- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-06-2014

Gold $1,318.00 +5.30 +0.40%

ICE Brent Crude Oil $113.97 -0.84 -0.73%

NYMEX Crude Oil $106.06 -1.10 -1.03%

Nikkei 15,369.28 +19.86 +0.13%

Hang Seng 22,804.81 -389.25 -1.68%

Shanghai Composite 2,024.37 -2.31 -0.11%

S&P 1,962.61 -0.26 -0.01%

NASDAQ 4,368.68 +0.64 +0.01%

Dow 16,937.26 -9.82 -0.06%

FTSE 1,388.34 -6.64 -0.48%

CAC 4,515.57 -25.77 -0.57%

DAX 9,920.92 -66.32 -0.66%

EUR/USD $1,3604 +0,04%

GBP/USD $1,7027 +0,09%

USD/CHF Chf0,8942 -0,07%

USD/JPY Y101,90 -0,16%

EUR/JPY Y138,62 -0,12%

GBP/JPY Y173,49 -0,07%

AUD/USD $0,9422 +0,38%

NZD/USD $0,8719 +0,28%

USD/CAD C$1,0728 -0,26%

02:00 China Leading Index May +0.9%

06:00 Switzerland Trade Balance May 2.45 2.77

08:00 Germany IFO - Business Climate June 110.4 110.3

08:00 Germany IFO - Current Assessment June 114.8

08:00 Germany IFO - Expectations June 106.2

08:30 United Kingdom BBA Mortgage Approvals May 42.2 41.3

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Inflation Report Hearings

12:05 U.S. FOMC Member Charles Plosser Speaks

13:00 Belgium Business Climate June -6.8 -4.1

13:00 U.S. Housing Price Index, m/m April +0.7% +0.6%

13:00 U.S. Housing Price Index, y/y April +6.5%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April +12.4% +11.7%

14:00 U.S. Richmond Fed Manufacturing Index June 7 6

14:00 U.S. Consumer confidence June 83.0 83.6

14:00 U.S. New Home Sales May 433 442

14:00 U.S. Treasury Sec Lew Speaks

20:30 U.S. API Crude Oil Inventories June -5.7

23:50 Japan CSPI, y/y May +3.4% +3.2%

Stock indices traded lower due to the weaker-than-expected data from the Eurozone. Eurozone's manufacturing purchasing managers' index dropped to 51.9 in June from 52.2 in May. Analysts had expected the index to remain unchanged.

Eurozone's services PMI fell to 52.8 in June from 53.2 in May, missing expectations for an increase to 53.4.

Germany's manufacturing PMI climbed to 52.4 in June to from 52.3 in May, but missing expectations for a gain to 52.7.

Germany's services PMI declined to 54.8 in June from 56.0 in May. Analysts had forecasted a decrease to 55.8.

The French manufacturing PMI fell to 47.8 in June from 49.6 in May. Analysts had expected the index to remain unchanged.

The French services PMI decreased to 48.2 in June from 49.1 in May, missing expectation for an increase to 49.5.

Concerns over violence in Iraq also weighed on stock markets.

Alstom SA shares declined 3.9%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,800.56 -24.64 -0.36%

DAX 9,920.92 -66.32 -0.66%

CAC 40 4,515.57 -25.77 -0.57%

Brent traded near the highest level since September and West Texas Intermediate was little changed as militants in Iraq seized more territory and President Barack Obama warned that the crisis may spill over into other countries.

Brent futures climbed as much as 0.7 percent in London. Fighters from the Islamic State in Iraq and the Levant took control of Iraq's border crossings with Jordan and Syria, Hameed Ahmed Hashim, a member of the Anbar provincial council, said by phone yesterday. A Chinese manufacturing gauge rose to a seven-month high in June, indicating that the economy of the world's second-biggest oil user may be picking up.

"We see further price gains, regardless of the fact that oil supply remains unaffected" in Iraq, Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt, said by e-mail. "It's fear that drives prices up, not real supply disruptions. The latter remain very unlikely."

Brent for August settlement advanced as much as 85 cents to $115.66 a barrel on the London-based ICE Futures Europe exchange and was at $114.83 at 1:37 p.m. London time. The grade traded at $115.71 on June 19, the highest since Sept. 9. Prices have gained 3.6 percent this year. The European benchmark crude was at a premium of $8.04 to WTI on ICE, from $7.98 on June 20.

