- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-12-2013

The euro exchange rate fell sharply earlier against the dollar, which was associated with the release of the employment report in the eurozone. In statistical agency Eurostat reported that employment in the euro area remained unchanged during the third quarter . Add that employment has not changed for the second consecutive quarter . As it became known , the seasonally adjusted number of persons employed in the euro area remained unchanged at the end of the third quarter. Meanwhile, we note that the annualized employment decreased by 0.8 percent in the three months to September , which followed after falling 1.1 percent in the previous quarter .

In the European Union (EU ), employment has remained unchanged in the third quarter as it was in the second quarter . In annual terms, employment in the EU fell by 0.3 percent last quarter, compared with a fall of 0.6 percent in the second quarter .

Statistical agencies reported that among the Member States , Portugal, Ireland and Luxembourg recorded the highest rate of employment growth ( qoq ) . At the same time , Estonia, Lithuania , Cyprus , Finland, Greece registered the largest decrease in the number of employees.

Recall that the unemployment rate in the 17 countries of the eurozone in October fell to 12.1 % from 12.2 % in September , while the experts did not predict change indicator. Within two months ( August and September) keeps unemployment at a record level of 12.2 % , and the decline is a sign the labor market recovery after the release of the most prolonged recession in the history of the eurozone.

Yen falls seventh week against the U.S. dollar on the eve of the U.S. central bank meetings and Japan, which will be held next week. Expectations as to what the Federal Reserve may soon curtail the program to stimulate the economy continued to dominate the financial markets , pushing the Japanese yen to reach a new five-year low against the U.S. dollar . In today's trading in the Asian session , the dollar / yen hit Y103.93, its highest level since September 2008 .

The focus of investors still remained the upcoming Fed meeting , which is scheduled for December 17-18 . Many expect that the central bank will decide on its program minimized by buying bonds in the amount of 85 billion dollars a month. This contributed to the strengthening of the dollar against the yen. Published on Thursday strong retail sales data also pushed the U.S. currency to further growth .

Although the Fed sketched an exit plan from the current policy of "cheap money " , investors also expect further easing of monetary policy the central bank of Japan , putting more pressure on the yen .

Cpred yield between U.S. bonds and Japanese government bonds widened to a maximum since April 2011 . Yen reached a five-year low against the euro and is on track for the fifth consecutive week of decline.

During the U.S. session data released on producer prices in the U.S., which weakened the dollar . They showed that U.S. producer prices fell again last month, while fixing the third monthly decline in a row, which is the latest sign of easing inflation.

According to the report , the producer price index fell last month by 0.1 %, reflecting the continuing decline in energy prices. Basic prices , which exclude volatile components such as food and energy , rose 0.1%.

Many experts predicted that overall prices will remain unchanged after declining by 0.2 % in the previous month , and the basic prices will increase by 0.1 % , after rising 0.1 % in October.

In addition, data showed that the annual rate of producer price inflation rose moderately - by 0.7 %, compared with an increase of 0.3 % in October , but still remained historically weak. Add that economists were expecting a little more growth , namely at the level of 0.8%.

Today's report underscores the weak demand in the U.S. and abroad constrains core inflation. Producer prices may give a sense of where the inflation at the consumer level , as firms can charge higher prices for goods and services to offset their own cost increases.

Reducing inflation is putting pressure on the Fed , namely their decision to reduce the amount of its bond-buying program , which is designed to reduce long-term interest rates and stimulate investment . Officials have discussed a few months , when it is necessary to reduce the data buying amid fears about the risks and signs that the economy is gaining momentum.

European stocks were little changed, with the Stoxx Europe 600 Index posting a second weekly drop, as investors awaited next week’s Federal Reserve meeting, and as gains in AstraZeneca Plc offset PSA Peugeot Citroen’s slide.

The Stoxx 600 fell 0.2 percent to 309.75 at the close of trading. The regional benchmark has retreated 2.1 percent this week as U.S. economic data fueled speculation the Fed could slow the pace of bond buying sooner than forecast.

About 34 percent of economists surveyed on Dec. 6 by Bloomberg predicted that the U.S. central bank may reduce its $85 billion of monthly bond purchases at its Dec. 17-18 meeting, up from 17 percent in a Nov. 8 poll.

