- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-08-2014

Stock indices traded lower. U.S. President Barack Obama has authorised airstrikes against militants in Iraq. Losses were trimmed as news reported that Russia could de-escalate the Ukraine conflict.

Germany's trade surplus decreased to €16.2 billion in June from €18.8 billion in May. Analysts had expected the trade surplus to increase to €19.8 billion.

French industrial production climbed 1.3% in June, beating forecasts of a 1.1% rise, after a 1.6% fall in May. May's figure was revised up from a 2.3% decline.

Britain's trade deficit rose to £9.41 billion in June from £9.15 billion in May. May's figure was revised up from a deficit of £9.20 billion. Analysts had expected the deficit to decline to £8.90 billion in June.

Banca Monte dei Paschi di Siena SpA shares dropped 8.1% after reporting the weaker-than-expected net loss in the second quarter.

Nokian Renkaat Oyj shares plunged 6.1% after missing second-quarter earnings forecast. The company's sales in Russia plunged 31% in the first half of 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,567.36 -30.01 -0.45%

DAX 9,009.32 -29.65 -0.33%

CAC 40 4,147.81 -2.02 -0.05%

Brent crude rose for a second day as the U.S. conducted airstrikes against militants in Iraq, OPEC's second-largest producer. West Texas Intermediate futures also gained.

Airstrikes have been launched against Islamic militant artillery, Pentagon Spokesman Admiral John Kirby said on Twitter. President Barack Obama yesterday authorized the strikes in parts of Iraq. Chevron Corp. and Afren Plc withdrew some staff from their operations in the country's Kurdish region.

"The airstrikes in Iraq seem to be shaking the market," said Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut. "We are seeing some geopolitical risk priced into the market again."

Brent for September settlement gained 41 cents, or 0.4 percent, to $105.85 a barrel at 9:18 a.m. New York time on the London-based ICE Futures Europe exchange. The volume of all futures traded was 36 percent above the 100-day average for the time of day. Prices are up 1 percent this week.

WTI for September delivery climbed 36 cents to $97.70 a barrel on the New York Mercantile Exchange in volume that was 0.7 percent below the 100-day average. The grade is little changed this week. The U.S. benchmark crude was at a discount of $8.15 to Brent after closing at $8.10 yesterday.

Obama said the strikes, if needed, would be used to protect U.S. personnel and the Yezidis, a minority sect concentrated in northern Iraq that has been targeted by militants and are stranded on a mountain. The U.S. will strike militants if they move toward the Kurdish city of Erbil, where it has diplomatic personnel, he said.

The U.S. dollar traded mixed against the most major currencies after nonfarm productivity in the U.S. Preliminary nonfarm productivity increased 2.5% in the second quarter, exceeding expectations for 1.4% gain, after a 4.5% drop in the first quarter. The first quarter's figure was revised down from a 3.2% fall.

Preliminary unit labour cost in the U.S. rose 0.6% in the second quarter, missing expectations for 1.3% increase, after a 11.8% gain in the first quarter. The first quarter's figure was revised up from a 5.7% rise.

The U.S. currency came under pressure as after news reported that Russia could de-escalate the Ukraine conflict.

The euro traded higher against the U.S. dollar after mixed economic data from the Eurozone. Germany's trade surplus decreased to €16.2 billion in June from €18.8 billion in May. Analysts had expected the trade surplus to increase to €19.8 billion.

French industrial production climbed 1.3% in June, beating forecasts of a 1.1% rise, after a 1.6% fall in May. May's figure was revised up from a 2.3% decline.

The British pound traded lower against the U.S. dollar after the weaker-than-expected trade data from UK. Britain's trade deficit rose to £9.41 billion in June from £9.15 billion in May. May's figure was revised up from a deficit of £9.20 billion. Analysts had expected the deficit to decline to £8.90 billion in June.

The Swiss franc climbed against the U.S. dollar. Switzerland's unemployment rate remained unchanged at 3.2% in July, in line with expectations.

