- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 17-03-2015.

(time / country / index / period / previous value / forecast)

05:00 Japan BoJ monthly economic report

09:30 United Kingdom Average earnings ex bonuses, 3 m/y January +1.7%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y January +2.1% +2.2%

09:30 United Kingdom Claimant Count Rate February 2.5%

09:30 United Kingdom Claimant count February -38.6 -31.0

09:30 United Kingdom ILO Unemployment Rate February 5.7% 5.6%

09:30 United Kingdom Bank of England Minutes

10:00 Eurozone Trade balance unadjusted January 24.3

10:00 Eurozone Trade Balance s.a. January 23.3 21.1

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) March -73.0

12:30 United Kingdom Annual Budget Release

12:30 Canada Wholesale Sales, m/m January +2.5% +2.1%

14:30 U.S. Crude Oil Inventories March +4.5

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

21:45 New Zealand GDP q/q Quarter IV +1.0% +0.8%

21:45 New Zealand GDP y/y Quarter IV +3.2%

The U.S. dollar traded higher against the most major currencies ahead of the Fed's monetary policy decision on Wednesday. Housing starts in the U.S. dropped 17.0% to 897,000 annualized rate in February from a 1.081 million pace in January, missing expectations for a decrease to 1.050 million. January's figure was revised up from 1.065 million units.

Building permits in the U.S. increased 3.0% to 1.092 million annualized rate in February from a 1.06 million pace in January. Analysts had expected building permits to climb to 1.07 million units.

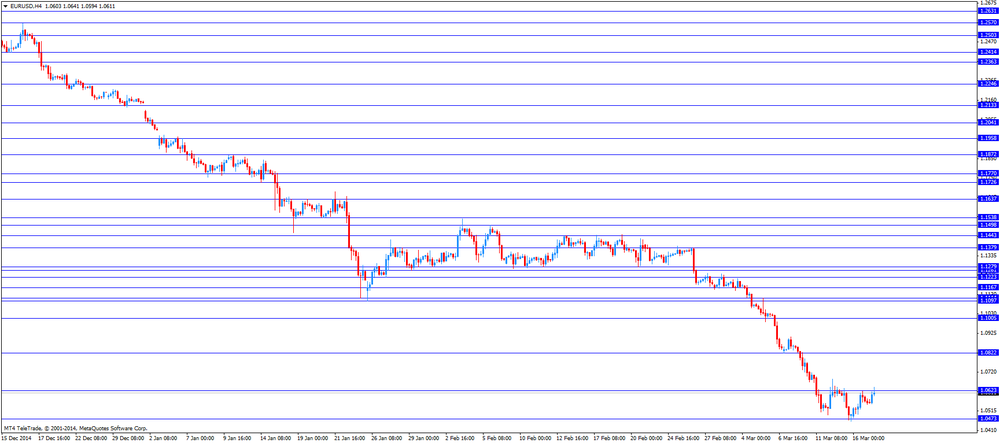

The euro traded lower against the U.S. dollar. Germany's ZEW economic sentiment index increased to 54.8 in March from 53.0 in February, but missing expectations for a rise to 58.9. That was the highest reading since February 2014.

The increase was driven by lower oil prices and a weaker euro. Greek debt talks and the Ukraine conflict continue to weigh on sentiment.

Eurozone's ZEW economic sentiment index rose to 62.4 in March from 52.7 in February, beating expectations for a gain to 58.2.

Eurozone's consumer price index rose 0.6% in February, after a 1.6% decrease in January.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.3% in February, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.7% in February from a previous estimate of 0.6%. Analysts had expected the index to remain unchanged at 0.6%.

