- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 08-06-2016.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1397 +0,36%

GBP/USD $1,4510 -0,21%

USD/CHF Chf0,969 +0,40%

USD/JPY Y106,89 -0,39%

EUR/JPY Y121,84 -0,03%

GBP/JPY Y155,1 -0,61%

AUD/USD $0,7483 +0,41%

NZD/USD $0,7086 +1,68%

USD/CAD C$1,2689 -0,51%

(time / country / index / period / previous value / forecast)

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

01:30 China PPI y/y May -3.4% -3.3%

01:30 China CPI y/y May 2.3% 2.3%

05:30 France Non-Farm Payrolls (Finally) Quarter I 0.2% 0.2%

05:45 Switzerland Unemployment Rate (non s.a.) May 3.5% 3.5%

06:00 Germany Current Account April 30.4

06:00 Germany Trade Balance (non s.a.), bln April 26.0

06:00 Japan Prelim Machine Tool Orders, y/y May -26.4%

07:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Total Trade Balance April -3.83

12:30 Canada Capacity Utilization Rate Quarter I 81.1% 81.3%

12:30 Canada New Housing Price Index, MoM April 0.2% 0.2%

12:30 U.S. Continuing Jobless Claims May 2172 2171

12:30 U.S. Initial Jobless Claims June 267 270

14:00 U.S. Wholesale Inventories April 0.1% 0.1%

15:15 Canada BOC Gov Stephen Poloz Speaks

The US dollar fell moderately against the euro, updating the five-week minimum. Experts point out that the US currency continues to be under pressure due to uncertainty regarding the timing of the next increase of the interest rates of the US Federal Reserve.

Prospects of rate increases significantly worsened after the release of US labor market report showed that the pace of hiring slowed sharply at the end of May. The recent speech of Fed Yellen also confirmed the central bank's intention to postpone the rate hike as long as the uncertainty about the economic outlook does not shatter. Today futures on interest rates Fed indicate that the probability of a rate hike of 2% in June. Meanwhile, the chances increase rate estimated at 25% in July.

A slight effect on the dollar also provided an overview of vacancies and labor turnover (JOLTS), published by the US Bureau of Labor Statistics. As it became known, in April, the number of vacancies grew to 5,788,000. To 5.67 million. In March (revised from 5.757 million.). Analysts had expected the number of vacancies will be 5,672,000. Vacancy rate was 3.9 percent in April. The number of jobs has changed little in the private sector and the government sector. Hiring fell to 5.1 million. The level of employment was 3.5 per cent. Hiring has not changed in the private sector and decreased government services (-31,000). As for the layoffs, the number is almost unchanged in April and amounted to 2.9 million. The level of redundancies was 2.0 percent.

The British pound fell against the dollar, returning to the level of opening of the session, which was due to technical factors and changes in risk appetite. The growth of the pound holding back continued uncertainty regarding the outcome of the forthcoming referendum in Britain. In the course of trading and continue to influence today's data for the UK, which exceeded forecasts. The Office for National Statistics said that industrial output advanced 2 percent in April from March, when it grew by 0.3 per cent. Economists had forecast a zero change. Production growth in the manufacturing sector accelerated to 2.3 percent from 0.1 percent the previous month, while the projected he had to abide by. On an annual basis, industrial output jumped 1.6 percent after falling 0.2 percent in March. This growth rate was last seen in October. It was predicted to fall 0.4 percent. Similarly, manufacturing output rose by 0.8 percent, in contrast to the 1.9 percent decrease in March and a 1.3 percent drop forecast by economists. It was the first increase in production since May 2015.

The Canadian dollar lost some ground against the US dollar, retreating from the highest point on May 3. Most likely, the cause of this trend is a profit after prolonged strengthening of the Canadian currency. Further fall was restrained by the positive dynamics of the oil market. Oil prices are rising for the third consecutive session, while establishing new highs in 2016. Support for oil have oil supply disruptions in Nigeria, as well as statistics on US petroleum inventories. Yesterday, the American Petroleum Institute (API) reported that US crude stocks in the previous week fell by 3,560 million barrels. Analysts had expected a decrease of 3.5 million barrels. Meanwhile, the US Department of Energy today announced that during the week 28 May - 3 June oil stocks fell by 3.2 million barrels to 532.5 million barrels. Experts predicted a decline of 2.7 million. Barrels. Oil reserves in Cushing terminal fell by 1.4 million barrels to 65.6 million barrels. Gasoline stocks rose by 1 million barrels to 239.6 million barrels. Analysts had expected stocks will fall 500,000 barrels. Distillate stocks rose by 1.8 million barrels to 151.4 million barrels. Analysts had forecast a drop to 300,000 barrels. The utilization of refining capacity increased by 1.1% to 90.9%. Analysts expected an increase of 0.6%. Meanwhile, oil production rose to 8.745 million barrels per day to 8.735 million barrels per day in the previous week

