- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 27-02-2015.

The U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data. The U.S. revised GDP grew 2.2% in the fourth quarter, lower than the previous estimated growth of 2.6%. Analysts had expected U.S. GDP to rise 2.1%.

The Chicago purchasing managers' index declined to 45.8 in February from 59.4 in January, missing expectations for a fall to 58.4. That was the lowest level since July 2009.

A reading below the 50 mark indicates contraction.

The decline was driven by drops in production, new orders, order backlogs and employment.

Pending home sales in the U.S. rose 1.7% in January, missing expectations for a 2.5% increase, after a 1.5% decline in December. December's figure was revised up from a 3.7% drop.

The final University of Michigan's consumer sentiment index was 95.4 in February, beating expectations for a decline to 94.2, down from the preliminary estimate of 98.2.

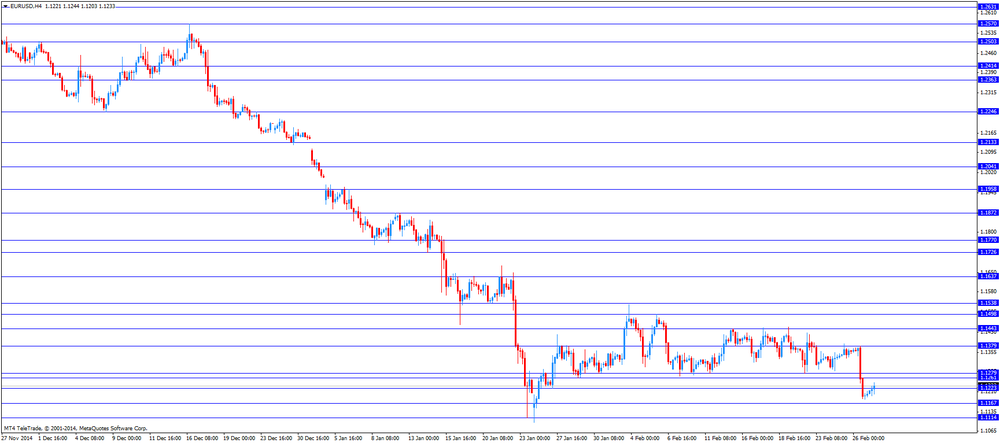

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. German preliminary consumer price index rose 0.9% in February, exceeding expectations for a 0.6% increase, after a 1.1% drop in January.

On a yearly basis, German preliminary consumer price index increased to 0.1% in February from -0.4% in January.

The increase was driven by lower decline in energy and food prices.

French consumer spending increased 0.6% in January from a year earlier, after a 1.6% rise. December's figure was revised up from a 1.5% gain.

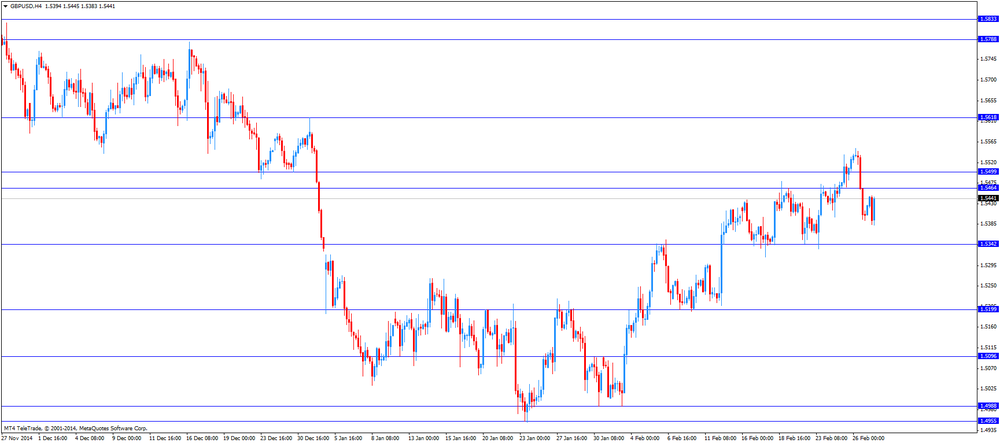

The British pound traded higher against the U.S. dollar in the absence any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. The KOF leading indicator decreased to 90.1 in February from 96.1 in January, beating expectations for a decrease to 89.1. January's figure was revised down from 97.0.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the mixed economic data from New Zealand. The ANZ business confidence index for New Zealand climbed to 34.4 in January from 30.4 in December.