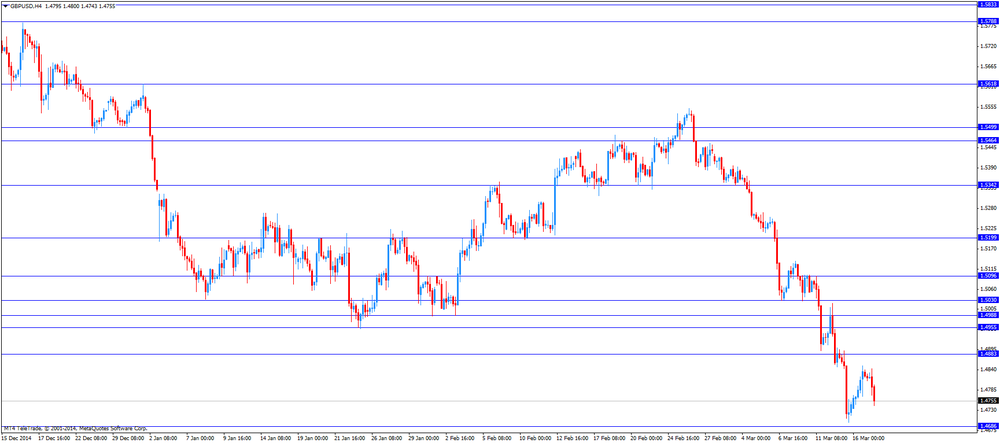

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar. Canadian manufacturing shipments dropped 1.7% in January, missing forecasts of a 1.1% decrease, after a 1.6% increase in December. December's figure was revised down from a 1.7% rise.

The decline was driven by a drop in sales of petroleum and coal products.

The New Zealand dollar declined against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded slightly higher against the greenback after the release of the Reserve Bank of Australia's (RBA) monetary policy meeting minutes. The RBA is likely to cut its interest rate this year but it will wait for April's inflation and labour market data.

The RBA board discussed whether or not to lower its interest rate further at this meeting but "members saw benefit in allowing some time for the structure of interest rates and the economy to adjust to the earlier change".

The central bank pointed out that the Aussie "remained above most estimates of its fundamental value" despite the recent depreciation.

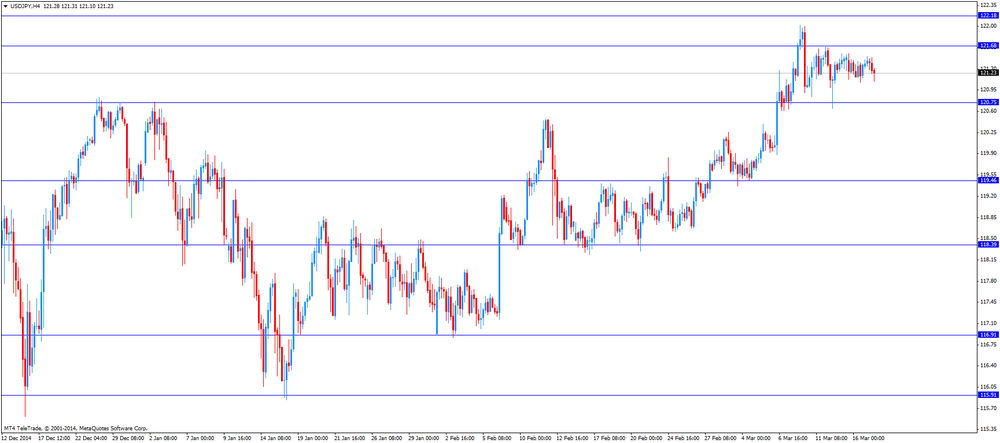

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the Bank of Japan's (BoJ) interest rate decision. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The central bank voted 8-1 to keep its monetary policy unchanged. The BoJ said that Japan's economy has continued to recover moderately.

Japan's central bank downgraded its consumer inflation forecast to around zero per cent "for the time being" due to the decline in energy prices.

The BoJ Governor Haruhiko Kuroda said in a press conference on Tuesday that a decline in consumer prices is temporary as the consumer prices were driven by lower energy costs. He added that the consumer inflation could decline below zero.

Mr Kuroda expects that consumer prices will rise in the second half of the fiscal year that ends in March 2016. The central bank will adjust its monetary policy if needed, Mr Kuroda said.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Tuesday that a decline in consumer prices is temporary as the consumer prices were driven by lower energy costs. He added that the consumer inflation could decline below zero.

Mr Kuroda expects that consumer prices will rise in the second half of the fiscal year that ends in March 2016. The central bank will adjust its monetary policy if needed, Mr Kuroda said.

The BoJ governor pointed out that even if consumer prices will be negative, it won't necessarily affect the inflation.

The Bank of Japan (BoJ) released its interest rate decision on Tuesday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The central bank voted 8-1 to keep its monetary policy unchanged. The BoJ said that Japan's economy has continued to recover moderately.

Japan's central bank downgraded its consumer inflation forecast to around zero per cent "for the time being" due to the decline in energy prices.

The Reserve Bank of Australia (RBA) released its minutes from March monetary policy meeting on Tuesday. The RBA is likely to cut its interest rate this year but it will wait for April's inflation and labour market data.

