- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 13-01-2023.

- USD/CAD finished Friday’s session with gains, though it faltered to clear 1.3400.

- USD/CAD Price Analysis: Exposed to selling pressure below 1.3400.

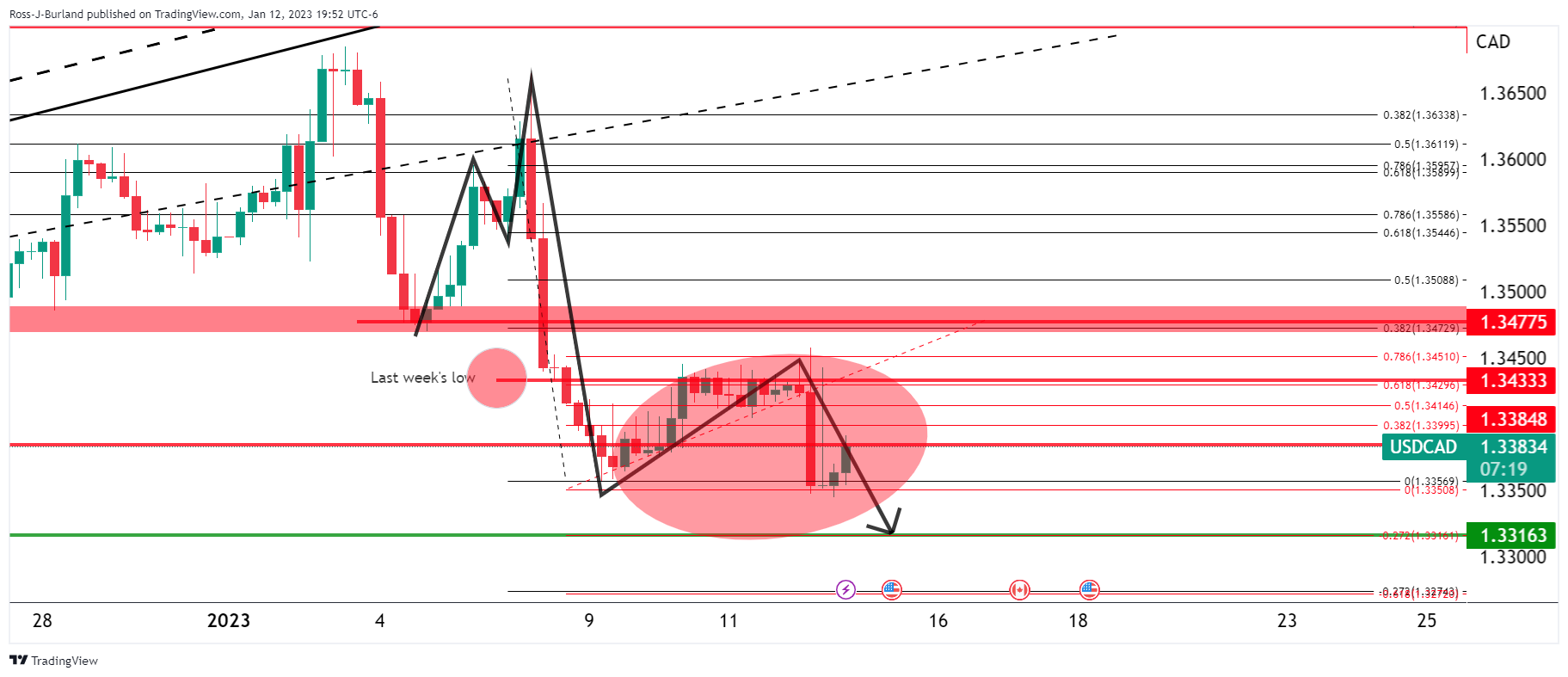

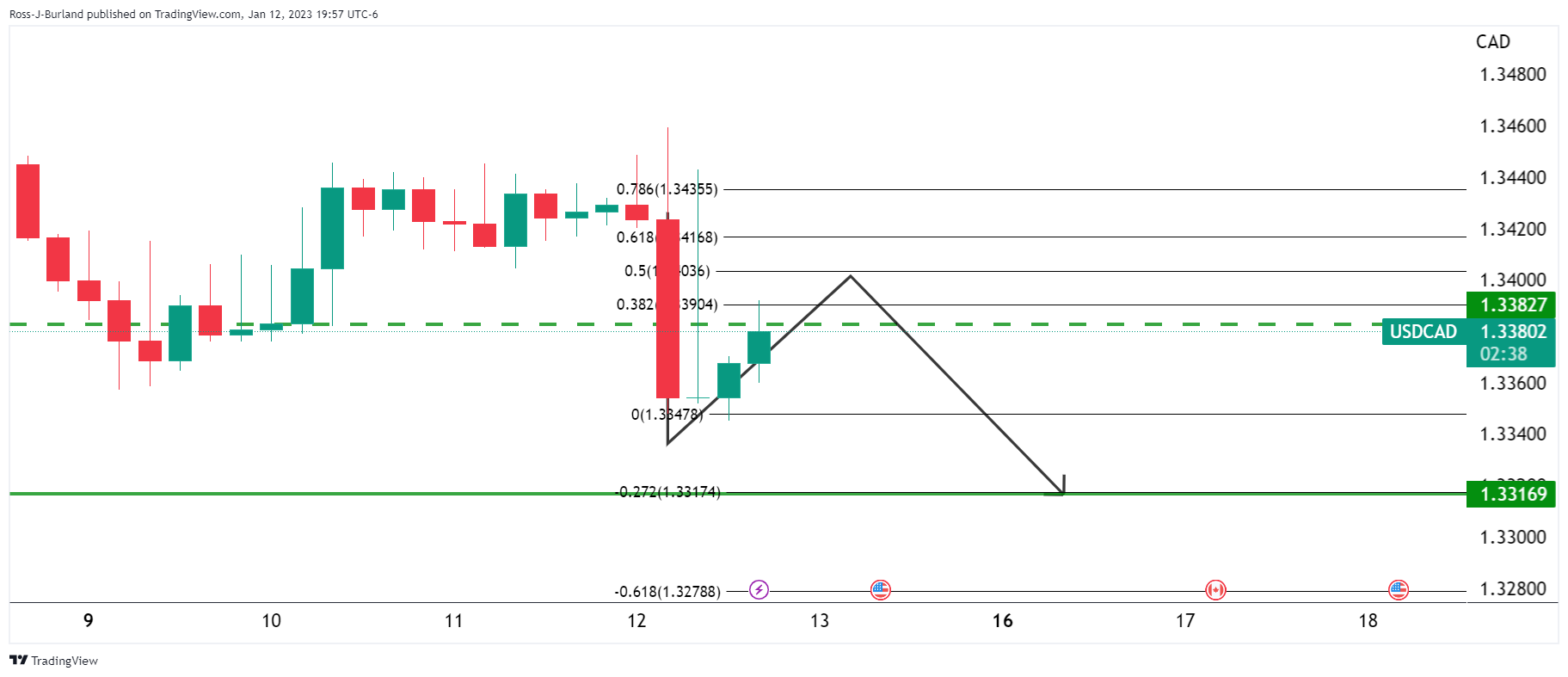

The USD/CAD prolonged its weekly losses and tumbled for the fourth consecutive week, losing 0.36%, but on the day, the USD/CAD is up 0.22%. After the University of Michigan (UoM) Consumer Sentiment release showed that sentiment improved, it weighed on the US Dollar (USD). Therefore, the USD/CAD is trading at 1.3393, below its opening price by 0.37%.

USD/CAD Price Analysis: Technical outlook

Once the USD/CAD dropped below the 100-day Exponential Moving Average (EMA) at 1.3425, it was the seller’s excuse to drag the exchange rate below the 1.3400 mark. The Relative Strength Index (RSI) is still in bearish territory, suggesting that sellers are in charge. The Rate of Change (RoC) shows sellers are gathering momentum, as they outweighed buyers in Friday’s session, though it wasn’t enough to keep the pair in the green.

The USD/CAD first support level would be the November 24 daily low of 1.3316. A breach of the latter will expose the 200-day Exponential Moving Average (EMA) at 1.3239, followed by the 1.3200 figure.

On the other hand, the USD/CAD first resistance would be 1.3400. Once cleared, the bear’s next line of defense would be the 100-day EMA at 1.3425, ahead of the confluence of the 20-day EMA and the 1.3500 mark.

USD/CAD Key Technical Levels

- NZD/USD finished the week with solid gains of 0.6700%, spurred by softer US CPI data.

- Consumer inflation expectations in the US edged lower and weighed on the US Dollar.

- NZD/USD Technical Analysis: Failure at 0.6400, cheered by sellers, eyeing a fall to 0.6300.

The NZD/USD retraced after testing the current week’s high of 0.6417, dropped beneath the 0.6400 mark, as the pair consolidated in the 0.6300-0.6420 range during the last week’s. Positive US consumer sentiment readings proved to be harmful to the American Dollar (USD), which will end the week on a lower note. At the time of writing, the NZD/USD spot price is 0.6389, slightly down by 0.03%.

NZD/USD trimmed its daily gains, despite a risk-on impulse

Wall Street held to its gains as the week came to an end. The release of US inflation data on Thursday was cheered by investors and spurred hopes for slower rate hikes by the US Federal Reserve (Fed), weakening the US Dollar (USD). The CME FedWatchTool shows that the Fed’s probabilities for a 25 bps rate hike lie at 94.2%, which would lift the Federal Funds rate(FFR) to the 4.50% - 4.75% range.

The University of Michigan (UoM) Consumer Sentiment survey showed that sentiment improved, exceeding expectations of 60.5, coming at 64.6. Meanwhile, Americans’ inflation expectations for one year were revised to 4% from 4.4% in December, while for a five-year horizon, inflation is estimated to reach 3% from 2.9% in the previous month.

