- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-06-2016

(raw materials / closing price /% change)

Oil 46.61 +0.60%

Gold 1,327.60 +0.22%

(index / closing price / change items /% change)

Nikkei 225 15,309.21+357.19+2.39%

Hang Seng 20,227.3-31.83-0.16%

S&P/ASX 200 5,137.23+24.05+0.47%

Shanghai Composite 2,895.52+41.24+1.44%

Topix 1,225.76+21.28+1.77%

FTSE 100 5,982.2 -156.49 -2.55 %

CAC 40 3,984.72 -122.01 -2.97 %

Xetra DAX 9,268.66 -288.50 -3.02 %

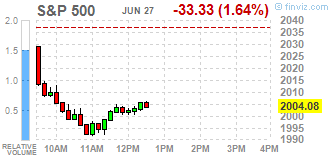

S&P 500 2,000.54 -36.87 -1.81 %

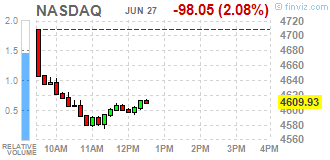

NASDAQ Composite 4,594.44 -113.54 -2.41 %

Dow Jones 17,140.24 -260.51 -1.50 %

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1018 -0,83%

GBP/USD $1,3226 -3,42%

USD/CHF Chf0,9775 +0,48%

USD/JPY Y101,91 -0,29%

EUR/JPY Y112,28 -1,18%

GBP/JPY Y134,75 -3,63%

AUD/USD $0,7338 -1,79%

NZD/USD $0,6995 -1,92%

USD/CAD C$1,3079 +0,58%

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence June 98 97

12:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter I 1.3% 2.1%

12:30 U.S. GDP, q/q (Finally) Quarter I 1.4% 1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 5.4% 5.5%

14:00 U.S. Richmond Fed Manufacturing Index June -1 2

14:00 U.S. Consumer confidence June 92.6 93.7

23:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Retail sales, y/y May -0.8% -1.6%

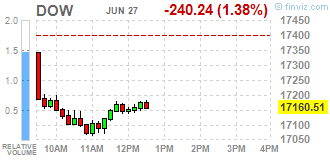

U.S. stocks continued a rout sparked by Britain's shock vote to leave the European Union, with the Dow Jones Industrial Average falling more than 250 points after equities on Friday tumbled the most in 10 months.

Banks remained the focal point in the downdraft, with no sign of the pummeling letting up as lenders marked the worst two-day drop in almost five years. Raw-material and industrial shares also posted the steepest back-to-back slide since 2011. Sentiment was dealt another blow after S&P Global Ratings today cut the U.K.'s top credit grade by two levels.

"Today seems to be a repeat of Friday," said Ben Rozin, senior analyst and portfolio manager at Manning & Napier Advisors, which manages $37.3 billion. "We came into this year with first-quarter earnings being weak, and we were just beginning to see signs that the second quarter would be better. A big shock isn't good for confidence or investments. There's a lot of uncertainty and people weren't positioned for the vote ahead of time."

Risk assets have been under pressure since Britons voted to secede from the EU, raising concerns that an already-fragile global economic recovery will falter as trade snarls in one of the world's biggest consumer blocs. Friday's losses reversed a weekly advance in the S&P 500 and pushed the CBOE Volatility Index up 49 percent. The measure of market turmoil known as the VIX fell Monday, even as stocks continued to drop.

The U.K.'s Brexit vote left investors around the world scurrying toward safe havens for a second session after the S&P 500 on Friday fell 3.6 percent to erase its advance for the year. Investors are watching for policy action by central banks worldwide to ease the turmoil and pump liquidity into financial markets. European equities continued to bear the brunt of the selling, with the Stoxx Europe 600 Index losing 4.1 percent to its lowest since February.

Major U.S. stock-indexes fell on Wall Street on Monday as aftershocks from Britain's vote to leave the European Union roiled global markets for a second day.