European Central Bank (ECB) Governing Council member Ardo Hansson said in an interview with The Wall Street Journal on Wednesday that purchases of corporate bonds could be more effective than purchases of government bonds.

"I've always thought that channels that work directly through enterprises and banks are the most likely channels to have an impact," he said.

The ECB started on Wednesday to buy corporate bonds under its quantitative easing programme.

Hanson also said that the central bank was prepared for the possible Britain's exit from the European Union (EU).

European Central Bank (ECB) Governing Council member François Villeroy de Galhau said on Wednesday that there were limits to negative interest rates.

"Not all unconventional instruments are legitimate. There are limits on how negative interest rates can go," he said.

de Galhau pointed out that helicopter money was not an option.

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia rose 1.7% in April, missing expectations for a 2.5% rise, after 0.7% decrease in March. March's figure was revised up from a 0.9% fall.

The value of owner occupied loans increased at a seasonally adjusted 0.1% in April, investment lending dropped 5.0%, while the number of loans for the construction of dwellings climbed 4.4%.

Japan's Cabinet Office released Eco Watchers' Index figures on Wednesday. Japan's economy watchers' current conditions index fell to 43.0 in May from 43.5 in April. It was the lowest level since November 2014.

Japan's economy watchers' future conditions index increased to 47.5 in May from 45.5 in April.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to May, after a 0.4% growth in three months to April. The previous figure was revised up from a 0.3% growth.

"A rebound of production sector output in April has supported a reasonable GDP growth in the three months to May 2016," James Warren, NIESR Research Fellow, said.

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Wednesday. Job openings jumped to 5.788 million in April from 5.670 million in March, missing expectations for a rise to 5.672. March's figure was revised down from 5.757 million.

The number of job openings rose for total private (5.289 million) and for government (498,000) in April from March.

The hires rate was 3.5% in April.

Total separations decreased to 4.988 million in April from 5.096 million in March.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Wednesday. The composite leading indicator remained unchanged at 99.6 in April.

It signalled stable growth in the Eurozone as a whole, Canada, France, Japan, Germany and China.

Growth firmed in India.

The index for Italy and the U.K. pointed to an easing in growth momentum.

The index for the U.S. confirmed signs of stabilisation.

The index for Russia showed signs of positive change in growth momentum.

EUR/USD 1.1300 (EUR 267m) 1.1375 (478m)

USD/JPY 107.50 (USD 250m) 107.90 (280m) 108.20 (260m)

EUR/GBP 0.7700 (EUR 363m)

AUD/USD 0.7345 (AUD 447m) 0.7425 (577m)

USD/CAD 1.2870 -75 (USD 300m) 1.2920 (250m)

NZD/USD 0.6835 (NZD 298m)

AUD/JPY 80.00 (EUR 270m)

Statistics Canada released housing market data on Wednesday. Building permits in Canada declined 0.3% in April, missing expectations for a 1.5% rise, after a 6.3% drop in March. March's figure was revised up from a 7.0% decrease.

The decrease was driven by a decline in building permits in Ontario, Quebec and Nova Scotia.

Building permits for non-residential construction were up 2.5% in April, while permits in the residential sector plunged 1.8%.

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Wednesday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 188,570 units in May from 191,388 units in April. April's figure was revised down from 191,512 units.

Housing starts were mainly driven by a drop in the multi-unit segment.

