- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 13-04-2015.

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0568 -0,33%

GBP/USD $1,4671 +0,29%

USD/CHF Chf0,9777 -0,14%

USD/JPY Y120,12 -0,04%

EUR/JPY Y126,94 -0,40%

GBP/JPY Y176,21 +0,22%

AUD/USD $0,7584 -1,24%

NZD/USD $0,7450 -1,09%

USD/CAD C$1,2950 +3,01%

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence February 2

08:00 China New Loans March 1020 1050

08:30 United Kingdom Producer Price Index - Output (MoM) March 0.2% 0.2%

08:30 United Kingdom Retail Price Index, m/m March 0.5%

08:30 United Kingdom Retail prices, Y/Y March 1.0% 0.9%

08:30 United Kingdom RPI-X, Y/Y March 1.0%

08:30 United Kingdom Producer Price Index - Input (MoM) March 0.2% -0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) March -13.5%

08:30 United Kingdom Producer Price Index - Output (YoY) March -1.8%

08:30 United Kingdom HICP, m/m March 0.3%

08:30 United Kingdom HICP, Y/Y March 0.0% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y March 1.2% 1.2%

09:00 Eurozone Industrial production, (MoM) February -0.1% 0.3%

09:00 Eurozone Industrial Production (YoY) February 1.2% 0.5%

12:30 U.S. Retail sales March -0.6% 1.1%

12:30 U.S. Retail sales excluding auto March -0.1% 0.7%

12:30 U.S. PPI, m/m March -0.5% 0.2%

12:30 U.S. PPI, y/y March -0.6%

12:30 U.S. PPI excluding food and energy, m/m March -0.5% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y March 1.0%

14:00 U.S. Business inventories February 0.0% 0.2%

20:30 U.S. API Crude Oil Inventories April 12.2

22:45 New Zealand Food Prices Index, m/m March -0.7%

22:45 New Zealand Food Prices Index, y/y March 1.5%

The Bank of Japan (BoJ) released its March monetary policy meeting minutes. The central bank said that the economy will continue to recover moderately. The consumer inflation is expected to be about zero percent "for the time being".

Many board members believes that the BoJ's monetary policy have a positive effect on the economy.

The U.S. dollar traded mixed lower against the most major currencies. The greenback remained supported by the speculation the Fed could start to hike its interest rate in June.

There will released no major economic reports in the U.S.

The euro traded higher against the U.S. dollar in the absence of any major reports from the Eurozone.

Concerns over Greece's debt problems continue to weigh on the euro, despite the fact that Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros last week.

The British pound traded higher against the U.S. dollar in the absence of any major reports from the U.K.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi declined against the greenback in the absence of any economic reports from New Zealand.

The weak Chinese trade data weighed on the kiwi. China's trade surplus fell to $3.10 billion in March from $60.60 billion in February, missing expectations for a decline to a surplus of $43.40 billion.

Exports dropped 14.6% in March, while imports slid 12.3%.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback in the absence of any economic reports from Australia.

The weak Chinese trade data weighed on the Aussie.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback despite the better-than-expected core machinery orders from Japan. Japan's core machinery orders declined 0.4% in February, beating expectations for a 2.8% drop, after a 1.7% fall in January.

On a yearly basis, Japan's core machinery orders climbed 5.9% in February, exceeding expectations for a 3.7% gain, after a 1.9% rise in January.

The Bank of Japan (BoJ) released its March monetary policy meeting minutes. The central bank said that the economy will continue to recover moderately. The consumer inflation is expected to be about zero percent "for the time being".

The European Central Bank (ECB) purchased 9.159 billion euros of government bonds last week.

The ECB said on Monday that purchases of sovereign bonds totalled 61.681 billion euros as of April 10, up from 52.522 billion the previous week.

The ECB settled 2.48 billion euros of covered bond purchases and 371 million euros in total purchases of asset-backed securities (ABS) last week.

The Chinese Customs Office released its trade data on Monday. China's trade surplus fell to $3.10 billion in March from $60.60 billion in February, missing expectations for a decline to a surplus of $43.40 billion.

Exports dropped 14.6% in March, while imports slid 12.3%.

Exports climbed 4.9% in the first quarter, while imports dropped 17.3%.

