- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 20-12-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1871 +0,26%

GBP/USD $1,3375 -0,07%

USD/CHF Chf0,98672 +0,19%

USD/JPY Y113,38 +0,44%

EUR/JPY Y134,59 +0,70%

GBP/JPY Y151,649 +0,37%

AUD/USD $0,7665 +0,05%

NZD/USD $0,7012 +0,57%

USD/CAD C$1,28341 -0,34%

00:30 Australia RBA Bulletin

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

07:00 Switzerland Trade Balance November 2.333 2.877

09:30 United Kingdom PSNB, bln November -7.46

13:30 Canada Retail Sales YoY October 6.2%

13:30 Canada Retail Sales, m/m October 0.1% 0%

13:30 Canada Consumer price index, y/y November 1.4% 1.3%

13:30 Canada Consumer Price Index m / m November 0.1% 0%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November 0.9% 0.8%

13:30 Canada Retail Sales ex Autos, m/m October 0.3% 0%

13:30 U.S. Continuing Jobless Claims December 1886 1928

13:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter III 0.9% 1.4%

13:30 U.S. Initial Jobless Claims December 225 241

13:30 U.S. Philadelphia Fed Manufacturing Survey December 22.7 23.0

13:30 U.S. Chicago Federal National Activity Index November 0.65 0.09

13:30 U.S. GDP, q/q (Finally) Quarter III 3.1% 3.3%

14:00 U.S. Housing Price Index, m/m October 0.3% 0.2%

15:00 Eurozone Consumer Confidence (Preliminary) December 0.1 0.0

15:00 U.S. Leading Indicators November 1.2% 0.4%

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.5 million barrels from the previous week. At 436.5 million barrels, U.S. crude oil inventories are in the middle of the average range for this time of year.

Total motor gasoline inventories increased by 1.2 million barrels last week, and are near the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories increased by 0.8 million barrels last week but are in the lower half of the average range for this time of year. Propane/propylene inventories decreased by 3.3 million barrels last week, and are in the middle of the average range. Total commercial petroleum inventories decreased by 14.2 million barrels last week.

Existing-home sales surged for the third straight month in November and reached their strongest pace in almost 11 years, according to the National Association of Realtors. All major regions except for the West saw a significant hike in sales activity last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, jumped 5.6 percent2 to a seasonally adjusted annual rate of 5.81 million in November from an upwardly revised 5.50 million in October. After last month's increase, sales are 3.8 percent higher than a year ago and are at their strongest pace since December 2006 (6.42 million).

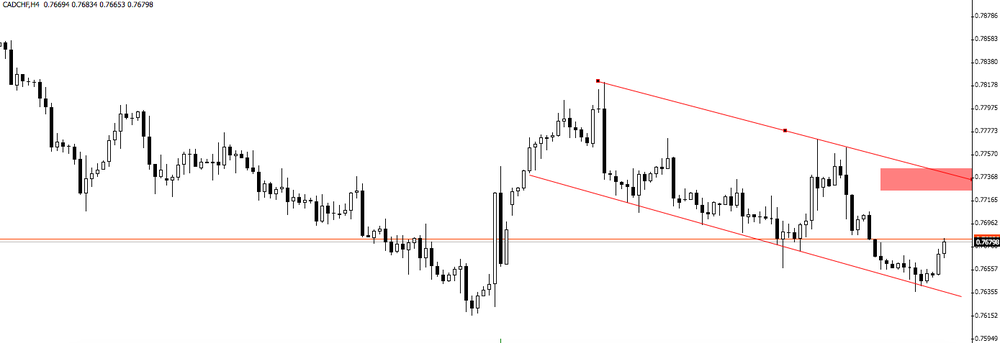

AUD/CAD is showing a potential to start a new bullish movement.

We can see that the price is rejecting the bottom of the downside channel which can be an opportunity to go long, at least, to the top of this channel.

EUR/USD: 1.1770 (EUR 478m), 1.1800-10 (1.5bn), 1.1820-25 (364m), 1.1880 (250m), 1.1900 (323m), 1.1940-50 (331m)

USD/JPY: 112.00 (USD 601m), 112.60 (650m), 113.00 (612m), 113.25-30 (890m), 113.50 (591m), 113.75-80 (380m), 114.00 (525m), 114.25 (300m)

GBP/USD: 1.3445-50 (GBP 226m), 1.3500 (204m)

USD/CHF: 0.9850 (USD 120m), 0.9895-00 (291m), 0.9950 (830m)

USD/CAD: 1.2750 (USD 297m), 1.2875 (160m), 1.2955-60 (601m), 1.3000 (2.5bn)

AUD/USD: 0.7595 (AUD 300m), 0.7700 (206m)

EUR/GBP: 0.8800 (EUR 529m), 0.9000 (809m)

Wholesale sales increased 1.5% to $63.0 billion in October, more than offsetting the 1.1% decline in September. Gains were reported in six of seven subsectors, together representing 81% of total wholesale sales. The machinery, equipment and supplies and the personal and household goods subsectors contributed the most to the increase.

