- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-07-2015

(raw materials / closing price /% change)

Oil 53.32 +0.53%

Gold 1,154.90 +0.12%

(index / closing price / change items /% change)

Nikkei 225 20,385.33 25,120.91 -103.10 -0.41 %

S&P/ASX 200 5,577.4 +104.23 +1.90 %

Shanghai Composite 3,926.03 -44.36 -1.12 %

FTSE 100 6,753.75 +15.80 +0.23 %

CAC 40 5,032.47 +34.37 +0.69 %

Xetra DAX 11,516.9 +32.52 +0.28 %

S&P 500 2,108.95 +9.35 +0.45 %

NASDAQ Composite 5,104.89 +33.38 +0.66 %

Dow Jones 18,053.58 +75.90 +0.42 %

(pare/closed(GMT +3)/change, %)

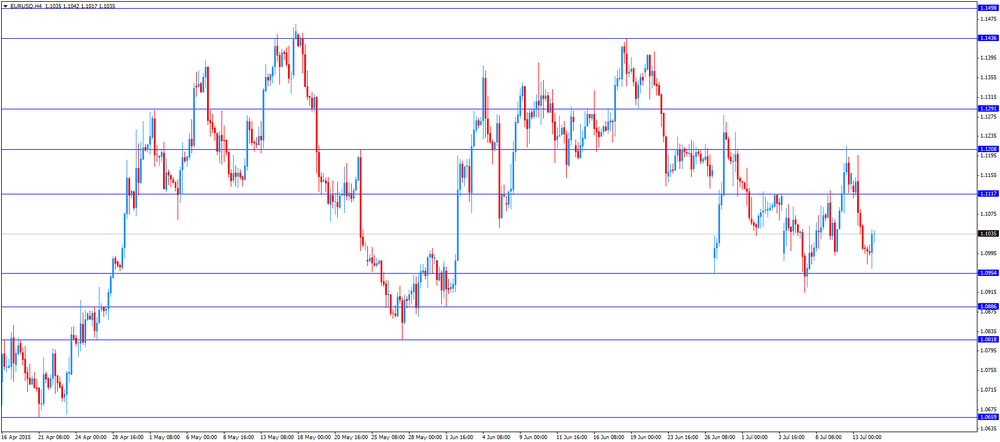

EUR/USD $1,1007 +0,02%

GBP/USD $1,5631 +0,92%

USD/CHF Chf0,945 -0,49%

USD/JPY Y123,37 -0,06%

EUR/JPY Y135,80 -0,04%

GBP/JPY Y192,83 +0,86%

AUD/USD $0,7449 +0,64%

NZD/USD $0,6707 +0,28%

USD/CAD C$1,2731 -0,05%

(time / country / index / period / previous value / forecast)

00:00 China New Loans June 900.8 1050

00:30 Australia Westpac Consumer Confidence July -6.9%

01:30 Australia New Motor Vehicle Sales (YoY) June 0.8%

01:30 Australia New Motor Vehicle Sales (MoM) June -1.3%

02:00 China Retail Sales y/y May 10.1% 10.2%

02:00 China Industrial Production y/y May 6.1% 6.0%

02:00 China Fixed Asset Investment May 11.4% 11.2%

02:00 China GDP y/y Quarter II 7.0% 6.9%

03:00 Japan BoJ Interest Rate Decision 0%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

06:45 France CPI, m/m June 0.2%

06:45 France CPI, y/y June 0.3%

08:30 United Kingdom Average Earnings, 3m/y May 2.7% 3.3%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May 2.7% 2.9%

08:30 United Kingdom ILO Unemployment Rate May 5.5% 5.5%

08:30 United Kingdom Claimant count June -6.5 -9.0

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 0.1

12:30 Canada Manufacturing Shipments (MoM) May -2.1% 0.4%

12:30 U.S. PPI, m/m June 0.5% 0.2%

12:30 U.S. PPI, y/y June -1.1% -0.9%

12:30 U.S. PPI excluding food and energy, m/m June 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y June 0.6% 0.7%

12:30 U.S. NY Fed Empire State manufacturing index July -1.98 3.5

13:15 U.S. Industrial Production (MoM) June -0.2% 0.2%

13:15 U.S. Industrial Production YoY June 1.4%

13:15 U.S. Capacity Utilization June 78.1% 78.1%

14:00 Canada Bank of Canada Rate 0.75% 0.75%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Fed Chairman Janet Yellen Speaks

14:30 U.S. Crude Oil Inventories July 0.384

16:25 U.S. FOMC Member Mester Speaks

18:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Williams Speaks

22:30 New Zealand Business NZ PMI June 51.5

22:45 New Zealand CPI, q/q Quarter II -0.3% 0.6%

22:45 New Zealand CPI, y/y Quarter II 0.1% 0.4%

Major indexes fodovye Wall Street rose slightly on Tuesday, helped boost shares of energy and technology sectors.

As it became known today, retail sales in the US fell in June, suggesting that consumer spending may weaken after recovering from a sluggish winter season sales. Sales in the retail and restaurants decreased by 0.3% compared to the previous month to a seasonally adjusted reached 442 billion. USD. In June, the Ministry of Commerce said on Tuesday. Economists had expected growth in June to 0.3%.

In addition, the prices of imported goods fell in June, recalling that a strong dollar and a weak foreign growth is constrained by the US economy. Import prices fell by a seasonally adjusted 0.1% in June compared to the previous month, the Labor Department said Tuesday. Economists had expected import prices to rise 0.1% in June from May. Over the past year, import prices fell by 10%.

At the same time, inventories rose 0.3 percent after increasing 0.4 percent in April. The increase was in line with expectations.

It is also worth noting that confidence among small business owners US worsened the end of June, while reaching lowest level in more than a year, due to expectations of lower profits and a decline in the labor market. This was reported by the National Federation of Independent Business (NFIB). According to the data, small business confidence index fell in June by 4.2 points - to 94.1 points (the lowest level since March 2014). It is worth emphasizing, we participated in the survey of 620 small businesses.

