- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 16-11-2016.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0690 -0,30%

GBP/USD $1,2440 -0,11%

USD/CHF Chf1,0019 +0,03%

USD/JPY Y109,06 -0,12%

EUR/JPY Y116,60 -0,40%

GBP/JPY Y135,67 -0,22%

AUD/USD $0,7479 -1,04%

NZD/USD $0,7069 -0,42%

USD/CAD C$1,3444 -0,83%

00:30 Australia Changing the number of employed October -9.8 20

00:30 Australia Unemployment rate October 5.6% 5.6%

09:30 United Kingdom Retail Sales (MoM) October 0% 0.4%

09:30 United Kingdom Retail Sales (YoY) October 4.1% 5.3%

10:00 Eurozone Harmonized CPI October 0.4% 0.3%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October 0.4% 0.5%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) October 0.8% 0.8%

13:30 Canada Foreign Securities Purchases September 12.74

13:30 U.S. Continuing Jobless Claims 2041 2038

13:30 U.S. Housing Starts October 1047 1155

13:30 U.S. Building Permits October 1225 1198

13:30 U.S. Philadelphia Fed Manufacturing Survey November 9.7 8

13:30 U.S. Initial Jobless Claims 254 258

13:30 U.S. CPI, m/m October 0.3% 0.4%

13:30 U.S. CPI, Y/Y October 1.5% 1.6%

13:30 U.S. CPI excluding food and energy, m/m October 0.1% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y October 2.2% 2.2%

13:50 U.S. FOMC Member Dudley Speak

15:00 U.S. Fed Chairman Janet Yellen Speaks

17:30 U.S. FOMC Member Brainard Speaks

21:45 New Zealand Retail Sales, q/q Quarter III 2.3%

21:45 New Zealand Retail Sales YoY Quarter III 6%

21:45 New Zealand PPI Input (QoQ) Quarter III 0.9%

21:45 New Zealand PPI Output (QoQ) Quarter III 0.2%

Gold futures steadied today as the dollar was little changed versus major rivals.

The precious metal has lost some of its appeal this week as markets reacted with calm to the election of underdog Donald Trump as president. The dollar's advance to yearly highs also weighed on gold.

Dec. gold climbed $2.80, or 0.2%, to settle at $1,224.50/oz, a slight improvement from the recent multi-week low.

Upside was capped by hawkish comments from Boston Federal Reserve President Eric Rosengren.

The nation's homebuilders continue to have a positive outlook on their market, but no more positive than last month.

Homebuilder sentiment held steady in November at 63 says the National Association of Home Builders/Wells Fargo Housing cited by cnbc. Anything above 50 is considered "positive." That confidence, however, may change in the next report.

Industrial production was unchanged in October after decreasing 0.2 percent in September. Although the level of industrial production in September was the same as the previous estimate, revisions to the index for utilities raised the rate of change in total industrial production in August and lowered it in September.

In October, manufacturing output increased 0.2 percent, and mining posted a gain of 2.1 percent for its largest increase since March 2014. The index for utilities dropped 2.6 percent, as warmer-than-normal temperatures reduced the demand for heating.

At 104.3 percent of its 2012 average, total industrial production in October was 0.9 percent lower than its year-earlier level. Capacity utilization for the industrial sector edged down 0.1 percentage point in October to 75.3 percent, a rate that is 4.7 percentage points below its long-run (1972-2015) average.

EURUSD 1.0700 (EUR 525m) 1.0800 (645m) 1.0875 (253m) 1.0900 (1.22bn) 1.1000 (1.54bn)

USDJPY 105.00 (1.0bn) 106.00 (336m) 108.50 (255m)

AUDUSD 0.7625-30 (AUD 278m) 0.7650 (202m)

NZDUSD 0.7100-05 (NZD 343m)

USDCAD 1.3255 (USD 371m) 1.3425 (485m) 1.3500 (216m) 1.3650 (381m)

EUR/SEK: 9.8000 (EUR 329m)

Manufacturing sales rose for the fourth consecutive month, up 0.3% to $51.5 billion in September. The gain reflected higher sales in the transportation equipment and fabricated metal industries.

Sales were up in 12 of 21 industries, representing 70.1% of the total manufacturing sector.

In constant dollar terms sales edged down 0.2%, indicating that lower volumes of manufactured goods were sold in September. Prices for the manufacturing sector rose 0.4% in September according to the Industrial Product Price Index.

The Producer Price Index for final demand was unchanged in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.3 percent in September and were unchanged in August. On an unadjusted basis, the final demand index increased 0.8 percent for the 12 months ended in October, the largest 12-month rise since advancing 0.9 percent in December 2014.

Within final demand in October, a 0.4-percent increase in the index for final demand goods offset a 0.3-percent decline in prices for final demand services.

