- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-08-2015

(raw materials / closing price /% change)

Oil 39.32 +1.87%

Gold 1,122.70 -0.17%

(index / closing price / change items /% change)

Nikkei 225 18,376.83 +570.13 +3.20 %

Hang Seng 21,080.39 -324.57 -1.52 %

S&P/ASX 200 5,172.78 +35.52 +0.69 %

FTSE 100 5,979.2 -102.14 -1.68 %

CAC 40 4,501.05 -63.81 -1.40 %

Xetra DAX 9,997.43 -130.69 -1.29 %

S&P 500 1,940.51 +72.90 +3.90 %

NASDAQ Composite 4,697.54 +191.05 +4.24 %

Dow Jones 16,285.51 +619.07 +3.95 %

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1313 -1,79%

GBP/USD $1,5457 -1,50%

USD/CHF Chf0,954 +1,50%

USD/JPY Y120,20 +1,08%

EUR/JPY Y136,00 -0,71%

GBP/JPY Y185,94 -0,32%

AUD/USD $0,7126 -0,21%

NZD/USD $0,6450 -0,59%

USD/CAD C$1,3396 +0,50%

(time / country / index / period / previous value / forecast)

01:30 Australia Private Capital Expenditure Quarter II -4.4% -2.5%

06:00 United Kingdom Nationwide house price index, y/y August 3.5% 3.1%

06:00 United Kingdom Nationwide house price index August 0.4% 0.4%

08:00 Eurozone Private Loans, Y/Y July 0.6% 0.8%

08:00 Eurozone M3 money supply, adjusted y/y July 5.0% 4.9%

12:30 U.S. Continuing Jobless Claims August 2254 2250

12:30 U.S. PCE price index, q/q (Revised) Quarter II -2% 2.2%

12:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter II 1% 1.8%

12:30 U.S. Initial Jobless Claims August 277 274

12:30 U.S. GDP, q/q (Revised) Quarter II 0.6% 3.2%

17:00 U.S. Jackson Hole Symposium

23:05 United Kingdom Gfk Consumer Confidence August 4 4

23:30 Japan Household spending Y/Y July -2.0% 1.3%

23:30 Japan Tokyo Consumer Price Index, y/y August 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August -0.1% -0.2%

23:30 Japan Unemployment Rate July 3.4% 3.4%

23:30 Japan National Consumer Price Index, y/y July 0.4% 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y July 0.1% -0.2%

23:50 Japan Retail sales, y/y July 0.9% 1.1%

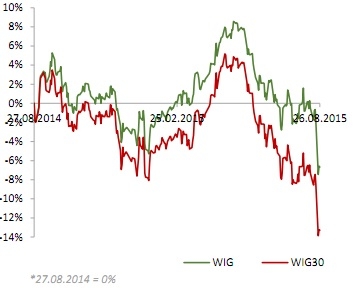

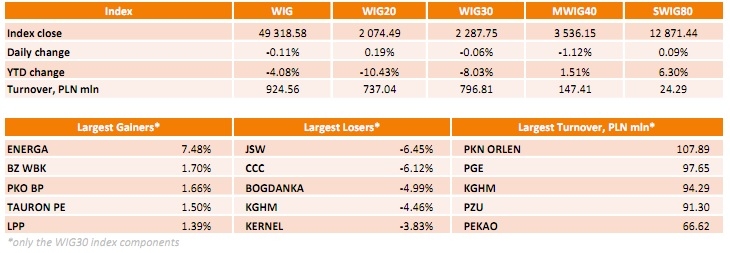

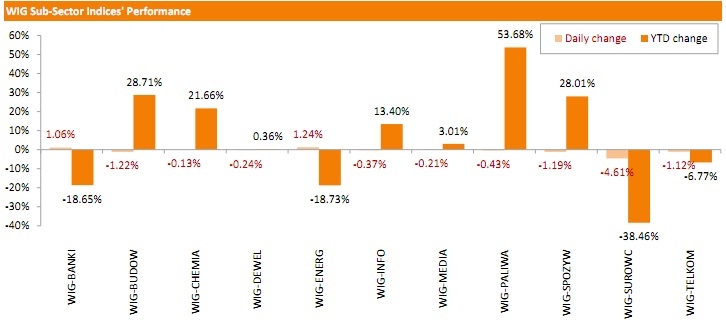

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, slid down 0.11%. Sector-wise, utilities (+1.24%) and banks (+1.06%) were the only sectors, which posted positive results. At the same time, materials (-4.61%) recorded the sharpest drop.