Oil prices rose moderately, after recovering from a 2 percent drop, which was caused by the news on Iran. As reported earlier, Iran reached an historic agreement with the US and five other world powers agreement on its nuclear program, said Tuesday morning the diplomats of Western countries. The successful completion of negotiations on Iran was long-standing goal of administration of US President Barack Obama, and now the White House to be many months of political struggle with opponents in Congress and in the allied countries of the Middle East.

Most components of the index DOW closed in positive territory (22 of 30). Outsider were shares Johnson & Johnson (JNJ, -0.56%). Most remaining shares rose UnitedHealth Group Incorporated (UNH, + 2.20%).

All sectors of the index S & P closed in the positive zone. Leaders of growth were the health sector (+ 1.2%).

At the close:

Dow + 0.42% 18,053.58 +75.90

Nasdaq + 0.66% 5,104.89 +33.38

S & P + 0.44% 2,108.94 +9.34

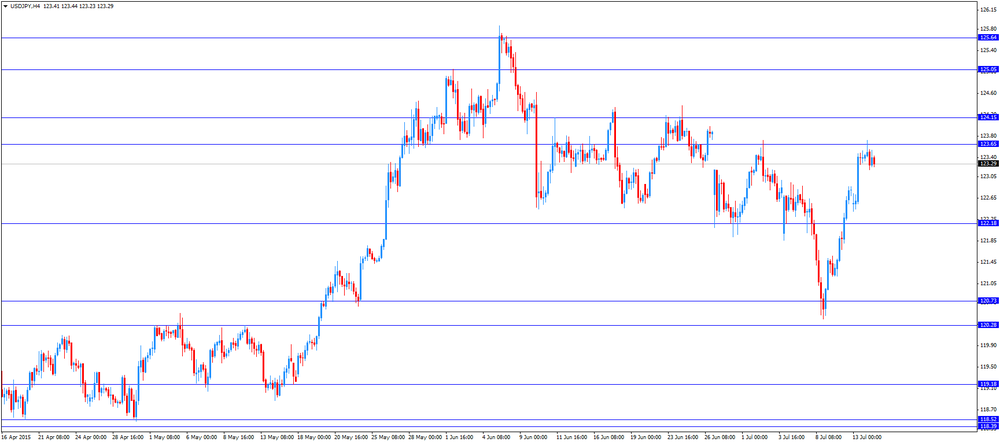

The dollar rose sharply against the euro, returning to the level of opening of the session. Analysts said pressure on the euro has a continuing concern about the situation in Greece, where the parliament should vote for tomorrow, recently reached an agreement. Prime Minister Alexis Tsipras country be until Wednesday night to push through parliament a package of radical measures, which are still absolutely unacceptable for many of his party members, but without which Athens will not be able to start negotiations with creditors and - to escape from imminent bankruptcy. Meanwhile, experts expect that the ECB will continue to fund Greek banks until the end of the negotiations on a new program of assistance. ECB Governing Council kept the amount of emergency financing programs at the level of 89 billion euros, but probably will decide to increase it after the Greek government on Wednesday approved the implementation of the necessary measures.

In the course of trading will also affect the expectations of tomorrow's speech by Federal Reserve Janet Yellen before the Senate Banking Committee to give any hints on the possible terms of a rate hike in the United States. Last week, Fed Chairman Yellen said that the central bank retains plans to raise interest rates this year, but warned that the weakness in the labor market persists. It is worth stressing, expectations of rate hikes led to the fall in gold prices by 2.5 per cent this year.

Previously, the pressure on the dollar was US data. The Commerce Department reported that sales in the retail and restaurants decreased by 0.3% compared with the previous month to a seasonally adjusted reached $ 442 billion. In June Economists had expected growth in June to 0.3%. Retail sales rose 1% in May, compared with the originally reported 1.2% gain. Sales in April were unchanged, reflecting a downward revision from the previously reported 0.2% increase. The decline last month was broad-based, with a drop in sales in several categories, including furniture and clothing stores, auto dealers in building materials and garden materials and suppliers. Excluding autos, sales fell 0.1% in June. And with the exception of gasoline sales fell by 0.4%. With the exclusion of both categories of sales decreased by 0.2% last month.

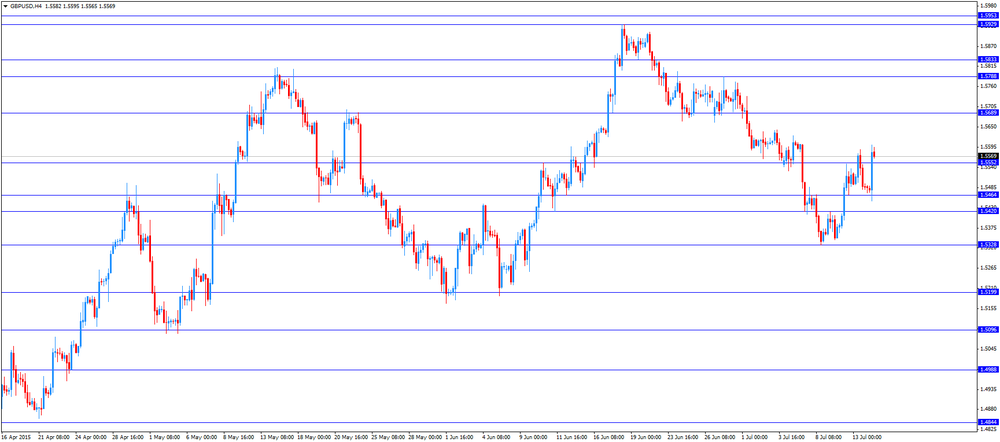

The pound has appreciated significantly against the US dollar, which was a reaction to the comments of the Bank of England. During his speech, Carney said that the moment of a rate hike is getting closer. He noted that monetary policy has become more accommodative. He added: "In the next 3 years, I do not foresee a scenario in which rates could reach historic levels." He also noted that a key factor for the growth of consumption is to increase wages, and expressed the hope that the announced in the July budget increase in the minimum wage should favorably affect performance. In the matter of productivity supported him colleague CB McCafferty. McCafferty said: "The normalization of rates may support the performance." Monetary authorities are believed to be that the pace of rate hikes will be gradual. Commenting on the inflationary dynamics, MPC member Miles said that inflation expectations are still confident enough restrained. "

A slight pressure on the pound have inflation data, which showed that the CPI remained unchanged on an annual basis in June, as expected by economists, after rising 0.1 percent in May. Core inflation, which excludes energy, food, alcoholic drinks and tobacco decreased slightly to 0.8 percent in June from 0.9 percent in May.

