- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 11-10-2016.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1054 -0,75%

GBP/USD $1,2116 -2,04%

USD/CHF Chf0,9883 +0,58%

USD/JPY Y103,54 -0,38%

EUR/JPY Y114,45 -0,85%

GBP/JPY Y125,43 -2,14%

AUD/USD $0,7535 -0,93%

NZD/USD $0,7052 -1,23%

USD/CAD C$1,3253 +0,68%

06:00 Japan Prelim Machine Tool Orders, y/y September -8.4%

09:00 Eurozone Industrial production, (MoM) August -1.1% 1.5%

09:00 Eurozone Industrial Production (YoY) August -0.5% 1.1%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October 2.7

12:00 U.S. FOMC Member Dudley Speak

13:40 U.S. FOMC Member Esther George Speaks

14:00 U.S. JOLTs Job Openings August 5.871 5.72

18:00 U.S. FOMC meeting minutes

21:30 New Zealand Business NZ PMI September 55.1

The cost of oil futures declined moderately, departing from the multi-month highs, which was caused by the publication International Energy Agency's report.

The IEA report says that world oil supply rose in September, but it was noticed the decline in world oil reserves. "Forecast of supply and demand suggests that the market itself will remain in a supersaturated state during the first half of next year if OPEC will stick to the set threshold production, market re-balancing can occur more quickly". In addition, the IEA revised its forecast for oil demand in 2016 to 96.3 million barrels a day, which implies an increase of 1.2 million.

According to Goldman Sachs, oil prices may return to $ 43 a barrel if the oil-producing countries fail to agree on production cuts, as the excess supply in the market will continue for the 4th quarter of 2016. Experts believe that despite the "increased likelihood of" the conclusion of the planned agreement on limiting production OPEC and producers outside the cartel, including Russia, any reduction in its volume will not be enough to balance the market in 2017. "The increase in production in Libya, Nigeria and Iraq, reducing the chances that such an agreement would lead to balancing the market in 2017."

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 50.74 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 52.20 dollars a barrel on the London Stock Exchange ICE Futures Europe.

EUR/USD: 1.1000 (EUR 1.96bln) 1.1100 (509m)1.1225-30 (868m) 1.1255 (270m) 1.1275 (247m) 1.1285-90 (503m)

USD/JPY: 101.50-55 (USD 566m) 102.25 (476m) 102.80 (303m) 102.90-103.00 (1.12bln) 103.50 (405m)

AUD/USD: 0.7500 (AUD 424m) 0.7548-50 (522m) 0.7575 (226m) 0.7730 (269m) 0.7750 (350m)

USD/CAD: 1.2815 (USD 205m) 1.3005-10($262mn)

USD/SGD: 1.3500 (USD 600m) 1.3700 (1.03bn)

"EUR/USD failure to stabilize above a projected E-wave target at 1.1347 (int. 61.8 %) seven weeks ago leaves EUR/USD at great risk of having completed a 1 ½ year old consolidation triangle with very negative implications.

Only a break above 1.1367 (August high) and ultimately above 1.1426/50 (pivot/int. 76.4 %) would constitute a game change in favor of a re-test of former highs at 1.1617 and at 1.1712 with the option to extend to the classical wave IV target on big scale at 1.1811 (int. 38.2 % on highest scale).

So considering the classical overshooting at 76.4 % retracements it would most likely take a break above the 1.1500 handle to eliminate the imminent sell-off risk. It would take breaks above 1.1876 and 1.2042 (2010 & 2012 lows) though to call for a long-term trend reversal.

In the short.-run we are now watching the daily triangle between 1.1313 and 1.1056 closely as a breakout would provide an early indication whether we are dealing with a stronger recovery or with the potential resumption of the downtrend.

A decisive hourly close above 1.1347 (i.e. above 1.1370) would thereafter bring 1.1426/50 (pivot/int. 76.4 %) and possibly former highs at 1.1617 and 1.1712 back into focus whereas breaks below 1.1056/49 (daily triangle/minor 76.4 %) would challenge the essential countertrend decline target zone between 1.0782 and 1.0710 (int. 76.4 % on higher scale/pivot).

It would take a break below the latter though to confirm the resumption of the long-term downtrend in favor of an extension to 1.0072 (76.4 % of the 2000-2008 rally) and to wave 3 projections between 0.9652 and 0.9298".

