- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-12-2014

(raw materials / closing price /% change)

Light Crude 63.02 -0.05%

Gold 1,203.70 +0.74%

(index / closing price / change items /% change)

Nikkei 225 17,935.64 +15.19 +0.08%

Hang Seng 24,047.67 +45.03 +0.19%

Shanghai Composite 3,021.52 +83.88 +2.86%

FTSE 100 6,672.15 -70.69 -1.05%

CAC 40 4,375.48 -44.00 -1.00%

Xetra DAX 10,014.99 -72.13 -0.72%

S&P 500 2,060.31 -15.06 -0.73%

NASDAQ Composite 4,740.69 -40.06 -0.84%

Dow Jones 17,852.48 -106.31 -0.59%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2316 +0,22%

GBP/USD $1,5651 +0,51%

USD/CHF Chf0,9759 -0,29%

USD/JPY Y120,68 -0,62%

EUR/JPY Y148,59 -0,42%

GBP/JPY Y188,87 -0,11%

AUD/USD $0,8281 -0,52%

NZD/USD $0,7650 -0,77%

USD/CAD C$1,1477 +0,41%

(time / country / index / period / previous value / forecast)

00:01 United Kingdom BRC Retail Sales Monitor y/y November 0.0%

00:30 Australia National Australia Bank's Business Confidence November 4

06:00 Japan Prelim Machine Tool Orders, y/y November +30.8% Revised From +31.2%

06:45 Switzerland Unemployment Rate November 3.2% 3.2%

07:00 Germany Current Account October 22.3

07:00 Germany Trade Balance October 18.5 18.1

07:45 France Trade Balance, bln October -4.7 -4.5

09:30 United Kingdom Industrial Production (MoM) October +0.6% +0.3%

09:30 United Kingdom Industrial Production (YoY) October +1.5% +1.8%

09:30 United Kingdom Manufacturing Production (MoM) October +0.4% +0.2%

09:30 United Kingdom Manufacturing Production (YoY) October +2.9% +3.2%

10:00 Eurozone ECOFIN Meetings

15:00 United Kingdom NIESR GDP Estimate November +0.7%

15:00 U.S. Wholesale Inventories October +0.3% +0.1%

15:00 U.S. JOLTs Job Openings October 4735 4820

21:30 U.S. API Crude Oil Inventories December -6.5

23:30 Australia Westpac Consumer Confidence December +1.9%

23:50 Japan BSI Manufacturing Index Quarter IV 12.7 13.1

Stock indices closed lower on comments by the European Central Bank's Governing Council Member Ewald Nowotny. He expressed concerns about the health of the Eurozone's economy.

The cut of Italy's credit rating by S&P weighed on stocks and weak Chinese trade data also weighed on markets. S&P downgraded Italy's credit rating to BBB- from BBB late on Friday.

China's imports fell 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

The Sentix investor confidence index for the Eurozone increased to -2.5 in December from -11.9 in November. Analysts had expected the index to climb to -9.9.

German industrial production rose 0.2% in October, in line with expectations, after a 1.1% gain in September. September's figure was revised down from a 1.4% increase.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,672.15 -70.69 -1.05%

DAX 10,014.99 -72.13 -0.72%

CAC 40 4,375.48 -44.00 -1.00%

Brent crude and West Texas Intermediate slumped to five-year lows amid concern that hedge funds and other money managers bet too much on rising prices.

Futures dropped as much as 3.7 percent in London and 3.4 percent in New York. Net-long positions on Brent rose to the highest in four months in the week to Dec. 2, according to data from the ICE Futures Europe exchange, while bullish bets on WTI climbed the most in 20 months. Brent declined 9.9 percent in the period and WTI slumped 9.7 percent.

"People might consider it a buying opportunity but we still have an over-supplied market," said Tom Finlon, Jupiter, Florida-based director of Energy Analytics Group LLC. "New lows will be tested. We are in for a volatile market. You have to expect very sharp swings."

