- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 23-10-2022.

China's Xi Jinping secured a precedent-breaking third leadership term on Sunday and introduced a top governing body stacked with loyalists, cementing his place as the country's most powerful ruler since Mao Zedong, Reuters reported:

''Xi faces stiff challenges as the world's second-largest economy slows and frustration over his zero-COVID policy grows. China is also increasingly estranged from the West, exacerbated by Xi's support for Russia's Vladimir Putin and mounting tensions over Taiwan.''

"This is a leadership that will be focused on achieving Xi’s political goals, rather than pursuing their own agendas for what they think is best for the country," said Drew Thompson, a visiting senior research fellow at the National University of Singapore’s Lee Kuan Yew School of Public Policy. "There is only one correct way to govern, and that is Xi’s way."

- GBP/JPY reverses the week-start rebound while taking a U-turn from a six-month-old resistance line.

- Oscillators, sustained trading beyond monthly support keeps buyers hopeful.

- 50-DMA adds to the downside filters, 175.00 could lure bulls during a strong run-up.

GBP/JPY takes offers to renew intraday low around 166.60, reversing the week-start run-up, as it drops towards one-month-old support during Monday’s Asian session. In doing so, the yen cross again reverses from the six-month-old upward-sloping resistance line.

However, bullish MACD signals and the steady RSI requires the GBP/JPY bears to remain cautious unless they break the aforementioned support line, around 166.20 by the press time, as well as conquer the 166.00 thresholds.

Following that, a downward trajectory towards the 50-DMA support of 163.10 becomes imminent.

Though, the 160.00 psychological magnet and the monthly low near 159.70 could challenge the GBP/JPY sellers afterward.

On the flip side, a daily closing beyond the ascending resistance line from April, around 169.85, as well as a successful break of the 170.00 round figure, becomes necessary for the GBP/JPY buyers.

In that case, a run-up toward the February 2016 high near 175.00 will be much more likely on the bull’s radar.

Overall, GBP/JPY remains on the buyer’s radar despite the latest pullback from the key resistance line. However, the odds of the short-term downside can't be ruled out.

GBP/JPY: Daily chart

Trend: Further upside expected

USD/JPY is highly volatile ahead of the Tokyo fix, climbing 149.71 and plummeting to 145.80.

Japan's finance minister Suzuki said earlier that they are confronting speculators

More to come ...

The commander of Ukraine’s ground forces General Oleksandr Syrskiy, in an exclusive interview with ABC News' Chief Foreign Correspondent Ian Pannell, said the world should be worried about Russian President Vladimir Putin's threat to use nuclear weapons.

This follows Putin's threat that Russia would resort to using nuclear weapons in its war against Ukraine following a series of setbacks for Moscow on the battlefield.

"We are and should be worried," Syrskiy told ABC News.

- USD/CHF picks up bids to reverse Friday’s pullback from three-year top.

- Challenges to sentiment, consolidation of previous sharp moves recall buyers.

- The first readings of US PMIs for October, Q3 GDP will be important for clear directions.

- Fed’s silence might challenge the buyers, especially after the recently mixed comments.

USD/CHF pares Friday’s losses around 1.0010 as the US dollar sellers step back during early Monday in Asia.

While the market’s rebalancing of the previous expectations appears to play a major role in the USD/CHF pair’s latest rebound, fresh challenges to the risk appetite, mainly from China and North/South Korea also propel the quote of late.

News that Both North and South Korea have exchanged warning shots near their disputed western sea boundary, published on Monday, seemed to have triggered the US dollar’s latest recovery. On the same line could be the fears that China President Xi Jinping won’t hesitate to escalate geopolitical matters with the US when it comes to Taiwan. The reason could be linked to Jinping’s dominating performance at the annual Communist Party Congress after winning the third term in a row.

