- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 23-02-2017.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0581 +0,22%

GBP/USD $1,2554 +0,85%

USD/CHF Chf1,0059 -0,42%

USD/JPY Y112,60 -0,62%

EUR/JPY Y119,15 -0,39%

GBP/JPY Y141,36 +0,25%

AUD/USD $0,7713 +0,17%

NZD/USD $0,7229 +0,57%

USD/CAD C$1,3103 -0,45%

07:45 France Consumer confidence February 100 100

09:30 United Kingdom BBA Mortgage Approvals January 43.23 41.9

13:30 Canada Consumer Price Index m / m January -0.2% 0.3%

13:30 Canada Consumer price index, y/y January 1.5% 1.6%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.6%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index January 98.5 96

15:00 U.S. New Home Sales January 536 575

U.S. house prices rose 1.5 percent in the fourth quarter of 2016 according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). House prices rose 6.2 percent from the fourth quarter of 2015 to the fourth quarter of 2016. FHFA's seasonally adjusted monthly index for December was up 0.4 percent from November.

"Although interest rates rose sharply during the fourth quarter, our data show no signs of a home price slowdown," said FHFA Deputy Chief Economist Andrew Leventis. "Although it will certainly take more time for the full effects of the elevated interest rates to be felt, there is no evidence of a normalization in the unusually low inventories of homes available for sale, which has been the primary force behind the extraordinary price gains."

EUR/USD 1.0400 (EUR 394 M) 1.0450 (EUR 500 M) 1.0486-1.0500 (EUR 1,116 M) 1.0550 (EUR 741 M) 1.0570-1.0580 (EUR 364 M) 1.0590-1.0600 (EUR 905 M) 1.0615-1.0625 (EUR 251 M) 1.0650-1.0665 (EUR 602 M) 1.0675-1.0685 (EUR 305 M) 1.0700 (EUR 460 M)

GBP/USD 1.2330 (GBP 205 M) 1.2596-1.2600 (GBP 194 M)

EUR/GBP 0.8400 (EUR 450 M)

USD/JPY 112.00 (USD 1,183 M) 112.70-112.75 (USD 587 M) 113.00-113.16 (USD 495 M) 113.20-113.35 (USD 431 M) 113.50-113.55 (USD 1,048 M) 113.90-114.00 (USD 305 M) 114.10-114.25 (USD 271 M) 114.40-114.50 (USD 489 M) 115.00 (USD 724 M)

EUR/JPY 117.75 (EUR 693 M) 119.25 (EUR 743 M)

USD/CHF 0.9990-1.0000 (USD 377 M)

AUD/USD 0.7490-0.7500 (AUD 223 M) 0.7650-0.7660 (AUD 226 M) 0.7675 (AUD 681 M) 0.7695-0.7700 (AUD 263 M)

USD/CAD 1.3105-1.3115 (USD 485 M) 1.3190-1.3200 (USD 420 M)

Canadian corporations earned $86.8 billion in operating profits in the fourth quarter, up 3.6% from the previous quarter. The operating profits in the non-financial and the financial industries were both up by $1.5 billion.

Overall, operating profits for Canadian corporations rose 13.2% compared with the fourth quarter of 2015.

n the non-financial industries, operating profits increased 2.6% from the third quarter to $58.7 billion in the fourth quarter on a $7.5 billion increase in operating revenues. Overall, profits were up in 14 of 17 non-financial industries.

Operating profits for Canadian non-financial corporations increased 11.9% compared with the fourth quarter of 2015.

-

Both tax plan and regulatory relief will use "Dynamic scoring" to boost revenues

-

Going to have a combined tax plan with congress

-

Sees limited impact from trump administration policies in 2017

-

Does not expect to see growth until 2018

EUR/USD

Offers 1.0580 1.0600 1.0620 1.0635 1.0650

Bids 1.0550 1.0530 1.0500 1.0480-85 1.0450 1.0430 1.0400

GBP/USD

Offers 1.2480-85 1.2500 1.2520 1.2550 1.2575-80 1.2600

Bids 1.2450 1.2425-30 1.2400 1.2380 1.2345-50

EUR/GBP

Offers 0.8485 0.8500 0.8520 0.8535 0.8550

Bids 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers 119.85 120.00 120.30 120.50 120.80 121.00

Bids 119.30 119.00 118.80 118.50 118.30 118.00

USD/JPY

Offers 113.50 113.80-85 114.00-05114.20114.35 114.50

Bids 113.00 112.80 112.50 112.30 112.00

AUD/USD

Offers 0.7700 0.7720 0.7735 0.7750 0.7780 0.7800

Bids 0.7675-80 0.7665 0.7650 0.7620 0.7600

The survey of 128 firms, of which 64 were retailers, showed that sales volumes are expected to rise again in the year to March, albeit at a slightly slower pace.