"Housing starts slowed in May, and are now on pace to reach 191,000 units in Canada - falling within the upper range of our housing market outlook forecast for the year. The decline we see in the trend is led by fewer multiple starts in urban areas, particularly in larger centres like Toronto," the CMHC's Chief Economist Bob Dugan said.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans April -0.7% Revised From -0.9% 2.5% 1.7%

02:00 China Trade Balance, bln May 45.56 58 49.9

06:00 Japan Eco Watchers Survey: Current May 43.5 43

06:00 Japan Eco Watchers Survey: Outlook May 45.5 47.5

07:15 Switzerland Consumer Price Index (MoM) May 0.3% 0.2% 0.1%

07:15 Switzerland Consumer Price Index (YoY) May -0.4% -0.4% -0.4%

08:30 United Kingdom Industrial Production (MoM) April 0.3% 0% 2%

08:30 United Kingdom Industrial Production (YoY) April -0.2% -0.4% 1.6%

08:30 United Kingdom Manufacturing Production (MoM) April 0.1% 0% 2.3%

08:30 United Kingdom Manufacturing Production (YoY) April -1.9% 0.8%

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. Job openings are expected to decline to 5.672 million in April from 5.757 million in March.

The euro traded higher against the U.S. dollar in the absence of any major economic data from the Eurozone.

The British pound traded higher against the U.S. dollar on the industrial production data from the U.K. The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 2.0% in April, exceeding forecasts of a flat reading, after a 0.3% rise in March.

The increase was mainly driven by a rise in manufacturing.

On a yearly basis, industrial production in the U.K. increased 1.6% in April, beating expectations for a 0.4% drop, after a 0.2% decrease in March.

Manufacturing production in the U.K. was up 2.3% in April, beating expectations for a flat reading, after a 0.1% rise in March. It was the largest rise since July 2012.

The rise was mainly driven by an increase in the manufacture of basic pharmaceutical products and pharmaceutical preparations, which rose by 8.6% in April.

On a yearly basis, manufacturing production in the U.K. increased 0.8% in April, after a 1.9% drop in March.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian housing market data. Housing starts in Canada are expected to decline to 190,000 in May from 191,500 in April.

The Canadian building permits are expected to rise 1.5% in April, after a 7.0% drop in February.

The Swiss franc traded higher against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Wednesday. Switzerland's consumer price index rose 0.1% in May, missing expectations for a 0.2% gain, after a 0.3% increase in April.

The increase was mainly driven by higher prices for petroleum products, food and rents.

On a yearly basis, Switzerland's consumer price index remained unchanged at -0.4% in May, in line with forecasts.