Both Brent and WTI tumbled 18 percent in November as the Organization of Petroleum Exporting Countries decided to maintain its 30 million-barrel-a-day output target. Crude has traded in a bear market since October amid the fastest pace of U.S. production in three decades, rising output from OPEC and signs of weakening global demand. Banks including Morgan Stanley, BNP Paribas SA and Barclays Plc have cut price forecasts.

Brent for January settlement declined $2.42, or 3.5 percent, to $66.65 a barrel at 10:50 a.m. New York time on the London-based ICE Futures Europe exchange after reaching $66.53, the lowest intraday level since October 2009. The volume of all futures was 18 percent below the 100-day average.

WTI for January delivery dropped $2.11, or 3.2 percent, to $63.73 a barrel on the New York Mercantile Exchange, after reaching $63.63, the lowest since July 2009. Volume was 8.3 percent below the 100-day average.

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The U.S. currency was also supported by weak Chinese trade data. China's imports dropped 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

There were released no major economic reports in the U.S. today.

The euro traded higher against the U.S. dollar. The Sentix investor confidence index for the Eurozone increased to -2.5 in December from -11.9 in November. Analysts had expected the index to climb to -9.9.

German industrial production rose 0.2% in October, in line with expectations, after a 1.1% gain in September. September's figure was revised down from a 1.4% increase.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian housing market data. Building permits in Canada rose 0.7% in October, missing expectations for a 2.1% gain, after a 12.5% rise in September. September's figure was revised down from a 12.7% increase.

Housing starts in Canada increased to a seasonally adjusted annualized rate of 195,620 units in November from a revised reading of 183,659 units in October. Analysts had expected an increase to 201,000 units.

The Swiss franc increased against the U.S. dollar. Switzerland's consumer price index was flat in November, in line with expectations.

On a yearly basis, Switzerland's consumer price index declined 0.1% in November, missing expectations for a flat reading, after the flat reading in October.

Retail sales in Switzerland increased at an annual rate of 0.3% in October, missing expectations for a 0.9% rise, after a 0.5% gain in September. September's figure was revised up from a 0.3% increase.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi declined against the greenback due to stronger the U.S. currency.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback despite the solid economic data from Australia. Job advertisements in Australia increased 0.7% in November, after a 0.2% rise in October.