However, the volume of orders placed upon suppliers fell over the year to February, having been stable last month, and a further decline is expected next month. Sales for the time of year remained broadly in line with seasonal norms in February - for a second consecutive month - following above-average sales in the final two months of 2016.

-

On Brexit you cannot only be optimistic, these things can turn very nasty

-

Signals from Trump are worrying because they are simple narratives but with complex stories behind them

-

Global system can go into a very vicious circle if you go into very simplistic narratives

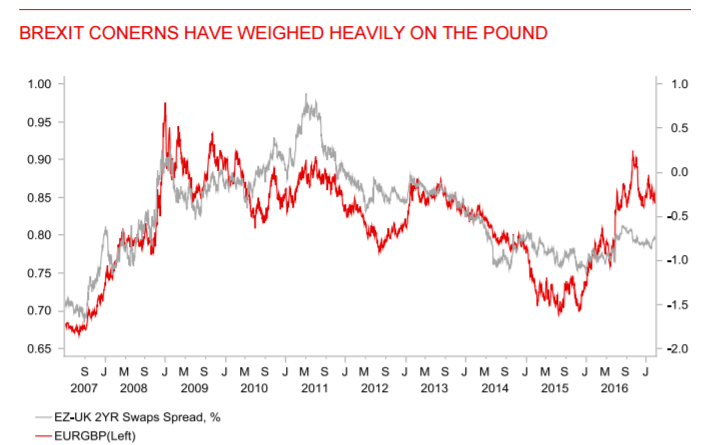

"The pound has continued to strengthen during the Asian trading session despite further dovish comments yesterday from BoE policymakers.

The pound's upward momentum has been reinforced after EUR/GBP closed below its' 200-day moving average at around 0.8470 for the first time yesterday since late in 2015.

It could provide an important bullish technical signal for the pound in the near-term, and supports our view that the pound will outperform more bearish expectations during the first half of this year and lower EUR/GBP closer to the 0.80000-level.

Building political risks in Europe are providing support for the pound and are beginning to outweigh Brexit concerns at least in the near-term.

We have never bought into the view that the triggering of Article 50 which is still likely next month should justify further pound weakness after it has already lost around a fifth of its value against the currencies of the UK's main trading partners in recent years.

We continue to believe that the bulk of the Brexit adjustment is already behind us with a lot of bad news and uncertainty already priced into the pound at current weak levels".

Copyright © 2017 BTMU, eFXnews™

This morning the New York futures for Brent rose by + 0.7% to 56.23 and WTI rose 0.75% to the level of 53.99. Prices for black gold rose slightly amid optimism associated with themOPEC production cut. Prices rose despite the decline in oil reserves in the United States.

Yesterday, the American Petroleum Institute reported a reduction in reserves of black gold in the United States by -0.9 million barrels, gasoline inventories -0.9 million barrels, while distillates -4.2 million barrels.

In December 2016 the seasonally adjusted retail trade index decreased by 0.5% with respect to November 2016 (-0.2% for food goods and -0.8% for non-food goods). The average of the last three months increased with respect to the previous three months (+0.1%). The unadjusted index decreased by 0.2% with respect to December 2015.

-

At 08:55 GMT the ECB Board Member Peter Praet will make a speech

-

At 10:00 GMT ECB Jens Weidmann will make a speech

-

At 10:30 GMT, Britain will hold an auction of 10-year bonds

-

At 11:00 GMT the ECB Board Member Peter Praet will make a speech

-

At 13:35 GMT FOMC member Dennis Lockhart will give a speech

-

At 18:00 GMT FOMC members Robert Kaplan will deliver a speech

-

At 22:30 GMT RBA Governor Philip Lowe will deliver a speech

EUR/USD

Resistance levels (open interest**, contracts)

$1.0675 (2818)

$1.0643 (3430)

$1.0604 (1963)