The Canadian dollar dropped against the U.S. dollar after the disappointing labour market data from Canada. Canada's unemployment rate declined to 7.0% in July from 7.1% in June, in line with expectations. The unemployment rate declined as fewer people went looking for a job.

Canada's economy added only 200 in July, missing expectations for a rise of 25,400, after a 9,400 drop in June.

The New Zealand dollar traded higher against the U.S dollar. In the overnight session, the New Zealand dollar declined against the greenback due to risk aversion of investors. Investors preferred safe-haven assets as geopolitical tensions in Iraq and Ukraine weighed on markets. U.S. President Barack Obama has authorised airstrikes against militants in Iraq. A build-up of Russian troops on the Ukraine border also makes investors cautious.

The kiwi was also sapped after dairy prices decreased to a 2-year low.

No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight session, the Asutralian dollar traded lower against the greenback due to risk aversion of investors as geopolitical tensions in Iraq and Ukraine weighed on markets.

The Reserve Bank of Australia's quarterly monetary policy statement also put the Australian currency under pressure. The RBA lowered its GDP forecast for 2014 to a range of 2% - 3%, down from a range of 2.25% - 3.25%.

The better-than-expected trade data from China helped the Aussie to trim its losses. China's trade surplus rose to $47.30 billion in July from $31.6 billion in June. Analysts had expected to narrow to $26 billion.

Home loans in Australia climbed 0.2% in June, missing expectations for a 0.7% rise, after 0.0% in May.

The Japanese yen traded slightly lower against the U.S. dollar. The Bank of Japan released its interest rate decision. The BoJ's interest rate remained unchanged at 0.10%. Japan's central bank will continue to increase the monetary base at an annual pace of 60 trillion yen to 70 trillion yen.

Japan's adjusted current account balance decreased to 125.6 billion yen in June from 384.6 in May, beating expectation for a fall to 110.0 billion yen.

Gold prices rose to a three-week high, as renewed geopolitical tensions in Iraq and Ukraine continues to support the demand for the precious metal as a safe haven.

Gold prices strengthened after Thursday, President Barack Obama has authorized air strikes on Iraq to crush Islamic militants in northern Iraq, and began dropping humanitarian aid to besieged areas in order to prevent "possible genocide" of religious minorities.

Meanwhile, the demand for this precious metal has also received support amid growing conflict between Russia and the West about the situation in Ukraine.

On Thursday, Moscow banned the import of products from Europe and the United States in response to the sanctions imposed because of the Ukrainian crisis.

Visiting Kiev this week, NATO Secretary General said that Moscow has focused 20000th troops at the border with Ukraine in preparation for a possible ground invasion.

Some investors believe gold is a safer asset than stocks or bonds, in times of geopolitical uncertainty.

The cost of the August gold futures on the COMEX today rose to $ 1322.10 per ounce.

The Bank of Japan released its interest decision on Friday. The BoJ's interest rate remained unchanged at 0.10%. Japan's central bank will continue to increase the monetary base at an annual pace of 60 trillion yen to 70 trillion yen.

The BoJ said that Japan's economy has continued to recover moderately. But exports and factory output "have shown some weakness", so the central bank.

The BoJ added the employment and wage growth is improving steadily, but private consumption and housing investment have remained resilient.

EUR/USD $1.3200, $1.3300, $1.3330, $1.3400, $1.3425, $1.3500

USD/JPY Y101.50, Y101.80, Y102.00, Y102.15, Y102.30, Y102.50

EUR/GBP stg0.8000

AUD/USD $0.9275, $0.9300, $0.9315, $0.9350

EUR/AUD A$1.4300

NZD/USD $0.8450

USD/CAD C$1.0825, C$1.0850, C$1.0860, C$1.0920, C$1.0930, C$1.0950, C$1.0975, C$1.1000

Statistics Canada released the labour market report today. Canada's unemployment rate declined to 7.0% in July from 7.1% in June, in line with expectations. The unemployment rate declined as fewer people went looking for a job. The labour force participation rate dropped to 65.9%. That was the lowest level since October 2001.

