- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 25-10-2016.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0887 +0,12%

GBP/USD $1,2180 -0,34%

USD/CHF Chf0,9941 +0,02%

USD/JPY Y104,20 -0,02%

EUR/JPY Y113,45 +0,10%

GBP/JPY Y126,92 -0,35%

AUD/USD $0,7643 +0,59%

NZD/USD $0,7161 +0,61%

USD/CAD C$1,3355 +0,06%

00:30 Australia CPI, q/q Quarter III 0.4% 0.5%

00:30 Australia CPI, y/y Quarter III 1% 1.1%

00:30 Australia Trimmed Mean CPI q/q Quarter III 0.5% 0.4%

00:30 Australia Trimmed Mean CPI y/y Quarter III 1.7% 1.7%

06:00 Germany Gfk Consumer Confidence Survey November 10 10

08:30 United Kingdom BBA Mortgage Approvals September 36.97

12:45 U.S. Services PMI (Preliminary) October 52.3 52.3

13:00 U.S. New Home Sales September 609 600

14:30 U.S. Crude Oil Inventories October -5.2

21:45 New Zealand Trade Balance, mln September -1265

The Conference Board Consumer Confidence Index, which had increased in September, declined in October. The Index now stands at 98.6 (1985=100), down from 103.5 in September. The Present Situation Index decreased from 127.9 to 120.6, while the Expectations Index declined from 87.2 last month to 83.9.

"Consumer confidence retreated in October, after back-to-back monthly gains," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers' assessment of current business and employment conditions softened, while optimism regarding the short-term outlook retreated somewhat. However, consumers' expectations regarding their income prospects in the coming months were relatively unchanged. Overall, sentiment is that the economy will continue to expand in the near-term, but at a moderate pace."

Fifth District manufacturing activity remained sluggish in October, according to the most recent survey by the Federal Reserve Bank of Richmond. New orders and backlogs decreased this month, while shipments flattened. Hiring activity strengthened mildly across firms and wage increases were more widespread. Prices of raw materials and finished goods rose more quickly in October, compared to last month.

Firms looked for better business conditions during the next six months. Manufacturers expected positive growth in shipments and in the volume of new orders. In addition, manufacturers looked for rising backlogs of new orders.

Producers anticipated increased capacity utilization and looked for slightly longer vendor lead times. Survey participants' outlook for the months ahead included moderate growth in hiring, while future wage increases outweighed declines in the October expectations index. Producers anticipated somewhat longer average workweeks. Firms expected faster growth in prices paid and prices received.

USD/JPY 99.00, 99.25,100.00, 100.25, 100.65/67/70/75, 100.90, 101.00, 102.00,103.50/55, 103.75, 104.50/54, 104.75, 105.00, 105.75

EUR/USD 1.0895,1.0900 (2.38bn), 1.0925,1.1000, 1.1025, 1.1075, 1.1090,1.1100 (511m),1.1150, 1.1160,1.1200

GBP/USD 1.2400, 1.2450,1.2500, 1.2560

AUD/USD 0.7600, 0.7615, 0.7670, 0.7680

NZD/USD 0.7100,0.7235/40

AUD/NZD 1.0625 (823m)

EUR/GBP 0.9050

USD/CAD 1.3055, 1.3080/85,1.3130/35, 1.3150,1.3220, 1.3250,1.3300, 1.3350/55

USD/CHF 0.9700 (600m),0.9825,0.9925

EUR/JPY 116.00

USD/MXN 17.35 (2.31bn)

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.5% in August. Both the 10-City Composite and the 20-City Composite posted a 0.4% increase in August. After seasonal adjustment, the National Index recorded a 0.6% month-over-month increase, and both the 10-City Composite and the 20-City Composite reported 0.2% month-over-month increases. After seasonal adjustment, 14 cities saw prices rise, two cities were unchanged, and four cities experienced negative monthly prices changes.

"Supported by continued moderate economic growth, home prices extended recent gains," says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. "All 20 cities saw prices higher than a year earlier with 10 enjoying larger annual gains than last month. The seasonally adjusted month-over-month data showed that home prices in 14 cities were higher in August than in July. Other housing data including sales of existing single family homes, measures of housing affordability, and permits for new construction also point to a reasonably healthy housing market".