The large-cap stocks' measure, the WIG30 Index, edged down 0.06%. Within the WIG30 Index components, JSW (WSE: JSW) was hit the hardest, tumbling 6.45% after the company announced it would take a PLN 211.2 mln writedown on one of its coal mines. It was followed by CCC (WSE: CCC), BOGDANKA (WSE: LWB), KGHM (WSE: KGH) and KERNEL (WSE: KER), declining by 3.83%-6.12%. On the plus side, ENERGA (WSE: ENG) was the standout performer of the day, skyrocketing by 7.48%.

Major U.S. stock-indexes rose on Wednesday, helped by stronger-than-expected durable goods data, raising hopes that Wall Street will snap its six-day losing streak. Durable goods orders rose 2% in July, compared with analysts' average forecast of a 4% fall. Orders for core capital goods, a proxy for business investment, rose 2.2% - their biggest gain in 13 months. The data suggested U.S. economy was in good shape. Wednesday's gains followed a dramatic day of trading on Tuesday, when the three main indexes reversed course suddenly to close sharply lower amid lingering worries about slowing growth in China.

Almost all of Dow stocks in positive area (29 of 30). Top looser - The Boeing Company (BA, -0.06%). Top gainer - Merck & Co. Inc. (MRK, +3.22).

Almost all S&P index sectors in positive area. Top looser - Conglomerates (-0.3%). Top gainer - Technology (+1,1%).

At the moment:

Dow 15821.00 +102.00 +0.65%

S&P 500 1885.50 +12.75 +0.68%

Nasdaq 100 4077.00 +48.50 +1.20%

10 Year yield 2,14% +0,01

Oil 39.05 -0.26 -0.66%

Gold 1123.30 -15.00 -1.32%

Stock indices closed lower as concerns over a slowdown in the Chinese economy turned in focus again. The People's Bank of China (PBoC) lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

The European Central Bank (ECB) Executive Board Member Peter Praet said on Wednesday that the downside risk of achieving the central bank's 2% inflation target are increased. He added that the ECB will add further stimulus measures if needed.

The Organization for Economic Cooperation and Development (OECD) released its real gross domestic product (GDP) growth figures on Wednesday. Real GDP of 34 OECD member countries rose 0.4% in the second quarter, after a 0.5% gain in the first quarter.

Real GDP of the United States was up 0.6% in the second quarter, real GDP of Germany rose to 0.4%, while Britain's economy climbed to 0.7%.

GDP of France remained flat in the second quarter, Italy's economy increased 0.2%, while Japan's GDP was down 0.4%.

Eurozone's economic growth remained unchanged at 0.4% in the second quarter.

On yearly basis, GDP of 34 OECD member countries remained unchanged at 2.0% in the second quarter.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 46,033 in July from 44,802 in June. It was the highest reading since February 2014.

"Savvy homeowners are snapping up competitive deals before an expected increase in interest rates," the chief economist at the BBA, Richard Woolhouse, said.

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance increased to +24% in August from +21% in July.

The increase was driven by a rise in sales in clothing stores.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,979.2 -102.14 -1.68 %

DAX 9,997.43 -130.69 -1.29 %

CAC 40 4,501.05 -63.81 -1.40 %

Oil prices declined on concerns over the global oil oversupply. The U.S. crude oil inventories data had only a moderate impact on oil prices. The U.S. Energy Information Administration (EIA) said on Wednesday that U.S. crude inventories dropped by 5.45 million barrels to 450.8 million in the week to August 21.

Analysts had expected U.S. crude oil inventories to decline by 2.0 million barrels.

Gasoline inventories increased by 1.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 256,000 barrels.

U.S. crude oil imports decreased by 839,000 barrels per day.

Refineries in the U.S. were running at 94.5% of capacity, down from 95.1% the previous week.

Yesterday's interest rate cut by the Chinese central bank slightly supported oil prices.

WTI crude oil for October delivery declined to $39.24 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $43.00 a barrel on ICE Futures Europe.

