- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 16-10-2022.

- WTI crude oil pares the biggest weekly loss since early August, renews intraday high of late.

- Most OPEC+ members defend output cut decision after the White House criticized the move.

- DXY pullback adds strength to oil’s recovery amid a sluggish week-start.

- China trade numbers, updates from CCP can entertain intraday buyers.

WTI crude oil picks up bids to renew intraday high around $85.30 as bulls cheer the latest US attack, verbally, on the OPEC+ decision and the response from the oil producers. In doing so, the black gold consolidates the biggest weekly loss in 2.5 months.

Ever since the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, countries ignored the US push for a smaller output cut, the White House is at loggerheads with Saudi Arabia. The criticism gained a response from the major OPEC+ members including United Arab Emirates, Kuwait, Bahrain, Oman and Algeria in recent days.

“OPEC+ member states lined up on Sunday to endorse the steep production cut agreed this month after the White House, stepping up a war of words with Saudi Arabia, accused Riyadh of coercing some other nations into supporting the move,” mentioned Reuters. The news also adds that the United States noted on Thursday that the cut would boost Russia's foreign earnings and suggested it had been engineered for political reasons by Saudi Arabia, which on Sunday denied it was supporting Moscow in its invasion of Ukraine.

In response, Saudi King Salman bin Abdulaziz said, per Reuters, that the kingdom was working hard to support stability and balance in oil markets, including by establishing and maintaining the agreement of the OPEC+ alliance. “His comments were backed by ministers of several OPEC+ member states including the United Arab Emirates,” adds Reuters.

Elsewhere, a softer start of the US Dollar Index (DXY) also helped the black gold to pare recent losses. That said, the DXY prints mild losses at around 113.00 by the press time. The greenback’s latest losses could be linked to the cautious optimism in the UK, after the latest political upheaval and comments from the Bank of England (BOE) Governor Andrew Bailey.

Moving on, a light calendar may restrict WTI moves but the geopolitical tensions emanating from Russia, China and recently from Saudi Arabia due to the OPEC+ moves, could keep the short-term buyers hopeful. That said, China’s monthly trade numbers and updates from the yearly Congress could also offer more directions. However, oil buyers should remain cautious amid the broad recession fears and hawkish central banks.

Technical analysis

Recovery remains elusive unless crossing the previous support line from September 27, close to $88.00 by the press time.

The Japanese authorities are off the marks early doors in Asia today with verbal intervention aimed to tame the rally in USD/JPY and in order to put psychological pressure on speculative long plays.

Reuters reported that ''Japan would firmly respond to any excessive currency fluctuations, its top currency diplomat Masato Kanda said, following the yen's sharp fall to a 32-year low to the dollar.

Each country would respond appropriately to an agreement on foreign exchange market moves by the Group of Seven (G7) and G20 meetings last week, he said.''

Japan's Finance Miniter Shun'ichi Suzuki has also stepped in and said that they will take decisive action against excess forex moves based on speculation.

Suzuki says they are constantly watching fx movements with a sense of urgency.

USD/JPY is subsequently under pressure ahead of the open and fix in Tokyo. At the time of writing, the pair is trading at 148.50 and has printed a low of 148.41 from 148.71 the high of the day. The bull cycle high was set last Friday at 148.85. Below 148.40/50, there will be prospects of a retracement to 147.80. However, so far, the acts of verbal intervention, or physical, have fallen on deaf ears in the markets and have only a momentary impact, therefore, a break of the highs opens risk into he the 150s:

(USD/JPY H1 chart)

(USD/JPY M5 chart)

- AUD/NZD has jumped to near 1.1170 as the focus has shifted to RBA minutes.

- The downbeat consensus for Australian job additions data would keep aussie on tenterhooks.

- NZ inflation data is seen lower at 6.6% against the former release of 7.3%.

The AUD/NZD pair has driven to near 1.1170 in the early Tokyo session after picking fresh demand from around 1.1134. On a broader note, the cross has been declining consecutively for the past five trading sessions. Last week, the asset witnessed an intense sell-off after dropping below the critical cushion of 1.1240.

The pair has sensed a buying interest ahead of the Reserve Bank of Australia (RBA)’s minutes, which will release on Tuesday. The RBA minutes will provide a detailed explanation behind announcing a rate hike by 25 basis points (bps). In October monetary policy meeting, RBA Governor Philip Lowe went against the projections and trimmed the pace of hiking the Official Cash Rate (OCR) to 25 bps. Earlier, the central bank was hiking its OCR by 50 bps.

