- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-06-2016

(raw materials / closing price /% change)

Oil 49.71 +0.04%

Gold 1,247.70 +0.02%

(index / closing price / change items /% change)

Nikkei 225 16,580.03 -62.20 -0.37 %

Hang Seng 21,030.22 +82.98 +0.40 %

S&P/ASX 200 5,360.42 +41.53 +0.78 %

Shanghai Composite 2,934.29 -4.40 -0.15 %

FTSE 100 6,273.4 +63.77 +1.03 %

CAC 40 4,423.38 +1.60 +0.04 %

Xetra DAX 10,121.08 +17.82 +0.18 %

S&P 500 2,109.41 +10.28 +0.49 %

NASDAQ Composite 4,968.71 +26.20 +0.53 %

Dow Jones 17,920.33 +113.27 +0.64 %

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1356 -0,09%

GBP/USD $1,4454 -0,41%

USD/CHF Chf0,9705 -0,53%

USD/JPY Y107,53 +0,94%

EUR/JPY Y122,12 +0,85%

GBP/JPY Y155,41 +0,51%

AUD/USD $0,7363 -0,03%

NZD/USD $0,6913 -0,59%

USD/CAD C$1,2823 -0,90%

(time / country / index / period / previous value / forecast)

04:30 Australia Announcement of the RBA decision on the discount rate 1.75% 1.75%

04:30 Australia RBA Rate Statement

05:00 Japan Leading Economic Index (Preliminary) April 93.3

05:00 Japan Coincident Index (Preliminary) April 111.1

06:00 Germany Industrial Production s.a. (MoM) April -1.3% 0.6%

06:45 France Trade Balance, bln April -4.37

07:30 United Kingdom Halifax house price index May -0.8% 0.3%

07:30 United Kingdom Halifax house price index 3m Y/Y May 9.2% 8.9%

12:30 U.S. Unit Labor Costs, q/q (Finally) Quarter I 2.7% 4%

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter I -1.7% -0.6%

14:00 Canada Ivey Purchasing Managers Index May 53.1

19:00 U.S. Consumer Credit April 29.67 18

23:50 Japan Current Account, bln April 2980 2318.9

23:50 Japan GDP, q/q (Finally) Quarter I -0.4% 0.5%

23:50 Japan GDP, y/y (Finally) Quarter I -1.7% 1.9%

The British pound rose significantly against the dollar, recovering almost all the previously lost positions today, which was due to the widespread weakening of the US currency and profit-taking after a sharp decline due to the results of a survey on the subject of the referendum.

Residents of the UK at the moment tend to need the country's exit from the European Union, according to the survey, which published today in the European media. Thus, 45% of respondents in favor of the UK out of the EU, while 41% opposed this step. Other respondents have not yet decided on the choice. The survey, conducted by the YouGov Institute, was attended by about 3.5 thousand. Man. At the same time, according to TNS online survey, 43% of respondents would vote for the exit from the EU, while 41% would vote for it to stay. 11% of respondents were undecided. 1213 people were interviewed. The referendum on Britain's membership of the EU was appointed on June 23.

Later this week, the focus will be on industrial production statistics and foreign trade, which is likely to point to the weakness of the British economy. Manufacturing probably felt the most strongly negative impact from the global challenges for the manufacturing sector and uncertainty about the outcome of the referendum on EU membership. Meanwhile, the trade deficit is likely to increase slightly. The reason for this is the weak support from external demand, the deterioration of the situation in the manufacturing sector and a referendum on Britain's membership of the EU.

The US dollar was down against the euro, approaching to the lowest level since May 12th. The main pressure on the currency had a statement of Fed Yellen. She noted that the outlook for the US economy is very uncertain. "Published on Friday employment data were disappointing, causing fear, but it is important not to attach special importance to only one employment report The overall situation in the labor market is quite positive should closely monitor for signs of a slowdown in the number of jobs..", - Added the head of the Fed . Moreover, Yellen said that the course of monetary policy is not determined, given the uncertainty about the future. "If the situation in the labor market improves, inflation close to the target level, it would be appropriate to raise rates gradually. If inflation remains low, the Fed can only take limited measures to stimulate in the background of almost zero interest rates. Now the soft monetary policy remains appropriate" - he explained Yellen.

Atlanta Fed President Dennis Lockhart said in an interview with Bloomberg Television on Monday that the Fed should wait until July before raising its interest rates further, noting that the U.S. weak labour market data for May and the referendum on Britain's membership in the European Union may weigh on the interest rate decision in June.

Atlanta Fed president also said that he expected two interest rate hikes this year.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

Boston Fed President Eric Rosengren said on Monday that the Fed should raise its interest rate further as the U.S. economy rebounded from the weak first quarter.

