- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 30-05-2018.

| Pare | Closed | % change |

| EUR/USD | $1,1667 | +1,05% |

| GBP/USD | $1,3283 | +0,19% |

| USD/CHF | Chf0,98889 | -0,18% |

| USD/JPY | Y108,89 | +0,29% |

| EUR/JPY | Y127,04 | +1,34% |

| GBP/JPY | Y144,654 | +0,50% |

| AUD/USD | $0,7575 | +0,92% |

| NZD/USD | $0,6983 | +1,24% |

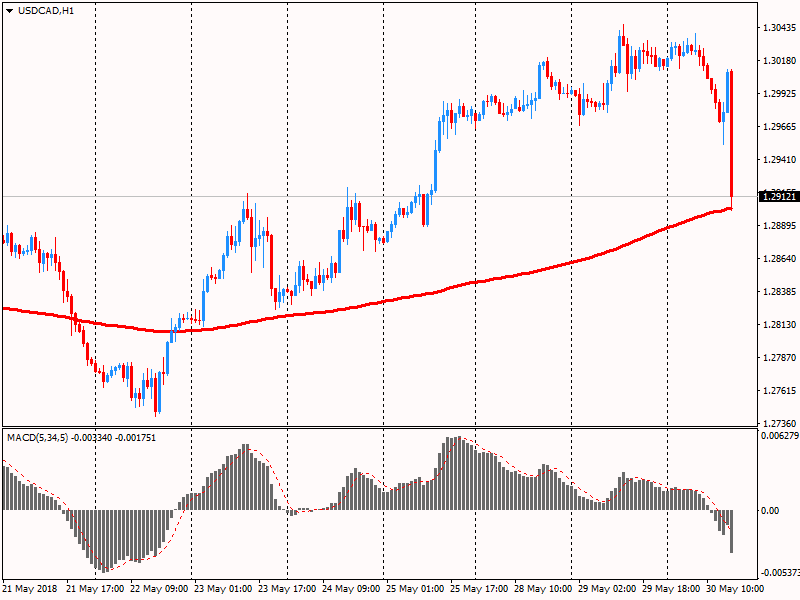

| USD/CAD | C$1,28765 | -1,07% |

| Time | Region | Event | Period | Previous | Forecast |

| 02:01 | United Kingdom | Gfk Consumer Confidence | May | -9 | -8 |

| 02:50 | Japan | Industrial Production (MoM) | April | 1.2% | 1.2% |

| 02:50 | Japan | Industrial Production (YoY) | April | 2.2% | 3.6% |

| 04:00 | China | Non-Manufacturing PMI | May | 54.8 | 54.8 |

| 04:00 | China | Manufacturing PMI | May | 51.4 | 51.3 |

| 04:00 | New Zealand | ANZ Business Confidence | May | -23.4 | |

| 04:30 | Australia | Private Sector Credit, m/m | April | 0.5% | 0.4% |

| 04:30 | Australia | Private Sector Credit, y/y | April | 5.1% | |

| 04:30 | Australia | Private Capital Expenditure | I quarter | -0.2% | 0.7% |

| 08:00 | Japan | Construction Orders, y/y | April | -4.0% | |

| 08:00 | Japan | Housing Starts, y/y | April | -8.3% | -8.9% |

| 08:45 | Switzerland | Gross Domestic Product (QoQ) | I quarter | 0.6% | 0.5% |

| 08:45 | Switzerland | Gross Domestic Product (YoY) | I quarter | 1.9% | 2.3% |

| 09:00 | United Kingdom | Nationwide house price index, y/y | May | 2.6% | 3% |

| 09:00 | United Kingdom | Nationwide, м/м | May | 0.2% | 0.2% |

| 09:45 | France | CPI, m/m | May | 0.2% | |

| 09:45 | France | CPI, y/y | May | 1.6% | |

| 10:15 | Switzerland | Retail Sales (MoM) | April | 0.1% | |

| 10:15 | Switzerland | Retail Sales Y/Y | April | -1.8% | -1.4% |

| 11:30 | United Kingdom | Net Lending to Individuals, bln | April | 4.2 | 5.2 |

| 11:30 | United Kingdom | Mortgage Approvals | April | 62.91 | 63 |

| 11:30 | United Kingdom | Consumer credit, mln | April | 0.254 | 1.30 |

| 12:00 | Eurozone | Harmonized CPI, Y/Y | May | 1.2% | 1.6% |

| 12:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | May | 0.7% | 1% |

| 12:00 | Eurozone | Unemployment Rate | April | 8.5% | 8.4% |

| 15:30 | Canada | GDP (m/m) | March | 0.4% | 0.2% |

| 15:30 | Canada | GDP (YoY) | I quarter | 1.7% | 1.8% |

| 15:30 | Canada | GDP QoQ | I quarter | 0.4% | |

| 15:30 | USA | Continuing Jobless Claims | May | 1741 | 1749 |

| 15:30 | USA | Initial Jobless Claims | May | 234 | 228 |

| 15:30 | USA | PCE price index ex food, energy, m/m | April | 0.2% | 0.1% |

| 15:30 | USA | PCE price index ex food, energy, Y/Y | April | 1.9% | 1.8% |

| 15:30 | USA | Personal spending | April | 0.4% | 0.4% |

| 15:30 | USA | Personal Income, m/m | April | 0.3% | 0.3% |

| 16:45 | USA | Chicago Purchasing Managers' Index | May | 57.6 | 58.0 |

| 17:00 | USA | Pending Home Sales (MoM) | April | 0.4% | 0.4% |