Apart from the explanation of slowing down the pace of hiking crucial rates, the minutes will disclose the economic fundamentals and guidance over interest rates.

Going forward, Thursday’s employment data also holds significant importance. The Employment Change data is expected to decline to 25k against the prior print of 33.5k. While the jobless is seen as stable at 3.5%.

On the kiwi front, Tuesday’s Consumer Price Index (CPI) data will be of utmost importance. The expectations for annual inflation data for the third quarter are significantly lower at 6.6% vs. the prior print of 7.3%. The occurrence of the same could trim the extent of the hawkish tone by Reserve Bank of New Zealand (RBNZ) policymakers.

- AUD/JPY probes five-week downtrend around 11-week low, grinds higher of late.

- MACD, RSI favor bearish move inside the falling wedge chart pattern.

- Clear break of 93.30 could convince buyers to renew monthly high.

AUD/JPY pares recent losses around the 2.5-month low, seesaws around the intraday high near 92.35 during Monday’s Asian session. In doing so, the cross-currency pair bounces off a one-week-old support line to begin the week on a firmer note after five consecutive weeks of downside.

Although the immediate support line restricts the AUD/JPY pair’s downside near 92.10, backed by steady RSI, the recovery moves remain elusive as the quote stays inside a three-week-long falling wedge bullish chart pattern.

That said, the 100-SMA adds to the upside filters near 93.00, in addition to the stated wedge’s upper line near 93.30.

It’s worth noting, however, that a clear upside break of the 93.30 hurdle will allow the AUD/JPY buyers to aim for the fresh high, currently near 94.70, on the way to the theoretical target of 99.10.

Meanwhile, pullback moves need to break the aforementioned support line, close to 91.10 of late, to favor sellers.

Following that, the lower line of the wedge around 90.65 could act as a buffer during the fall targeting the 90.00 psychological magnet.

AUD/JPY: Four-hour chart

Trend: Further weakness expected

The Party Congress has kicked off this weekend with President Xi Jinping in the running to defy the Party’s retirement norms by securing a landmark 3rd term in power, as analysts at TD Securities explained. '

''Markets will watch out for headlines on easing China's zero COVID strategy and focus will also be on the reshuffle of top economic roles as current incumbents are due to step down given retirement age and term-limit norms.''

So far, as per Xi's opening speech to Congress, there is no change to the one-party state's approach to covid nor the property sector.

''Chinese President Xi Jinping signalled no change in direction for two main risk factors dragging down China’s economy -- strict Covid rules and housing market policies -- providing little lift to a worsening growth outlook.

Xi praised Covid Zero, his no-tolerance approach to containing infections, during a speech opening the 20th Communist Party congress in Beijing on Sunday, although he didn’t reference the virus again in sections laying out plans for the future. His slogans on China’s property market, meanwhile, repeated prior language even as the sector experiences its longest-ever slump due to policies aimed at curbing debt and financial risks,'' Bloomberg wrote in an article.

- AUD/USD has witnessed fresh demand after dropping to near 0.6200.

- The risk appetite has emerged as S&P500 has rebounded after a sell-off on Friday.

- RBA’s minutes will provide a detailed view of announcing a 25 bps rate hike.

The AUD/USD pair has bounced marginally after building a base around the critical support of 0.6200 in the early Tokyo session. The asset has picked bids after a north-side break of a compact rangebound structure in a 0.6195-0.6210 range as the risk appetite theme has fetched the spotlight.

A rebound in S&P500 in the early trade after a bearish Friday has raised a sense of hope in the risk-perceived currencies. Meanwhile, the US dollar index (DXY) is attempting to rebound after dropping to near 113.10. However, the index will keep facing pressure amid the emergence of the risk-on profile.

The DXY is not getting traction despite the soaring bets for a 75 basis point (bps) rate hike by the Federal Reserve (Fed). As per the CME FedWatch tool, the chances of an increment in the interest rates by 75 bps stand at 99.4%.

On the Aussie front, investors are awaiting the release of the Reserve Bank of Australia (RBA) minutes for October’s monetary policy. This will provide a detailed view of the reasoning behind the slowdown of the pace of the interest rate hike by the central bank. It is worth noting that RBA Governor Philip Lowe announced a 25 bps rate hike, and suspended the 50 bps rate hike movement, to carry the motive of maintaining economic prospects along with the agenda of bringing price stability.