Prices for final demand less foods, energy, and trade services edged down 0.1 percent in October after rising 0.3 percent in both August and September. For the 12 months ended in October, the index for final demand less foods, energy, and trade services advanced 1.6 percent, the largest increase since climbing 1.7 percent for the 12 months ended September 2014.

EUR/USD

Offers 1.0730 1.0750-60 1.0780 1.0800 1.0825-30 1.0850 1.0865 1.0900 1.0925-301.0950

Bids 1.0700 1.0680 1.0650 1.0630 1.0600

GBP/USD

Offers 1.2500 1.2530 1.2550 1.2580-85 1.2600 1.2620 1.2650

Bids 1.2450 1.2435 1.2420 1.2400 1.2375-80 1 .2350 1.2330 1.2300

EUR/GBP

Offers 0.8600-05 0.8620-25 0.8660 0.8680-85 0.8700 0.8730 0.8750

Bids 0.8565-70 0.8550 0.8500 0.8480 0.8450

EUR/JPY

Offers 117.50 118.00 118.45-50 119.00 119.50 120.00

Bids 117.00 116.80 116.50 116.30 116.00 115.80 115.60 115.30 115.00

USD/JPY

Offers 109.20-25 109.35 109.50 109.80 110.00 110.20

Bids 108.75-80 108.50 108.20 108.00 107.70-75 107.50 107.30 107.00

AUD/USD

Offers 0.7570 0.7585 0.7600 0.7630 0.7660 0.7685 0.7700 0.7730 0.7750

Bids 0.7520 0.7500 0.7475-80 0.7450 0.7420-25 0.7400

European stocks started in the green zone but soon moved into negative territory. The pressure on the indices put renewed rise in bond yields and falling oil prices. Investors' attention is also focused on corporate accountability and the political situation in the United States.

A slight effect on the dynamics of trade had statistical data from the UK. The Office for National Statistics reported that the unemployment rate declined in the first three months after Brexit, reaching at the same time the lowest value in the last 11 years. According to the data, in the period from July to September, the unemployment rate dropped to 4.8 percent from 4.9 percent in the previous three-month period. Meanwhile, the number of employed increased by 49,000 in the period from July to September, which is the weakest increase since January-February this year. The report also showed that the number of people claiming unemployment benefits rose in October by 9800, recording the largest increase since May. The number of applications for the previous month was revised to 5600 compared with the original estimate of 700. The ONS said that the total income of workers, including bonuses, increased by 2.3 percent per annum in the period from July to September. Last rate of growth coincided with a change in the previous three months. Economists had expected an increase of 2.4 percent. Excluding bonuses, earnings rose by 2.4 per cent per annum, registering the fastest growth during the year and confirming experts' assessments.

The composite index of the largest companies in the region Stoxx Europe Index 600 added 0.1 percent. Earlier today, the index showed an increase of 0.6 percent.

Capitalization of Prudential rose 1.8 percent after the insurer said it will increase the dividend on the background of the jump in sales in Asia.

Bouygues shares rose 4.9 percent, as the French conglomerate reported a higher-than-expected net profit for the first nine months of this year.

Bayer shares fell by 5 percent, pulling down shares of chemical companies.

The price of Wirecard securities, a German operator of payment systems, rose by 6.5 percent as profit forecasts for 2017 exceeded the estimates of some analysts.

Electrolux quotes jumped 1.4 percent after data showed that US shipments of household appliances rose in October. Recall, the Swedish manufacturer of dishwashers and cookers gets about a third of its revenue from North America.

Hugo Boss AG shares fell 7 percent, as the company warned of slowing the expansion of its store network.

At the moment:

FTSE 100 6778.48 -14.26 -0.21%

DAX -31.82 10703.32 -0.30%

CAC 40 4521.57 -14.96 -0.33%

The ZEW-CS Indicator for the economic sentiment in Switzerland continues to improve in November 2016. Compared to the previous month, it increased by 3.7 points to a current reading of 8.9 points.

This marks the third successive rise of the indicator. In contrast, the assessment of the current economic situation in Switzerland deteriorates: the corresponding indicator declines by 3.2 points to a level of 14.7 points.

Almost three quarters of the surveyed experts expect the economic development to remain unchanged within the next six months. Furthermore, a large majority of 85 per cent of the respondents considers the current economic situation to be "normal".

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.3% including bonuses and by 2.4% excluding bonuses compared with a year earlier.

There were 31.80 million people in work, 49,000 more than for April to June 2016 and 461,000 more than for a year earlier.

There were 23.24 million people working full-time, 350,000 more than for a year earlier. There were 8.56 million people working part-time, 110,000 more than for a year earlier.