In volume terms, wholesale sales were up 1.2%.

In dollar terms, the machinery, equipment and supplies subsector reported the largest increase in October, as sales rose 5.2% to $12.7 billion. Sales were up in all four industries, led by the farm, lawn and garden machinery and equipment industry (+19.0%) following a 9.7% decline in September.

Retail sales rose in the year to December, building further on November's solid performance, according to the latest monthly CBI Distributive Trades Survey.

The survey of 109 firms, of which 56 were retailers, showed that in the year to December, retail sales and orders continued to rise, although both disappointed expectations of somewhat stronger growth.\

Overall, sales for the time of year were considered to be in line with seasonal norms. Growth in online sales remained reasonably firm in the year to December, at a pace just below the long-run average (indicating that the internet sales of Black Friday and Cyber Monday were unspectacular), and is expected to slow further in the year to January.

EUR/USD: 1.1770 (478m), 1.1800-10 (1.5b), 1.1820-25 (364m), 1.1880 (250m), 1.1900 (323m), 1.1940-50 (331m)

USD/JPY: 112.00 (601m), 112.60 (650m), 113.00 (612m), 113.25-30 (890m), 113.50 (591m), 113.75-80 (380m), 114.00 (525m), 114.25 (300m)

GBP/USD: 1.3445-50 (226m), 1.3500 (204m)

USD/CHF: 0.9850 (120m), 0.9895-00 (291m), 0.9950 (830m)

USD/CAD: 1.2750 (297m), 1.2875 (160m), 1.2955-60 (601m), 1.3000 (2.5b)

AUD/USD: 0.7595 (300m), 0.7700 (206m)

EUR/GBP: 0.8800 (529m), 0.9000 (809m)

-

Deputy governors Martin Flodén and Henry Ohlsson entered reservations against decision to begin reinvesting in january 2018 bonds that mature in 2019

-

Executive board has also decided to begin reinvesting in january 2018 bonds that mature in 2019

-

Sees repo rate averaging -0.27 pct in q4, 2018 vs pvs forecast -0.27 pct

-

Economic prospects and outlook for inflation in Sweden are largely unchanged from october

-

Important that krona does not appreciate too quickly

This reflected surpluses for goods (€26.2 billion), primary income (€9.8 billion) and services (€7.3 billion), which were partly offset by a deficit for secondary income (€12.5 billion).

The 12-month cumulated current account for the period ending in October 2017 recorded a surplus of €349.6 billion (3.2% of euro area GDP), compared with one of €363.4 billion (3.4% of euro area GDP) for the 12 months to October 2016. This development was due to a decrease in the surplus for goods (from €373.7 billion to €340.4 billion) and an increase in the deficit for secondary income (from €137.9 billion to €150.6 billion). These were partly offset by increases in the surpluses for services (from €48.4 billion to €66.2 billion) and primary income (from €79.1 billion to €93.6 billion).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1992 (3302)

$1.1948 (4104)

$1.1924 (616)

Price at time of writing this review: $1.1835

Support levels (open interest**, contracts):

$1.1786 (4828)

$1.1742 (3583)

$1.1696 (4051)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 94002 contracts (according to data from December, 19) with the maximum number of contracts with strike price $1,2200 (5574);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3509 (2647)

$1.3469 (1586)

$1.3443 (859)

Price at time of writing this review: $1.3383

Support levels (open interest**, contracts):

$1.3349 (2253)

$1.3316 (1865)

$1.3278 (2712)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 31618 contracts, with the maximum number of contracts with strike price $1,3500 (4136);

- Overall open interest on the PUT options with the expiration date January, 5 is 32925 contracts, with the maximum number of contracts with strike price $1,3300 (2712);

- The ratio of PUT/CALL was 1.04 versus 1.02 from the previous trading day according to data from December, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

New Zealand's seasonally adjusted current account deficit for the September 2017 quarter narrowed to $1.3 billion, Stats NZ said today. This is $183 million smaller than the June quarter's deficit and was driven by a fall in imported good.

The shortfall between the value of exports and imports in the September quarter was much smaller than in the June quarter - the seasonally adjusted goods deficit was $26 million, down from the June quarter's $437 million deficit and the smallest since the June 2014 quarter.

In November 2017 the index of producer prices for industrial products rose by 2.5 compared with the corresponding month of the preceding year. In October 2017 the annual rate of change all over had been 2.7%, as reported by the Federal Statistical Office.

Compared with the preceding month October 2017 the overall index rose slightly by 0.1% in November 2017 (+0.3% in October and in September).

In November 2017 the price indices of all main industrial groups increased compared with November 2016: Prices of intermediate rose goods by 3.3%. Energy prices were up 3.0%, though the development of prices of the different energy carriers diverged. Prices of petroleum products increased by 8.5% and prices of electricity by 2.7%, whereas prices of natural gas (distribution) decreased by 3.7%. Prices of non-durable consumer goods rose by 2.4%. Prices of durable consumer goods increased by 1.2% whereas prices of capital goods increased by 1.1%.

© 2000-2025. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.