| 18:00 | USA | Crude Oil Inventories | May | 5.778 | 2.214 |

| 19:30 | USA | FOMC Member Bostic Speaks | | | |

| 20:00 | USA | FOMC Member Brainard Speaks | | |

-

Canada Q1 economic activity 'a little stronger' than projected

-

Core measures of inflation near 2%, reflect economy close to potential

-

Data suggest some upside to U.S. economic outlook

-

Trade policy uncertainty dampening global investment

-

Stresses developing in some emerging market economies

-

Will continue to assess economy's sensitivity to rate rises

-

Recent data supports BoC's outlook for 2% growth in H1

"The Bank of Canada today maintained its target for the overnight rate at 1¼ per cent. The Bank Rate is correspondingly 1½ per cent and the deposit rate is 1 per cent.

Global economic activity remains broadly on track with the Bank's April Monetary Policy Report (MPR) forecast. Recent data point to some upside to the outlook for the US economy. At the same time, ongoing uncertainty about trade policies is dampening global business investment and stresses are developing in some emerging market economies. Global oil prices have been higher than assumed in April, in part reflecting geopolitical developments.

Inflation in Canada has been close to the 2 per cent target and will likely be a bit higher in the near term than forecast in April, largely because of recent increases in gasoline prices. Core measures of inflation remain near 2 per cent, consistent with an economy operating close to potential. As usual, the Bank will look through the transitory impact of fluctuations in gasoline prices.

In Canada, economic data since the April MPR have, on balance, supported the Bank's outlook for growth around 2 per cent in the first half of 2018. Activity in the first quarter appears to have been a little stronger than projected. Exports of goods were more robust than forecast, and data on imports of machinery and equipment suggest continued recovery in investment. Housing resale activity has remained soft into the second quarter, as the housing market continues to adjust to new mortgage guidelines and higher borrowing rates. Going forward, solid labour income growth supports the expectation that housing activity will pick up and consumption will continue to contribute importantly to growth in 2018".

Canada's current account deficit (on a seasonally adjusted basis) rose by $3.0 billion in the first quarter to $19.5 billion. Higher deficits on trade in goods and investment income were the main contributors to this increase.

In the financial account (unadjusted for seasonal variation), foreign direct investment activity was the largest contributor to the inflow of funds in the economy in the quarter.

The deficit on international trade in goods and services increased by $1.2 billion to $15.2 billion in the first quarter, the largest deficit since the second quarter of 2016.

