- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-01-2015

(time / country / index / period / previous value / forecast)

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m November -0.1% +0.1%

06:30 Japan BOJ Press Conference

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Average Earnings, 3m/y November +1.4% +1.7%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y November +1.6% +1.9%

09:30 United Kingdom Claimant count December -26.9 -24.2

09:30 United Kingdom Claimant Count Rate December 2.7%

09:30 United Kingdom ILO Unemployment Rate November 6.0% 5.9%

09:30 United Kingdom Bank of England Minutes

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) January -4.9

13:30 Canada Wholesale Sales, m/m November +0.1% +0.2%

13:30 U.S. Building Permits, mln December 1.050 Revised From 1.035 1.054

13:30 U.S. Housing Starts, mln December 1.028 1.040

15:00 Canada BOC Rate Statement

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada Bank of Canada Monetary Policy Report

16:15 Canada BOC Press Conference

21:30 New Zealand Business NZ PMI December 55.2

21:30 U.S. API Crude Oil Inventories January +3.9

Stock indices traded higher on speculation the European Central Bank (ECB) will add further stimulus measures. Analysts expect that the ECB President Mario Draghi will announce on Thursday a 550 billion-euro bond-buying programme.

European stocks also benefited from the better-than-expected ZEW economic sentiment index from the Eurozone. Germany's ZEW economic sentiment index increased to 48.4 in January from 34.9 in December, exceeding expectations for a rise to 40.1.

Eurozone's ZEW economic sentiment index rose to 45.2 in January from 31.8 in December, beating expectations for a gain to 37.6.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,620.1 +34.57 +0.52%

DAX 10,257.13 +14.78 +0.14%

CAC 40 4,446.02 +51.09 +1.16%

Oil dropped after Iraqi crude production surged to a record and the International Monetary Fund cut its global growth outlook.

Crude fell as much as 5.1 percent in New York and 2.2 percent in London. Iraq is pumping 4 million barrels a day and will boost exports, Oil Minister Adel Abdul Mahdi said at a news conference in Baghdad. The IMF made the steepest reduction to its global-growth outlook since January 2012 in its quarterly global outlook yesterday. Projections for the euro area, Japan, China and Latin America were trimmed.

Oil slid more than 50 percent since June as the U.S. pumped at the fastest pace in more than three decades and the Organization of Petroleum Exporting Countries resisted calls to reduce production. Goldman Sachs Group Inc. and Societe Generale SA were among banks to reduce their price forecasts last week.

"We continue to get news of rising supplies and a shaky economy." John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone. "The surge in Iraqi production is going to add barrels to an oversupplied market. The IMF report was lousy and further crimps the demand outlook."

WTI for February delivery, which expires today, decreased $2.05, or 4.2 percent, to $46.64 a barrel at 10:46 a.m. on the New York Mercantile Exchange. The more active March contract slipped $2.03 to $47.10. WTI fell to $44.20 on Jan. 13, the lowest level since April 2009. The volume of all futures traded 72 percent above the 100-day average for the time of day.

Brent for March settlement fell 38 cents, or 0.8 percent, to $48.46 a barrel on the London-based ICE Futures Europe exchange, following a 2.7 percent drop yesterday. Volume for all futures traded was 2 percent higher than the 100-day average. The European benchmark crude traded at a $1.36 premium to the March WTI contract.

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected NAHB housing market index. The NAHB housing market index declined to 57 in January from 58 in December. December's figure was revised up from 57. Analysts had expected the index to remain at 58.

U.S. markets were closed for Martin Luther King holiday on Monday.

The euro traded lower against the U.S. dollar after the better-than-expected ZEW economic sentiment index from the Eurozone. Germany's ZEW economic sentiment index increased to 48.4 in January from 34.9 in December, exceeding expectations for a rise to 40.1.