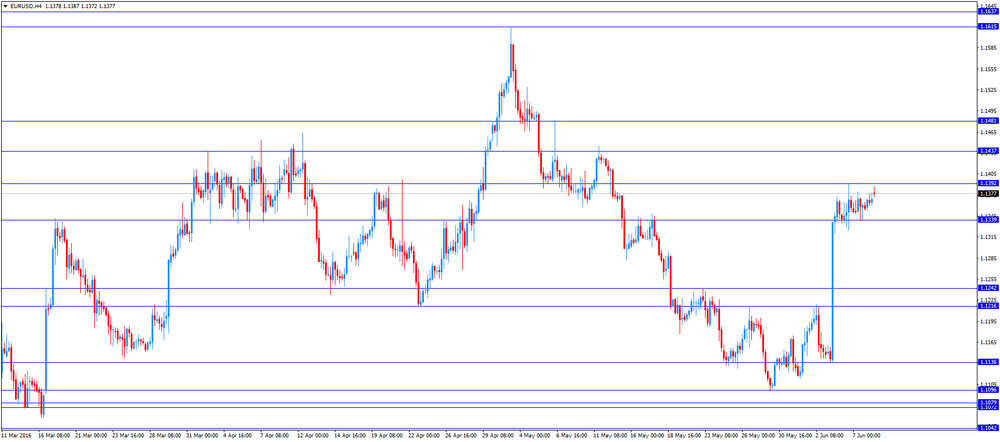

EUR/USD: the currency pair was up to $1.1387

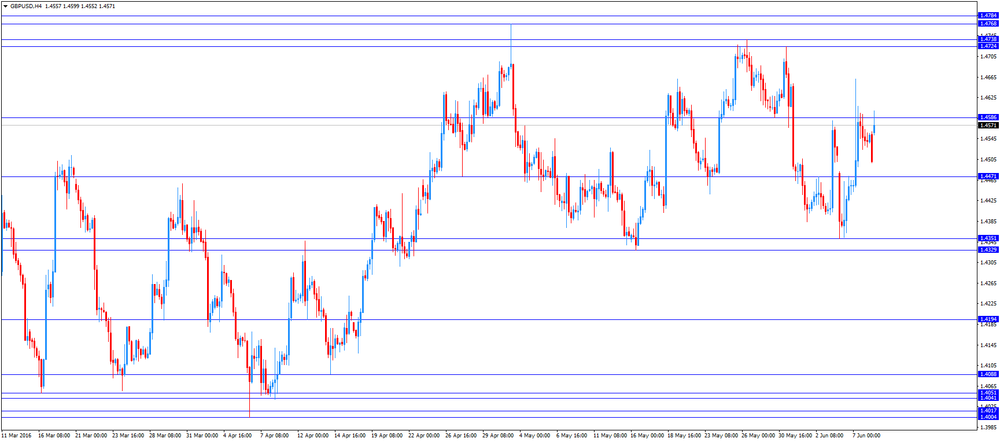

GBP/USD: the currency pair rose to $1.4599

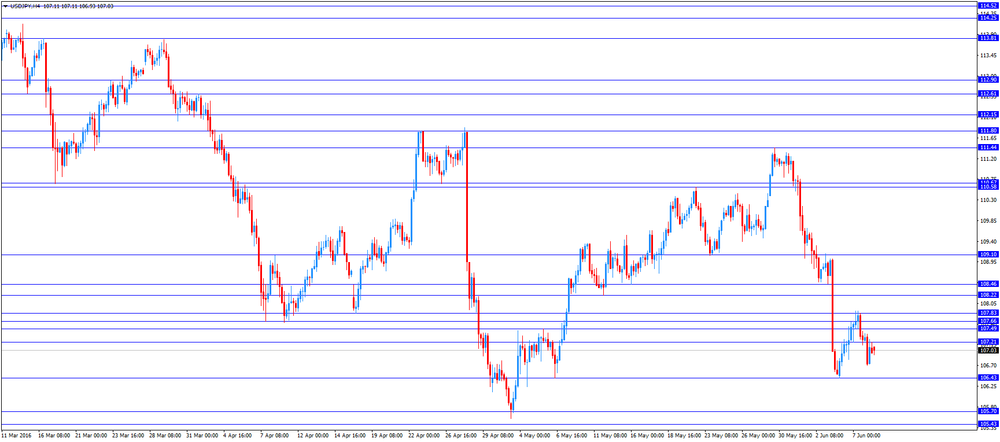

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:15 Canada Housing Starts May 191.5 190

12:30 Canada Building Permits (MoM) April -7.0% 1.5%

14:00 United Kingdom NIESR GDP Estimate May 0.3%

14:00 U.S. JOLTs Job Openings April 5.757 5.672

14:30 U.S. Crude Oil Inventories June -1.366 -2.7

21:00 New Zealand RBNZ Interest Rate Decision 2.25% 2.25%

21:00 New Zealand RBNZ Rate Statement

23:00 New Zealand RBNZ Press Conference

23:50 Japan Core Machinery Orders, y/y April 3.2% -2.3%

23:50 Japan Core Machinery Orders April 5.5% -3.8%

EUR/USD

Offers : 1.1380 1.1400 1.1420 1.1450 1.1465 1.1480 1.1500

Bids: 1.1350 1.1330 1.1300 1.1285 1.1265 1.1250 1.1220 1.1200

GBP/USD

Offers : 1.4560 1.4575 1 .4600 1.4625-30 1.4650-60 1.4680 1.4700 1.4725-30 1.4750

Bids: 1.4500 1.4480 1.4450 1.4430 1.4400 1.4380 1.4365 1.4350 1.4300-10

EUR/GBP

Offers : 0.7835 0.7850 0.7885 0.7900 0.7925-30 0.7950 0.7980 0.8000

Bids: 0.7800 0.7785 0.7750-60 0.77200.7700 0.7650

EUR/JPY

Offers : 122.00 122.30 122.60 122.80 123.00 123.30 123.50 123.80 124.00

Bids: 121.25-30 121.00 120.80 120.50 120.00

USD/JPY

Offers : 107.20 107.50 107.80 108.00 108.30 108.50 108.85 109.00 109.20 109.50-60

Bids: 106.85 106.70 106.50 106.25-30 106.00-05 105.75 105.50

AUD/USD

Offers : 0.7470 0.7490-0.7500 0.7520 0.7550 0.7600

Bids: 0.7425-30 0.7400 0.7385 0.7365 0.7350 0.7320 0.7300

Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 0.8% in April, after a 0.7% fall in March. March's figure was revised up a 1.1% decrease.

