- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 09-10-2022.

- GBP/JPY has surrendered the 161.00 cushion amid the risk-off market mood.

- Pound bulls will respond relatively better after the release of the UK employment data.

- The Japanese yen is holding itself despite rising geopolitical tensions.

The GBP/JPY pair is oscillating below the round-level cushion of 161.00 in the early Tokyo session as the risk-averse market mood has brought a sell-off for the risk-sensitive assets. The cross has witnessed a steep fall after failing to sustain above the 162.00 hurdle and is expected to continue to remain on the edge ahead of the US employment data.

As per the consensus, the UK Office for National Statistics will report the Claimant Count Change data with a decline of 11.4k vs. the prior addition of a 6.3k. While the Unemployment Rate will land unchanged at 3.6%. The catalyst which will be worth scrutiny is the Average Earnings data, which is seen higher at 5.3% vs. the prior release of 5.2%.

Price pressures in the UK economy have not witnessed a peak yet due to the unavailability of exhaustion signals. And, in order to offset the impact of higher payouts due to inflation-adjusted necessities and durable goods, households need higher paychecks. Stagnant growth in the labor cost data is a reason for worry for the Bank of England policymakers.

On Friday, Deputy Governor Dave Ramsden warned that UK's energy support package represents a very significant fiscal intervention, which can be thought of as a shock, as reported by Reuters.

Meanwhile, yen bulls are performing relatively better despite the escalating geopolitical tensions between Japan and North Korea. The statement from North Korean leader Kim stated that their administration need not have a dialogue with the enemy and the former will continue to strengthen its nuclear operations ahead. In response to North Korean military activities, Japan, South Korea, and the US have performed military drills.

- USD/CHF grinds higher at eight-day top amid sluggish session.

- Firmer US data, hawkish Fedspeak propel DXY ahead of Fed Minutes, US CPI.

- Escalating geopolitical, recession fears also underpin US dollar’s safe-haven demand.

- Buyers need confirmation of 75 bps rate hike from FOMC Minutes to keep the reins.

USD/CHF seesaws near 0.9950 during Monday’s inactive Asian session, after a three-day uptrend. That said, the holidays in the US, Japan and Canada restrict the pair’s immediate moves. However, fears of recession and aggressive Fed rate hikes keep the buyers hopeful around one-week high.

The US dollar’s strength is the key force behind the pair’s recent up-moves. That said, the US Dollar Index (DXY) rose during the last three days while reversing the previous weekly pullback from the 20-year high as markets priced in the 75 basis points (bps) of a rate hike from the Fed. Behind the hawkish Fed bets could be the firmer US jobs report and upbeat comments from the policymakers that suggest further rate increases before the pause.

The DXY cheered Friday’s jobs report for September as the headline Nonfarm Payrolls (NFP) rose to 265K versus the 250K expected. Also adding strength to the greenback gauge was an unexpected fall in the Unemployment Rate to 3.5% compared to forecasts suggesting no change in the 3.7% prior.

Elsewhere, the recent escalation in the Russia-Ukraine tussles, following an explosion that destroyed a part of the bridge in Crimea which is crucial for Russia's war supplies, also propelled the market’s rush to risk safety and favored the US dollar.

On the contrary, concerns that the recession woes could probe the global central banks from hiking the rates at a faster pace challenge the USD/CHF bulls. On the same line could be the cautious sentiment ahead of this week’s Federal Open Market Committee (FOMC) Minutes, US Consumer Price Index (CPI) and a speech from the Swiss National Bank (SNB) Chairman Thomas Jordan.

Given the hawkish concerns from the Fed and the risk aversion wave, the USD/CHF prices are likely to remain firmer. However, upbeat comments from SNB’s Jordan could trigger the pair’s pullback.

Technical analysis

The higher low and higher high formation join upbeat RSI (14) and bullish MACD signals to suggest a clear upside break of the 0.9965 key hurdle that holds the gate for the USD/CHF pair’s further advances.

- WTI keeps Friday’s pullback from six-week high, dribbles around intraday low of late.

- US criticism of OPEC+ move joins downbeat China data, hawkish Fed bets to probe oil bulls.

- Escalating geopolitical tensions and challenges for rate hikes from the global central banks favor bulls.

- IMF, World Bank meetings could entertain oil traders, US inflation, Fed minutes will be crucial to justify the latest pullback.

WTI crude oil holds lower ground near $91.50 as risk-aversion joins the hawkish Fed bets to propel the US dollar. However, a holiday in the US, Canada and Japan restricts the black gold’s immediate moves during Monday’s Asian session.

Other than the extended weekend in the major markets, downbeat PMI data from China and the criticism of the latest move of the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, also probe the oil buyers.

US Treasury Secretary Janet Yellen said, per the Financial Times (FT), the move by Opec+ to cut oil production was “unhelpful and unwise” for the global economy, particularly emerging markets already struggling with high energy prices.

During the weekend, China’s Caixin Services PMI for September dropped to 49.3 from 55.0 prior. With this, the private activity gauge marked the first contraction since May.