"Economic conditions will continue to gradually improve, which in turn would justify further actions to normalize policy, continuing a gradual return to a more normal interest rate environment," he said.

"I expect that the U.S. central bank will gradually normalize monetary policy as the three conditions set out in the April FOMC minutes are met," Boston Fed president added.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

Stock closed higher, supported by a rise in oil prices and mining shares. Commodities were driven by a weaker U.S. dollar, which dropped on Friday's weak U.S. labour market data.

Market participants are awaiting a speech by the Fed Chairwoman Janet Yellen later in the day. They will monitor her speech for hints for further monetary policy steps.

Market participants also eyed the economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 9.9 in June from 6.2 in May, exceeding expectations for an increase to 7.1. It was the highest level since December 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Investors' perception brightens with regards to both current situation and expectation values," Sentix said in its statement.

The current conditions index was up to 9.8 in June from 7.0 in May. The expectations index climbed to 10.0 in June from 5.5 in May.

German investor confidence index rose to 20.7 in June from 18.3 in May.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders fell 0.2% in April, beating expectations for a 0.5% decrease, after a 2.6% rise in March. March's figure was revised up from a 1.9% increase.

The decline was driven by a drop in foreign orders. Foreign orders dropped by 4.3% in April, while domestic orders rose by 1.3%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,273.4 +63.77 +1.03 %

DAX 10,121.08 +17.82 +0.18 %

CAC 40 4,423.38 +1.60 +0.04 %

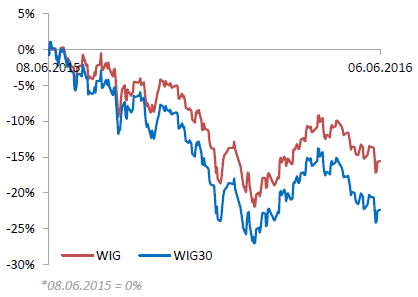

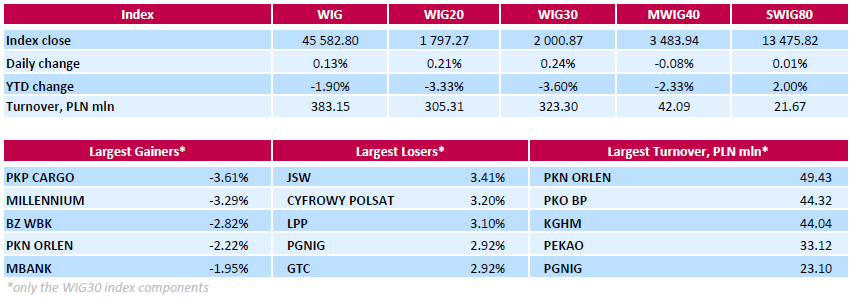

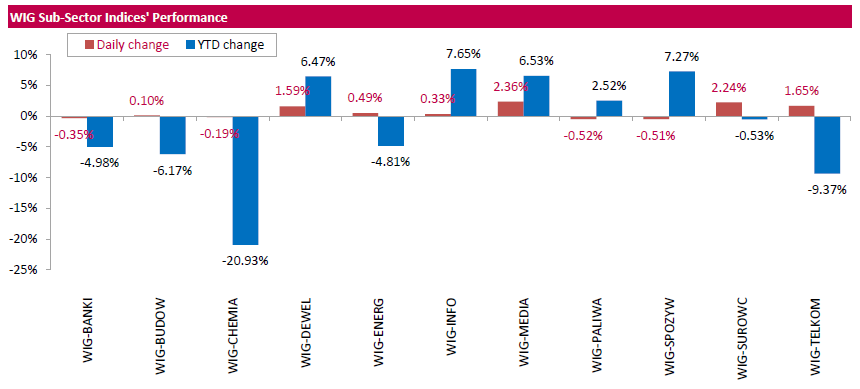

Polish equities closed higher on Monday, with the broad-market measure, the WIG index, edging up 0.13%. From a sector perspective, media (+2.36%) recorded the biggest gains, while oil and gas sector (-0.52%) lagged behind.

The large-cap stocks' measure, the WIG30 Index rose by 0.24%. Within the index components, coking coal miner JSW (WSE: JSW) and media group CYFROWY POLSAT (WSE: CPS) topped the list of advancers, climbing by 3.41% and 3.2% respectively. They were followed by clothing retailer LPP (WSE: LPP), oil and gas producer PGNIG (WSE: PGN) and property developer GTC (WSE: GTC), adding 3.1%, 2.92% and 2.92% respectively. On the contrary, railway freight transport operator PKP CARGO (WSE: PKP) was the worst performer, dropping by 3.61%. Oil refiner PKN ORLEN (WSE: PKN) and three banking sector names MILLENNIUM (WSE: MIL), BZ WBK (WSE: BZW) and MBANK (WSE: MBK) also posted notable declines, losing between 1.95% and 3.29%.