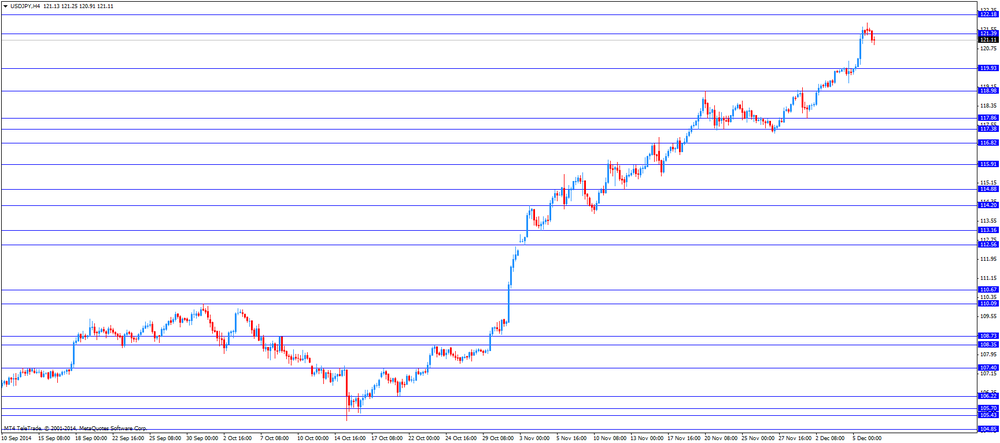

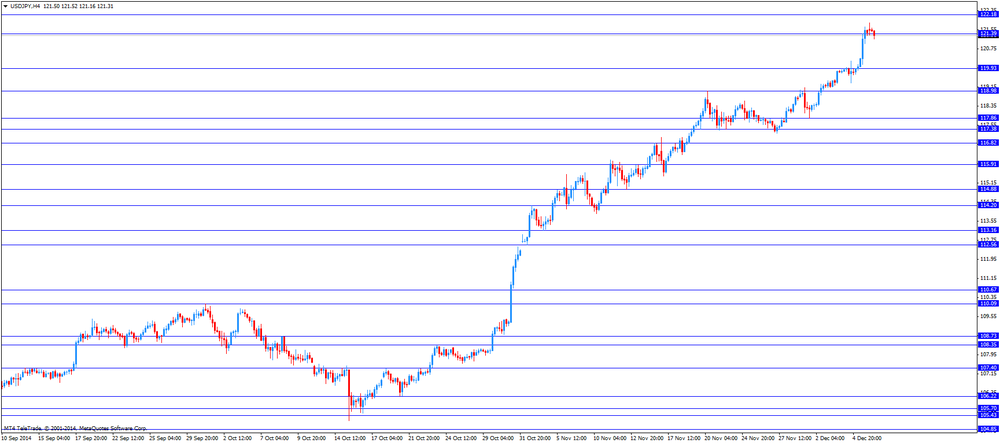

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the mostly weak economic data from Japan. Japan's gross domestic product (GDP) was revised down to an annual fall of 1.9% in the third quarter from the preliminary estimate of a 1.6% decrease.

Japan's adjusted current account surplus rose to 947.0 billion yen in October from 414.4 billion yen in September.

Japan's economy watchers' current conditions index declined to 41.5 in November from 44.0 in October, missing expectations for an increase to 45.9.

Japan's economy watchers' future conditions index dropped to 44.0 in November from 46.6 in October.

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 195,620 units in November from a revised reading of 183,659 units in October.

Analysts had expected an increase to 201,000 units.

The CMHC's Chief Economist Bob Dugan that new home building is "concentrated in multiple starts, particularly in Quebec, British Columbia and Ontario".

U.S. stock-index futures declined as Chinese trade data missed forecasts and oil companies slid as crude continued a selloff.

Global markets:

Nikkei 17,935.64 +15.19 +0.08%

Hang Seng 24,047.67 +45.03 +0.19%

Shanghai Composite 3,021.52 +83.88 +2.86%

FTSE 6,683.89 -58.95 -0.87%

CAC 4,381.31 -38.17 -0.86%

DAX 10,032.53 -54.59 -0.54%

Crude oil $64.37 (-2.22%)

Gold $1194.70 (+0.36%)

(company / ticker / price / change, % / volume)