Furthermore, Friday’s strong US jobs report propelled the odds of the 75 basis points (bps) rate hike from the Fed, which in turn weighed on the oil prices. The latest US jobs report for September showed that the headline Nonfarm Payrolls (NFP) rose to 265K versus the 250K expected. Also portraying the strength of the US employment conditions was an unexpected fall in the Unemployment Rate to 3.5% compared to forecasts suggesting no change in the 3.7% prior.

Even so, the recent explosion on the Crimea bridge and the European sanctions on Russia’s oil exports keep the commodity buyers hopeful.

Moving on, this week’s annual meetings of the World Bank (WB) and the International Monetary Fund (IMF) in Washington will be crucial as the global financial leaders will discuss geopolitical tensions and inflation pressure, as well as central bank moves. Also important will be Wednesday’s Federal Open Market Committee (FOMC) Minutes and Thursday’s US Consumer Price Index (CPI).

It should be noted that WTI crude oil prices are near the short-term key resistances amid supply crunch fears and hence any positive news could easily propel the quote.

Technical analysis

100-day EMA and a three-month-old resistance line, respectively around $92.20 and $92.70, challenge the WTI crude oil buyers. That said, the RSI retreat hints at a short-term pullback toward revisiting the $90.00 threshold.

- The greenback bulls are on the verge of delivering a break of the Inverted Flag.

- A defend of a bull cross by the 20-and 50-EMAs has added to the downside filters.

- The RSI (14) has shifted into the bearish range of 20.00-40.00, signals more weakness ahead.

The NZD/USD pair has stepped below the critical support of 0.5600 in the early Asian session as soaring risk-off bets have forced the market participants to ditch the risk-perceived assets. The asset has delivered a downside break of the minor consolidation in a 0.5597-0.5611 range and is expected to remain in the tenterhooks ahead.

The comments from North Korean leader Kim Jong-un, reported by KCNA news agency, that he doesn’t need to have a dialogue with the enemy and will continue to strengthen its nuclear operations ahead have escalated geopolitical tensions.

On an hourly scale, the asset is on the verge of a break of the inverted flag chart pattern. The continuation pattern delivers a downside wave after a breakdown of the mark-up inventory distribution phase.

It is worth noting that the 20-and 50-period Exponential Moving Averages (EMAs) have defended the occurrence of a bullish cross at around 0.5729, which indicates the strength of the greenback bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which signals that the downside momentum has been activated.

The kiwi bulls could display more weakness if the asset drops below September’s low at 0.5565. An occurrence of the same will drag the asset toward the psychological support and March 2020 low at 0.5500 and 0.5469 respectively.

On the flip side, a decisive break above September 29 high at 0.5752 will send the asset toward the round-level resistance at 0.5800, followed by September 22 high at 0.5888.

NZD/USD hourly chart

-638009541866224831.png)

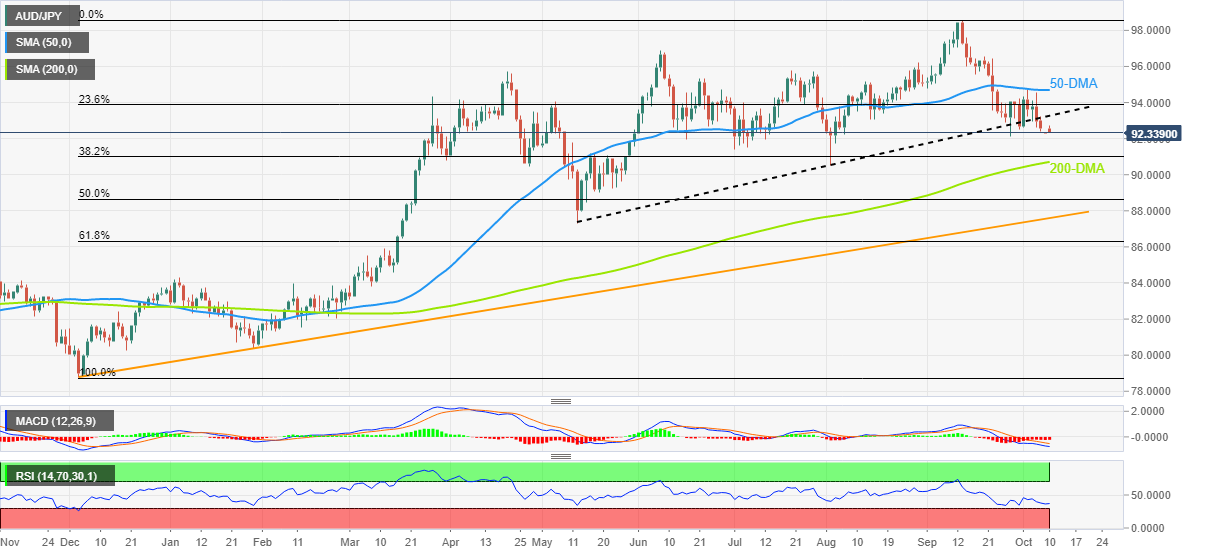

- AUD/JPY holds lower ground at weekly bottom, stays pressured for the fifth consecutive week.