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Germany IFO expectations index in October 104.5 104.5 106.1

8:00 Germany IFO current conditions index in October 114.7 114.9 115

8:00 Germany IFO business climate index in October 109.5 109.5 110.5

The euro rose at the start of the session against the US dollar, supported by strong data on business confidence in Germany. Business confidence in Germany improved in October, IFO survey indicated.

The business climate index rose to 110.5 in October from 109.5 in the previous month. The expected value was 109.5.

The current conditions index rose to 115.0 from 114.7 a month ago vs 114.9 forecast.

Meanwhile, expectations rose to 106.1 compared with 104.5 the previous month.

Today, investors will also monitor the US consumer confidence and statements by ECB President Draghi.

Political issues, such as the referendum in Italy and concerns about further Brexit concerns, continue to put pressure on the euro. In addition, the possibility of further easing of monetary policy by the ECB carries risks for the banking sector of the eurozone.

At the same time, investors continue to believe in a Fed hike this year. Higher rates support the US currency, making it more attractive to investors. According to the futures market, the likelihood of tighter monetary policy in December is 73.9% against 69.5% the previous day.

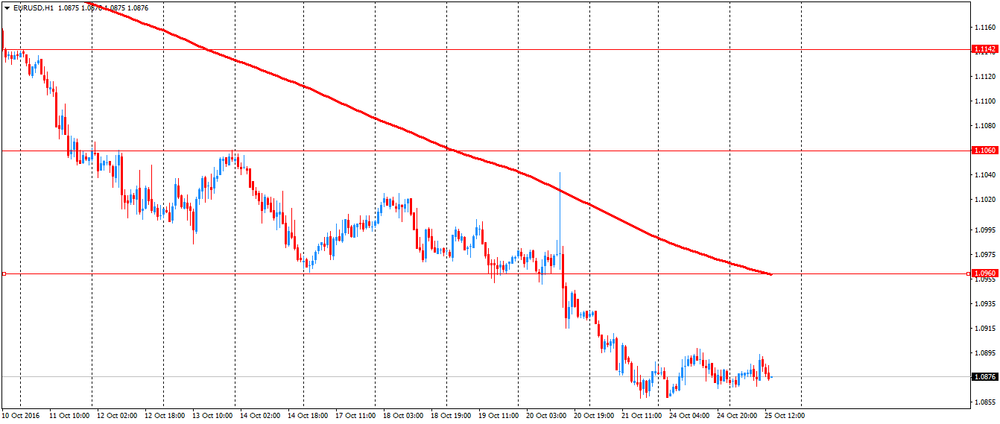

EUR / USD: during the European session, the pair rose to $ 1.0894

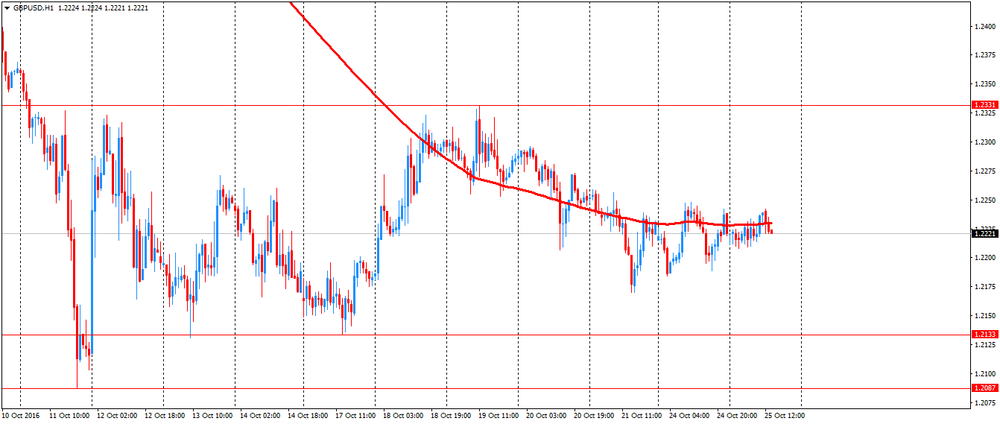

GBP / USD: during the European session, the pair rose to $ 1.2242

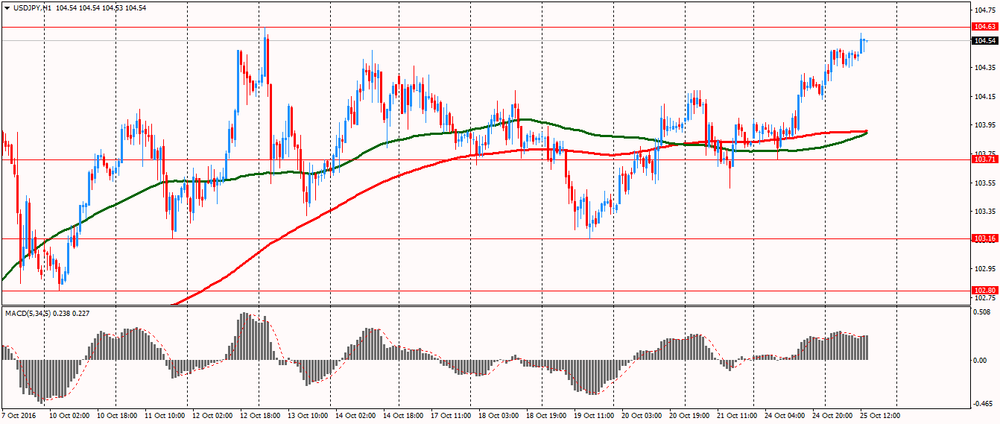

USD / JPY: during the European session, the pair rose to Y104.59

EUR/USD

Offers : 1.0900 1.0915-20 1.0940-50 1.0980 1.1000

Bids : 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0700

GBP/USD

Offers : 1.2250 1.2280 1.2300 1.2325-30 1.2350 1.2380 1.2400

Bids : 1.2200 1.2185 1.2165 1.2145-50 1.2130 1.2100 1.2085 1.2050

EUR/GBP

Offers : 0.8920-25 0.8955 0.8975-80 0.9000

Bids : 0.8880-85 0.8870 0.8850-55 0.8830 0.8800