The RBA board discussed whether or not to lower its interest rate further at this meeting but "members saw benefit in allowing some time for the structure of interest rates and the economy to adjust to the earlier change".

The central bank pointed out that the Aussie "remained above most estimates of its fundamental value" despite the recent depreciation.

The RBA warned that "risks in the household sector continued to be centred on housing and mortgage markets".

The RBA kept its interest rate unchanged at 2.25% on March 03. Analysts had expected the RBA to cut its interest rate to 2.00%.

Australia's central bank cut its interest rate to 2.25% on February 03, 2015, down from 2.50%.

The European Central Bank President Mario Draghi said in a speech to a finance conference in Frankfurt on Monday that an economic recovery is taking hold in the Eurozone thanks in part to the central bank's quantitative easing. He urged governments to implement reforms that would improve the Eurozone's long-term growth prospects.

"Confidence among firms and consumers is rising. Growth forecasts have been revised upwards. And bank lending is improving on both the demand and supply sides," he added.

Mr Draghi noted that the Eurozone's economy benefited from lower oil prices and a revival in bank lending.

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments dropped 1.7% in January, missing forecasts of a 1.1% decrease, after a 1.6% increase in December.

December's figure was revised down from a 1.7% rise.

The decline was driven by a drop in sales of petroleum and coal products. Sales of petroleum and coal products plunged 11.9% in January. It was the biggest one-month drop since 2008.

Sales of motor vehicles decreased 2.0%, while sales of machinery dropped 8.9% in January.

Food sales declined 1.7% in January.

Sales declined in 14 of 21 categories.

EUR/USD: $1.0700 (E429mn)

USD/JPY: Y120.00 ($1.6bn), Y121.00 ($931mn), Y122.00($612mn)

GBP/USD: $1.4900 (Gbp175mn)

USD/CAD: C$1.2700(520mn), $1.2780(C$244mn), C$1.2800 ($220mn): C$1.2825

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. dropped 17.0% to 897,000 annualized rate in February from a 1.081 million pace in January, missing expectations for a decrease to 1.050 million. It was the lowest level since January 2014.

January's figure was revised up from 1.065 million units.

The decline was driven by bad weather in the U.S.

Building permits in the U.S. increased 3.0% to 1.092 million annualized rate in February from a 1.06 million pace in January. Analysts had expected building permits to climb to 1.07 million units.

Starts of single-family homes dropped 14.9% to 539,000 units in February. Building permits for single-family homes declined 6.2% to 620,000 units.

Starts of multifamily buildings plunged 20.8% to 304,000 units in February. Permits for multi-family housing increased 18.3% to 472,000 units.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

10:00 Eurozone Employment Change Quarter IV +0.2% +0.1% +0.1%

10:00 Eurozone ZEW Economic Sentiment March 52.7 58.2 62.4

10:00 Eurozone Harmonized CPI February -1.6% +0.6%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) February -0.3% -0.3% -0.3%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y February +0.6% +0.6% +0.7%

10:00 Germany ZEW Survey - Economic Sentiment March 53.0 58.9 54.8

12:30 Canada Manufacturing Shipments (MoM) January +1.6% Revised From +1.7% -1.1% -1.7%

12:30 U.S. Building Permits, mln February 1.06 Revised From 1.05 1.07 1.09

12:30 U.S. Housing Starts, mln February 1.08 Revised From 1.07 1.05 0.90

The U.S. dollar traded mixed against the most major currencies after the mixed U.S. housing market data. Housing starts in the U.S. dropped 17.0% to 897,000 annualized rate in February from a 1.081 million pace in January, missing expectations for a decrease to 1.050 million. January's figure was revised up from 1.065 million units.

Building permits in the U.S. increased 3.0% to 1.092 million annualized rate in February from a 1.06 million pace in January. Analysts had expected building permits to climb to 1.07 million units.

The euro traded higher against the U.S. dollar after the ZEW economic sentiment index from the Eurozone. Germany's ZEW economic sentiment index increased to 54.8 in March from 53.0 in February, but missing expectations for a rise to 58.9. That was the highest reading since February 2014.

The increase was driven by lower oil prices and a weaker euro.

Eurozone's ZEW economic sentiment index rose to 62.4 in March from 52.7 in February, beating expectations for a gain to 58.2.