WTI for August delivery rose as much as 62 cents to $107.45 a barrel in electronic trading on the New York Mercantile Exchange. The July contract expired at $107.26 on June 20. The volume of futures traded was about 2.4 percent below the 100-day average for the time of day.

The U.S. dollar traded mixed against the most major currencies after the U.S. manufacturing purchasing managers' index and existing home sales. The existing home sales rose 4.9% to 4.89 million units in May from 4.66 million in April. That was the highest monthly increase since August 2011.

April's figures were revised up to a rate of 4.66 million from 4.65 million. Analysts had expected an increase to 4.74 million units.

The U.S. manufacturing purchasing managers' index climbed to 57.5 in June from 56.4 in May, beating expectations for a decline to 56.1.

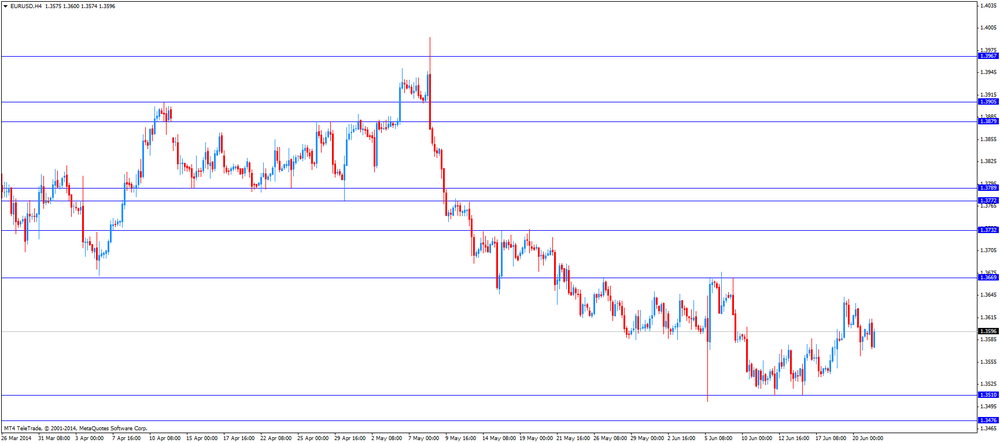

The euro traded slightly lower against the U.S. dollar after the weaker-than-expected data from the Eurozone. Eurozone's manufacturing purchasing managers' index dropped to 51.9 in June from 52.2 in May. Analysts had expected the index to remain unchanged.

Eurozone's services PMI fell to 52.8 in June from 53.2 in May, missing expectations for an increase to 53.4.

Germany's manufacturing PMI climbed to 52.4 in June to from 52.3 in May, but missing expectations for a gain to 52.7.

Germany's services PMI declined to 54.8 in June from 56.0 in May. Analysts had forecasted a decrease to 55.8.

The French manufacturing PMI fell to 47.8 in June from 49.6 in May. Analysts had expected the index to remain unchanged.

The French services PMI decreased to 48.2 in June from 49.1 in May, missing expectation for an increase to 49.5.