| AT&T Inc | T | 33.96 | +0.06% | 4.3K |

| Boeing Co | BA | 132.32 | +0.08% | 0.3K |

| Home Depot Inc | HD | 99.79 | +0.15% | 0.2K |

| Walt Disney Co | DIS | 93.96 | +0.21% | 1.7K |

| Merck & Co Inc | MRK | 61.65 | +0.26% | 7.1K |

| United Technologies Corp | UTX | 111.75 | +0.41% | 2.3K |

| 3M Co | MMM | 162.27 | 0.00% | 0.5K |

| Goldman Sachs | GS | 195.45 | 0.00% | 0.5K |

| E. I. du Pont de Nemours and Co | DD | 73.07 | 0.00% | 0.7K |

| UnitedHealth Group Inc | UNH | 100.21 | -0.12% | 1.2K |

| Caterpillar Inc | CAT | 98.65 | -0.13% | 1.5K |

| The Coca-Cola Co | KO | 43.47 | -0.14% | 0.5K |

| JPMorgan Chase and Co | JPM | 62.60 | -0.16% | 3.1K |

| International Business Machines Co... | IBM | 162.75 | -0.32% | 0.5K |

| Verizon Communications Inc | VZ | 48.45 | -0.33% | 4.8K |

| Pfizer Inc | PFE | 31.86 | -0.41% | 0.3K |

| Microsoft Corp | MSFT | 48.21 | -0.43% | 3.3K |

| Wal-Mart Stores Inc | WMT | 83.75 | -0.44% | 0.8K |

| Intel Corp | INTC | 37.50 | -0.45% | 4.4K |

| General Electric Co | GE | 25.87 | -0.54% | 4.3K |

| Cisco Systems Inc | CSCO | 27.32 | -0.65% | 3.0K |

| Nike | NKE | 98.49 | -0.85% | 1.9K |

| Chevron Corp | CVX | 109.74 | -1.02% | 5.1K |

| Exxon Mobil Corp | XOM | 92.85 | -1.03% | 9.1K |

| McDonald's Corp | MCD | 93.45 | -2.97% | 66.9K |

Upgrades:

eBay (EBAY) upgraded to Buy from Hold at Stifel

United Tech (UTX) upgraded to Outperform from Mkt Perform at Bernstein

Downgrades:

Yandex (YNDX) downgraded to Neutral from Buy at UBS

Nike (NKE) downgraded to Market Perform from Outperform at Telsey Advisory Group

Other:

Home Depot (HD) target raised to $110 from $105 at Argus

Apple (AAPL) target raised to $135 from $120 at Citigroup

Johnson & Johnson (JNJ) target raised to $114 from $110 at RBC Capital Mkts

McDonald's (MCD) resumed at Neutral at Goldman, target $90

Starbucks (SBUX) resumed at Buy at Goldman, target $95

Statistics Canada released housing market on Monday. Building permits in Canada rose 0.7% in October, missing expectations for a 2.1% gain, after a 12.5% rise in September. September's figure was revised down from a 12.7% increase.

Building permits for non-residential construction climbed 2.4% in October, while permits in the residential sector decreased 0.4%.

EUR/USD: $1.2200(E900mn), $1.2240-50(E1.0bn), $1.2300(E1.5bn), $1.2320-25(E1.1bn), $1.2350(E387mn), $1.2400-10(E3.3bn), $1.2435(E1.1bn), $1.2450(E1.88bn)

USD/JPY: Y120.00($2.4bn), Y121.50(Y2.0bn)

GBP/USD: $1.5700(stg330mn)

EUR/GBP: stg0.7805-15(E1.0bn)

EUR/CHF: Chf1.2075(E600mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BOE Quarterly Bulletin

00:30 Australia ANZ Job Advertisements (MoM) November +0.2% +0.7%

02:00 China Trade Balance, bln November 45.4 44.3 54.5

05:00 Japan Eco Watchers Survey: Current November 44.0 45.9 41.5

05:00 Japan Eco Watchers Survey: Outlook November 46.6 44.0

07:00 Germany Industrial Production s.a. (MoM) October +1.1% Revised From +1.4% +0.2% +0.2%

07:00 Germany Industrial Production (YoY) October -0.1% +0.8%

08:15 Switzerland Retail Sales Y/Y October +0.5% +0.9% +0.3%

08:15 Switzerland Consumer Price Index (MoM) November 0.0% 0.0% 0.0%

08:15 Switzerland Consumer Price Index (YoY) November 0.0% 0.0% -0.1%

09:30 Eurozone Sentix Investor Confidence December -11.9 -9.9 -2.5

10:00 Eurozone Eurogroup Meetings

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The U.S. currency was also supported by weak Chinese trade data. China's imports dropped 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

There will be released no major economic reports in the U.S. today.

