- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 23-01-2017.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0764 +0,64%

GBP/USD $1,2533 +1,40%

USD/CHF Chf0,9963 -0,58%

USD/JPY Y112,79 -1,50%

EUR/JPY Y121,31 -0,93%

GBP/JPY Y141,24 -0,16%

AUD/USD $0,7582 +0,42%

NZD/USD $0,7331 +2,29%

USD/CAD C$1,3236 -0,67%

00:30 Japan Manufacturing PMI (Preliminary) January 52.4

08:00 France Manufacturing PMI (Preliminary) January 53.5 53.3

08:00 France Services PMI (Preliminary) January 52.9 53.2

08:30 Germany Manufacturing PMI (Preliminary) January 55.6 55.4

08:30 Germany Services PMI (Preliminary) January 54.3 54.5

09:00 Eurozone Manufacturing PMI (Preliminary) January 54.9 54.8

09:00 Eurozone Services PMI (Preliminary) January 53.7 53.9

09:30 United Kingdom PSNB, bln December -12.21 -7.2

09:30 United Kingdom EU Membership Court Ruling

14:45 U.S. Manufacturing PMI (Preliminary) January 54.3 54

15:00 U.S. Richmond Fed Manufacturing Index January 8

15:00 U.S. Existing Home Sales December 5.61 5.56

23:30 Australia Leading Index December 0%

23:50 Japan Trade Balance Total, bln December 153 270

"The instinctive reaction of markets to a more isolationist/protectionist world is to favour the currencies of countries with large current account surpluses, as these are the winners if capital stays at home. That may be too simplistic, but the yen and Euro are natural initial winners. FX positions are much less stretched than bond ones but a further final flush of Euro and Yen shorts is a risk here.

The first round of the French Socialist Primaries shows a clear shift to the left, with Benoit Hamon gaining most votes and heading into the second round with Manuel Valls this weekend. A Hamon win would leave a big gap in the centre ground, to the benefit of Emmanuel Macron. In many ways, it is easier for a centrist candidate to galvanise cross-party support in the Presidential election and so, this result may well be seen in FX=-terms as Euro-friendly. There are far too many twists and turns ahead in this election us to alter a view that at some point, political nerves will drag the euro down but today or tomorrow we may well see a break back above EUR/USD 1.08".

Copyright © 2017 Societe Generale, eFXnews™

In January 2017, the DG ECFIN flash estimate of the consumer confidence indicator was broadly unchanged in both the euro area (+0.2 points to -4.9) and the EU (+0.3 points to -4.3) compared to December 2016.

EURUSD 1.0500 (EUR 1.33bln) 1.0600 (815m) 1.0700 (535m)

USDJPY 112.00 (USD 525m) 114.00 (426m) 115.00 (586m) 115.50 (516m) 116.00 (1.25bln) 116.50 (536m) 117.15 (407m)

GBPUSD 1.2060 (GBP 464m) 1.2300 (628m)

AUDUSD 0.7500 (AUD 363m)

USDCAD 1.3550 (USD 410m)

Higher sales in four subsectors were partially offset by lower sales in two subsectors. The motor vehicle and parts subsector posted the largest decline, while the miscellaneous subsector, which includes wholesalers of agricultural supplies, chemicals and allied products, and paper, paper product and disposable plastic products, posted the largest increase.

In volume terms, wholesale sales edged down 0.1%.

EUR/USD

Offers 1.0760 1.0785 1.0800 1.0830 1.0850-55 1.0880 1.0900

Bids 1.0720 1.0700 1.0680 1.0650 1.0625-30 1.0600 1.0580 1.0565 1.0550

GBP/USD

Offers 1.2480 1.2500 1.2520 1.2550 1.2585 1.2600

Bids 1.2420 1.2400 1.2375-80 1.2350 1.2320-25 1.2300 1.2280 1.2250

EUR/GBP

Offers 0.8650 0.8665 0.8680 0.8700 0.8730 0.8750 0.8780 0.8800

Bids 0.8620 0.8600 0.8585 0.8550 0.8530 0.8500

EUR/JPY

Offers 122.30 122.50 122.80 123.00 123.50 124.00

Bids 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers 113.65 113.80 114.00 114.20 114.50 114.80 115.00 115.20 115.35 115.55-60115.80 116.00

Bids 113.20 113.00 112.80 112.65 112.50 112.30 112.00

AUD/USD

Offers 0.7580-85 0.7600 0.7630 0.7650 0.7675 0.7700

Bids 0.7545-50 0.7525-30 0.7500 0.7480-85 0.7450

"While there has been significant pullback in the USD/JPY, it still remains significantly above where rates and other short-term fundamentals suggest it should be. USD/JPY remains vulnerable given extended short positioning in the JPY.