EUR/JPY

Offers : 113.80-85 114.00 114.20 114.70-75 115.00

Bids : 113.30 113.00 112.85 112.60 112.00 111.85 111.50 111.00

USD/JPY

Offers : 104.00 104.25-30 104.50 104.80 105.00

Bids : 103.50 103.20-25 103.00 102.85 102.50 102.30 102.00

AUD/USD

Offers : 0.7650 0.7665 0.7680 0.7700 0.7730-35 0.7755-60

Bids : 0.7610 0.7600 0.7580 0.7555-60 0.7500

USD/JPY 99.00, 99.25,100.00, 100.25, 100.65/67/70/75, 100.90, 101.00, 102.00,103.50/55, 103.75, 104.50/54, 104.75, 105.00, 105.75

EUR/USD 1.0895,1.0900 (2.38bn), 1.0925,1.1000, 1.1025, 1.1075, 1.1090,1.1100 (511m),1.1150, 1.1160,1.1200

GBP/USD 1.2400, 1.2450,1.2500, 1.2560

AUD/USD 0.7600, 0.7615, 0.7670, 0.7680

NZD/USD 0.7100,0.7235/40

AUD/NZD 1.0625 (823m)

EUR/GBP 0.9050

USD/CAD 1.3055, 1.3080/85,1.3130/35, 1.3150,1.3220, 1.3250,1.3300, 1.3350/55

USD/CHF 0.9700 (600m),0.9825,0.9925

EUR/JPY 116.00

USD/MXN 17.35 (2.31bn)

Sentiment in the German economy continued to improve this month. The Ifo Business Climate Index rose from 109.5 points in September to 110.5 points in October. Companies were more satisfied with their current business situation. They also expressed far greater optimism about the months ahead. The upturn in the German economy is gathering impetus.

In manufacturing the business climate index rose. This was once again due to a far more positive outlook for the months ahead, with expectations rising to a two-year high. Assessments of the current business situation also improved. Demand for capital goods is particularly strong. The capacity utilisation rate rose by 0.9 percent to 85.7 percent versus last quarter.

Strong domestic demand in August boosted Italian industrial orders, which jumped 10.2% on the month, national statistics institute Istat says. Domestic orders rose 12.3%, while foreign orders were up 7.1% from July. Orders are a proxy for future industrial output, a key metric for Italy, which has Europe's second-largest manufacturing sector after Germany. Industrial sales rose 4.1% on the month and 10.0% on the year, Istat says.