Almost all Dow stocks in negative area (28 of 30). Top looser - American Express Company (AXP, -4,00%). Top gainer - Johnson & Johnson (JNJ, +0,55%).

Almost all S&P sectors in negative area. Top gainer - Financial (-3,1%). Top gainer - Utilities (+0,4%).

At the moment:

Dow 17062.00 -185.00 -1.07%

S&P 500 1994.25 -24.25 -1.20%

Nasdaq 100 4196.00 -66.25 -1.55%

Oil 46.24 -1.40 -2.94%

Gold 1324.50 +2.10 +0.16%

U.S. 10yr 1.46 -0.12

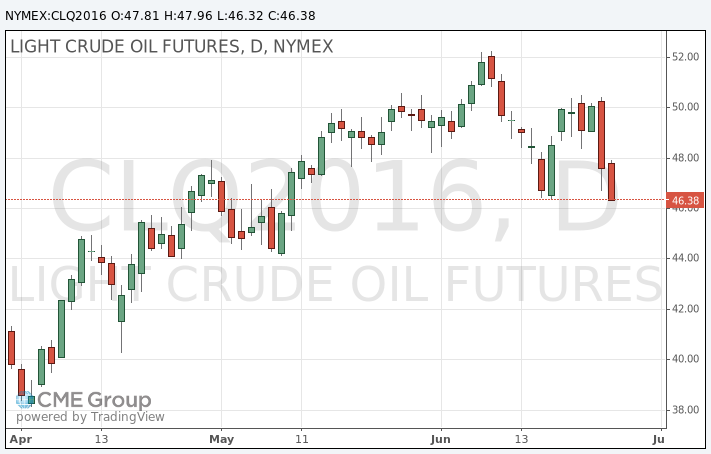

Oil prices fell as markets continue to show a decline in the unexpected results of the referendum in the UK, which led investors turn to safer assets.

On Friday, the contracts fell at the fastest pace since February - about 5%.

But on Monday, prices have stabilized, as market analysts argue that Brexit would have little impact on the levels of supply and demand on the world market.

Oil demand from the UK is less than 2% of the global demand.

On Friday, Baker Hughes said that the number of drilling rigs in the US fell for the first time in four weeks.

Increasing the number of drilling rigs in recent weeks intensified fears that the price of oil at $ 50 a barrel could push US producers to increase production volume and increase the already excessive supply of oil on the world market.

However, some analysts have warned that the global market is still oversupplied and prices could fall in the coming months.

The cost of the August futures for US light crude oil WTI fell to 46.32 dollars per barrel.

The price of August futures for Brent fell to 47.05 dollars a barrel on the London Stock Exchange ICE Futures Europe.