Building permits in New Zealand fell 3.8% in January, after a 2.1% decline in December.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback. Private sector credit in Australia climbed 0.6% in January, after a 0.5% increase in December.

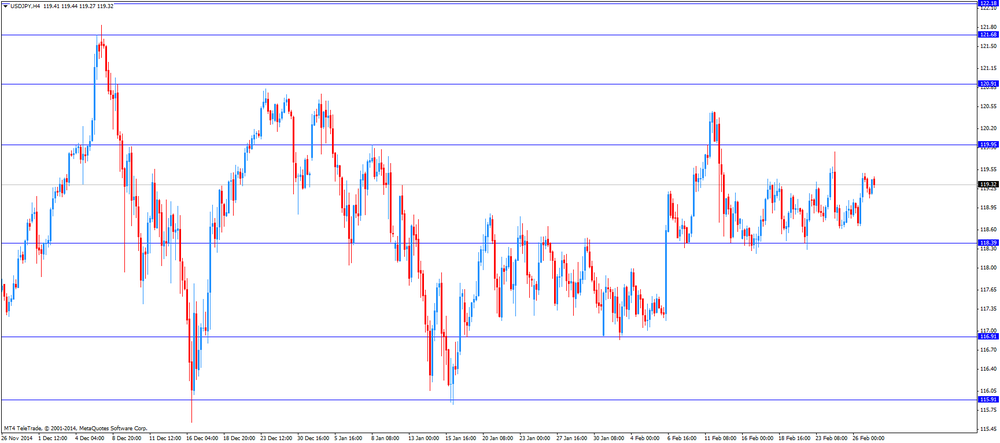

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded declined against the greenback after the mostly weaker-than-expected economic data from Japan. Japan's national consumer price index (CPI) remained unchanged at an annual rate of 2.4% in Japan.

Japan's national CPI excluding fresh food declined to an annual rate of 2.2% in January from 2.5% in December, missing expectations for a 2.4% gain.

Tokyo's CPI remained unchanged at an annual rate of 2.3% in February.

Tokyo's CPI excluding fresh food remained unchanged at an annual rate of 2.2% in February, in line with expectations.

Household spending in Japan dropped at annual rate of 5.1% in January, missing forecasts of a 4.0% decrease, after a 3.4% fall in December.

Japan's unemployment rate increased to 3.6% in January from 3.4% in December. Analysts had expected the unemployment rate to remain unchanged.

Preliminary industrial production in Japan climbed 4.0% in January, exceeding expectations for a 3.1% increase, after a 0.8% rise in December.

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Friday. Pending home sales in the U.S. rose 1.7% in January, missing expectations for a 2.5% increase, after a 1.5% decline in December. December's figure was revised up from a 3.7% drop.

The NAR's chief economist Lawrence Yun said that contract activity is increasing.

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The index declined to 45.8 in February from 59.4 in January, missing expectations for a fall to 58.4. That was the lowest level since July 2009.

A reading below the 50 mark indicates contraction.

The decline was driven by drops in production, new orders, order backlogs and employment.

The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP grew 2.2% in the fourth quarter, lower than the previous estimated growth of 2.6%.

Analysts had expected U.S. GDP to rise 2.1%.

Consumer spending rose by 4.2% in the fourth quarter, the fastest pace since the first of 2006.

Business investment slowed in the fourth quarter and grew at 4.8% in fourth quarter.

Exports climbed 3.2% due to a stronger dollar and trouble in Asia and Europe.

Destatis released its consumer price inflation data for Germany on Friday. German preliminary consumer price index rose 0.9% in February, exceeding expectations for a 0.6% increase, after a 1.1% drop in January.