- A clear U-turn from 50-DMA, downside break of the five-month-old support line keeps sellers hopeful.

- 200-DMA, August month’s low lure bears unless the quote remains below 94.70.

AUD/JPY remains on the back foot at the eight-day low, near 92.35 amid Monday’s Asian session, as sellers keep reins during the fifth consecutive week.

In doing so, the bears cheer the previous week’s pullback from the 50-DMA, as well as a clear downside break of the upward-sloping trend line from May, amid bearish MACD signals and the RSI.

With this, the bears are all set to poke the previous monthly low surrounding 92.10 before challenging July’s bottom near 91.40.

However, the 200-DMA and the lows marked in August, respectively near 90.70 and 90.50 in that order, could challenge the AUD/JPY bears afterward.

In a case where the pair sellers break the 90.50 support, the 90.00 psychological magnet may test the further downside.

Alternatively, the support-turned-resistance line, around 93.25, guards the AUD/JPY pair’s immediate recovery moves ahead of the 50-DMA level of 94.70.

Following that, late September’s swing high near 96.55 and June’s peak of 96.88 may probe the bulls before directing them to the recently flashed multi-month top of 98.60.

AUD/JPY: Daily chart

Trend: Further downside expected

- USD/CAD licks its wounds after snapping three-week uptrend.

- Oil buyers take a breather at six-week high as firmer DXY probe commodity buyers.

- Canada employment numbers also came in positive but hawkish Fed bets, strong US NFP propelled USD.

- IMF, World Bank meetings, geopolitical tension could keep oil buyers hopeful but US dollar strength might stop USD/CAD bears.

USD/CAD picks up bids to refresh intraday high around 1.3750 during the early Asian session on Monday. The Loonie pair’s latest gains could be linked to a pullback in oil prices, Canada’s main export item, as well as the hawkish expectations from the US Federal Reserve (Fed).

WTI crude oil posted the biggest weekly gains since February after the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, agreed to lower oil output by 2 million barrels per day. Also favoring the black gold could be the recent escalation in the Russia-Ukraine tussles after an explosion destroyed a part of the bridge in Crimea which is crucial for Russia's war supplies. However, the oil benchmark eased from the six-week high on Friday while consolidating recent gains amid the firmer US dollar, taking rounds to $91.50 by the press time.

That said, the US Dollar Index (DXY) rose during the last three days while reversing the previous weekly pullback from the 20-year high as markets priced in the 75 basis points (bps) of rate hike from the Fed. Behind the hawkish Fed bets could be the firmer US jobs report and upbeat comments from the policymakers that suggest further rate increases before the pause.

The US Dollar Index (DXY) cheered Friday’s jobs report for September as the headline Nonfarm Payrolls (NFP) rose to 265K versus 250K expected. Also adding strength to the greenback gauge was an unexpected fall in the Unemployment Rate to 3.5% compared to forecasts suggesting no change in the 3.7% prior.

On the other hand, Canada’s Net Change in Employment rose to 21.1K in September from -39.7K prior, versus the 20K expected. Further, the Unemployment Rate surprised markets with 5.2% figure compared to 5.4% market consensus and prior.

Against this backdrop, the US Treasury yields regain upside momentum whereas the equities witnessed the red. It should be noted that the S&P 500 Futures print mild losses by the press time.

Moving on, a holiday in the US and Canada may restrict intraday moves of the USD/CAD pair. However, the broad strength of the US dollar and the market’s risk-off mood may keep the buyers hopeful ahead of Wednesday’s Federal Open Market Committee (FOMC) and Thursday’s US Consumer Price Index (CPI).

Technical analysis

Unless breaking a one-month-old ascending trend line, at 1.3645 by the press time, the USD/CAD bears may not take the risk of entry.

- GBP/USD has sensed selling pressure around 1.1100 as the risk-off tone has escalated.

- Japan-North Korea geopolitical tensions have trimmed demand for risk-sensitive assets.

- Going forward, investors will shift their focus toward the UK labor market data.

The GBP/USD pair has picked offers around the immediate hurdle of 1.1100 in the early Tokyo session. The cable is displaying signs of surrendering Friday’s low at around 1.0560 as the risk-off impulse has been heightened. Headlines from Reuters, that North Korea has apparently been conducting nuclear operation training have trimmed the demand for the risk-perceived currencies.

On Sunday, North Korea fired two ballistic missiles, making it a total of seven, launched around Pyongyang. The military event by North Korea forced Japan, South Korea, and the US to conduct their own military drills in response to military activities from the Kim Yong-un region. Adding to that, the statement from North Korean leader Kim stated that their administration need not have a dialogue with the economy and the former will continue to strengthen its nuclear operations ahead.

Apart from the geopolitical tensions, the risk-off profile has escalated after the upbeat US nonfarm Payrolls (NFP) data. The economic data landed at 263k, higher than the expectations of 250k but lower than the prior release of 315k. Apart from that, the Unemployment Rate has slipped to 3.5% vs. the projections and the former print of 3.7%. Signs of extremely tight labor market conditions will provide confidence to the Federal Reserve (Fed) to go full-armed after mounting inflation.