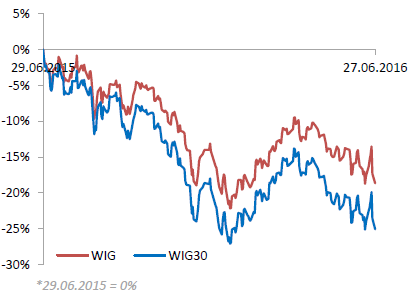

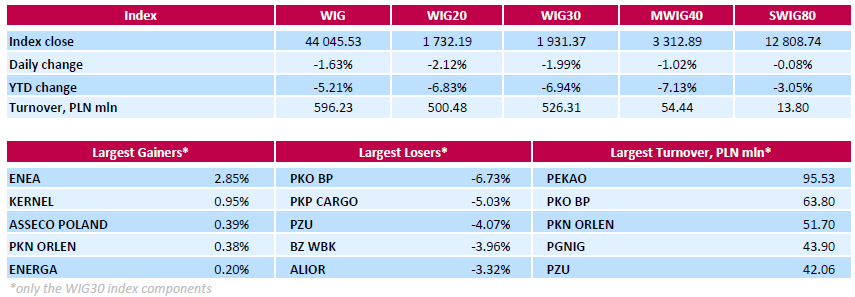

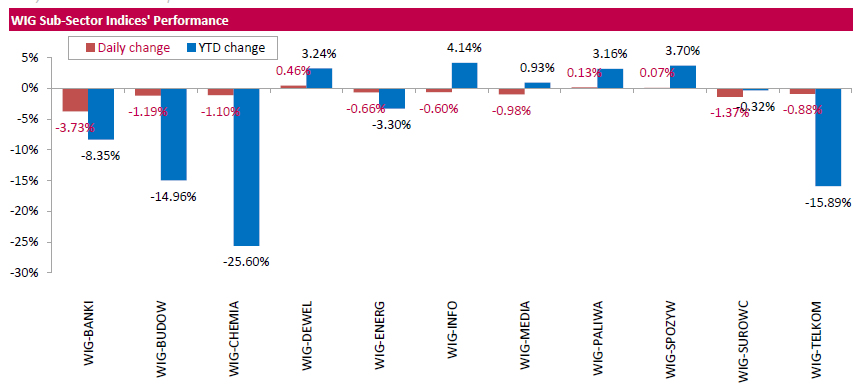

Polish equity market continued to decline on Monday. The broad market measure, the WIG index, lost 1.63%. From a sector perspective, banking sector (-3.73%) fared the worst, while developing sector (+0.46%) was the best-performing group.

The large-cap stocks' measure, the WIG30 Index, fell by 1.99%. Within the WIG30 Index components, bank PKO BP (WSE: PKO) recorded the biggest decline, slumping 6.73%. It was followed by railway freight transport operator PKP CARGO (WSE: PKP), insurer PZU (WSE: PZU) and two banks BZ WBK (WSE: BZW) and ALIOR (WSE: ALR), dropping between 3.32% and 5.03%. On the other side of the ledger, genco ENEA (WSE: ENA) led a handful of advancers with a 2.85% gain, followed by agricultural producer KERNEL (WSE: KER), climbing by 0.95%.

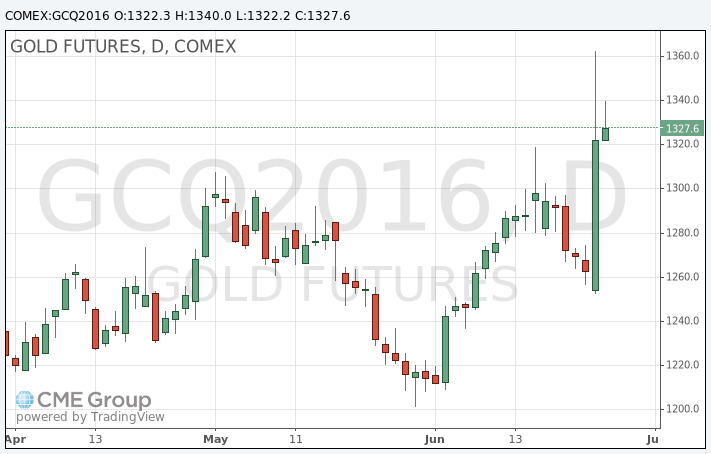

Gold rose more than 1% in today's trading, remaining near the highs of the last two years, recorded on Friday as uncertainty due to Britain's decision to withdraw from the European Union has forced investors to sell shares and invest in safe assets.

On Friday, the increase in the price of gold reached 8%, touching $ 1358.20 - the highest since March 2014.

"The uncertainty around the timing of talks on the withdrawal from the EU not only means that investors become more cautious and buy gold and dollars, but also continues to put pressure on the pound sterling and converted into an irreversible loss of economic activity at the domestic level," - Martin Arnold of ETF Securities said.

Goldman Sachs raised its forecast for gold prices, citing the fact that Brexit could have a more lasting impact on the trajectory of rising interest rates in the United States.

"The price of gold will rise in the third quarter, when they start to feel the full impact of Brexit, but expect it to fall in the fourth quarter after the elections in the United States and against the background of preparations for the next Fed raise rates", - said the financial company Macquarie.