Major U.S. stock-indexes rose on Tuesday as energy stocks rallied and Micron Technologies (MU.O) led tech stocks higher on reports of buyout interest. Twitter (TWTR) jumped as much as 8.5% to $38.82 after a report, purportedly from Bloomberg, that the company was made a $31 billion offer. The stock quickly gave up most of its gains after Bloomberg said the report was fake. Micron jumped as much as 12.4% and was the biggest gainer on the S&P 500. China's state-backed Tsinghua Unigroup Ltd is preparing a $23 billion bid for the U.S. memory chip maker, Reuters reported, in what would be the biggest Chinese takeover of a U.S. company. Oil prices steadied after Iran and six global powers reached a landmark nuclear deal that left sanctions on the country in place for now, continuing to limit its crude exports. Oil prices had tumbled earlier on fears that the deal would ease sanctions, allowing more oil into the markets.

Almost all of Dow stocks in positive area (22 of 30). Top looser - Johnson & Johnson (JNJ, -0.76%). Top gainer - The Coca-Cola Company (KO, +1.41).

Almost all of S&P index sectors also in positive area. Top looser - Utilities (-0.1%). Top gainer - Healthcare (+0.9%).

At the moment:

Dow 17948.00 +48.00 +0.27%

S&P 500 2100.75 +6.25 +0.30%

Nasdaq 100 4518.25 +30.25 +0.67%

10-year yield 2.41% -0.02

Oil 53.00 +0.80 +1.53%

Gold 1154.90 -0.50 -0.04%

Stock indices closed slightly higher as investors are cautious if the Greek government will be able to pass a series of reforms in the Greek parliament, while Greek banks remain closed until July 15.

The deal also needs to be approved by national parliaments before talks about a bailout programme can start.

The head of the Eurogroup Jeroen Dijsselbloem said that detailed development of the new bailout programme could take about four weeks. Greece will need short-term funding. Dijsselbloem said that Eurozone finance ministers had not been able to find a solution yet.

Greece has not repaid €456 million IMF loan on Monday. On June 30, Greece failed to make €1.5 billion repayment of IMF loans.

Meanwhile, the economic data from the Eurozone was mostly weaker-than-expected. Industrial production in the Eurozone dropped 0.4% in May, missing expectations for a 0.2% gain, after a 0.1% rise in April.

The decrease was driven by a drop in energy output and non-durable consumer goods output.

On a yearly basis, Eurozone's industrial production gained 1.6% in May, missing expectations for a 1.9% rise, after a 0.9% increase in April. April's figure was revised up from a 0.8 gain.

The increase was driven by a rise in durable consumer goods, capital goods and intermediate goods.

Germany's ZEW economic sentiment index declined to 29.7 in July from 31.5 in June, missing expectations for a decline to 30.0.

"Neither the difficulties in dealing with the Greek sovereign debt crisis nor the turmoil on Chinese financial markets seem to impress the financial market experts strongly. Despite the slight decline of the indicator, the overall economic outlook for Germany remains positive," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index dropped to 42.7 in July from 53.7 in June.

German final consumer price index declined 0.1% in June, in line with the preliminary estimate, after a 0.1% rise in May.

On a yearly basis, German final consumer price index decreased to 0.3% in June from 0.3% in May, in line with the preliminary estimate. It was the highest level since October 2014.

The decline was driven by falling energy prices which dropped 5.9% year-on-year in June.

The Bank of England (BoE) Governor Mark Carney said the Treasury Select Committee on Tuesday that the time for interest rate hike is nearing. He added that interest rates would not move back to the pre-crisis levels.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.0% in June from 0.1% in May, in line with expectations.

The decrease was driven by lower food and summer clothing prices.

The BoE Governor Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices was flat in June, missing expectations for a 0.1% gain, after a 0.2% rise in May.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 0.8% in June from 0.9% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,753.75 +15.80 +0.23 %

DAX 11,516.9 +32.52 +0.28 %

CAC 40 5,032.47 +34.37 +0.69 %

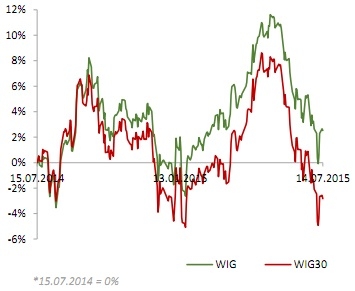

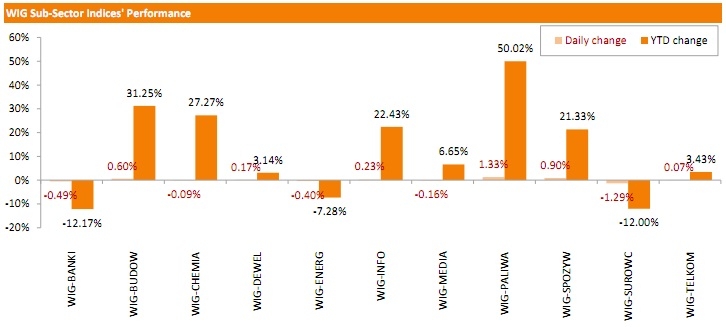

The Polish equity market finished lower Tuesday, with the broad-market measure, the WIG Index, sliding 0.14%. Sector performance in the WIG Index was mixed. Materials stocks (-1.29%) fared the worst, while oil and gas sector names (+1.33%) recorded the biggest gains.

The large-cap stocks' measure, the WIG30 Index, lost 0.28%. Within the index components, TAURON PE (WSE: TPE) fell the most, down 2.37%. It was followed by PZU (WSE: PZU) and KGHM (WSE: KGH), which corrected down 1.74% and 1.46% respectively. On the other side of the ledger, the biggest advancers were LPP (WSE: LPP), PGNIG (WSE: PGN), EUROCASH (WSE: EUR) and LOTOS (WSE: LTS), climbing 1.29%-2.77%.