On Friday, the US Dollar Index (DXY) marked heavy losses while amplifying the first weekly negative in three as the hawkish Fed bets retreat after mixed Fedspeak. That said, St. Louis Fed President James Bullard said, “I want rates that put significant downward pressure on inflation.” On the same line, Chicago Fed President Charles Evans stated that they will need to raise rates further and hold them for a while. However, Nick Timiraos, Chief Economics Correspondent at The Wall Street Journal (WSJ) wrote that the Federal Reserve officials are barreling toward another interest-rate rise of 75 bps at their meeting in November and are likely to debate then whether and how to signal plans to approve a smaller increase in December.

It should be noted that the US equities posted the largest weekly gains in four months while the US 10-year Treasury yield marked a 5% weekly gain while refreshing a 14-year high, despite posting mild losses on Friday. Also, the CME’s FedWatch Tool suggested a nearly 88% chance of the Fed’s 75 bps rate hike in November, after posting nearly 95% odds for the outcome earlier in the week.

Moving on, the Fed policymakers’ two-week silence ahead of November’s Federal Open Market Committee (FOMC) meeting may restrict USD/CHF moves. However, the preliminary readings for the US PMIs for October and the first readings of the US Gross Domestic Product for the third quarter (Q3), up for publishing on Monday and Thursday respectively, could entertain the pair traders. That said, the bulls may witness easy days ahead considering the likely mixed statistics and the recent risk-negatives.

Technical analysis

Despite the latest rebound, a daily closing beyond the previous support line from September 13, around 1.0010 by the press time, appears necessary to recall the USD/CHF buyers.

- AUD/JPY is hovering around 95.00 after the release of mixed Aussie PMI data.

- The RBA will determine the size and timing of interest rate hikes on the basis of economic data.

- Japan officials have preferred to restrict themselves from making commentary on intervention in FX.

The AUD/JPY pair has dropped to near the immediate support of 95.00 after facing hurdles around 95.00 in early Tokyo. The asset has picked offers while attempting to test Friday's high at 95.74, where a knee-jerk reaction was recorded.

The IHS Markit has reported mixed Aussie S&P PMI data, which has brought some pressure after an elevation in the risk barometer. The Manufacturing PMI has escalated to 52.8 vs. the projections of 52.5 but lower than the prior release of 53.0. While the Service PMI has dropped sharply to 49.0 against the consensus of 50.5 and the former release of 50.6.

Meanwhile, commentary from Christopher Kent, Assistant Governor (Economic) at the Reserve Bank of Australia (RBA) in Monday Tokyo has weighed responsibility on economic fundamentals. RBA policymaker believes that economic prospects size and timing of rate increase will bank upon incoming data. He further added that the costly US dollar will restrict demand for US goods and commodities.

This week, the Aussie Consumer Price Index (CPI) data will be of utmost importance. On an annual basis, the headline CPI figure will accelerate to 6.9% vs. the former release of 6.1%. While a decline to near 1.5% is expected from the prior settlement of the inflation rate at 1.8% on a quarterly basis. This may force the RBA to return to the 50 basis points (bps) rate hike structure.

On the Tokyo front, commentaries on the Bank of Japan (BOJ)’s intervention in the currency markets have kept the Japanese yen unnerved. Japan’s top currency diplomat Masato Kanda said on Monday that they “Will continue to take appropriate action against excessive, disorderly market moves.” He reiterated that the administration won’t comment on whether BOJ has intervened in the FX market or not. It is worth noting that a knee-jerk move was recorded in the AUD/JPY pair on Friday.

Both North and South Korea have exchanged warning shots near their disputed western sea boundary on Monday, their militaries said. This comes at a time of heightened tensions over North Korea's recent barrage of weapons tests in response to what the nation calls provocative military drills between South Korea and the United States

North Korea's military said it fired 10 rounds of artillery shells as a warning to South Korea. It accused a South Korean navy ship of intruding into North Korean waters on the pretext of cracking down on an unidentified ship. South Korea's Joint Chiefs of Staff said in a statement that its navy fired warning shots to repel a North Korean merchant ship that it says violated the sea boundary early Monday.