Apart from that, Thursday’s Aussie employment data will remain in focus. As per the projections, the Employment Change is seen lower at 25k against the prior print of 33.5k. While the Employment Rate is seen as stable at 3.5%. A decline in additions in payrolls could trigger volatility for the aussie bulls.

- USD/CAD seesaws around intraday low after a downbeat week-start trade.

- Geopolitical fears, OPEC+ determination to shrug off US push to halt supply cuts underpin WTI crude oil rebound.

- Hawkish Fedspeak, US data favored buyers before lack of major catalysts, optimism over UK triggered DXY pullback.

- Light calendar in the US may allow USD/CAD bulls to take a breather.

USD/CAD eases around a 29-month high, retreating to 1.3870 of late, as crude oil prices rebound and the US dollar bulls seek fresh catalysts to keep the reins during Monday’s Asian session. That said, the quote’s latest pullback could also be linked to the cautious mood ahead of this week’s key data from Canada.

WTI crude oil consolidates the biggest weekly loss since early August as a softer US dollar joins fears of a supply crunch. That said, the black gold price rises 0.70% intraday to regain $85.00 by the press time. US President Joe Biden’s failure to convince the global oil suppliers to put a halt on their output cut decision renews bullish bias for the energy benchmark despite economic fears and firmer fundamentals for the US dollar.

Elsewhere, the US Dollar Index (DXY) struggles to extend a two-week uptrend around the highest levels in 20 years amid a light calendar and a lack of market focus on the US-linked catalysts. Also exerting downside pressure on the DXY could be the week-start optimism in the UK after the firing of Chancellor Kwasi Kwarteng and hints of more rate hikes from the Bank of England (BOE) Governor Andrew Bailey.

Previously, the DXY managed to reverse Thursday’s notable losses after upbeat US data and hawkish Fed bets.

On Friday, US Retail Sales remained unchanged with 0.0% growth for September versus 0.2% expected 0.4% upwardly revised prior. Further, the preliminary readings of the Michigan Consumer Sentiment Index for October was 59.8, better than the forecasted figure of 59 and 58.6 previous readings. More importantly, the University of Michigan’s 1-year and 5-year inflation expectations increased for October, respectively to 2.9% and 5.1% compared to 2.7% and 4.7% priors in that order.

Also notable is the nearly certain case of the 0.75% Fed rate hike, as per the latest readings of the CME’s Fedwatch Tool for the next Federal Open Market Committee (FOMC).

Looking forward, the market’s upbeat start and a light calendar may help the USD/CAD bulls to take a breather ahead of the Bank of Canada (BOC) Consumer Price Index (CPI) and Retail Sales for September. Although the BOC appears mostly neutral when it comes to announcing any new deviations from the rate hike path, softer Canada data may push the CAD bulls to take a pause and propel the pair further toward the north.

Technical analysis

Unless breaking a six-week-old ascending support line, around 1.3810 by the press time, USD/CAD sellers are likely to remain cautious.

- NZD/USD has sensed demand from around 0.5560 amid an improvement in the risk appetite.

- Improvement in US CPI has left no other option for the Fed than to continue the current pace of rate hike.

- Kiwi’s inflation rate for Q3 is expected to decline to 6.6% vs. the prior release of 7.3%.

The NZD/USD pair is displaying a rebound move after witnessing exhaustion in the downside momentum. The major has given an upside break of the consolidation formed in a narrow range of 0.5550-0.5567 as the risk-off impulse has taken a sigh of relief after remaining in the spotlight. S&P500 futures have rebounded firmly after a bearish Friday, therefore, the risk appetite is emerging now.

The US dollar index (DXY) has dropped in the initial trade to near 113.10 as the risk-on impulse has rebounded. It seems that investors have started shrugging off the fears of a bigger rate hike by the Federal Reserve (Fed). After the release of bigger-than-projected inflation numbers last week, odds of a fourth consecutive 75 basis points (bps) rate hike have jumped dramatically. As per the CME FedWatch tool, the chances of an increment in the interest rates by 75 bps stand at 99.4%.