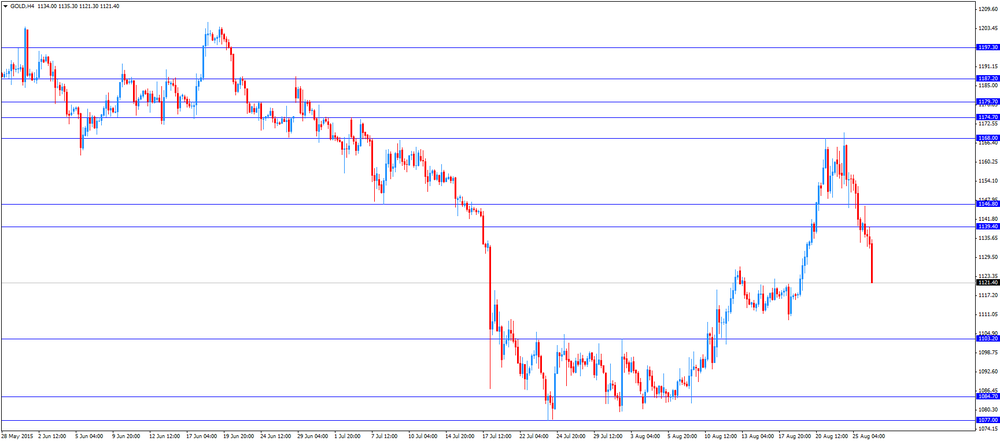

Gold price declined on a stronger U.S. dollar and as stock markets seem to stabilise. The U.S. dollar rose against other currencies as the U.S. durable goods orders were better than expected. The U.S. durable goods orders increased 2.0% in July, beating expectations for a 0.4% decrease, after a 4.1% gain in June. June's figure was revised up from a 3.4% rise.

The increase was partly driven by rises in new machinery, electronics and other goods.

The U.S. durable goods orders excluding transportation rose 0.6% in July, exceeding expectations for a 0.4% gain, after a 0.8% increase in June.

The U.S. durable goods orders excluding defence climbed 1.0 % in July, after a 4.2% gain in June. June's figure was revised up from a 3.8% increase.

Comments by Federal Reserve Bank of New York President William Dudley supported gold price. Dudley said on Wednesday that the interest rate hike in September seems less compelling.

September futures for gold on the COMEX today decreased to 1122.30 dollars per ounce.

Federal Reserve Bank of New York President William Dudley said Wednesday that the interest rate hike in September seems less compelling.

"From my perspective, at this moment, the decision to begin the normalization process at the September FOMC meeting seems less compelling to me than it was a few weeks ago. But normalization could become more compelling by the time of the meeting as we get additional information on how the U.S. economy is performing and more information on international and financial market developments, all of which are important in shaping the U.S. economic outlook," he noted.

Dudley pointed out that the interest rate hike remains data depended, and the developments abroad could affect the economic outlook.

He also said that low oil prices weigh on the inflation.

Dudley is a voting member of the Federal Open Market Committee (FOMC) this year.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories dropped by 5.45 million barrels to 450.8 million in the week to August 21.

Analysts had expected U.S. crude oil inventories to decline by 2.0 million barrels.

Gasoline inventories increased by 1.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 256,000 barrels.

U.S. crude oil imports decreased by 839,000 barrels per day.

Refineries in the U.S. were running at 94.5% of capacity, down from 95.1% the previous week.

The European Central Bank (ECB) Executive Board Member Peter Praet said on Wednesday that the downside risk of achieving the central bank's 2% inflation target are increased. He added that the ECB will add further stimulus measures if needed.

"Recent developments in the world economy and in commodity markets have increased the downside risk of achieving the sustainable inflation path toward 2 percent. There should be no ambiguity on the willingness and ability of the Governing Council to act if needed," Praet said.

The ECB will release its inflation and growth forecasts on September 3.

The Netherlands Bureau for Economic Policy Analysis release the world trade data on Tuesday. The volume of global trade declined 0.5% in the second quarter, after a 1.5% drop in the first quarter.

Global trade in the first half of the year showed the worst performance since the 2009 collapse in global trade.

"We have had a miserable first six months of 2015," chief economist of the World Trade Organisation, Robert Koopman, said. He pointed out that a faltering recovery in Europe and a slowdown in the Chinese economy weighed on global trade.

EUR/USD: $1.1300(E653mn)

USD/JPY: Y117.00($377mn), Y120.00($300mn), Y122.00($579mn)

EUR/GBP: Gbp0.7070(E289mn)

AUD/USD: $0.6950(A$403mn), $0.7300(A$286mn)

USD/CAD: C$1.3100($305mn)

U.S. index futures extended gains after a report showed orders for capital goods increased in July by the most in more than a year, showing corporate spending was finding its footing prior to the turmoil in financial markets.