On a yearly basis, German preliminary consumer price index increased to 0.1% in February from -0.4% in January.

The increase was driven by lower decline in energy and food prices. Energy prices plunged 7.3% in February, after a 9% drop in the previous month. Food prices decreased 0.4%, after a 1.3% fall in January.

USD/JPY 118.00 (USD 648m) 118.50 (USD 804m) 118.90 (USD 400m) 119.00 (USD 483m) 119.50 (USD 717m) 120.00 (USD 473m) 120.50 (USD 981m) 120.75 (USD 806m)

EUR/USD 1.1250 (EUR 1.4bln) 1.1300 (EUR 1bln) 1.1325 (EUR 1.2bln) 1.1400 (EUR 1.8bln) 1.1500 (EUR 1.6bln)

GBP/USD 1.5200 (GBP 359m) 1.5500 (GBP 301m)

USD/CAD 1.2390 (USD 330m) 1.2440 (USD 540m) 1.2500 (USD 1bln) 1.2700 (USD 401m)

AUD/USD 0.7700 (AUD 1.4bln) 0.7775-80 (AUD 2bln) 0.7800 (AUD 704m) 0.7850 (AUD 1.7bln) 0.7900 (AUD 687m)

Economic calendar (GMT0):

00:00 New Zealand ANZ Business Confidence February 30.4 40.9

00:05 United Kingdom Gfk Consumer Confidence February 1 3 1

00:30 Australia Private Sector Credit, m/m January +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y January +5.9% +6.2%

05:00 Japan Housing Starts, y/y January -14.7% -11.1% -13.0%

07:45 France Consumer spending, y/y January +0.5% +0.6%

08:00 Switzerland KOF Leading Indicator February 96.1 Revised From 97.0 89.1 90.1

The U.S. dollar traded mixed to higher against the most major currencies ahead the U.S. economic data. The U.S. revised GDP is expected to rise 2.1% in fourth quarter.

The Chicago purchasing managers' index is expected to decline to 58.4 in February from 59.4 in January.

The final Reuters/Michigan Consumer Sentiment Index is expected to decline to 94.2 in February.

Pending home sales in the U.S. are expected to climb 2.5% in January, after a 3.7% decrease in December.

The euro traded higher against the U.S. dollar after the positive economic data from France. French consumer spending increased 0.6% in January from a year earlier, after a 1.6% rise. December's figure was revised up from a 1.5% gain.

The British pound traded mixed against the U.S. dollar in the absence any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected KOF leading indicator. The KOF leading indicator decreased to 90.1 in February from 96.1 in January, beating expectations for a decrease to 89.1. January's figure was revised down from 97.0.

EUR/USD: the currency pair rose to $1.1244

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y119.44

The most important news that are expected (GMT0):

13:00 Germany CPI, m/m (Preliminary) February -1.1% +0.6%

13:00 Germany CPI, y/y (Finally) February -0.4%

13:30 U.S. PCE price index, q/q Quarter IV +4.3%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.1%

13:30 U.S. GDP, q/q (Revised) Quarter IV +2.6% +2.1%

14:45 U.S. Chicago Purchasing Managers' Index February 59.4 58.4

15:00 U.S. Pending Home Sales (MoM) January -3.7% +2.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 98.1 94.2