The cost of the August gold futures on the COMEX rose to $ 1340.0 per ounce.

Brexit will not lead to a recession in the EU, said on Monday the member of European Commission for Economy and Finance, Pierre Moscovici.

"There is still uncertainty with which you want to work, but we do not expect strong shocks or crisis", - said P.Moskovici.

According to him, the EU has the necessary tools to ensure financial stability, especially in view of availability of the central banks to cooperate.

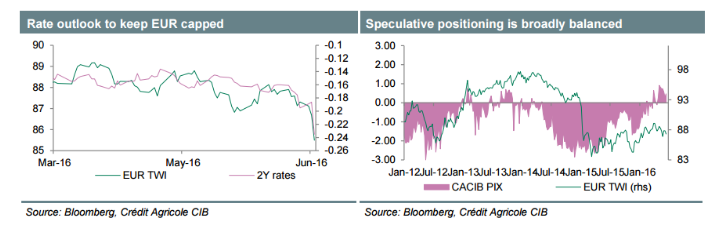

"We expect interest to continue building EUR short positions in the aftermath of the UK vote, amid anticipation that political pressure will build for reduced integration. We would caution that the eurozone's large current account surplus should limit EUR vulnerability, particularly in the context of growing doubts on the US economic outlook.

However, in the near-term bears are likely to have the upper hand and we see scope for EURUSD to reach 1.09.

Elections in Spain have reported a hung parliament for the second time leading to further political uncertainty as a coalition is negotiated. Today, ECB President Draghi speaks as the ECB kicks off a three-day forum on central banking which will include speeches from Fed Chair Yellen and BOE Governor Carney later in the week".

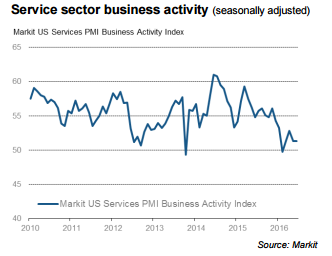

June data highlighted another subdued month for the U.S. service sector, with activity growth remaining marginal and job creation easing to its least marked for a year-and-a-half. Incoming new work increased at the fastest pace since January, but the rate of expansion remained weaker than its post-crisis trend.

Meanwhile, service providers indicated another drop in confidence regarding the year-ahead business outlook, with the latest reading the weakest since the survey began in late- 2009. At 51.3 in June, the seasonally adjusted Markit Flash U.S. Services PMI™ Business Activity Index1 was unchanged since May and only 1 Please note that Markit's PMI data, flash and final, are derived from information collected by Markit from a different panel of companies to those that participate in the ISM Non-Manufacturing Report on Business.

The session on Wall Street began with the discount, which is not a special surprise in the face of falling from this morning contracts. We are concerned, however, about the scale of declines, which already exceeding 1%. So, the trade of the main indices begins below the important supports, which are the May lows. Their loss opens the door to the development of the profits taking from this year's approach, which of course Euroland done a long time ago. The American market remains surprisingly weak in the face of Brexit, especially in the context of the previously presented fairly resistant and irreverent attitude towards the possibility of the UK exit from the EU. It does not help Europe, and the Warsaw parquet comes back around session lows.

EURUSD 1.1100 (EUR 381m)

USDJPY 100.65 (USD 500m) 107.00 (382m) 108.00 (240m)

AUDUSD 0.7425 (AUD 561m) 0.75200 (333m)

USDCAD 1.3200 (USD 430m)

U.S. stock-index futures fell.

Global Stocks:

Nikkei 15,309.21 +357.19 +2.39%

Hang Seng 20,227.3 -31.83 -0.16%

Shanghai Composite 2,895.52 +41.24 +1.44%

FTSE 6,013.01 -125.68 -2.05%

CAC 4,014.13 -92.60 -2.25%

DAX 9,361.9 -195.26 -2.04%

Crude $46.77 (-1.83%)

Gold $1333.30 (+0.82%)

- US economy doing pretty well despite headwinds.