Copyright © 2016 eFXplus™

-

Calls on Greece To Speed Up Completion Of Bailout Review

The trend measure of housing starts in Canada was 199,503 units in September compared to 196,465 in August, according to Canada Mortgage and Housing Corporation (CMHC). The trend is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"Housing starts were on an upward trend in September, as residential construction increased across the country with the exception of Ontario, where the multiples segment softened to levels that are more consistent with household formation," said Bob Dugan, CMHC Chief Economist. "Quebec saw the largest gain in housing starts due to the development of new rental apartments intended for seniors. That said, Quebec's growing apartment stock emphasizes the importance of inventory management."

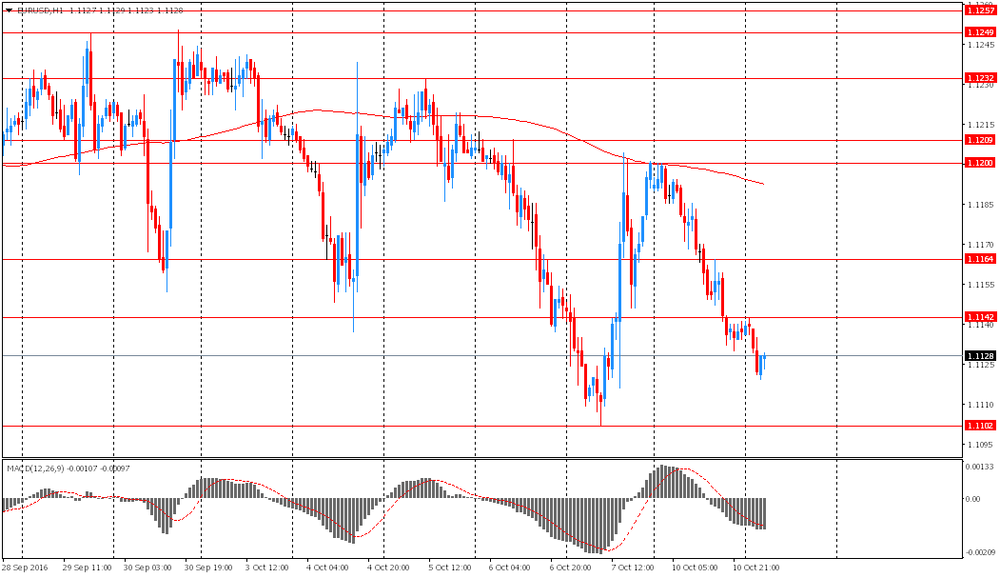

EUR/USD

Offers : 1.1130 1.1150 1.1180 1.1200 1.1220 1.1235 1.1250 1.1280 1.1300

Bids : 1.1100 1.1080-85 1.1050 1.1030 1.1000

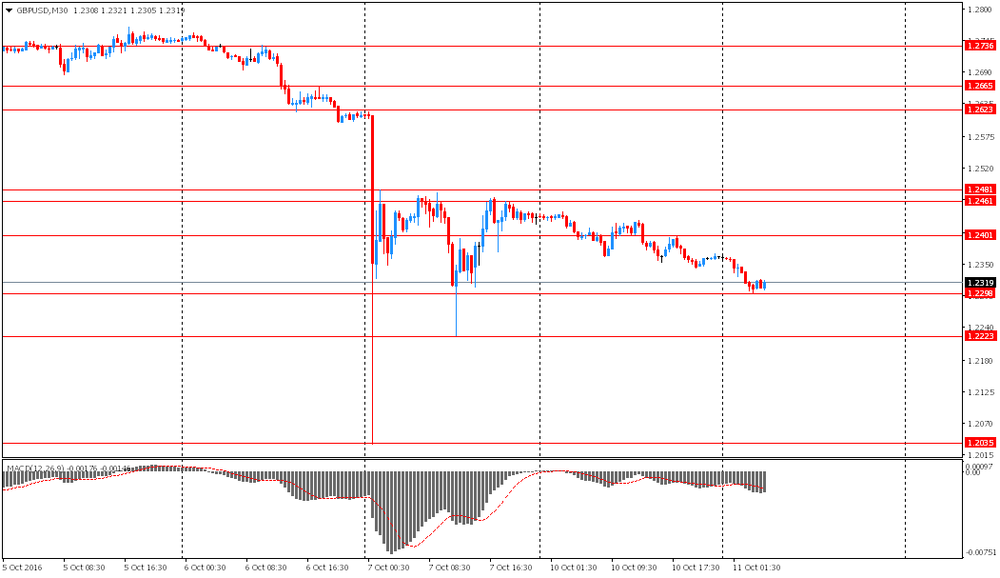

GBP/USD

Offers : 1.2325-30 1.2350 1.2380 1.2400 1.2430 1.2445-50 1.2480 1.2500

Bids : 1.2250 1.2230-35 1.2200 1.2160 1.2100 1.2085 1.2050 1.2000

EUR/GBP

Offers : 0.9055 0.9085 0.9100 0.9155 0.9200 0.9220 0.9250 0.9285 0.9300

Bids : 0.9030 0.9000-10 0.8985 0.8960-65 0.8900 0.8850-55 0.8835 0.8800

EUR/JPY

Offers : 115.80 116.00 116.25-30 116.50 117.00 117.30 117.50 118.00

Bids : 115.20 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers : 104.00-05 104.20 104.30 104.50 104.80 105.00