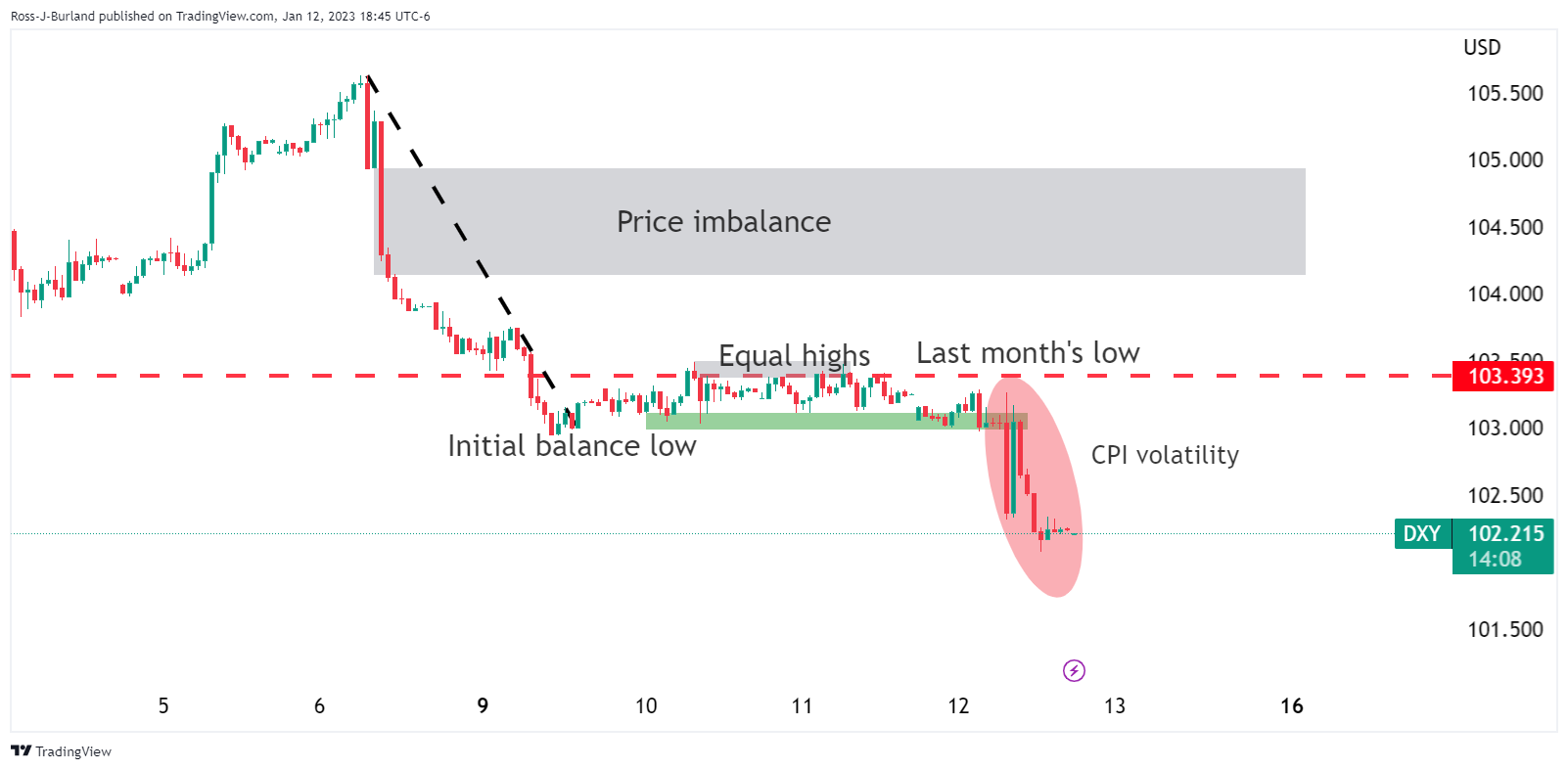

Elsewhere, the US Dollar Index (DXY), which measures the buck’s performance against a basket of six rivals, erases its earlier gains, down 0.06%, at 102.184.

NZD/USD Technical Analysis

Therefore, the NZD/USD shifted downwards though it remained supported by the 20-day Exponential Moving Average (EMA) around0.6329. Nevertheless, failure at 0.6400 exposed the NZD/USD to further selling pressure, with bears eyeing a break below the 20-day EMA ahead of testing the 0.6300 mark.

On the flip side, if the NZD/USD reclaims 0.6400, that could set the pair poised to test December 2022 high at 0.6513.

NZD/USD Key Technical Levels

- USD/CHF retraced earlier gains after printing a daily high of 0.9316.

- Upbeat US economic data is bad for the greenback as the US Dollar weakens.

- USD/CHF Price Analysis: A break / daily close below 0.9300 would expose the pair to further selling pressure.

The USD/CHF is trading below its opening price, though it failed to crack the 20-day Exponential Moving Average (EMA) and missed to hold to 0.9300, albeit upbeat US data crossed newswires. Therefore, the USD/CHF is exchanging hands at 0.9265 at the time of writing.

Wall Street has resumed its uptrend after a brief hiccup that witnessed the S&P 500 and the Nasdaq turning red. Thursday’s release of softer inflation in the United States (US) spurred hopes for a less aggressive US Federal Reserve (Fed); hence the US Dollar (USD) weakened. A University of Michigan (UoM) survey showed that consumer sentiment improved, as it exceeded estimates of 60.5, hitting 64.6. In the same poll, inflation expectations for one year were revised to 4% from 4.4% in December, while for a five-year horizon, inflation is foreseen to hit 3% from 2.9% in the previous month.

In the meantime, the US Dollar Index (DXY), which measures the buck’s performance against a basket of six rivals, erases its earlier gains, down 0.04%, at 102.201.

During the session, the USD/CHF cleared the 20-day EMA at 0.9293 and cleared the 0.9300 mark. Nevertheless, as the greenback weakened, the major retreated those gains and is tumbling to fresh two-day lows around 0.9255.

USD/CHF Price Analysis: Technical outlook

From a technical perspective, the USD/CHF would likely continue its downtrend, though it’s fair to say that if not for the US CPI report missing estimates, the USD/CHF had momentum, and it could have tested the 50-day EMA at 0.9405. Aside from this, oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that sellers remain in charge. Therefore, the USD/CHF key support levels would be 0.9200, followed by the current week’s low of 0.9167, ahead of the 2022 low of 0.9091.

- Consumer Sentiment in the United States improved and capped AUD/USD rally.

- The US last inflation report, spurred speculation that the Fed would decelerate the pace of interest rate increases.

- Improvement in Australia – China relations is a tailwind for the Australian Dollar.

The Australian Dollar (AUD) hit a fresh six-month high against the US Dollar (USD) on Friday, though it has paired some of its earlier gains, albeit Thursday’s US data showed that inflation continued to grind lower. Therefore, the AUD/USD is trading at 0.6964, almost flat at the time of typing.

Investors’ mood is mixed as US equities fluctuate between gains/losses. Hence, the AUD/USD erased its earlier gains, albeit a slowdown in core inflation data in the US suggests the US Federal Reserve might slow the pace of rate hikes ahead of the February 1 decision.

In the meantime, the US economic docket featured the Consumer Sentiment, revealed by a poll of the University of Michigan, showed an improvement, exceeding estimates of 60.5, hitting 64.6. Delving into the report, inflation expectations by US consumers were mixed, reduced in the near term, while uptick to 3% from 2.9% for a five-year period.

“Inflation is easing in the US, with markets taking that as a sign that the Fed will be able to pause, and that as the economy starts to react to the monetary tightening put into place, the Fed will cut rates in the second half of the year,” NAB analysts said.

Meanwhile, a hotter-than-expected CPI reading in Australia augmented speculations for further tightening by the Reserve Bank of Australia (RBA), bolstering the AUD/USD to fresh multi-month highs. However, money market futures shifted on the release of US CPI data, and traders expect rates to peak at around 3.73%, from 4% last week.

Another factor that underpinned the AUD was China’s easing restrictions on coal imports, which should be positive as the largest Asian economy reopens.

What to watch?

Australia: the calendar will feature Building Permits, inflation data, Consumer Confidence, and employment data.

United States: the docket will unveil Fed speaking, Retail Sales, the Producer Price Index, and housing data.

AUD/USD Key Technical Levels

Analysts at MUFG Bank have a bullish outlook for the EUR/CHF cross, considering it could benefit from a further scaling back of fears over recession in the Eurozone.

Key quotes:

“After trading within a narrow range between 0.9800 and 0.9950 throughout most of Q4, the pair has broken higher in recent days as it first climbed above the 200-day moving average at 0.9940 and then above parity for the first time since the middle of last year. We expect a further move higher back towards levels that were in place during Q2 of last year between 1.0200 and 1.0500.”

“The release today of the latest German GDP data for Q4 has provided further evidence that euro-zone economies are proving more resilient over the winter period.”

“Given the CHF’s role as a regional safe haven currency, the CHF should weaken as downside risks in the euro-zone continue to ease. We also believe there is room for EUR/CHF to play catch up with the move higher in EUR/USD since late last year. The SNB has been intervening to support the CHF recently. With inflation pressure globally and in Switzerland now easing, the SNB could become more tolerant of allowing the CHF to weaken somewhat.”

According to analysts at MUFG Bank, the Japanese Yen is set to gain further ground on the back of monetary policy expectations from the Bank of Japan. They consider possible a slide under 120.00 for later in 2023.

Key quotes:

“USD/JPY has fallen further still today and is now 15.5% down from the peak on 21st October – each of the three months in Q4 brought reason to buy the yen – intervention by the BoJ in October and November and the YCC change in December. On top of that US inflation has fallen faster than expected. Will we get another clear reason to sell USD/JPY in January too? That looks very plausible at this juncture. YCC as a policy is only sustainable if credible and has the confidence of the market. That confidence is unravelling quickly.”

“USD/JPY today broke below the 61.8% Fibonacci level (128.61) of the retracement of the entire move from March last year to the high in October and suggests further downside ahead. Positioning could be turning excessive in anticipation of a YCC change next week so a risk of a near-term correction is increasing. Nonetheless, the downside move suggests a complete reversal of the 2022 move is feasible this year implying levels below 120.00 are plausible for later this year.”

