- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 20-03-2020.

On Monday, at 11:00 GMT in Germany Bundesbank's monthly report will be published. At 12:30 GMT, Canada will announce changes in wholesale trade for January. Also at 12: 30 GMT, the US will release the NY Fed Empire State manufacturing index for February. At 15:00 GMT in the euro zone, will be presented an indicator of consumer confidence for March

On Tuesday, initially, the focus will be on manufacturing PMI and services PMI for March: Japan will report at 00: 30 GMT, France at 08:15 GMT, Germany at 08:30 GMT, the Eurozone at 09:00 GMT, and UK at 09:30 GMT. The G20 meeting will also be held on Tuesday. At 11:00 GMT, UK will release the balance of industrial orders according to the Confederation of British Industrialists for March. At 13: 00 GMT, the US will announce the change in the s&P/Case-Shiller housing price index for January. At 13: 45 GMT, the US will publish the index of business activity in the manufacturing sector and the PMI for the services sector for March. At 14:00 GMT, the US will report changes in new home sales for February and release the Richmond Fed Manufacturing Index for March. At 21:45 GMT, New Zealand will announce a change in the foreign trade balance for February.

On Wednesday, at 09:00 GMT, Germany will present the IFO business environment indicator, the IFO current situation assessment indicator, and the IFO economic expectations indicator for March. At 09:30 GMT, UK will release the consumer price index, retail price index, producer purchasing price index and producer selling price index for February, and at 11:00 GMT, the CBI retail sales volume balance for March will be released. At 12: 30 GMT, the US will announce changes in the durable goods orders for February and publish the housing price index for January. At 14:00 GMT in Switzerland, the quarterly inflation report from the SNB will be released. Also at 14:00 GMT, Belgium will present the business sentiment index for March. At 14:30 GMT, the US will announce changes in oil reserves according to the Ministry of energy.

On Thursday, at 07:00 GMT, Germany will release the Gfk consumer climate index for April. At 09:00 GMT in the euroarea the ECB Economic Bulletin will be released. Also at 09: 00 GMT, the Euro zone will report changes in the aggregate M3 of money supply and the volume of lending to the private sector for February. At 09:30 GMT, UK will announce changes in retail sales for February. At 12: 30 GMT, the US will announce changes in the volume of GDP for the 4th quarter, the balance of foreign trade in goods for February and the number of initial applications for unemployment benefits. At 23:30 GMT in Japan, Tokyo's consumer price index for March will be released.

On Friday, at 07:45 GMT, France will release the consumer confidence index for March. At 12: 30 GMT, the US will publish the PCE price index ex food, energy for February, and will report changes in the personal Income and personal spending for February. At 14:00 GMT, the US will release the Reuters/Michigan consumer sentiment index for March. At 17:00 GMT, the US will release a Baker Hughes report on the number of active oil rigs.

- Says national lockdown is not under consideration at this time

- U.S. and Mexico both have agreed to limit non-essential travel

- Border restrictions with Canada will go into effect Saturday and do not effect trade

FXStreet reports that economists at Morgan Stanley apprise that ending the year at around 2750 for the S&P 500 would imply lingering issues beyond a garden-variety recession that currently seem unlikely.

“We still think that 2750 may be a reasonable year-end bear case for the S&P.”

“We've been watching 2550-2600 as a level for the S&P in an overshoot—a level the S&P has already traded below. Further investor reductions in gross exposure could push the liquidity-driven overshoot further than we expected.”

“For investors with a 6-12-month horizon, the 2550-2600 level may offer an attractive risk-reward buying opportunity.”

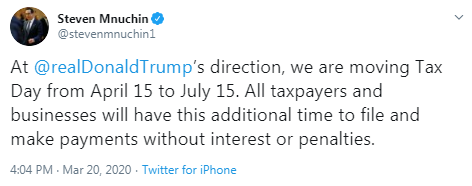

US: Helicopter money may be the better option – Rabobank

FXStreet notes that the US federal government is considering sending ‘helicopter money’ to Americans. Under current circumstances, helicopter money is an attractive alternative to outright monetary financing, especially for the US, according to analysts at Rabobank.

“Helicopter money will be very effective in helping people, preventing misery and even hunger among a substantial size of the population and it may also help to restore people’s confidence in the future.”

“People may spend the money or they may not. If people lack confidence in the future, they may decide to save the money for a rainy day and put it on a savings account (or keep it in the form of cash).”