Oil prices rose, recovering losses as a deal with Iran on its nuclear programme has been reached. A deal means that sanctions on Iranian crude exports will be lifted and the country sell more crude oil on the global market. The global oil market is already oversupplied. More crude oil will lead to falling oil prices.

It is not clear how long it would take for the sanctions to be lifted.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for August delivery increased to $52.31 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $58.28 a barrel on ICE Futures Europe.

Gold recovered losses after the release of the weaker-than-expected U.S retail sales data. The U.S. retail sales unexpectedly fell 0.3% in June, missing expectations for a 0.3% increase, after a 1.0% gain in May. May's figure was revised down from a 1.2% rise.

The decline was partly driven by lower automobiles and clothing stores purchases. Automobiles sales fell 1.1% in June, while sales at clothing retailers slid 1.5%, the largest fall since September 2014.

Retail sales excluding automobiles decreased 0.1% in June, missing forecasts for a 0.5% rise, after a 0.8% gain in May. May's figure was revised down from a 1.0% increase.

Market participants are awaiting a speech by the Federal Reserve Chair Janet Yellen tomorrow. Yellen said on Friday that she expects the interest rate hike by the Fed at some point this year. But she added that the U.S. labour market remains week.

August futures for gold on the COMEX today declined to 1154.60 dollars per ounce.

The Bank of England Governor Mark Carney said on Tuesday that implementing a third Greek bailout programme would require a "Herculean effort" from all sides.

"The statement by the Eurogroup leaders on Monday morning is an attempt to craft a programme that will allow ... a return to sustainable growth. I would observe that what's embedded in that statement requires Herculean efforts of all sides," he said.

"It will be tested, the scale of structural reforms, the scale of fiscal adjustment that is required. The scale of fiscal adjustment and privatisations are significant," he added.

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.3% in May, in line with expectations, after a 0.4% gain in April.

The increase was driven by a rise in wholesale inventories. Wholesale inventories climbed 0.8% in May.

Business sales climbed 0.4% in May, while retail sales rose 1.1%.

The business inventories/sales ratio remained unchanged at 1.36 months in May. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

A deal with Iran on its nuclear programme has been reached. A deal means that sanctions on Iranian crude exports will be lifted and the country sell more crude oil on the global market. The global oil market is already oversupplied. More crude oil will lead to falling oil prices.

According to a deal, UN inspectors will have access to all suspect Iranian sites.

EUR/USD: $1.0950(E1.4bn), $1.1000(E1.7bn), $1.1050(E455mn), $1.1100(E350mn)

USD/JPY: Y122.50($360mn), Y123.45($300mn), Y123.65($320mn), Y125.00($600mn)

GBP/USD: $1.5620(Gbp275mn)

AUD/USD: $0.7400(A$270mn), $0.7440-50(A$300mn)

NZD/USD: $0.6760(NZ$320mn)

USD/CAD: C$1.2600($630mn)

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index declined by 0.1% in June, missing expectations for a 0.1% increase, after a 1.2% rise in May. May's figure was revised down from a 1.3% increase.

The decline was driven by lower no-fuel import prices, which fell 0.2% in June.

Fuel import prices rose 0.7% in June.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.2% in June, after a 0.6% gain in May.

The Bank of England (BoE) Governor Mark Carney said the Treasury Select Committee on Tuesday that the time for interest rate hike is nearing.

"The point at which interest rates may begin to rise is moving closer with the performance of the economy, consistent growth above trend, a firming in domestic costs, counter-balanced somewhat by disinflation imported from abroad. Once rates begin to adjust, we expect for those adjustments to be at a gradual pace and to a limited extent," he said.

Carney added that interest rates would not move back to the pre-crisis levels.

"I do think there are a variety of factors that mean that the new normal, certainly over the policy horizon over the next three years, is substantially lower than it was previously. I see no scenario in which they would move towards historic levels," the BoE governor said.

U.S. stock-index futures were little changed while data showed sales at U.S. retailers unexpectedly dropped in June.

Nikkei 20,385.33 +295.56 +1.47%

Hang Seng 25,120.91 -103.10 -0.41%

Shanghai Composite 3,926.03 -44.36 -1.12%

FTSE 6,725.8 -12.15 -0.18%

CAC 4,989.13 -8.97 -0.18%

DAX 11,417.46 -66.92 -0.58%

Crude oil $52.13 (-0.13%)

Gold $1156.50 (+0.10%)

(company / ticker / price / change, % / volume)

| Cisco Systems Inc | CSCO | 27.80 | +0.04% | 0.5K |

| Google Inc. | GOOG | 546.79 | +0.04% | 1.1K |

| Ford Motor Co. | F | 14.65 | +0.07% | 14.6K |

| Wal-Mart Stores Inc | WMT | 73.95 | +0.09% | 1.3K |

| ALCOA INC. | AA | 10.83 | +0.09% | 3.4K |

| Starbucks Corporation, NASDAQ | SBUX | 55.75 | +0.09% | 24.5K |

| Boeing Co | BA | 146.85 | +0.16% | 0.7K |

| Visa | V | 69.64 | +0.17% | 1.9K |

| Twitter, Inc., NYSE | TWTR | 35.84 | +0.17% | 34.5K |

| Walt Disney Co | DIS | 118.31 | +0.22% | 1.1K |

| Facebook, Inc. | FB | 90.30 | +0.22% | 173.1K |

| ALTRIA GROUP INC. | MO | 51.45 | +0.23% | 1.1K |

| Exxon Mobil Corp | XOM | 82.65 | +0.28% | 3.5K |

| Procter & Gamble Co | PG | 82.26 | +0.43% | 1.4K |

| Yandex N.V., NASDAQ | YNDX | 15.40 | +0.46% | 2.4K |

| E. I. du Pont de Nemours and Co | DD | 59.80 | +0.49% | 1.7K |

| The Coca-Cola Co | KO | 40.89 | +0.57% | 15.4K |

| Barrick Gold Corporation, NYSE | ABX | 10.03 | +0.60% | 12.5K |

| Amazon.com Inc., NASDAQ | AMZN | 461.05 | +1.20% | 33.1K |

| American Express Co | AXP | 78.53 | 0.00% | 0.2K |

| Chevron Corp | CVX | 94.60 | 0.00% | 5.1K |

| International Business Machines Co... | IBM | 169.38 | 0.00% | 0.2K |

| Apple Inc. | AAPL | 125.66 | 0.00% | 122.3K |

| United Technologies Corp | UTX | 111.50 | -0.07% | 0.3K |

| General Electric Co | GE | 26.43 | -0.15% | 9.5K |

| Microsoft Corp | MSFT | 45.47 | -0.15% | 4.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 261.64 | -0.20% | 10.4K |

