- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 26-08-2016.

The final results of the studies submitted by Thomson-Reuters and the Institute of Michigan revealed that in August US consumers feel more pessimistic about the economy than last month.

Consumer sentiment index fell to 89.8 points compared with a reading of 90.0 in July. The index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage.

Also the results have shown:

- 12-month inflation expectations + 2.5%, + 2.7% in July.

- 5-year inflation expectations + 2.5% versus + 2.6% in July.

- final expectations index in August was 78.7 compared to 77.8 in July.

- final current conditions index in August was 107.0, which was worse than the value of 109.0 in July.

Case for interest rate increase has strengthened in recent months

Economyc nearing Fed's employment and inflation goals

Our ability to predict Fed rate path is quite limited

Gradual hikes over time are 'appropriate'

Fed expects inflation to rise to 2% goal in next few years

Fed depends on data, not on a preset course

Range of possible rate hikes paths is wide, shocks could change path

USDJPY 99.00, 99.45/50 100.00, 100.25, 100.70/71/75 (485m) 101.00 104.50 105.00

EURUSD 1.0950 1.1015 1.1150 (407m) 1.1225, 1.1285/90 1.1350

GBPUSD 1.2750 1.3000 1.3700

AUDUSD 0.9163 (592m) 0.7375 0.7580 0.7600 (541m), 0.7615, 0.7675 (720m) 0.7850

NZDUSD 0.7165

EURGBP 0.8400

USDCAD 0.1650 1.2800 (507m) 1.2900, 1.2945/50/55, 1.2965 (458m) 1.3025 1.3100

-

Looks at the path of interest rates. Thinks that path is to higher rates

-

Does not mean every meeting is a hike

-

Fed perhaps not communicating as well as it could

-

Economy is still on track for pickup growth, inflation rising and employment falling

-

Appropriate to raise rates but not giving an exact number

-

There is a potential for instability in environment for potential bubbles.

-

Not saying there is a bubble in the stock market

-

Commercial real estate is a little bit frothy, but not an imminent problem

Real gross domestic product increased at an annual rate of 1.1 percent in the second quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent.

Real gross domestic income (GDI) increased 0.2 percent in the second quarter, compared with an increase of 0.8 percent in the first (revised). The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 0.6 percent in the second quarter, compared with an increase of 0.8 percent in the first

The price index for gross domestic purchases increased 2.1 percent in the second quarter, compared with an increase of 0.2 percent in the first. The PCE price index increased 2.0 percent, compared with an increase of 0.3 percent. Excluding food and energy prices, the PCE price index increased 1.8 percent, compared with an increase of 2.1 percent

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany consumer confidence index from the GfK September 10 9.9 10.2

8:00 Changing the Eurozone lending to the private sector, the y / y in July 1.8% 1.8% 1.8%