Japan’s top currency diplomat Masato Kanda said on Monday that they “Will continue to take appropriate action against excessive, disorderly market moves.”

More comments

Won't comment on whether we intervened in fx market.

Will continue to take appropriate action against excessive, disorderly market moves.

Demerits far outweigh advantages for excessive yen weakness.

USD/JPY renews upside momentum

The news failed to tame USD/JPY prices as the yen pair takes the bids to reverse Friday’s pullback from the 32-year high, grinding higher around 149.20 by the press time.

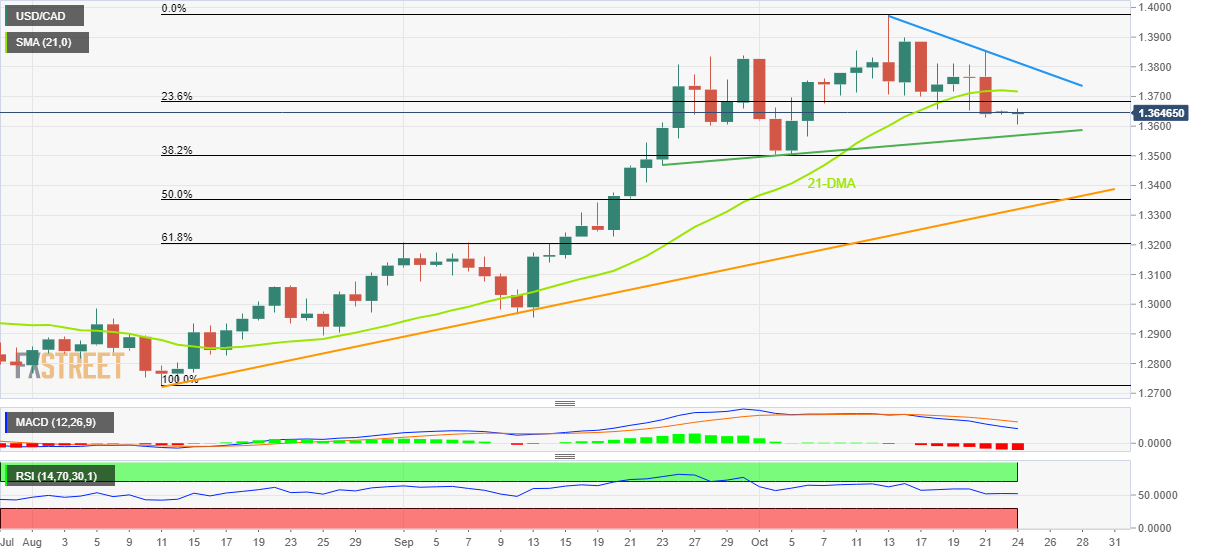

- USD/CAD remains pressured around fortnight low, keeps Friday’s break of 21-DMA.

- The first daily close below 21-DMA in six weeks, bearish MACD signals favor sellers.

- One-week-old descending trend line adds to the upside filters.

USD/CAD fades the bounce off a two-week low, marked earlier in the day, as it retreats to 1.3645 during Monday’s Asian session. In doing so, the Loonie pair keeps Friday’s downside break of the 21-DMA, the first in over a month.

In addition to the 21-DMA breakdown, the bearish MACD signals and a downward sloping RSI, not oversold, also direct the USD/CAD sellers towards an ascending support line from late September, around 1.3570 by the press time. However, the 1.3600 threshold may act as an immediate rest for the bears.

In a case where the quote breaks the aforementioned support, the monthly low and the 38.2% Fibonacci retracement of the pair’s August-October upside, near 1.3500, will be crucial to watch for the further downside.

Should the USD/CAD bears dominate past 1.3500, an upward-sloping support line from August, close to 1.3320 by the press time.

Alternatively, a daily closing beyond the 21-DMA level of 1.3716 appears necessary for the pair buyer’s return.