“In normal recessions monetary financing seems to be more effective than helicopter money in stimulating economic activity. But in today’s situation, helicopter money may be the better option. Certainly in the US.”

"Through the Money Market Mutual Fund Liquidity Facility, or MMLF, the Federal Reserve Bank of Boston will now be able to make loans available to eligible financial institutions secured by certain high-quality assets purchased from single state and other tax-exempt municipal money market mutual funds", the Fed says in its statement.

FXStreet reports that Sandra Phlippen, a Chief Economist at ABN Amro, thinks the ‘recession territory’ has worsened into a deeper worldwide recession with a less favourable recovery outlook.

“The economic impact of the coronavirus crisis is unprecedented and the effects will not have disappeared after the second quarter.”

“We foresee an initial revival in the third quarter, followed by a pullback in the fourth quarter due to second-order effects.”

“All in all, a strong recovery of the global economy is not on the cards until 2021.”

FXStreet reports that economists at Rabobank are expecting a contraction for the Dutch economy in 2020.

“We are lowering our expectations for the Dutch economy again, and expect a contraction of 0.2% in 2020.”

“The Dutch government has initially pledged EUR 15.6 billion to support measures for workers and businesses.”

“We estimate that household consumption will grow by just half a percent in the whole of 2020.”

“We expect companies to invest 2.1% less in 2020 than in 2019.”

“We expect a 1.5% drop in 2020 for both exports and imports.”

The National Association of Realtors (NAR) announced on Friday that the U.S. existing home sales climbed 6.5 percent m-o-m to a seasonally adjusted rate of 5.77 million in February from a revised 5.42 million in January (originally 5.46 million). That was the highest level since February of 2007.

Economists had forecast home resales increasing to a 5.50 million-unit pace last month.

In y-o-y terms, existing-home sales climbed 9.6 percent in February.

According to the report, single-family home sales stood at 5.17 million in February, up from 4.82 million in January, and up 7.3 percent from a year ago. The median existing single-family home price was $272,400 in February, up 8.1 percent from February 2019. Meanwhile, existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 600,000 units in February, about even with January's sales, but 7.1 percent higher than a year ago. The median existing condo price was $249,900 in February, a gain of 7.0 percent, from a year ago.

Lawrence Yun, NAR's chief economist, noted that February's home sales were encouraging but not reflective of the current turmoil in the stock market or the significant hit the economy is expected to take because of the coronavirus and corresponding social quarantines. "These figures show that housing was on a positive trajectory, but the coronavirus has undoubtedly slowed buyer traffic and it is difficult to predict what short-term effects the pandemic will have on future sales," he said.

FXStreet notes that Canadian retail sales increased 0.4% in January. The soft start to 2020 will get much worse as containment measures kick in, Nathan Janzen from the Royal Bank of Canada informs. USD/CAD trades at 1.427.

“That retail sales edged up 0.4% in January will carry little or no weight in markets or from policymakers given the dramatic shock to come.”

“February sales will likely already be impacted to a degree with much larger declines to follow. One exception will be food stores. Online sales also, presumably, could see a boost.”

FXStreet reports that economists at JP Morgan Asset Management apprise the Fed’s options for additional stimulus are limited, and each comes with a set of complications that challenge their viability.

“An overhaul of regulatory conditions: Current liquidity requirements and a ban on proprietary trading prevents banks from supporting credit markets; adjustments to these rules could ease conditions. However, regulatory reform is a slow process and unlikely in the near-term.”

“A broadened policy remit: Negative interest rates or an expanded asset purchase program by which the Fed can purchase corporate bonds. Such changes would likely require Congressional approval.”

“A targeted lending program: Additional support for virus-impacted small and medium-size firms. Future lending programs will require additional support from and coordination with the U.S. Treasury.”

Statistics Canada reported on Friday that the Canadian retail sales rose 0.4 percent m-o-m at CAD51.97 billion in January 2020, following a revised 0.2 percent m-o-m advance in December 2019 (originally flat m-o-m).

Economists had forecast a 0.3 percent m-o-m increase for January.

According to the report, the January gain was primarily attributable to higher sales at motor vehicle and parts dealers (+1.8 percent m-o-m) and gasoline stations (+1.5 percent m-o-m), both of which declined in December. Meanwhile, the other nine subsectors, which comprise the core retail sector, collectively fell 0.3 percent m-o-m in January.