8:00 Eurozone M3 Money Supply, y / y in July 5% 4.9% 4.8%

8:30 UK GDP q / q (revised data) II quarter 0.4% 0.6% 0.6%

8:30 UK GDP y / y (revised data) II q 2% 2.2% 2.2%

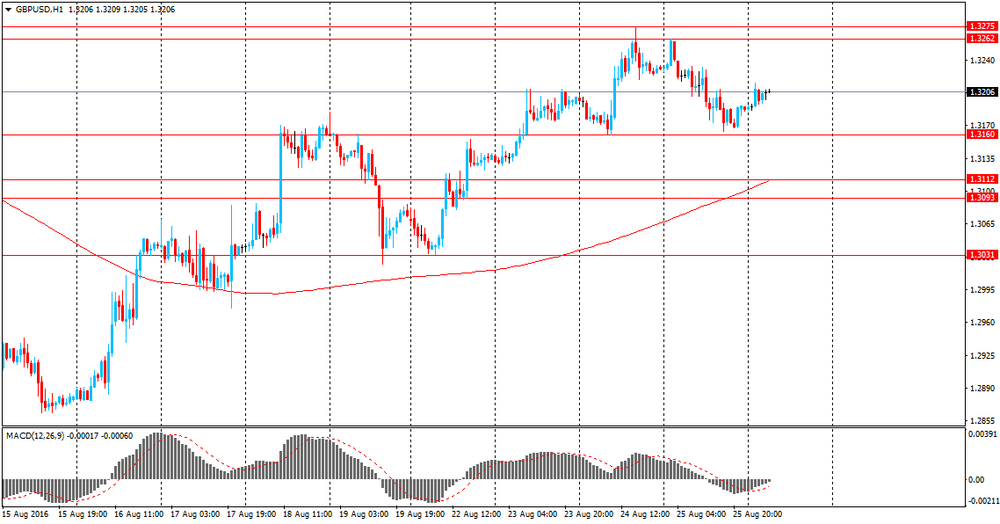

The pound fell moderately against the US dollar retreated from a session high, ahead of the data on US GDP and the speech by Fed Yellen. Limited impact on the pound provided statistics on Britain's GDP, which coincided with forecasts.Revised data published by the ONS showed that in the second quarter UK GDP grew by 0.6 percent relative to the previous three-month period and increased by 2.2 percent in annual terms. The last change was in line with the preliminary readings and forecasts. Household spending rose in the 2nd quarter by 0.9 percent compared to the first three months of 2016. In annual terms, the increase in household expenditure (+3.0 percent) was the strongest since the end of 2007. Business investment rose by 0.5 percent q/q, despite the predicted fall. This change helped offset the decline in the first three months of this year. On an annual basis, business investment fell by 0.8 per cent, which corresponds to a change in the 1st quarter.

The dollar consolidated against the euro while remaining near the opening level of the day. Consumer confidence data in Germany gave little support, while the situation on the stock markets is flat. In general, experts point out that many investors prefer not to risks, waiting for the Fed's Yellen speech. Traders believe that the further tightening of monetary policy the Fed is unlikely against the backdrop of weak data on GDP growth and productivity. However, the positive comments from the Federal Reserve voiced in recent days have increased hopes for a rate hike.

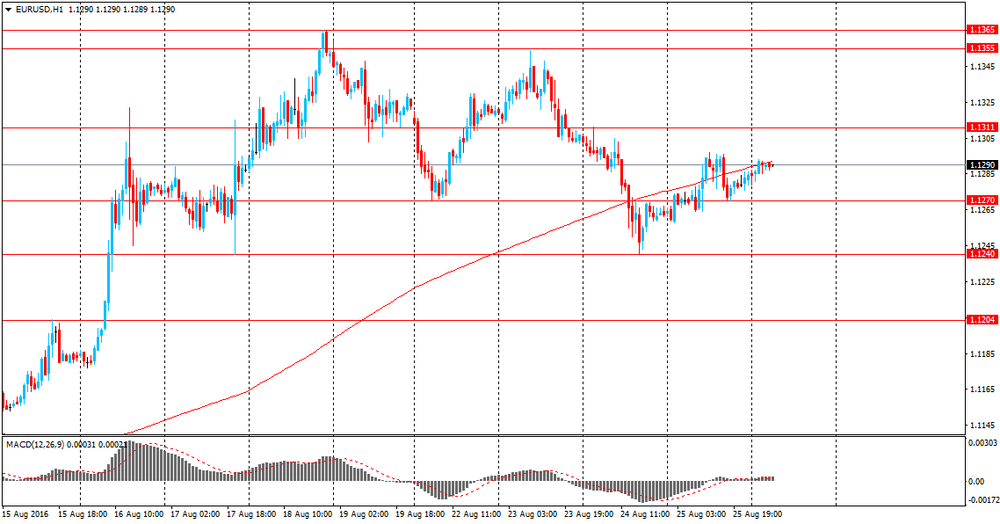

EUR / USD: during the European session, the pair traded in a narrow range

GBP / USD: during the European session, the pair rose to $ 1.3232, but then fell back slightly