| Pfizer Inc | PFE | 34.73 | -0.26% | 0.8K |

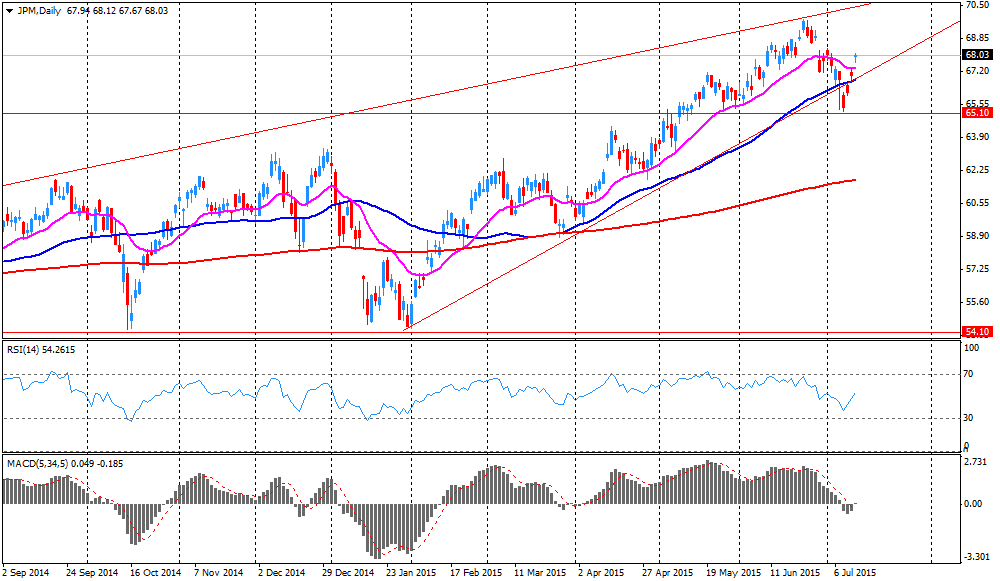

| JPMorgan Chase and Co | JPM | 67.86 | -0.34% | 540.4K |

| Goldman Sachs | GS | 209.25 | -0.41% | 3.1K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.85 | -0.41% | 2.5K |

| Yahoo! Inc., NASDAQ | YHOO | 38.59 | -0.44% | 0.1K |

| AT&T Inc | T | 34.72 | -0.46% | 13.3K |

| Home Depot Inc | HD | 114.30 | -0.52% | 8.4K |

| Johnson & Johnson | JNJ | 99.75 | -0.52% | 63.7K |

| Citigroup Inc., NYSE | C | 55.25 | -0.52% | 67.6K |

| Intel Corp | INTC | 29.51 | -0.74% | 181.6K |

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales unexpectedly fell 0.3% in June, missing expectations for a 0.3% increase, after a 1.0% gain in May. May's figure was revised down from a 1.2% rise.

The decline was partly driven by lower automobiles and clothing stores purchases. Automobiles sales fell 1.1% in June, while sales at clothing retailers slid 1.5%, the largest fall since September 2014.

Retail sales excluding automobiles decreased 0.1% in June, missing forecasts for a 0.5% rise, after a 0.8% gain in May. May's figure was revised down from a 1.0% increase.

Sales at building material and garden equipment stores were down 1.3% in June and sales at furniture stores decreased 1.6%.

Sales at electronics and appliance outlets were up 0.1% in June, whiles sales at service stations gained 0.8%.

These figures indicate that U.S. economy slowed down.

Upgrades:

Downgrades:

Intel (INTC) downgraded from Mkt Perform to Underperform at Bernstein

Other:

Hewlett-Packard (HPQ) initiated at Hold at Maxim Group, target $34

Boeing (BA) initiated at Overweight at JP Morgan

Visa (V) reiterated at Outperform at Bernstein, target raised from $77 to $81

The Italian statistical office Istat released its final consumer price inflation data on Tuesday. Final Italian consumer prices rose 0.2% in June, beating the preliminary reading of a 0.1% gain, after 0.1% rise in May.

On a yearly basis, final Italian consumer prices climbed 0.2% in June, exceeding the preliminary reading of a 0.1% gain, after a 0.1% increase in May.

Company reported Q2 profit of $1.71 per share versus $1.69 consensus. Revenues fell 8.8% year/year to $17.79 bln versus $17.78 bln consensus.

Domestic sales decreased 2.4%. International sales decreased 14.3%.

Company issued in-line guidance for FY15, raises EPS to $6.10-6.20 from $6.04-6.19 versus $6.15 consensus.

JNJ rose to $100.80 (+0.53%). on the premarket.

The Spanish statistical office INE released its final consumer price inflation data on Tuesday. Final consumer price inflation in Spain was up 0.3% in June, in line with preliminary estimate, after a 0.5% gain in May.

On a yearly basis, final consumer prices climbed by 0.1% in June from a year ago, in line with preliminary estimate, after a 0.2% decline in May. It was the first rise since last June.

Company reported Q2 profit of $1.54 per share versus $1.44 consensus. Revenues fell 3.5% year/year to $23.81 bln versus $24.31 bln consensus.

Net revenue on a U.S. GAAP basis totaled $23.8 billion for the second quarter of 2015 versus $24.1 billion for first quarter of 2015 and $24.7 billion for second quarter of 2014. Net revenue Non-GAAP was $24.5 billion, down 3%.