In y-o-y terms, Canadian retail sales climbed 3.4 percent in January, following an unrevised 2.4 percent surge in December.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:00 | Eurozone | Current account, unadjusted, bln | January | 51.2 | 20.5 | 8.7 |

| 09:30 | United Kingdom | PSNB, bln | February | 12.43 | -0.85 | 0.39 |

| 12:00 | United Kingdom | BOE Quarterly Bulletin |

GBP rose against other major currencies in the European session on Friday, bouncing off more than three-decade lows against USD, as the Bank of England's (BoE) fresh stimulus measures underpinned investor sentiment.

Sterling, along with several other currencies, had suffered significant slumps as investors worried by the coronavirus outbreak rushed to the U.S. dollar, the world’s most liquid currency.

The Bank of England (BoE) cut benchmark interest rates 15 bps to a record low of 0.1% and expanded its bond-buying program by GBP200 billion on Thursday in a new attempt to support the UK economy and financial system amid coronavirus outbreak, helping British government bond yields. And this did provided support to sterling in money markets.

Market participants also digested the Office for National Statistics' (ONS) report, which showed that the UK budget deficit narrowed in February. According to the reportt, public sector net borrowing excluding banks fell to GBP0.3 billion from GBP 0.6 billion in February 2019, as local government and public corporations borrowed GBP3.8 billion and GBP0.2 billion, respectively, while the central government was in surplus by GBP 2.9 billion.

FXStreet reports that in light of the recent price action in EUR/USDFX, Strategists at UOB Group believe that further pullbacks are likely in the next weeks.

24-hour view: "We highlighted yesterday that EUR 'could revisit 1.0800, possibly testing last month's low of 1.0775'. While our view for a lower EUR was correct, we did not anticipate the subsequent outsized sell-off as EUR posted the largest 1-day drop (-2.04%) since June 2016. Obviously, downward momentum is strong and this coupled with lack of support levels of note could lead to further sharp and rapid decline in EUR. From here, barring a move above 1.0800 (minor resistance at 1.0750), EUR could weaken further to 1.0550, possibly as low as 1.0480."

Next 1-3 weeks: "We highlighted yesterday (19 Mar, spot at 1.0935) that 'a break of last month's low of 1.0775 would open up the way for further EUR weakness to 1.0700'. The price action after the breach of the critical level of 1.0775 was more severe than expected as EUR plunged to 1.0653 before ending the day lower by a whopping -2.04% (1.0690), the largest 1-day drop since June 2016. The surging downward momentum coupled with breach of critical support level suggests EUR is likely to continue to decline in the coming days. While it is premature for now, we are not ruling out the possibility of EUR dropping to the 2017 low near 1.0340. Meanwhile, EUR is expected to stay under pressure unless it can move above 1.1000 ('strong resistance' level was at 1.1100 yesterday). On a shorter-term note, 1.0940 is already a strong level."

FXStreet notes that there are four main reasons that an investor might choose to buy a negative yielding bond. Kathy Jones, a strategist at Charles Schwab, explains it.

“Safety. U.S. Treasury securities are considered risk-free, and when markets are in turmoil, investors may prefer to lose a small amount in exchange for knowing that the rest of their principal is safe.”

“Deflation fears. If an investor believes that prices will fall, then the purchasing power of the money saved could rise.”

“Speculation. Some investors may believe that yields will continue to fall and therefore believe that the price of their negative-yielding bonds will rise.”

“Regulatory requirements. Institutional investors like banks may be forced into holding Treasury securities by regulation.”

FXStreet reports that FX Strategists at UOB Group note cable remains under pressure and faces contention in the 1.1400 area ahead of the psychological 1.1000 mark.

24-hour view: “We highlighted yesterday, ‘barring a move above 1.1820, GBP could drop further to 1.1400’. GBP subsequently rebounded to 1.1792 after rate cut by BOE before dropping back to end the day at 1.1480 (low has been 1.1450). While the pace of decline appears to be slowing, there is still no sign that the recent weakness in GBP is about to stabilize. From here, GPB could drop below 1.1400 and weaken to 1.1330. On the upside, only a move above 1.1820 (minor resistance is at 1.1650) would indicate that GBP is ready to take a breather from its recent dramatic sell-off.”

