- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-02-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | Germany | Gfk Consumer Confidence Survey | March | 10.8 | 10.8 |

| 07:45 | France | Consumer confidence | February | 91 | 92 |

| 09:30 | United Kingdom | BBA Mortgage Approvals | January | 38.779 | 39.2 |

| 13:30 | U.S. | Housing Starts | December | 1.256 | 1.253 |

| 13:30 | U.S. | Building Permits | December | 1.328 | 1.29 |

| 14:00 | U.S. | Housing Price Index, m/m | December | 0.4% | 0.3% |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | December | 4.7% | 4.9% |

| 14:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 15:00 | U.S. | Richmond Fed Manufacturing Index | February | -2 | 8 |

| 15:00 | U.S. | Consumer confidence | February | 120.2 | 125 |

| 15:00 | U.S. | Fed Chair Powell Speaks | |||

| 21:45 | New Zealand | Trade Balance, mln | January | 264 | -300 |

Major US stock indexes rose, helped by the rise in prices of shares of technological and industrial companies after the US president promised to postpone the increase in tariffs for Chinese imports. The market received additional support from reports of large transactions in the corporate segment.

On Sunday evening, Trump announced in a series of messages on Twitter that the United States plans to postpone the introduction of additional tariffs on Chinese goods, which were supposed to take effect in early March. In his posts, he referred to “substantial progress” in bilateral negotiations between the two largest economies in the world, including the protection of intellectual property and the transfer of technology, agriculture and currency. As a result, the president said that he would delay new tariffs, but he did not specify a new date.

In addition, speaking at the White House this morning, Trump said he was optimistic that a final trade agreement could be concluded with China, and that he plans to meet with Chinese President Xi Jinping to conclude a deal, but warned that the parties still may not reach an agreement. According to him, both sides are “very, very close” to a deal.

Trump's statements were perceived by the market as a clear signal that both parties would conclude a deal that would end a lengthy trade dispute that led to a slowdown in global growth and caused damage to the markets.

Optimism also added a message that as General Electric (GE) sells its biopharmaceutical business to Danaher for $ 21.4 billion. The news of the deal pushed GE shares up more than 6%. Meanwhile, Barrick Gold (GOLD) announced that they had made an offer for Newmont Mining to buy for $ 17.8 billion. If the deal goes through, it will create the world's largest gold producer.

Regarding macroeconomic data, the Ministry of Commerce reported that wholesale inventories rose 1.1 percent in December, after rising 0.4 percent in November (revised from +0.3 percent). Economists had expected stocks to grow by 0.3 percent. More than expected, the increase in wholesale stocks fell to stocks of durable goods, which increased by 1.5 percent in December after increasing by 0.7 percent in November. Meanwhile, wholesale sales fell 1.0 percent in December after falling 1.2 percent in November. Due to a sharp increase in stocks and falling sales, the ratio of stocks to sales for wholesalers rose to 1.33 in December from 1.30 in November.

Most of the components of DOW finished trading in positive territory (20 of 30). The growth leader was DowDuPont Inc. (DWDP, + 2.37%). The Walt Disney Co. shares turned out to be an outsider. (DIS; -1.31%).

Almost all sectors of the S & P recorded an increase. The industrial goods sector grew the most (+ 0.7%). Only the utilities sector decreased (-0.7%).

At the time of closing:

Dow 26,091.95 +60.14 +0.23%

S & P 500 2,796.11 +3.44 + 0.12%

Nasdaq 100 7,554.46 +26.91 +0.36%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | Germany | Gfk Consumer Confidence Survey | March | 10.8 | 10.8 |

| 07:45 | France | Consumer confidence | February | 91 | 92 |

| 09:30 | United Kingdom | BBA Mortgage Approvals | January | 38.779 | 39.2 |

| 13:30 | U.S. | Housing Starts | December | 1.256 | 1.253 |

| 13:30 | U.S. | Building Permits | December | 1.328 | 1.29 |

| 14:00 | U.S. | Housing Price Index, m/m | December | 0.4% | 0.3% |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | December | 4.7% | 4.9% |

| 14:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 15:00 | U.S. | Richmond Fed Manufacturing Index | February | -2 | 8 |

| 15:00 | U.S. | Consumer confidence | February | 120.2 | 125 |

| 15:00 | U.S. | Fed Chair Powell Speaks | |||

| 21:45 | New Zealand | Trade Balance, mln | January | 264 | -300 |

The U.S. Commerce Department reported on Monday the U.S. wholesale inventories rose a seasonally adjusted 1.1 percent m-o-m in December, following a revised 0.4 percent m-o-m advance in November. That was the largest monthly gain since October 2013.