EUR/USD

Offers 1.1225 1.1260 1.1285 1.1300 1.1325 1.1350-60 1.1385 1.1400

Bids 1.1200-1.1190 1.1165 1.1150 1.1130 1.1100

GBP/USD

Offers 1.5450-55 1.5475-80 1.5500 1.5530 1.5550-55 1.5580 1.5600

Bids 1.5400 1.5375-80 1.5360 1.5340 1.5325 1.53001.5285 1.5260

EUR/JPY

Offers 134.00 134.30 134.50 134.80 135.00 135.50

Bids 133.50 133.00 132.85 132.50

USD/JPY

Offers 119.50 119.80 120.00 120.25-30

Bids 119.00 118.85 118.60 118.40 118.20 118.00 117.85

EUR/GBP

Offers 0.7300 0.7320-25 0.7345-50 0.7385 0.7400

Bids 0.7250-55 0.7230 0.7200-10 0.7180-85 0.7160

AUD/USD

Offers 0.7825 0.7840 0.7880 0.7900-10 0.7930

Bids 0.7800-0.7790 0.7770-75 0.7750 0.7730 0.7700

USD/JPY 118.00 (USD 648m) 118.50 (USD 804m) 118.90 (USD 400m) 119.00 (USD 483m) 119.50 (USD 717m) 120.00 (USD 473m) 120.50 (USD 981m) 120.75 (USD 806m)

EUR/USD 1.1250 (EUR 1.4bln) 1.1300 (EUR 1bln) 1.1325 (EUR 1.2bln) 1.1400 (EUR 1.8bln) 1.1500 (EUR 1.6bln)

GBP/USD 1.5200 (GBP 359m) 1.5500 (GBP 301m)

USD/CAD 1.2390 (USD 330m) 1.2440 (USD 540m) 1.2500 (USD 1bln) 1.2700 (USD 401m)

AUD/USD 0.7700 (AUD 1.4bln) 0.7775-80 (AUD 2bln) 0.7800 (AUD 704m) 0.7850 (AUD 1.7bln) 0.7900 (AUD 687m)

BLOOMBERG

Saudis' Oil Price War Is Paying Off

(Bloomberg) -- Three months after Saudi Arabia made clear it was going to let oil prices keep tumbling, the strategy is showing signs of working.

U.S. drillers are idling rigs at a record pace, gutting investment plans and laying off thousands of workers.

Those steps highlight how the Saudi-led OPEC decision on Nov. 27 to maintain output levels and protect its market share is having the desired effect -- pushing prices down so far that they threaten to curb output in the U.S. and other non-OPEC countries. Saudi Arabia, the most powerful member of the Organization of Petroleum Exporting Countries, will maintain that tack when the group next meets in June, according to some of the world's biggest banks.

REUTERS

FOREX-Dollar on track for eighth month of gains on US data, Fed outlook

LONDON, Feb 27 (Reuters) - The dollar index slipped on Friday, pegged back by month-end selling, but was still on track for its eighth straight month of gains on better data and comments from Federal Reserve officials that bolstered bets for a rate rise this year.

The index, which measures the dollar's performance against major currencies, was set to mark its longest streak of monthly gains since the greenback was floated as a fiat currency in 1971.

On the day however, the index was off 0.2 percent at 95.124, having hit a one-month high of 95.357 on Thursday. The index had rallied 1.1 percent on Thursday, bringing it close to the more than 11-year high of 95.481 struck on Jan. 23.

Data released on Thursday showed U.S. core consumer price index, which excludes food and energy costs, rose 0.2 percent in January, more than the 0.1 percent increase economists had expected.

Source: http://www.reuters.com/article/2015/02/27/markets-forex-idUSL5N0W11OD20150227

REUTERS

Apple faces second suit from victorious patent firm

(Reuters) - Fresh off a $532.9 million jury win against Apple Inc, a Texas company is again suing the tech giant, this time over the same patents' use in devices introduced after the original case was underway.

Smartflash LLC aims to make Apple pay for using the patent licensing firm's technology without permission in devices not be included in the previous case, such as the iPhone 6 and 6 Plus and the iPad Air 2. The trial covered older Apple devices.

On Tuesday, a jury in federal court in Tyler, Texas found that Apple willfully violated three Smartflash patents with devices that use its iTunes software. The patents relate to accessing and storing downloaded songs, videos and games.