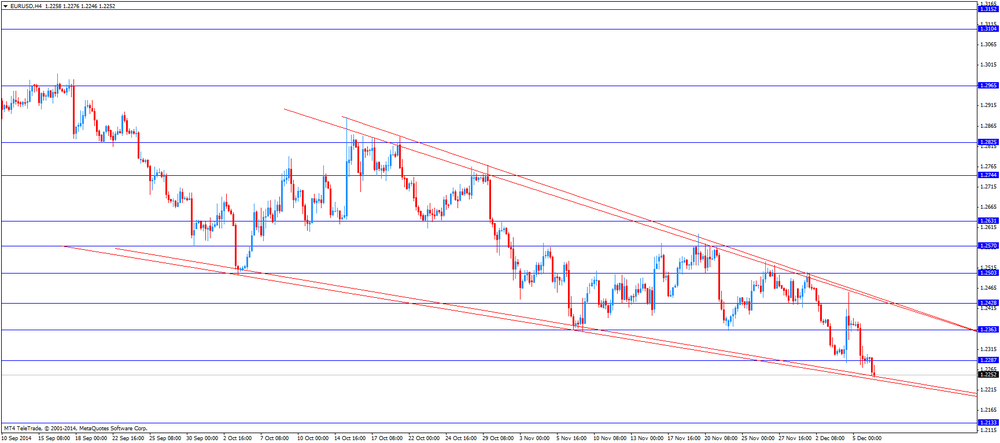

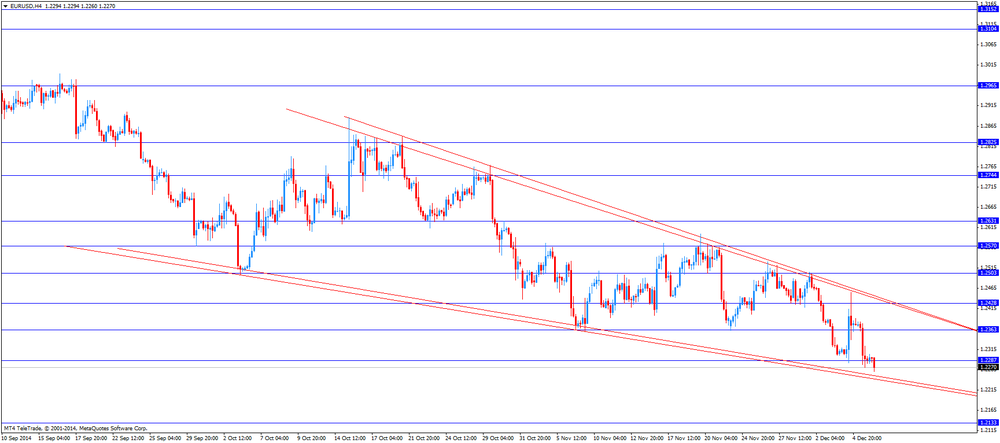

The euro traded lower against the U.S. dollar. The Sentix investor confidence index for the Eurozone increased to -2.5 in December from -11.9 in November. Analysts had expected the index to climb to -9.9.

German industrial production rose 0.2% in October, in line with expectations, after a 1.1% gain in September. September's figure was revised down from a 1.4% increase.