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index declined to 126.81 in May from 128.53 in April. April's figure was revised up from 128.30.

Six of eight components decreased in May.

"The Employment Trends Index decreased in May. Its continued weakness suggests that job growth will remain modest in the coming months. Despite softening in the ETI, its recent decline is not nearly as large as those that have preceded past employment contractions," Chief Economist, North America, at The Conference Board, Gad Levanon, said.

Major U.S. stock-indexes rose on Monday morning, buoyed by energy stocks and a rebound in financial stocks following a pounding on Friday after a dismal jobs report all but ruled out chances of an interest rate hike in June.

Almost all of Dow stocks in positive area (28 of 30). Top looser - The Home Depot, Inc. (HD, -2,10%). Top gainer - The Boeing Company (BA, +1,86%).

All of S&P sectors also in positive area. Top looser - Basic Materials (+1,8%).

At the moment:

Dow 17909.00 +109.00 +0.61%

S&P 500 2107.50 +9.75 +0.46%

Nasdaq 100 4526.00 +17.00 +0.38%

Oil 49.69 +1.07 +2.20%

Gold 1249.20 +6.30 +0.51%

U.S. 10yr 1.74 +0.3

Oil prices rose modestly, climbing above $ 50, aided by the decline of the dollar and fears of oil supply disruptions in Nigeria. A further price growth is limited to the US data on oil production, which indicate the production recovery.

The dollar continues to fall in price today, continuing Friday's dynamics, which is associated with the publication of an extremely weak US labor market data. These findings have significantly reduced market expectations regarding the Fed's base rate increase of participants at the next meeting. Now, investors' attention is directed to the speech of the Fed's Yellen. She previously stated about the possibility of raising interest rates in the near future.

With regard to the situation in Nigeria, concerns about supply disruptions worsened after local rebels took responsibility for three successive attacks on oil infrastructure in Nigeria this weekend, promising to completely stop production.

According to experts, in recent weeks, supply disruptions from Nigeria and Canada have reduced the supply of oil on the market for more than 3 million barrels per day.

On the dynamics of trading also continues to influence Friday's report from the American company Baker Hughes, which showed that on the basis of which ended June 3 workweek in the United States the number of drilling rigs has increased by 4 points, or 0.9%, and amounted to 408 units. In annual terms, a decline of 460 units or 52.9%. The amount of oil rigs week increased by 9 units, or 2.8%, up to 325 pieces.

WTI for delivery in July rose to $49.62 a barrel. Brent for July rose to $50.54 a barrel.

The Bank of Italy downgraded its economic growth forecasts on Monday. Italy's economy is expected to expand 1.1% this year, down from the previous forecast of a 1.5% growth, 1.2% in 2017, down from the previous estimate of 1.4%, and 1.2% in 2018.

Inflation is expected to be flat this year, 0.9% in 2017 and 1.5% in 2018.

The European Central Bank (ECB) purchased €17.59 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €973 million of covered bonds, and €66 million of asset-backed securities.

In May as whole, the central bank purchased €79.67 billion of government and agency bonds, €5.56 billion of covered bonds, and €17 million of asset-backed securities

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Monday. Eurozone's construction purchasing managers' index (PMI) rose to 50.6 in May from 47.9 in April.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in Italy declined in May, while sales in Germany and France rose.

"The Eurozone Retail PMI moved into growth territory amid increases in sales across both Germany and France, although it was only the former where conditions improved more generally," an economist at Markit, Phil Smith, said.

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Monday. Germany's retail PMI climbed to 54.0 in May from 51.0 in April.

The increase was driven by a rise in purchasing activity.

"Not only did the Retail PMI rise to one of its highest levels for a year, but companies also reported to have exceeded their sales targets for a second month running," an economist at Markit, Oliver Kolodseike, said.

On the threshold of the final hour of the Monday session the Warsaw market seems to fit in well known from the past diagram. After strong exchanges between supply and demand in previous sessions the market started the new week with calm and stability. As a result, a bit more than an hour before the end of trading the turnover on the WIG20 index does not extend PLN 250 mln, and the change in the average amounts is barely about 0.15 percent. Our concerns are: the poor response of the Warsaw Stock Exchange on the strengthening of the zloty and price increases in other emerging markets, which indicate that the positive climate to this segment - associated with the receding prospect of interest rate hikes in the United States - remains valid.