The upbeat US employment data pushed the US dollar index (DXY) toward the crucial hurdle of 113.00. Also, the 10-year US Treasury yields recorded four consecutive bullish trading sessions and are directed towards 4%.

It is worth noting that US markets are closed on Monday on account of Columbus Day.

On the UK front, investors are awaiting the release of the employment data. The Claimant Count Change is expected to decline by 11.4k vs. an increment of 6.3k. While the ILO Unemployment Rate is seen steady at 3.6%. As price pressures are at elevated levels in the UK economy, therefore, the Average Earnings data will also remain in focus. The economic data excluding bonuses is seen higher by 10 basis points (bps) to 5.3%.

- Gold price struggles to keep pullback from the monthly high, rebounds from short-term key supports.

- Hawkish Fed bets, geopolitical concerns underpinned the US dollar’s demand.

- Firmer US jobs report, mixed concerns in the EU add strength to the USD buying.

- Softer inflation numbers may probe bears but Fed hawks could weigh on XAU/USD.

Gold price (XAU/USD) begins the week on a front foot, bouncing off the 200-SMA support to $1,700 while also keeping the previous pullback from the monthly high amid hawkish Fed bets and geopolitical concerns. However, cautious sentiment ahead of Wednesday’s Fed Minutes and Thursday’s US inflation data challenge the commodity bears.

XAU/USD began the last week on the positive side before recalling the bears on Wednesday as Europe levied more sanctions on Russia while the UK announced the reversal of its controversial tax cut plan. Adding strength to the gold selling were the firmer US job numbers and strongly hawkish comments from the Fed policymakers. Recently, an explosion on a Crimea bridge and China’s downbeat PMI data seemed to have favored the gold sellers.

Friday’s jobs report for September showed that the headline Nonfarm Payrolls (NFP) rose to 265K versus the 250K expected. Also portraying the strength of the US employment conditions was an unexpected fall in the Unemployment Rate to 3.5% compared to forecasts suggesting no change in the 3.7% prior.

Considering the firmer US data and hawkish Fedspeak the market expectations of witnessing a 0.75% rate hike in the next Federal Open Market Committee (FOMC) became stronger of late. Elsewhere, downbeat EU PMIs and the European Central Bank’s (ECB) Monetary Policy Accounts showing support for the 50 basis points (bps) rate hike, versus 0.75% announced, also favored the US dollar and weighed on the XAU/USD prices.

During the weekend, China’s Caixin Services PMI for September dropped to 49.3 from 55.0 prior. With this, the private activity gauge marked the first contraction since May. It’s worth noting that an explosion destroyed a part of the bridge in Crimea which is crucial for Russia's war supplies and escalated the market Russia-Ukraine tension.

Amid these plays, the US Treasury yields regain upside momentum whereas the equities witnessed the red.

Moving on, Monday’s holiday in the US, Canada and Japan could restrict the metal’s momentum while allowing the bears to keep the reins. However, the US FOMC Minutes and US Consumer Price Index (CPI) will be crucial for near-term trade directions. That said, softer inflation data may challenge the XAU/USD sellers but hawkish Fed bets can keep the metal bears hopeful.

Also read: Gold Weekly Forecast: XAU/USD remains sensitive to US yields as focus shifts to CPI

Technical analysis

Gold price flirts with the 200-SMA support, around $1,695 by the press time, after breaking an eight-day-old support line. Also keeping the XAU/USD bears hopeful are the downbeat RSI (14) and bearish MACD signals.

That said, the metal’s further downside hinges on the previous resistance line from late August and the 100-SMA, close to $1,684 and $1,672 in that order. It’s worth noting that the metal’s downside past $1,672 could convince the bullion sellers.

Alternatively, the support-turned-resistance line from September 28, around $1,723 by the press time, guards the quote’s immediate recovery.

Following that, the recent top and the 61.8% Fibonacci retracement level of the metal’s August-September downside, close to $1,730 and $1,735 in that order, could challenge the XAU/USD buyers before giving them control.

Overall, the gold price returns to the bear’s table but there’s a bumpy road to the south.