Domestic turnover increased by 0.2% in April, while the business with foreign customers climbed 1.5%.

Sales to euro area countries rose 0.5% in April, while sales to other countries were up 2.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.9% in April, after a 0.9% rise in March.

The Bank of France lowered its growth forecast for the second quarter on Wednesday. The central bank expects the French economy to expand 0.2% in the second quarter, down from the previous estimate of a 0.3% growth.

The manufacturing business confidence index rose to 97 in May from 99 in April.

The services business sentiment index increased to 98 in May from 96 in April.

The construction business sentiment index remained unchanged at 97 in May.

Japan's Ministry of Finance released its current account data for Japan late Tuesday evening. Japan's current account surplus fell to ¥1,879 billion in April from ¥2,980 billion in March, missing expectations for a surplus of ¥2,318.9 billion.

The trade surplus rose to ¥697.1 billion in April, down from a surplus of ¥927.2 billion in March.

Exports dropped at an annual rate of 10.4% in April, while imports plunged 23.1%.

The Swiss Federal Statistics Office released its consumer inflation data on Wednesday. Switzerland's consumer price index rose 0.1% in May, missing expectations for a 0.2% gain, after a 0.3% increase in April.

The increase was mainly driven by higher prices for petroleum products, food and rents.

On a yearly basis, Switzerland's consumer price index remained unchanged at -0.4% in May, in line with forecasts.

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 2.0% in April, exceeding forecasts of a flat reading, after a 0.3% rise in March.

The increase was mainly driven by a rise in manufacturing.

On a yearly basis, industrial production in the U.K. increased 1.6% in April, beating expectations for a 0.4% drop, after a 0.2% decrease in March.

Manufacturing production in the U.K. was up 2.3% in April, beating expectations for a flat reading, after a 0.1% rise in March. It was the largest rise since July 2012.

The rise was mainly driven by an increase in the manufacture of basic pharmaceutical products and pharmaceutical preparations, which rose by 8.6% in April.

On a yearly basis, manufacturing production in the U.K. increased 0.8% in April, after a 1.9% drop in March.

According to a survey by the European Union Chamber of Commerce in China, European companies in China expressed pessimism about doing business in China. 56% of respondents said that doing business became more difficult over the past year. Companies said that there were controls on the internet, and the Chinese government's implementation of the reforms was too slow.

The Fed released its consumer credits figures on Tuesday. Consumer credit in the U.S. rose by $13.42 billion in April, missing expectations for a $18.00 billion increase, after a $28.38 billion gain in March. March's figure was revised down from a $29.67 billion rise.

The increase was mainly driven by gains in non-revolving credit. Revolving credit rose by 2.1% in April, while non-revolving credit jumped by 5.4%.

The Chinese Customs Office released its trade data on Wednesday. China's trade surplus climbed to $49.9 billion in May from $45.56 billion in April, missing expectations for a rise to a surplus of $58.00 billion.

Exports fell at an annual rate of 4.1% in May, while imports declined at an annual rate of 0.4%.

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Tuesday evening. Japan's GDP increased by 0.5% in the first quarter, up from the preliminary reading of a 0.4% growth, after a 0.3% drop in the fourth quarter.

Business spending fell 0.7% in the first quarter, up from a preliminary reading of a 1.4% drop, while household spending increased 0.6%, unchanged from a preliminary reading.

On a yearly basis, Japan's economy expanded 1.9% in the first quarter, up from the preliminary reading of a 1.7% rise, after a 1.1% decline in the fourth quarter.

EUR/USD 1.1300 (EUR 267m) 1.1375 (478m)

USD/JPY 107.50 (USD 250m) 107.90 (280m) 108.20 (260m)

EUR/GBP 0.7700 (EUR 363m)

AUD/USD 0.7345 (AUD 447m) 0.7425 (577m)

USD/CAD 1.2870 -75 (USD 300m) 1.2920 (250m)

NZD/USD 0.6835 (NZD 298m)

AUD/JPY 80.00 (EUR 270m)

The World Bank on Tuesday cut its global economic growth forecast for 2016 and 2017 due to weak growth in advanced economies, low commodity prices, weak global trade, and diminishing capital flows.