Next 1-3 weeks: “We highlighted yesterday the ‘2019 low near 1.1960 is beckoning to GBP’. The call was much stronger than expected as GBP staged a ‘flash-crash’ within a crash as it dived vertically and hit a low of 1.1452. We are going to be brief and point out that since the 1.3200 peak last Monday (09 Mar), GBP has posted seven consecutive days of ‘lower low’, ‘lower high’ and obviously ‘lower close’. The way the price action is playing out, the seven days could turn into several more. Support is at 1.1400, below that there is kind of a ‘vacuum’ until the round number level of 1.1000. The ‘strong resistance’ level has moved lower to 1.2150 from yesterday’s level of 1.2350.”

- Coronavirus death toll increases by 235 to 1,002

- Thus, Spain becomes the fourth country to report more than 1,000 coronavirus deaths

FXStreet reports that the experience of the global financial crisis suggests that the AUD is unlikely to turn around until equities bottom. The Reserve Bank of Australia's latest easing measures have limited FX impact in the view of analysts at HSBC.

"'Risk-on-Risk-off' (RORO) is firmly in the driving seat and the AUD is the most risk-sensitive G7 currency, helping to explain why it is also the worst performer this year."

"It seems unlikely that the AUD will turn around until equities bottom. This was the experience during the global financial crisis. A similar fall this time could put AUD-USD close to a 20-year low, around the 0.50 level."

"The RBA has announced it will cut its cash rate by 25 basis points to an all-time low of 0.25%. However, the FX impact is limited, given policy rates are already close to zero across G10 central banks."

FXStreet reports that at yet another emergency meeting, the Bank of England MPC has unanimously decided to cut Bank rate. Analysts at Rabobank would not be surprised by further cuts.

"The BoE MPC suddenly announced that it had unanimously decided to cut Bank rate by 15 bps to 0.10% in an additional special meeting."

"The MPC also voted unanimously to increase the Bank's holdings of UK government bonds and sterling non-financial investment-grade corporate bonds by a massive GBP 200bn to a total of GBP 645bn."

"Wartime economics means wartime deficits: it does not seem out of the question that we could see the fiscal deficit hitting double digits."

"We would certainly not find ourselves surprised if the Bank of England continues down this path."

CNBC reports that markets are "very oversold," with a lot of "forced selling" going on, says a Fidelity analyst, who compared the recent volatility to extreme downturns in the past.

"We're certainly very oversold," said Jurrien Timmer, director of global macro at Fidelity Investments.

"We're at the levels of '08, of '87 crash, 1970, even 1929, 1930," he said, referring to the 2008 financial crisis, Black Monday in 1987, and the 1929 Great Depression. "So you can count almost on one hand the times that we've been this oversold."

As the coronavirus pandemic spread rapidly through the U.S., Europe and elsewhere, investors have fled markets. Even assets traditionally considered safe havens like gold have not been spared.

Efforts to contain the outbreak have severely impacted companies, as travel comes to a near standstill, consumers stop activities, and businesses shut their doors. The shutdowns have also sparked predictions of massive job losses.

Many major investors are selling every asset class - from stocks to bonds to gold - in order to raise cash.

"It's the fastest, sharpest decline we've ever seen. It's been contagious across all asset classes - bonds, credit, commodities, you name it," Timmer told CNBC.

"Clearly there is a lot of forced selling going on amongst the leveraged set, as I call them ... A lot of positions are being unwound," Timmer added. Essentially, traders need to raise cash to pay for the over-exposed calls that have generated losses.

-

There is no price war between Russia and Saudi Arabia

-

Our relations are good and doesn't think anyone should intervene

-

Russia has safety buffer against unfavourable oil prices

FXStreet reports that economist at UOB Group Lee Sue Ann assessed the recent announcements by the ECB.

"In an unexpected move, unveiled late on Wednesday (18 March), the European Central Bank (ECB) announced a new EUR750bn bond-buying programme, called the Pandemic Emergency Purchase Programme (PEPP)."

"In a nutshell, this programme will last until the end of 2020, and will target both publicand private-sector assets."

"In the press release, the Governing Council of the ECB stated that it was committed to playing its role in supporting all citizens of the euro area through this extremely challenging time and would ensure that all sectors of the economy can benefit from supportive financing conditions that enable them to absorb this shock."

"Just slightly less than a week ago on 12 March, the ECB had disappointed markets by keeping its three key interest rates unchanged; but pledged instead to re-open its dormant quantitative easing (QE) programme to support the economy as it grapples with the COVID-19 pandemic."

"In all, we think the ECB has made a fairly aggressive move here… Whilst we think that these monetary policy measures will be better complemented with even more fiscal measures; this is, for now, definitely Lagarde's "whatever it takes" moment."