Gold: Four-hour chart

Trend: Further downside expected

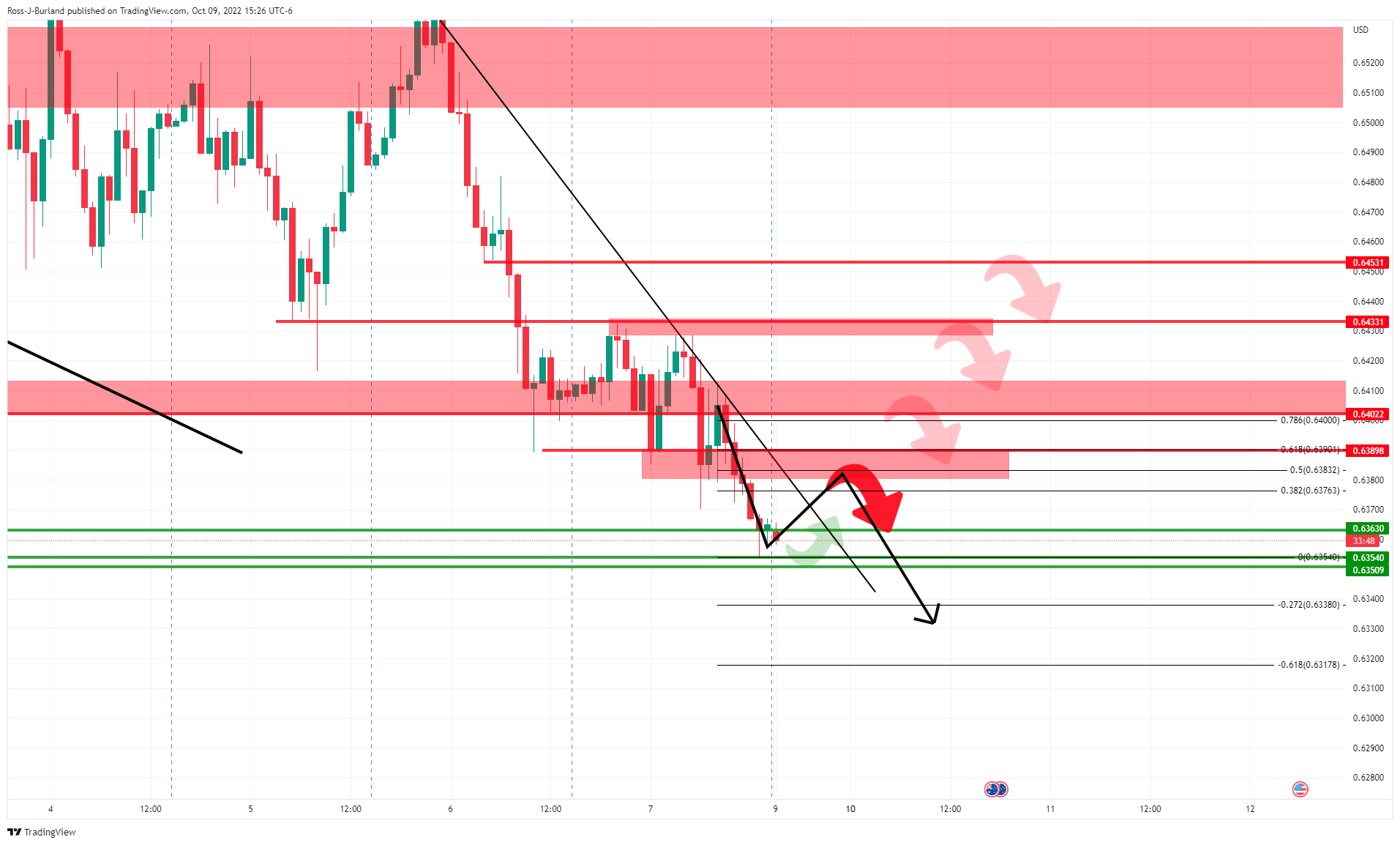

- AUD/USD bulls eye the channel top near 0.6450 on a break of the 38.2% Fibonacci and 50% mean reversion area near 0.6380/0.6400.

- AUD/USD bears are moving the price towards the edge of the abyss and 0.6350.

AUD/USD has opened at support but hangs over the edge of the abyss at 0.6350 which guards the risk of a fall to 0.6150 for the week (s) ahead. The US dollar is on the march, supported by strong yields and the Federal Reserve's campaign to hike rates following Friday's strong US Nonfarm Payrolls data.

Speculators' net long positioning on the US dollar fell in the latest week to the lowest since mid-March, according to calculations by Reuters and U.S. Commodity Futures Trading Commission data released on Friday. This leaves scope for a reaccumulation of those positions that could add pressure to AUS/USD. The value of the net long dollar position slid to $9.44 billion in the week ended Oct. 4, from $10.43 billion the previous week, CFTC data showed.

The following illustrates both the bullish and bearish scenarios for days ahead with a strong bias to the downside longer term:

AUD/USD weekly charts

While there are prospects of a retracement of the weekly downtrend, the broader trend is lower. The Fibonacci scale can be drawn to look for confluences with structure. In this regard, the 61.8% aligns with the July lows near 0.6700. However, should the dollar remain strong, that will be a tall order to achieve.

AUD/USD daily chart

Moreover, the bulls will first need to overcome the daily resistance near 0.6550.

AUD/USD H4 chart

On the 4-hour time frame, the price has slid beyond the trendline resistance but is failing to hold convincingly within the channel. Nevertheless, bulls could be attracted at this stage for a discount so long as the support structure holds and the price can form a build-up of bullish candles for traders to lean into.

AUD/USD H1 chart

If the bulls do overcome the bears, there will be potentially strong resistance on the way up, as signified by the bearish arrows at key structural points along the way to the midpoint of the channel near 0.6450. This first hurdle comes at the confluence of the 38.2% Fibonacci and 50% mean reversion area near 0.6380/0.6400. A break there could be the most significant as it will open the way to higher levels.

- EUR/USD to test more supports amid soaring hawkish Fed bets.

- Firmer US NFP data could keep the risk-off profile highlighted for a while.