National benchmark indexes declined in 12 of the 18 western-European markets today. France’s CAC 40 lost 0.2 percent, Germany’s DAX slipped 0.1 percent and the U.K.’s FTSE 100 dropped 0.1 percent.

AstraZeneca Plc gained 1.8 percent to 3,518.5 pence. The benefits of the new diabetes drug outweigh a potential higher risk of bladder cancer and liver toxicity, an advisory panel to the Food and Drug Administration said. The FDA is expected to decide by Jan. 11 whether to approve the treatment, known as dapagliflozin.

ARM Holdings Plc climbed 3 percent to 1,001 pence. The U.K. chip designer announced the acquisition of Geomerics, a provider of lighting technology for the gaming and entertainment industry, without giving financial details.

Home Retail Group Plc added 2.2 percent to 189.7 pence. Deutsche Bank AG raised the owner of the Argos chain to buy from hold, citing a “more buoyant consumer atmosphere.”

Peugeot declined 12 percent to 9.34 euros. General Motors, the U.S. automaker that acquired a stake in Peugeot last year, is selling its entire 7 percent holding -- 24.8 million shares - - through a private placement to institutional investors. GM is offering the shares to money managers for 10 euros to 10.25 euros apiece, according to a person with knowledge of the transaction who wasn’t authorized to speak publicly.

RSA Insurance plunged 7.2 percent to 92.5 pence, its lowest price in more than eight years. The London-based insurer added an additional 130 million pounds ($212 million) to its Irish reserves and forecast a further reduction in 2013 earnings. Chairman Martin Scicluna will lead the company until a new CEO is appointed.

Delta Lloyd NV dropped 3 percent to 17.14 euros. Goldman Sachs Group Inc. cut its rating on the biggest Dutch provider of group life insurance to neutral from buy, citing the stock’s rally. The shares have gained 39 percent this year, compared with the Stoxx Insurance 600 Index’s 20 percent increase.

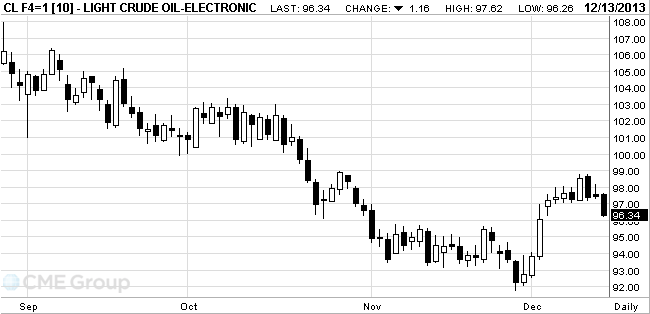

West Texas

Intermediate crude dropped to the lowest level in more than a week as falling

demand boosted fuel inventories amid concern that the Federal Reserve will curb

stimulus.

Prices slid

as much as 1.1 percent. Stockpiles of gasoline and distillate fuels, including

diesel and heating oil, jumped the most last week since Jan. 4, the Energy

Information Administration reported on Dec. 11. The Fed will start slowing its

monthly bond purchases at its Dec. 17-18 meeting, according to 34 percent of

economists surveyed Dec. 6 by Bloomberg, an increase from 17 percent in on Nov.

8.

“Demand is

weak and if we don’t see it become stronger, the market will come under pressure,”

said Gene McGillian, an analyst and broker at Tradition Energy in

WTI for

January delivery declined 84 cents, or 0.9 percent, to $96.66 a barrel at 10:07

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

3.2 percent below the 100-day average. Futures are down 1 percent this week.

Prices increased $6.98 between Nov. 27 and Dec. 11, based on intraday prices.

Brent for

January settlement, which expires on Dec. 16, dropped 29 cents, or 0.3 percent,

to $108.38 a barrel on the London-based ICE Futures Europe exchange. The

more-active February contract traded 38 cents lower at $108. The European

benchmark crude was at a $11.72 premium to WTI, compared with $11.06 yesterday.

Gold prices rose after nearly 3 percent decline in the previous two sessions, but growth may be unstable due to expectations the Fed reduce the incentives and outflows from exchange-traded funds .

Gold cheaper for the year for the first time in 13 years as investors , inspired by the growth of the world economy, prefer riskier assets .

U.S. retail sales in November rose more than expected , which increases the possibility of folding ongoing Fed bond buying program in the near future . Some analysts believe that the central bank will announce the reduction of incentives at a meeting next week.

