 (1.23bln) 1.3000 (582m)

EUR/GBP 0.8800 (EUR 200m) 0.8865 (236m)

USD/CHF 0.9625 (USD 220m) 0.9705 (200m) 1.0000 (390m)

AUD/USD: 0.7300 (AUD 443m) 0.7390 (300m) 0.7400 (715m) 0.7475 (297m) 0.7560 (201m) 0.7595-0.7600 (670m) 0.7635 (318m)

USD/CAD: 1.3025 ((USD 260m) 1.3100 (441m) 1.3120-25 (358m) 1.3170 (717m) 1.3200 (815m) 1.3245-50 (346m) 1.3275 (350m) 1.3300 (440m)

NZD/USD: 0.7100 (NZD 517m) 0.7150 (239m)

EUR/JPY 113.00 (EUR 300m)

-

House prices in the three months to September were 5.8% higher than in the same three months of 2015

-

Prices in the last three months (JulySeptember) were 0.1% lower than in the preceding quarter

Martin Ellis, Halifax housing economist, said: "House prices in the three months to September were largely unchanged compared with the previous quarter. The annual rate of growth eased from 6.9% in August to 5.8%.

"The housing market has followed a steady downward trend over the past six months with clear evidence of both a softening in activity levels and an easing in house price inflation.

"The reduction in annual house price growth from a peak of 10.0% in March to 5.8% six months later remains in line with our forecast at the end of 2015. A lengthy period where house prices have risen more rapidly than earnings has put pressure on affordability, therefore constraining demand. Very low mortgage rates and a shortage of properties available for sale should, however, help support price levels over the coming months."

In August 2016, output rebounded sharply in the manufacturing industry (+2.2% after -0.2% in July). It also bounced back in the whole industry (+2.1% after -0.5%).

Manufacturing output diminished slightly over the past three months (-0.2%)

Over the past three months, output decreased slightly in the manufacturing industry (-0.2% q-o-q). It diminished in the overall industry (-0.5% q-o-q).

Output shrank strongly in mining and quarrying; energy; water supply (-1.9%) and in the manufacture of transport equipment (-1.8%), and more moderately in the manufacture of food products and beverages (-0.6%). It dropped sharply in the manufacture of coke and refined petroleum products (-4.3%). Conversely, output grew in the manufacture of machinery and equipment goods (+0.5%). It was stable in "other manufacturing".

The sharp fall in the British pound against the U.S. dollar that rattled markets earlier Friday is a worrying sign for the sterling, says Sean Callow, a senior currency strategist at Westpac Banking in Sydney. "This is a price move you would expect from an emerging-market currency, not from the third most-heavily traded pair in the world," says Callow. He says the move is reminiscent of a flash crash in April 2013 that sent the gold price down by about $200 in just moments. The metal price never fully rebounded, signaling a similar scenario might transpire for the pound. "It's not going to recover, there's no bottom, just air below," he says.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1302 (3373)

$1.1256 (2382)

$1.1194 (1186)

Price at time of writing this review: $1.1120

Support levels (open interest**, contracts):

$1.1091 (5824)

$1.1046 (4358)

$1.0998 (4344)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 39308 contracts, with the maximum number of contracts with strike price $1,1500 (6100);

- Overall open interest on the PUT options with the expiration date October, 7 is 42032 contracts, with the maximum number of contracts with strike price $1,1150 (6497);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from October, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.2712 (828)

$1.2675 (313)

$1.2632 (70)

Price at time of writing this review: $1.2467

Support levels (open interest**, contracts):

$1.2400 (221)

$1.2300 (89)

$1.2200 (25)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 32962 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 21817 contracts, with the maximum number of contracts with strike price $1,3000 (3210);

- The ratio of PUT/CALL was 0.66 versus 0.72 from the previous trading day according to data from October, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

"I initially doubted what I saw on my screen," said Kenji Yoshii, a foreign exchange strategist at Mizuho Securities

Traders and strategists said the initial catalyst for the pound's drop came from remarks by French President François Hollande ... His comments came early in the Asian session, where light trading volumes likely exacerbated the move, they added

"There was a complete lack of two way interest in buying the pound on the way down," said Jeffrey Halley, a senior market strategist at Oanda.

Chris Weston, chief market strategist at IG, a broker. "This is the sort of time when the big U.S. traders are going home and Asian traders are getting back to the desk"

*via forexlive

The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index (Australian PCI®) lifted by 4.8 points to 51.4 points in the month (50 points is the threshold that separates expansion from contraction). This signalled a mild expansion across the construction industry led by stronger engineering construction activity.

Australian PCI® data for September revealed a marginal improvement in the activity subindex which remained in expansion (i.e. above 50 points) for a second consecutive month. In addition, businesses lifted their workforces, with employment increasing at its highest pace in two years. New orders continued to contract in September, although the rate of decline was slight, and slower than in August.

In August 2016, production in industry was up by 2.5% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In July 2016, the corrected figure shows a decrease of 1.5% from June 2016, thus confirming the provisional result published in the previous month.

In August 2016, production in industry excluding energy and construction was up by 3.3%. Within industry, the production of capital goods increased by 4.7% and the production of consumer goods by 3.3%.The production of intermediate goods showed an increase by 1.6%. Energy production was up by 1.1% in August 2016 and the production in construction decreased by 1.2%.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.