- sees long period of change after Brexit vote.

- watching exchange rates very closely, unilateral action to intervene would be inappropriate.

- tools are in place to manage Brexit fallout.

- EU banks better positioned than they were in 2008.

- market impact from Brexit has been orderly so far.

- UK and EU leaders must provide for stability, continuity.

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.27 | -0.11(-1.1727%) | 50479 |

| ALTRIA GROUP INC. | MO | 66.58 | -0.44(-0.6565%) | 3955 |

| Amazon.com Inc., NASDAQ | AMZN | 691.77 | -7.19(-1.0287%) | 76756 |

| American Express Co | AXP | 59.09 | -0.97(-1.6151%) | 320 |

| AMERICAN INTERNATIONAL GROUP | AIG | 49.65 | -1.07(-2.1096%) | 7936 |

| Apple Inc. | AAPL | 93.1 | -0.30(-0.3212%) | 204430 |

| AT&T Inc | T | 41.35 | -0.17(-0.4094%) | 32405 |

| Barrick Gold Corporation, NYSE | ABX | 21.03 | 0.56(2.7357%) | 184034 |

| Boeing Co | BA | 125.77 | -0.75(-0.5928%) | 2814 |

| Caterpillar Inc | CAT | 71.9 | -1.13(-1.5473%) | 6215 |

| Chevron Corp | CVX | 100.97 | -0.93(-0.9127%) | 8805 |

| Cisco Systems Inc | CSCO | 27.55 | -0.20(-0.7207%) | 26094 |

| Citigroup Inc., NYSE | C | 39.58 | -0.72(-1.7866%) | 346866 |

| Deere & Company, NYSE | DE | 81.25 | -0.47(-0.5751%) | 2131 |

| E. I. du Pont de Nemours and Co | DD | 65 | -1.00(-1.5152%) | 250 |

| Exxon Mobil Corp | XOM | 88.75 | -0.64(-0.716%) | 5841 |

| Facebook, Inc. | FB | 111.31 | -0.77(-0.687%) | 137802 |

| FedEx Corporation, NYSE | FDX | 147.51 | -3.06(-2.0323%) | 1288 |

| Ford Motor Co. | F | 12.41 | -0.11(-0.8786%) | 131420 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.44 | -0.14(-1.3233%) | 113421 |

| General Electric Co | GE | 29.57 | -0.25(-0.8384%) | 23129 |

| General Motors Company, NYSE | GM | 28.11 | -0.24(-0.8466%) | 17120 |

| Goldman Sachs | GS | 140.29 | -1.57(-1.1067%) | 56795 |

| Google Inc. | GOOG | 671.45 | -3.77(-0.5583%) | 8054 |

| Hewlett-Packard Co. | HPQ | 12.2 | -0.06(-0.4894%) | 200 |

| Home Depot Inc | HD | 125.31 | -1.09(-0.8623%) | 5504 |

| HONEYWELL INTERNATIONAL INC. | HON | 111.48 | -1.50(-1.3277%) | 610 |

| Intel Corp | INTC | 31.33 | -0.22(-0.6973%) | 33737 |

| International Business Machines Co... | IBM | 145.55 | -1.04(-0.7095%) | 3925 |