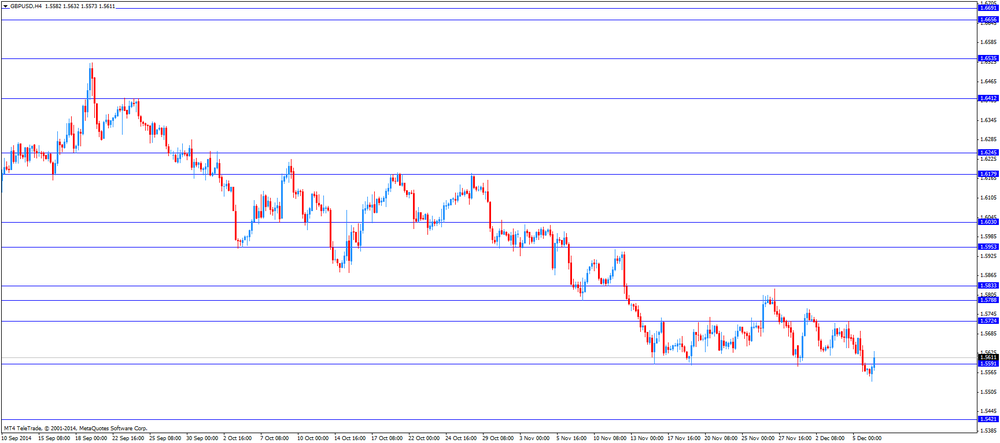

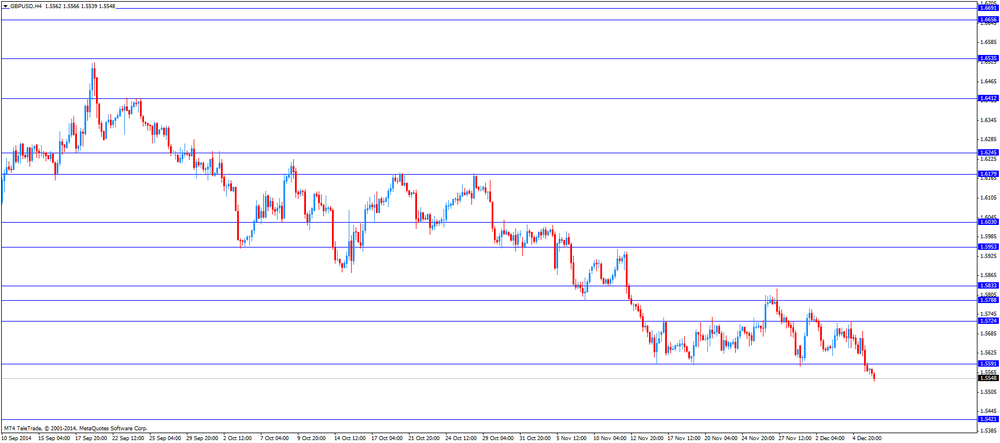

The British pound rose against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian housing market data. Housing starts in Canada are expected to rise by 201,000 units in November, after 184,000 units in October.

Building permits in Canada are expected to climb 2.1% in October, after a 12.7% increase in September.

The Swiss franc traded lower against the U.S. dollar. Switzerland's consumer price index was flat in November, in line with expectations.

On a yearly basis, Switzerland's consumer price index declined 0.1% in November, missing expectations for a flat reading, after the flat reading in October.

Retail sales in Switzerland increased at an annual rate of 0.3% in October, missing expectations for a 0.9% rise, after a 0.5% gain in September. September's figure was revised up from a 0.3% increase.

EUR/USD: the currency pair fell to $1.2246

GBP/USD: the currency pair rose to $1.5632

USD/JPY: the currency pair decreased to Y120.91

The most important news that are expected (GMT0):

13:15 Canada Housing Starts November 184 201

13:30 Canada Building Permits (MoM) October +12.7% +2.1%

EUR/USD

Offers $1.2450, $1.2410/20, $1.2400, $1.2350/45, $1.2300

Bids $1.2250, $1.2200

GBP/USD

Offers $1.5780/00, $1.5750, $1.5720, $1.5650

Bids $1.5550/40, $1.5520, $1.5500

AUD/USD

Offers $0.8540/50, $0.8500, $0.8450, $0.8400, $0.8355

Bids $0.8260/50, $0.8200

EUR/JPY

Offers Y150.50, Y150.00, Y149.80

Bids Y148.00, Y147.55/50

USD/JPY

Offers Y122.00, Y121.80

Bids Y120.00, Y119.50, Y119.00, Y118.50

EUR/GBP

Offers stg0.8020, stg0.8000, stg0.7980, stg0.7950, stg0.7920

Bids stg0.7830/20, stg0.7800

Stock indices traded lower after the cut of Italy's credit rating by S&P weighed on stocks and weak Chinese trade data. S&P downgraded Italy's credit rating to BBB- from BBB late on Friday.

China's imports fell 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

The Sentix investor confidence index for the Eurozone increased to -2.5 in December from -11.9 in November. Analysts had expected the index to climb to -9.9.

German industrial production rose 0.2% in October, in line with expectations, after a 1.1% gain in September. September's figure was revised down from a 1.4% increase.