Bids : 103.65 103.50 103.30 103.00 102.80-85 102.70 102.50 102.25-30 102.00

AUD/USD

Offers : 0.7585 0.7600 0.7630 0.7650 0.7685 0.7700 0.7720

Bids : 0.7550 0.7530-40 0.7500 0.7485 0.7450 0.7420-25 0.7400

-

Theoretical Risk QE's Distributional Effects Could Reduce Effectiveness

The ZEW Indicator of Economic Sentiment for Germany increased in October 2016. The index gained 5.7 points compared to the previous month, now standing at a level of 6.2 points (long-term average: 24.1 points). "The improved economic sentiment is a sign of a relatively robust economic activity in Germany. However, positive impulses from industry and exports should not distract from existing political and economic risks. In particular, the risks concerning the German banking sector are currently a burden to the economic outlook," comments ZEW President Professor Achim Wambach.

The assessment of the current situation in Germany has also increased. Gaining 4.4 points, the index now stands at 59.5 points.

Financial market experts' sentiment concerning the economic development of the eurozone has improved notably. The respective indicator has increased by 6.9 points to a reading of 12.3 points. On the other hand, the indicator for the current situation in the eurozone declined by 2.3 points in October 2016 to a level of minus 12.8 points.

"Volatility in euro markets rose last week on media reports, that the ECB may be discussing tapering its asset purchase program, scheduled to end in March 2017. However, such speculation was quickly denied by Vice President Vitor Constancio. The ECB's communication this week, including speeches by ECB's Mersch (Tuesday, Wednesday) and Coeure (Wednesday) will likely also attempt to curb speculation of premature tapering. A unified message regarding the ECB's ability to continue easing should keep EURUSD in check, in our view. We continue to envision EURUSD at 1.08 by year-end.

The accounts of the GC meeting released last week offer some comfort to our view that the ECB will announce changes to the technical parameters and an extension of QE beyond March 2017, at its December meeting (see ECB minutes: Monetary support still warranted, 6 October 2016). At this stage, we think changes to the size or composition of the PSPP are unlikely before March 2017 and in any case with related communication that reassures markets that policy will remain accommodative for the foreseeable future (see ECB Watching: Reducing QE is not tapering).

In other words, the ECB faces a communications challenge that will be crucial for the future path of the EUR and euro area rates. The challenge is essentially to succeed where the Fed did not during the Taper Tantrum, by convincing markets that a slower pace of balance sheet expansion is still stimulatory".

Copyright © 2016 Barclays Capital, eFXnews™

According to rttnews, Romania's consumer prices decreased at a faster-than-expected pace in September, figures from the National Institute of Statistics showed Tuesday.

The consumer price index dropped 0.6 percent year-over-year in September, following a 0.2 percent fall in August. It was forecast to decline at a stable pace of 0.2 percent.

Prices of non-food products fell 1.1 percent annually in September and costs for services by 1.2 percent. A the same time, grocery prices rose 0.5 percent.

On a monthly basis, consumer prices edged down 0.1 percent in September, defying economists' expectations for an increase of 0.3 percent.

EUR/USD: 1.1000 (EUR 1.96bln) 1.1100 (509m)1.1225-30 (868m) 1.1255 (270m) 1.1275 (247m) 1.1285-90 (503m)

USD/JPY: 101.50-55 (USD 566m) 102.25 (476m) 102.80 (303m) 102.90-103.00 (1.12bln) 103.50 (405m)

AUD/USD: 0.7500 (AUD 424m) 0.7548-50 (522m) 0.7575 (226m) 0.7730 (269m) 0.7750 (350m)

USD/CAD: 1.2815 (USD 205m) 1.3005-10($262mn)

USD/SGD: 1.3500 (USD 600m) 1.3700 (1.03bn)

-

At 09:00 GMT the Bank of England Member of the Commission Michael Saunders will make a speech

-

At 16:00 GMT the ECB member Yves Mersch of the Board will make a speech

EUR/USD

Resistance levels (open interest**, contracts)