| International Paper Company | IP | 41.13 | -0.24(-0.5801%) | 2797 |

| Johnson & Johnson | JNJ | 114.72 | -0.91(-0.787%) | 3620 |

| JPMorgan Chase and Co | JPM | 58.65 | -0.95(-1.594%) | 150996 |

| McDonald's Corp | MCD | 118.5 | -0.94(-0.787%) | 4133 |

| Merck & Co Inc | MRK | 55.38 | -0.50(-0.8948%) | 872 |

| Microsoft Corp | MSFT | 49.25 | -0.58(-1.164%) | 95851 |

| Nike | NKE | 52.26 | -0.33(-0.6275%) | 14643 |

| Pfizer Inc | PFE | 33.7 | -0.27(-0.7948%) | 4873 |

| Procter & Gamble Co | PG | 81.89 | -0.37(-0.4498%) | 4192 |

| Starbucks Corporation, NASDAQ | SBUX | 54 | -0.68(-1.2436%) | 13467 |

| Tesla Motors, Inc., NASDAQ | TSLA | 190.25 | -2.90(-1.5014%) | 42536 |

| The Coca-Cola Co | KO | 43.75 | -0.18(-0.4097%) | 2277 |

| Travelers Companies Inc | TRV | 109.6 | -1.42(-1.2791%) | 365 |

| Twitter, Inc., NYSE | TWTR | 16.32 | -0.12(-0.7299%) | 95455 |

| United Technologies Corp | UTX | 98 | -0.89(-0.90%) | 931 |

| UnitedHealth Group Inc | UNH | 135.85 | -1.44(-1.0489%) | 1876 |

| Verizon Communications Inc | VZ | 54.25 | -0.18(-0.3307%) | 6605 |

| Visa | V | 74.1 | -0.95(-1.2658%) | 3939 |

| Wal-Mart Stores Inc | WMT | 71.47 | -0.49(-0.6809%) | 1638 |

| Walt Disney Co | DIS | 94.86 | -0.86(-0.8985%) | 11791 |

| Yahoo! Inc., NASDAQ | YHOO | 35.92 | -0.32(-0.883%) | 20650 |

| Yandex N.V., NASDAQ | YNDX | 21.1 | -0.29(-1.3558%) | 8700 |

Upgrades:

Barrick Gold (ABX) upgraded to Sector Outperform from Sector Perform at CIBC

Downgrades:

Other:

Barrick Gold (ABX) added to Conviction Buy List at Goldman

The euro depreciated moderately against the dollar, returning to the session lows. Risk aversion pressure continued on the background of the unexpected outcome of the British referendum.

Impact of Brexit is expected to increase due to the potential negative impact of the European economic and political landscape. "The focus right now is Europe, where Brexit can cause a domino effect among the States that wish to withdraw from the EU. The main problem for the foreign exchange market is the European political uncertainty, which could lead to monetary and credit paralysis." - Said Junichi Ishikawa, an analyst at IG Securities .

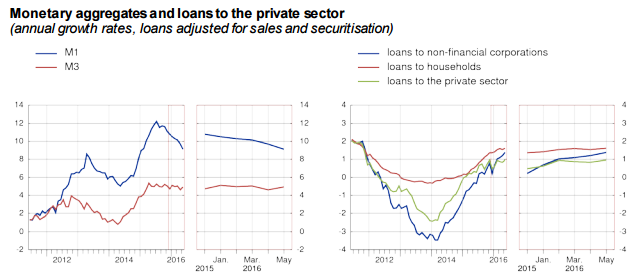

Economic data from Europe had little influence on the price action. In May, the M3 money aggregate grew by 4.9%, which was higher than expected (4.8%) and the previous value (4.6%). From January to May, the indicator increased by 4.8% versus + 4.9% in the same period of 2015. Also, the data showed that lending to households increased by 1.6% in May, compared to 1.5% in April. Total credid in May increased by 1.4% after a 1.2% increase in April.

The pound fell more than 3.7% against the dollar, approaching 31-year lows, which is associated with increased risk aversion amid Brexit concerns and mass resignations of Labour MPs. Also today, the yield on 10-year UK bonds dropped below 1% for the first time. The fall of the pound continues despite current attempts of Chancellor George Osborne to reassure the financial markets. He said that the government has a plan of action in emergency situations, which will help support the economy.