Canada's economy added only 200 in July, missing expectations for a rise of 25,400, after a 9,400 drop in June.

Part-time jobs increased by 60,000 jobs last month, while full-time jobs decreased by 59,700.

Construction, health care and social assistance sector were affected by the most job losses.

U.S. stock futures rose slightly on a report that Russia wants to de-escalate the crisis in eastern Ukraine that outweighed increased tensions over Iraq. RIA Novosti cited Russian Security Council head Nikolai Patrushev which reported that Russia seeks a de-escalation of the conflict in Ukraine.

Global markets:

Nikkei 14,778.37 -454.00 -2.98%

Hang Seng 24,331.41 -56.15 -0.23%

Shanghai Composite 2,194.42 +6.76 +0.31%

FTSE 6,574.74 -22.63 -0.34%

CAC 4,154 +4.17 +0.10%

DAX 9,031.96 -7.01 -0.08%

Crude oil $97.59 (+0.69%)

Gold $1310.50 (-0.15%)

(company / ticker / price / change, % / volume)

| United Technologies Corp | UTX | 103.58 | -0.61% | 0.4K |

| McDonald's Corp | MCD | 92.82 | -0.53% | 79.3K |

| UnitedHealth Group Inc | UNH | 79.06 | -0.25% | 0.8K |

| Procter & Gamble Co | PG | 80.02 | -0.15% | 4.6K |

| Merck & Co Inc | MRK | 55.63 | -0.02% | 1.9K |

| Nike | NKE | 76.35 | 0.00% | 1.9K |

| Wal-Mart Stores Inc | WMT | 73.95 | 0.00% | 2.0K |

| The Coca-Cola Co | KO | 39.69 | +0.86% | 9.4K |

| Travelers Companies Inc | TRV | 90.25 | +0.39% | 2.4K |

| Chevron Corp | CVX | 126.10 | +0.36% | 0.5K |

| Exxon Mobil Corp | XOM | 98.60 | +0.34% | 0.7K |

| JPMorgan Chase and Co | JPM | 56.10 | +0.34% | 0.2K |

| Intel Corp | INTC | 32.77 | +0.28% | 25.6K |

| General Electric Co | GE | 25.57 | +0.27% | 5.4K |

| American Express Co | AXP | 86.24 | +0.26% | 0.1K |

| Caterpillar Inc | CAT | 102.20 | +0.26% | 0.1K |

| International Business Machines Co... | IBM | 184.75 | +0.24% | 3.2K |

| 3M Co | MMM | 139.45 | +0.23% | 0.4K |

| Verizon Communications Inc | VZ | 48.75 | +0.21% | 19.0K |

| Cisco Systems Inc | CSCO | 24.90 | +0.16% | 41.5K |

| AT&T Inc | T | 34.26 | +0.15% | 7.5K |

| Boeing Co | BA | 120.00 | +0.13% | 8.8K |

| Walt Disney Co | DIS | 85.61 | +0.12% | 5.5K |

| Visa | V | 209.23 | +0.09% | 1.4K |

| Johnson & Johnson | JNJ | 100.02 | +0.09% | 4.8K |

| Microsoft Corp | MSFT | 43.25 | +0.05% | 4.1K |

| Pfizer Inc | PFE | 28.май | +0.04% | 25.8K |

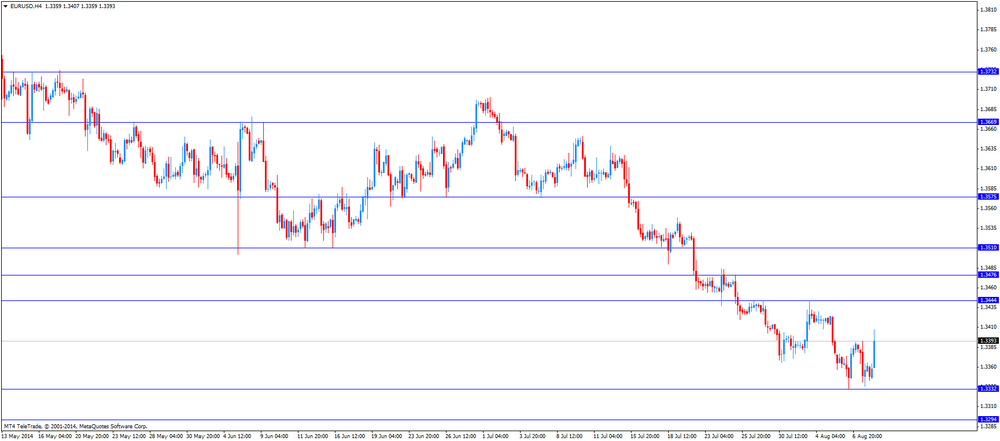

EUR/USD

Offers $1.3530, $1.3500-10, $1.3485, $1.3445-50, $1.3400

Bids $1.3320, $1.3300, $1.3295

GBP/USD

Offers$1.6700, $1.6926, $1.6890/00

Bids $1.6785/80, $1.6750, $1.6700-693

AUD/USD