Even so, a descending resistance line from October 13 and the previous monthly high, respectively around 1.3815 and 1.3840, will be tough challenges for the USD/CAD bulls.

USD/CAD: Daily chart

Trend: Further downside expected

- NZD/USD is aiming to hit the 0.5800 resistance amid an upbeat market mood.

- Fed’s Desy is in favor that the central bank should trim the current pace of hiking interest rates.

- NZ markets are off on account of Labor Day.

The NZD/USD pair is moving towards the north with sheer confidence as investors’ risk appetite has improved dramatically. The pair is marching towards the critical hurdle of 0.5800 as a less-hawkish tone on interest rate guidance by a Fed policymaker, in such a long time, has infused an adrenaline rush into the risk-perceived currencies.

The US dollar index (DXY) has shifted into a negative trajectory amid a major drop in safe-haven appeal. On Friday, the DXY settled below the critical support of 112.00 as S&P500 recovered its two-day losses quickly.

San Francisco Fed President Mary Daly cited the risk of weaker economic prospects led by a heightened policy tightening environment in a short period. She added that the economy is facing the pressure of higher interest rates and the Fed may slow down the pace of hiking borrowing costs further to avoid sending the economy into an ‘unforced downturn’.

Meanwhile, the returns on US government bonds have trimmed as Fed’s less-hawkish tone on interest rate guidance forced a decline in ultra-hawkish bets. The 10-year US Treasury yields dropped to 4.22% from a fresh 14-year high of 4.34%. As per the CME FedWatch tool, the chances for a 75 basis point (bps) rate hike by the Fed have declined to 88%.

On the NZ front, markets are on holiday on account of Labor Day. Last week’s upbeat Trade Balance data also supported the kiwi bulls. The annual NZ fiscal deficit has widened by $11.95M, lower than the projections of $13.19B and the prior release of $12.5B. And, on a monthly basis, the fiscal deficit has widened by $1,615M against the projections of $2,205M and the former figure of $2,625M.

Imports in the kiwi zone have dropped to $7.64B against the figure of 47.92B reported earlier exports have advanced to $6.03B vs. the prior figure of $5.29B. While major countries are facing the headwinds of external demand shocks, kiwi’s exports have accelerated firmly.

This week, China’s Gross Domestic Product (GDP) data will be of utmost importance. The annual GDP data is expected to improve sharply to 3.45 vs. the prior release of 0.4%. Also, the quarterly GDP will escalate to 3.5% against a decline of 2.5% reported earlier.

- AUD/USD pares recent gains after an upbeat start to the week, renews intraday low of late.

- Aussie PMIs for October came in softer, RBA’s Kent signals further rates increases but size, timing will depend upon data.

- US PMIs, risk catalysts will offer intraday directions, bulls may find it difficult to keep the reins.

AUD/USD takes offers to renew intraday low around 0.6370, after an initial jump to a fortnight high, as the Aussie pair traders witness downbeat catalysts at home to start the trading week.

That said, Australia’s S&P Global Manufacturing PMI eased to 52.8 in October versus 53.5 previous readings and 52.5 market forecast while the Services counterpart dropped to 49 from 50.6 prior and 50.5 forecast. With this, S&P Global Composite PMI slipped into the contraction territory with 49.6 figure versus 50.9 previous readouts.

On the other hand, Reserve Bank of Australia (RBA) Assistant Governor (Economic) Christopher Kent repeats that the RBA board expects to increase interest rates further in the period ahead. The policymaker, however, also stated that the size and timing of rate increases will depend on incoming data, per Reuters.

Hence, mostly downbeat data and return of China’s active days, after a one-week-long annual Communist Party Congress, seemed to have teased the AUD/USD bears after the pair posted the first weekly gain in three.

That said, hopes of witnessing signals for easy rate hikes from the US Federal Reserve starting from December seemed to have triggered the AUD/USD pair buyers the previous day.