The impact of accelerating rate hikes by the Fed seems absent on the price pressures. The core CPI that excludes oil and food prices stepped up to 6.6% vs. the expectations of 6.5% and the prior release of 6.3%. While the headline CPI increased to 8.2% from the projections of 8.1% but lower than the prior release of 8.3%. It seems ‘fit and proper to claim that the responsiveness of decline in headline CPI with the extent of increment in rate hike is extremely poor while the relationship with core CPI stands positive. Therefore, the Fed has been left with no other option than to tighten its policy measures further.

On the NZ front, investors are awaiting the release of Tuesday’s inflation data. Projections for annual inflation data for the third quarter are extremely lower at 6.6% vs. the former release of 7.3%. A drop of 70 bps looks mouth-watering from the front of Reserve Bank of New Zealand (RBNZ) policymakers. An occurrence of the same would bolster the case of a slowdown in the current pace of hike in the Official Cash Rate (OCR) by the RBNZ.

- EUR/GBP retreats from support-turned-resistance, grinds lower of late.

- Looming bull-cross on MACD contrasts with downbeat RSI to confuse sellers.

- Bulls need to cross 0.8800 to retake control.

EUR/GBP struggles to extend the week-start losses, grinding around an intraday low of 0.8651 during the initial hour of Monday’s Asian session. In doing so, the cross-currency pair reverses from the six-week-old previous support line to extend the previous week’s losses.

However, the MACD appears to test the bears and sluggish RSI adds to the trading filter, which in turn suggests further hardships for the bears.

That said, the latest trough surrounding 0.8610 lures intraday sellers before highlighting September’s bottom of 0.8566.

It should be noted, though, that a clear downside break of 0.8566 won’t hesitate to challenge the mid-August peak close to 0.8510 before directing the EUR/GBP bears towards the 0.8340 mark comprising the August month’s bottom.

Alternatively, recovery moves not only need to cross the support-turned-resistance line, around 0.8705 by the press time, but also the 61.8% Fibonacci retracement level of August 17 to September 26 upside, at 0.8718 by the press time, to tease the buyers.

Even so, a convergence of the 13-day-old descending trend line and 50% Fibonacci retracement level, around 0.8800 appears a tough nut to crack for the EUR/GBP bulls before they can retake control.

EUR/GBP: Four-hour chart

Trend: Further weakness expected

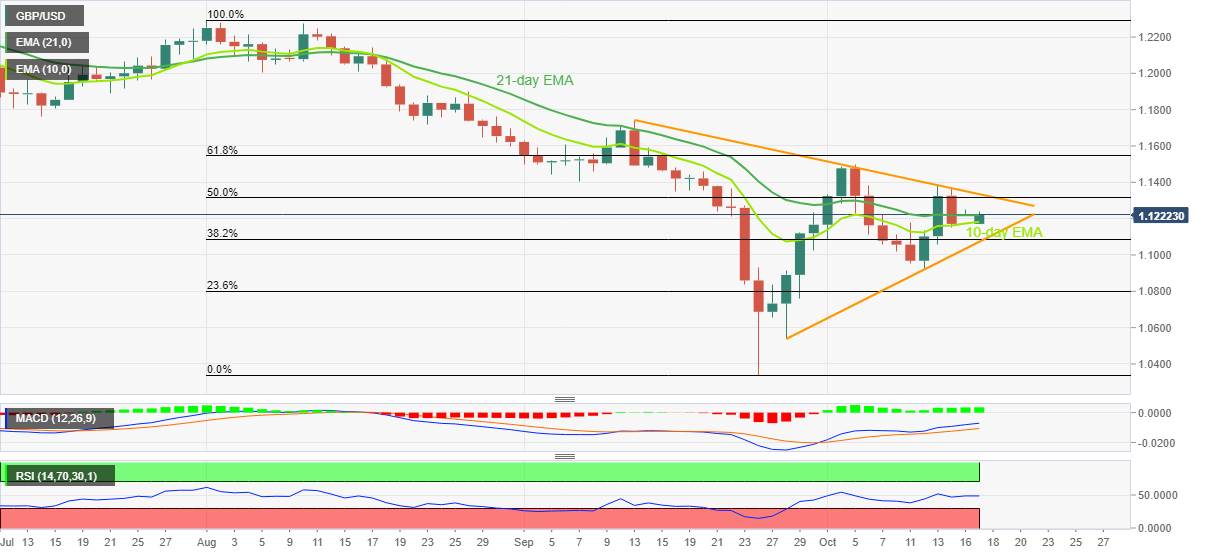

GBP/USD

Alternatively, GBP/USD struggles to extend week-start gains as it grinds higher of late. That said, firmer oscillators and sustained trading beyond 10-day EMA favor buyers. It should be noted, however, that a five-week-old resistance line near 1.1340 appears the key hurdle while bears need to conquer 1.1085 to return to the throne.