Economists had expected a 0.3 percent m-o-m gain in December.

According to the report, furniture inventories increased at the fastest pace since the end of 2012, and hardware inventories clocked the largest month-over-month gain since June 2012. Most other major item categories' inventories increased.

In y-o-y terms, inventories surged 7.3 in December.

The ratio of inventories to sales in December was 1.33 compared to 1.25 in December 2017.

- Will have a signing Summit with China on trade

- China trade deal may happen soon, may not happen at all

U.S. stock-index rose on Tuesday, as investor hopes that a trade war between Washington and Beijing will be resolved increased after the U.S. President Donald Trump said he would delay a hike in tariffs on Chinese imports.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,528.23 | +102.72 | +0.48% |

Hang Seng | 28,959.30 | +143.00 | +0.50% |

Shanghai | 2,961.28 | +157.06 | +5.60% |

S&P/ASX | 6,186.30 | +19.00 | +0.31% |

FTSE | 7,173.80 | -4.80 | -0.07% |

CAC | 5,234.07 | +18.22 | +0.35% |

DAX | 11,524.01 | +66.31 | +0.58% |

Crude | $55.88 | -2.41% | |

Gold | $1,333.20 | +0.01% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 210.2 | 0.85(0.41%) | 4493 |

ALCOA INC. | AA | 30.3 | 0.13(0.43%) | 11690 |

ALTRIA GROUP INC. | MO | 52.05 | 0.55(1.07%) | 21160 |

Amazon.com Inc., NASDAQ | AMZN | 1,645.79 | 14.23(0.87%) | 45482 |

Apple Inc. | AAPL | 174.08 | 1.11(0.64%) | 254115 |

AT&T Inc | T | 31.28 | 0.13(0.42%) | 32322 |

Boeing Co | BA | 429 | 4.95(1.17%) | 39815 |

Caterpillar Inc | CAT | 140.33 | 1.65(1.19%) | 18262 |

Chevron Corp | CVX | 119.39 | -0.00(-0.00%) | 1149 |

Cisco Systems Inc | CSCO | 50.42 | 0.31(0.62%) | 16557 |

Citigroup Inc., NYSE | C | 64.6 | 0.46(0.72%) | 13321 |

Deere & Company, NYSE | DE | 166.46 | 0.49(0.30%) | 784 |

Exxon Mobil Corp | XOM | 77.88 | -0.54(-0.69%) | 3347 |

Facebook, Inc. | FB | 163 | 1.11(0.69%) | 86963 |

FedEx Corporation, NYSE | FDX | 181.87 | 1.38(0.76%) | 508 |

Ford Motor Co. | F | 8.78 | 0.07(0.80%) | 127509 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.3 | 0.08(0.61%) | 56043 |