The World Bank expects that the global economy would grow 2.4% in 2016, down from January forecast of 2.9%. 2017 global growth was downgraded to 2.8%, down from its January forecast of 3.1%.

"As advanced economies struggle to gain traction, most economies in South and East Asia are growing solidly, as are commodity-importing emerging economies around the world," World Bank Senior Vice President and Chief Economist Kaushik Basu said.

China's economy is expected to expand 6.7% in 2016 and 6.5% in 2017, both unchanged from January forecasts.

Growth in the U.S. is expected to expand 1.9% in 2016, down from January forecast of 2.7, and 2.2% in 2017, down from January forecast of 2.4.

In the Eurozone, the economy is expected to grow 1.6% in 2016, down from January forecast of 1.7%, and 1.6% in 2017, down from January forecast of 1.7%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1528 (1707)

$1.1488 (1169)

$1.1460 (1797)

Price at time of writing this review: $1.1361

Support levels (open interest**, contracts):

$1.1300 (1543)

$1.1246 (1394)

$1.1180 (2143)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 30387 contracts, with the maximum number of contracts with strike price $1,1500 (5557);

- Overall open interest on the PUT options with the expiration date July, 8 is 58045 contracts, with the maximum number of contracts with strike price $1,0900 (12425);

- The ratio of PUT/CALL was 1.91 versus 1.85 from the previous trading day according to data from June, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.4825 (1719)

$1.4730 (758)

$1.4636 (678)

Price at time of writing this review: $1.4540

Support levels (open interest**, contracts):

$1.4465 (488)

$1.4368 (652)

$1.4271 (455)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 15306 contracts, with the maximum number of contracts with strike price $1,5000 (1844);

- Overall open interest on the PUT options with the expiration date July, 8 is 28737 contracts, with the maximum number of contracts with strike price $1,4100 (2491);

- The ratio of PUT/CALL was 1.88 versus 1.48 from the previous trading day according to data from June, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The dollar plumbed a fresh four-week trough against a basket of currencies on Wednesday, though better-than-expected Chinese import figures helped it climb off session lows.

The dollar index, which tracks the greenback against a basket of six rivals, edged down 0.1 percent to 93.740 after dropping as low as 93.695, its lowest since May 11.

Against its Japanese counterpart, the dollar slipped 0.3 percent to 107.05 yen, after hitting a session low of 106.72 earlier. It remained off the one-month low of 106.35 touched on Monday but still a long way away from levels above 111 yen at the end of May.

Underpinning risk appetite and helping the dollar climb off its lows against the perceived safe-haven yen, data showed that China's imports beat forecasts in May, adding to hopes that the economy may be stabilising even though exports fell more than expected.

The euro rose 0.2 percent to $1.1373. It had closed the last two days virtually flat after its 2 percent surge on Friday's disappointing U.S. non-farm payrolls report that all but quashed expectations for a Federal Reserve interest rate hike this month.

"A June U.S. rate hike is now out of the question and the focus is whether the Fed provides any hints of a July hike. There are no major U.S. indicators until the Fed's policy meeting next week, and the dollar is likely to remain bearish until then," said Junichi Ishikawa, forex analyst at IG Securities in Tokyo.

The Fed concludes a two-day policy meeting on June 15.

The Australian dollar edged up 0.1 percent to $0.7462 after surging more than 1 percent in the previous session to a one-month high of $0.7465 following the Reserve Bank of Australia's decision to stand pat on monetary policy and hint it was not in a hurry to raise rates.

Chinese dollar-denominated exports declined 4.1 percent in May from a year earlier, compared with the expected drop of 3.6 percent. Imports fell 0.4 percent, less than the expected 6 percent. China's trade surplus is forecast to hit $50 billion in May.

The New Zealand dollar added 0.3 percent to $0.6999 after scaling a one-month peak of $0.7006 earlier.

The Reserve Bank of New Zealand is scheduled to announce its policy decision early on Thursday, with the market expecting the central bank to keep monetary policy unchanged.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1350-75

GBP / USD: during the Asian session, the pair was trading in the $ 1.4550-60

USD / JPY: during the Asian session, the pair is trading in the range of $ 106.70-107.40

Based on Reuters materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.