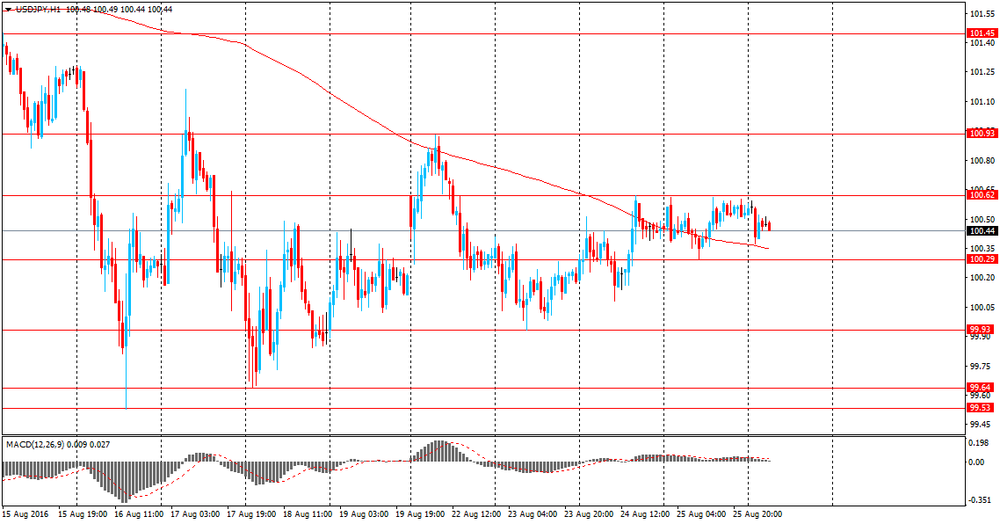

USD / JPY: during the European session, the pair consolidated in a narrow range

EUR/USD

Offers 1.1320-25 1.1350-55 1.1380-85 1.1400

Bids 1.1280 1.1250 1.1230 1.1200 1.1185 1.1150

GBP/USD

Offers 1.3235 1.3250 1.3280 1.3300 1.3320 1.3350 1.3380 1.3400

Bids 1.3200 1.3185 1.3165 1.3150 1.3130 1.3100 1.3085 1.3050

EUR/GBP

Offers 0.8560-65 0.8580 0.8600 0.8625-30 0.8655-60 0.8685 0.8700

Bids 0.8520 0.8500 0.8480-85 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers 113.60 113.80 114.00 114.30 114.50 114.75 115.00

Bids 113.30 113.00 112.75-80 112.50 112.30 112.00-10

USD/JPY

Offers 100.65 100.85 101.00 101.25-30 101.50 101.75-80 102.00

Bids 100.30 100.20 100.00 99.85 99.65 99.50 99.30 99.00 98.80 98.50

AUD/USD

Offers 0.7650-55 0.7680 0.7700 0.7725-30 0.7750-55

Bids 0.7620 0.7600 0.7585 0.7565 0.7550 0.7500

"Lower USD, higher EUR: A weaker USD, looser financial conditions and the Brexit risk event out of the way have meant that there are signs of businesses starting to grow around the world. We are not saying that all is rosy and that growth rates will reach average pre-2007 levels, but we believe that the FX markets right now will respond to changes in economic circumstances and surprises. In fact, the MSCI world equity index has become more correlated with global economic surprises, as noted by our equity colleagues.Economic data divergence between the eurozone and US should help EURUSD to break beyond the previous high at 1.1366, opening room towards our 1.16 target.

US investment down, eurozone investment up: The regional Fed surveys have also been pointing towards a flat reading in July. In contrast, eurozone activity has been stabilising, with the WSJ reporting that eurozone companies are planning to raise investment spending even after the Brexit vote. A larger proportion of companies in Germany, France and Spain were planning to increase capital spending relative to the previous survey in February. The ECB's corporate bond purchases pushing down borrowing costs and money supply data released tomorrow expected to have grown by 5%Y (M3) in July support the case for EUR-USD data divergence".

