- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-01-2017

(raw materials / closing price /% change)

Oil 52.94 -0.45%

Gold 1,200.40 +0.22%

(index / closing price / change items /% change)

Nikkei +269.51 19057.50 +1.43%

TOPIX +15.25 1521.58 +1.01%

Hang Seng +99.26 23049.12 +0.43%

CSI 300 +11.45 3375.90 +0.34%

Euro Stoxx 50 +44.62 3326.15 +1.36%

FTSE 100 +14.09 7164.43 +0.20%

DAX +211.11 11806.05 +1.82%

CAC 40 +47.64 4877.67 +0.99%

DJIA +155.80 20068.51 +0.78%

S&P 500 +18.30 2298.37 +0.80%

NASDAQ +55.38 5656.34 +0.99%

S&P/TSX +33.15 15643.84 +0.21%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0748 +0,16%

GBP/USD $1,2631 +0,89%

USD/CHF Chf0,9993 -0,14%

USD/JPY Y113,27 -0,45%

EUR/JPY Y121,74 -0,29%

GBP/JPY Y143,07 +0,45%

AUD/USD $0,7570 -0,13%

NZD/USD $0,7296 +0,70%

USD/CAD C$1,3069 -0,67%

07:00 Germany Gfk Consumer Confidence Survey February 9.9 10

07:00 Switzerland Trade Balance December 3.64 2.81

08:30 Eurozone ECB's Jens Weidmann Speaks

09:30 United Kingdom BBA Mortgage Approvals December 40.66 41.1

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV 0.6% 0.5%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV 2.2% 2.1%

11:00 United Kingdom CBI retail sales volume balance January 35 22

13:30 U.S. Continuing Jobless Claims 2046 2040

13:30 U.S. Initial Jobless Claims 234 247

14:45 U.S. Services PMI (Preliminary) January 53.9 54.4

15:00 U.S. Leading Indicators December 0.0% 0.5%

15:00 U.S. New Home Sales December 592 588

23:30 Japan Tokyo Consumer Price Index, y/y January 0.0% 0.0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January -0.6% -0.4%

23:30 Japan National Consumer Price Index, y/y December 0.5% 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y December -0.4% -0.3%

Major U.S. stock-indexes higher in midday trading after hitting 20,000 for the first time on Wednesday as strong earnings and President Donald Trump's pro-growth initiatives reignited a post-election rally. Trump has made several business-friendly decisions since taking office on Friday, including signing executive orders to reduce regulatory burden on domestic manufacturers and clearing the way for the construction of two oil pipelines.

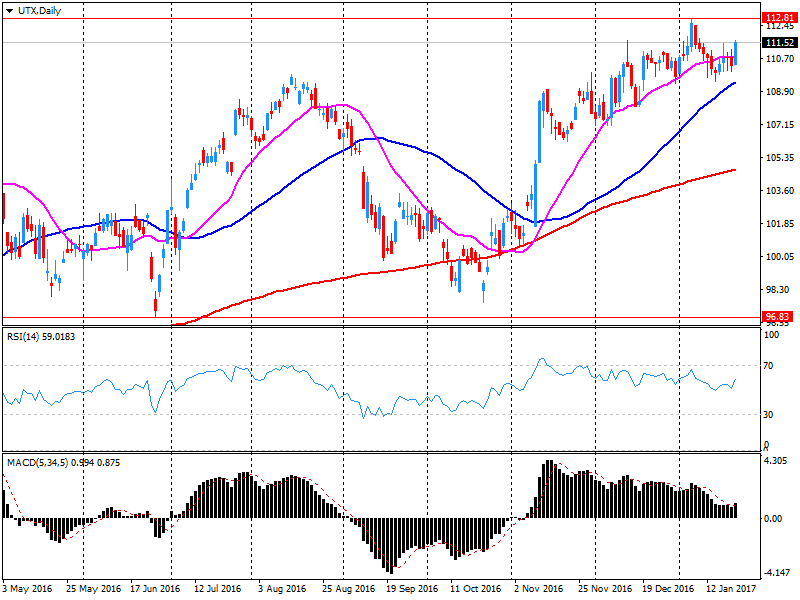

Most of Dow stocks in positive area (24 of 30). Top loser - United Technologies Corporation (UTX, -0.87%). Top gainer - The Boeing Company (BA, +4.99%).