EUR/USD: $1.0450(E521mn), $1.0550 (E593mn), $1.0630(E592mn), $1.0670-75(E825mn), $1.0750(E1.1bn)

USD/JPY: Y120.00($498mn), Y121.00($482mn), Y121.80($800mn), Y122.00(372mn)*Y121.00 $2bn

GBP/USD: $1.5000(Gbp256mn)

AUD/USD: $0.7600(A$1.7bn)

NZD/USD: $0.7325(NZ$771mn), $0.7400(NZ$337mn), $0.7525(NZ$400mn), $0.7710(NZ$806mn), $0.7750(NZ$552mn)

USD/CAD: C$1.1.2580($375mn)

Italy's statistics institute Istat released its industrial production figures on Monday. Italian industrial output rose 0.6% in February, after a 0.7% decline in January.

The increase was driven by gains in energy and investment products. Energy products climbed by 3.6% in February, while investment products increased 1.1%.

On a yearly basis, industrial output in Italy decreased at an adjusted rate of 0.2%, after a 2.2% fall in January.

The Italian government forecasts that the economy will grow at 0.7% this year.

The Federal Reserve Bank of Minneapolis President Narayana Kocherlakota noted on Friday that the Fed should wait until the second half of 2015 before starting to hike its interest rate.

"Under my current outlook, I continue to believe that it would be a mistake to raise the target range for the fed funds rate in 2015," Mr. Kocherlakota said.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Trade Balance, bln March 60.6 43.4 3.1

The U.S. dollar traded higher against the most major currencies, supported by the speculation the Fed could start to hike its interest rate in June.

There will released no major economic reports in the U.S.

The euro declined toward 1-month low against the U.S. dollar in the absence of any major reports from the Eurozone.

Concerns over Greece's debt problems continue to weigh on the euro, despite the fact that Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros last week.

The British pound traded higher against the U.S. dollar in the absence of any major reports from the U.K.