General Electric Co | GE | 11.66 | 1.49(14.65%) | 20425409 |

General Motors Company, NYSE | GM | 40.09 | 0.10(0.25%) | 4399 |

Goldman Sachs | GS | 197.1 | 1.10(0.56%) | 1287 |

Google Inc. | GOOG | 1,115.45 | 5.08(0.46%) | 5495 |

Hewlett-Packard Co. | HPQ | 23.81 | 0.07(0.29%) | 4410 |

Home Depot Inc | HD | 193.25 | 0.86(0.45%) | 1827 |

Intel Corp | INTC | 53 | 0.51(0.97%) | 67561 |

International Business Machines Co... | IBM | 139.98 | 0.73(0.52%) | 6186 |

Johnson & Johnson | JNJ | 136.2 | 0.50(0.37%) | 1405 |

JPMorgan Chase and Co | JPM | 105.59 | 0.59(0.56%) | 18530 |

Merck & Co Inc | MRK | 80.98 | 0.21(0.26%) | 822 |

Microsoft Corp | MSFT | 112.07 | 1.10(0.99%) | 108981 |

Nike | NKE | 85.02 | 0.26(0.31%) | 3702 |

Pfizer Inc | PFE | 42.99 | 0.03(0.07%) | 7106 |

Procter & Gamble Co | PG | 100.53 | 0.28(0.28%) | 1613 |

Starbucks Corporation, NASDAQ | SBUX | 71.74 | 0.44(0.62%) | 7731 |

Tesla Motors, Inc., NASDAQ | TSLA | 298.5 | 3.79(1.29%) | 56635 |

The Coca-Cola Co | KO | 45.49 | 0.21(0.46%) | 30493 |

Twitter, Inc., NYSE | TWTR | 31.9 | 0.19(0.60%) | 92387 |

United Technologies Corp | UTX | 127.6 | -0.17(-0.13%) | 1147 |

Verizon Communications Inc | VZ | 57.08 | 0.16(0.28%) | 18047 |

Visa | V | 146.78 | 0.91(0.62%) | 12163 |

Wal-Mart Stores Inc | WMT | 100.06 | 0.51(0.51%) | 30552 |

Walt Disney Co | DIS | 115.5 | 0.25(0.22%) | 8886 |

Yandex N.V., NASDAQ | YNDX | 33.5 | -0.19(-0.56%) | 62806 |

The Chicago Federal Reserve announced on Monday the Chicago Fed national activity index (CFNAI), a weighted average of 85 different economic indicators, stood at -0.43 in January 2019, down from a revised +0.05 in September (originally +0.27), pointing to a decrease in economic growth.

At the same time, the index’s three-month moving average declined slightly to +0.09 in January from +0.18 in the prior month.

According to the report, only one of the four broad categories of indicators that make up the index from December, and two of the four categories made negative contributions to the index in January.

The employment-related indicators made a contribution of +0.05 to the CFNAI in January, up slightly from +0.02 in December. The sales, orders, and inventories category contributed +0.02 to the CFNAI in January, up slightly from a neutral contribution in December. Meanwhile, the contribution of the personal consumption and housing category to the CFNAI edged up to -0.04 in January from -0.06 in December, while the contribution of the production-related indicators fell to -0.45 in January from +0.08 in December.

- Urges parliament to come together to deliver Brexit

- Did not sell any shares of Apple

- Does not see himself selling

- Lower it goes, the better he likes it

- Not buying it at current levels

- Generally does not like to go above 10%

The Berkshire chairman and CEO said CNBC's Becky Quick:

- Market valuations depend on interest rates

- Might be in a new world of low-interest rates; might look back and stocks will be very cheap

- Was close to making a large acquisition in Q4, but it fell apart.

- Would really like to find a business to buy; has a lot of cash right now.

China’s imports of U.S. soybeans nearly doubled in January from the previous month as more cargoes booked earlier after a China-U.S. trade truce, according to Chinese customers data.

China brought in 135,814 tonnes of U.S. soybeans in January, up 95 percent from 69,298 tonnes in December.

However, the volume was still 99.7 percent down from 5.82 million tonnes in January 2018 as Beijing’s hefty tariffs on American shipments curbed purchases.

Billionaire investor Warren Buffett told CNBC Monday that Berkshire Hathaway investment managers Ted Weschler and Todd Combs have trailed the S&P 500 by a "tiny bit" since each joined the company.

However, the Berkshire chairman points out that they've done better in the market then he has over the same period of time. He noted it's a tough time to beat the S&P 500.

Good progress is being made on Brexit

Juncker and May agreed on need to conclude Brexit work by March summit (due to March 21)

UK negotiators to hold talks with Barnier Tuesday

- It may make sense to delay Brexit by a couple of months

I would prefer that we not take any stimulating position

Judging by the projections, there is still room for rate increases.

Monetary policy should now be neutral

Fed rate close is at the lower limit of the neutral range

So long as the economy is "running fine"

Aim is to get Fed benchmark rate to so-called neutral level

Slow approach to get to neutral is a good path for the Fed

Expects economic growth in the region of 2.2% to 2.5% this year

Doesn't expect inflation to exceed the 2% target

According to the report from Ifo Institute for Economic Research, the Export Expectations in manufacturing rose to 7.2 balance points in February, from 6.0 balance points in January. The index is based on around 2,700 monthly reports from manufacturers.

“The tariff threats of the US government are currently having no negative impact on the automotive industry’s export expectations. However, firms are clearly reserved in their assessments of the current situation. At the moment, neither an increase nor a decline in exports is anticipated. By contrast, the food and beverage industry is expecting significant growth in foreign business. The export momentum in the mechanical engineering sector, however, has leveled off considerably in recent months, with hardly any additional orders from abroad being awaited." Ifo President Clemens Fuest said.