Eurozone's ZEW economic sentiment index rose to 45.2 in January from 31.8 in December, beating expectations for a gain to 37.6.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar dropped against the U.S. dollar after the weaker-than-expected Canadian economic data. Canada's manufacturing shipments plunged 1.4% in November, missing expectations for a 0.5% decrease, after a 1.1% drop in October. October's figure was revised down from a 0.6% decline.

The New Zealand dollar declined against the U.S. dollar. In the overnight trading session, the kiwi fell against the greenback despite the solid NZIER business confidence index from New Zealand. The index rose to 23 in the fourth quarter from 19 in the third quarter.

Chinese economic data weighed on the kiwi. Chinese gross domestic product (GDP) rose by 7.3% in the fourth quarter, beating forecasts of a 7.2% gain, after a 7.3% increase in the third quarter.

China's industrial production climbed 7.9% in December, exceeding expectations for a 7.4% increase, after a 7.2% gain in November.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia. In the overnight trading session, the Aussie decreased against the greenback as Chinese economic data weighed on the Aussie.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index declined to 57 in January from 58 in December. December's figure was revised up from 57. Analysts had expected the index to remain at 58.

A level above 50.0 is considered positive, below indicates a negative outlook.

The NAHB Chairman Kevin Kelly said that "steady economic growth, rising consumer confidence and a growing labor market will help the housing market continue to move forward in 2015".

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments plunged 1.4% in November, missing expectations for a 0.5% decrease, after a 1.1% drop in October.

October's figure was revised down from a 0.6% decline.

The decline was driven by weaker motor vehicle and chemical sales. Motor vehicle sales dropped 5.9% in November, while chemical sales declined 3.6%.

The International Monetary Fund cut its outlook for Canada's growth late Monday. It expect that Canada's economy will expand 2.3% this year, down from 2.4%.

The International Monetary Fund (IMF) cut its forecasts for global growth. It expects the world economy to expand 3.5% in 2015, down from an earlier projected 3.8% rise, and 3.7% in 2016, down from an earlier projected 4.0% gain.

The IMF expects that an economic slowdown in most major economies will outweigh the boost from lower oil prices.

The IMF estimates that Eurozone's economy will expand 1.2% this year and 1.4% in 2016.

U.S. stock-index futures advanced as China's economy grew more than forecast and investors speculated the European Central Bank will boost stimulus.

Global markets:

Nikkei 17,366.3 +352.01 +2.07%

Hang Seng 23,951.16 +212.67 +0.90%

Shanghai Composite 3,173.93 +57.58 +1.85%

FTSE 6,634.31 +48.78 +0.74%

CAC 4,454.59 +59.66 +1.36%

DAX 10,261.97 +19.62 +0.19%

Crude oil $47.21 (-3.04%)

Gold $1286.30 (+0.74%)

(company / ticker / price / change, % / volume)

| Goldman Sachs | GS | 177.34 | +0.06% | 1.2K |

| Exxon Mobil Corp | XOM | 91.29 | +0.19% | 15.8K |

| Merck & Co Inc | MRK | 63.15 | +0.19% | 0.6K |

| Microsoft Corp | MSFT | 46.35 | +0.24% | 7.4K |

| The Coca-Cola Co | KO | 42.64 | +0.26% | 2.5K |

| International Business Machines Co... | IBM | 157.57 | +0.27% | 1K |

| McDonald's Corp | MCD | 91.75 | +0.28% | 19.2K |

| Pfizer Inc | PFE | 32.91 | +0.34% | 23.0K |

| Walt Disney Co | DIS | 95.50 | +0.34% | 0.6K |

| Facebook, Inc. | FB | 75.44 | +0.35% | 50.7K |

| 3M Co | MMM | 162.59 | +0.36% | 1.3K |

| JPMorgan Chase and Co | JPM | 56.15 | +0.39% | 16.3K |

| Hewlett-Packard Co. | HPQ | 38.50 | +0.42% | 23.4K |

| Home Depot Inc | HD | 104.58 | +0.44% | 2.8K |

| Verizon Communications Inc | VZ | 48.23 | +0.50% | 4.0K |

| Procter & Gamble Co | PG | 91.72 | +0.52% | 1.5K |

| Google Inc. | GOOG | 510.74 | +0.52% | 1.5K |

| AMERICAN INTERNATIONAL GROUP | AIG | 51.38 | +0.53% | 0.3K |

| Wal-Mart Stores Inc | WMT | 87.25 | +0.55% | 2.8K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.35 | +0.57% | 16.3K |