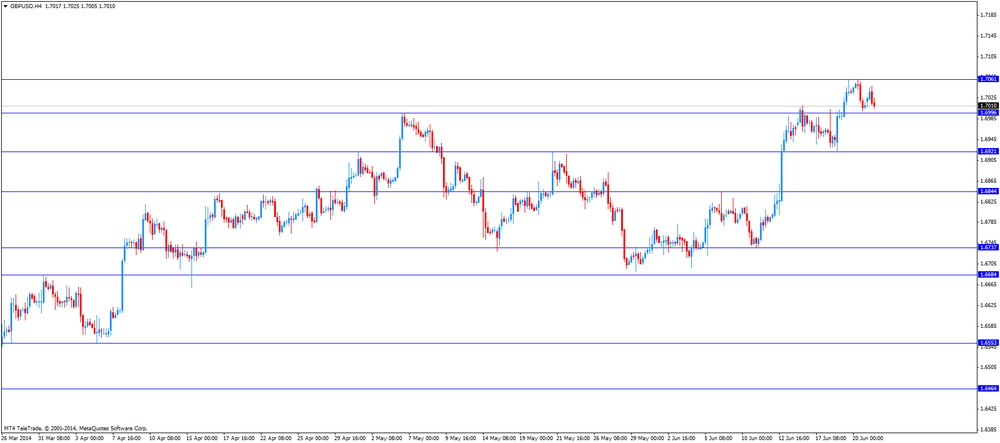

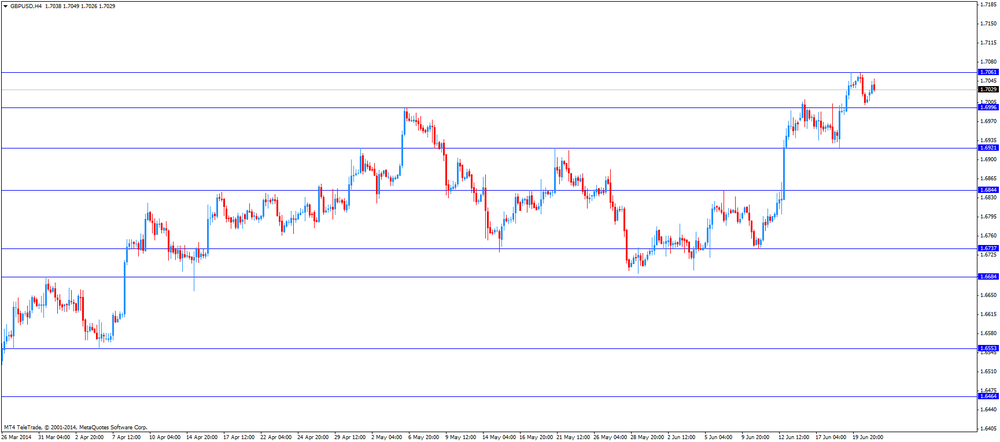

The British pound traded lower against the U.S. dollar. The Bank of England (BoE) released its latest Credit Conditions Survey on Monday. The BoE said that the demand for secured lending for house purchases and demand for corporate credit rose significantly in the second quarter. The BoE also said the demand for secured lending from household and corporates should rise in the third quarter. The BoE added that banks expect mortgage approvals to decrease significantly in the third quarter.

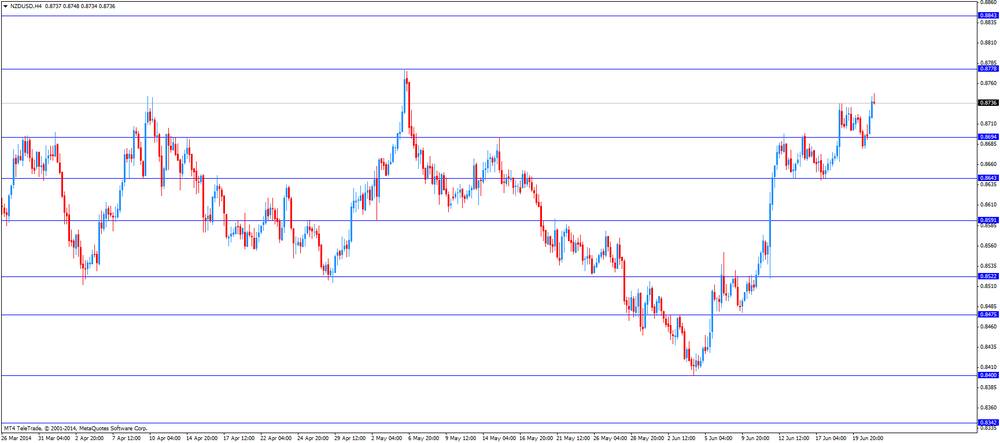

The New Zealand dollar increased against the U.S dollar due to the better-than-expected economic data from China, but later lost its gains. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The credit card spending in New Zealand rose 7.5% in May, after a 3.2% gain in April.

Westpac consumer sentiment for New Zealand declined to 121.2 in the second quarter from 121.7 the previous quarter.