EUR / USD: during the European session, ose from $ 1.0984 to $ 1.1083, but then fell back to $ 1.0977

GBP / USD: fell to $ 1.3150

USD / JPY: fell to Y101.45

EUR/USD

Offers 1.1080-85 1.1100 1.1120-25 1.1150 1.1170 1.1200 1.1200 1.1230-40 1.1280 1.1300

Bids 1.1030 1.1000 1.0975-80 1.0930 1.0900 1.0885 1.0850 1.0820-25 1.0800

GBP/USD

Offers 1.3430 1.3450 1.3475-80 1.3500 1.3550 1.3580 1.3600 1.3650 1.3700

Bids 1.3350 1.3325-30 1.3300 1.3225-30 1.3200 1.3100 1.3040 1.3000

EUR/GBP

Offers 0.8270 0.8285 0.8300 0.8315-20 0.8335 0.8350 0.8370-75 0.8400

Bids 0.8200-0.8195 0.8165 0.8150 00.8130 0.8100 0.8080 0.8050 0.8000

EUR/JPY

Offers 113.00 113.20-25 113.50-55 114.00 114.30 114.50 115.00

Bids 112.00 111.70 111.50 111.00 110.60 110.00 109.50 109.00

USD/JPY

Offers 102.20-25 102.50 102.80-85 103.00 103.25 103.50 103.85 104.00 104.40-50

Bids 101.65 1101.50 101.20-25 100.00 99.85 99.50 99.00

AUD/USD

Offers 0.7450-55 0.7485 0.7500 0.7520 0.7550 0.7570 0.7600 0.7630 0.7650 0.7700

Bids 0.7400 0.7385 0.7370 0.7350-55 0.7320 0.7300

Poor sentiment in Europe means that European indexes are trading at minima, losing approx. 2% in Frankfurt and Paris. The main declining sectors are banks whose index is near the lows from the end of the last week and clearly below support at minima of February and early April. Paradoxically, the relatively well copes London.

On the Warsaw market bulls managed so far to halt the downward above support at 1,720 points. However, the style of correction may suggest that this is not the last word of the supply side and the market could include the next wave, which will reduce the WIG20 towards support at 1,720 points. Also, the attitude of the other markets where Friday's approach is clearly tested, may encourage such a scenario.

European stocks continued the decline but at more moderate pace. The main pressure on the indices was Brexit concerns.

Today, Chancellor George Osborne tried to calm financial markets, saying that the government has a plan of action in emergency situations, which will help support the economy. Meanwhile, he said that should not wait for the launch of new financial measures until the new prime minister will be elected, that is, until the autumn. "Undoubtedly, measures must be taken to combat the influence of Brexit on public finances, but it is wise to wait until we have a new prime minister,". Even before the referendum Osborne warned that the country is in need of an emergency budget and the risk of a total loss of confidence in the state finances.

It is worth emphasizing that today the yield on 10-year UK bonds dropped below 1% for the first time.

The composite index of the largest companies in the region Stoxx Europe 600 was down 2.4 percent. The drop among the 19 industry groups was mainly due to large-scale decline of UK bank shares.

Shares of Royal Bank of Scotland Group Plc fell by 15 percent, and Barclays Plc - 12 percent.

The Spanish IBEX 35 index fell 0.4 percent on the background of the election results. Early parliamentary elections have demonstrated that none of the four major Spanish parties can not gain enough votes to form a government alone. Therefore, the chairman of the winning People's Party Mariano Rajoy said he would talk with all political forces for coalition formation.

Capitalization of EasyJet Plc decreased by 18 percent after the company's warning that reducing travel demand will reduce profit the rest of the summer.

At the moment:

FTSE 100 6,059.63 -79.06 -1.29%

CAC 40 4,048.12 -58.61 -1.43%

DAX 9,404.19 -152.97 -1.60%

The British government must act urgently to minimize the uncertainty of Brexit, which affects investment decisions and slows down job creation. This is stated in a letter to Times newspaper, written by the general director of the Confederation of British Industry (CBI) Carolyn Fairbairn

"The first part of the plan is to get a strong and decisive leadership as soon as possible. Companies welcomed the decision to postpone the beginning of the separation process in accordance with Article 50 of the EC Treaty. Secondly, we must agree on the principles, which should be the basis of our new relationship with Europe and the rest of the world. The government should strive to protect and barrier-free access to the single market of 500 million consumers. The third part of the plan is to forge closer and deeper cooperation between business and government to help shape future economic relations",

At the moment the yield of 10-year UK bonds is trading 0.962%. Since the beginning of the day yields decreased by 11.5%. The reason for such dynamics is a concern about the consequences of Brexit, which is enhanced by the resignations Labour MPs. A high demand for safer bonds leads to a decrease in yield and this can be seen (at a lower scale though) globally.