USD/JPY 107.00 (USD 293m) 108.00 (434m) 108.70 (466m) 109.00 (1.07bln) 109.90-110.00 (563m) 110.50 (591m)

EUR/USD: 1.1000 (EUR 500m) 1.1100 (1.05bln) 1.1150 (398m) 1.1175 (318m) 1.1200 (1.03bln) 1.1250 (705m) 1.1300 (883m)

GBP/USD 1.4300 (GBP 190m) 1.4400 (287m) 1.4425 (250m) 1.4450 (181m)

AUD/USD 0.7100 (AUD 570m) 0.7170-75 (586m) 0.7200 (500m) 0.7250-55 (422m)

USD/CAD 1.2500 (USD 640m) 1.2800-10 (845m) 1.2850 (330m) 1.2900 (755m) 1.3000 (975m) 1.3050 (600m) 1.3100 (300m)

NZD/USD 0.6600 (NZD 394m)

AUD/NZD 1.0750 (AUD 350m)

Markit Economics released construction purchasing managers' index (PMI) for Germany on Monday. Germany's construction PMI decreased to 52.7 in May from 53.4 in April.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by a softer growth in output and new orders.

"The upturn in Germany's building sector lost further momentum in May, with companies reporting the weakest expansion of construction activity for half a year," an economist at Markit, Oliver Kolodseike, said.

U.S. stock-index futures edged higher.

Global Stocks:

Nikkei 16,580.03 -62.20 -0.37%

Hang Seng 21,030.22 +82.98 +0.40%

Shanghai Composite 2,934.29 -4.40 -0.15%

FTSE 6,276.1 +66.47 +1.07%

CAC 4,430.5 +8.72 +0.20%

DAX 10,131.72 +28.46 +0.28%

Crude $49.68 (+2.18%)

Gold $1245.90 (+0.24%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 168.86 | 0.48(0.2851%) | 100 |

| ALCOA INC. | AA | 9.6 | 0.08(0.8403%) | 43052 |

| ALTRIA GROUP INC. | MO | 65.48 | 0.18(0.2757%) | 780 |

| Amazon.com Inc., NASDAQ | AMZN | 728.15 | 2.61(0.3597%) | 9674 |

| Apple Inc. | AAPL | 97.83 | -0.09(-0.0919%) | 47784 |

| AT&T Inc | T | 39.24 | 0.03(0.0765%) | 4020 |

| Barrick Gold Corporation, NYSE | ABX | 19 | -0.18(-0.9385%) | 128914 |

| Cisco Systems Inc | CSCO | 29.18 | 0.05(0.1716%) | 3940 |

| Citigroup Inc., NYSE | C | 45.43 | 0.04(0.0881%) | 26306 |

| Facebook, Inc. | FB | 118.74 | 0.27(0.2279%) | 7134 |

| FedEx Corporation, NYSE | FDX | 163.7 | -0.12(-0.0733%) | 373 |

| Ford Motor Co. | F | 13.1 | 0.06(0.4601%) | 13060 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.35 | 0.24(2.1602%) | 301659 |

| General Electric Co | GE | 30.04 | 0.10(0.334%) | 3700 |

| General Motors Company, NYSE | GM | 29.65 | 0.05(0.1689%) | 267 |

| Goldman Sachs | GS | 156.1 | 0.43(0.2762%) | 1600 |

| Google Inc. | GOOG | 724.6 | 2.26(0.3129%) | 3192 |

| Home Depot Inc | HD | 131.25 | -0.49(-0.3719%) | 3966 |

| Intel Corp | INTC | 31.66 | 0.04(0.1265%) | 4725 |

| JPMorgan Chase and Co | JPM | 64.8 | 0.16(0.2475%) | 36512 |

| Merck & Co Inc | MRK | 56.9 | 0.26(0.459%) | 2465 |

| Microsoft Corp | MSFT | 51.84 | 0.05(0.0965%) | 13146 |

| Nike | NKE | 53.83 | 0.38(0.7109%) | 3193 |

| Pfizer Inc | PFE | 34.76 | 0.07(0.2018%) | 1371 |

| Procter & Gamble Co | PG | 82.5 | 0.03(0.0364%) | 2085 |

| Starbucks Corporation, NASDAQ | SBUX | 54.82 | 0.21(0.3845%) | 3722 |

| Tesla Motors, Inc., NASDAQ | TSLA | 219.5 | 0.51(0.2329%) | 3991 |

| Twitter, Inc., NYSE | TWTR | 15.35 | 0.15(0.9868%) | 6505 |

| Visa | V | 80.1 | 0.16(0.2001%) | 413 |

| Wal-Mart Stores Inc | WMT | 71.61 | 0.74(1.0442%) | 15232 |

| Walt Disney Co | DIS | 98.75 | 0.00(0.00%) | 622 |

| Yahoo! Inc., NASDAQ | YHOO | 36.77 | 0.17(0.4645%) | 350 |

| Yandex N.V., NASDAQ | YNDX | 21.57 | 0.68(3.2551%) | 14614 |

Upgrades:

Wal-Mart (WMT) upgraded to Buy from Hold at Jefferies; target raised to $82 from $60

Downgrades:

Other:

Visa (V) resumed with a Overweight at JP Morgan; target $88

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia MI Inflation Gauge, m/m 0.1% -0.2%

01:30 Australia ANZ Job Advertisements (MoM) May -0.6% Revised From -0.8% 2.4%

06:00 Germany Factory Orders s.a. (MoM) April 1.9% -0.5% -0,2%

08:30 Eurozone Sentix Investor Confidence June 6.2 7.1 9.9

The U.S. dollar traded mixed to lower against the most major currencies ahead of a speech by the Fed Chairwoman Janet Yellen. Market participants will monitor her speech for hints for further monetary policy steps.

Market participants continued to eye Friday's U.S. labour market data. The U.S. economy added 38,000 jobs in May, missing expectations for a rise of 164,000 jobs, after a gain of 123,000 jobs in April. It was the smallest rise since September 2010. April's figure was revised down from a rise of 160,000 jobs.

The U.S. unemployment rate dropped to 4.7% in May from 5.0% in April, beating expectations for a fall to 4.9%. It was the lowest level since November 2007. The decline was driven by a fact that people dropped out of the labour force.

The euro traded mixed against the U.S. dollar after the release of the better-than-expected economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 9.9 in June from 6.2 in May, exceeding expectations for an increase to 7.1. It was the highest level since December 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Investors' perception brightens with regards to both current situation and expectation values," Sentix said in its statement.

The current conditions index was up to 9.8 in June from 7.0 in May. The expectations index climbed to 10.0 in June from 5.5 in May.

German investor confidence index rose to 20.7 in June from 18.3 in May.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders fell 0.2% in April, beating expectations for a 0.5% decrease, after a 2.6% rise in March. March's figure was revised up from a 1.9% increase.

The decline was driven by a drop in foreign orders. Foreign orders dropped by 4.3% in April, while domestic orders rose by 1.3%.

The British pound traded mixed against the U.S. dollar in the absence of any major economic data from the U.K.

According to a YouGov poll for ITV on Monday, 45% of Britons support Britain's exit from the EU, while 41% would vote for "Remain". YouGov surveyed 3,405 people.

According to a TNS online poll, 43% of respondents would vote for "Leave", while 41% would vote for "Remain". 11% of respondents were undecided. 1,213 people were surveyed.