Experts note that the growth of the labor market and changes in monetary policy will push down the gold market .

Reduced prices on Thursday brought new buyers to the Asian markets , and the >

U.S. stock-index futures advanced, as the House of Representatives passed the first bipartisan federal budget in four years.

Global markets:

Nikkei 15,403.11 +61.29 +0.40%

Hang Seng 23,245.96 +27.84 +0.12%

Shanghai Composite 2,196.07 -6.72 -0.31%

FTSE 6,443.41 -1.84 -0.03%

CAC 4,072.83 +3.71 +0.09%

DAX 9,004.46 -12.54 -0.14%

Crude oil $96.48 (-1.05%).

Gold $1231.50 (+0.54%).

USD/JPY Y102.50, Y102.70, Y103.00, Y103.25, Y103.50, Y104.00, Y105.00

EUR/JPY Y142.00

EUR/USD $1.3600, $1.3700, $1.3750, $1.3760, $1.3800, $1.3810

GBP/USD $1.6360

GBP/USD Y168.50

USD/CHF Chf0.9000

AUD/USD $0.8820, $0.8950, $0.9000, $0.9010, $0.9020, $0.9100, $0.9160

NZD/USD $0.8200, $0.8275

NZD/JPY Y84.50

USD/CAD C$1.0590, C$1.0595, C$1.0600, C$1.0615, C$1.0640, C$1.0750

Dats

4:30 Japan Industrial Production m / m (final ) October +0.5 % +0.5 % +1.0 %

4:30 Japan Industrial Production y / y (final ) October +4.7 % +4.7 % +5.4%

8:15 Switzerland PPI and import , m / m in November -0.4% +0.3 % -0.1 %

8:15 Switzerland PPI and import y / y in November -0.3% -0.3 % -0.4 %

8:45 Great Speech BOE Mark Carney

12:30 Speech UK BoE chief economist Spencer Dale

Rate of the euro fell sharply against the dollar, which has been associated with the release of the employment report in the eurozone. In statistical agency Eurostat reported that employment in the euro area remained unchanged during the third quarter. Add that employment has not changed for the second consecutive quarter . As it became known , the seasonally adjusted number of persons employed in the euro area remained unchanged at the end of the third quarter. Meanwhile, we note that the annualized employment decreased by 0.8 percent in the three months to September , which followed after falling 1.1 percent in the previous quarter .

In the European Union (EU ), employment has remained unchanged in the third quarter as it was in the second quarter . In annual terms, employment in the EU fell by 0.3 percent last quarter, compared with a fall of 0.6 percent in the second quarter .

Statistical agencies reported that among the Member States , Portugal, Ireland and Luxembourg recorded the highest rate of employment growth ( qoq ) . At the same time , Estonia, Lithuania , Cyprus , Finland, Greece registered the largest decrease in the number of employees.

Recall that the unemployment rate in the 17 countries of the eurozone in October fell to 12.1 % from 12.2 % in September , while the experts did not predict change indicator. Within two months ( August and September) keeps unemployment at a record level of 12.2 % , and the decline is a sign the labor market recovery after the release of the most prolonged recession in the history of the eurozone.

Pound fell substantially against the U.S. currency , as many market participants were waiting for the intervention of the Bank of England's Dale .

Also the focus of the market are U.S. data on producer prices , which will be presented later. After their publication in the focus of the market will be a meeting of FOMC. Recall that the Fed will hold its last meeting in 2013 on Tuesday and Wednesday next week. Data released earlier this week, was better than expected, prompting some analysts to raise GDP growth forecast in the fourth quarter by as much as half a percentage point to 2.2 percent on an annualized basis .

Also had little impact statements Andrew Haldane , executive director of the Bank of England's financial stability. He said that " the UK housing market recovery has spread to all regions of the country , but is still in the early stages ." "Now is not the time to slow down the housing market or any other market , as we are in the very early stages of recovery. But we have said that now is the time , do not push on the brake pedal , and at least loosen the gas pedal . "

Last month, the Bank of England said it would cut its support to mortgage lending in the UK in response to growing concerns about a sharp rise in activity in the housing sector , which , ultimately , can create trouble for banks and borrowers.

.