Also read: GBP/USD propped up in pre-open APAC on BoE Bailey weekend comments

GBP/USD: Daily chart

Trend: Limited upside expected

- EUR/USD bulls attempt to move the needle to the upside in the open.

- The euro will remain under pressure below 0.9800.

EUR/USD is catching an opening bid at the start of the week but the weekly chart is pressured on the front side of a well-defined trendline as the following analysis will show.

EUR/USD weekly chart

The weekly wick highlighted was followed by a lower low last week, so while last week's close was an indecisive one, the path of least resistance remains to the downside until a close above last week's highs near 0.98 the figure.

EUR/USD daily charts

The daily chart's structure aligns with the bearish weekly bias. The M-formation's neckline is holding up, so far, as resistance and the price remains below Friday's and last week's high in the open. Another test and failure to break there, near a 50% mean reversion of the prior bearish impulse, 0.9815, could lead to a downside extension for the days ahead. A break of last week's low will likely seal the deal for a move into the bear cycle lows of 0.9535 and beyond with 0.9400 on the radar.

EUR/USD H1 chart

EUR/USD's structure is bearish while the price remains below the trendline resistance. The double top and M-formation would be expected to keep the pressure tilted to the downside for the opening sessions of the week.

- Gold price has rebounded after dropping to near $1,640.00 as the risk-off impulse eases.

- A 75 bps rate hike by the Fed looks real as the odds have reached almost 100%.

- Soaring odds for hawkish Fed have pushed 10-year yields above 4% confidently.

Gold price (XAU/USD) has sensed a buying interest after dropping to near $1,640.00 in the Tokyo session. The precious metal has witnessed a loss in the downside momentum and a rebound move has played in, which is approaching $1,650.00.

The rebound move has developed as the risk-off sentiment has been eased for a while as investors have already discounted the expectations of a 75 basis point (bps) rate hike by the Federal Reserve (Fed). The US dollar index (DXY) oscillates around 113.30 after a firmer rebound from 112.20. Also, the 10-year US Treasury yields are above 4% on soaring bets for a hawkish Fed ahead.

As per the CME FedWatch tool, the chances of an increment in the interest rates by 75 bps consecutive for the fourth time stand at 99.4% at the press time. The odds of continuation of a bigger rate have jumped after the release of higher-than-expected US Consumer Price Index (CPI) data, released last week. The headline US CPI landed higher at 8.2% than the projections of 8.1% but lower than the prior release of 8.3%. While the core CPI advanced to 6.6% vs. the expectations of 6.5%.

Gold technical analysis

Gold price has picked demand after dropping to near the horizontal support plotted from Sep 29 low at $1,641.59. The 20-and 50-Exponential Moving Averages (EMAs) at $1,652.68 and $1,660.00 are declining, which adds to the downside filters.

Also, the Relative Strength Index (RSI) (14) is oscillating in a bearish range of 20.00-40.00, which favors more weakness ahead.

Gold hourly chart

The UK's Daily Mail's front pages report on the Conservative party leader's plot to topple the UK's Prime Minister Liz Truss despite warnings that this could lead to an early general election.

UK politics has been a driver of financial markets given the uncertainty over Truss initially betting her premiership on true-blue pleasing tax cuts only to U-turn on the proposal and fire the head of the Treasury, Kwasi Kwarteng and replaced him with Jeremy Hunt, a long-time lawmaker who has served three previous stints as a Cabinet minister. The PM is attempting to restore confidence and rebuild her credibility with international investors and members of her own party after the “mini-budget” she and Kwarteng unveiled three weeks ago sparked political and economic turmoil.

The government’s September 23 announcement of a plan to cut taxes by 45 billion pounds ($50 billion) without detailing how it would pay for them or offering independent analysis about the impact on public finances caused havoc on the money markets as investors worried that the government's borrowing could rise to unsustainable levels. GBP/USD has been a roller coaster ride and there is little abating of the same in sight.

GBP/USD H1 chart

In the open today, there was a big bullish gap of around 50 pips:

So long as the bears stay committed on the front side of the trendline, favouring the US dollar, then the price would be expected to close the gap and on a break of the 1.1150's doors will be open for a downside extension to test below 1.1100.