JPM rose to $68.30 (+0.31%). on the premarket.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence June 8 Revised From 7 10

06:00 Germany CPI, m/m (Finally) June 0.1% -0.1% -0.1%

06:00 Germany CPI, y/y (Finally) June 0.7% 0.3% 0.3%

07:15 Switzerland Producer & Import Prices, y/y June -6% -6.1%

07:15 Switzerland Producer & Import Prices, m/m June -0.8% -0.1%

08:30 United Kingdom Producer Price Index - Input (MoM) June -1.1% Revised From -0.9% -0.7% -1.3%

08:30 United Kingdom Producer Price Index - Output (MoM) June 0.1% 0.1% 0%

08:30 United Kingdom Producer Price Index - Output (YoY) June -1.6% -1.5% -1.5%

08:30 United Kingdom Producer Price Index - Input (YoY) June -12.3% Revised From -12.0% -11.8% -12.6%

08:30 United Kingdom Retail prices, Y/Y June 1% 1% 1%

08:30 United Kingdom Retail Price Index, m/m June 0.2% 0.1% 0.2%

08:30 United Kingdom HICP, m/m June 0.2% 0.1% 0.0%

08:30 United Kingdom HICP, Y/Y June 0.1% 0.0% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y June 0.9% 0.8%

09:00 Eurozone Industrial production, (MoM) May 0.1% 0.2% -0.4%

09:00 Eurozone Industrial Production (YoY) May 0.9% Revised From 0.8% 1.9% 1.6%

09:00 Eurozone ZEW Economic Sentiment July 53.7 42.7

09:00 Eurozone ECOFIN Meetings

09:00 Germany ZEW Survey - Economic Sentiment July 31.5 30 29.7

09:15 United Kingdom Inflation Report Hearings

11:45 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The U.S. retail sales are expected to rise 0.3% in June, after a 1.2% gain in May.

Retail sales excluding automobiles are expected to climb 0.5% in June, after a 1.0% increase in May.

The U.S. business inventories are expected to rise 0.3% in May, after a 0.4% gain in April.

The euro traded higher against the U.S. dollar on a deal between Greece and its lenders. The Greek government have to pass a series of reforms in the Greek parliament, while Greek banks remain closed until July 15.

The deal also needs to be approved by national parliaments before talks about a bailout programme can start.

The head of the Eurogroup Jeroen Dijsselbloem said that detailed development of the new bailout programme could take about four weeks. Greece will need short-term funding. Dijsselbloem said that Eurozone finance ministers had not been able to find a solution yet.

Greece has not repaid €456 million IMF loan on Monday. On June 30, Greece failed to make €1.5 billion repayment of IMF loans.

Meanwhile, the economic data from the Eurozone was mostly weaker-than-expected. Industrial production in the Eurozone dropped 0.4% in May, missing expectations for a 0.2% gain, after a 0.1% rise in April.

The decrease was driven by a drop in energy output and non-durable consumer goods output.

On a yearly basis, Eurozone's industrial production gained 1.6% in May, missing expectations for a 1.9% rise, after a 0.9% increase in April. April's figure was revised up from a 0.8 gain.

The increase was driven by a rise in durable consumer goods, capital goods and intermediate goods.

Germany's ZEW economic sentiment index declined to 29.7 in July from 31.5 in June, missing expectations for a decline to 30.0.

"Neither the difficulties in dealing with the Greek sovereign debt crisis nor the turmoil on Chinese financial markets seem to impress the financial market experts strongly. Despite the slight decline of the indicator, the overall economic outlook for Germany remains positive," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index dropped to 42.7 in July from 53.7 in June.

German final consumer price index declined 0.1% in June, in line with the preliminary estimate, after a 0.1% rise in May.

On a yearly basis, German final consumer price index decreased to 0.3% in June from 0.3% in May, in line with the preliminary estimate. It was the highest level since October 2014.

The decline was driven by falling energy prices which dropped 5.9% year-on-year in June.

The British pound traded higher against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney. He said on Tuesday that the time for interest rate hike is nearing.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.0% in June from 0.1% in May, in line with expectations.

The decrease was driven by lower food and summer clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices was flat in June, missing expectations for a 0.1% gain, after a 0.2% rise in May.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 0.8% in June from 0.9% the month before.

The consumer price inflation is below the Bank of England's 2% target.

The Swiss franc traded higher against the U.S. dollar after the economic data from Switzerland. Switzerland's producer and import prices fell 0.1% in June, after a 0.8% drop in May.

The Import Price Index decreased by 0.2% in June due to lower prices of products made from aluminium and copper.

On a yearly basis, producer and import prices plunged 6.1% in June, after a 6.0% drop in May.

The decline was driven by lower prices for chemical and pharmaceutical products. Prices for petroleum and petroleum products increased in May.

The Import Price Index fell by 10% year-on year in June.

EUR/USD: the currency pair rose to $1.1044

GBP/USD: the currency pair climbed to $1.5601

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Retail sales June 1.2% 0.3%

12:30 U.S. Retail sales excluding auto July 1.0% 0.5%

14:00 U.S. Business inventories May 0.4% 0.3%

17:00 United Kingdom MPC Member Miles Speaks

EUR/USD

Offers 1.1020 1.1050 1.1080 1.1100 1.1125 1.1140 1.1165 1.1180 1.1200 1.1220-25 1.1245

Bids 1.0960 1.0940 1.0925 1.0900 1.0880 1.0850 1.0825 1.0800

GBP/USD

Offers 1.5480 1.5500 1.5520 1.5545-50 1.5580 1.5600 1.5625 1.5650 1.5680 1.5700-10

Bids 1.5450 1.5425-30 1.5400 1.5380 1.5365 1.5350 1.5330 1.5300 1.5285 1.5265 2.5250

EUR/GBP

Offers 0.7120-25 0.7150 0.7170 0.7185 0.7200 0.7225-30 0.7240 0.7260

Bids 0.7085-90 0.7055-60 0.7040 0.7020 0.7000 0.6980 0.6950

EUR/JPY

Offers 136.00 136.30 136.50 136.75 137.00 137.50 137.80 138.00

Bids 135.20 135.00 134.80 134.50 134.30 134.00 133.80 133.50 133.00

USD/JPY

Offers 123.80 124.00 124.30 124.50 124.75 125.00

Bids 123.20 123.00 122.80 122.50-60 121.85 121.60 121.40 121.00

AUD/USD

Offers 0.7450 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7400 0.7380 0.7350 0.7330 0.7300

Stock indices traded lower on concerns if the Greek government will be able to pass a series of reforms in the Greek parliament, while Greek banks remain closed until July 15.