Global Stocks:

Nikkei 18,376.83 +570.13 +3.20%

Hang Seng 21,080.39 -324.57 -1.52%

Shanghai Composite 2,926.38 -38.59 -1.30%

FTSE 6,082.13 +0.79 +0.01%

CAC 4,566.93 +2.07 +0.05%

DAX 10,121.83 -6.29 -0.06%

Crude oil $39.69 (+0.94%)

Gold $1125.30 (-1.11%)

(company / ticker / price / change, % / volume)

| Wal-Mart Stores Inc | WMT | 64.01 | +1.44% | 9.4K |

| McDonald's Corp | MCD | 93.00 | +1.96% | 0.3K |

| Caterpillar Inc | CAT | 73.60 | +2.14% | 17.6K |

| United Technologies Corp | UTX | 90.70 | +2.14% | 0.9K |

| Yahoo! Inc., NASDAQ | YHOO | 32.42 | +2.14% | 11.0K |

| AT&T Inc | T | 32.49 | +2.17% | 51.8K |

| Cisco Systems Inc | CSCO | 25.16 | +2.19% | 28.0K |

| HONEYWELL INTERNATIONAL INC. | HON | 96.00 | +2.20% | 0.3K |

| Johnson & Johnson | JNJ | 92.75 | +2.23% | 6.9K |

| E. I. du Pont de Nemours and Co | DD | 50.20 | +2.32% | 1.1K |

| International Business Machines Co... | IBM | 144.30 | +2.37% | 4.7K |

| Verizon Communications Inc | VZ | 44.54 | +2.39% | 18.6K |

| Exxon Mobil Corp | XOM | 70.37 | +2.42% | 46.0K |

| Procter & Gamble Co | PG | 70.10 | +2.46% | 7.7K |

| Walt Disney Co | DIS | 98.30 | +2.51% | 28.6K |

| Yandex N.V., NASDAQ | YNDX | 10.83 | +2.51% | 14.7K |

| General Motors Company, NYSE | GM | 27.97 | +2.53% | 35.0K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.45 | +2.55% | 64.1K |

| Merck & Co Inc | MRK | 52.50 | +2.61% | 1.5K |

| The Coca-Cola Co | KO | 38.99 | +2.63% | 10.4K |

| Ford Motor Co. | F | 13.24 | +2.64% | 45.1K |

| ALTRIA GROUP INC. | MO | 53.20 | +2.66% | 0.2K |

| Intel Corp | INTC | 26.56 | +2.67% | 29.5K |

| Pfizer Inc | PFE | 32.19 | +2.71% | 6.6K |

| Deere & Company, NYSE | DE | 81.23 | +2.71% | 2.5K |

| UnitedHealth Group Inc | UNH | 113.00 | +2.75% | 0.9K |

| Boeing Co | BA | 129.00 | +2.80% | 5.5K |

| ALCOA INC. | AA | 8.34 | +2.84% | 48.7K |

| Apple Inc. | AAPL | 106.70 | +2.85% | 808.7K |

| General Electric Co | GE | 23.95 | +2.92% | 98.3K |

| Home Depot Inc | HD | 114.30 | +3.00% | 4.0K |

| Visa | V | 69.00 | +3.03% | 2.5K |

| Goldman Sachs | GS | 183.75 | +3.10% | 4.1K |

| Microsoft Corp | MSFT | 41.75 | +3.16% | 101.8K |

| Nike | NKE | 106.89 | +3.24% | 0.8K |

| JPMorgan Chase and Co | JPM | 61.85 | +3.24% | 11.9K |

| AMERICAN INTERNATIONAL GROUP | AIG | 58.49 | +3.27% | 2.7K |

| Chevron Corp | CVX | 72.32 | +3.28% | 7.5K |

| Citigroup Inc., NYSE | C | 51.54 | +3.33% | 40.9K |

| American Express Co | AXP | 75.98 | +3.35% | 1.2K |

| Twitter, Inc., NYSE | TWTR | 25.20 | +3.36% | 55.2K |

| Tesla Motors, Inc., NASDAQ | TSLA | 227.50 | +3.39% | 29.4K |

| 3M Co | MMM | 142.60 | +3.60% | 19.1K |

| Starbucks Corporation, NASDAQ | SBUX | 52.96 | +3.66% | 3.9K |

| Facebook, Inc. | FB | 86.12 | +3.76% | 229.2K |

| Amazon.com Inc., NASDAQ | AMZN | 485.00 | +3.99% | 22.7K |

| Google Inc. | GOOG | 610.00 | +4.80% | 15.8K |

| Barrick Gold Corporation, NYSE | ABX | 6.91 | -1.14% | 46.2K |

Upgrades:

Google (GOOG, GOOGL) upgraded to Buy from Neutral at Goldman, target raised to $800 from $660

IBM upgraded to Buy from Hold at Argus, target $175

NIKE (NKE) upgraded to Positive from Neutral at Susquehanna

Downgrades:

Other:

The U.S. Commerce Department released durable goods orders data on Wednesday. The U.S. durable goods orders increased 2.0% in July, beating expectations for a 0.4% decrease, after a 4.1% gain in June. June's figure was revised up from a 3.4% rise.