All of S&P sectors in positive area. Top gainer - Industrial Goods (+1.2%).

At the moment:

Dow 20005.00 +161.00 +0.81%

S&P 500 2292.25 +17.75 +0.78%

Nasdaq 100 5144.25 +48.00 +0.94%

Oil 53.06 -0.12 -0.23%

Gold 1196.70 -14.10 -1.16%

U.S. 10yr 2.53 +0.06

Polish equity market enjoyed a strong run on Wednesday amid global rally. The broad market measure, the WIG index, rose by 2.77%. All sectors in the WIG gained, with banking stocks (+5.57%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 3.23%. Oil refiner LOTOS (WSE:LTS) was the sole decliner among the index components. It lost 0.61%. At the same time, all six constituents, belonging to the banking sector, were among the session's best performers with MBANK (WSE: MBK) and BZ WBK (WSE: BZW) outpacing with advances of 7.35% and 6.97%. MBANK's CEO, Cezary Stypulkowski, told the local media that there is no room to pay dividend on 2016 results. BZ WBK announced better-than-expected Q4 earnings. The bank unveiled its net earnings stood at PLN 460.9 mln in Q4, while analysts' had forecast PLN 426.1 mln. Coking coal producer JSW (WSE: JSW), footwear retailer CCC (WSE: CCC) and copper producer KGHM (WSE: KGH) also were among growth leaders, jumping by 7.08%, 4.85% and 4.29% respectively.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.8 million barrels from the previous week. At 488.3 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 6.8 million barrels last week, and are above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories remained virtually unchanged last week and are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 4.0 million barrels last week but are in the upper half of the average range. Total commercial petroleum inventories increased by 8.9 million barrels last week.

U.S. stock-index futures rose amid earnings results.

Global Stocks:

Nikkei 19,057.50 +269.51 +1.43%

Hang Seng 23,049.12 +99.26 +0.43%

Shanghai 3,149.43 +6.88 +0.22%

FTSE 7,182.11 +31.77 +0.44%

CAC 4,882.80 +52.77 +1.09%

DAX 11,784.25 +189.31 +1.63%

Crude $52.71 (-0.88%)

Gold $1,203.50 (-0.60%)

U.S. house prices rose in November, up 0.5 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.4 percent increase in October was revised downward to a 0.3 percent increase.

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From November 2015 to November 2016, house prices were up 6.1 percent.

.

The economic climate has firmed up in business-related services, for the fourth consecutive month. Although to a lesser extent, the economic situation has also firmed up again in the manufacturing industry and in the building industry, albeit more moderately than last month. By contrast, confidence among company managers has weakened in the trade sector for the second time in a row.

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 38.37 | 0.87(2.32%) | 352365 |