Copyright © 2016 Morgan Stanley, eFXnews

USD/JPY 99.00, 99.45/50, 100.00, 100.25, 100.70/71/75 (485m),101.00,104.50,105.00

EUR/USD 1.0950,1.1015,1.1150 (407m),1.1225, 1.1285/90,1.1350

GBP/USD 1.2750,1.3000,1.3700

AUD/USD 0.9163 (592m),0.7375,0.7580,0.7600 (541m), 0.7615, 0.7675 (720m),0.7850

NZD/USD 0.7165

EUR/GBP 0.8400

ONS: the Index of Services was estimated to have increased by 2.4% in June 2016 compared with June 2015. All of the 4 main components of the services industries increased in the most recent month compared with the same month a year ago.

The largest contribution to total growth came from business services and finance, which contributed 1.1 percentage points.

The latest Index of Services estimates show that output increased by 0.2% between May 2016 and June 2016. This follows flat growth of 0.0% between April 2016 and May 2016.

The reporting period for this release covers Quarter 2 (Apr to June) 2016, and therefore includes data for a short period after the EU referendum. There is very little anecdotal evidence at present to suggest that the referendum has had an impact on GDP in Quarter 2 2016.

According to ONS, UK gross domestic product in volume terms was estimated to have increased by 0.6% between Quarter 1 (Jan to Mar) 2016 and Quarter 2 2016, unrevised from the preliminary estimate of gross domestic product published on 27 July 2016. This is the 14th consecutive quarter of positive growth since Quarter 1 2013.

Between Quarter 2 2015 and Quarter 2 2016, GDP in volume terms increased by 2.2%, unrevised from the previously published estimate.

GDP in current prices increased by 1.6% between Quarter 1 2016 and Quarter 2 2016.

GDP per head in volume terms was estimated to have increased by 0.4% between Quarter 1 2016 and Quarter 2 2016.

According to ECB, the annual growth rate of the broad monetary aggregate M3 decreased to 4.8% in July 2016, from 5.0% in June, averaging 4.9% in the three months up to July. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate, including currency in circulation and overnight deposits (M1), decreased to 8.4% in July, from 8.7% in June. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) stood at -1.4% in July, compared with -1.5% in June.

The annual growth rate of marketable instruments (M3-M2) decreased to 4.9% in July, from 6.5% in June. Within M3, the annual growth rate of deposits placed by households stood at 4.8% in July, compared with 4.7% in June, while the annual growth rate of deposits placed by non-financial corporations decreased to 7.3% in July, from 7.8% in June. Finally, the annual growth rate of deposits placed by non-monetary financial corporations (excluding insurance corporations and pension funds) decreased to 0.4% in July, from 2.8% in June.

At 14:00 GMT the Federal Reserve Board of Governors Chairwoman Janet Yellen will deliver a speech.

At 14:50 GMT deputy Governor of the Bank of England and the banking Nemat Shafik will deliver a speech.

The following data was published:

23:30 Japan Consumer Price Index in the region of Tokyo y / y in August -0.4% -0.5%

23:30 Japan Consumer Price Index with the exception of the price of fresh produce in the region of Tokyo y / y in August -0.4% -0.3% -0.4%

23:30 Japan National CPI y / y in July -0.4% -0.4%

23:30 Japan National Consumer Price Index with the exception of the price of fresh food, y / y in July -0.5% -0.4% -0.5%

06:00 Germany consumer confidence index from the GfK September 10 9.9 10.2

The US dollar continues to decline against major currencies in anticipation of Fed's Yellen speech.

Traders consider a further tightening of monetary policy unlikely in the background of weak data on economic growth and productivity. However, the positive comments from the Federal Reserve's officials in recent days have increased hopes for a rate hike.

Esther George said it is time to change the interest rate. Consumer spending and the labor market - the bright spots of the US economy, but business investment continues to disappoint. George agreed to the plan to gradually raise interest rates.

Fed funds futures indicates that investors see a 54% chance of a rate hike in December, according to the CME Group.

The yen is trading in a narrow range. Data published today show that consumer prices in Japan continued to fall in July, which means that the Bank of Japan may be forced to act to stimulate inflation.

Japan National Consumer Price Index in July, year on year, down by -0.4%, in line with economists' forecast and the previous value. In August, the indicator for Tokyo area fell by -0.5%. The largest drop in July showed prices for electricity and gasoline.