The increase was partly driven by rises in new machinery, electronics and other goods.

Transportation orders climbed 4.7% in July.

The U.S. durable goods orders excluding transportation rose 0.6% in July, exceeding expectations for a 0.4% gain, after a 0.8% increase in June.

The U.S. durable goods orders excluding defence climbed 1.0 % in July, after a 4.2% gain in June. June's figure was revised up from a 3.8% increase.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

The Organization for Economic Cooperation and Development (OECD) released its real gross domestic product (GDP) growth figures on Wednesday. Real GDP of 34 OECD member countries rose 0.4% in the second quarter, after a 0.5% gain in the first quarter.

Real GDP of the United States was up 0.6% in the second quarter, real GDP of Germany rose to 0.4%, while Britain's economy climbed to 0.7%.

GDP of France remained flat in the second quarter, Italy's economy increased 0.2%, while Japan's GDP was down 0.4%.

Eurozone's economic growth remained unchanged at 0.4% in the second quarter.

On yearly basis, GDP of 34 OECD member countries remained unchanged at 2.0% in the second quarter.

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance increased to +24% in August from +21% in July.

The increase was driven by a rise in sales in clothing stores.

Sales expectations for next month were up to +35%.

"Household spending seems to have remained firm going into the second half of this year, so the outlook for the retail sector looks upbeat," CBI Director of Economics, Rain Newton-Smith, said.

The People's Bank of China (PBoC) injected 140 billion yuan (about €19 billion) into the financial system via a short-term liquidity operation on Wednesday. The central bank wants to support the country's economy and to calm down the markets.

The PBoC lowered the one-year benchmark bank lending rate by 25 basis points to 4.6% on Tuesday. One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Construction Work Done Quarter II -0.8% Revised From -2.4% -1.5% 1.6%

06:00 Switzerland UBS Consumption Indicator July 1.61 Revised From 1.68 1.64

08:30 United Kingdom BBA Mortgage Approvals July 44.8 Revised From 44.5 46.0

11:00 U.S. MBA Mortgage Applications August 3.6% 0.2%

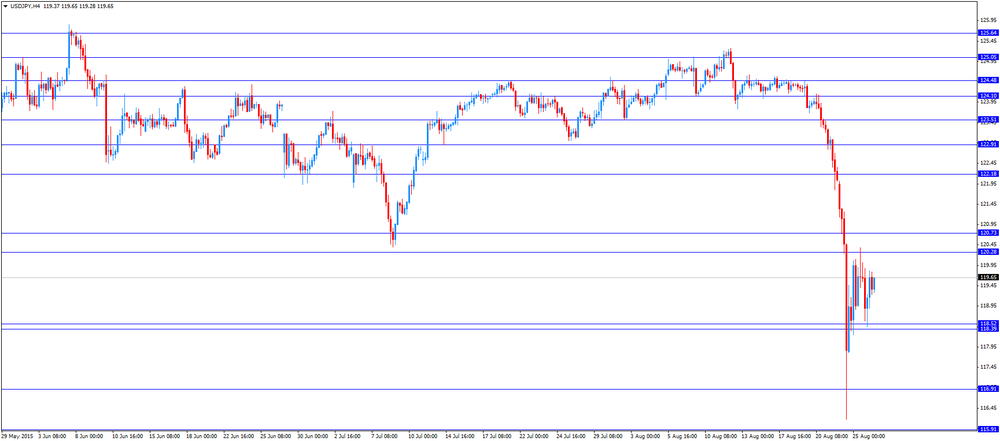

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. durable goods orders data. The U.S. durable goods orders are expected to decrease 0.4% in July, after a 3.4% gain in June.

The U.S. durable goods orders excluding transportation are expected to rise 0.4% in July, after a 0.8% gain in June.

The greenback remained supported by yesterday's U.S. consumer confidence data. The index rose to 101.5 in August from 91.0 in July, exceeding expectations for a rise to 93.4.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic report from the U.K.

The Swiss franc traded lower against the U.S. dollar. The UBS consumption index increased to 1.64 in July from 1.61 in June. June's figure was revised down from 1.68.

Retailer sentiment remained pessimistic due to the weak outlook for the development of prices and sales.

Consumer sentiment continued to worsen.