| Yahoo! Inc., NASDAQ | YHOO | 46.75 | +0.60% | 26.3K |

| Visa | V | 256.50 | +0.61% | 0.2K |

| Cisco Systems Inc | CSCO | 27.85 | +0.61% | 2.9K |

| UnitedHealth Group Inc | UNH | 106.42 | +0.61% | 0.6K |

| Citigroup Inc., NYSE | C | 47.90 | +0.61% | 27.4K |

| Boeing Co | BA | 131.60 | +0.63% | 0.4K |

| FedEx Corporation, NYSE | FDX | 177.88 | +0.63% | 0.6K |

| ALCOA INC. | AA | 15.38 | +0.65% | 3.0K |

| Nike | NKE | 93.60 | +0.66% | 1.5K |

| Starbucks Corporation, NASDAQ | SBUX | 81.14 | +0.66% | 0.7K |

| Tesla Motors, Inc., NASDAQ | TSLA | 194.42 | +0.70% | 13.3K |

| General Electric Co | GE | 23.76 | +0.72% | 14.1K |

| Ford Motor Co. | F | 15.13 | +0.73% | 4.2K |

| Amazon.com Inc., NASDAQ | AMZN | 292.90 | +0.74% | 1.3K |

| General Motors Company, NYSE | GM | 33.93 | +0.74% | 1.8K |

| Caterpillar Inc | CAT | 84.50 | +0.76% | 1.1K |

| HONEYWELL INTERNATIONAL INC. | HON | 99.00 | +0.79% | 26.5K |

| Twitter, Inc., NYSE | TWTR | 37.72 | +1.10% | 25.2K |

| ALTRIA GROUP INC. | MO | 53.65 | +1.13% | 4.0K |

| E. I. du Pont de Nemours and Co | DD | 75.16 | +1.23% | 1.5K |

| Apple Inc. | AAPL | 107.32 | +1.25% | 601.2K |

| Barrick Gold Corporation, NYSE | ABX | 12.21 | +3.91% | 82.0K |

| AT&T Inc | T | 33.75 | -0.15% | 25.3K |

| Chevron Corp | CVX | 104.81 | -0.29% | 11.1K |

| Intel Corp | INTC | 36.20 | -0.69% | 107.8K |

| Johnson & Johnson | JNJ | 103.00 | -1.00% | 112.8K |

| Yandex N.V., NASDAQ | YNDX | 17.45 | -2.89% | 15.7K |

Upgrades:

Downgrades:

Intel (INTC) downgraded to Mkt Underperform from Mkt Perform at JMP Securities

Yandex N.V.(YNDX) downgraded to Sell from Neutral at Goldman, target lowered from $29.30 to $14.80

Other:

Bank of America (BAC) added to Conviction Buy list at Goldman

Home Depot (HD) reiterated at Outperform at Credit Suisse, target raised from $100 to $120

Johnson & Johnson (JNJ) earned $1.27 per share in the fourth quarter, beating analysts' estimate of $1.25. Revenue in the fourth quarter decreased 0.6% year-over-year to $18.25 billion, missing analysts' estimate of $18.53 billion.

The company forecast $6.12-$6.27 per share in 2015 (analysts' estimate: $6.15 per share).

Johnson & Johnson (JNJ) shares increased to $103.25 (-0.76%) prior to the opening bell.