Reuters reports that Germany's unemployment could climb by 90,000 to 2.356 million in 2020 if the crisis caused by the coronavirus epidemic is mild, but the number of people out of work could top 3 million if the crisis is more severe, the IAB labour market research institute said.

The institute said it expected Germany's economic output to shrink by 2% in 2020 as a result of the epidemic. Its predictions are based on the assumption that parts of the economy would effectively shut down for six weeks and that the return to normal would take as long.

According to the report from Office for National Statistics, borrowing (public sector net borrowing excluding public sector banks, PSNB ex) in February 2020 was £0.3 billion, £0.3 billion less than in February 2019.

Borrowing in the current financial year-to-date (April 2019 to February 2020) was £44.0 billion, £4.2 billion more than in the same period the previous year.

The current budget deficit (public sector current budget deficit excluding public sector banks) in the current financial year-to-date was £2.4 billion, £0.4 billion less than in the same period the previous year.

Debt (public sector net debt excluding public sector banks, PSND ex) at the end of February 2020 was £1,791.5 billion (or 79.1% of gross domestic product, GDP); this is an increase of £32.1 billion (or a decrease of 1.1 percentage points) on February 2019.

Central government net cash requirement excluding both UK Asset Resolution Ltd and Network Rail was £35.2 billion in the current financial year-to-date; this is £20.4 billion more than in the same period last year.

According to the report from European Central Bank, in January 2020 the current account of the euro area recorded a surplus of €35 billion, compared with a surplus of €33 billion in December 2019.

In the 12-month period to January 2020, the current account recorded a surplus of €364 billion (3.1% of euro area GDP), compared with a surplus of €359 billion (also 3.1% of euro area GDP) in the 12 months to January 2019.

In the financial account, euro area residents made net acquisitions of foreign portfolio investment securities totalling €393 billion in the 12-month period to January 2020 (up from €138 billion in the 12 months to January 2019). Over the same period, non-residents made net acquisitions of euro area portfolio investment securities amounting to €419 billion (in comparison with net sales of €45 billion).

FXStreet reports that it's still early days but indicators are beginning to show the widespread anxiety gripping consumers and business alike in Canada, according to economists at the Royal Bank of Canada.

"The Conference board's Canadian consumer confidence indicator registered its largest monthly decrease (~32points) on record."

"Despite recently announced fiscal and monetary stimulus we are already seeing businesses announce layoffs."

"How Canadians respond to this downturn depends largely on how quickly we can see signs of normalcy emerging. For now it's too early to tell when that time will come."

CIBC Research discusses EUR/USD outlook and maintains a structural bullish bias targeting 1.11 by end of Q2, and 1.14 by end of Q4.

"Looking past the current funding crunch, the USD should go back on the defensive as markets become more in sync with Fed measures taken over the past few weeks.

Longer-dated spreads to EUR rates have narrowed considerably, which suggests that EUR/USD dips will likely be bought into once the current fear around the virus dissipates. Both the EU and US are expected to fall into recession, though effect of fiscal multiplier is likely stronger for the EUR," CIBC notes.

"Longer-term, USD headwinds such as diversification will continue to work against the USD and simultaneously favour the euro," CIBC adds.

CNBC reports that Bank of America warned investors that a coronavirus-induced recession is no longer avoidable - it's already here.

"We are officially declaring that the economy has fallen into a recession ... joining the rest of the world, and it is a deep plunge," Bank of America U.S. economist Michelle Meyer wrote in a note. "Jobs will be lost, wealth will be destroyed and confidence depressed."

The firm expects the economy to "collapse" in the second quarter, shrinking by 12%. GDP for the full year will contract by 0.8%, it said.

Bank of America looked at the labor market as a way to understand the "magnitude of the economic shock." The firm expects the unemployment rate to nearly double, with roughly 1 million jobs lost each month of the second quarter for a total of 3.5 million.

As the economy continues to face uncharted territory, Meyer said "salvation" will come from aggressive action. "When it comes to the policy response, there should be no upper bound for the size of stimulus, in our view," she said.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Germany | Producer Price Index (YoY) | February | 0.2% | 0.2% | -0.1% |

| 07:00 | Germany | Producer Price Index (MoM) | February | 0.8% | -0.1% | -0.4% |

During today's Asian trading, the US dollar index fell significantly after a jump of 1.5% at the end of the previous session.