- Subdued German Retail Sales data has kept the shared currency bulls on the tenterhooks.

The EUR/USD pair is juggling around the crucial cushion of 0.9730 in early Tokyo and is expected to remain prepared for testing more supports. The major is displaying a tough time scenario around the afore-mentioned support and may drop to near the 0.9700 round-level resistance as odds of a 75 basis point (bps) rate hike by the Federal Reserve (Fed) has advanced significantly.

As per the CME Fedwatch tool, chances of a 75 bps rate hike announcement by the Fed have soared to 82%. The reason behind the escalating possibility of a fourth consecutive 75 bps rate hike is the better-than-projected US Nonfarm Payrolls (NFP) data. The US economy has added 263 fresh jobs in September month vs. the expectation of 250k and the prior release of 315k. The release of the upbeat employment generation data directs the US dollar index (DXY) to hit the round-level resistance of 0.9700.

Also, the better-than-expected US NFP brought party for yields. The 10-US US Treasury yields continued their winning streak for four-trading sessions and hit a 3.91% figure. The yields are expected to extend further to the psychological resistance of 4% as the risk-off profile has been underpinned by the market participants. The upbeat US NFP will support the Fed to announce a 75 bps rate hike unhesitatingly. So confident Fed policymakers will continue to discuss the 75 bps and the risk-off profile will continue to remain in traction.

Investors should be aware of the fact that US markets are closed on Monday on account of Columbus Day.

On the Eurozone front, the shared currency bulls are underperforming on subdued German Retail Sales data. The annual Retail Sales have declined by 4.3% but remained better than the expectations of a decline of 5.1%. While the monthly catalyst declined by 1.3% than the projections of a drop by 1%.

North Korea has apparently been conducting nuclear operation training, as per Reuters reporting that has cited North Korea's KCNA news agency reporting this on Monday.

the nation fired two ballistic missiles early on Sunday, authorities in neighbouring countries said, the seventh such launch by Pyongyang in recent days that added to widespread alarm in Washington and its allies in Tokyo and Seoul.

Officials in the South Korean capital have said the uptick in the North’s missile launches could signal it is closer than ever to resuming nuclear testing for the first time since 2017, with preparations observed at its test site for months.

Sunday’s missiles reached an altitude of 100 km (60 miles) and covered 350 km (218 miles), Japan’s state minister of defence, Toshiro Ino, told reporters.

The first was fired at about 1:47 a.m. (1647 GMT) and the second some six minutes later.

The US, Japan and South Korea conducted their own military drills in response.

This escalation of Pyongyang’s missile tests has prompted immediate backlash from Tokyo and has put markets on risk-off alert.