EUR/USD: the currency pair declined to $1.1401

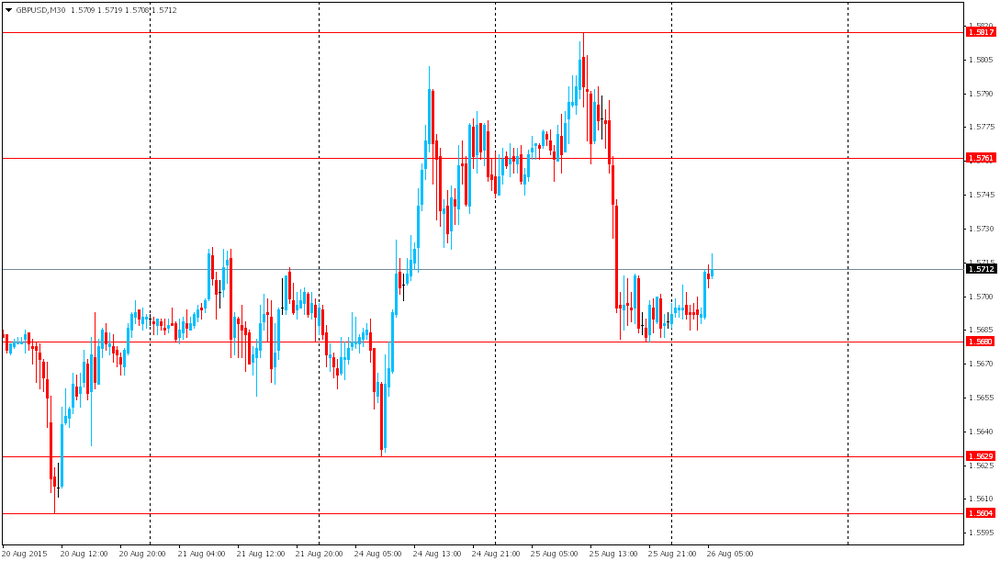

GBP/USD: the currency pair fell to $1.5577

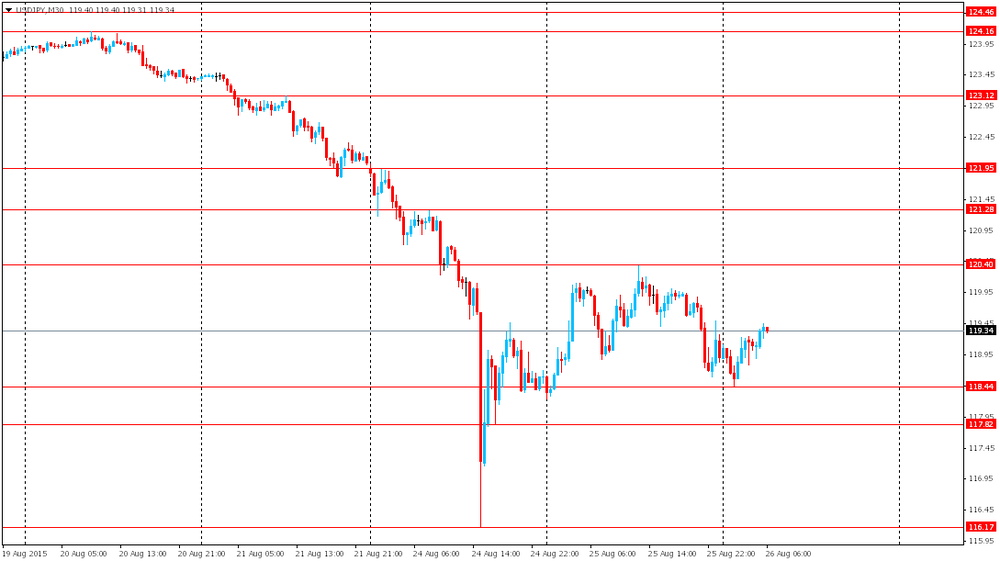

USD/JPY: the currency pair rose to Y119.65

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders July 3.4% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation July 0.8% 0.4%

12:30 U.S. Durable goods orders ex defense July 3.8%

14:00 U.S. FOMC Member Dudley Speak

EUR/USD

Offers 1.1520-25 1.1550 1.1565 1.1580 1.1600 1.1620 1.1650 1.1680 1.1700 1.1720

Bids 1.1500 1.1485 1.1470 1.1450 1.1420-25 1.1400 1.1385 1.1350

GBP/USD

Offers 1.5700 1.5720-25 1.5745-50 1.5780-85 1.5800 1.5830 1.5850

Bids 1.5650-55 1.5630-35 1.5625 1.5600 1.5585 1.5565 1.5550

EUR/GBP

Offers 0.7340-50 0.7365 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7300 0.7285 0.7265-70 0.7250 0.7230 0.7200