Data released on Friday showed a significant increase in Consumer Confidence in January according to the preliminary report from the University of Michigan. Analysts at Wells Fargo point out the 64.6 reading for consumer sentiment in January marks the top print in the past year. The see that the relief on the inflation front and wage growth are lifting spirits, but warn the still-sour buying conditions suggest the good vibes in this report may not translate into a spending surge.

Key quotes:

“Consumers may not feel awesome about their finances, but they are undoubtedly less worried than they were when gas prices were north of $4/gallon and wage growth wasn't keeping up with inflation. Current assessments of personal finances surged 16% to its highest reading in eight months thanks to higher incomes and easing inflation...and a bit of a bounce in the stock market certainly did not hurt either.”

“The euphoria did not extend to the housing market. Home buying conditions improved slightly but are still very near the lowest levels on record. Elsewhere, buying conditions improved somewhat in January, potentially on the back of some recent reprieve in inflation, but a majority of households still view it as a bad time to buy a major household item or vehicle. We take this as a sign that higher financing costs are weighing on the purchases of these traditionally bigger ticket items. More plainly, the good vibes in this report may not translate into a spending surge.”

“The consumer price data for December showed signs that inflation is continuing to slow and thus suggest the Fed will slow the pace of tightening at its next policy meeting on February 1 by electing to bring the federal funds rate up just 25 bps.”

- US Consumer Sentiment improved, while inflation expectations edged lower.

- UK’s GDP for the fourth quarter contracted and flashed a gloomy economic outlook.

- GBP/USD traders are eyeing UK CPI, Retail Sales, and US Retail Sales data.

The Pound Sterling (GBP) slid slightly vs. the US Dollar (USD) Friday, following the release of the University of Michigan (UoM) Consumer Sentiment for January in the US, which exceeded estimates, while the poll showed that inflation expectations for one-year were downward revised. At the time of writing, the GBP/USD is trading at 1.2204 after hitting a daily low of 1.2150.

GBP/USD range-bound awaiting next week’s data

The GBP/USD languished late in the European session/early New York session after printing a four-week high. Data released on Thursday flashed that inflation in the United States (US) is indeed cooling down. With December’s Consumer Price Index (CPI) dropping beneath 7% and core CPI below 6%, spurring hopes that the US Federal Reserve would shift to lower-sized rate hikes, in the amount of 25 bps.

Later, the University of Michigan (UoM) revealed that Consumer sentiment for January was better than expected, with the reading hitting 64.6 vs. forecasts of 60.5. Americans estimate inflation for one year would edge to 4%, from December’s 4.4%, while estimates for five years uptick to 3%, from 2.9%.

In the UK, the Gross Domestic Product (GDP) on a monthly basis beat estimates, rising by 0.1%, while for a three-month changed was at -0.3%, cementing the case for a gloomy economic outlook.

Looking ahead to next week, the UK economic docket will feature labor market data, the Consumer Price Index, and Retail Sales. Across the pond, the US economic docket will unveil Retail Sales, US Housing Starts, Initial Jobless Claims, and Existing Home Sales.

GBP/USD Key Technical Levels

- EUR/USD about to post the highest weekly close since May 2022.

- US Dollar back under pressure, heads for sharp weekly losses.

- US Consumer Confidence rises more than expected in January.

The EUR/USD trimmed daily losses during Friday’s American session, rising back above 1.0800. The euro was holding onto significant weekly gains, headed toward the biggest close since May 2022.

US Dollar recovers but remains under pressure

The US Dollar rebounded modestly on Friday after a sharp decline the day before, following US inflation data. The numbers showed the Consumer Price Index slowed down further in December, increasing expectations that the Federal Reserve will hike by 25 basis points in February, instead of 50 bps.

Data released on Friday showed the University of Michigan Consumer Sentiment Index rose in January to 64.6, surpassing expectations of 60.5 and above the 59.7 of December. The numbers helped risk appetite but not the Dollar that pulled back.

EUR/USD resumes uptrend

After pulling back last week, EUR/USD resumed the upside breaking the 1.0700 area decisively. The chart shows the euro clearly bullish but many technical indicators are in overbought territory.

“Should the pair advance beyond 1.0870, the bullish case will gain adepts. 1.0950 and 1.1020 are the next resistance levels to watch, ahead of the afore mentioned 1.1106. A daily close below 1.0745 will discourage buyers, and could trigger a downward corrective extension, initially towards 1.0640 and later to 1.0515, the 50% retracement of the 2022 slump”, says Valeria Bednarik, Chief Analyst at FXStreet.

Technical levels

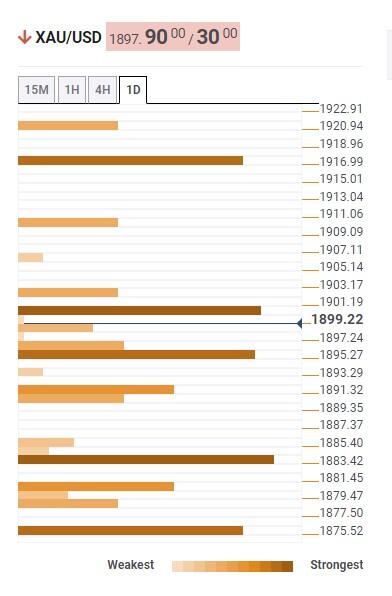

Gold has climbed above $1,900 for the first time in seven months ahead of the weekend. But the technical outlook suggests XAU/USD eyes correction before extending rally, FXStreet’s Eren Sengezer reports.

$1,880 aligns as initial support

“XAU/USD's near-term technical outlook points to overbought conditions with the pair trading slightly above the ascending regression channel coming from early November and the daily Relative Strength Index (RSI) holding above 70. Hence, Gold could stage a technical correction before extending its uptrend.”

“On the downside, $1,880 aligns as initial support ahead of $1,860. In case the latter support fails, XAU/USD could continue to fall toward $1,830.”

“In case Gold price stabilizes above $1,900 and confirms that level as support, it could target $1,920, $1,940 and $1,960, all static levels from April 2022.”

Economists at TD Securities think the Yen will trade with an asymmetric bias that is tilted to the upside.

EUR/JPY: Downside towards 130 in the coming months is likely

“With the Fed ceding leadership on policy to the ECB and the BoJ, JPY trading bias remains asymmetric and with considerable room for gains.”

“We expect USD/JPY to register a 120-125 handle this quarter. We think rallies to 133/134 in will make for an attractive short.”

“We are biased to appreciable strategic EUR/JPY downside towards 130 in the coming months.”

- Gold price continued to extend its weekly gains, above the $1,900 mark.

- Trader’s speculations that the US Federal Reserve would slow rate hikes pace boosted Gold prices.

- Gold Price Analysis: Daily close above $1,920 could pave the way toward $2,000.

Gold price hit a new 9-month high at $1,913.18 on Friday, amidst investors’ speculations that the US Federal Reserve (Fed) could shift to a less aggressive stance following the release of softer inflation data. Therefore, XAU/USD is trading at $1,912, gains 0.82%, headed for a fourth consecutive week of gains.

XAU/USD got bolstered by speculations of a less hawkish Fed, falling US bond yields

Global equities remain mixed, while Wall Street is headed for a soft opening. Earnings season began in the United States (US), with banks like Bank of America and JP Morgan topping expectations, while Wells Fargo missed estimates, as reported by Q4 results. Thursday’s US inflation report, which witnessed December’s Consumer Price Index (CPI) dropping beneath 7% and core CPI below 6%, was cheered by the financial markets.

In the meantime, the greenback is staging a recovery though it’s been ignored by Gold traders. The US Dollar Index, which tracks the buck’s value against a basket of peers, is trimming some of its weekly losses, gaining 0.18%, at 102.418.

Another reason bolstering XAU/USD’s recent price action is US Treasury bond yields. The 10-year benchmark note rate tumbles one bps, down at 3.434%, though it has fallen 12 bps in the week.

According to the CME FedWatch Tool, odds for a 25 bps rate hike by the Federal Reserve lie at a 94.2% chance after the release of US inflation.

Meanwhile, the University of Michigan’s Consumer Sentiment for January beat estimates of 60.5 and reached 64.6. Regarding consumer inflation expectations, for one year, it dropped from 4.4% to 4%, while for a 5-year horizon ticked to 3% from 2.9%.

Gold Price Analysis: Technical outlook

From a daily chart perspective, XAU/USD would likely continue to edge higher, as it has broken May 5, 2022, daily high of $1909.80. Oscillators like the Relative Strength Index (RSI) at overbought conditions but still beneath the 80 mark suggest the uptrend continues to gain strength. While the Rate of Change (RoC), portrays that buyers are gathering momentum.

Gold key resistance levels would be the April 29 high of $1,919.90, followed by April 18 at $1,998.39, slightly below $2,000.

Despite 2022’s drawdown, analysts at Barclays believe that global equity markets have room to drop further.

Cash should be the real winner of 2023

“We observe that US stocks tend to bottom out 30-35% below peak in the middle of a recession. That suggests fair value of 3200 on the S&P500 sometime in H1 23. European valuations look more reasonable, but that is offset by a considerably worse macro outlook than in the US.”

“Bonds have massively underperformed equities in 2022, and our analysts now see limited downside in longer US fixed income. If forced to choose between stocks and bonds, we would be overweight core fixed income over equities.”

“But cash should be the real winner of 2023, with US front-end yields likely to go to 4.5% or higher and stay there for several quarters. The ability to earn over 4% while taking virtually no risk is a factor that should drag on both stock and bond markets next year.”

- Japanese yen extends gains across the board on Friday.

- US Dollar up for the day, sharply lower for the week.

- USD/JPY drops for the second day in a row.

The USD/JPY is falling sharply for the second day in a row and it is trading under 128.00 at the lowest level since late May of last year. The decline takes place even amid a modest recovery of the US Dollar following Thursday’s slide after US CPI data.