The goods deficit rose by $1.5 billion from the previous quarter to $9.0 billion. The goods surplus with the United States decreased by $2.7 billion on higher imports. Meanwhile, the deficit with non-US countries narrowed by $1.3 billion to $16.0 billion, mainly reflecting a higher surplus with United Kingdom and lower deficits with Korea and the Netherlands.

Real gross domestic product (GDP) increased at an annual rate of 2.2 percent in the first quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2017, real GDP increased 2.9 percent.

Real gross domestic income (GDI) increased 2.8 percent in the first quarter, compared with an increase of 1.0 percent (revised) in the fourth quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.5 percent in the first quarter, compared with an increase of 2.0 percent in the fourth quarter.

The increase in real GDP in the first quarter reflected positive contributions from nonresidential fixed investment, personal consumption expenditures (PCE), exports, private inventory investment, federal government spending, and state and local government spending that were partly offset by a negative contribution from residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

Private sector employment increased by 178,000 jobs from April to May according to the May ADP National Employment Report.

"The hot job market has cooled slightly as the labor market continues to tighten," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Healthcare and professional services remain a model of consistency and continue to serve as the main drivers of growth in the services sector and the broader labor market as well."

Mark Zandi, chief economist of Moody's Analytics, said, "Job growth is strong, but slowing, as businesses are unable to fill a record number of open positions. Wage growth is accelerating in response, most notably for young, new entrants and those changing jobs. Finding workers is increasingly becoming businesses number one problem."

The inflation rate in Germany as measured by the consumer price index is expected to be 2.2% in May 2018. The last time the inflation rate reached this level was in February 2017. A major reason for the increase in the inflation rate is the price development for liquid fuels (heating oil and motor fuels). Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.5% on April 2018.

In May 2018, the harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to increase by 2.2% year on year and 0.6% on April 2018.

The Bank of Canada is widely expected to keep the interest rate unchanged at 1.25% on Wednesday, but USD/CAD could still rise higher than 1.3125 in the future, according to Societe Generale. "The prevailing uncertainties surrounding NAFTA and the housing market are clouding the near-term outlook," but "the overnight index-swaps curve is pricing up to two rate increases this year," says the bank. USD/CAD is down 0.2% at 1.2988. "For EUR/CAD, key support below 1.50 lies at 1.4818," SocGen says. EUR/CAD is up by 0.4% at 1.5081. The BOC decision is due at 1400 GMT

"The dollar is likely to benefit from its safe-haven status as long as the repositioning in Italian/eurozone assets endures, says Societe Generale. Solid ADP data on U.S. private sector payrolls at 1215 GMT could add to this trend, potentially pushing the DXY dollar index to 96, it says. DXY is at 94.55, down 0.2%. There is no arguing over the safe-haven status of the U.S. dollar in today's troubled political waters. Solid U.S. ADP private sector employment data today...will only reinforce bullish dollar momentum. A WSJ poll forecasts a rise in ADP payrolls of 187,000. EUR/USD rises 0.6% to 1.1611 on Wednesday, in a correction after steep losses the previous day. Against the Japanese yen, the dollar is down 0.1% at 108.65."

-

Eurozone must complete banking, capital markets union

-

Fiscal stimulus supplants monetary policy, is 'new game in town'

-

Sees first quarter slowdown as blip, leaves most forecasts little changed

Germany's unemployment rate decreased in April, according to rttnews. The jobless rate dropped to adjusted 3.4 percent in April from 3.5 percent in March. In the same period of last year, the unemployment rate was 3.8 percent.

The number of unemployed decreased around 20,000 from the previous month to 1.47 million.

On an unadjusted basis, the jobless rate held steady at 3.5 percent in April.

The number of persons in employment rose by 138,000 or 0.3 percent on month due to the spring upturn. After seasonal adjustment, employment increased by 35,000 or 0.1 percent from March.