The ICE index, which tracks the dynamics of the dollar against six currencies (Euro, Swiss franc, yen, canadian dollar, pound sterling and Swedish Krona), finished seven of the last eight trading sessions higher and rose more than 8% during this time.

Currently, the dollar index is at its highest since the beginning of 2017, despite a sharp reduction in the base interest rate by the Federal reserve, while usually policy easing by the Central Bank leads to a weakening of the national currency.

Experts warn that the US currency will not become cheaper, despite the significant easing of the Fed's policy, given the huge demand for dollars in the world in the context of the crisis caused by the coronavirus pandemic.

Many companies are holding on to cash, expecting serious business problems due to the coronavirus pandemic, financial institutions are building up dollar reserves, while investors are selling everything from stocks to bonds and commodities. Against this background, demand for the dollar is increasing, and for several days in the past two weeks, the dollar index was the only indicator that was in the "green zone".

On Thursday, the Fed announced the opening of currency swap lines with 9 countries to improve foreign countries ' access to dollar liquidity.

-

The new package will be effective

-

There will be no liquidity problems

-

Fall in long-term rates will help governments fighting the virus

-

We have all the necessary flexibility

According to the report from Federal Statistical Office (Destatis), in February 2020 the index of producer prices for industrial products decreased by 0.1% compared with the corresponding month of the preceding year. Economists had expected a 0.2% increase. In January the annual rate of change all over had been +0.2%. Compared with the preceding month January the overall index fell by 0.4% in February 2020 (+0.8% in January). Economists had expected a 0.1% decrease.

Energy prices as a whole decreased by 2.5% (-1.6% compared to January 2020). On an annual basis, prices of natural gas (distribution) decreased by 11.5% whereas prices of petroleum products increased by 0.1% and prices of electricity rose by 0.9%.

The overall index disregarding energy was 0.6% up on February 2019 and remained unchanged compared to January 2020.

Prices of intermediate goods decreased by 1.6% compared to February 2019 (-0.2% compared with January 2020). Prices decreased especially regarding non-metallic secondary raw materials (-47.6%). Prices of basic iron, steel and ferro-alloys fell by 8.8%. By contrast, prices of precious metals increased by 23.5% compared to February 2019. Prices of fresh concrete were up 7.9%.

Prices of non-durable consumer goods increased by 3.9% compared to February 2019 (+0.4% on January 2020). Food prices were up 5.7% on February 2019. Pork prices increased by 31.8%, the price of sugar by 18.0%. By contrast, prices of butter fell by 18.2% compared to February 2019 and prices for processed and preserved potatoes were 8.5% down on February 2019.

-

CNBC reports that China's National Health Commission reported 39 new confirmed cases, and three additional deaths as of Mar. 19.

-

California estimates that more than half of the state - 25.5 million people - will get the new coronavirus over the next eight weeks, according to a letter sent by Gov. Gavin Newsom to U.S. President Donald Trump.

-

Global cases: At least 209,839, according to the latest figures from the World Health Organization

-

Global deaths: At least 8,778, according to the latest figures from the WHO

EUR/USD

Resistance levels (open interest**, contracts)

$1.1012 (1875)

$1.0976 (1382)

$1.0943 (710)

Price at time of writing this review: $1.0772

Support levels (open interest**, contracts):

$1.0657 (3326)

$1.0643 (2364)

$1.0626 (1946)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 3 is 84538 contracts (according to data from March, 19) with the maximum number of contracts with strike price $1,0800 (4018);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3009 (966)

$1.2910 (259)

$1.2811 (160)

Price at time of writing this review: $1.1696

Support levels (open interest**, contracts):

$1.1553 (1298)

$1.1545 (664)

$1.1538 (355)

Comments:

- Overall open interest on the CALL options with the expiration date April, 3 is 16682 contracts, with the maximum number of contracts with strike price $1,3200 (2380);

- Overall open interest on the PUT options with the expiration date April, 3 is 21670 contracts, with the maximum number of contracts with strike price $1,2900 (2837);

- The ratio of PUT/CALL was 1.30 versus 1.19 from the previous trading day according to data from March, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.57276 | -0.94 |

| EURJPY | 118.187 | 0.32 |

| EURUSD | 1.06576 | -2.32 |

| GBPJPY | 127.086 | 1.64 |

| GBPUSD | 1.14634 | -0.99 |

| NZDUSD | 0.56657 | -1.23 |

| USDCAD | 1.45006 | -0.05 |

| USDCHF | 0.98761 | 2.17 |

| USDJPY | 110.842 | 2.63 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.