EUR/JPY

Offers 137.80 138.00 138.25 138.50 138.85 139.00 139.35 139.50

Bids 137.00 136.80 136.50 136.20 136.00 135.50 135.20

USD/JPY

Offers 119.65 119.85 120.00 120.20 120.45-50 120.80 121.00 121.25-30

Bids 119.25-30 119.00 118.85 118.50 118.35 118.20 118.00

AUD/USD

Offers 0.7150-55 0.7175 0.7200 0.7220-25 0.7250 0.7265 0.7285 0.7300

Bids 0.7100 0.7075-80 0.7050 0.7000 0.6950

Stock indices traded lower as concerns over a slowdown in the Chinese economy turned in focus again. The People's Bank of China (PBoC) announced on Tuesday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.6%. The central bank hopes with this decision to support the country's economy and to calm down the markets. The interest rate cut would be effective from Wednesday.

One-year benchmark deposit rates were cut by 25 basis point, reserve requirements (RRR) were lowered by 50 basis points to 18% for most big banks.

New reserve requirements would be effective on September 6.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 46,033 in July from 44,802 in June. It was the highest reading since February 2014.

"Savvy homeowners are snapping up competitive deals before an expected increase in interest rates," the chief economist at the BBA, Richard Woolhouse, said.

Current figures:

Name Price Change Change %

FTSE 100 6,005.38 -75.96 -1.25 %

DAX 10,014.42 -113.70 -1.12 %

CAC 40 4,506.4 -58.46 -1.28 %

The Fed Chairwoman Janet Yellen was asked to testify on bank supervision matters before the House Financial Services Committee in September. No date has been finalized for Yellen's testimony.

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.64 in July from 1.61 in June. June's figure was revised down from 1.68.

Retailer sentiment remained pessimistic due to the weak outlook for the development of prices and sales.

Consumer sentiment continued to worsen.

EUR/USD: $1.1300(E653mn)

USD/JPY: Y117.00($377mn), Y120.00($300mn), Y122.00($579mn)

EUR/GBP: Gbp0.7070(E289mn)

AUD/USD: $0.6950(A$403mn), $0.7300(A$286mn)

USD/CAD: C$1.3100($305mn)

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals increased to 46,033 in July from 44,802 in June. It was the highest reading since February 2014.

"Savvy homeowners are snapping up competitive deals before an expected increase in interest rates," the chief economist at the BBA, Richard Woolhouse, said.

Statistics New Zealand released its trade data on late Tuesday evening. New Zealand's trade deficit widened to NZ$649 million in July from NZ$194 million in June. June's figure was revised down from a deficit of NZ$60 million.

The increase in deficit was driven by higher exports. Exports rose 1.5% in July, while imports increased by 11.9%.

Dairy exports were up 0.1% in July, the first increase in dairy exports since August 2014.

"The small rise in dairy export values combined with the falling New Zealand dollar contributed to the rise in total exports value this month. A weaker dollar means that exporters receive more New Zealand dollars for transactions in foreign currencies while imports cost more," Statistics NZ international statistics senior manager Jason Attewell said.

The U.S: Congressional Budget Office (CBO) said on Tuesday that the U.S. budget deficit could decline by $60 billion in 2015 due to higher revenue gains. The CBO expects a $426 billion deficit for fiscal year 2015, down from its previous $486 billion estimate, a $414 billion deficit for fiscal year 2016, a reduction of $41 billion from the previous estimate.

The new forecast may mean that the deficit for fiscal year 2015 could be the lowest since 2007, and there will be likely no need to raise a debt limit in December.

The Australian Bureau of Statistics released its construction work done figures on Wednesday. Construction work done in Australia climbed 1.6% in the second quarter, beating forecasts of a 1.5% drop, after a 0.8% decrease in the previous quarter. The first quarter's figure was revised up from a 2.4% decline.

The seasonally adjusted estimate of total building work done fell 2.6% in the second quarter.

On a yearly basis, total construction work plunged 3.3%.

Chinese Premier Li Keqiang said on Tuesday that there is no basis for the further yuan devaluation.

"Currently, there is no basis for continued depreciation in the renminbi (yuan), which is able to stay at a reasonable and balanced level," he said.

Li added that the Chinese government could achieve main economic targets for this year.

West Texas Intermediate futures for October delivery advanced to $39.61 (+0.76%), while Brent crude rebounded to $43.51 (+0.69%) after China's central bank stepped in to support the country's economy. However both crudes remained not far from 6-1/2 year lows as concerns over ongoing supply glut limited gains. At the same time some investors believe that a rate cut, which was conducted by the People's Bank of China on Tuesday, will not be enough to stabilize China's slowing economic growth.