$1.1299 (2159)

$1.1245 (2061)

$1.1210 (248)

Price at time of writing this review: $1.1126

Support levels (open interest**, contracts):

$1.1074 (3137)

$1.1043 (3900)

$1.1009 (4032)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32060 contracts, with the maximum number of contracts with strike price $1,1300 (3780);

- Overall open interest on the PUT options with the expiration date November, 4 is 38122 contracts, with the maximum number of contracts with strike price $1,0950 (4567);

- The ratio of PUT/CALL was 1.19 versus 1.13 from the previous trading day according to data from October, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.2606 (1047)

$1.2509 (468)

$1.2413 (317)

Price at time of writing this review: $1.2317

Support levels (open interest**, contracts):

$1.2287 (602)

$1.2191 (575)

$1.2094 (1062)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 22700 contracts, with the maximum number of contracts with strike price $1,2800 (2258);

- Overall open interest on the PUT options with the expiration date November, 4 is 23555 contracts, with the maximum number of contracts with strike price $1,2600 (1487);

- The ratio of PUT/CALL was 1.04 versus 1.03 from the previous trading day according to data from October, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

"GBP was front and center last week as the currency has broken a primary trendline formed across the lows since '93 (1.2788)

Going back even further, GBPUSD started a multi-year corrective process at the peak in '07, within which it is currently in the later stages of a final C wave. Because of the impulsive nature of wave A (from '07 through '08), it's actually not too surprising to see an equally impulsive sell-off in wave C (since Jun. '14).

In the nearer term, it may have just recently completed a 3 rd of 5-waves from Jun. '14 (i.e. within the larger degree C leg). It has come close enough to reaching the ideal target at 1.1681 (1.618 from Jul. '15). '

As such, a period of counter-trend corrective price action seems likely, before the next leg lower. Put another way, it's now likely based and started a corrective process/ 4 th wave.

A 4 th wave typically retraces back into wave iv/3 territory; in this case 1.2798-1.3445. It also often retraces between 23.6% and 38.2% of the length of wave 3; also ~1.28 and 1.34.

Bottom line, GBPUSD may consolidate in the near-term, but it is likely to continue declining over time".

Copyright © 2016 Goldman Sachs, eFXnews™

The New Zealand dollar has fallen vs the US dollar on the backdrop of today's speech by Deputy Governor of the Reserve Bank of New Zealand, Mr. McDermott. The official noted that the quarterly inflation rate in September was likely low, to the lower boundary of the minimum target range. In addition, McDermott has suggested that further easing of the monetary policy is posible in the future, until inflation stabilized in the middle of the target range.

The yen fell despite the positive data on the balance of payments of Japan. The Current Account released by Japan's Ministry of Finance, in August was Y2000,8 bln, higher than forecast (Y1502,7 bln) and the previous value of Y1938,2 billion. The high value of the index is a positive factor for the Japanese currency. The report noted that in August, Japan's largest current account surplus in the balance of payments since 2007 has been registered. The overall rate increased due to improved foreign trade balance due to lower import prices.

Today, Charles Evans said that the Fed has made progress with employment, but the situation remains unsatisfactory with inflation. Evans said that US will probably not have reached full employment. "More underutilized production capacities observed in the labor market", - said the representative of the Federal Reserve. He also added that the natural rate of unemployment is around 4.7%, but it is likely that unemployment will reach 4.5% by 2020.

EUR / USD: during the Asian session the pair fell to $ 1.1120

GBP / USD: during the Asian session the pair fell to $ 1.2300

USD / JPY: rose to Y104.00 in the Asian session

-

High US Dollar Has Been Headwind to Economy

-

Decision on Rates will Come Down to Job Market, Inflation

-

Wouldn't Be Surprised If He Was Agreeble to December Hike

-

Might be Well Served to Wait for Inflation Pickup

-

Good GDP Growth in 2H

-

Non-Farm Payrolls Report was a Good Number

-

US Economy on Solid Footing

During his speech today Deputy Governor of the Reserve Bank of New Zealand, noted that quarterly inflation rate in September was likely low, to the lower boundary of the minimum target range. In addition, McDermott has suggested that further easing of the monetary policy is posible in the future, until inflation stabilized in the middle of the target range.

Business confidence in Australia was fairly unchanged in September, the latest survey from National Australia Bank revealed on Tuesday with an index score of +6.

That was unchanged from the August reading, although it beat forecasts for +5.

The index for business conditions came in at +8, topping expectations for +7, which would have been unchanged.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.