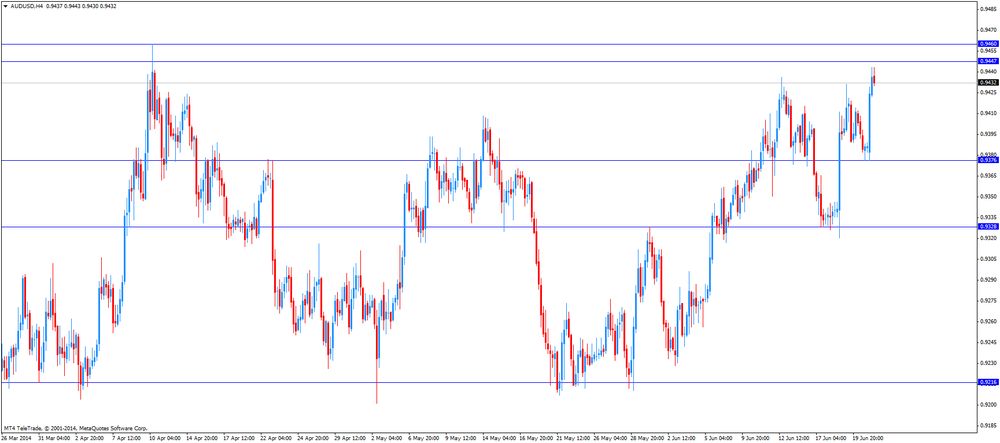

The Australian dollar climbed against the U.S. dollar due to the better-than-expected HSBC manufacturing purchasing managers' index from China, but later lost its gains. No economic reports were released in Australia.

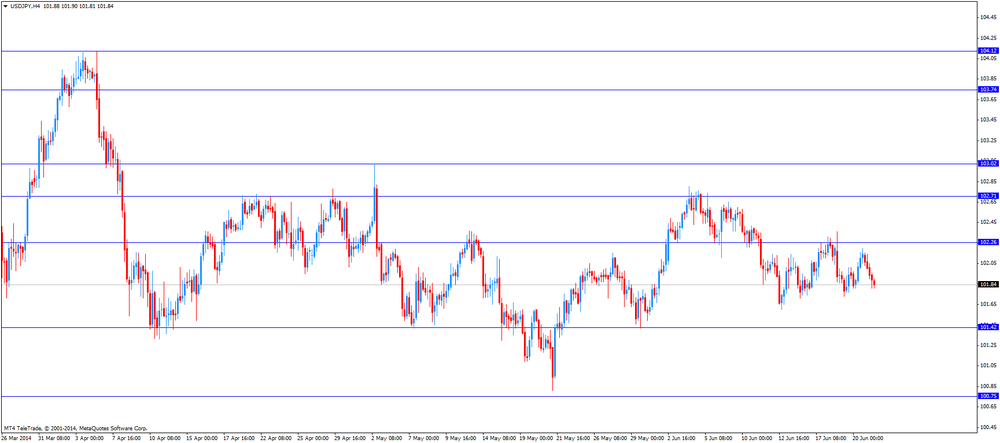

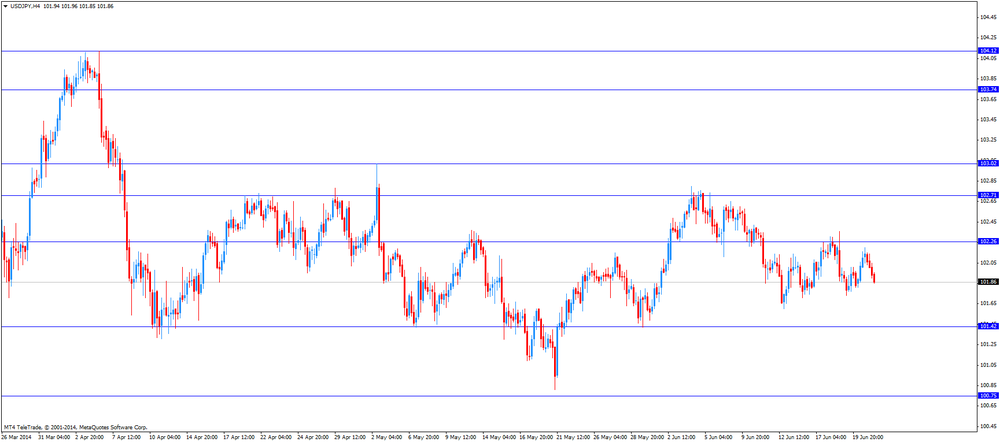

The Japanese yen traded higher against the U.S. dollar after the manufacturing purchasing managers' index. The manufacturing purchasing managers' index in Japan climbed to 51.1 in June from 49.9 in May.

The price of gold is slightly increased while as investors assess data on the U.S. housing market.

Sales in the secondary housing market increased significantly by the end of May, exceeding expectations in this, which is a sign of improvement during an important shopping season.

National Association of Realtors reported that the seasonally adjusted volume of home sales in May increased by 4.9% to an annual rate of 4.89 million units. Economists forecast a decline of this indicator to the level of 4.74 million units.