Meanwhile data from the American Petroleum Institute showed on Tuesday that U.S. crude inventories fell by 7.3 million barrels last week to 449.3 million, compared with analysts' expectations for a 1 million barrels rise. Energy Information Administration data is due 14:30 GMT today.

Gold fell to $1,136.30 (-1.50%) after Chinese stocks rebounded amid actions of the country's central bank and pushed equities in other countries up. On Tuesday the People's Bank of China cut its key lending and deposit rates by 0.25% to 4.6% and 1.75% respectively.

Stronger stocks raise a question of probability of an interest rate hike by the Federal Reserve this year thus putting pressure on bullion.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1681 (1560)

$1.1606 (3855)

$1.1543 (1968)

Price at time of writing this review: $1.1481

Support levels (open interest**, contracts):

$1.1406 (405)

$1.1356 (1560)

$1.1311 (1837)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 82441 contracts, with the maximum number of contracts with strike price $1,1350 (5249);

- Overall open interest on the PUT options with the expiration date September, 4 is 124321 contracts, with the maximum number of contracts with strike price $1,0500 (7791);

- The ratio of PUT/CALL was 1.51 versus 1.46 from the previous trading day according to data from August, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1650)

$1.5902 (2266)

$1.5804 (2527)

Price at time of writing this review: $1.5698

Support levels (open interest**, contracts):

$1.5595 (1001)

$1.5498 (2757)

$1.5399 (2132)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30385 contracts, with the maximum number of contracts with strike price $1,5600 (2725);

- Overall open interest on the PUT options with the expiration date September, 4 is 35323 contracts, with the maximum number of contracts with strike price $1,5500 (2757);

- The ratio of PUT/CALL was 1.16 versus 1.16 from the previous trading day according to data from August, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

U.S. stock indices fell at the end of Tuesday session losing gains accumulated at the session's beginning.

The People's Bank of China cut its key lending and deposit rates by 0.25% to 4.6% and 1.75% respectively. This information supported equities at the beginning of the session.

The Dow Jones Industrial Average dropped 204.91 points, or 1.3%, to 15,666.44. The S&P 500 fell 25.59 points, or 1.4%, to 1,867.61. The Nasdaq Composite lost 19.76 points, or 0.4% to 4,506.49.

Meanwhile a report from the Conference Board showed that the index of consumer confidence in the U.S. rose to 101.5 in August from 91.0 in July (revised from 90.9). Economists expected the index to come in at 93.4. The index of expectations improved to 92.5 in August from 82.3 in July, while the current situation index advanced to 115.1 from 104.0.

This morning in Asia Hong Kong Hang Seng recovered 1.11%, or 236.60 points, to 21,641.56. China Shanghai Composite Index rose 2.72%, or 80.56 points, to 3,045.53. The Nikkei added 2.57%, or 457.08 points, to 18,263.78.

Chinese stocks revived and helped other Asian markets rebound amid new supportive measures from the government. On Tuesday the People's Bank of China cut its key lending and deposit rates by 0.25% to 4.6% and 1.75% respectively.

The PBOC also said it would require large banks to keep less money in reserve, making it easier for banks to lend money (effective from September 6).

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Construction Work Done Quarter II -0.8% Revised From -2.4% -1.5% 1.6%

06:00 Switzerland UBS Consumption Indicator July 1.61 Revised From 1.68 1.64

The U.S. dollar fluctuated with modest changes to the euro and the yen. It's worth to remember that concerns over China's economic growth triggered massive declines in stocks worldwide on Monday. This also made the greenback very volatile. Investors are still cautious about short-term outlook of the dollar. They are waiting for signs of stabilization in China and strong data on the U.S. economy, which would suggest that the Federal Reserve is still on track to raise rates in 2015.

At the beginning of today's session the Australian dollar declined against the U.S. dollar. However later economic data supported the AUD. The seasonally adjusted Construction Work Done index rose by 1.6% in the second quarter. Economists expected the index to rise by 1.5%.

The New Zealand dollar is under pressure. Statistics showed that the country's trade balance came in at -Nz649 in July missing expectations for -NZ600. The deficit expanded as imports continued rising. Exports of dairy products have picked up for the first time in nearly a year.

EUR/USD: the pair fluctuated within $1.1500-60 in Asian trade

USD/JPY: the pair traded around Y119.00

GBP/USD: the pair rose to $1.5720

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals July 44.5

11:00 U.S. MBA Mortgage Applications August 3.6%

12:30 U.S. Durable Goods Orders July 3.4% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation July 0.8% 0.4%

12:30 U.S. Durable goods orders ex defense 3.8%

14:00 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August 2.62 2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.