The deal also needs to be approved by national parliaments before talks about a bailout programme can start.

The head of the Eurogroup Jeroen Dijsselbloem said that detailed development of the new bailout programme could take about four weeks. Greece will need short-term funding. Dijsselbloem said that Eurozone finance ministers had not been able to find a solution yet.

Greece has not repaid €456 million IMF loan on Monday. On June 30, Greece failed to make €1.5 billion repayment of IMF loans.

Meanwhile, the economic data from the Eurozone was mostly weaker-than-expected. Industrial production in the Eurozone dropped 0.4% in May, missing expectations for a 0.2% gain, after a 0.1% rise in April.

The decrease was driven by a drop in energy output and non-durable consumer goods output.

On a yearly basis, Eurozone's industrial production gained 1.6% in May, missing expectations for a 1.9% rise, after a 0.9% increase in April. April's figure was revised up from a 0.8 gain.

The increase was driven by a rise in durable consumer goods, capital goods and intermediate goods.

Germany's ZEW economic sentiment index declined to 29.7 in July from 31.5 in June, missing expectations for a decline to 30.0.

"Neither the difficulties in dealing with the Greek sovereign debt crisis nor the turmoil on Chinese financial markets seem to impress the financial market experts strongly. Despite the slight decline of the indicator, the overall economic outlook for Germany remains positive," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index dropped to 42.7 in July from 53.7 in June.

German final consumer price index declined 0.1% in June, in line with the preliminary estimate, after a 0.1% rise in May.

On a yearly basis, German final consumer price index decreased to 0.3% in June from 0.3% in May, in line with the preliminary estimate. It was the highest level since October 2014.

The decline was driven by falling energy prices which dropped 5.9% year-on-year in June.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.0% in June from 0.1% in May, in line with expectations.

The decrease was driven by lower food and summer clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices was flat in June, missing expectations for a 0.1% gain, after a 0.2% rise in May.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 0.8% in June from 0.9% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 6,732.5 -5.45 -0.08 %

DAX 11,426.87 -57.51 -0.50 %

CAC 40 4,987.11 -10.99 -0.22 %

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.1% in June, after a 0.8% drop in May.

The Import Price Index decreased by 0.2% in June due to lower prices of products made from aluminium and copper.

On a yearly basis, producer and import prices plunged 6.1% in June, after a 6.0% drop in May.

The decline was driven by lower prices for chemical and pharmaceutical products. Prices for petroleum and petroleum products increased in May.

The Import Price Index fell by 10% year-on year in June.

Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone dropped 0.4% in May, missing expectations for a 0.2% gain, after a 0.1% rise in April.

The decrease was driven by a drop in energy output and non-durable consumer goods output. Non-durable consumer goods were down 1.4% in May, while energy output slid by 3.2%.

Intermediate goods rose by 0.1%, consumer goods climbed by 0.4%, while capital goods output increased by 1.0%.

On a yearly basis, Eurozone's industrial production gained 1.6% in May, missing expectations for a 1.9% rise, after a 0.9% increase in April. April's figure was revised up from a 0.8 gain.

The increase was driven by a rise in durable consumer goods, capital goods and intermediate goods. Durable consumer goods climbed by 4.8% in May from a year ago, capital goods rose by 4.1%, while intermediate goods output gained by 2.2%.

Non-durable consumer goods declined by 0.5%, while energy output dropped 4.2%.

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 29.7 in July from 31.5 in June, missing expectations for a decline to 30.0.

"Neither the difficulties in dealing with the Greek sovereign debt crisis nor the turmoil on Chinese financial markets seem to impress the financial market experts strongly. Despite the slight decline of the indicator, the overall economic outlook for Germany remains positive," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index dropped to 42.7 in July from 53.7 in June.

EUR/USD: $1.0950(E1.4bn), $1.1000(E1.7bn), $1.1050(E455mn), $1.1100(E350mn)

USD/JPY: Y122.50($360mn), Y123.45($300mn), Y123.65($320mn), Y125.00($600mn)

GBP/USD: $1.5620(Gbp275mn)

AUD/USD: $0.7400(A$270mn), $0.7440-50(A$300mn)

NZD/USD: $0.6760(NZ$320mn)

USD/CAD: C$1.2600($630mn)

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.0% in June from 0.1% in May, in line with expectations.

The decrease was driven by lower food and summer clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices was flat in June, missing expectations for a 0.1% gain, after a 0.2% rise in May.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 0.8% in June from 0.9% the month before.

The Retail Prices Index remained unchanged at 1.0% in June, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index declined 0.1% in June, in line with the preliminary estimate, after a 0.1% rise in May.

On a yearly basis, German final consumer price index decreased to 0.3% in June from 0.3% in May, in line with the preliminary estimate. It was the highest level since October 2014.

The decline was driven by falling energy prices which dropped 5.9% year-on-year in June.

Food prices climbed 1.0% year-on-year in June, while recreation and culture prices fell 0.6%.

The head of the Eurogroup Jeroen Dijsselbloem said that detailed development of the new bailout programme could take about four weeks. Greece will need short-term funding. Dijsselbloem said that Eurozone finance ministers had not been able to find a solution yet.

"This is very complex, we looked at a number of possibilities. We have not yet found the 'golden key' to solve this issue," he noted.

Greek banks remain closed until July 15.

"The aim is to reopen branches on Thursday," a Greek banker said.

The Greek government imposed capital controls to avert the collapse of its financial system. Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

Greece has not repaid €456 million IMF loan on Monday. On June 30, Greece failed to make €1.5 billion repayment of IMF loans.

Britain's Prime Minister David Cameron welcomed the deal between Greece and its creditors.

"What's in Britain's interest is that there is stability in the Eurozone and there isn't the threats of uncertainty and instability and I think this deal gives that sort of stability a chance. But obviously there is long way to go to put into place all the things that have been agreed," he said.