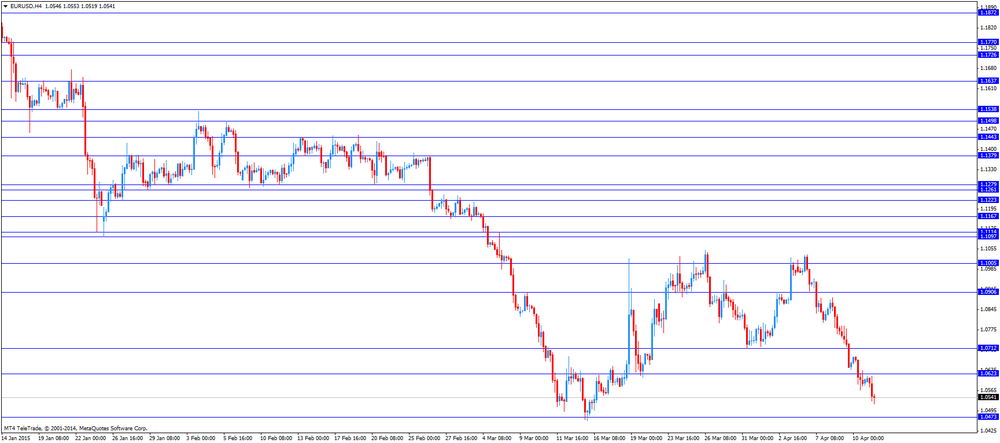

EUR/USD: the currency pair fell to $1.0519

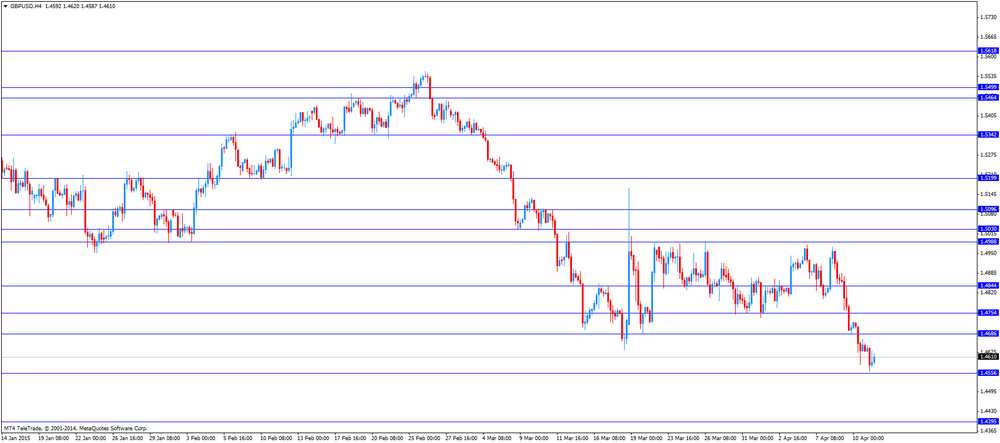

GBP/USD: the currency pair increased to $1.4630

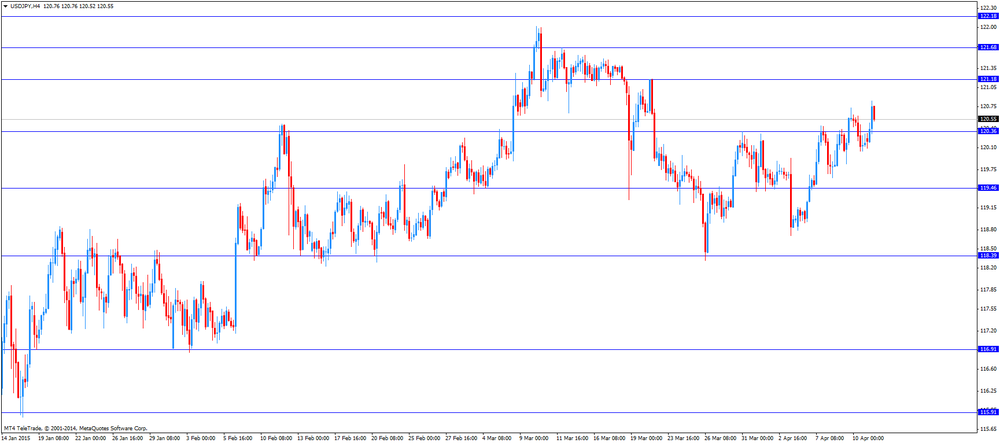

USD/JPY: the currency pair rose to Y120.84

The most important news that are expected (GMT0):

22:00 New Zealand NZIER Business Confidence Quarter I 23

EUR/USD

Offers 1.0750 1.0720/30 1.0700 1.0650

Bids 1.0500 1.0460/50 1.0400

GBP/USD

Offers 1.4800 1.4750 1.4725 1.4700 1.4660/70

Bids 1.4565/55 1.4510/05 1.4500

EUR/JPY

Offers 129.20 129.00 128.50 128.00/20 127.80

Bids 126.50 126.00

USD/JPY

Offers 122.00 121.50 121.00

Bids 120.10/00 119.50 119.00

EUR/GBP

Offers 0.7315 0.7290/00 0.7275

Bids 0.7200 0.7150 0.7080/75

AUD/USD

Offers 0.7850 0.7780/00 0.7750 0.7700 0.7635

Bids 0.7530 0.7500

EUR/USD: $1.0450(E521mn), $1.0550 (E593mn), $1.0630(E592mn), $1.0670-75(E825mn), $1.0750(E1.1bn)

USD/JPY: Y120.00($498mn), Y121.00($482mn), Y121.80($800mn), Y122.00(372mn)*Y121.00 $2bn

GBP/USD: $1.5000(Gbp256mn)

AUD/USD: $0.7600(A$1.7bn)

NZD/USD: $0.7325(NZ$771mn), $0.7400(NZ$337mn), $0.7525(NZ$400mn), $0.7710(NZ$806mn), $0.7750(NZ$552mn)

USD/CAD: C$1.1.2580($375mn)

BLOOMBERG

The Curious Case of Japan's Hidden Inflation

If the Bank of Japan's core price gauge is anything to go by, inflation has all but disappeared. Try telling that to anyone who pays the bills.

The general public thinks the cost of living is rising more than twice as fast as the official inflation rate, a survey of consumers by the Bank of Japan shows.

So why the gap? Naohito Abe, a professor at Hitotsubashi University, has one possible answer in an index that captures changes in prices of new products that account for almost half of goods sold at an average retail shop, and often don't show up in official data.

Together with Intage Inc. and the New Supermarket Association of Japan, he's come up with a measure that also captures the sneaky ways businesses milk consumers -- by reducing the size of a product while charging the same price.