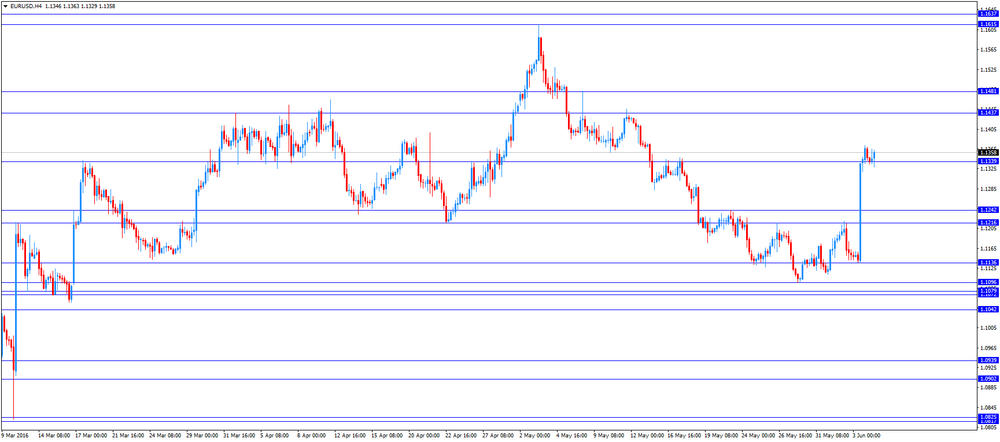

EUR/USD: the currency pair traded mixed

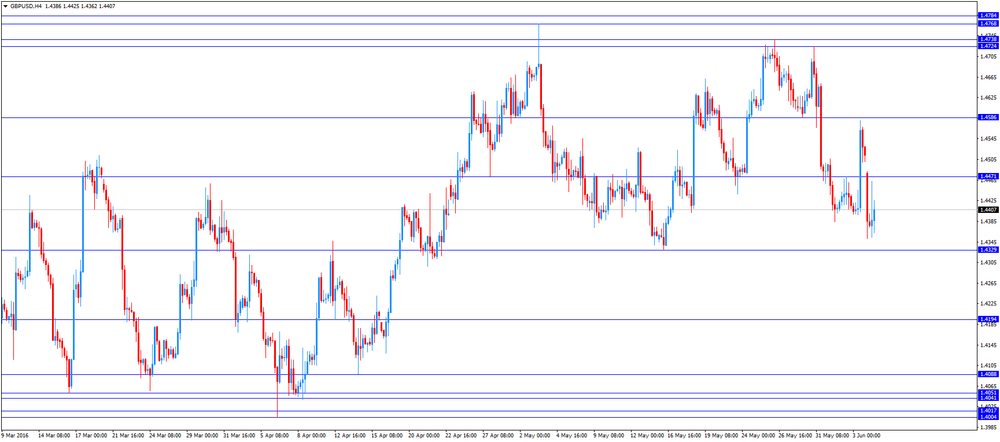

GBP/USD: the currency pair traded mixed

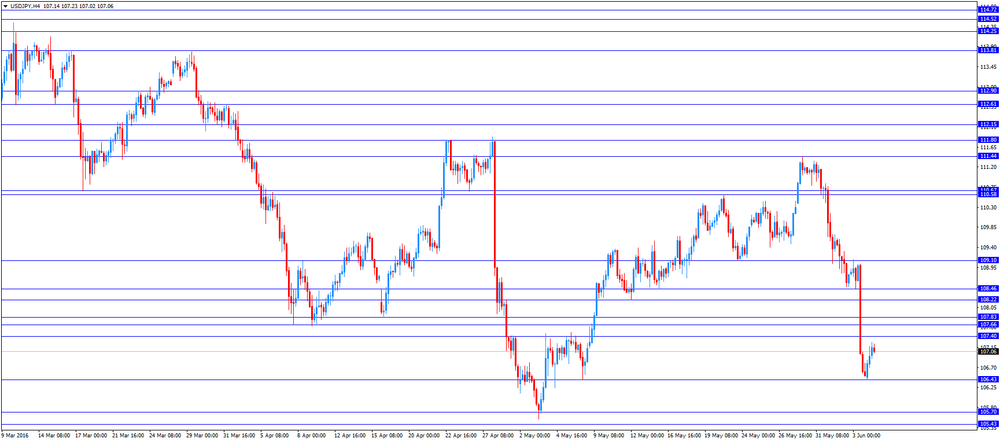

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Labor Market Conditions Index May -0.9

16:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Australia AiG Performance of Construction Index May 50.8

EUR/USD

Offers : 1.1365 1.1380 1.1400 1.1420 1.1450 1.1465 1.1480 1.1500

Bids: 1.1330 1.1300 1.1285 1.1265 1.1250 1.1220 1.1200 1.1175 1.1150 1.1130 1.1100-10

GBP/USD

Offers : 1.4430 1.4450 1.4480 1.4500 1.4530 1.4550 1.4575-80 1.4600 1.4625-30 1.4650

Bids: 1.4400 1.4380 1.4365 1.4350 14330 1.4300-10 1.4280 1.4250 1.4200

EUR/GBP

Offers : 0.7900-10 0.7925-30 0.7950 0.7980 0.8000

Bids: 0.7865 0.7850 0.7830 0.7800 0.7760 0.7720 0.7700

EUR/JPY

Offers : 121.60 122.00 122.30 122.60 122.80 123.00 123.30 123.50 123.80 124.00

Bids: 121.00 120.80 120.50 120.00 119.00

USD/JPY

Offers : 107.20 107.50 107.80 108.00 108.30 108.50 108.85 109.00 109.20 109.50-60

Bids: 106.85 106.70 106.50 106.25-30 106.00-06 105.75 105.50 105.00

AUD/USD

Offers : 0.7350 0.7365 0.7385 0.7400 0.7430 0.7450

Bids: 0.7320 0.7300 0.7285 0.7365 0.7250 0.7225 0.7200

The first half of the session was unsuccessful output of the WIG20 above the level of 1,800 points. Low turnover indicates that the market suffers from a lack of activity and new ideas for the game. Therefore now appears a dangerous moment. Rebound of Wednesday's drop on Friday and return to the area of 1800-1789 points lead the market to the point at which on Wednesday began the panic associated with overcoming of supports levels and which led to test 1,750 points.

In the mid-session, the WIG20 index was at 1,784 points level and the counter of turnover on the WIG20 showed less than PLN 170 mln. Being over the 1,800 points did not arouse a great capital. In practice, this means that investors have to wait for a new impulse, which does not want to be delivered today from Europe and the US, where changes are modest and indicate that also the major stock exchanges continue waiting for new impetus.

Stock indices traded higher, supported by a rise in oil prices and mining shares. Commodities were driven by a weaker U.S. dollar, which dropped on Friday's weak U.S. labour market data.

Market participants also eyed the economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 9.9 in June from 6.2 in May, exceeding expectations for an increase to 7.1. It was the highest level since December 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Investors' perception brightens with regards to both current situation and expectation values," Sentix said in its statement.