On Friday, St. Louis Fed President James Bullard said, “I want rates that put significant downward pressure on inflation.” On the same line, Chicago Fed President Charles Evans stated that they will need to raise rates further and hold them for awhile. However, Nick Timiraos, Chief Economics Correspondent at The Wall Street Journal (WSJ) wrote that the Federal Reserve officials are barreling toward another interest-rate rise of 75 bps at their meeting in November and are likely to debate then whether and how to signal plans to approve a smaller increase in December.

While portraying the risk-on mood, US equities posted the largest weekly gains in four months while the US 10-year Treasury yield marked 5% weekly gain while refreshing 14-year high, despite posting mild losses on Friday.

Technical analysis

A clear upside break of the descending trend line from September 12 and the 21-DMA, respectively around 0.6370 and 0.6280, keeps AUD/USD buyers hopeful to rush refresh the monthly high, currently around 0.6550.

“Size and timing of rate increases will depend on incoming data,” said Christopher Kent, Assistant Governor (Economic) at the Reserve Bank of Australia (RBA) during early Monday morning in Australia.

Additional comments

Fall in trade-weighted A$ will add only modestly to inflation.

While A$ down 14% on US$ this year, its trade-weighted index has fallen only 2%.

Estimate dip in the TWI will add only 0.2 ppt to CPI inflation over a few years.

A$ TWI has moved broadly in line with fundamentals, commodity prices.

Broad rise in US$ will raise import costs for many countries.

Higher US$ will restrain demand for u.s. goods, commodities and global inflation.

Strong US$ of concern to emerging markets with high levels of us$ debt.

Australian offshore debt well hedged, and higher US rates should not affect local bank borrowing costs.

RBA board expects to increase interest rates further in the period ahead.

AUD/USD extends Friday’s run-up

AUD/USD manages to stretch Friday’s upbeat performance while piercing the 0.6400 threshold, despite the softer data and mixed comments from the RBA’s Kent.

- GBP/USD bulls move in at the start of the week in bullish gap.

- Bulls eye the 1.1500 area for the days ahead.

GBP/USD starts where it left off the week, bid. The US dollar has been pressured following a report in the WSJ that said some Fed officials have signalled greater unease with big interest rate rises to fight inflation. In politics, UK Boris Johnson and Rishi Sunak did not strike a deal this weekend putting Sunak firmly on course for the leader. Cable has consequently penetrated a key resistance as follows:

GBP/USD daily chart

GBP/USD H4 chart

The price has carved a bullish scenario on the daily and 4-hour charts whereby a correction of the open could see support come in between 1.1300 and 1.1250. Resistance is marked just below 1.1400 which guards a break towards 1.1500 and early October highs.

- Gold price is advancing towards $1,660.0 amid an upbeat market mood.

- A Fed policymaker adopted a less-hawkish approach in a long time on interest rate guidance.

- The returns on 10-year US bonds have trimmed to 2.20% amid a decline in hawkish Fed bets.

Gold price (XAU/USD) is marching towards the immediate hurdle of $1,660.00 sharply as the positive market sentiment witnessed on Friday is expected to continue further. The precious metal picked significant bids around the two-year low at $1,614.85 and displayed a juggernaut rally, which may advance further.

The risk-on impulse shot vigorously after the Federal Reserve (Fed) policymaker supported a slowdown in the current pace of hiking interest rates to avoid sending the economy into an ‘unforced downturn’. San Francisco Fed President Mary Daly cited that too sharp increment in interest rates has trimmed the consensus for growth prospects. Therefore, a slowdown in the rate hike pace would lift some pressure on the economy. A less-hawkish commentary from a Fed policymaker in a very long time lifted the market sentiment and the S&P500 soared by more than 2.60%.

Meanwhile, the US dollar index (DXY) displayed a vertical fall and settled below the 112.00 cushion. The 10-year benchmark US Treasury yields declined to 4.20% as chances for a 75 basis point (bps) rate hike by the Fed have trimmed to 88%.