| ALTRIA GROUP INC. | MO | 70.94 | 0.18(0.2544%) | 5687 |

| Amazon.com Inc., NASDAQ | AMZN | 827.2 | 4.76(0.5788%) | 22782 |

| American Express Co | AXP | 235.5 | 1.82(0.7788%) | 19788 |

| AMERICAN INTERNATIONAL GROUP | AIG | 235.5 | 1.82(0.7788%) | 19788 |

| Apple Inc. | AAPL | 138.5 | 0.44(0.3187%) | 663 |

| AT&T Inc | T | 41.41 | 0.05(0.1209%) | 6313 |

| Barrick Gold Corporation, NYSE | ABX | 138.5 | 0.44(0.3187%) | 663 |

| Boeing Co | BA | 162.8 | 2.25(1.4014%) | 79537 |

| Caterpillar Inc | CAT | 97.6 | 1.36(1.4131%) | 15111 |

| Cisco Systems Inc | CSCO | 30.79 | 0.19(0.6209%) | 13806 |

| Citigroup Inc., NYSE | C | 57.46 | 0.72(1.2689%) | 69142 |

| E. I. du Pont de Nemours and Co | DD | 76.15 | 0.10(0.1315%) | 2390 |

| Facebook, Inc. | FB | 129.71 | 0.34(0.2628%) | 101700 |

| FedEx Corporation, NYSE | FDX | 191.75 | 0.14(0.0731%) | 510 |

| Ford Motor Co. | F | 235.5 | 1.82(0.7788%) | 19788 |

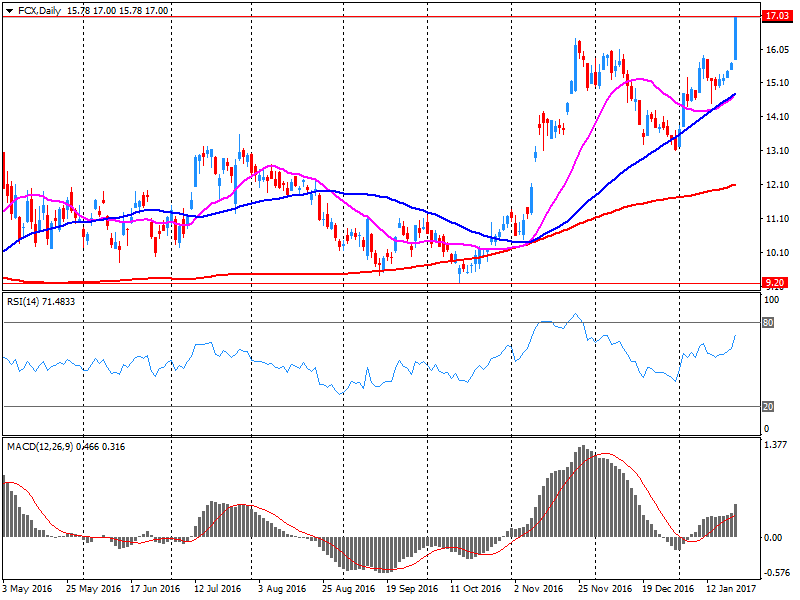

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.59 | -0.43(-2.5264%) | 2499401 |

| General Electric Co | GE | 30.19 | 0.19(0.6333%) | 54620 |

| General Motors Company, NYSE | GM | 37.56 | 0.56(1.5135%) | 12988 |

| Goldman Sachs | GS | 235.5 | 1.82(0.7788%) | 19788 |

| Google Inc. | GOOG | 829 | 5.13(0.6227%) | 5371 |

| Hewlett-Packard Co. | HPQ | 15.16 | -0.01(-0.0659%) | 1998 |

| Home Depot Inc | HD | 138.5 | 0.44(0.3187%) | 663 |

| Intel Corp | INTC | 235.5 | 1.82(0.7788%) | 19788 |

| International Business Machines Co... | IBM | 176.3 | 0.40(0.2274%) | 4748 |

| International Paper Company | IP | 56.2 | 0.30(0.5367%) | 2500 |

| Johnson & Johnson | JNJ | 76.15 | 0.10(0.1315%) | 2390 |

| Merck & Co Inc | MRK | 235.5 | 1.82(0.7788%) | 19788 |

| Microsoft Corp | MSFT | 63.97 | 0.45(0.7084%) | 21236 |

| Nike | NKE | 53.54 | 0.09(0.1684%) | 906 |

| Pfizer Inc | PFE | 235.5 | 1.82(0.7788%) | 19788 |

| Procter & Gamble Co | PG | 88 | 0.14(0.1593%) | 2877 |

| Tesla Motors, Inc., NASDAQ | TSLA | 257.75 | 3.14(1.2333%) | 40819 |

| The Coca-Cola Co | KO | 235.5 | 1.82(0.7788%) | 19788 |

| Twitter, Inc., NYSE | TWTR | 56.2 | 0.30(0.5367%) | 2500 |

| United Technologies Corp | UTX | 138.5 | 0.44(0.3187%) | 663 |

| UnitedHealth Group Inc | UNH | 235.5 | 1.82(0.7788%) | 19788 |

| Verizon Communications Inc | VZ | 76.15 | 0.10(0.1315%) | 2390 |

| Wal-Mart Stores Inc | WMT | 67.58 | 0.18(0.2671%) | 828 |

| Walt Disney Co | DIS | 108.2 | 0.30(0.278%) | 2492 |

| Yahoo! Inc., NASDAQ | YHOO | 235.5 | 1.82(0.7788%) | 19788 |

| Yandex N.V., NASDAQ | YNDX | 23.15 | -0.04(-0.1725%) | 2552 |

Upgrades:

Intl Paper (IP) upgraded to an Outperform from Market Perform at BMO Capital

Alcoa (AA) upgraded to Hold from Sell at Deutsche Bank

Alcoa (AA) upgraded to Buy from Neutral at Citigroup

Downgrades:

Verizon (VZ) downgraded to Mkt Perform from Outperform at Raymond James

Verizon (VZ) downgraded to Sector Perform at RBC Capital Mkts; target lowered to $51

Verizon (VZ) downgraded to Mkt Perform from Outperform at FBR & Co; target $52

Other:

3M (MMM) target raised to $190 from $187 at Stifel

Johnson & Johnson (JNJ) target lowered to $128 from $133 at RBC Capital Mkts

Wal-Mart (WMT) initiated with a Market Perform at Wells Fargo

Alcoa reported Q4 FY 2016 earnings of $0.14 per share, missing analysts' consensus estimate of $0.24.

The company's quarterly revenues amounted to $2.537 bln (+3.5% y/y), beating analysts' consensus estimate of $2.366 bln.

AA rose to $38.46 (+2.56%) in pre-market trading.

EUR/USD 1.0595-1.0600 (EUR 567 M) 1.0700 (EUR 214 M) 1.0715-1.0725 (EUR 339 M) 1.0750-1.0765 (EUR 309 M) 1.0800 (EUR 335 M)

USD/JPY 113.00 (USD 310 M) 113.45-113.50 (USD 224 M) 114.00-114.10 (USD 814 M) 115.00 (USD 298 M)

AUD/USD 0.7550-0.7560 (AUD 539 M)

USD/CAD 1.3000 (USD 236 M) 1.3120 (USD 290 M) 1.3185 (USD 1,430 M) 1.3190-1.3200 (USD 480 M)

Freeport-McMoRan reported Q4 FY 2016 earnings of $0.25 per share (versus -$0.02 in Q4 FY 2015), missing analysts' consensus estimate of $0.33.

The company's quarterly revenues amounted to $4.377 bln (+24.5% y/y), generally in-line with analysts' consensus estimate of $4.336 bln.

FCX fell to $16.58 (-2.59%) in pre-market trading.

Boeing reported Q4 FY 2016 earnings of $2.47 per share (versus $1.60 in Q4 FY 2015), beating analysts' consensus estimate of $2.33.

The company's quarterly revenues amounted to $23.286 bln (-1.2% y/y), generally in-line with analysts' consensus estimate of $23.129 bln.

The company also issued guidance for FY 2017, projecting EPS of $9.10-9.30 (versus analysts' consensus estimate of $9.27) and revenues of $90.5-92.5 bln (versus analysts' consensus estimate of $92.83 bln).

BA rose to $161.65 (+0.69%) in pre-market trading.

EUR/USD

Offers 1.0760 1.0780 1.0800 1.0830 1.0850-55 1.0880 1.0900

Bids 1.0720 1.0700 1.0680 1.0650 1.0625-30 1.0600 1.0580 1.0565 1.0550

GBP/USD

Offers 1.2550 1.2585 1.2600 1.2630 1.2650 1.2675-80 1.2700

Bids 1.2480-85 1.2450 1.2420 1.2400 1.2375-80 1.2350 1.2320-25 1.2300

EUR/GBP

Offers 0.8580-85 0.8600 0.8625-30 0.8650 0.8665 0.8680 0.8700

Bids 0.8530 0.8500 0.8485 0.8450 0.8400

EUR/JPY

Offers 122.30 122.50 122.80 123.00 123.50 124.00

Bids 121.80 121.60 121.20 121.00 120.80 120.50 120.00

USD/JPY

Offers 113.80-85 114.00 114.20 114.50 114.80 115.00 115.50 115.80 116.00

Bids 113.20-30 113.00 112.80 112.65 112.50 112.30 112.00 111.80 111.50

AUD/USD

Offers 0.7550-55 0.7585 0.7600 0.7630 0.7650 0.7675 0.7700

Bids 0.7520 0.7500 0.7480-85 0.7450 0.7430 0.7400

United Tech reported Q4 FY 2016 earnings of $1.56 per share (versus $1.53 in Q4 FY 2015), coinciding with analysts' consensus estimate.