Offers $0.9505, $0.9465, $0.9400, $0.9370

Bids $0.9200, $0.9135, $0.9100, $0.9045

EUR/JPY

OffersY138.80, Y138.50, Y138.00, Y137.30, Y137.00, Y136.45

Bids Y135.70, Y135.00, Y134.05/00

USD/JPY

OffersY104.00, Y103.50, Y103.15, Y102.90, Y102.45

Bids Y101.30, Y101.05, Y100.80

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7985

Bids stg0.7920, stg0.7900, stg0.7885, stg0.7870

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:50 Japan Current Account (adjusted), bln June 384.6 110.0 125.6

03:30 Australia Home Loans June 0.0% +0.7% +0.2%

03:30 Australia RBA Monetary Policy Statement Quarter III

04:00 China Trade Balance, bln July 31.6 26.0 47.3

05:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

05:00 Japan Bank of Japan Monetary Base Target 270 270 270

05:00 Japan BoJ Monetary Policy Statement

07:00 Japan Eco Watchers Survey: Current July 47.7 48.7 51.3

07:00 Japan Eco Watchers Survey: Outlook July 53.3 51.5

07:45 Switzerland Unemployment Rate July 3.2% 3.2% 3.2%

08:00 Germany Current Account June 12.2 Revised From 13.2 15.0

08:00 Germany Trade Balance June 18.8 19.8 16.2

08:45 France Industrial Production, m/m June -1.6% +1.1% +1.6%

08:45 France Industrial Production, y/y June -3.7% +0.1%

09:30 Japan BOJ Press Conference

10:30 United Kingdom Trade in goods June -9.2 -8.9 -9.4

The U.S. dollar traded mixed against the most major currencies ahead of nonfarm productivity in the U.S. Preliminary nonfarm productivity is expected to increase 1.4% in the second quarter, after a 3.2% drop in the first quarter.

The euro traded mixed against the U.S. dollar after mixed economic data from the Eurozone. Germany's trade surplus decreased to €16.2 billion in June from €18.8 billion in May. Analysts had expected the trade surplus to increase to €19.8 billion.

French industrial production climbed 1.3% in June, beating forecasts of a 1.1% rise, after a 1.6% fall in May. May's figure was revised up from a 2.3% decline.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected trade data from UK. Britain's trade deficit rose to £9.41 billion in June from £9.15 billion in May. May's figure was revised up from a deficit of £9.20 billion. Analysts had expected the deficit to decline to £8.90 billion in June.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's unemployment rate remained unchanged at 3.2% in July, in line with expectations.

The Canadian dollar traded mixed against the U.S. dollar ahead of the labour market report from Canada. The unemployment rate is expected to decline to 7.0% in July from 7.1% in June.