The current conditions index was up to 9.8 in June from 7.0 in May. The expectations index climbed to 10.0 in June from 5.5 in May.

German investor confidence index rose to 20.7 in June from 18.3 in May.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders fell 0.2% in April, beating expectations for a 0.5% decrease, after a 2.6% rise in March. March's figure was revised up from a 1.9% increase.

The decline was driven by a drop in foreign orders. Foreign orders dropped by 4.3% in April, while domestic orders rose by 1.3%.

Current figures:

Name Price Change Change %

FTSE 100 6,266.72 +57.09 +0.92 %

DAX 10,132.32 +29.06 +0.29 %

CAC 40 4,426.03 +4.25 +0.10 %

According to a TNS online poll, 43% of respondents would vote for "Leave", while 41% would vote for "Remain". 11% of respondents were undecided.

1,213 people were surveyed.

According to a YouGov poll for ITV on Monday, 45% of Britons support Britain's exit from the EU, while 41% would vote for "Remain".

YouGov surveyed 3,405 people.

The Melbourne Institute (MI) released its monthly inflation data for Australia on Monday. MI Inflation gauge for Australia declined 0.2% in May, after a 0.1% rise in April.

On a yearly basis, inflation gauge climbed 1.0% in May, after a 1.5% increase in April.

Prices for fruit and vegetables slid 4.1% in May, nondurable household products prices declined 2.2%, while prices for holiday travel and accommodation fell 1.0%.

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements climbed 2.4% in May, after a 0.6% fall in April. April's figure was revised up from a 0.8% drop.

The increase was mainly driven by a rise in internet job advertisements, which rose by 2.6% in May.

"After six months of broadly flat job ads, the strong rise in ads in May is encouraging. Despite some ongoing headwinds, the economy is tracking along quite well and the transition to nonmining activity is occurring," the ANZ Head of Australian Economics Felicity Emmett noted.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders fell 0.2% in April, beating expectations for a 0.5% decrease, after a 2.6% rise in March. March's figure was revised up from a 1.9% increase.

The decline was driven by a drop in foreign orders. Foreign orders dropped by 4.3% in April, while domestic orders rose by 1.3%.

New orders from the Eurozone rose 2.5% in April, while orders from other countries slid 8.3%.

Orders of the intermediate goods increased by 4.8% in April, capital goods orders were down 6.1%, while consumer goods orders fell 1.0%.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 9.9 in June from 6.2 in May, exceeding expectations for an increase to 7.1. It was the highest level since December 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Investors' perception brightens with regards to both current situation and expectation values," Sentix said in its statement.

The current conditions index was up to 9.8 in June from 7.0 in May.

The expectations index climbed to 10.0 in June from 5.5 in May.

German investor confidence index rose to 20.7 in June from 18.3 in May.

Fed Governor Lael Brainard said on Friday that the Fed should wait until the U.S. economy strengthens before raising its interest rates further, adding that the interest rate decision was data dependent.

"Recognizing the data we have on hand for the second quarter is quite mixed and still limited, and there is important near-term uncertainty, there would appear to be an advantage to waiting until developments provide greater confidence," she said.

Brainard noted that the U.S. labour market slowed, while there were risks to the outlook from the slowdown in emerging economies and the referendum on Britain's membership in the European Union.

Brainard is a voting member of the Federal Open Market Committee.

U.S. Treasury Secretary Jack Lew said in an interview with Reuters on Friday that there would be "very bad consequences" for China's economy if the country does not open its markets and rebalance its economy.

Frankly, if China takes a time-out or a step back on the reform agenda, that will have very bad consequences for China's economy and it will flow over and not be good in terms of our bilateral economic relations," he said.

USD/JPY 107.00 (USD 293m) 108.00 (434m) 108.70 (466m) 109.00 (1.07bln) 109.90-110.00 (563m) 110.50 (591m)

EUR/USD: 1.1000 (EUR 500m) 1.1100 (1.05bln) 1.1150 (398m) 1.1175 (318m) 1.1200 (1.03bln) 1.1250 (705m) 1.1300 (883m)

GBP/USD 1.4300 (GBP 190m) 1.4400 (287m) 1.4425 (250m) 1.4450 (181m)

AUD/USD 0.7100 (AUD 570m) 0.7170-75 (586m) 0.7200 (500m) 0.7250-55 (422m)

USD/CAD 1.2500 (USD 640m) 1.2800-10 (845m) 1.2850 (330m) 1.2900 (755m) 1.3000 (975m) 1.3050 (600m) 1.3100 (300m)

NZD/USD 0.6600 (NZD 394m)

AUD/NZD 1.0750 (AUD 350m)

Saudi Arabia on Sunday lowered the prices it charges for crude oil in Europe. Saudi Arabian Oil Co., the country's state-owned oil company, said that it cut its light crude by $0.35 a barrel to Northwest Europe and by $0.10 a barrel in the Mediterranean for July delivery.