Rttnews says that Spain's producer prices declined at the slowest pace in more than a year in September, the statistical office INE said Tuesday.

Producer prices declined 2 percent on a yearly basis in September, slower than the 3.2 percent decrease seen in August. This was the slowest pace of decline since July 2015.

Excluding energy, producer prices dropped 0.4 percent after easing 0.6 percent in August.

Energy prices plunged 6.5 percent and cost of intermediate goods and consumer goods slid 1.1 percent and 0.1 percent, respectively. Meanwhile, prices of capital goods gained 0.3 percent.

Month-on-month, producer prices advanced 0.3 percent in September, offsetting a 0.3 percent fall in August. This was the first increase in three months.

.

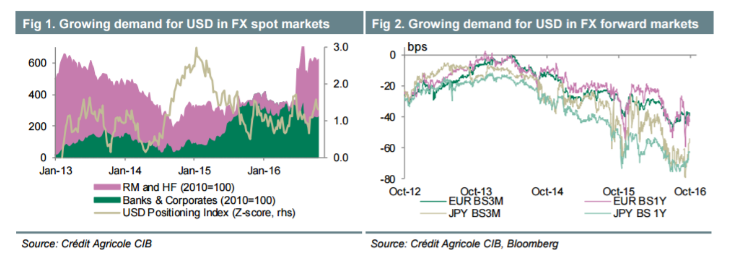

"The USD buying has intensified ahead of the December Fed meeting. Expectations of USD appreciation supports demand from both global investors and corporates, with the former trying to buy the currency to meet the payments on their sizeable USD-denominated debt.

Some EM central banks appear to respond to the growing demand for USD by selling FX reserves. Recent history further suggests that the drop in FX reserves was usually accompanied by weakness in majors like EUR, implying that the central banks sold liquid G10 holdings and converted the proceeds into USD to meet the FX demand at home.

This turns into a powerful virtuous cycle for the USD that broadens and strengthens its recent uptrend. It can explain the latest EUR/USD selloff that is seemingly at odds with currency fundamentals like rate spreads and sovereign bond yield spreads.

Recent history could suggest that the EUR-undervaluation may persist so long as global demand for USD continues to erode central bank FX reserves and forces them to liquidate assets in liquid USD-proxies".

Copyright © 2016 Credit Agricole CIB, eFXnews™

EUR/USD

Resistance levels (open interest**, contracts)

$1.1108 (3057)

$1.1023 (1763)

$1.0961 (676)

Price at time of writing this review: $1.0882

Support levels (open interest**, contracts):

$1.0811 (2044)

$1.0775 (4431)

$1.0735 (2903)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 41371 contracts, with the maximum number of contracts with strike price $1,1300 (3751);

- Overall open interest on the PUT options with the expiration date November, 4 is 45646 contracts, with the maximum number of contracts with strike price $1,1000 (7374);

- The ratio of PUT/CALL was 1.10 versus 1.11 from the previous trading day according to data from October, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.2502 (1333)

$1.2404 (1042)

$1.2307 (1479)

Price at time of writing this review: $1.2218

Support levels (open interest**, contracts):

$1.2191 (1012)

$1.2095 (1409)

$1.1997 (892)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 31150 contracts, with the maximum number of contracts with strike price $1,2800 (1965);

- Overall open interest on the PUT options with the expiration date November, 4 is 30416 contracts, with the maximum number of contracts with strike price $1,2300 (2007);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from October, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

maintains copper production for 2016 at a level of 570 000-600 000 tonnes

-

mining is expected to slightly exceed the annual forecast at 12 million tonnes

-

retains the forecast of nickel production for 2016 at the level of 45 000-47 000 tonnes

According to rttnews, South Korea's gross domestic product expanded 2.7 percent on year in the third quarter of 2016, the Bank of Korea said in Tuesday's preliminary reading.

That beat forecasts for an increase of 2.4 percent, although it slowed from 3.3 percent in the previous three months.

On a seasonally adjusted annualized basis, GDP gained 0.7 percent - also exceeding forecasts for 0.5 percent but down from 0.8 percent in the three months prior.

Real gross domestic income slipped 0.3 percent on quarter.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.