We also learned that the April sales figure was revised up to 4.66 million from 4.65 million, registering a 1.5% increase compared with the previous month. Add that it was the second consecutive monthly increase after a decline in sales in each of the first three months of the year. However, sales were down 5% compared with May last year.

Recall that the pace of home sales began to decline gradually in the middle of last year, after mortgage interest rates rose sharply. Unusually cold winter in much of the country also dampened demand. Potential buyers at the same time struggling with the rising cost of housing and limited reserves. Nevertheless, in recent years, this trend is starting to change for the better.

Today's report also showed that the average price of housing in the secondary market rose in May by 5.1% compared with last year - to $ 213,400. This was the slowest annual increase since March 2012.

The National Association of Realtors also said that inventories of homes for sale rose by 6% compared with 2013 year. At the current pace of sales, require 5.6 months to exhaust the entire stock.

The cost of the August gold futures on the COMEX today rose to $ 1318.8 per ounce.

The National Association of Realtors released the existing home sales in the U.S. The existing home sales rose 4.9% to 4.89 million units in May from 4.66 million in April. That was the highest monthly increase since August 2011.

April's figures were revised up to a rate of 4.66 million from 4.65 million. Analysts had expected an increase to 4.74 million units.

Despite an improving trend, existing home sales were down 5% from the year-earlier level.

EUR/USD $1.3500, $1.3600, $1.3640, $1.3700

USD/JPY Y102.00, Y102.10, Y102.20, Y102.25/30, Y102.55, Y103.00, Y103.25, Y103.40

GBP/USD $1.6490

USD/CAD Cad1.0800, Cad1.0815, Cad1.0925, Cad1.0950

AUD/USD $0.9350, $0.9400

U.S. stock futures were little changed as investors considered corporate deals and awaited reports on manufacturing and home purchases.

Global markets:

Nikkei 15,369.28 +19.86 +0.13%

Hang Seng 22,804.81 -389.25 -1.68%

Shanghai Composite 2,024.37 -2.31 -0.11%

FTSE 6,809.53 -15.67 -0.23%

CAC 4,526.39 -14.95 -0.33%

DAX 9,958.06 -29.18 -0.29%

Crude oil $106.80 (-0.04%)

Gold $1314.80 (-0.14%)

(company / ticker / price / change, % / volume)

| Wal-Mart Stores Inc | WMT | 75.69 | +0.01% | 0.3K |

| Walt Disney Co | DIS | 82.85 | +0.04% | 1.0K |

| Chevron Corp | CVX | 132.40 | +0.05% | 1.2K |

| Verizon Communications Inc | VZ | 49.43 | +0.08% | 8.1K |

| Pfizer Inc | PFE | 29.82 | +0.13% | 107.0K |

| Exxon Mobil Corp | XOM | 104.00 | +0.16% | 1.4K |

| AT&T Inc | T | 35.45 | +0.17% | 0.1K |

| Cisco Systems Inc | CSCO | 24.88 | +0.20% | 0.2K |

| Boeing Co | BA | 132.46 | +0.27% | 8.1K |

| Nike | NKE | 75.30 | +0.27% | 11.5K |

| Procter & Gamble Co | PG | 80.15 | +0.28% | 1.7K |

| General Electric Co | GE | 26.97 | 0.00% | 23.1K |

| Intel Corp | INTC | 30.20 | 0.00% | 4.5K |

| JPMorgan Chase and Co | JPM | 57.55 | 0.00% | 70.8K |

| Goldman Sachs | GS | 169.80 | -0.02% | 0.5K |

| 3M Co | MMM | 145.11 | -0.03% | 0.2K |

| Microsoft Corp | MSFT | 41.65 | -0.07% | 0.7K |

| Caterpillar Inc | CAT | 109.20 | -0.16% | 1.3K |

| Johnson & Johnson | JNJ | 105.10 | -0.16% | 0.5K |

| The Coca-Cola Co | KO | 41.60 | -0.22% | 0.2K |

Economic calendar (GMT0):

01:35 Japan Manufacturing PMI June 49.9 51.1

01:45 China HSBC Manufacturing PMI (Preliminary) June 49.4 49.7 50.8

03:00 New Zealand Credit Card Spending May +3.2% +7.5%

06:00 Japan BOJ Governor Haruhiko Kuroda Speaks

06:58 France Manufacturing PMI (Preliminary) June 49.6 49.6 47.8

06:58 France Services PMI (Preliminary) June 49.1 49.5 48.2

07:28 Germany Manufacturing PMI (Preliminary) June 52.3 52.7 52.4

07:28 Germany Services PMI (Preliminary) June 56.0 55.8 54.8

07:58 Eurozone Manufacturing PMI (Preliminary) June 52.2 52.2 51.9

07:58 Eurozone Services PMI (Preliminary) June 53.2 53.4 52.8

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar traded higher against the most major currencies ahead of the U.S. manufacturing purchasing managers' index and existing home sales. The U.S. manufacturing purchasing managers' index should decline to 56.1 in June from 56.4 in May.