So it remains up to President Trump and US economic data to start pushing US rates higher again to justify the level of the USD/JPY. The weaker JPY should help push Japan's trade balance and inflation higher. Inflation data will be the main focus locally, but it is unlikely to accelerate enough to jeopardise any change in the BoJ's current stance.

The JGB yield curve has been steepening in 2017 relative to the UST curve, which is weighing on the USD/JPY. So, the outcome of the JGB 40Y auction this coming week could also be of some interest for the USD/JPY".

Copyright © 2017 Credit Agricole CIB, eFXnews™

During his presentation Coeure said that the recent rise in inflation rates was associated with an increase in oil prices. According to the banker, the ECB would be ready to raise interest rates only in the case of higher salaries. "At the moment this is not happening".

EUR/USD 1.0500 (EUR 1.33bln) 1.0600 (815m) 1.0700 (535m)

USD/JPY 112.00 (USD 525m) 114.00 (426m) 115.00 (586m) 115.50 (516m) 116.00 (1.25bln), 116.50 (536m) 117.15 (407m)

GBP/USD 1.2060 (GBP 464m) 1.2300 (628m)

AUD/USD 0.7500 (AUD 363m)

USD/CAD 1.3550 (USD 410m)

Информационно-аналитический отдел TeleTrade

-

At 11:00 GMT the Bundesbank Monthly Report

-

At 11:30 GMT ECB president Mario Draghi will deliver a speech

-

At 13:15 GMT ECB Board Member Peter Praet will make a speech

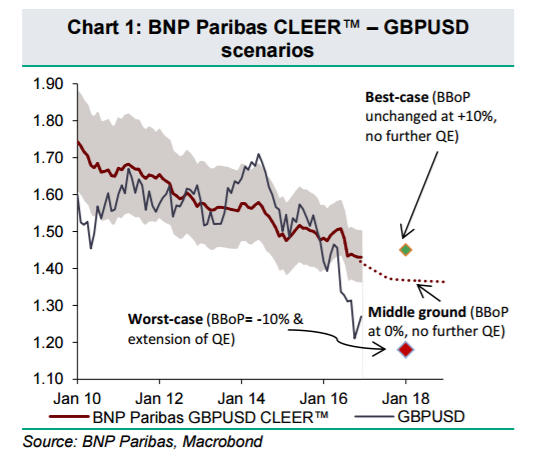

"The GBP will remain in focus heading into the ruling on Brexit from the Supreme Court, expected on Monday.

The government is generally not expected to win this appeal, but we think the significance of this ruling has diminished since last month's parliamentary resolution supporting the Q1 timeline for Article 50.

We continue to believe the GBP is trading near levels reflecting a worst-case scenario for trade and capital flows, and therefore expect long-term-oriented investors to be buyers below GBPUSD 1.20".

Copyright © 2017 BNP Paribas™, eFXnews™

According to data released today by the Ministry of Economy, Trade and Industry of Japan, the index of business activity in all sectors of the Japanese economy increased in November by 0.3% compared with October, better than the previous value. However, the October data was revised downward from 0.2% to 0.0%. The indicator measures the activity in all sectors of Japanese industry and allows to estimate the overall trend in services and production.

Japan's leading index climbed more than initially estimated in November and remained at the highest level in fifteen months, latest figures from from the Cabinet Office showed Monday, cited by rttnews.

The leading index, which measures the future economic activity, rose to 102.8 in November from 100.8 in October. The November reading was revised up slightly from 102.7.

Moreover, the latest score was the highest since August 2015, when it marked 103.4.

The coincident index that reflects the current economic activity, climbed to 115.0 in November from 113.5 a month earlier. The score was slightly below the preliminary estimate of 115.1.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0842 (2720)

$1.0805 (2454)

$1.0778 (2226)

Price at time of writing this review: $1.0749

Support levels (open interest**, contracts):

$1.0636 (1395)

$1.0588 (1492)

$1.0525 (2877)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 57617 contracts, with the maximum number of contracts with strike price $1,0800 (3628);

- Overall open interest on the PUT options with the expiration date March, 13 is 66859 contracts, with the maximum number of contracts with strike price $1,0000 (4928);

- The ratio of PUT/CALL was 1.16 versus 1.20 from the previous trading day according to data from January, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.2706 (1060)

$1.2609 (1367)

$1.2512 (1376)

Price at time of writing this review: $1.2431

Support levels (open interest**, contracts):

$1.2286 (1238)

$1.2190 (1076)

$1.2093 (560)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 18400 contracts, with the maximum number of contracts with strike price $1,2800 (1520);

- Overall open interest on the PUT options with the expiration date March, 13 is 22683 contracts, with the maximum number of contracts with strike price $1,1500 (3228);

- The ratio of PUT/CALL was 1.23 versus 1.22 from the previous trading day according to data from January, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.