Canada's economy is expected to add 25,400 jobs in July, after a loss of 9,400 jobs in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y101.98

The most important news that are expected (GMT0):

14:30 Canada Employment July -9.4 +25.4

14:30 Canada Unemployment rate July 7.1% 7.0%

14:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter II -3.2% +1.4%

14:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter II +5.7% +1.3%

16:00 U.S. Wholesale Inventories June +0.5% +0.6%

Stock indices traded lower. U.S. President Barack Obama has authorised airstrikes against militants in Iraq.

Germany's trade surplus decreased to €16.2 billion in June from €18.8 billion in May. Analysts had expected the trade surplus to increase to €19.8 billion.

French industrial production climbed 1.3% in June, beating forecasts of a 1.1% rise, after a 1.6% fall in May. May's figure was revised up from a 2.3% decline.

Britain's trade deficit rose to £9.41 billion in June from £9.15 billion in May. May's figure was revised up from a deficit of £9.20 billion. Analysts had expected the deficit to decline to £8.90 billion in June.

Banca Monte dei Paschi di Siena SpA shares dropped 5.5% after reporting the weaker-than-expected net loss in the second quarter.

Nokian Renkaat Oyj shares dropped 5.9% after missing second-quarter earnings forecast. The company's sales in Russia plunged 31% in the first half of 2014.

Current figures:

Name Price Change Change %

FTSE 100 6,556.66 -40.71 -0.62%

DAX 8,966.63 -72.34 -0.80%

CAC 40 4,137.52 -12.31 -0.30%

The Reserve Bank of Australia (RBA) released its quarterly monetary policy statement today. The RBA lowered its GDP forecast for 2014 to a range of 2% - 3%, down from a range of 2.25% - 3.25%.

Australia's central bank said that Australia's "financial conditions remain very accommodative". The RBA added that the Australian currency remains high by historical standards.

The labour market remained subdued, but the labour market improved a little this year, so the RBA. "There remains a degree of spare capacity in the labour market", the statement said.

The RBA lowered its inflation forecast. Inflation is to be lower in 2014/15, but a bit higher in 2015/16.

The central bank reiterated that the most prudent course of RBA's monetary policy is likely to be "a period of stability in interest rates".

Most Asian stock closed lower as U.S. President Barack Obama has authorised airstrikes against militants in Iraq.

The better-than-expected trade data from China trimmed some losses on markets. China's trade surplus rose to $47.30 billion in July from $31.6 billion in June. Analysts had expected to narrow to $26 billion.

The Bank of Japan released its interest rate decision. The BoJ's interest rate remained unchanged at 0.10%. Japan's central bank will continue to increase the monetary base at an annual pace of 60 trillion yen to 70 trillion yen.

Japan's adjusted current account balance decreased to 125.6 billion yen in June from 384.6 in May, beating expectation for a fall to 110.0 billion yen.

Nikon Corp. shares declined 9.4% as the company lowered its full-year forecast.

Nippon Electric Glass Co. fell 8.8% after the company cut its nine-month net-income forecast.

Indexes on the close:

Nikkei 225 14,778.37 -454.00 -2.98%

Hang Seng 24,331.41 -56.15 -0.23%

Shanghai Composite 2,194.42 +6.76 +0.31%

EUR/USD $1.3200, $1.3300, $1.3330, $1.3400, $1.3425, $1.3500

USD/JPY Y101.50, Y101.80, Y102.00, Y102.15, Y102.30, Y102.50

EUR/GBP stg0.8000

AUD/USD $0.9275, $0.9300, $0.9315, $0.9350

EUR/AUD A$1.4300

NZD/USD $0.8450

USD/CAD C$1.0825, C$1.0850, C$1.0860, C$1.0920, C$1.0930, C$1.0950, C$1.0975, C$1.1000

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:50 Japan Current Account (adjusted), bln June 384.6 110.0 125.6