EUR/USD: $1.1700(E335mn)

USD/JPY: Y114.00($800mn), Y117.00($600mn), Y118.50($390mn)

GBP/USD: $1.5340(stg195mn)

USD/CHF: Chf0.9160-70($800mn)

AUD/USD: $0.7980(A$450mn), $0.8250(A$325mn)

NZD/USD: $0.7780(NZ$200mn), $0.7900(NZ$221mn)

January 20

Prior to the opening bell:

Johnson & Johnson (JNJ). Analysts' forecast: EPS $1.25, revenue $18528.16 million.

After close of trading:

IBM. Analysts' forecast: EPS $5.42, revenue $24796.50 млн.

January 21

Prior to the opening bell:

UnitedHealth (UNH). Analysts' forecast: EPS $1.50, revenue $33146.29 million.

After close of trading:

American Express (AXP). Analysts' forecast: EPS $1.39, revenue $8560.31 million.

eBay (EBAY). Analysts' forecast: EPS $0.89, revenue $4935.04 million.

January 22

Prior to the opening bell:

Travelers (TRV). Analysts' forecast: EPS $2.52, revenue $5999.82 million.

Verizon (VZ). Analysts' forecast: EPS $0.74, revenue $32645.86 million.

January 23

Prior to the opening bell:

General Electric (GE). Analysts' forecast: EPS $0.55, revenue $42121.49 million.

McDonald's (MCD). Analysts' forecast: EPS $1.23, revenue $6715.17 million.

Honeywell (HON). Analysts' forecast: EPS $1.42, revenue $10174.59 million.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Retail Sales y/y December +11.7% +11.7% +11.9%

02:00 China Industrial Production y/y December +7.2% +7.4% +7.9%

02:00 China Fixed Asset Investment December +15.8% +15.7% +15.7%

02:00 China GDP y/y Quarter IV +7.3% +7.2% +7.3%

07:00 Germany Producer Price Index (MoM) December 0.0% -0.3% -0.7%

07:00 Germany Producer Price Index (YoY) December -0.9% -1.4% -1.7%

10:00 Eurozone ZEW Economic Sentiment January 31.8 37.6 45.2

10:00 Germany ZEW Survey - Economic Sentiment January 34.9 40.1 48.4

The U.S. dollar traded mixed against the most major currencies ahead of the NAHB housing market index. The NAHB housing market index is expected to climb to 58 in January from 57 in December.

U.S. markets were closed for Martin Luther King holiday on Monday.

The euro traded mixed against the U.S. dollar after the better-than-expected ZEW economic sentiment index from the Eurozone. Germany's ZEW economic sentiment index increased to 48.4 in January from 34.9 in December, exceeding expectations for a rise to 40.1.

Eurozone's ZEW economic sentiment index rose to 45.2 in January from 31.8 in December, beating expectations for a gain to 37.6.

The British pound rose against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data. Canada's manufacturing shipments are expected to decrease 0.5% in November, after a 0.6% drop in October.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.5177

USD/JPY: the currency pair climbed to $118.78

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) November -0.6% -0.5%

15:00 U.S. FOMC Member Jerome Powell Speaks

15:00 U.S. NAHB Housing Market Index January 57 58

21:45 New Zealand CPI, q/q Quarter IV +0.3% 0.0%

21:45 New Zealand CPI, q/q Quarter IV +1.0% +0.9%

23:30 Australia Westpac Consumer Confidence January -5.7%

EUR/USD

Offers $1.1710, $1.1700, $1.1675, $1.1650

Bids $1.1500/490, $1.1450, $1.1400

GBP/USD

Offers $1.5230/35, $1.5200/10, $1.5150

Bids $1.5030, $1.5000

AUD/USD

Offers $0.8390/00, $0.8350, $0.8300, $0.8250

Bids $0.8160, $0.8150, $0.8110/00

EUR/JPY

Offers Y137.90/00, Y137.50, Y137.30

Bids Y136.00, Y135.50, Y135.00, Y134.50

USD/JPY

Offers Y119.95, Y119.00, Y118.85

Bids Y116.90, Y116.50, Y116.20/00, Y115.85

EUR/GBP

Offers stg0.7800, stg0.7745, stg0.7700

Bids stg0.7630, stg0.7600

Stock indices traded higher as speculation the European Central Bank (ECB) will add further stimulus measures still supports. Analysts expect that the ECB President Mario Draghi will announce on Thursday a 550 billion-euro bond-buying programme.