The company's quarterly revenues amounted to $14.659 bln (+2.5% y/y), being generally in-line with analysts' consensus estimate of $14.710 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $6.30-6.60 (versus analysts' consensus estimate of $6.56) and revenues of +1-3% y/y to $57.5-59.0 bln (versus analysts' consensus estimate of $58.8 bln).

UTX closed Tuesday's trading session at $111.61 (+1.15%).

The survey of 461 manufacturers reveals that the volume of domestic orders rose at the fastest pace since July 2014 in the three months to January, while export orders continued to grow, but below expectations. Headcount edged higher having dipped for the first time in more than six years in the last quarter.

UK manufacturers are more optimistic about their business situation and exporting prospects, while reporting strong growth in domestic orders over the previous quarter, according to the latest quarterly CBI Industrial Trends Survey.

"The ECB's already-low forecast of 1.1 percent for core HICP this year is subject to downside risk. This analysis for core is compatible with our Rates strategists' view of long Euro zone breakeven inflation as a 2017 Top Trade, given that the dynamics of headline and core inflation are different. Their trade aims to capitalize on a normalization of an "excessive" deflation risk premium, which may also lead to a rebuilding of term premia in nominal European government bonds.

The same downside risk exists in Japan, where a large rebound in core inflation is needed for the BoJ to meet its forecast of 1.5 percent in FY2017, especially given that the appreciation of the Yen over the past year is only now feeding into the data. Special factors - large amounts of slack and periphery structural reforms in the Euro zone and entrenched low inflation expectations in Japan - will keep underlying inflation low in both places, so that further ECB tapering or a hike in the 10-year yield target from the BoJ are unlikely this year.

The "global reflation" theme has therefore drowned out what in reality are increasingly divergent fundamentals in the G10, so that what markets are calling "global reflation" is really a strengthening of the divergence theme that will ultimately drive the Dollar stronger".

Copyright © 2017 Goldman Sachs, eFXnews™

This morning, the New York futures for Brent fell 0.65% to $ 55.08 and WTI fell 0.64% to $ 52.84. Thus, the black gold prices traded in the red zone on the background of the US oil reserves growth.

US crude stocks rose 2.9 million barrels for the week ending January 20, up to 482.2 million, while analysts had expected an increase of 2.8 million barrels, according to data from the American Petroleum Institute. US domestic oil production has increased by more than 6% since mid-2016, but is still below the historical high reached in 2015, about 7%.

EUR/USD 1.0700 (1.7bln) 1.0725 (579m)

USD/JPY 112.00 (USD 795m) 113.00 (641m) 113.60 (335m) 114.00 (916m)

EUR/GBP 0.8790-0.8800 (EUR 1.1bln)

AUD/USD 0.7500 (AUD 353m) 0.7600-10 (447m) 0.7635 (298m)

USD/CAD 1.3400 (USD 290m)

Информационно-аналитический отдел TeleTrade

Sentiment among German managers weakened in January. The Ifo Business Climate Index fell to 109.8 points this month from 111.0 points in December. Companies expressed greater satisfaction with their current business situation, but are less optimistic about their six-month business outlook. The German economy made a less confident start to the year.

In the manufacturing sector, the index fell. This was due to markedly less optimistic business expectations. Manufacturers, however, were more satisfied with their current business situation. This pattern can be seen in several key branches of German manufacturing. Capacity utilisation rose by 0.3 percentage points to 86.0 percent and more manufacturers expect price increases.

-

At 10:30 GMT Germany will hold an auction of 30-year bonds

-

At 16:30 GMT the Bank of England Governor Mark Carney will deliver a speech

-

At 23:00 GMT the RBNZ Governor Graeme Wheeler will deliver a speech

-

Australia is celebrating 'Australia Day'

"We want to buy DXY below 100, which means selling EUR/USD around 1.08.