Current figures:

Name Price Change Change %

FTSE 100 6,687.27 -55.57 -0.82%

DAX 10,035.26 -51.86 -0.51%

CAC 40 4,386.15 -33.33 -0.75%

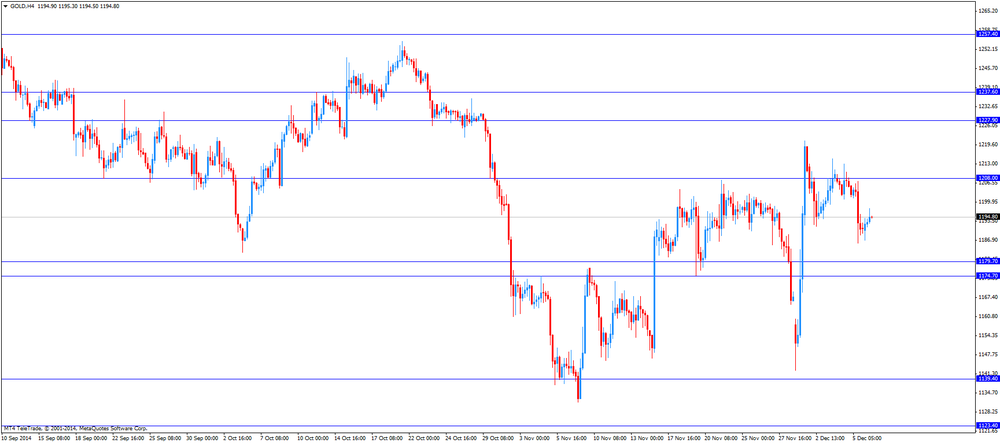

Gold prices traded higher on Monday. Spot gold rose to $1,197.80 a troy ounce in morning European trade. Gold lost 1.1% on Friday after the better-than-expected U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

Gold was also supported by speculation on further stimulus measures in China, Japan and the Eurozone.

Bloomberg

Dollar Gauge at Five-Year High as Kiwi, Aussie Decline on China

A gauge of the dollar headed for its highest close in more than five years after China said imports unexpectedly fell in November, underpinning demand for the currency of the U.S. where growth is beating forecasts.

Reuters

Bank on 'Super Mario' to give Europe a monetary jolt

(Reuters) - From his office on the 41st floor of the gleaming new European Central Bank headquarters, Mario Draghi's view stretches far beyond Frankfurt's high-rise financial centre and he doesn't like what he sees.

The darkening outlook for the euro zone's flat and nearly inflation-less economy, exacerbated by tumbling oil prices, is driving him inexorably towards radical action.

Source:

Reuters

China faces more pressure as November imports shrink unexpectedly, exports slow

(Reuters) - China's imports shrank unexpectedly in November while export growth slowed, fuelling concerns the world's second-largest economy could be facing a sharper slowdown and adding pressure on policymakers to ramp up stimulus measures.

Source: http://uk.reuters.com/article/2014/12/08/uk-china-economy-trade-idUKKBN0JM04O20141208

U.S. stocks closed higher on Friday, supported by the better-than-expected U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The Dow Jones Industrial Average rose 0.335 to 17,958.79 points on Friday, while the S&P 500 increased 017% to 2,075.37 points.

Europe's stock indices traded lower.

UK's FTSE 100 index was down 0.68% to 6,696.67 points. Germany's DAX 30 declined 0.27% to 1 0,059.67 points, while France's CAC 40 fell 0.49% to 4,397.98.

The cut of Italy's credit rating by S&P weighed on the European markets. S&P downgraded Italy's credit rating to BBB- from BBB late on Friday.

Hong Kong's Hang Seng gained 0.19% to 24,047.67, China's Shanghai Composite rose 2.86% to 3,021.52 after China's imports dropped in November, while exports slowed. China's imports fell 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

Investors speculate that China's government will add further stimulus measures to boost the economy.

Japan's Nikkei climbed 0.08% to 17,935.64 after mostly weak economic data. Japan's gross domestic product (GDP) was revised down to an annual fall of 1.9% in the third quarter from the preliminary estimate of a 1.6% decrease.

Japan's adjusted current account surplus rose to 947.0 billion yen in October from 414.4 billion yen in September.