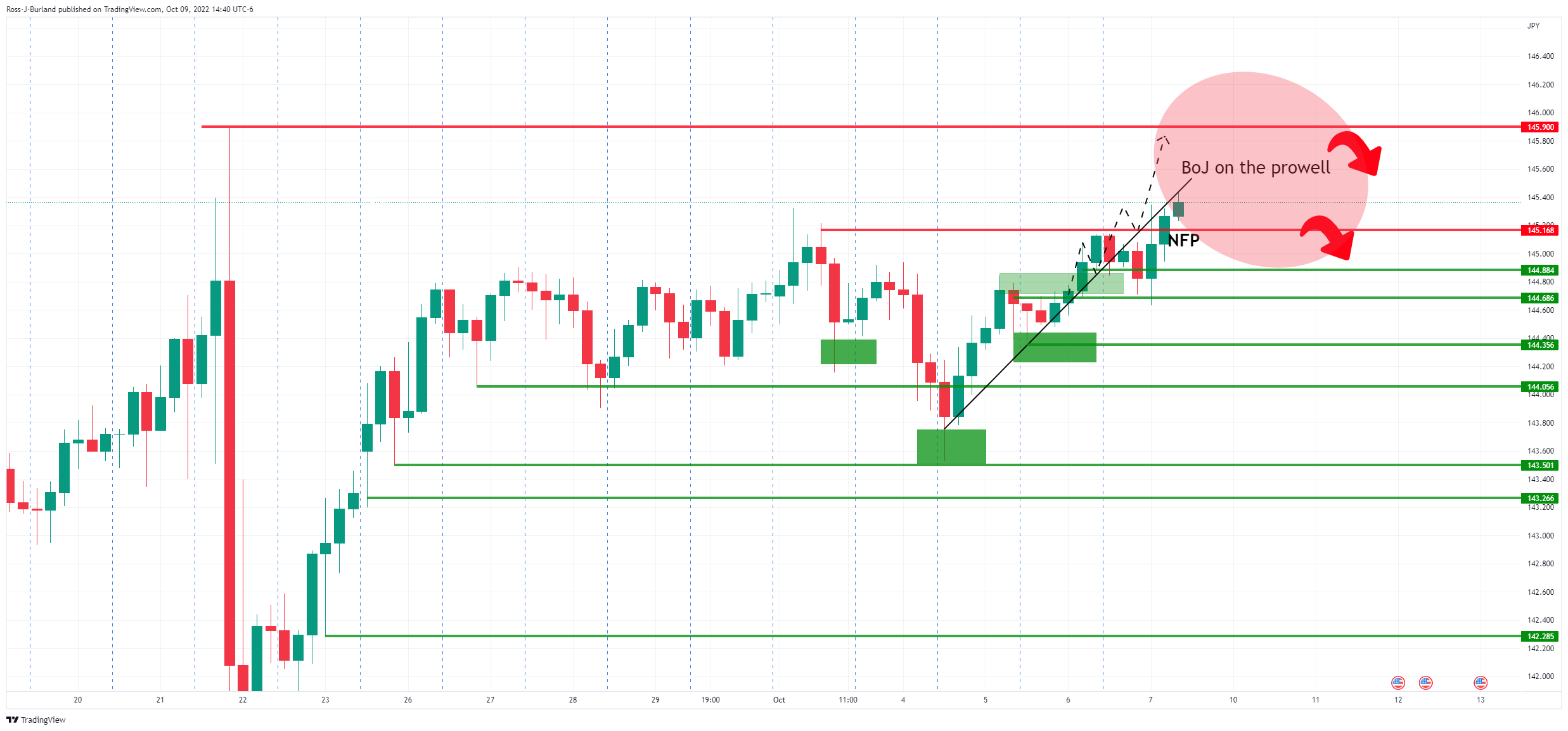

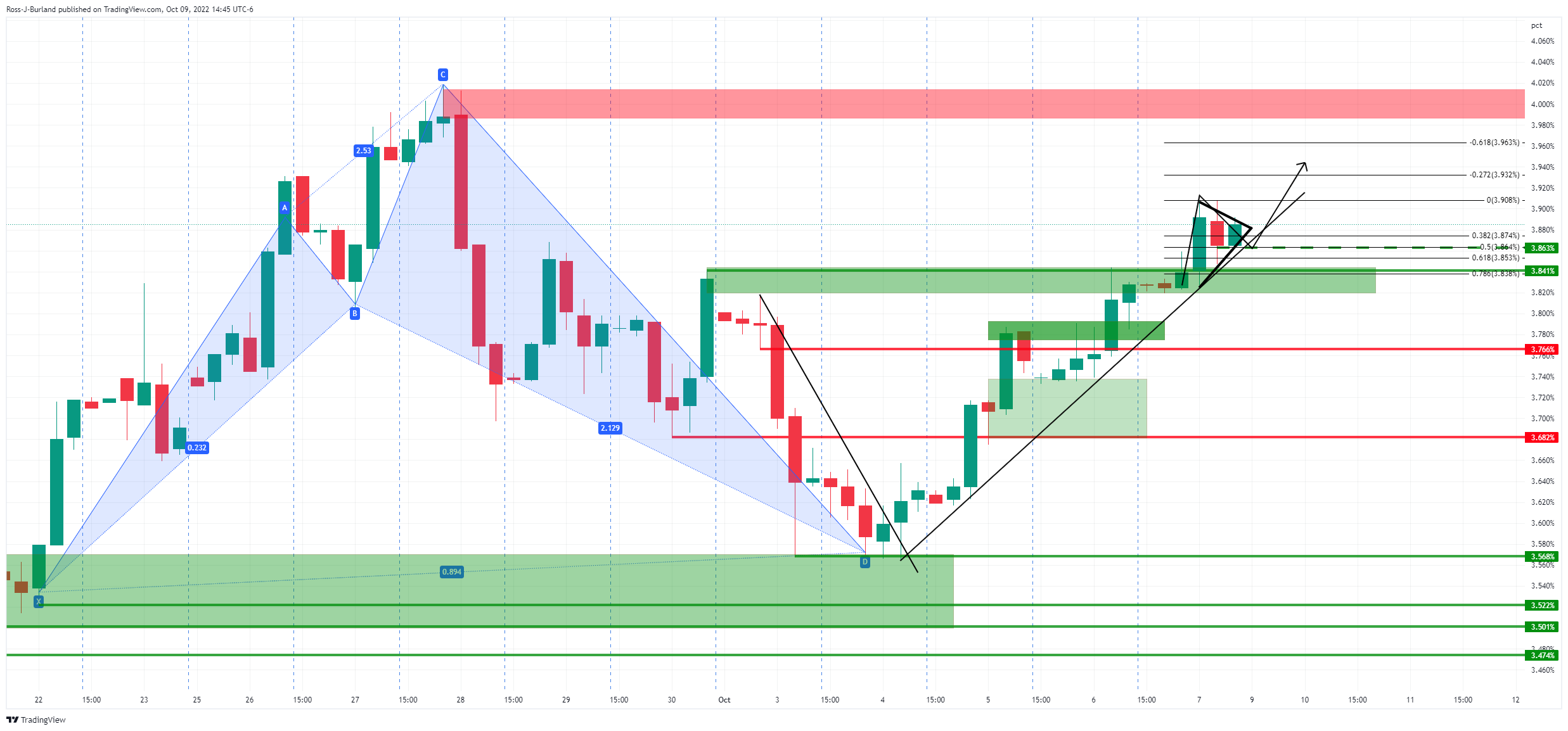

- US dollar falling back into the hands of the bulls with rampant US yields.