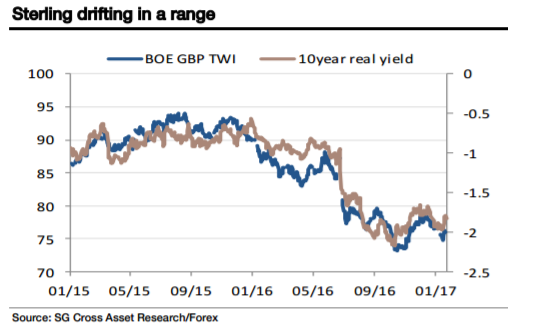

USD/JPY is trickier because the yen, lacking Europe's political headwinds, is the natural hedge against trade wars. We're still convinced that here too what happens to real yields will dominate in the end, but the Washington rhetoric needs to shift to another topic before we really dare re-engage with long USD/JPY.

With real yields edging higher, the pound doesn't look a screaming sell yet (short gilts still looks like a better long-term trade than short GBP/USD to me) and the most likely outcome from here is that the last few months' 1.20-1.28 range holds. We'd prefer better levels to get short".

Copyright © 2017 Societe Generale, eFXnews™

The UBS consumption indicator rose from 1.45 to 1.50 points in December due primarily to the strong year-end results of the Swiss automobile sector. Compared with the previous December, new car registrations were up by 8.2%. The mood in the retail sector remains pessimistic, though. Domestic tourism managed to maintain its robust November showing. Compared with December 2015, the number of overnight hotel stays rose 0.9%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0839 (2819)

$1.0803 (2402)

$1.0780 (2238)

Price at time of writing this review: $1.0716

Support levels (open interest**, contracts):

$1.0654 (1333)

$1.0604 (1834)

$1.0539 (3206)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 57585 contracts, with the maximum number of contracts with strike price $1,0750 (3668);

- Overall open interest on the PUT options with the expiration date March, 13 is 67639 contracts, with the maximum number of contracts with strike price $1,0000 (4941);

- The ratio of PUT/CALL was 1.17 versus 1.16 from the previous trading day according to data from January, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.2805 (1605)

$1.2708 (1117)

$1.2612 (1428)

Price at time of writing this review: $1.2502

Support levels (open interest**, contracts):

$1.2389 (244)

$1.2292 (1241)

$1.2194 (1102)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 19954 contracts, with the maximum number of contracts with strike price $1,2500 (2399);

- Overall open interest on the PUT options with the expiration date March, 13 is 22956 contracts, with the maximum number of contracts with strike price $1,1500 (3237);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from January, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The six month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, rose from 0.00% in November to 1.28% in December.

Westpac's Chief Economist, Bill Evans, commented, "This marks the fifth consecutive month where the growth rate in the Index is at or above trend. That followed a period of fifteen consecutive months where the growth rate had been below trend. That sustained period of below trend growth in the series had been pointing to the weakness we have seen in the economy in the September quarter (although no lead indicator could have prepared us for a negative growth print)" Mr Evans said.

-

CPI rose 0.5% this quarter, compared with a rise of 0.7% in the September quarter 2016.

-

CPI rose 1.5% over the twelve months to the December quarter 2016, compared with a rise of 1.3% over the twelve months to the September quarter 2016.

The most significant price rises this quarter are tobacco (+7.4%), automotive fuel (+6.7%), domestic holiday travel and accommodation (+5.5%) and new dwelling purchase by owner-occupiers (+0.5%).

The most significant offsetting price falls this quarter are international holiday travel and accommodation (-2.6%), accessories (-5.1%) and waters, soft drinks and juices (-3.2%).

European stocks finished modestly higher Tuesday after Britain's top court ruled the U.K. government must consult lawmakers before starting the Brexit process. The pan-European benchmark remained largely steady after the U.K. Supreme Court in an 8-3 decision upheld a High Court ruling from November. That ruling said an Act of Parliament is needed before the British government can invoke Article 50, the beginning of the process for Britain to exit the European Union.

The S&P 500 and the Nasdaq Composite closed at new records on Tuesday while the Dow Jones Industrial Average resumed its march toward the psychologically-important 20,000, finishing less than 90 points away from the elusive milestone. Gains for stocks came after a solid round of corporate earnings boosted investor sentiment, providing a catalsyt after mostly lackluster trading following President Donald Trump's inauguration on Friday.

Asian shares climbed on improved risk sentiment from both regional economic data and overnight gains in the U.S. for both stocks and the dollar. The greenback, though, has reversed some of that advance versus the yen, trading around ¥113.45 after nearly reaching ¥114 in early Asian trading.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.