After a short-lived recovery, USD/JPY resumed the downside, breaking below 128.00. As of writing, it is trading at fresh lows at 127.70/75, as the recovery of the greenback losses momentum and Wall Street moves off lows.

Japanese Yen among the top performers

The divergence between the Federal Reserve and the Bank of Japan that has been boosting the USD/JPY pair for months has now partially reversed, not because of clear action but on the back of a change in expectations. The Fed is seen near the end of its rate hike cycle while there are growing speculations about a shift at the Bank of Japan. Some reports indicate the BoJ could review the side effects of its ultra-accommodative policy as soon as next week.

Japanese bond yields soared also helping the JPY. The 10-year yield rose to the highest since 2015. On the contrary, the decline in US yields weighed on USD/JPY. The US 10-year yield stands at 3.46% compared to 3.70% from a week ago.

On Friday, the deterioration in risk sentiment contributed to the strength of the Japanese currency. The Dow Jones is falling by 0.15% while the Nasdaq declines by 0.35%.

The latest economic report of the week showed the US Michigan Consumer Sentiment Index rose in January to 64.6 surpassing expectations of 60.5.

Technical levels

- Consumer confidence in the US continued to rise in early January.

- US Dollar Index holds in daily range above 102.00 after the data.

Consumer sentiment improved in the US in early January with the University of Michigan's (UoM) Consumer Confidence Index rising to 64.6 from 59.7 in December. This reading came in better than the market expectation of 60.5.

"Year-ahead inflation expectations receded for the fourth straight month, falling to 4.0% in January from 4.4% in December," the UoM noted in its publication. "The current reading is the lowest since April 2021 but remains well above the 2.3-3.0% range seen in the two years prior to the pandemic."

Finally, long-run inflation expectations were little changed from December at 3.0%, again staying within the narrow 2.9-3.1% range for 17 of the last 18 months.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen trading little changed on the day at 102.28.

USD/JPY accelerates the downfall to 128.00. The pair could dive as low as 124.00, economists at Société Générale report.

Channel at 134/134.80 should cap short-term upside

“Daily MACD has flattened recently however signals of an extended bounce are not yet visible.”

“The pair is likely to drift towards next projections at 128 and 126.80. Peak of 2015 near 125.85/124.00 could be the next significant support zone.”

“The channel at 134/134.80 should cap short-term upside.”

See: USD/JPY looks set to challenge the 126.50 mark – ING

- The index reverses part of the recent acute sell-off.

- US yields remain directionless across the curve on Friday.

- Flash Michigan Consumer Sentiment will be next on tap.

The greenback’s recovery picks up extra pace and revisits the 102.65/70 band when gauged by the USD Index (DXY) on Friday.

USD Index meets contention around 102.00

Following the earlier retracement to levels just below the 102.00 mark, the index manages to regain some composure and advance to the 102.60 region on the back of the profit talking sentiment in the risk complex.

In the US money markets, yields across the curve advance marginally as market participants continue to assess Thursday’s soft US inflation figures for the month of December and the expected impact on the Fed’s tightening cycle.

Later in the session, the advanced reading of the Michigan Consumer Sentiment is predicted to have improved a tad to 60.5 for the current month.

What to look for around USD

The dollar remains under pressure despite the firm rebound from post-US CPI lows near 102.00, an area last visited back in June 2022.

Another soft prints from US inflation figures in December prop up the idea of a probable pivot in the Fed’s policy in the next months, which also comes in contrast to the hawkish message from the latest FOMC Minutes and recent rate-setters, all pointing to the need to remain within a restrictive stance for longer, at the time when the likelihood any interest rate reduction in the current year remains near zero.

On the latter, the tight labour market and the resilience of the economy are also seen supportive of the firm message from the Federal Reserve and its hiking cycle.

Key events in the US this week: Flash Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.14% at 102.38 and faces the next hurdle at 105.63 (monthly high January 6) followed by 106.39 (200-day SMA) and then 107.19 (weekly high November 30). On the other side, the breach of 102.07 (monthly low January 12) would open the door to 101.29 (monthly low May 30) and finally 100.00 (psychological level).

In the view of economists at Wells Fargo, end to monetary tightening should bring the US Dollar's gains to an end by early 2023.

Eventual US recession to soften the greenback

“An end to rate hikes will coincide with an end to USD gains during early 2023. Indeed, we believe a peak in the trade-weighted US Dollar for the current cycle has already been reached.”

“Over time, we forecast a trend of USD depreciation to gather pace. Initially, that depreciation may be modest during the latter part of 2023, as the US economy falls into recession while other international economies stabilize.”

“We forecast a somewhat more pronounced pace of USD depreciation in 2024, once the Fed begins cutting its policy interest rate by early next year.”

Bank of Korea (BoK) decided to hike its policy rate today by 25 bps to 3.50%. Economists at TD Securities expect the Won to strengthen in the weeks ahead.

Less urgency to tighten further

“BoK hiked its 7-day repo rate by 25 bps to 3.50% as widely expected. The decision was not unanimous however, with two members opposing the decision voting for rates to remain on hold.”

“While there was no clear signal that BoK has reached terminal we think the bar is high for another hike in the months ahead. Weakening growth, eating inflation pressures and a stronger KRW suggest less urgency to tighten further. Markets are also pricing no further tightening. However, we concur that rate pricing for a cut in the next 6 months is premature.”

“Meanwhile, KRW is likely to remain a key beneficiary of USD weakness in the weeks ahead.”

China FX has front-loaded the China reopening and economists at Société Générale are cautious about chasing a CNY rally.

Neutral on Yuan

“As USD/CNY has already reversed more than 50% of the rise in 2022, it would be necessary to feed more positive surprises to the market to deepen a CNY rally to the 6.30 level, but we are sceptical.”

“Our year-end USD/CNY forecast of 6.80 incorporates a ‘gradual’ turnaround in major policies including Zero-COVID. However, nearly all major policies that were seen as negative to the market have been reversed in the past two weeks.”

“The FX market has selectively front-loaded the positive policy surprises and their future implications for the economy.”

- USD/CAD stages a solid intraday recovery amid a strong pickup in the USD demand.

- Rebounding US bond yields and the risk-off impulse lifts the safe-haven greenback.

- Positive crude oil prices could underpin the Loonie and cap the upside for the major.

The USD/CAD pair rebounds sharply from the 1.3320 area, or its lowest level since November 25 touched earlier this Friday and scales higher through the early North American session. The momentum lifts spot prices further beyond the 1.3400 mark and is sponsored by a goodish pickup in the US Dollar demand.

The USD Index, which measures the greenback's performance against a basket of currencies, stages a solid recovery from a seven-month low and draws support from a combination of factors. Concerns about a deeper global economic downturn continue to cap any optimism in the markets. This is evident from a fresh wave of the global risk-aversion trade and benefits the safe-haven status buck. Apart from this, an intraday rally in the US Treasury bond yields offers additional support to the USD.

That said, growing acceptance that the Federal Reserve will soften its hawkish stance could act as a headwind for the US bond yields and the greenback. In fact, the markets are now pricing in a smaller 25 bps rate hike in February. The bets were lifted by Thursday's release of the US consumer inflation figures and comments by several Fed officials. This, in turn, might hold back the USD bulls from placing aggressive bets and keep a lid on any meaningful upside for the USD/CAD pair.

Apart from this, positive crude oil prices could underpin the commodity-linked Loonie and contribute to capping the USD/CAD pair. Hence, it will be prudent to wait for strong follow-through buying before confirming that spot prices have formed a near-term bottom and positioning for further gains. Traders now look to the Preliminary Michigan Consumer Sentiment Index from the US for some impetus. This, along with oil price dynamics, could allow traders to grab short-term opportunities.

Technical levels to watch

- EUR/USD sees its recent strong advance momentarily halted.

- The resumption of the bullish bias should target the 1.0900 level.

EUR/USD comes under pressure soon after hitting fresh 9-month peaks around 1.0870 on Friday.

Despite the ongoing knee-jerk, bulls remain well in control of the mood around the pair for the time being. Against that, further north of the so far YTD high at 1.0867 (January 13) should appear the round level at 1.0900 in the short-term horizon.

Furthermore, while above the short-term support line near 1.0550, the pair should maintain its bullish outlook.

In the longer run, the constructive view remains unchanged while above the 200-day SMA at 1.0308.

EUR/USD daily chart

US Treasury Secretary Janet Yellen told the NPR on Friday that inflation has been quite moderate for the last six months but noted that rent indexes were still rising.

Yellen further added that she was expecting rent indexes to come down substantially in next six months and said that she sees a path to loft landing for the US economy.

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen rising 0.2% on a daily basis at 102.45.

White House economic adviser Brian Deese told CNBC on Friday that the investment environment for the next two-to-five years in the US looks promising, as reported nu Reuters.

"We have seen real progress in price reductions for households in past six months, including gas price moderation," Deese noted and added that Congress will need to address US debt limit without conditions or drama.

Market reaction

These comments don't seem to be having a significant impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.15% on a daily basis at 102.40.

- AUD/USD fails ahead of the 0.7000 mark and corrects from a multi-month top touched on Friday.

- A combination of factors helps revive the USD demand and exerts downward pressure on the pair.

- The technical setup favours bulls and supports prospects for the emergence of some dip-buying.

The AUD/USD pair retreats from the vicinity of the 0.7000 psychological mark or the highest level since August 26 and continues losing ground through the early North American session. The pair drops to a fresh daily low, around the 0.6935 region in the last hour, eroding a part of the previous day's post-US CPI gains and snapping a two-day winning streak.

A modest bounce in the US Treasury bond yields helps the US Dollar to stall its recent decline to a seven-month low. Apart from this, the risk-off impulse - as depicted by a sharp fall in the equity markets - further benefits the greenback's relative safe-haven status and weighs on the risk-sensitive Aussie. That said, rising bets for smaller Fed rate hikes might keep a lid on any meaningful gains for the buck and limit deeper losses for the major, at least for the time being.