Eurozone's consumer price index rose 0.6% in February, after a 1.6% decrease in January.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.3% in February, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.7% in February from a previous estimate of 0.6%. Analysts had expected the index to remain unchanged at 0.6%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian manufacturing shipments. Canadian manufacturing shipments dropped 1.7% in January, missing forecasts of a 1.1% decrease, after a 1.6% increase in December. December's figure was revised down from a 1.7% rise.

The decline was driven by a drop in sales of petroleum and coal products.

EUR/USD: the currency pair rose to $1.0641

GBP/USD: the currency pair decreased to $1.4743

USD/JPY: the currency pair fell to Y121.10

The most important news that are expected (GMT0):

21:45 New Zealand Current Account Quarter IV -5.01 -3.12

23:50 Japan Trade Balance Total, bln February -1177

23:50 Japan Adjusted Merchandise Trade Balance, bln February -406 -1210

EUR/USD

Offers 1.0680 1.0700 1.0720 1.0735 1.0750 1.0800

Bids 1.0500 1.0460 1.0400 1.0300

GBP/USD

Offers 1.4900 1.4925 1.4940-50 1.4985 1.5000 1.5030-35 1.5060 1.5080 1.5100

Bids 1.4695 1.4645 1.4600 1.4500

EUR/JPY

Offers 129.05 129.60 129.80 130.00 130.20

Bids 128.00-10 127.00 126.85 126.55 126.00 124.95

USD/JPY

Offers 121.80 122.00-10 122.35 122.50 122.80 123.00

Bids 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7170 0.7185 0.7200 0.7220-25 0.7245-50

Bids 0.7080 0.7050 0.7035 0.7020 0.7000

AUD/USD

Offers 0.7700-10 0.7725 0.7740 0.7760

Bids 0.7610 0.7600 0.7585 0.7565 0.7550

Economic Sentiment of the largest economy in the Eurozone further improved and rose for a fifth month suggesting further recovery in Germany in the next 6 months. The ZEW Center for European Economic Research reported an increase from 53.0 to 54.8 points for the month of February - although below estimates of an increase to 58.9 points. The Sentiment improved as a consequence of lower oil prices and a lower euro, trading near 12-year lows against the greenback, boosting export-heavy sectors and fuelled consumption. The quantitative easing, started last week on Monday, further stimulated the economy.

ZEW Economic Sentiment for the whole Eurozone rose more-than-expected from a previous reading of 52.7 to 62.4. Analysts expected the index to rise to 58.2.

EUR/USD: $1.0700 (E429mn)

USD/JPY: Y120.00 ($1.6bn), Y121.00 ($931mn), Y122.00($612mn)

GBP/USD: $1.4900 (Gbp175mn)

USD/CAD: C$1.2700(520mn), $1.2780(C$244mn), C$1.2800 ($220mn): Digital C$1.2825

BLOOMBERG

When Yellen Gets Less Predictable She's Getting Back to Normal

(Bloomberg) -- Janet Yellen wants to be less predictable, if only a little.

Should the Federal Reserve this week jettison a promise to remain "patient" about raising interest rates, as anticipated by economists, the omission will mark the end of an era in Fed communications policy and could usher in a period of greater market volatility.

Beginning in June, and for the first time since 2008, officials would be making rate decisions meeting-by-meeting, based purely on the data in front of them, rather than committing themselves to keeping borrowing costs low.

BLOOMBERG

China's Swaps Drop Most in Six Weeks as Central Bank Cuts Yield

(Bloomberg) -- China's interest-rate swaps dropped the most in six weeks after the central bank cut a short-term lending rate for the second time this month, helping counter a slowdown in the world's second-largest economy.

The People's Bank of China said it auctioned seven-day reverse-repurchase agreements at 3.65 percent, down from 3.75 percent last week. The rate was also lowered by 10 basis points on March 3, two days after benchmark interest rates were reduced for the second time in three months. Capital outflows are complicating efforts to bring down borrowing costs as the economy expands at the slowest pace in two decades.

The cost of one-year swaps, the fixed payment to receive the floating seven-day repurchase rate, fell 13 basis points to 3.63 percent as of 4:38 p.m. in Shanghai, data compiled by Bloomberg show. That's the biggest drop since Feb. 4. The rate climbed to 3.83 percent earlier, the highest level since July.

REUTERS

Brent comes off 6-week low to rise above $54, but glut worries drag

(Reuters) Brent Crude rose above $54 a barrel in choppy trade on Tuesday, recovering some of the previous session's losses when it hit a six-week low, but concerns over a growing supply glut kept a lid on gains.