The existing home sales in the U.S. should rise to 4.74 million units in May after 4.65 million units in April.

The euro traded lower against the U.S. dollar after the weaker-than-expected data from the Eurozone. Eurozone's manufacturing purchasing managers' index dropped to 51.9 in June from 52.2 in May. Analysts had expected the index to remain unchanged.

Eurozone's services PMI fell to 52.8 in June from 53.2 in May, missing expectations for an increase to 53.4.

Germany's manufacturing PMI climbed to 52.4 in June to from 52.3 in May, but missing expectations for a gain to 52.7.

Germany's services PMI declined to 54.8 in June from 56.0 in May. Analysts had forecasted a decrease to 55.8.

The French manufacturing PMI fell to 47.8 in June from 49.6 in May. Analysts had expected the index to remain unchanged.

The French services PMI decreased to 48.2 in June from 49.1 in May, missing expectation for an increase to 49.5.

The British pound traded lower against the U.S. dollar. The Bank of England (BoE) released its latest Credit Conditions Survey on Monday. The BoE said that the demand for secured lending for house purchases and demand for corporate credit rose significantly in the second quarter. The BoE also said the demand for secured lending from household and corporates should rise in the third quarter. The BoE added that banks expect mortgage approvals to decrease significantly in the third quarter.

EUR/USD: the currency pair declined to $1.3573

GBP/USD: the currency pair decreased to $1.7005

USD/JPY: the currency pair declined to Y101.81

The most important news that are expected (GMT0):

13:43 U.S. Manufacturing PMI (Preliminary) June 56.4 56.1

14:00 U.S. Existing Home Sales May 4.65 4.74

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3645

Bids $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6992, $1.6980, $1.6950, $1.6910/00

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.50, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

Stock indices declined due to the weaker-than-expected data from the Eurozone. Eurozone's manufacturing purchasing managers' index dropped to 51.9 in June from 52.2 in May. Analysts had expected the index to remain unchanged.

Eurozone's services PMI fell to 52.8 in June from 53.2 in May, missing expectations for an increase to 53.4.

Germany's manufacturing PMI climbed to 52.4 in June to from 52.3 in May, but missing expectations for a gain to 52.7.

Germany's services PMI declined to 54.8 in June from 56.0 in May. Analysts had forecasted a decrease to 55.8.

The French manufacturing PMI fell to 47.8 in June from 49.6 in May. Analysts had expected the index to remain unchanged.

The French services PMI decreased to 48.2 in June from 49.1 in May, missing expectation for an increase to 49.5.

Concerns over violence in Iraq also weighed on stock markets.

Current figures:

Name Price Change Change %

FTSE 100 6,806.53 -18.67 -0.27%

DAX 9,950.63 -36.61 -0.37%

CAC 40 4,526.67 -14.67 -0.32%

EUR/USD $1.3500, $1.3600, $1.3640, $1.3700

USD/JPY Y102.00, Y102.10, Y102.20, Y102.25/30, Y102.55, Y103.00, Y103.25, Y103.40

GBP/USD $1.6490

USD/CAD Cad1.0800, Cad1.0815, Cad1.0925, Cad1.0950

AUD/USD $0.9350, $0.9400

Asian stock traded mixed after the better-than-expected economic data from China. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The manufacturing purchasing managers' index in Japan climbed to 51.1 in June from 49.9 in May.

Indexes on the close:

Nikkei 225 15,369.28 +19.86 +0.13%

Hang Seng 22,804.81 -389.25 -1.68%

Shanghai Composite 2,024.37 -2.31 -0.11%

Olympus Corp. shares rose 4.9%.