From a technical perspective, the AUD/USD pair has been scaling higher along an ascending channel over the past three months or so, which points to a well-established uptrend. Adding to this, the recent breakout through the very important 200-day SMA and the overnight strength beyond the 50% Fibonacci retracement level of the April-October 2022 downfall favours bullish traders. This, along with positive oscillators on the daily chart, supports prospects for the emergence of some dip-buying.

Hence, any subsequent slide is more likely to find decent support near the 0.6900 mark ahead of the 0.6870-0.6865 horizontal zone. This is followed by support near the 0.6830 region (200- DMA), which should now act as a pivotal point for the AUD/USD pair. A convincing break below could accelerate the fall towards the 0.6800 mark en route to the trend-channel support. The latter is pegged around the mid-0.6700s and nears the 38.2% Fibo. level, which should protect any further decline.

On the flip side, bulls might now wait for a sustained strength beyond the 0.7000 mark before placing fresh bets. The AUD/USD pair might then aim to surpass an intermediate hurdle near the 0.7030-0.7035 region and the 0.7070-0.7075 zone before eventually climbing to the 0.7100 round figure.

AUD/USD daily cahrt

Key levels to watch

Gold has continued on the road to recovery this week. However, economists at Commerzbank expect the yellow metal to struggle to extend its gains.

Short-term-oriented investors are optimistic

“We believe that the market will initially take a breather until it becomes clearer whose prediction of the future course of US monetary policy is more accurate – the market’s or the Fed’s.”

“The CFTC’s data are likely to confirm once again that short-term-oriented investors in particular are optimistic; by contrast, the stagnating ETF holdings indicate that ETF investors remain sceptical.”

- The index manages to regain some poise near 102.00.

- Further losses remain on the cards below 102.00.

Finally, some respite for the dollar sees the index pick up some upside traction and leave the area of recent lows near the 102.00 yardstick on Friday.

In case bears regain the upper hand, the loss of the January low at 101.98 (January 13) should put a potential deeper drop to the May 2022 low around 101.30 (May 30) back on the investors’ radar prior to the psychological 100.00 level.

In the meantime, while below the 200-day SMA at 106.39 the outlook for DXY should remain tilted to the negative side.

DXY daily chart

- EUR/JPY adds to Thursday’s strong pullback and breaches 140.00.

- The loss of the 200-day SMA opens the door to extra decline.

EUR/JPY extends the weekly leg lower and drops to multi-session lows just below the 139.00 mark on Friday.

The acute correction forces the cross to break below the key 200-day SMA (140.67) and paves the way for a deeper retracement in the short term. Against that, EUR/JPY could revisit the so far YTD low at 137.38 (January 3), which also coincides with the September 2022 low.

The outlook for EUR/JPY should remain negative while below the 200-day SMA.

EUR/JPY daily chart

GBP/USD drifts from the 1.2250 area. A dip under 1.2180 could drag the pair down a little more, in the view of economists at Scotiabank.

Resistance is seen at 1.2250

“A sharp rebound from last week’s low and additional gains in Cable this week are positive developments for the Pound but Cable gains are struggling to overcome still weak or bearish longer run trend oscillators which may hamper progress unless or until spot can better the Dec peak at 1.2450.”

“Intraday losses below 1.2180 may see the Pound dip a little more.”

“Resistance is 1.2250. Firmer support is 1.2100/10.”

EUR/USD consolidates gains above 1.08. Economists at Scotiabank expect the world’s most popular currency pair to test the 1.10 level.

Minor dips set to remain well-supported

“A solid, technical bull trend in the EUR/USD pair is developing and minor dips are set to remain well-supported as a consequence.”

“EUR gains through the 1.0700/50 zone this week imply more near-term upside risk towards the 1.1000/50 area at least.”

“Resistance is seen at 1.0900/10.”

See: EUR/USD could extend its race higher to the 1.0950 mark – ING

- GBP/USD struggles to capitalize on its modest intraday gains to a nearly one-month high.

- A modest USD recovery attracts fresh sellers amid a bleak outlook for the UK economy.

- Bets for smaller Fed rate hikes could cap the greenback and lend support to the major.

The GBP/USD pair retreats from nearly a one-month high, around mid-1.2200s set earlier this Friday and hits a fresh daily low during the mid-European session. Spot prices drop to the 1.2170 region in the last hour, reversing a part of the previous day's positive move.

A combination of factors assists the US Dollar to stage a goodish recovery from its lowest level since June, which, in turn, attracts fresh sellers around the GBP/USD pair. An uptick in the US Treasury bond yields, along with a softer risk tone, help revive demand for the safe-haven greenback. The worst COVID-19 outbreak in China, which overshadows the optimism led by the country's pivot away from its zero-COVID policy. Apart from this, the protracted Russia-Ukraine war has been fueling worries about a deeper global economic downturn and weighing on investors' sentiment.

The GBP bulls, meanwhile, seem rather unimpressed by the better-than-expected UK monthly GDP print, which showed that the domestic economy posted a modest 0.1% growth in November. This, however, was largely offset by the disappointing release of the UK Manufacturing and Industrial Production figures. The data adds to a bleak outlook for the domestic economy and fuels speculations that the Bank of England (BoE) is nearing the end of the current rate-hiking cycle. This exerts additional downward pressure on the GBP/USD pair, though the downside seems limited, at least for now.

The UK consumer inflation figures released on Thursday reinforced market expectations that the Fed will soften its hawkish stance. Adding to this, several FOMC members backed the case for a smaller 25 bps rate hike in February. This might keep a lid on any meaningful upside for the US bond yields and act as a headwind for the greenback, warranting some caution before placing aggressive bearish bets around the GBP/USD pair. Market participants now look forward to the US economic docket, featuring the Preliminary Michigan Consumer Sentiment Index for a fresh trading impetus.

Technical levels to watch

Another surprise policy change by the Bank of Japan next week it is not a high probability outcome. In the view of economists at Credit Suisse, an unchanged outcome might cause some disappointment.

Fading USD/JPY strength towards the top end of the target range at 135.00

“Ahead of next week’s BoJ rate decision, markets are aware of the risk of further possible tweaks to YCC policy, but do not seem to attribute a high probability to it.”

“While we acknowledge some potential for disappointment in the event of an unchanged policy outcome, we continue to see the USD/JPY outlook as asymmetrical to the downside, we hold on to our 125.00 Q1 target and remain committed to fading USD/JPY rallies to the top of our 120.00-135.00 target range.”

The US Dollar is weaker but trading has been choppy following the US December inflation data. Economists at Scotiabank expect USD weakness to linger in 2023.

USD yield support has peaked

“Peak US inflation means peak US yields which in turn means peak USD.”

“Friction between Fed messaging and market pricing may keep the USD trend choppy in the near-term.”

“Positioning and sentiment have shifted against the USD in the past month or two but there is ample room for this trend to develop.”

EUR/CHF has broken out above the sideways range since October affirming extension in up move. Economists at Société Générale expect the pair to extend its advance.

0.9970/0.9950 to be important support near term

“The pair is expected to head higher gradually towards 1.0130 and projections of 1.0240/1.0260; this could be an interim resistance zone.”

“Upper end of previous consolidation zone and the 200-Day Moving Average at 0.9970/0.9950 is likely to be an important support near term.”

See: EUR/CHF could extend its advance back to levels between 1.02 and 1.04 – MUFG

Brent has dropped just below $80/b territory recently. Strategists at TD Securities expect the global benchmark crude to trade at $100/b in the latter part of 2023.

China reopening and OPEC rightsizing to place bid under Oil

“The prospects for crude oil should materially improve as the New Year matures. Once China normalizes post-COVID, the Middle Kingdom's consumption should jump by as much as one million b/d over the next six months from recent lows, with demand increasing another 0.5 million b/d by year-end. At the same time, the worst of the demand erosion in the Western world should also end.”

“Supply side will likely help to tighten conditions to support prices. Saudi Arabia and friends may right-size production to match any demand growth decline later in the year. It is possible that OPEC will cut production just as Chinese demand starts to bounce higher. Plus, at the same time, the market will price the Fed tilting toward a more dovish policy, which should attract specs back into the market en masse.”

“We judge that $100/b Brent is within reach in the latter part of 2023.”

USD/JPY remains the stand-out interest. Economists at ING expect the pair to nosedive towards the 126.50 mark.

Plenty of downside in USD/JPY

“The BoJ may be on the verge of its biggest policy change in decades. Even short-dated JPY Interest Rate Swaps have started to move and are at the highest levels (near 30 bps) since 2008!”

“Clearly, USD/JPY has come a long way very fast, but some of the longer-term skews in the FX options market point to a structural shift in the market’s view in USD/JPY.”

“We suspect few will want to stand in the way of the USD/JPY downside.”

“126.50 looks like the clear near-term target for USD/JPY.”

- USD/CAD drops to its lowest level since November and is pressured by a combination of factors.

- Bullish oil prices underpin the Loonie and act as a headwind amid the prevalent USD selling bias.

- The fundamental backdrop favours bearish traders and supports prospects for additional losses.

The USD/CAD pair attracts fresh sellers in the vicinity of the 1.3400 mark on Friday and drops to its lowest level since November 25 during the first half of the European session. The pair is currently placed just below mid-1.3300s, down around 0.15% for the day, and is pressured by a combination of factors.

Crude oil prices trade with modest gains near a one-and-half-week high amid hopes that China's pivot away from its zero-COVID policy will boost fuel demand. This, in turn, is seen underpinning the commodity-linked Loonie, which, along with the prevalent US Dollar selling bias, drags the USD/CAD pair lower for the second straight day.

The USD Index, which measures the greenback's performance against a basket of currencies, languishes near a seven-month low amid expectations that the Fed will soften its hawkish tone. The bets for smaller Fed rate hikes were lifted by the US consumer inflation figures and comments by several FOMC officials on Thursday.

In fact, the markets now seem convinced that the Fed will further slow the pace of its rate-hiking cycle and deliver a smaller 25 bps lift-off in February. This, in turn, keeps the US Treasury bond yields depressed near a multi-week low, which, along with a positive risk tone, continues to weigh on the safe-haven greenback.