Price at time of writing this review: $1.0546

Support levels (open interest**, contracts):

$1.0509 (5053)

$1.0475 (4956)

$1.0435 (3362)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 73849 contracts, with the maximum number of contracts with strike price $1,0800 (4751);

- Overall open interest on the PUT options with the expiration date March, 13 is 83468 contracts, with the maximum number of contracts with strike price $1,0550 (5462);

- The ratio of PUT/CALL was 1.13 versus 1.15 from the previous trading day according to data from February, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.2701 (2440)

$1.2602 (2246)

$1.2505 (3043)

Price at time of writing this review: $1.2435

Support levels (open interest**, contracts):

$1.2396 (1610)

$1.2298 (3256)

$1.2199 (1489)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33714 contracts, with the maximum number of contracts with strike price $1,2500 (3043);

- Overall open interest on the PUT options with the expiration date March, 13 is 36733 contracts, with the maximum number of contracts with strike price $1,2300 (3256);

- The ratio of PUT/CALL was 1.09 versus 1.05 from the previous trading day according to data from February, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

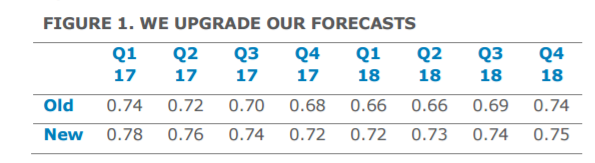

"Significant AUD downside has started to look more like a tail risk than a central forecast. Commodity prices have risen more than anticipated, liquidity remains ample and volatility is expected to remain in check.

Valuation has also corrected. There is now a negative risk premium priced into the AUD which suggests that even if a tail risk does manifest, the current level of the AUD provides some protection relative to other cyclical currencies.

Putting this altogether, we continue to think that the current risk premium will be retained in the AUD, that fundamentals will be more stable, and that there is some further downside risk via a USD overshoot on policy.

As such we raise our forecasts, expecting the AUD to remain in its recent range for longer, and shift our bias. We recommend using weakness to buy rallies, rather than aggressively selling into strength".

ANZ maintains a long AUD/USD position from 0.7380 targeting 0.78, with a revised profit-stop at 0.7595.

Copyright © 2017 ANZ, eFXnews™

The trend volume estimate for total new capital expenditure fell 3.1% in the December quarter 2016 and the seasonally adjusted estimate fell 2.1%.

The trend volume estimate for buildings and structures fell 4.7% in the December quarter 2016 and the seasonally adjusted estimate fell 4.1%.

The trend volume estimate for equipment, plant and machinery fell 0.4% in the December quarter 2016 while the seasonally adjusted estimate rose 0.4%.

After a splendid start into 2017, consumer confidence in Germany suffers a minor setback in February. Both economic and income expectations, as well as propensity to buy are expected to decline. The consumer climate forecast for March is at 10.0 points following a level of 10.2 in February. The change of administration in the United States and the considerable recent increase in inflation have put a damper on the generally positive consumer mood in February.

As a result, expectations for the economy and income forfeited a major part of their gains from previous months. Pulled down by the lowered income expectations, propensity to buy also dropped moderately. Economic expectation: tangible

The German economy continued its moderate growth at the end of 2016. As the Federal Statistical Office (Destatis) already reported in its first release of 14 February 2017, the gross domestic product (GDP) increased 0.4% - upon price, seasonal and calendar adjustment - in the fourth quarter of 2016 compared with the previous quarter. The economic situation in Germany in 2016 thus was characterised by solid and steady growth (+0.7% in the first quarter, +0.5% in the second quarter and +0.1% in the third quarter). For the whole year of 2016, this was an increase of 1.9% (calendar-adjusted: +1.8%). The provisional annual GDP result released in January has thus been confirmed.

The quarter-on-quarter comparison (upon adjustment for price, seasonal and calendar variations) shows that positive contributions came mainly from domestic demand. The final consumption expenditure of general government rose by 0.8% and household final consumption expenditure increased by 0.3% on the third quarter of 2016. A largely positive development was also observed for capital formation. Especially gross fixed capital formation in construction was up (+1.6%) on the previous quarter. Gross fixed capital formation in machinery and equipment fell slightly (-0.1%) on the previous quarter. On the whole, domestic uses rose by 0.9% (upon price, seasonal and calendar adjustment) compared with the third quarter of 2016.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.