01:35 Japan Manufacturing PMI June 49.9 51.1

01:45 China HSBC Manufacturing PMI (Preliminary) June 49.4 49.7 50.8

03:00 New Zealand Credit Card Spending May +3.2% +7.5%

06:00 Japan BOJ Governor Haruhiko Kuroda Speaks

06:58 France Manufacturing PMI (Preliminary) June 49.6 49.6 47.8

06:58 France Services PMI (Preliminary) June 49.1 49.5 48.2

07:28 Germany Manufacturing PMI (Preliminary) June 52.3 52.7 52.4

07:28 Germany Services PMI (Preliminary) June 56.0 55.8 54.8

07:58 Eurozone Manufacturing PMI (Preliminary) June 52.2 52.2 51.9

07:58 Eurozone Services PMI (Preliminary) June 53.2 53.4 52.8

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained under pressure due to Fed's comments that interest rates in the U.S. will remain unchanged for a considerable time after the Fed's asset purchase program ends.

The New Zealand dollar increased against the U.S dollar due to the better-than-expected economic data from China. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The credit card spending in New Zealand rose 7.5% in May, after a 3.2% gain in April.

Westpac consumer sentiment for New Zealand declined to 121.2 in the second quarter from 121.7 the previous quarter.

The Australian dollar climbed against the U.S. dollar due to the better-than-expected HSBC manufacturing purchasing managers' index from China. No economic reports were released in Australia.

The Japanese yen gained against the U.S. dollar after the manufacturing purchasing managers' index. The manufacturing purchasing managers' index in Japan climbed to 51.1 in June from 49.9 in May.

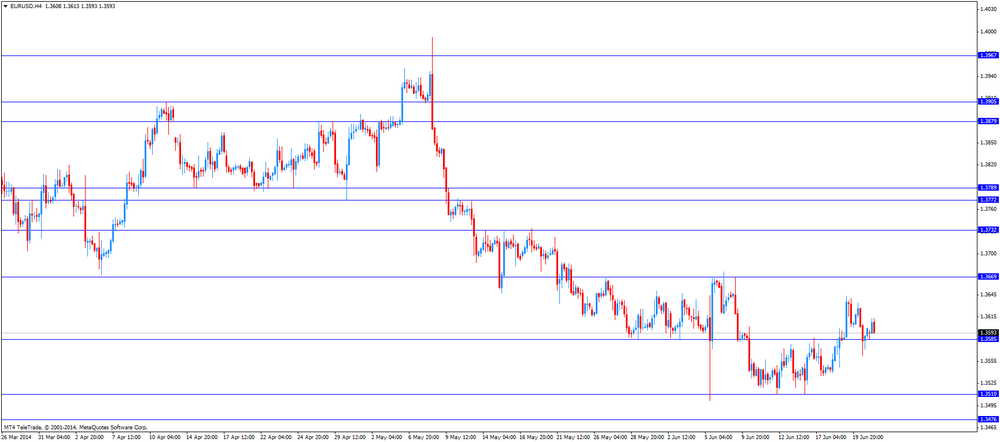

EUR/USD: the currency pair increased to $1.3610

GBP/USD: the currency pair climbed to $1.7045

USD/JPY: the currency pair declined to Y101.90

AUD/USD: the currency pair climbed to $0.9443

NZD/USD: the currency pair increased to $0.8748

The most important news that are expected (GMT0):

13:43 U.S. Manufacturing PMI (Preliminary) June 56.4 56.1

14:00 U.S. Existing Home Sales May 4.65 4.74

EUR / USD

Resistance levels (open interest**, contracts)

$1.3682 (2388)

$1.3654 (3542)

$1.3633 (1814)

Price at time of writing this review: $ 1.3607

Support levels (open interest**, contracts):

$1.3579 (1572)

$1.3542 (3966)

$1.3513 (5089)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 30803 contracts, with the maximum number of contracts with strike price $1,3700 (3836);

- Overall open interest on the PUT options with the expiration date July, 3 is 42275 contracts, with the maximum number of contracts with strike price $1,3500 (5304);

- The ratio of PUT/CALL was 1.37 versus 1.39 from the previous trading day according to data from June, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (385)

$1.7201 (2145)

$1.7102 (2195)

Price at time of writing this review: $1.7042

Support levels (open interest**, contracts):

$1.6897 (1332)

$1.6799 (1689)

$1.6700 (2252)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 119645 contracts, with the maximum number of contracts with strike price $1,7100 (2195);

- Overall open interest on the PUT options with the expiration date July, 3 is 23528 contracts, with the maximum number of contracts with strike price $1,6750 (2279);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from June, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.