Traders now look to the US economic docket, featuring the release of the Preliminary Michigan Consumer Sentiment Index later during the early North American session. This, along with oil price dynamics, could provide some impetus to the USD/CAD pair. Nevertheless, spot prices remain on track to end in the red for the fourth straight week.

Technical levels to watch

The Australian Dollar is likely to remain the favoured G10 expression of the bullish implications for China-sensitive currencies. Thus, the AUD/USD pair could hit the 0.74 level sooner than economists at Société Générale expected.

Asia should benefit from China’s recovery, lifting the Aussie

“As Australia is a major exporter of raw materials, including energy, metals and agriculture, there are clear direct benefits to a rapid Chinese re-opening, but they may be less important than the impact of improved broader Asian economic prospects, which would help the Australian economy.”

“The Aussie has been held back by the RBA being less aggressive in tightening monetary policy than other central banks, but a boost to exports in the months ahead, when the Federal Reserve is approaching the end of its tightening cycle, could see a move in AUD/USD to our year-end target (0.74) sooner than expected.”

Economists at ING recaps their forecasts for the CEE currencies. In their view, the region could enjoy mild gains.

Higher EUR/USD is a small boost for region

“On the FX market, we found the CEE currencies almost unchanged after yesterday's US inflation number. However, higher EUR/USD today will give them a chance to erase this week's losses. But still, it shouldn't change much in the picture of a flat week.”

“For the Polish Zloty we see a return below 4.680 EUR/PLN and for the Czech Koruna levels below 24.00 EUR/CZK.”

“Hungarian inflation numbers should be good news for Forint and we can go back below 396 EUR/HUF.”

Economist at UOB Group Ho Woei Chen assesses the latest inflation figures in China and potential moves by the PBoC.

Key Takeaways

“Headline CPI inflation edged higher to 1.8% y/y in Dec in line with expectation. This was helped by a low base comparison arising from the decline in food prices in the year-ago period. However, the broader price pressure has continued to be contained in Dec, with core inflation at a modest 0.7% y/y and services inflation at 0.6% y/y.”

“Meanwhile, the deflation trend in the PPI is likely to continue through 1H23. Despite the boost to demand from China’s Covid reopening, the recovery in prices would still be affected by a high base comparison and drag from weaker global demand.”

“For the full year in 2022, headline and core inflation registered 2.0% and 0.9% respectively. We forecast headline inflation to rise to 2.8% this year given the low base comparison and expected recovery in consumption demand which will gain more traction ahead with the borders reopening. For the PPI, we expect it to be flat in 2023 after rising 4.1% y/y in 2022.”

“We see prospects for the 1Y LPR to fall to 3.55% and 5Y LPR to 4.20% by end1Q23. Consensus forecast is factoring in the possibility of a 5-15 bps decline in the 5Y LPR at the upcoming fixing on 20 Jan, which will reduce mortgage costs for homebuyers. Meanwhile, the 1Y LPR may stay unchanged this month given flushed domestic liquidity.”

“The loosening bias for the monetary policy may start to reverse in 2H23 should the economy show stronger rebound and inflation quickens. Our end-4Q23 forecast for the 1Y LPR is at 3.60% to reflect this potential shift.”

- EUR/USD gives away part of the recent advance.

- The dollar’s price action looks inconclusive near 102.00.

- Germany’s Full Year GDP Growth surprised to the upside.

Investors appear to be cashing up part of the recent strong advance in EUR/USD and force the pair to recede to the 1.0830 region at the end of the week.

EUR/USD: Upside looks limited around 1.0870

Following an earlier move to fresh tops near 1.0870, EUR/USD comes under some modest selling pressure and gives away part of those gains against the backdrop of the vacillating price action in the dollar and alternating risk appetite trends on Friday.

Indeed, the greenback remains under scrutiny following weak US inflation figures for the month of December (released on Thursday), while some profit taking mood appears to be hitting the euro.

In the domestic calendar, France’s final headline CPI contracted 0.1% MoM in December and rose 5.9% over the last twelve months. In Germany, the Full Year GDP Growth expanded 1.9% in November, while Industrial Production in Italy contracted 0.3% MoM also in November and 3.7% from a year earlier.

Later in the session, Balance of Trade figures and Industrial Production in the broader Euroland will be in the limelight.

Across the pond, the advanced readings of the Michigan Consumer Sentiment for the month of January will be the salient event.

What to look for around EUR

EUR/USD extends the solid rebound to levels last seen in late April 2022 around 1.0870 at the end of the week.

Price action around the European currency should continue to closely follow dollar dynamics, as well as the impact of the energy crisis on the euro bloc and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: France final Inflation Rate, Germany Full Year GDP Growth, EMU Balance of Trade/Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.15% at 1.0835 and the breach of 1.0481 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0442 (55-day SMA). On the upside, the next barrier comes at 1.0867 (monthly high January 13) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022).

- Gold price continues scaling higher on Friday and touches a fresh multi-month peak.

- Bets for smaller Fed rate hikes continue to weigh on the USD and remain supportive.

- A sustained strength above $1,900 supports prospects for a further appreciating move.

Gold price catches fresh bids during the early part of the European session on Friday and appreciates further beyond the $1,900 round-figure mark. The XAU/USD now trades with gains of over 0.60% for the day and is currently placed just below the $1,910 level, or its highest level since May 2022.

Weaker US Dollar continues to benefit Gold price

The US Dollar (USD) remains depressed near a seven-month low amid growing acceptance that the Federal Reserve (Fed) will soften its hawkish stance amid signs of easing price pressures. A weaker Greenback turns out to be a key factor benefitting the US Dollar-denominated Gold price. In fact, inflation in the United States (US), as measured by the Consumer Price Index (CPI), dipped 0.1% in December, marking the first decline since May 2020. Adding to this, the yearly rate decelerated from 7.1% rate in November to 6.5% or the lowest level since October 2021. Furthermore, core inflation, which excludes food and energy prices, rose 0.3% and slowed to the 5.7% YoY rate from 6.0% in November.

Bets for smaller rate hikes by Federal Reserve further lend support

The markets started pricing in a smaller 25 bps Fed rate hike in February. The bets were lifted by Philadelphia Fed President Patrick Harker's comments that hikes of 25 bps will be appropriate going forward. Separately, Richmond Fed President Thomas Barkin suggested that it made sense to steer more deliberately as the central bank works to bring inflation down. This overshadows more hawkish remarks by St. Louis Fed president James Bullard, reaffirming that rates would be north of 5% by the end of 2023. Nevertheless, the prospects for less aggressive policy tightening by the Fed keep the US Treasury bond yields depressed near a multi-week low and further lend support to the non-yielding gold price.

Technical buying contributes to the ongoing positive move

Apart from this, the prevalent cautious market mood - amid worries about a deeper global economic downturn - underpins the safe-haven Gold price. This, along with some technical buying above the $1,900 mark, contributes to the latest leg-up witnessed over the past hour or so. Nevertheless, the fundamental and technical setup supports prospects for additional near-term gains for the XAU/USD. Market participants now look forward to the US economic docket, featuring the Preliminary Michigan Consumer Sentiment Index later during the early North American session. Traders will further take cues from the US bond yields and the broader market risk sentiment to grab short-term opportunities.

Gold price technical outlook

From a technical perspective, some follow-through buying beyond the $1,910 area will validate a fresh bullish breakout and lift the Gold price to the $1,920 horizontal zone. The momentum could get extended further towards the next relevant hurdle near the $1,935-$1,936 region. On the flip side, any meaningful pullback below the $1,900 mark could attract fresh buyers near the $1,885-$1,880 zone. This, in turn, should help limit the downside near the $1,865 level or the weekly low. A convincing break below the latter might shift the near-term bias in favour of bearish traders and prompt aggressive selling around the XAU/USD.

Key levels to watch

The key macro event of the week – US Consumer Price Index – is behind us. And the weak Dollar trend is set to persist, according to economists at MUFG Bank.

EUR/USD reverting back significantly to entertain the idea of testing parity again

“The Dollar remains on a w eaker footing because the CPI data was not enough to change the forw ard rates markets. The data wasn’t as big a surprise as the October and November CPI reports but did still contain elements that are encouraging for those believing inflation will fall further.”

“The hawkish Fed view that would encourage renewed USD strength seems further away now and with it the prospects of EUR/USD reverting back significantly to entertain the idea of testing parity again.”

Germany’s preliminary Gross Domestic Product (GDP) expanded by 1.9% on an annualized basis in 2022 when compared to the +1.8% market consensus and +2.6% previous, Statistisches Bundesamt Deutschland reported on Friday.

Key takeaways

German economy likely stagnated in the fourth quarter of 2022.

Measured as a percentage of nominal GDP, there was a 2.6% deficit ratio of the general government for 2022.

German government budget recorded a financial deficit of EUR117.6 billion at end of 2022.

Market reaction

The Euro is picking up fresh bids on the upbeat German data, with EUR/USD adding 0.07% on the day to 1.0854, at the press time.

The US Dollar is having a difficult time finding demand with the US Dollar Index trading flat slightly above 102.00. Soft US consumer sentiment and softening inflation expectations should keep the Dollar bias bearish today, in the view of economists at ING.

Slip sliding away

“It is a quiet day for US data, and a soft University of Michigan consumer sentiment plus declining inflation expectations can keep the Dollar on the back foot.”

“With USD/JPY expected to stay under pressure into next Wednesday’s Bank of Japan meeting, the DXY can stay biased to the 102.00 area near term.”

People’s Bank of China (PBOC) Vice-Governor said in a statement on Friday, the central bank “will keep the Yuan exchange rate basically stable.”

Additional comments

Impact from rate hikes in developed countries on China's economy will be limited.

Expects China inflation to remain moderate in 2023.

Inflation pressure under control in the near-term.

Central bank will closely monitor price rises.

Rising demand may boost prices, should also guard against imported inflation.

Expects M2 money supply growth to be stable this year.

Market reaction

At the time of writing, USD/CNY is trading at 6.7068, down 0.46% on the day.

Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group note that a convincing breach of 6.7000 in USD/CNH remains unlikely.

Key Quotes

24-hour view: “Yesterday, we highlighted that USD ‘could break the major support at 6.7500’. We added, ‘the next support at 6.7000 is unlikely to come into view’. Our view was not wrong as USD dropped to a low of 6.7250. Despite the relatively large decline, downward momentum has not improved significantly. While there is room for USD to weaken to 7.0000, a sustained decline below this major support is unlikely today. Overall, only a breach of 6.7620 (minor resistance is at 6.7480) would indicate that the USD weakness has stabilized.”

Next 1-3 weeks: “We have expected USD to weaken since last week. As USD fell, we indicated in our most recent narrative from Tuesday (10 January, spot at 6.7850) that USD is likely to weaken further and that a break of 6.7500 will shift the focus to 6.7000. USD took out 6.7500 in NY trade yesterday and plummeted to a low of 6.7250. We continue to expect USD weakness even though after such a large decline over a short period, the prospect of a sustained drop below 6.7000 is not high. On the upside, a breach of 6.7920 (‘strong resistance’ level was at 6.8250 yesterday) would indicate that the USD weakness has run its course.”

- USD/JPY drifts lower for the second straight day and drops to a fresh multi-month low.

- Bets for smaller Fed rate hikes continue to weigh on the USD and exert some pressure.

- Speculations for another BoJ policy tweak boost the JPY and contribute to the decline.

The USD/JPY pair breaks down from its intraday consolidative range and drops to the lowest level since late May during the early part of the European session. The pair currently trades just above the 128.00 mark and seems vulnerable to extending its depreciating move.

The US Dollar struggles to capitalize on its modest recovery and languishes near a seven-month low, which, in turn, drags the USD/JPY pair lower for the second straight day. The US consumer inflation figures released on Thursday reinforced expectations that the Fed will soften its hawkish stance. Adding to this, several FOMC members backed the case for a smaller 25 bps lift-off in February and continue to weigh on the greenback.

The Japanese Yen, on the other hand, draws support from speculations that the Bank of Japan (BoJ) could unwind its ultra-loose monetary policy in 2023. Furthermore, reports on Thursday indicated that BoJ will review the side effects of its ultra-loose policy and may take measures to correct distortions in the yield curve. This, in turn, pushes the 10-year Japanese government bond to the highest since mid-2015 and provides an additional lift to the JPY.

The selloff around Japanese government bonds forces the BoJ to announce two rounds of emergency buying. This, along with extremely oversold conditions on intraday charts, could help limit any further losses for the USD/JPY pair, at least for the time being. Market participants now look forward to the US economic docket, featuring the Preliminary Michigan Consumer Sentiment Index for a fresh impetus later during the early North American session.

Technical levels to watch

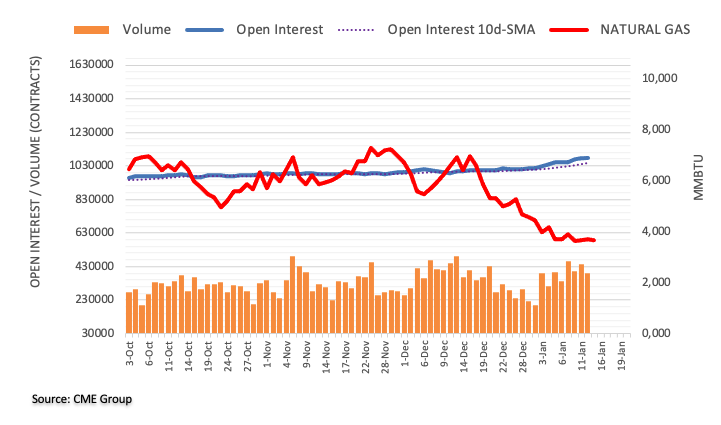

Considering advanced prints from CME Group for natural gas futures markets, traders added just 754 contracts to their open interest positions on Thursday, extending further the ongoing uptrend. Volume, instead, remained choppy and dropped by nearly 57K contracts.

Natural Gas looks supported around $3.50

Natural gas prices charted an inconclusive session on Thursday in tandem with a small uptick in open interest and diminishing volume. Against that, extra consolidation appears the most likely scenario for the commodity for the time being, with decent contention around the $3.50 mark per MMBtu.

Following Thursday's impressive rally, EUR/USD touched its highest level since April at 1.0868 early Friday. Economists at ING believe that the pair could hit 1.0950.

ECB will be happy with the stronger Euro

“The ECB’s trade-weighted Euro has now returned to levels seen last February. And actually, the year-on-year change in EUR/USD is now mildly positive. This will be welcome news to the ECB, where last summer’s 6% YoY EUR/USD decline was contributing to the inflation problem.”

“With short-dated (two-year) USD swaps drifting to new lows for the move, EUR/USD swap differentials continue to move in favour of EUR/USD. And this is a theme which we suspect will play a greater role in EUR/USD pricing over the next 12 months.”

“EUR/USD remains on course for 1.0900 and possibly 1.0950. Weekend profit-taking may pose the biggest risk to EUR/USD, but 1.0750 should now be a good near-term base.”

The Bank of Japan (BoJ) announced on Friday that it will conduct additional long-term Japanese Government Bonds (JGB) purchases on Monday.

“The amount to be bought will be based on prevailing market conditions,” the BoJ added.

Market reaction

USD/JPY keeps pushing lower, as the US Dollar resumes its downtrend so far this Friday. The pair is down 0.77% on the day to trade at 128.22, as of writing.

Further downside could force USD/JPY to grind lower and revisit the 128.00 region in the near term, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “While we expected USD to head lower yesterday, we were of the view that ‘a sustained decline below 131.30 appears unlikely’. We underestimated the downward momentum as USD nose-dived to a low of 128.86 before closing on a weak note at 129.22 (-2.45%). While the outsized decline appears to be overdone, the USD weakness is not showing any signs of stabilizing. In other words, USD could continue to weaken even though it remains to be seen if it has enough momentum to carry it lower to the next support at 128.00. Resistance is at 129.70, but only a breach of 130.50 would indicate the weakness in USD has stabilized.”

Next 1-3 weeks: “Our most recent narrative was from Monday (09 Jan, spot at 132.10) where we highlighted that USD is likely to trade within a broad range of 130.50 and 134.50. The sharp sell-off yesterday that sent it plunging below 130.50 (low of 128.86) came as a surprise. While the price actions suggest the risk for USD has shifted to the downside, the pace of any further decline is likely to be slower. Support is at 128.00, followed by 126.35. On the upside, a breach of 131.30 would indicate that the current increase in downward momentum has subsided.”

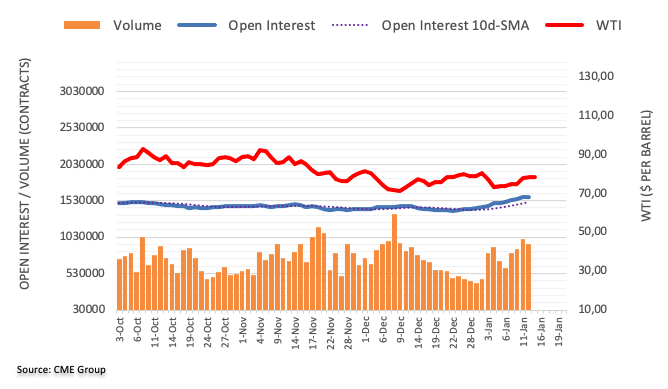

Open interest in crude oil futures markets shrank by nearly 1.1K contracts on Thursday, printing the first drop since December 22 according to preliminary readings from CME Group. In the same line, volume left behind three daily builds in a row and went down by around 77.3K contracts.

WTI: Another visit to $72.50 is not ruled out

Thursday’s uptick in prices of the WTI was on the back of shrinking open interest and volume and undermined the continuation of the ongoing bounce. That said, renewed weakness in the commodity carries the potential to drag prices to the recent contention region around $72.50 (January 5).

In the opinion of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, further upside could encourage AUD/USD to reclaim the area above the 0.7000 barrier in the short term.

Key Quotes

24-hour view: “We expected AUD to strengthen yesterday but we were of the view that ‘any advance is expected to face solid resistance at 0.6950’. However, in NY trade, AUD took out 0.6950 without much difficulty as it soared to a high of 0.6984. Despite the advance, there is no significant improvement in upward momentum. That said, as long as AUD stays above 0.6920 (minor support is at 0.6940), it could rise above 0.7000. While AUD could break 0.7000, it is not expected to challenge the next major resistance at 0.7070.”

Next 1-3 weeks: “Our latest narrative was from Tuesday (10 Jan, spot at 0.6910) where we highlighted that while momentum continues to point to a higher AUD, it must break and stay above 0.6950 before a move to 0.7000 is likely. AUD soared above 0.6950 yesterday before closing at 0.6967 (+0.88%). The price actions suggest AUD is likely to advance above 0.7000. As there is no marked improvement in momentum for now, the next resistance at 0.7070 is unlikely to come into view so soon. On the downside, a break of 0.6890 (‘strong support’ level was at 0.6835 yesterday) would indicate that AUD is not advancing further.”

FX option expiries for Jan 13 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0500 941m

- 1.0600 474m

- 1.0750 830m

- 1.0775 844m

- 1.0800 331m

- 1.0850 924m

- 1.0900 402m

- GBP/USD: GBP amounts

- 1.1800 411m

- 1.2000 402m

- 1.2500 381m

- AUD/USD: AUD amounts

- 0.6900 403m

- 0.6950 633m

- 0.7000 743m

- 0.7125 817m

USD/JPY fell sharply on Thursday. As economists at Rabobank expect the Bank of Jpan to tweak YCC again, the Yen is set to thrive.

Will they, won't they?

“While the doves may require a lot of convincing, ahead of the December BoJ policy meeting which brough a tweak to the YCC policy, speculation for a change appeared to already have found some support.”

“No change in policy this month would be a set back for the JPY. However, we would look to buy the JPY vs. the USD on dips on anticipation of another move in YCC in the spring.”