Taking all steps needed to ensure transatlantic derivatives trading continues seamlessly post-Brexit

Measures announced will ensure derivative markets stay open and that high regulatory standards are maintained post-Brexit

Progress in trade talks provides positive prospects for stability in China - US relationship and global economic development

UK PM May believes extending Brexit doesn’t solve issue

UK PM May, Varadkar due to meet later at summit

According to a commentary by the Chinese state news agency Xinhua, there could be “new uncertainties” in the final stage of the China-U.S. trade negotiations and China should do its best while preparing for the worst.

“Trade talks will be harder at the final stage, and new uncertainties can’t be ruled out. There needs to be a sober mind about the fact that the China-U.S. trade frictions are long-term, complicated and arduous,” Xinhua wrote Monday.

Xinhua said, the latest round of negotiations between China and the U.S showed that the two sides have some gaps that need a longer time to fill at this critical stage.

“Every step in the next phase is particularly crucial,” Xinhua said, calling on both nations to meet half way. “But we also need to prepare for the worst-case scenario, and take care of our own business in a down-to-earth way,” Xinhua said.

More than three-quarters of business economists expect the U.S. to enter a recession by the end of 2021, though a majority still estimate the Federal Reserve will continue raising interest rates this year.

10% saw a recession beginning this year, 42% project one next year, while 25% expect a contraction starting in 2021, according to a semiannual National Association for Business Economics (NABE) survey. The rest expect a recession later than 2021 or expressed no opinion, the January 30-February 8 poll of nearly 300 members showed.

NABE members were divided on the impact of the Fed’s balance sheet normalization process. Asked about the effect of the tightening on short-term funding rates, a fifth said saw no impact, a fifth said it would raise rates by 25 basis points, and a fifth said said they would rise 50 basis points or more. The remaining respondents didn’t know or express an opinion.

A plurality of 23% expected the Fed to raise the main rate 50 basis points to 3% before beginning to cut rates. 11% said the next rate move will be an easing.

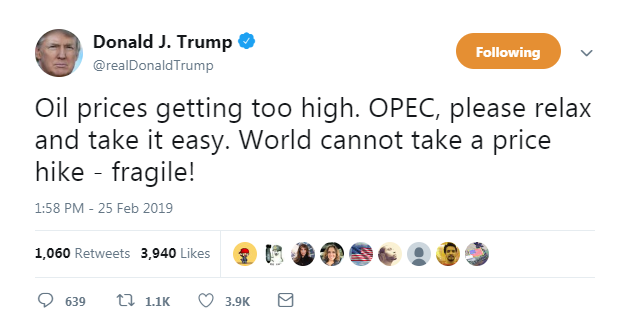

The upside potential for benchmark Brent crude prices exceeds the near-term outlook of $67.50/bbl and could easily trade between $70 and $75 per barrel.

However, bullishness needs to be tempered looking into the second half of 2019, anticipating an impact from U.S. shale exports and OPEC potentially relaxing production curbs.

Saudi Arabia has been vocal in suggesting markets will be re-balanced before June, implying further supply cuts are not needed during second half of 2019

Long-dated oil prices will likely remain under pressure below $60/bbl Brent and $55/bbl WTI due to the (output cut) exit strategy

The Confederation of British Industry (CBI) said, optimism across the service sector fell sharply in the three months to February, while business volumes and profitability continued to fall

The CBI said business and professional services firms - such as accountants, lawyers and marketing companies - had seen the biggest fall in profits in six years over the past three months, and sentiment was weakening at the fastest rate in a decade.

Consumer-focused companies - which have benefited from rising household incomes and employment - also reported falling profits and were the most negative about the outlook for business expansion since 2009.

"Dimmed expectations for the year ahead mean it's more important than ever for the UK to avoid a no-deal scenario, which would create a perfect storm of issues," CBI chief economist Rain Newton-Smith said.

"Until politicians can agree a deal that commands a majority in Parliament and is acceptable to the UK and protects our economy, sentiment will continue to deteriorate," Newton-Smith said.