Prices on the other side of the Atlantic fell for a sixth session to just above a six-year low, keeping their discount to Brent at near $10, a trend that analysts say could deepen.

"The oil market is currently oversupplied, driven in part by the success of North American shale," Morgan Stanley said.

While the U.S. rig count has dropped from 1,809 rigs a year ago to 1,125 last week, past cycles have shown there is "often a lag between when drilling stops and when oil supply stops growing", the bank said in a note.

Source: http://www.reuters.com/article/2015/03/17/us-markets-oil-idUSKBN0MD0AH20150317

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

The U.S. dollar traded lower against its major peers on Tuesday after the weaker-than expected economic data reported yesterday and ahead of this week's Federal Reserve policy meeting. The NAHB housing market index declined to 53 in March from 55 in February. It was the third consecutive decline. The U.S. industrial production increased 0.1% in February, missing expectations for a 0.3% rise, after a 0.3% drop in January. The NY Fed Empire State manufacturing index declined to 6.90 in March from 7.78 in February, missing expectations for a rise to 8.1.

The euro further stabilized rebounding from 12-year lows set on Monday. Quantitative Easing and concerns over Greece continue to weigh on the single currency.

The Australian dollar traded moderately higher against the greenback. The Reserve Bank of Australia published the minutes of the last policy meeting. The minutes stated that the cash rate cut to a record low at 2.25% in February needs time in order to have an impact on the economy and that additional rate cuts might be necessary to achieve the aimed effect. The aussie dipped after the minutes were released as the bank kept the door open to further rate cuts.

New Zealand's dollar added gains against the greenback on Tuesday in the absence of any major economic reports from New Zealand. Today at 21:45 GMT the data on the country's Current Account will be reported.

The Japanese yen traded higher against the greenback on Tuesday currently trading at USD121.26, further gaining ground from 8-year lows at USD122.20 set on Tuesday last week. The Bank of Japan held rates steady at 0.10% and the Monetary Base Target at 275 with an 8 to 1 vote and revised its inflation outlook on lower oil prices. Later in the day Japan's Trade Balance and Adjusted Merchandise Trade Balance will be reported.

EUR/USD: the euro traded higher against the greenback

(time / country / index / period / previous value / forecast)

10:00 Eurozone Employment Change Quarter IV +0.2% +0.1%

10:00 Eurozone ZEW Economic Sentiment February 52.7 58.2

10:00 Eurozone Harmonized CPI February -1.6%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) February -0.3% -0.3%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y February +0.6% +0.6%

10:00 Germany ZEW Survey - Economic Sentiment February 53.0 58.9

12:30 Canada Manufacturing Shipments (MoM) January +1.7% -1.1%

12:30 U.S. Building Permits, mln February 1.06 Revised From 1.05 1.07

12:30 U.S. Housing Price Index, m/m February 1.07 1.05

20:30 U.S. API Crude Oil Inventories March -0.4

21:45 New Zealand Current Account Quarter IV -5.01 -3.12

23:00 Australia Conference Board Australia Leading Index January +0.4%

23:30 Australia Leading Index February +0.1%

23:50 Japan Trade Balance Total, bln February -1177

23:50 Japan Adjusted Merchandise Trade Balance, bln February -406 -1210

EUR / USD

Resistance levels (open interest**, contracts)

$1.0778 (1946)

$1.0723 (1253)

$1.0681 (392)

Price at time of writing this review: $1.0585

Support levels (open interest**, contracts):

$1.0517 (2303)

$1.0472 (6202)

$1.0414 (4722)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 58585 contracts, with the maximum number of contracts with strike price $1,1200 (3445);

- Overall open interest on the PUT options with the expiration date April, 2 is 65751 contracts, with the maximum number of contracts with strike price $1,0600 (6202);

- The ratio of PUT/CALL was 1.12 versus 1.10 from the previous trading day according to data from March, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.5104 (1743)

$1.5006 (1263)

$1.4910 (1006)

Price at time of writing this review: $1.4831

Support levels (open interest**, contracts):

$1.4788 (992)

$1.4691 (1208)

$1.4594 (1491)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 24295 contracts, with the maximum number of contracts with strike price $1,5100 (1743);

- Overall open interest on the PUT options with the expiration date April, 2 is 26308 contracts, with the maximum number of contracts with strike price $1,5050 (2364);

- The ratio of PUT/CALL was 1.08 versus 1.09 from the previous trading day according to data from March, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.