EUR / USD: during the European session, the pair fell to $ 1.3706 , but later recovered slightly

GBP / USD: during the European session, the pair fell to $ 1.6260

USD / JPY: during the European session, the pair rose to Y103.93, then fell to Y103.35

At 13:30 GMT the U.S. producer price index will be released and the producer price index excluding prices for food and energy in November.

EUR/USD

Offers $1.3850, $1.3830/35, $1.3815/20, $1.3790-805

Bids $1.3720/00, $1.3670/65, $1.3650, $1.3620

GBP/USD

Offers $1.6420/30, $1.6395/400, $1.6380, $1.6360

Bids $1.6275/70, $1.6250, $1.6240, $1.6220

AUD/USD

Offers $0.9045/50, $0.9020, $0.8980, $0.8960/70, $0.8945/50

Bids $0.8900, $0.8880, $0.8850, $0.8832

EUR/JPY

Offers Y143.50, Y143.20, Y143.00, Y142.45/50

Bids Y142.00, Y141.80, Y141.50, Y141.25/20, Y141.00

USD/JPY

Offers Y105.00, Y104.75, Y104.50, Y104.40, Y104.15/20, Y104.00

Bids Y103.20, Y103.00, Y102.77, Y102.50

EUR/GBP

Offers stg0.8500, stg0.8475/80, stg0.8440/50, stg0.8430

Bids stg0.8410, stg0.8380, stg0.8355/45, stg0.8330/20

European stocks were little changed, heading for a second weekly drop, before next week’s Federal Reserve meeting, with gains in AstraZeneca Plc (AZN) offsetting PSA Peugeot Citroen’s slide. U.S. stock-index futures rose, while Asian shares fell.

The Stoxx Europe 600 Index added 0.2 percent to 310.87 at 10:54 a.m. in London. The regional benchmark has retreated 1.8 percent so far this week as U.S. economic data fueled speculation the Fed could slow the pace of additional stimulus sooner than forecast.

“The debate about the beginning of the Fed tapering at its Dec. 17-18 meeting hangs over markets like the sword of Damocles,” said Martin Schlatter, a fund manager at Swiss Rock Asset Management AG in Zurich, which oversees about $1 billion. “We don’t expect any actions yet. Therefore we believe the current weakness should be a buying opportunity.”

AstraZeneca Plc gained 2.5 percent to 3,544.5 pence, its highest price since May 28. The benefits of the new diabetes drug outweigh a potential higher risk of bladder cancer and liver toxicity, an advisory panel to the Food and Drug Administration said. The FDA is expected to decide by Jan. 11 whether to approve the treatment, known as dapagliflozin.

ARM Holdings Plc (ARM) climbed 5.5 percent to 1,025 pence. The U.K. chip designer announced the acquisition of Geomerics, a provider of lighting technology for the gaming and entertainment industry, without giving financial details.

Home Retail Group Plc (HOME) gained 2.3 percent to 189.8 pence. Deutsche Bank AG raised the owner of the Argos chain to buy from hold, citing a “more buoyant consumer atmosphere.”

Peugeot (UG) declined 9.8 percent to 9.58 euros. General Motors, the U.S. automaker that acquired a stake in Peugeot last year, is selling its entire 7 percent holding -- 24.8 million shares - - through a private placement to institutional investors. GM is offering the shares to money managers for 10 euros to 10.25 euros apiece, according to a person with knowledge of the transaction who wasn’t authorized to speak publicly.

Delta Lloyd NV (DL) dropped 1.7 percent to 17.36 euros. Goldman Sachs Group Inc. cut its rating on the biggest Dutch provider of group life insurance to neutral from buy, citing the stock’s rally. The shares have gained 41 percent this year, compared with the Stoxx Insurance 600 Index’s 20 percent increase.

FTSE 100 6,458.14 +12.89 +0.20%

CAC 40 4,084.2 +15.08 +0.37%

DAX 9,043.19 +26.19 +0.29%

USD/JPY Y102.50, Y102.70, Y103.00, Y103.25, Y103.50, Y104.00, Y105.00

EUR/JPY Y142.00

EUR/USD $1.3600, $1.3700, $1.3750, $1.3760, $1.3800, $1.3810

GBP/USD $1.6360

GBP/USD Y168.50

USD/CHF Chf0.9000

AUD/USD $0.8820, $0.8950, $0.9000, $0.9010, $0.9020, $0.9100, $0.9160

NZD/USD $0.8200, $0.8275

NZD/JPY Y84.50

USD/CAD C$1.0590, C$1.0595, C$1.0600, C$1.0615, C$1.0640, C$1.0750

Asian stocks fell, with the regional benchmark index extending its second weekly loss, as improving U.S. economic data boosted bets the Federal Reserve will reduce stimulus as early as next week.

