- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 23-10-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1748 -0,27%

GBP/USD $1,3196 +0,05%

USD/CHF Chf0,98483 +0,09%

USD/JPY Y113,47 -0,03%

EUR/JPY Y133,31 -0,29%

GBP/JPY Y149,741 +0,03%

AUD/USD $0,7808 -0,06%

NZD/USD $0,6975 +0,16%

USD/CAD C$1,26457 +0,16%

03:30 Japan Manufacturing PMI (Preliminary) October 52.9 53.1

10:00 France Services PMI (Preliminary) October 57.0 56.9

10:00 France Manufacturing PMI (Preliminary) October 56.1 55.9

10:30 Germany Manufacturing PMI (Preliminary) October 60.6 60.0

10:30 Germany Services PMI (Preliminary) October 55.6 55.6

11:00 Eurozone Services PMI (Preliminary) October 55.8 55.7

11:00 Eurozone Manufacturing PMI (Preliminary) October 58.1 58.2

16:00 Belgium Business Climate October -3.5 -3.0

16:45 U.S. Manufacturing PMI (Preliminary) October 53.1 53.6

16:45 U.S. Services PMI (Preliminary) October 55.3 55.6

17:00 U.S. Richmond Fed Manufacturing Index October 19 17

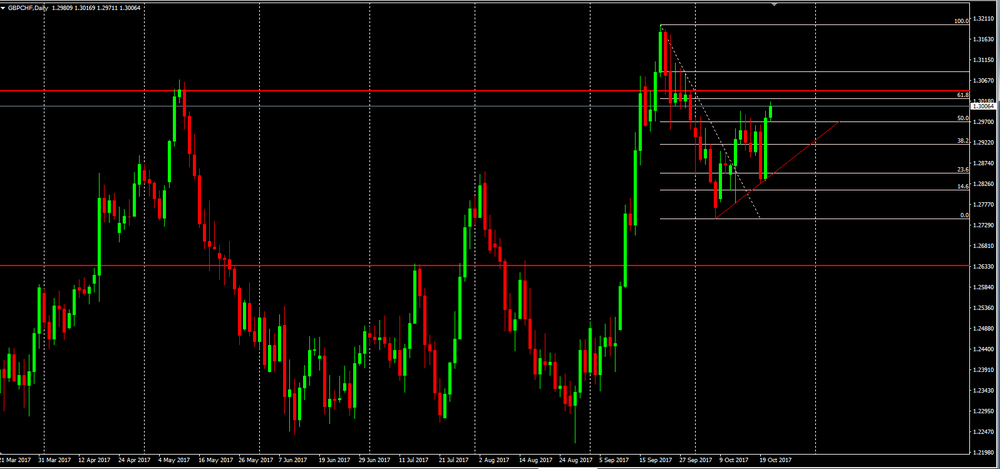

As we can seen on the daily chart, GBP/CHF reached new highs and since that it has been correcting his last bullish movement.

In this case, the use of fibonacci levels is useful to see if the price is showing signs of recovering its previous bullish tendency, or if in the case of rejecting the 61.8% fibonacci, a reversal of bearish.

Therefore, in this asset we have two possible bias.

Our suggestion is to wait for the closing of today's candle (Monday) and then draw conclusions for either long or short entries.

EURUSD: 1.1720 (EUR 345m) 1.1730 (895m) 1.1785 (605m) 1.1800 (505m)

1.1870 (465m) 1.1900-05 (390m) 1.1930-35 (415m) 1.1945 (645m) 1.1965 (475mn)

USDJPY: 112.85 (640m) 113.00 (445m) 113.20-25 (585m) 113.50 (400m)114.60 (415m)

GBPUSD: Ntg of note

USDCHF: 0.9695-0.9700 (USD 1.1bln)

AUDUSD: 0.7775 (AUD 395m) 0.7850 (380m)

USDCAD: 1.2520-25 (USD 490m) 1.2900 (500m)

Wholesale sales rose 0.5% to $62.8 billion in August, led by the personal and household goods and motor vehicle and parts subsectors.

Sales were up in four of the seven subsectors, together representing 47% of total wholesale sales.

In volume terms, wholesale sales rose 0.4%.

Sales in the personal and household goods subsector rose for the ninth consecutive month-posting the largest gain in dollar terms in August, rising 3.3% to a record $9.0 billion. Sales were up in four of the six industries, with the textile, clothing and footwear industry contributing the most to the gain.

Sales in the motor vehicle and parts subsector increased for the third time in four months, up 2.0% to $11.8 billion. The growth in the subsector was attributable to higher sales in the motor vehicle industry, which recorded its second consecutive monthly gain. There were higher imports of passenger cars and light trucks in August, and motor vehicle manufacturing sales increased.

-

Says should continue to demonstrate to people of Iran that they will be better off under Iran nuclear deal

EUR/USD: 1.1900 (390 m), 1.1870 (460 m), 1.1800 (505 m), 1.1785 (605 m), 1.1730 (895 m), 1.1720 (340 m)

USD/JPY: 114.60 (415 m), 113.50 (353 m), 113.20/25 (585 m), 113.00 (445 m), 112.85 (640 m)

AUD/USD: 0.7850 (380 m), 0.7775 (395 m)

-

2016 general government deficit at 2.5 pct of GDP vs. 2.4 pct estimated in april

-

Public debt at 54.1 pct of GDP in 2016 vs. 54.4 pct of GDP estimated in april

-

No-one but the catalan people has the right to change catalan institutions

-

Australian banks' funding and liquidity levels will stay stable

-

Home loan repricing will prop-up net interest margins and profitability

-

Expects that australian banks will strengthen capital to meet higher minimum capital requirements

EUR/USD

Resistance levels (open interest**, contracts)

$1.1909 (3331)

$1.1861 (1371)

$1.1818 (277)

Price at time of writing this review: $1.1768

Support levels (open interest**, contracts):

$1.1733 (2968)

$1.1704 (2928)

$1.1670 (4898)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 101573 contracts (according to data from October, 20) with the maximum number of contracts with strike price $1,2000 (6870);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3357 (3500)

$1.3301 (3956)

$1.3263 (2367)

Price at time of writing this review: $1.3199

Support levels (open interest**, contracts):

$1.3112 (1600)

$1.3083 (2274)

$1.3050 (2213)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 40098 contracts, with the maximum number of contracts with strike price $1,3200 (3956);

- Overall open interest on the PUT options with the expiration date November, 3 is 35442 contracts, with the maximum number of contracts with strike price $1,3000 (3175);

- The ratio of PUT/CALL was 0.88 versus 0.86 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.