According to the report from Spanish Statistical Office (INE), the annual rate of the Industrial Price Index (IPRI) general in the month of January is 1.8%, one tenth above that registered in December. The monthly rate of industrial prices is 0.2%

By economic destination of the goods, among the industrial sectors with positive influence in this rise, it stands out:

Energia, which increases its annual variation seven tenths and situates it at 5.1%, as a result of the increase in the prices of the production, transportation and distribution of electrical energy, compared to the decrease recorded in January 2018.

Intermediate goods, whose rate decreases to 1.1% from 1.4%. The decline in the prices of the manufacture of basic chemicals, nitrogen compounds, fertilizers, plastics and synthetic rubber in primary forms, which in 2018 increased, stands out in this evolution.

Non-durable consumer goods, which presents an annual variation of -0.9%, two tenths lower than December. This behavior is mainly due to the fact that the prices of the Manufacture of beverages rise this month less than in January of the previous year.

Overall financial risks have been under control

China will deepen financial supply side reform this year

Shadow banking was under effective supervision

According to a survey by real estate consultancy Cushman & Wakefield, China's property investment overseas is expected to be little changed this year at $10-$20 billion, after volumes dropped 63 percent in 2018 in response to tighter financing conditions.

Chinese real estate investment overseas hit a four-year low at $15.7 billion last year, while investors disposed over $12 billion of overseas assets.

Chinese regulators have been clamping down on speculative overseas deals for the last few years as part of efforts to staunch capital outflows and keep debt risks under control.

According to survey of 51 Chinese investors, 69% said they did not expect policy restrictions related to overseas property investment to ease in 2019, while 59% did not agree the domestic real estate lending environment would improve.

According to the report from Bank of Japan, producer prices were up 1.1% on year in January- in line with expectations and unchanged from the previous month.

On a monthly basis, producer prices sank 0.5% after sliding 0.1% in December.

Bank of Japan said, among the individual components prices were up for advertising, employment, accounting and architectural services. Prices were down for software development, air freight, communication, information and transportation services.

Can expect a very subdued economic upward trend, but still an upward trend

Must pay attention to economic risks like Brexit

EUR/USD

Resistance levels (open interest**, contracts)

$1.1433 (4880)

$1.1406 (1485)

$1.1387 (1173)

Price at time of writing this review: $1.1344

Support levels (open interest**, contracts):

$1.1303 (2777)

$1.1272 (5631)

$1.1234 (5480)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 8 is 99075 contracts (according to data from February, 22) with the maximum number of contracts with strike price $1,1700 (6210);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3197 (4068)

$1.3151 (3825)

$1.3121 (859)

Price at time of writing this review: $1.3072

Support levels (open interest**, contracts):

$1.2979 (762)

$1.2954 (1096)

$1.2925 (783)

Comments:

- Overall open interest on the CALL options with the expiration date March, 8 is 42517 contracts, with the maximum number of contracts with strike price $1,3100 (4068);

- Overall open interest on the PUT options with the expiration date March, 8 is 31056 contracts, with the maximum number of contracts with strike price $1,2700 (1949);

- The ratio of PUT/CALL was 0.73 versus 0.72 from the previous trading day according to data from February, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 67.07 | 0.07 |

| WTI | 57.26 | 0.63 |

| Silver | 15.9 | 0.7 |

| Gold | 1328.242 | 0.37 |

| Palladium | 1498.28 | 1.66 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -38.72 | 21425.51 | -0.18 |

| Hang Seng | 186.38 | 28816.3 | 0.65 |

| KOSPI | 1.84 | 2230.5 | 0.08 |

| ASX 200 | 28.1 | 6167.3 | 0.46 |

| FTSE 100 | 11.21 | 7178.6 | 0.16 |

| DAX | 34.42 | 11457.7 | 0.3 |

| CAC 40 | 19.74 | 5215.85 | 0.38 |

| Dow Jones | 181.18 | 26031.81 | 0.7 |

| S&P 500 | 17.79 | 2792.67 | 0.64 |

| NASDAQ Composite | 67.83 | 7527.54 | 0.91 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71295 | 0.57 |

| EURJPY | 125.419 | -0.01 |

| EURUSD | 1.13321 | 0 |

| GBPJPY | 144.44 | 0.12 |

| GBPUSD | 1.3051 | 0.13 |

| NZDUSD | 0.68441 | 0.65 |

| USDCAD | 1.31441 | -0.65 |

| USDCHF | 1.00036 | -0.08 |

| USDJPY | 110.67 | -0.01 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.