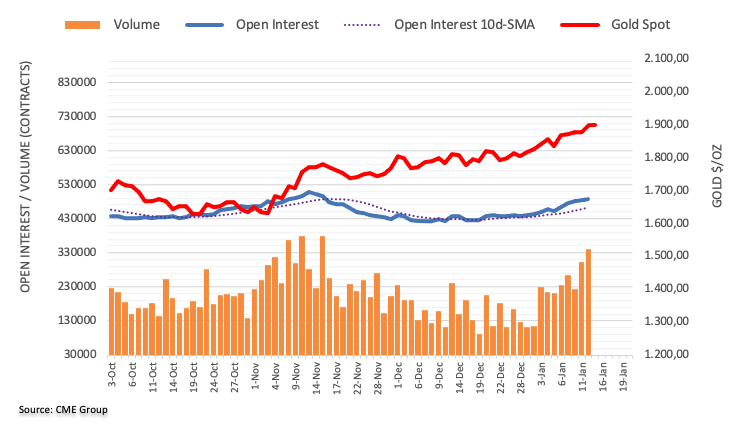

CME Group’s flash data for gold futures markets noted open interest rose for the fifth consecutive session on Thursday, this time by around 3.2K contracts. Volume followed suit and went up for the second straight session, now by around 38.4K contracts.

Gold continues to target $2000

Gold prices extended the uptrend on Thursday amidst increasing open interest and volume, indicating that extra gains look likely in the very near term. That said, the yellow metal keeps targeting the key $2000 mark per ounce troy for the time being.

GBP/USD needs to break above the 1.2270 level to allow for extra gains in the near term, according to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that GBP ‘may continue to trade sideways but a breach of the 1.2200 resistance could potentially lead to a sharp rise to 1.2270’. While GBP took out 1.2200, the anticipated sharp rise did not materialize as GBP traded choppily in NY session (high has been 1.2248). Upward momentum has improved a tad but while GBP is likely to trade with an upward bias, it is unlikely to break 1.2270 today. Support is at 1.2175, followed by 1.2140.”

Next 1-3 weeks: “On Tuesday (10 Jan, spot at 1.2180), we highlighted that the odds of GBP breaking the major resistance have increased. While GBP has not been able to make much headway on the upside, we continue to hold the same view for now. However, in order to keep the momentum going, GBP must break 1.2270 these 1-2 days or the prospect of further GBP strength would diminish quickly. Conversely, a break of 1.2100 (‘strong support’ level was 1.2050 yesterday) would indicate that GBP is not advancing further. Looking ahead, above 1.2270, there is a significant resistance level at 1.2305.”

- EUR/GBP struggles to gain any meaningful traction and oscillates in a narrow band on Friday.

- A bleak outlook for the UK economy undermines the Sterling and continues to lend support.

- The recent hawkish ECB rhetoric underpins the Euro and supports prospects for further gains.

The EUR/GBP cross consolidates its recent gains to the highest level since September 29 touched earlier this Friday and seesaws between tepid gains/minor losses through the early European session. The cross remains below the 0.8900 round-figure mark following the release of the UK macro data, though seems poised to prolong the uptrend witnessed since the beginning of this week.

The UK Office for National Statistics reported that the economy expanded a modest 0.1% in November as compared to estimates for a 0.2% contraction. This, however, marked a notable slowdown from the 0.5% growth recorded in October. Moreover, weaker-than-expected UK industrial and manufacturing production data adds to the bleak outlook for the UK economy, which has been fueling speculations that the Bank of England (BoE) is nearing the end of the current rate-hiking cycle. This, in turn, could undermine the British Pound and lend some support to the EUR/GBP cross.

The shared currency, on the other hand, continues to draw support from more hawkish signals from the European Central Bank (ECB). In fact, several ECB officials spoke this week and confirmed that they will have to raise interest rates further in the coming months to tame inflation. That said, a modest US Dollar recovery keeps a lid on the Euro and holds back traders from placing aggressive bullish bets around the EUR/GBP cross. Nevertheless, the aforementioned fundamental backdrop suggests that the path of least resistance for spot prices is to the upside.

Even from a technical perspective, the overnight convincing breakout through the 0.8865-0.8875 supply zone supports prospects for a further near-term appreciating move. Some follow-through buying beyond the 0.8900 round figure will reaffirm the positive outlook and allow the EUR/GBP cross to reclaim the 0.9000 psychological mark.

Technical levels to watch

The US inflation data yesterday did not provide any surprise whatsoever and as a result, the market was initially indecisive. However, economists at Commerzbank remain cautious and do not expect a further up-move in EUR/USD.

Some caution might be advisable

“After the EUR/USD rally seen over the past months, the question increasingly arises as to how much scope is still available, in particular, if there is no new momentum due to new developments. Of course, it is possible that EUR/USD might rise a little further but it makes increasing sense to question this move.”

“It cannot be excluded that the Fed might be correct in the end. If future data publications suggest that inflation might be more stubborn EUR/USD might come under increasing downside pressure as the market might then have to adjust its rate expectations. That means that the surprise potential on the downside in EUR/USD is likely to be much higher, suggesting that some caution might be advisable.”

- The index attempts a tepid rebound just above 102.00.

- Investors keep pricing in a 25 bps rate hike by the Fed in February.

- Advanced Michigan Consumer Sentiment only due later in the docket.

The greenback, when tracked by the USD Index (DXY), advances marginally on Friday following a marked drop to the 102.00 neighbourhood in the previous session.

USD Index remains under pressure in multi-month lows

Despite the mild bullish attempt ahead of the opening bell in the old continent on Friday, the index appears well under pressure, particularly after US inflation gave further signs of cooling down in the year to December (headline CPI +6.5%, Core CPI +5.7%).

Indeed, speculation around a potential pivot in the Fed’s monetary policy stance continues to run high and maintains the price action around the buck depressed for the time being.

Indeed, this view has gathered extra steam especially since the publication of the December Nonfarm Payrolls (+223K jobs) and it has magnified in the wake of the US inflation figures (released on Thursday). Against that, the probability of a 25 bps rate hike at the Fed’s February 1 meeting is now near 95%, always according to the FedWatch Tool by CME Group.

In the US data space, the flash prints of the Michigan Consumer Sentiment for the month of January will be the sole release later in the NA session.

What to look for around USD

The dollar remains under pressure and looks to rebound from post-US CPI lows near 102.00, an area last visited back in June 2022.

Another soft prints from US inflation figures in December prop up the idea of a probable pivot in the Fed’s policy in the next months, which also comes in contrast to the hawkish message from the latest FOMC Minutes and recent rate-setters, all pointing to the need to remain within a restrictive stance for longer, at the time when the likelihood any interest rate reduction in the current year remains near zero.

On the latter, the tight labour market and the resilience of the economy are also seen supportive of the firm message from the Federal Reserve and its hiking cycle.

Key events in the US this week: Inflation Rate, Initial Jobless Claims, Monthly Budget Statement (Thursday) – Flash Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.03% at 102.28 and faces the next hurdle at 105.63 (monthly high January 6) followed by 106.39 (200-day SMA) and then 107.19 (weekly high November 30). On the other side, the breach of 102.07 (monthly low January 12) would open the door to 101.29 (monthly low May 30) and finally 100.00 (psychological level).

A gradual depreciation of HUF vs. EUR is likely, but analysts at TD Securities still expect the Forint to record positive returns when accounting for carry.

May and June will likely be a period of increased EUR/HUF volatility

“We don't see any room for EUR/HUF to permanently move below 400. We think that a gradual HUF spot depreciation in the order of magnitude of 5-10% is in the interest of the NBH. As such, we think that EUR/HUF will gradually move higher through 2023 and end the year at 425.”

“Unless EUR/HUF falls notably below 400, the NBH will probably attempt to ease the longer-term rates first, rather than the overnight rate.”

“May and June will likely be a period of increased EUR/HUF volatility as EU member states will need to extend the current sanctions on Russia linked to Russia's invasion of Ukraine.”

Here is what you need to know on Friday, January 13:

After having suffered heavy losses against its major rivals on Thursday, the US Dollar is having a difficult time finding demand early Friday with the US Dollar Index trading flat slightly above 102.00. As investors assess how the December inflation data from the US will shape the Federal Reserve's rate outlook, the benchmark 10-year US Treasury bond yield stays below 3.5% and US stock index futures trade marginally lower on the day. The European economic docket will feature Industrial Production and Trade Balance data for November. In the second half of the day, the University of Michigan's Consumer Sentiment Survey for January and the Fed's Index of Common Inflation Expectations for the third quarter will be looked upon for fresh impetus.

The US Bureau of Labor Statistics announced on Friday that the annual Consumer Price Index declined to 6.5% in December from 7.1% in November. The Core CPI, which excludes volatile food and energy prices, edged lower to 5.7% from 6% in the same period. Following these data releases, the probability of a 25 basis points Fed rate hike jumped above 90%, according to the CME Group FedWatch Tool, from 75% early Thursday. Additionally, several Fed policymakers voiced their support for a 25 bps rate hike at the next meeting.

During the Asian trading hours on Friday, the data from China revealed that the trade surplus widened to $78 billion from $69.8 billion in November. With this reading surpassing the market expectation for a trade surplus of $76.2 billion, the Shanghai Composite Index gained traction and was last seen gaining more than 1% on the day.

Following Thursday's impressive rally, EUR/USD touched its highest level since April at 1.0868 early Friday before retreating below 1.0850.

GBP/USD gained more than 50 pips on Thursday but seems to have gone into a consolidation phase at around 1.2200 early Friday. The UK's Office for National Statistics reported that the Gross Domestic Product (GDP) expanded by 0.1% in November following October's 0.5% growth. Although this reading came in better than the market expectation for a contraction of 0.2%, it failed to help the Pound Sterling regather its bullish momentum.

USD/JPY fell sharply on Thursday and continued to push lower during the Asian trading hours on Friday. The pair was last seen trading at around 128.70, down 0.4% on the day.