European stocks also benefited from the better-than-expected ZEW economic sentiment index from the Eurozone. Germany's ZEW economic sentiment index increased to 48.4 in January from 34.9 in December, exceeding expectations for a rise to 40.1.

Eurozone's ZEW economic sentiment index rose to 45.2 in January from 31.8 in December, beating expectations for a gain to 37.6.

Current figures:

Name Price Change Change %

FTSE 100 6,630.12 +44.59 +0.68%

DAX 10,255.01 +12.66 +0.12%

CAC 40 4,442.07 +47.14 +1.07%

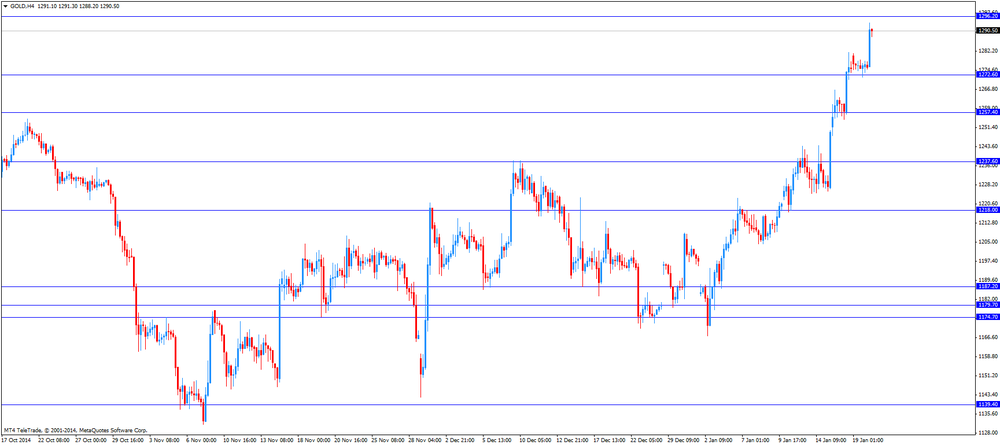

Gold prices traded higher on Tuesday. Spot gold rose to $1,293.80 a troy ounce in morning European trade. Gold price increased due to concerns over global economy. The International Monetary Fund (IMF) cut its forecasts for global growth. It expects the world economy to expand 3.5% in 2015, down from an earlier projected 3.8% rise, and 3.7% in 2016, down from an earlier projected 4.0% gain.

Gold also benefited from the Swiss National Bank's decision to discontinue the 1.20 per euro exchange rate floor.

Gold is expected to trade higher ahead of the European Central Bank (ECB) policy meeting on Thursday and parliament elections in Greece on Sunday.

Analysts expect that the ECB President Mario Draghi will announce on Thursday a 550 billion-euro bond-buying programme.

There is also speculation that Greece could leave the Eurozone. If a left-wing government wins Greek parliament elections, it may cancel austerity measures and may renegotiate Greece's debt.

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 48.4 in January from 34.9 in December, exceeding expectations for a rise to 40.1. That was the highest reading since February 2014.

The increase was driven by falling oil prices and a depreciating euro.

The ZEW President Clemens Fuest said that "news of the upcoming parliamentary elections in Greece and the Swiss National Bank's decision to abandon the euro cap on the franc's value have led to strong stock market fluctuations". Fuest added that these news "seems not to have impressed ZEW's financial market experts".

Eurozone's ZEW economic sentiment index rose to 45.2 in January from 31.8 in December, beating expectations for a gain to 37.6.

Bloomberg

HSBC Cuts GDP Outlook for 13 Oil Exporters as Price Plunges

The plunge in oil prices prompted HSBC Holdings Plc (HSBA) to cut this year's economic outlook for 13 crude exporters across central, eastern Europe and the Middle East, while singling out Turkey as the biggest winner from the slump.