- AUD/USD bulls could be stepping in at this juncture.

- Eyes on 0.6275 on the upside and 0.6170 on the downside.

AUD/USD will be at the mercy of risk sentiment and the value of the US dollar this week. However, technically, the price is decelerating on the offer and we could see a correction as the following technical analysis illustrates:

AUD/USD H1 chart

As per the hourly chart, the price is well below last month's lows and will remain in the bear's hands so long as Friday's highs of near 0.6250 are not violated. However, there are prospects of a correction into the greyed areas which are price imbalances on the hourly chart. This will put the prior bull candle's lows in focus near a 61.8% Fibonacci retracement near 0.6275. While below this area of resistance, the focus will be on a break of the fresh bear cycle lows near 0.6170 and for a downside continuation.

Such a thesis will stem from a strong US dollar outlook as follows:

DXY daily chart

If the US dollar bulls commit to the April/May 2002 areas, then this will be expected to weigh on the Aussie for the foreseeable future.

St. Louis Federal Reserve President James Bullard said on Saturday that it is ''way too early'' to discuss the end of QT and noted that the rapid interest rate increases have contributed to the strength of the dollar against other currencies. He said that this might only ease once the US central bank reaches the point of pausing the rate hikes, "where the committee thinks we're putting meaningful downward pressure on inflation," so rates don't need to continue rising, he said.

- GBP/USD set to open bid on UK politics and BoE noise.

- The BoE gov spoke on Saturday and said inflationary pressures might require a stronger interest rates response.

GBP/USD is set to open regular forex hours on the bid as indicated by pre-open markets in the Asia Pacific with the pair up over 0.9% into 1.1270s. Cable closed on Friday offered at 1.1177 and down 1.2%. As explained here, BoE Gov Bailey: Stronger rates response needed to fight inflation, GBP/USD back above 1.1230 pre-open, the Bank of England Governor Andrew Baily said on Saturday that inflationary pressures might require a stronger interest rates response from the central bank than it had envisioned in August.

"We will not hesitate to raise interest rates to meet the inflation target," Bailey said at an event on the sidelines of the International Monetary Fund Meetings in Washington.

However, the price would be weighed if markets continue the way they left off on Friday. As analysts at ANZ Bank explained, ''risk was firmly off in US markets as earnings results rolled in and the University of Michigan survey showed consumer inflation expectations rising for the first time in seven months.'' The analysts noted that ''the immediate market reaction to Truss’ tax U-turn was muted; Monday will bring the real test.''

Lizz Truss, the UK's new Prime Minister sacked her Chancellor Kwasi Kwarteng on Friday and then scrapped her plan to freeze corporate tax next year. “It is clear that part of our mini budget went further and faster than the markets were expecting,” she said.

''The initial market response wasn’t exactly a high five – GBP extended its losses, while 10-year gilts trimmed gains after Truss’ press conference. But the gilt market’s immediate concern is the cessation of BoE emergency bond-buying. Monday’s market action will provide a test, not only for the survival of Truss’ low-tax vision, but also her political future,'' the analysts at ANZ Bank explained.

UK CPI eyed

Meanwhile, the data this week will be key. UK inflation is on the cards and analysts at TD Securities expect the ''Consumer Price Index to once again enter double-digit territory after declining to 9.9% YoY in August, as further strength in core and food inflation likely more than outweighed another large decline in petrol prices. Looking ahead, we think September will finally mark the peak in core inflation, while headline should peak in October after the next energy price cap update.''

GBP/USD technical analysis

GBP/USD is trading at 1.1270 in pre-open markets, up 0.9%. Impossible to draw a technical analysis on such a move but the price will have broken trendline structures. However, if the gap were to be filled and if 1.1150 gives, 1.1050 will be eyed. A break of 1.1280 would be significant on the upside.

Reuters reported that the Bank of England Governor Andrew said on Saturday that inflationary pressures might require a stronger interest rates response from the central bank than it had envisioned in August."We will not hesitate to raise interest rates to meet the inflation target," Bailey said at an event on the sidelines of the International Monetary Fund Meetings in Washington.

"And, as things stand today, my best guess is that inflationary pressures will require a stronger response than we perhaps thought in August."

The remarks would be expected to support GBP/USD in the open. Early prices are showing GBP/USD rising by 0.58% into the 1.1230s in thin markets.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.