03:30 Australia Home Loans June 0.0% +0.7% +0.2%

03:30 Australia RBA Monetary Policy Statement Quarter III

04:00 China Trade Balance, bln July 31.6 26.0 47.3

05:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

05:00 Japan Bank of Japan Monetary Base Target 270 270 270

05:00 Japan BoJ Monetary Policy Statement

07:00 Japan Eco Watchers Survey: Current July 47.7 48.7 51.3

07:00 Japan Eco Watchers Survey: Outlook July 53.3 51.5

07:45 Switzerland Unemployment Rate July 3.2% 3.2% 3.2%

08:00 Germany Current Account June 12.2 Revised From 13.2 15.0

08:00 Germany Trade Balance June 18.8 19.8 16.2

08:45 France Industrial Production, m/m June -1.7% +1.1% +1.6%

08:45 France Industrial Production, y/y June -3.7% +0.1%

09:30 Japan BOJ Press Conference

10:30 United Kingdom Trade in goods June -9.2 -8.9 -9.4

The U.S. dollar traded mixed against the most major currencies. The greenback was supported by yesterday's U.S. economic data. The number of initial jobless in the U.S. in the week ending August 2 dropped by 14,000 to 289,000 from the previous week's figure of 303,000.

The New Zealand dollar declined against the U.S dollar due to risk aversion of investors. Investors preferred safe-haven assets as geopolitical tensions in Iraq and Ukraine weighed on markets. U.S. President Barack Obama has authorised airstrikes against militants in Iraq. A build-up of Russian troops on the Ukraine border also makes investors cautious.

The kiwi was also sapped after dairy prices decreased to a 2-year low.

No major economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar due to risk aversion of investors as geopolitical tensions in Iraq and Ukraine weighed on markets.

The Reserve Bank of Australia's quarterly monetary policy statement also put the Australian currency under pressure. The RBA lowered its GDP forecast for 2014 to a range of 2% - 3%, down from a range of 2.25% - 3.25%.

The better-than-expected trade data from China helped the Aussie to trim its losses. China's trade surplus rose to $47.30 billion in July from $31.6 billion in June. Analysts had expected to narrow to $26 billion.

Home loans in Australia climbed 0.2% in June, missing expectations for a 0.7% rise, after 0.0% in May.

The Japanese yen rose against the U.S. dollar due to increasing demand for safe-haven currency as U.S. President Barack Obama has authorised airstrikes against militants in Iraq.

The Bank of Japan released its interest rate decision. The BoJ's interest rate remained unchanged at 0.10%. Japan's central bank will continue to increase the monetary base at an annual pace of 60 trillion yen to 70 trillion yen.

Japan's adjusted current account balance decreased to 125.6 billion yen in June from 384.6 in May, beating expectation for a fall to 110.0 billion yen.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.6800

USD/JPY: the currency pair fell to Y101.60

The most important news that are expected (GMT0):

14:30 Canada Employment July -9.4 +25.4

14:30 Canada Unemployment rate July 7.1% 7.0%

14:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter II -3.2% +1.4%

14:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter II +5.7% +1.3%

16:00 U.S. Wholesale Inventories June +0.5% +0.6%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3501 (2789)

$1.3451 (2711)

$1.3403 (1706)

Price at time of writing this review: $ 1.3361

Support levels (open interest**, contracts):

$1.3340 (3253)

$1.3299 (2681)

$1.3249 (1412)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 34938 contracts, with the maximum number of contracts with strike price $1,3600 (4265);

- Overall open interest on the PUT options with the expiration date August, 8 is 32878 contracts, with the maximum number of contracts with strike price $1,3500 (5485);

- The ratio of PUT/CALL was 0.94 versus 0.95 from the previous trading day according to data from August, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2737)

$1.7000 (1625)

$1.6900 (1094)

Price at time of writing this review: $1.6809

Support levels (open interest**, contracts):

$1.6700 (1134)

$1.6600 (431)

$1.6500 (1047)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 20968 contracts, with the maximum number of contracts with strike price $1,7100 (2737);

- Overall open interest on the PUT options with the expiration date August, 8 is 26593 contracts, with the maximum number of contracts with strike price $1,6800 (3119);

- The ratio of PUT/CALL was 1.27 versus 1.28 from the previous trading day according to data from August, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.