Reuters

Europe shares follow Asia higher on China growth relief

(Reuters) - Shares in Europe and Asia rose on Tuesday and the dollar strengthened after China said its economy had not slowed as much as many in markets had feared.

However, the International Monetary Fund cut its forecast for global growth in 2015 by three-tenths of a percent to 3.5 percent and called on governments and central banks to pursue accommodative monetary policies and reforms.

Source:

The New York Times

On to Plan B as Oil Work Stalls in Texas

MIDLAND, Tex. - With oil prices plummeting by more than 50 percent since June, the gleeful mood of recent years has turned glum here in West Texas as the frenzy of shale oil drilling has come to a screeching halt.

Every day, oil companies are decommissioning rigs and announcing layoffs. Small companies that lease equipment have fallen behind in their payments.

U.S. markets were closed for a public holiday on Monday.

Europe's stock indices followed Asian stocks and traded higher. Speculation the European Central Bank (ECB) will add further stimulus measures and better-than-expected ZEW economic sentiment index from the Eurozone supports European stocks.

UK's FTSE 100 index was up 0.33% to 6,607.38 points. Germany's DAX 30 increased 0.23% to 10,265.55 points, while France's CAC 40 rose 0.74% to 4,427.33.

Analysts expect that the ECB President Mario Draghi will announce on Thursday a 550 billion-euro bond-buying programme.

Germany's ZEW economic sentiment index increased to 48.4 in January from 34.9 in December, exceeding expectations for a rise to 40.1.

Eurozone's ZEW economic sentiment index rose to 45.2 in January from 31.8 in December, beating expectations for a gain to 37.6.

Hong Kong's Hang Seng increased 0.90% to 23,951.16, China's Shanghai Composite rose 1.85% to 3,173.93. Asian stocks benefited from Chinese economic data. Chinese economic data weighed on the kiwi. Chinese gross domestic product (GDP) rose by 7.3% in the fourth quarter, beating forecasts of a 7.2% gain, after a 7.3% increase in the third quarter.

China's economy expanded 7.4% in 2014 (2013: +7.7%), the slowest growth since 1990.

China's industrial production climbed 7.9% in December, exceeding expectations for a 7.4% increase, after a 7.2% gain in November.

Japan's Nikkei gained 2.07% to 17,366.3 due to a weaker yen and better-than-expected Chinese GDP. The yen weakened against the greenback ahead of policy meetings at the Bank of Japan and the ECB.

EUR/USD: $1.1650(E211mn), $1.1700(E517mn), $1.1715(E639mn)

GBP/USD: $1.5300(stg231mn)

EUR/GBP: Stg0.7635(E200mn)

AUD/USD: $0.8000(A$625mn), $0.8110(A$236mn), $0.8260(A$305mn), $0.8400(A$1.68mn)

NZD/USD: $0.7850(NZ$301mn), $0.7900(NZ$372mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Retail Sales y/y December +11.7% +11.7% +11.9%

02:00 China Industrial Production y/y December +7.2% +7.4% +7.9%

02:00 China Fixed Asset Investment December +15.8% +15.7% +15.7%

02:00 China GDP y/y Quarter IV +7.3% +7.2% +7.3%

07:00 Germany Producer Price Index (MoM) December 0.0% -0.3% -0.7%

07:00 Germany Producer Price Index (YoY) December -0.9% -1.4% -1.7%

The U.S. dollar traded higher against the most major currencies. U.S. markets were closed for a public holiday yesterday.

The New Zealand dollar declined against the U.S. dollar despite the solid NZIER business confidence index from New Zealand. The index rose to 23 in the fourth quarter from 19 in the third quarter.

Chinese economic data weighed on the kiwi. Chinese gross domestic product (GDP) rose by 7.3% in the fourth quarter, beating forecasts of a 7.2% gain, after a 7.3% increase in the third quarter.