The unemployment rate was 4.8%, down from 5.3% for a year earlier and the lowest since July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

EUR/USD 1.0700 (EUR 525m) 1.0800 (645m) 1.0875 (253m) 1.0900 (1.22bn), 1.1000 (1.54bn)

USD/JPY 105.00 (1.0bn) 106.00 (336m) 108.50 (255m)

AUD/USD 0.7625-30 (AUD 278m) 0.7650 (202m)

NZD/USD 0.7100-05 (NZD 343m)

USD/CAD 1.3255 (USD 371m) 1.3425 (485m) 1.3500 (216m) 1.3650 (381m)

EUR/SEK: 9.8000 (EUR 329m)

-

At 14:00 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

-

At 17:05 GMT the Bank of Canada Deputy Governor Timothy Lane will deliver a speech

-

At 22:30 GMT FOMC members Patrick T. Harker will deliver a speech

-

Infrastructure Spending May Raise U.S. Productivity

-

Medium-Term Growth Prospects May Be Affected by Trump Policies

-

U.S. Monetary Policy Outlook Has Not Changed After Election

EUR/USD

Resistance levels (open interest**, contracts)

$1.1027 (2569)

$1.0948 (2461)

$1.0882 (1085)

Price at time of writing this review: $1.0741

Support levels (open interest**, contracts):

$1.0682 (4148)

$1.0648 (4044)

$1.0599 (3896)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 65773 contracts, with the maximum number of contracts with strike price $1,1400 (6082);

- Overall open interest on the PUT options with the expiration date December, 9 is 57588 contracts, with the maximum number of contracts with strike price $1,0900 (4148);

- The ratio of PUT/CALL was 0.88 versus 0.87 from the previous trading day according to data from November, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.2803 (1223)

$1.2705 (1708)

$1.2608 (1538)

Price at time of writing this review: $1.2496

Support levels (open interest**, contracts):

$1.2391 (1461)

$1.2294 (3897)

$1.2196 (1216)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34694 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36371 contracts, with the maximum number of contracts with strike price $1,2300 (3897);

- The ratio of PUT/CALL was 1.05 versus 1.04 from the previous trading day according to data from November, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

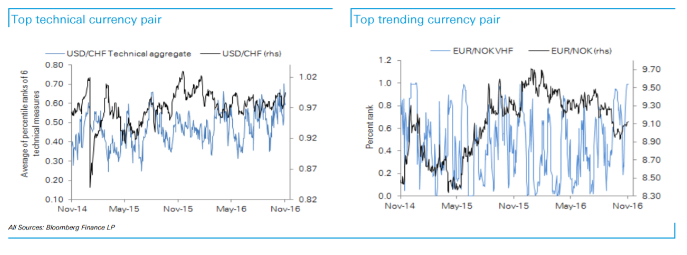

"After the US election surprise, the rise in treasury yields on expectations of fiscal stimulus has led to strengthening of dollar across G10 currency pairs which has held to a rise in trendiness across G10 pairs.

Among G10 currencies, USD/CHF is our top technical currency pair. The pair is highly trending as per VHF metrics and has broken new ground to the upside. The cross is the least stretched among G10 currency pairs from a RSI perspective and has smooth price action as measured by realized vol.

EUR/USD is also trending and is breaking new ground (100 percentile) but it is relatively stretched as per RSI metrics.

Similarly USD/JPY, EUR/GBP and USD/CAD are trending according to VHF metrics and breaking new ground but are highly stretched from an RSI perspective".

Copyright © 2016 DB, eFXnews™

During his interview with Bloomberg TV, Kazuo Momma said he did not agree with the official version of the guidance. In addition, added that further stimulus measures , "not needed and do not needed in the foreseeable future."

The index of leading economic indicators from Australia, published by the University of Melbourne, rose 0.1% in October as in September. This index tracks the performance of nine indicators of economic activity, including share prices. However, today's figure was insignificant and did not affect the Australian dollar.

The leading index, which indicates the likely pace of economic activity relative to trend from three to nine months into the future, fell from + 0.63% in September to +0.43% in October. Although the growth rate slowed slightly, the index still shows a clear positive signal for the near-term economic outlook.

-

The October 2016 trend estimate (98,997) increased by 0.3% when compared with September 2016.

-

When comparing national trend estimates for October 2016 with September 2016, sales for Passenger vehicles and Other vehicles decreased by 0.7% and 0.1% respectively. By contrast, sales for Sports utility vehicles increased by 1.4%.

-

The largest upward movement across all states and territories, on a trend basis, was in Tasmania (2.9%), continuing an upward trend which commenced in May 2016.

-

The largest downward movement across all states and territories, on a trend basis, was in the Northern Territory (-1.5%).

The wage index was 0.4%, lower than the previous value, and lower than analysts forecast of 0.5% in the third quarter. In annual terms, the indicator was also lower than the forecast of 2.0%, dropping to 1.9% from the previous value of 2.1%, which was the lowest level since data collection began in 1997.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.