The data are an assessment of price movements obtained by comparison of the retail prices of the relevant basket of goods and services. CPI - the most important barometer of changes in purchasing trends. Inflation reduces the purchasing power of the yen.

National CPI, except for the price of fresh food, decreased by 0.5%, after declining by 0.4% in June. The consumer price index except fresh products in the region of Tokyo, declined by -0.4% year on year, while economists forecasts -0.3%

The national consumer price index excluding food and energy for the period from January to July rose by 0.3% after rising 0.5% in the same period a year earlier

EUR / USD: during the Asian session, the pair was trading in the 1.1280-1.1310 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3180-1.3220 range

USD / JPY: during the Asian session, the pair was trading in the Y100.40-60 range

EUR/USD

Resistance levels (open interest**, contracts)

$1.1433 (4476)

$1.1399 (3346)

$1.1347 (4587)

Price at time of writing this review: $1.1303

Support levels (open interest**, contracts):

$1.1240 (1364)

$1.1192 (1855)

$1.1160 (2556)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 51979 contracts, with the maximum number of contracts with strike price $1,1250 (4587);

- Overall open interest on the PUT options with the expiration date September, 9 is 57605 contracts, with the maximum number of contracts with strike price $1,1000 (5790);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from August, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.3502 (1942)

$1.3403 (2354)

$1.3305 (2583)

Price at time of writing this review: $1.3217

Support levels (open interest**, contracts):

$1.3093 (1012)

$1.2996 (2084)

$1.2898 (1905)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32123 contracts, with the maximum number of contracts with strike price $1,3300 (2583);

- Overall open interest on the PUT options with the expiration date September, 9 is 26462 contracts, with the maximum number of contracts with strike price $1,2800 (2695);

- The ratio of PUT/CALL was 0.82 versus 0.82 from the previous trading day according to data from August, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

"Fed Chair Yellen's speech at Jackson Hole should strike a moderately positive tone with respect to the near-term economic outlook.

While we do not expect Yellen to explicitly pre-commit to raising interest rates at the September 20-21 FOMC meeting, she will no doubt want to retain the optionality of hiking next month if economic and financial conditions permit.

To be sure, Yellen may couch any potential discussion of the near-term trajectory of interest rates within the context of a significantly lower terminal rate. The topic of this year's Jackson Hole Symposium is "Designing Resilient Monetary Policy Frameworks for the Future". Therefore, Yellen's speech will likely focus on some of the themes outlined last week by San Francisco Fed President Williams.

...We anticipate that Yellen's speech will outline the rationale for taking another step in the policy normalization process, but will also discuss the broader ramifications of a potentially lower equilibrium real rate".

Copyright © 2016 DB, eFXnews™

According to the Wall Street Journal:

"Today my views are it is time to move"

"Where I was in July made sense to me and it still makes sense to me."

"I don't see better outcomes from waiting."

According to rttnews, consumer prices in Japan were down 0.4 percent on year in July, the Ministry of Internal Affairs and Communications said on Friday - in line with expectations and unchanged from June's annual reading.

Core CPI, which excludes volatile food costs, slid 0.5 percent on year - missing forecasts for -0.4 percent, which would have been unchanged.

On a monthly basis, overall inflation and core CPI both dipped 0.2 percent.

Overall inflation in Tokyo, considered a leading indicator for the nationwide trend, slipped 0.5 percent on year in August. That missed expectations for 0.4 percent, which would have been unchanged.

Core CPI in August was down an annual 0.4 percent - matching expectations and the same as in the previous month.

Consumer sentiment in Germany developed positively on the whole in August, with consumers appearing to digest the shocking Brexit news very well. The overall index for consumer climate is forecasting 10.2 points for September, following 10.0 points in August. Income expectations and propensity to buy are seeing improvements, while economic expectations suffered slight losses.

The Brits' decision to leave the EU only seems to have caused temporary uncertainty among German consumers. This is signaled by the increases in both income expectations and propensity to buy. Economic expectations, on the other hand, once again suffered slight losses, following significant losses in the previous month.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.