Source: http://www.reuters.com/article/2015/02/27/us-ip-apple-lawsuit-idUSKBN0LU27X20150227

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence February 30.4 40.9

00:05 United Kingdom Gfk Consumer Confidence February 1 3 1

00:30 Australia Private Sector Credit, m/m January +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y January +5.9% +6.2%

05:00 Japan Housing Starts, y/y January -14.7% -11.1% -13.0%

07:45 France Consumer spending January +1.5% -0.3% -0.9%

07:45 France Consumer spending, y/y January +0.5% +0.6%

08:00 Switzerland KOF Leading Indicator February 97.0 89.1 90.1

The U.S. dollar traded lower against its major peers after the mixed U.S. economic data yesterday. U.S. consumer price inflation fell 0.7% in January, missing expectations for a 0.6% decrease, after a 0.4% decline in December. That was largest decline since December 2008. On a yearly basis, the U.S. consumer price index fell to -0.1% in January from 0.8% in December. That was the lowest level since October 2009.

The U.S. durable goods orders rose 2.8% in January, exceeding expectations for a 1.7% increase, after a 3.7% decline in December. December's figure was revised down from a 3.3% decrease.

The number of initial jobless claims in the week ending February 21 in the U.S. climbed by 31,000 to 313,000 from 282,000 in the previous week, missing expectations for a rise by 3,000. The previous week's figure was revised up from 283,000.

The euro recovered moderately from yesterday's slump hitting a monthly-low yesterday.

The Australian dollar recovered from yesterday's slump and added gains versus the U.S. dollar. Private Sector Credit rose by +0.6% on a monthly basis in January, above estimates and a previous reading of +0.5%. Year on year Private Sector Credit rose +6.2% compared to +5.9%.

New Zealand's dollar rose against the greenback. The ANZ Business Confidence Index rose from 30.4 to 40.9 in February.

The Japanese yen traded higher against the greenback on Friday despite mostly disappointing Japanese economic reports as yesterday's U.S. data continued to weigh on the greenback. The Japanese Unemployment Rate for January rose to 3.6% from 3.4% in the previous month. Household spending decreases above estimates of -4.0% by -5.1%. The National Consumer Price index remained unchanged at +2.4%. Retail Sales declined by -2.0%, far more than the estimated -1.1%. Preliminary Industrial Production for January rose by +4.0% month on month, beating estimates of +3.1%. Year on year Industrial Production declined by -2.6%.

EUR/USD: the euro traded higher against the greenback

(time / country / index / period / previous value / forecast)

13:00 Germany CPI, m/m (Preliminary) February -1.1% +0.6%

13:00 Germany CPI, y/y (Finally) February -0.4%

13:30 U.S. PCE price index, q/q Quarter IV +4.3%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.1%

13:30 U.S. GDP, q/q (Revised) Quarter IV +2.6% +2.1%

14:45 U.S. Chicago Purchasing Managers' Index February 59.4 58.4

15:00 U.S. Pending Home Sales (MoM) January -3.7% +2.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 98.1 94.2

EUR / USD

Resistance levels (open interest**, contracts)

$1.1333 (2300)

$1.1300 (847)

$1.1252 (310)

Price at time of writing this review: $1.1211

Support levels (open interest**, contracts):

$1.1178 (1918)

$1.1149 (2854)

$1.1097 (2906)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 108686 contracts, with the maximum number of contracts with strike price $1,1500 (6196);

- Overall open interest on the PUT options with the expiration date March, 6 is 110797 contracts, with the maximum number of contracts with strike price $1,1100 (6077);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from February, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (1136)

$1.5601 (2647)

$1.5503 (2890)

Price at time of writing this review: $1.5432

Support levels (open interest**, contracts):

$1.5394 (1684)

$1.5297 (2133)

$1.5199 (1936)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 30246 contracts, with the maximum number of contracts with strike price $1,5500 (2890);

- Overall open interest on the PUT options with the expiration date March, 6 is 35884 contracts, with the maximum number of contracts with strike price $1,5300 (2133);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from February, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1197 -1,46%

GBP/USD $1,5404 -0,80%

USD/CHF Chf0,9525 +0,45%

USD/JPY Y119,41 +0,47%

EUR/JPY Y133,70 -0,97%

GBP/JPY Y183,95 -0,32%

AUD/USD $0,7795 -1,17%

NZD/USD $0,7532 -0,29%

USD/CAD C$1,2513 +0,63%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.