- Eyes will be kept on the yen's weakness and US CPI this week.

The US dollar made an impressive comeback on Friday and strengthened against major currencies on the back of US data that showed employers have taken on more workers than expected in September, suggesting the Federal Reserve will likely stick to its aggressive tightening policy for now. The likelihood of ongoing interest rate increases helped drive up the Treasury yields yet again. The dollar index DXY, which tracks the greenback versus a basket of six other major currencies, was up 0.43% by the close of play on Friday and made a high of 112.5882. The yield on benchmark 10-year Treasury notes climbed to a high of 3.908%.

Nonfarm payrolls climbed 263,000, above the consensus estimate for an addition of 250,000 jobs. The service sector added 244,000 jobs, driven by gains in education and health services and leisure and hospitality. The Unemployment Tate fell to 3.5% in September from 3.7% in August, compared with calls for the rate to remain unchanged. The labour force participation rate slipped 0.1 percentage point to 62.3%. This goes against their battle to restore demand-supply-side balance in the labour market in the face of inflation, meaning that strong rate hikes are a given for the foreseeable future and this is a headwind for gold prices vs. a flattening curve. This will make for another critical week for the days ahead with plenty of US calendar events, including the minutes f the prior Fed meeting, US inflation data and Retail Sales.

Markets are currently pricing in a 92% chance of a 75-basis-point increase for next month's Federal Open Market Committee meeting. The remaining 8% probability is for an increase of 50 basis points. US inflation data will be watched closely as well and could prove influential in setting investors' expectations for the Fed. In an effort to tame sky-high inflation, the central bank has hiked its policy rate from near-zero at the beginning of this year to the current range of 3.00% to 3.25%, and last month signalled more large increases were on the way this year. This is underpinning the greenback that seemed to have hit a floor last week as the following techncial analysis below ill show. The DXY is up about 18% for the year so far.

''Core prices likely stayed strong in September, with the series registering another large 0.5% MoM gain,'' analysts at TD Securities said ahead of the CPI data. ''Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% MoM. Our moM forecasts imply 8.2%/6.6% y/y for total/core prices.''

In other events, the FOMC minutes will be released. The September dot plot revealed a higher-than-expected Fed Funds terminal rate of 4.625%, with a fairly even dot distribution around this level. Analysts at TDS said that the ''question is how much of this was reflected in the deliberations at the Sep meeting. The tone of these deliberations likely was more hawkish given core CPI inflation trends, upsetting the current dovish pivot markets narrative.''

BoJ on the prowell

Meanwhile, a potential thorn in the side of the greenback could be the Bank of Japan. The dollar reversed early losses against the Japanese yen last week and that is the risk for US dollar bulls.

The dollar hit a 24-year peak of 145.90 yen last month, which had prompted an intervention by Japanese authorities to shore up the fragile yen. ''USD upside will be harder to achieve at this point in large part because the MOF/BOJ seem intent on squashing USDJPY vol,'' analysts at TD Securities argued.

''So far, that has been successful. Currently, they sit on about $1tn of reserves, so they have some ammo to engage in this operation. We think a move above 145 risks yen-intervention again and that could introduce some USD drag into the complex, albeit temporarily. 140/145 is fair for USDJPY at this time.''

US yields keep on keeping on

The dollar and US Treasury yields surged after the labour report, as investors bet on safe havens:

as seen, the 4-hour chart is showing little signs of deceleration following a move up from a 50% mean reversion of the prior bullish impulse. If the support structure holds, the 4.00% mark will stay on the bull's radar and that will be supportive of the greenback.

Lumber prices the canary n the coal mine?

The break of the head and shoulders neckline and move in on the M-formation's neckline are bullish prospects within the bullish rising wedge in lumber prices. The rate hikes that had hurt the housing market could be a tide that is turning. Lumber prices had dropped 70% year-to-date as mortgage rates jumped through the 5% threshold.

Meanwhile, we have seen a 62% retracement in the September rally and an attempt to move higher again on the front side of a dynamic supporting trendline that is yet to give. There is a price imbalance in the grey area around 114.00 that the bulls can target for the week ahead into the Consumer Price Index (CPI).

Also to keep in mind, the US dollar has been gaining against China's offshore yuan USDCNH and it is set to continue doing so as China's economy struggles under the weight of ongoing COVID outbreaks and lockdowns. We saw more evidence of that in the weekend's Caixin Services Purchasing Managers' Index (PMI) for September 2022 which came in lower at 49.3 from 55.0 in August, taking it back into contraction. We have also seen China official services PMI miss the mark at 50.6 (expected 52.0, prior 52.6) and China Caixin / Markit Manufacturing PMI for September was disappointing at 48.1 (expected 49.5, prior 49.5). this all should fall into the hands o the greenback, especially with the number of geopolitical risks thrown into the mix.

US dollar H4 chart

The US dollar broke above last week's lows of around 112.75 which is a bullish feature for the week ahead that leaves 114.00 on the radar as long as 111.95/55 holds:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.