Saudi Arabia tries to defend its market share as Iran was raising its oil exports after the lift-off of the sanctions.

Saudi Arabia raised its light-crude prices by $0.35 a barrel to the Far East and by $0.10 a barrel to the U.S.

The oil driller Baker Hughes reported on Friday that the number of active U.S. oil rigs rose by 9 to 325 last week.

The number of gas rigs declined by 5 to 82.

Combined oil and gas rigs increased by 4 to 408.

WIG20 index opened at 1797.23 points (+0.21%)*

WIG 45741.08 0.48%

WIG30 2007.63 0.58%

mWIG40 3495.08 0.24%

*/ - change to previous close

After a great Friday's session the Warsaw market in the first few minutes of trade coming back already above 1,800 points. However the turnover in the initial phase is quite low and do not exceed the rate of a million zlotys per minute in the WIG20. The largest part focuses on the KGHM shares, in terms of both, turnover and the scale of growth (+ 2.3%).

The end of Friday's trading on Wall Street did not bring surprises. As a result, the S&P500 has not changed the image of the day and does not deny the first reactions to the increase in the number of jobs outside agriculture in the US. The Tokyo Stock Exchange reacted standardly and overestimated the shares in response to the appreciation of the yen. The Chinese market, which is a part of the emerging markets, is growing and uses the receding prospect of rapid interest rate hikes in the US. The contract on the S&P500 recorded merely a cosmetic change compare to Friday's closing. Similarly, a contract for the DAX do not recorded a major change before opening of the new week. Thus, the image of the mood at the beginning of the new week can be described as a stable one.

In the macro calendar there is nothing particularly exciting. Another important event for the markets will be held in the middle of next week the meeting of the Federal Open Market Committee. The most important events of the next several hours will be today's speech by Janet Yellen, which should appear first assessment of Friday's report from the labor market. Yellen will begin his speech after the close of today's trading in Europe.

Friday shows the force of the bull side on market in Warsaw and has built a base for walking by the WIG20 over 1,800 points. But we need to keep in mind that two strong sessions on Thursday and Friday did not cover the weekly losses of the WIG20, which amounted to 2.5 percent, and confirmed the superiority of supply side. The new week will test the credibility of reflection, in order to assess whether Friday was just a rebound of Wednesday's panic, or the beginning of a new, short-term, upward trend.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1496 (1578)

$1.1462 (1971)

$1.1436 (727)

Price at time of writing this review: $1.1342

Support levels (open interest**, contracts):

$1.1293 (1306)

$1.1240 (1285)

$1.1175 (1086)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 27577 contracts, with the maximum number of contracts with strike price $1,1500 (4368);

- Overall open interest on the PUT options with the expiration date July, 8 is 42041 contracts, with the maximum number of contracts with strike price $1,1000 (5317);

- The ratio of PUT/CALL was 1.52 versus 1.15 from the previous trading day according to data from June, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.4631 (455)

$1.4537 (678)

$1.4444 (365)

Price at time of writing this review: $1.4389

Support levels (open interest**, contracts):

$1.4272 (250)

$1.4175 (424)

$1.4078 (779)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 13655 contracts, with the maximum number of contracts with strike price $1,5500 (1492);

- Overall open interest on the PUT options with the expiration date July, 8 is 20977 contracts, with the maximum number of contracts with strike price $1,3500 (1640);

- The ratio of PUT/CALL was 1.54 versus 1.06 from the previous trading day according to data from June, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

European stocks swung lower Friday, locking in a weekly loss, as a much weaker-than-anticipated U.S. jobs report stoked worries about global growth.

U.S. stocks pared earlier losses to close modestly lower Friday as investors weighed implications of a dismal jobs report on the Federal Reserve monetary policy decision in two weeks.

The U.S. economy created just 38,000 jobs last month, the weakest level of hiring in nearly six years.

Also, a pair of surveys released Friday show the services side of the U.S. economy slowed in May. The weak jobs report coupled with other data, pointing to relative weakness in the economy, likely squelches prospects for a rate increase by the Federal Reserve later this month, according to analysts.

Asian shares rose on Monday and the dollar wallowed close to its lowest in nearly a month after U.S. nonfarm payrolls showed the slowest job growth in more than five years, quashing expectations for a near-term U.S. interest rate hike.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.4 percent in early trade. Wall Street ended down on Friday, though off session lows, with the S&P 500 .SPX finishing within just 1.5 percent of its record closing high.

Japan's Nikkei stock index .N225 slipped 1.6 percent, after the dollar skidded 2 percent against the yen on Friday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.