Nikkei 225 15,403.11 +61.29 +0.40%

Hang Seng 23,273.51 +55.39 +0.24%

S&P/ASX 200 5,098.43 +35.91 +0.71%

Shanghai Composite 2,196.07 -6.72 -0.31%

Zhaojin Mining Industry Co., China’s second-largest gold producer, declined 2.3 percent in Hong Kong as the precious metal traded near a five-month low.

Nippon Telegraph & Telephone Corp. lost 1.7 percent after the Japanese government said it plans to raise 153.3 billion yen ($1.5 billion) by selling shares in the company.

Toyota Motor Corp., Asia’s largest largest carmaker, gained 0.8 percent as the yen weakened against the dollar to the lowest since 2008, boosting the earnings outlook for Japanese exporters.

04:30 Japan Industrial Production (MoM) (Finally) October +0.5% +0.5% +1.0%

04:30 Japan Industrial Production (YoY) (Finally) October +4.7% +4.7% +5.4%

Japan’s currency headed for a seventh weekly drop against its U.S. peer before the Federal Reserve and the Bank of Japan hold policy meetings next week.

The yen also touched its lowest in five years versus the euro, set to complete a five-week decline, before European Central Bank Vice President Vitor Constancio and executive board members Benoit Coeure and Peter Praet speak today. ECB policy makers Peter Praet and Benoit Coeure are also scheduled to speak separately in Antwerp and Paris today. Praet told Bloomberg Television on Nov. 14 that the bank may adopt negative rates as it battles slow inflation. Coeure said this month the ECB would consider offering more long-term loans to banks only when they are in a position to lend to companies and households.

Australia’s dollar headed for an eight-week loss as Reserve Bank Governor Glenn Stevens signaled a weaker currency is preferable over lower interest rates. It touched a more-than-three month low of 89.14 U.S. cents after he said 85 cents ‘‘would be closer to the mark than 95 cents,’’ in an interview in the Australian Financial Review today.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3740-60

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6330-60

USD / JPY: during the Asian session, the pair rose to Y103.95

There is a much quieter calendar Friday, with even the data schedule having a Christmas feel. Early European data sees German November wholesale prices released at 0700GMT, with the Bank of France retail trade data released at 0730GMT. At 0800GMT, Spain's November final HICP numbers will cross the wires. Analysts sees the number flat on month, with the final year-on-year coming in at +0.3%. Also at 0800GMT, BOE Governor Mark Carney, BOF Governor Christian Noyer and ECB Executive Board Member Benoit Coeure attend a French Treasury Conference taking place in Paris. Further European data is expected at 1000GMT, when the EMU third quarter employment numbers are released. There are further comments from ECB officials expected at 1115GMT, when Executive Board member Peter Praet delivers a speech on "The Role of the ECB in Times of Crisis," in Antwerp, Belgium. There is little on the US calendar, with just the November PPI data expected at 0830ET. The PPI is expected to be unchanged in November after an energy-led decline in October. Core PPI is forecast to rise 0.1%. Analysts see energy prices falling in the month, while a plunge in farm prices received suggests that food prices declined in November after rebounding in October.

04:30 Japan Industrial Production (MoM) (Finally) October +0.5% +0.5% +1.0%

04:30 Japan Industrial Production (YoY) (Finally) October +4.7% +4.7% +5.4%

08:15 Switzerland Producer & Import Prices, m/m November -0.4% +0.3%

08:15 Switzerland Producer & Import Prices, y/y November -0.3% -0.3%

08:45 United Kingdom BOE Gov Mark Carney Speaks

12:30 United Kingdom BOE Chief Economist Spencer Dale Speaks

13:30 U.S. PPI, m/m November -0.2% 0.0%

13:30 U.S. PPI, y/y November +0.3% +0.8%

13:30 U.S. PPI excluding food and energy, m/m November +0.2% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y November +1.4% +1.4%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.