Source: http://www.bloomberg.com/news/articles/2015-04-13/the-curious-case-of-japan-s-hidden-inflation

REUTERS

World Bank cuts East Asia growth forecast, warns of risks to outlook

(Reuters) - The World Bank cut its 2015 growth forecasts for developing East Asia and China, and warned of "significant" risks from global uncertainties including the potential impact from a strengthening dollar and higher U.S. interest rates.

The Washington-based lender expects the developing East Asia and Pacific (EAP) region, which includes China, to grow 6.7 percent in each of 2015 and 2016, down from 6.9 percent growth in 2014.

That's down from its previous forecast in October of 6.9 percent growth this year and 6.8 percent in 2016.

China's growth is likely to slow due to policies aimed at putting its economy on a more sustainable footing and tackling financial vulnerabilities, the World Bank said in its latest East Asia and Pacific Economic Update report on Monday.

Source: http://www.reuters.com/article/2015/04/13/us-worldbank-asia-idUSKBN0N404O20150413

BLOOMBERG

Oil Bulls Boost Wagers by Most Since 2010 as Output Seen Peaking

Speculators increased bullish oil bets by the most in more than four years, wagering that the U.S. production boom is slowing.

Hedge funds boosted net-long positions on West Texas Intermediate crude by 30 percent in the seven days ended April 7, the biggest jump since October 2010, U.S. Commodity Futures Trading Commission data show. Long bets rose to a nine-month high, while shorts tumbled 21 percent.

U.S. crude output and inventories may peak this month amid a record drop in rigs exploring for oil, Goldman Sachs Group said. Refiners returning from seasonal maintenance will add about 500,000 barrels a day of demand by July, the Energy Information Administration forecast, helping ease the biggest glut in 85 years.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Trade Balance, bln March 60.6 40.3 3.1

The U.S. dollar is trading broadly higher against its major peers as speculations about the timing of a future rate hike go on. Comments of some of the FOMC members about a rate hike this summer boosted the greenback.

The Australian dollar slumped against the U.S. dollar after the weaker-than-expected Chinese data. China is Australia's biggest trade partner due to Australia's raw material exports to the world's second largest economy.

The Chinese Trade Balance declined in March with exports slumping. The Balance fell to a surplus of 3.1 billion from 60.6 billion last month. Analysts expected a reading of 43.4 billion. Data on the Chinese GDP is scheduled for Wednesday.

New Zealand's dollar slumped against the greenback during the Asian in the absence of any major economic news.

The Japanese yen traded lower against the greenback in Asian trade. Yesterday at 23:50 GMT data on Core Machinery orders was reported. Orders for February declined -0.4%, less than the expected decline of -2.8%. The January reading was -1.7%. Year on year Order rose +5.9%, above the forecast of +3.7%. According to the minutes of the BoJ's March policy meetings board members said that the BoJ must pay closer attention to the effects of the aggressive monetary policy on Japanese government bonds.

EUR/USD: the euro traded almost flat against the greenback

(time / country / index / period / previous value / forecast)

18:00 U.S. Federal Budget

22:00 New Zealand NZIER Business Confidence Quarter I 23

23:01 United Kingdom BRC Retail Sales Monitor y/y March 0.2%

EUR / USD

Resistance levels (open interest**, contracts)

$1.0796 (1058)

$1.0745 (1463)

$1.0706 (226)

Price at time of writing this review: $1.0594

Support levels (open interest**, contracts):

$1.0552 (2586)

$1.0517 (4441)

$1.0468 (4553)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 49352 contracts, with the maximum number of contracts with strike price $1,1200 (5917);

- Overall open interest on the PUT options with the expiration date May, 8 is 62983 contracts, with the maximum number of contracts with strike price $1,0000 (7311);

- The ratio of PUT/CALL was 1.28 versus 1.29 from the previous trading day according to data from April, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.4909 (677)

$1.4813 (1011)

$1.4717 (283)

Price at time of writing this review: $1.4587

Support levels (open interest**, contracts):

$1.4486 (1394)

$1.4389 (1599)

$1.4292 (1001)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 20561 contracts, with the maximum number of contracts with strike price $1,5000 (2273);

- Overall open interest on the PUT options with the expiration date May, 8 is 27826 contracts, with the maximum number of contracts with strike price $1,4700 (2791);

- The ratio of PUT/CALL was 1.35 versus 1.38 from the previous trading day according to data from April, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.