According to The Wall Street Journal, Chinese financial institutions issued about 1.27 trillion yuan of new loans in June, up from 901 billion yuan in May.

The People's Bank of China said on Tuesday that Chinese lenders extended 6.56 trillion yuan of new loans in the first half of the year.

China's M2 money supply rose 11.8% year-on-year in June, up from a 10.8% increase in May.

The U.S. Treasury Department released its federal budget data on Monday. The budget deficit turned into a surplus of $51.8 billion in June from a deficit of $82.4 billion in May.

Analysts had expect a surplus of $51 billion.

Receipts in June totalled $342.9 billion, while outlays were $291.2 billion.

West Texas Intermediate futures for August delivery dropped to $51.48 (-1.38%); Brent crude declined to $57.25 (-1.04%) as markets prepared for announcement of a deal between Iran and global powers today. An agreement would allow Iran to increase its oil exports gradually.

Meanwhile the Organization of the Petroleum Exporting Countries raised its global oil demand forecast for this year by 100,000 barrels per day to 92.61 million bpd. According to the organization's July report, demand for oil in 2016 will be 93.94 million bpd. Thus demand growth will accelerate to 1.34 million bpd in 2016 from 1.28 million bpd in 2015. At the same time the cartel reported an increase in its own production by 283,000 bpd in June, to average of 31.38 million bpd.

U.S. stocks advanced after sources reported that Greece and its lenders reached a conditional deal to receive a possible $95 billion over three years, in exchange for strict reforms including pension overhauls and sales-tax increases. This agreement eased fears of an imminent Greece's exit from the euro zone.

The Dow Jones Industrial Average gained 217.27, or 1.2%, to 17977.68 (29 components out of 30 traded higher). The S&P 500 added 22.98, or 1.1%, to 2099.60. The Nasdaq Composite Index rose 73.82, or 1.5%, to 5071.51.

In Asia this morning Hong Kong Hang Seng slid 0.58%, or 145.09 points, to 25,078.92 in a volatile session. China Shanghai Composite Index declined by 0.32%, or 12.55 points, to 3,957.84. Meanwhile the Nikkei rose 1.64%, or 328.93 points, to 20,418.70 on Greece's deal with nonferrous metals, mining and steel products leading the gains.

Euro zone officials announced a deal between Greece and its creditors. In the first 15 minutes of trading, the Nikkei advanced by 298.65 points, or 1.49%. Chinese stocks were mixed. Analysts explained that markets had rebounded for three sessions and now investors need to take a breath.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia National Australia Bank's Business Confidence June 8 10

06:00 Germany CPI, m/m (Finally) June 0.1% -0.1% -0.1%

06:00 Germany CPI, y/y (Finally) June 0.7% 0.3% 0.3%

Yesterday the dollar advanced substantially against major currencies as investors shifted their attention to Fed rate hike prospects after Greece reached a conditional agreement with its lenders and China stock market stabilized. Traders are waiting for June retail sales data due today and Fed Chair Janet Yellen speech this week.

The sterling traded in a narrow range this morning as traders prepared for Bank of England Governor Mark Carney's speech. June inflation data will be released today too.

The Australian dollar advanced slightly after the National Australia Bank's business confidence index came in at 10 in June compared to 8 reported previously (the best result since September 2013). The business conditions index rose to 11 from 6.

EUR/USD: the pair traded around $1.0975-10 in Asian trade

USD/JPY: the pair traded around Y123.40-75

GBP/USD: the pair traded around $1.5470-90

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Producer & Import Prices, y/y June -6%

07:15 Switzerland Producer & Import Prices, m/m June -0.8%

08:30 United Kingdom Producer Price Index - Input (MoM) June -0.9% -0.7%

08:30 United Kingdom Producer Price Index - Output (MoM) June 0.1% 0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) June -1.6% -1.5%

08:30 United Kingdom Producer Price Index - Input (YoY) June -12.0% -11.8%

08:30 United Kingdom Retail prices, Y/Y June 1% 1%

08:30 United Kingdom Retail Price Index, m/m June 0.2% 0.1%

08:30 United Kingdom HICP, m/m June 0.2% 0.1%

08:30 United Kingdom HICP, Y/Y June 0.1% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y June 0.9%

09:00 Eurozone Industrial production, (MoM) May 0.1% 0.2%

09:00 Eurozone Industrial Production (YoY) May 0.8% 1.9%

09:00 Eurozone ZEW Economic Sentiment July 53.7

09:00 Eurozone ECOFIN Meetings

09:00 Germany ZEW Survey - Economic Sentiment July 31.5 30

09:15 United Kingdom Inflation Report Hearings

11:45 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Import Price Index June 1.3% 0.1%

12:30 U.S. Retail sales June 1.2% 0.3%

12:30 U.S. Retail sales excluding auto July 1.0% 0.5%

14:00 U.S. Business inventories May 0.4% 0.3%

17:00 United Kingdom MPC Member Miles Speaks

20:30 U.S. API Crude Oil Inventories July -0.95

EUR / USD

Resistance levels (open interest**, contracts)

$1.1145 (870)

$1.1103 (445)

$1.1072 (102)

Price at time of writing this review: $1.0976

Support levels (open interest**, contracts):

$1.0944 (2533)

$1.0909 (3132)

$1.0862 (4461)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 46513 contracts, with the maximum number of contracts with strike price $1,1400 (3278);

- Overall open interest on the PUT options with the expiration date August, 7 is 59406 contracts, with the maximum number of contracts with strike price $1,0800 (6032);

- The ratio of PUT/CALL was 1.28 versus 1.29 from the previous trading day according to data from July, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5705 (949)

$1.5607 (1698)

$1.5512 (373)

Price at time of writing this review: $1.5465

Support levels (open interest**, contracts):

$1.5390 (1146)

$1.5294 (1331)

$1.5196 (869)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 19511 contracts, with the maximum number of contracts with strike price $1,5750 (2449);

- Overall open interest on the PUT options with the expiration date August, 7 is 21292 contracts, with the maximum number of contracts with strike price $1,5250 (2075);

- The ratio of PUT/CALL was 1.09 versus 1.08 from the previous trading day according to data from July, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.