China's industrial production climbed 7.9% in December, exceeding expectations for a 7.4% increase, after a 7.2% gain in November.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia. Chinese economic data weighed on the Aussie.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair fell to $1.1567

GBP/USD: the currency pair decreased to $1.5056

USD/JPY: the currency pair rose to Y118.53

The most important news that are expected (GMT0):

10:00 Eurozone ZEW Economic Sentiment January 31.8 37.6

10:00 Germany ZEW Survey - Economic Sentiment January 34.9 40.1

13:30 Canada Manufacturing Shipments (MoM) November -0.6% -0.5%

15:00 U.S. FOMC Member Jerome Powell Speaks

15:00 U.S. NAHB Housing Market Index January 57 58

21:45 New Zealand CPI, q/q Quarter IV +0.3% 0.0%

21:45 New Zealand CPI, q/q Quarter IV +1.0% +0.9%

23:30 Australia Westpac Consumer Confidence January -5.7%

EUR / USD

Resistance levels (open interest**, contracts)

$1.1874 (3016)

$1.1783 (820)

$1.1697 (119)

Price at time of writing this review: $ 1.1571

Support levels (open interest**, contracts):

$1.1480 (6973)

$1.1432 (5816)

$1.1375 (4076)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 56208 contracts, with the maximum number of contracts with strike price $1,2100 (5544);

- Overall open interest on the PUT options with the expiration date February, 6 is 66095 contracts, with the maximum number of contracts with strike price $1,1700 (6973);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from January, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.5308 (410)

$1.5212 (999)

$1.5117 (138)

Price at time of writing this review: $1.5073

Support levels (open interest**, contracts):

$1.4992 (912)

$1.4894 (1418)

$1.4796 (1232)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15406 contracts, with the maximum number of contracts with strike price $1,5800 (1108);

- Overall open interest on the PUT options with the expiration date February, 6 is 16390 contracts, with the maximum number of contracts with strike price $1,5100 (1632);

- The ratio of PUT/CALL was 1.06 versus 1.12 from the previous trading day according to data from January, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Light Crude 48.69 +5.28%

Gold 1,276.90 +0.96%

(index / closing price / change items /% change)

S&P/ASX 200 5,309.14 +9.90 +0.19%

SHANGHAI COMP 3,116.44 -260.05 -7.70%

HANG SENG 23,729.87 -373.65 -1.55%

FTSE 100 6,585.53 +35.26 +0.54%

CAC 40 4,394.93 +15.31 +0.35%

Xetra DAX 10,242.35 +74.58 +0.73%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1603 +0,30%

GBP/USD $1,5111 -0,30%

USD/CHF Chf0,8795 +2,64%

USD/JPY Y117,55 -0,04%

EUR/JPY Y136,43 +0,29%

GBP/JPY Y177,62 -0,35%

AUD/USD $0,8210 -0,30%

NZD/USD $0,7780 -0,06%

USD/CAD C$1,1939 -0,22%

(time / country / index / period / previous value / forecast)

02:00 China Retail Sales y/y December +11.7% +11.7%

02:00 China Industrial Production y/y December +7.2% +7.4%

02:00 China Fixed Asset Investment December +15.8% +15.7%

02:00 China GDP y/y Quarter IV +7.3% +7.2%

07:00 Germany Producer Price Index (MoM) December 0.0% -0.3%

07:00 Germany Producer Price Index (YoY) December -0.9% -1.4%

10:00 Eurozone ZEW Economic Sentiment January 31.8 37.6

10:00 Germany ZEW Survey - Economic Sentiment January 34.9 40.1

13:30 Canada Manufacturing Shipments (MoM) November -0.6% -0.5%

14:00 U.S. NAHB Housing Market Index January 57 58

15:00 U.S. FOMC Member Jerome Powell Speaks

21:45 New Zealand CPI, q/q Quarter IV +0.3% 0.0%

21:45 New Zealand CPI, q/q Quarter IV +1.0% +0.9%

23:30 Australia Westpac Consumer Confidence January -5.7%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.