On Monday, investors will focus on the release of the S&P PMIs data. The Manufacturing PMI is expected to decline to 51.2 vs. the prior release of 52.0 while the Services PMI may drop to 49.2 from 49.3 reported earlier.

Gold technical analysis

Gold price has witnessed a stellar buying interest after testing the demand zone placed in a $1,614.85-1,621.60 range. The precious metal has crossed the 50-and 200-Exponential Moving Averages (EMAs) at $1,637.50 and $1,660.00 respectively in no time, which signals the strength of the gold bulls.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates more upside ahead.

Gold hourly chart

UK's Boris Johnson and Rishi Sunak did not strike a deal this weekend. Johnson told his supporters this morning that he is the only candidate with a democratic mandate. Hesaid he wants to form a Government that will reach 'far and wide'.

Johnson says he hoped he, Sunak and Mordaunt could come together and unite but they have been unable to do so.

Johnson said he had the numbers (102). But he also said "you can't govern effectively unless you have a united party.

This is a huge development and makes Rishi Sunak the firm favourite.

GBP/USD has gapped to a high of 1.1293 in the open.

- EUR/USD bulls emerge and eye a test of the coil's trendline.

- Bears need to get below hourly support around 0.9800.

Big moves in forex on Friday have put a bid into the euro. The US dollar index dropped as investors scaled back bets on aggressive monetary tightening after a WSJ report said that some Fed officials are concerned about overtightening with large rate hikes. Following Friday's volatility, the euro has moved out of bearish territory within the medium-term coil with prospects towards 0.99 for the days ahead as the following charts illustrate.

EUR/USD daily chart

Trendline resistance guards a break towards 1.0000 while the price embarks on the 0.9850 territories.

EUR/USD H4 chart

Zoomed into the 4-hour charts, a correction could be at hand from which the bulls will need to commit from prior resistance near 0.98 the figure or face pressures to prior lows that guard a break of the coil's support between 0.9750 and 0.9700.

EUR/USD H1 chart

From an hourly perspective, the 38.2% Fibonacci retracement of the bullish impulse aligns with 0.9800 resistance which could provide a firm support structure for the bulls in the upcoming sessions.

- AUD/USD bulls move in, but bears are lurking.

- Aussie CPI is on the radar for the week ahead.

AUD/USD rallied hard on Friday hitting a high of 0.6392 ending the day 1.59% in the green. The price has broken the technical structure but as investors fret about inflation and the economic effects of central bank's efforts to rein it in, there could be headwinds that put the downside back into focus. Meanwhile, Aussie data will be eyed this week with the Consumer POrice Index on the radar.

''We expect a more dovish headline CPI print due to the significant offset from the rebates and lower pump prices,'' analysts at TD Securities said. ''However, trimmed-mean CPI may stay elevated at 1.6% q/q as broader price pressures are still brewing, especially in the housing and food categories. Unless trimmed-mean inflation is strongly higher, we expect the Bank to stick with 25bps hikes until March 2023.''

US Treasury yields hit the pause button on Friday following suspected Bank of Japan intervention and signals that the Federal Reserve might consider less aggressive inflation-curbing tactics after November. This led to all three major US stocks to surge but more than 2%, notching their biggest Friday-to-Friday percentage gains since June, closing the book on a week marked by mixed earnings, soft economic data and political turmoil in Britain.

The two-year yield slumped 12.7 basis points to 4.48% and the 10-year rate slipped less than a basis point to 4.22% after the WSJ published the fact that certain Federal Reserve officials are becoming uncomfortable with the speed of interest-rate hikes. The Fed has raised its target funds rate by 300 basis points since the policy tightening began this year. The probability of the Fed lifting rates in November by 75 basis points is 96.5%, according to the CME FedWatch Tool.

AUD/USD technical analysis

The price could be in for a correction but the focus is now on the daily resistance structure around 0.6450 so long as 0.6400 holds.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.