Japan's economy watchers' current conditions index declined to 41.5 in November from 44.0 in October, missing expectations for an increase to 45.9.

Japan's economy watchers' future conditions index dropped to 44.0 in November from 46.6 in October.

EUR/USD: $1.2200(E900mn), $1.2240-50(E1.0bn), $1.2300(E1.5bn), $1.2320-25(E1.1bn), $1.2350(E387mn), $1.2400-10(E3.3bn), $1.2435(E1.1bn), $1.2450(E1.88bn)

USD/JPY: Y120.00($2.4bn), Y121.50(Y2.0bn)

GBP/USD: $1.5700(stg330mn)

EUR/GBP: stg0.7805-15(E1.0bn)

EUR/CHF: Chf1.2075(E600mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BOE Quarterly Bulletin

00:30 Australia ANZ Job Advertisements (MoM) November +0.2% +0.7%

02:00 China Trade Balance, bln November 45.4 44.3 54.5

05:00 Japan Eco Watchers Survey: Current November 44.0 45.9 41.5

05:00 Japan Eco Watchers Survey: Outlook November 46.6 44.0

07:00 Germany Industrial Production s.a. (MoM) October +1.1% Revised From +1.4% +0.2% +0.2%

07:00 Germany Industrial Production (YoY) October -0.1% +0.8%

08:15 Switzerland Retail Sales Y/Y October +0.5% +0.9% +0.3%

08:15 Switzerland Consumer Price Index (MoM) November 0.0% 0.0% 0.0%

08:15 Switzerland Consumer Price Index (YoY) November 0.0% 0.0% -0.1%

09:30 Eurozone Sentix Investor Confidence December -11.9 -9.9 -2.5

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by Friday's U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The U.S. currency was also supported by weak Chinese trade data. China's imports dropped 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

The New Zealand dollar declined against the U.S. dollar due to stronger the U.S. currency. No major market reports were released in New Zealand.

The Australian dollar fell against the U.S. dollar despite the solid economic data from Australia. Job advertisements in Australia increased 0.7% in November, after a 0.2% rise in October.

The Japanese yen traded mixed against the U.S. dollar after the mostly weak economic data from Japan. Japan's gross domestic product (GDP) was revised down to an annual fall of 1.9% in the third quarter from the preliminary estimate of a 1.6% decrease.

Japan's adjusted current account surplus rose to 947.0 billion yen in October from 414.4 billion yen in September.

Japan's economy watchers' current conditions index declined to 41.5 in November from 44.0 in October, missing expectations for an increase to 45.9.

Japan's economy watchers' future conditions index dropped to 44.0 in November from 46.6 in October.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5554

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

10:00 Eurozone Eurogroup Meetings

13:15 Canada Housing Starts November 184 201

13:30 Canada Building Permits (MoM) October +12.7% +2.1%

EUR / USD

Resistance levels (open interest**, contracts)

$1.2447 (1635)

$1.2400 (129)

$1.2353 (87)

Price at time of writing this review: $ 1.2290

Support levels (open interest**, contracts):

$1.2254 (1418)

$1.2221 (2231)

$1.2200 (2639)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 39107 contracts, with the maximum number of contracts with strike price $1,2500 (5301);

- Overall open interest on the PUT options with the expiration date January, 9 is 47052 contracts, with the maximum number of contracts with strike price $1,2000 (7143);

- The ratio of PUT/CALL was 1.20 versus 0.92 from the previous trading day according to data from December, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5804 (967)

$1.5707 (1211)

$1.5611 (275)

Price at time of writing this review: $1.5563

Support levels (open interest**, contracts):

$1.5490 (660)

$1.5393 (819)

$1.5296 (1134)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 12379 contracts, with the maximum number of contracts with strike price $1,5700 (1211);

- Overall open interest on the PUT options with the expiration date January, 9 is 13433 contracts, with the maximum number of contracts with strike price $1,5200 (1497);

- The ratio of PUT/CALL was 1.09 versus 0.94 from the previous trading day according to data from December, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.