The estimated annual inflation of the CPI in May 2018 is 2.0%, according to the advance indicator prepared by the INE. This indicator provides an advance of the CPI which, if confirmed, would imply increase of nine tenths in its annual rate, since in the month of April this variation was of 1.1%. This behavior highlights the rise in the prices of fuels (diesel oil and gasoline), compared to the decrease experienced in 2017. It also influences the increase in electricity prices.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1720 (2754)

$1.1681 (728)

$1.1648 (1904)

Price at time of writing this review: $1.1571

Support levels (open interest**, contracts):

$1.1500 (4373)

$1.1477 (2774)

$1.1448 (6179)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 8 is 163394 contracts (according to data from May, 29) with the maximum number of contracts with strike price $1,1500 (6179);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3423 (530)

$1.3385 (130)

$1.3353 (222)

Price at time of writing this review: $1.3271

Support levels (open interest**, contracts):

$1.3223 (1683)

$1.3205 (1228)

$1.3182 (994)

Comments:

- Overall open interest on the CALL options with the expiration date June, 8 is 38831 contracts, with the maximum number of contracts with strike price $1,3600 (2292);

- Overall open interest on the PUT options with the expiration date June, 8 is 42512 contracts, with the maximum number of contracts with strike price $1,3400 (2300);

- The ratio of PUT/CALL was 1.09 versus 1.08 from the previous trading day according to data from May, 29.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

In April 2018, household expenditure on goods declined strongly (−1.5%) in volume. Energy consumption fell sharply, as did food purchases. On the contrary, expenses on textile-clothing were on the rise.

Energy consumption fell again (−5.4% after −0.9%). Heating expenses dropped significantly due to well above seasonal norm temperatures in April, after the cold months of February and March. On the other hand, consumption of refined products was virtually stable (+0.1%): spending on diesel fuel declined while spending on gasoline increased.

In Q1 2018, GDP in volume terms decelerated: +0.2% after +0.7% in Q4 2017. Household consumption expenditures rose at a slower pace as in Q4 2017 (+0,1% after +0.2%). Total gross fixed capital formation (GFCF: +0.2% after +0.9%) significantly slowed down. Overall, final domestic demand excluding inventory changes slowed down and contributed less to GDP growth: +0.2 points after +0.4 points.

Exports slightly fell back (−0.3% after +2.3%) as well as imports (−0.3% after +0.1%). All in all, foreign trade balance didn't contribute to GDP growth in Q1. Similarly, changes in inventories were stable and therefore did not contribute to GDP growth

"If some countries want now to have an extensive amount of constraint and limitation on how we exercise our monetary policy powers, this will be an attack on the independence of the central bank," he told the audience.

Japan's retail sales increased at a faster-than-expected pace in April, according to rttnews.

Retail sales climbed 1.6 percent year-over-year in April, faster than the 1.0 percent rise in March. Meanwhile, sales were expected to increase the same by 1.0 percent.

It was the sixth successive monthly rise.

Month-on-month, retail sales advanced a seasonally adjusted 1.4 percent in April, exceeding economists' forecast for an increase of 0.5 percent.

As reported by the Federal Statistical Office (Destatis), the index of import prices increased by 0.6% in April 2018 compared with the corresponding month of the preceding year. In March and in February 2018 the annual rates of change were -0.1% and -0.6%, respectively. From March 2018 to April 2018 the index also increased by 0.6%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 0.7% compared with the level of a year earlier.

The index of export prices increased by 0.7% in April 2018 compared with the corresponding month of the preceding year. In March and in February 2018 the annual rates of change were +0.7% and +0.5%, respectively. From March 2018 to April 2018 the export price index rose by 0.2%.

According to provisional data turnover in retail trade in April 2018 was in real terms 1.2% and in nominal terms 2.8% larger than in April 2017. The number of days open for sale was 24 in April 2018 and 23 in April 2017.

Compared with the previous year, turnover in retail trade was in the first four months of 2018 in real terms 1.7% and in nominal terms 3.1% larger than in the corresponding period of the previous year.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.