French Finance Minister Michel Sapin said today that there were no disagreements between France and Germany that Britain should proceed to the planned exit from the European Union and the two countries agreed that this should be done quickly.

"France, like Germany, says that Britain voted Brexit, that is way out of the EU structures so Britain must quickly implement this scenario, we can not remain in an uncertain situation." - Sapin said.

Recall, last week German Foreign Minister Steinmeier also said that negotiations on the withdrawal of Britain from the European Union should begin as soon as possible, to enable member states to focus on the future of a united Europe.

Reuters:

-

According to CDU executive members, now is not the time to quickly deepen Eurozone cooperation.

-

We must act to prevent other countries from fleeing the EU.

EUR/USD 1.1100 (EUR 381m)

USD/JPY 100.65 (USD 500m) 107.00 (382m) 108.00 (240m)

AUD/USD 0.7425 (AUD 561m) 0.75200 (333m)

USD/CAD 1.3200 (USD 430m)

This morning, New York crude oil futures WTI rose by 0.46% to $ 47.85 per barrel and crude oil futures for Brent rose 0.69% to $ 49.37 per barrel. Thus, the black gold is recording some gains, after the recent collapse associated with market volatility after Brexit. It became known that the number of employees in the US oil rigs has decreased over the previous week for 7 to 330 and this could support the prices.

D/W

Israel and Turkey are ready to announce the normalization of relations

Israel and Turkey have reached an agreement on the normalization of bilateral relations after six years of cooling. The details will be officially announced on Monday, June 27, citing unnamed Israeli diplomat.

Brexit: Ten British "shadow" ministers resign

Ten Ministers of the British "shadow cabinet" Labour Party on Sunday, 26 June left their posts after the majority of the population voted to leave the European Union. According to Sky News, in the future, new applications will follow the resignation.

German Vice-Chancellor: EU will not be persuaded Britain to stay

Vice-Chancellor of Germany, Economy and Energy Minister Siegmar Gabriel spoke out against the possible concessions to address the UK with the aim to keep it in the European Union. "The British have now decided to leave and we will not talk about what EU can still offer." - Said Gabriel in an interview with Handelsblatt newspaper, the announcement of which was published in the Sunday, June 26.

Newspaper. ru

Lagarde: the financial markets have underestimated the consequences of Brexit

Director of the International Monetary Fund (IMF), Christine Lagarde, said that global financial markets had underestimated the effects of the British referendum on membership in the European Union, but the panic in the economy did not happen, according to TASS.

Bloomberg: Scotland will become the EU's new financial capital after Brexit

According to a member of parliament's Treasury Committee Mark Garner, Scotland can take the position of London, staying within the European Union. Garner believes that the minister Nikola Stardzhena tried to find an alternative role for the country.

Britain's Foreign Minister compared the loss of the European market with a disaster

British Foreign Secretary Philip Hammond said that it would be disastrous for the country to lose access to the European market, reports Reuters. It is noted that the minister himself is in favor of the United Kingdom to remain in the union. According to him, to maintain access to the market after Brexit will be impossible.

Moody's credit worsened Britain's rating outlook to "negative"

International rating agency Moody's decided to downgrade the UK's rating outlook after the referendum on withdrawal from the EU. The forecast has been lowered long-term issuer rating and debt rating from "stable" to "negative."

According to the head of the Eurogroup Jeroen Deysselbluma, Brexit limits the access of financial institutions to the internal European market, reports Reuters.

The Bank of England will allocate £ 250 billion to support the country after Brexit

Governor of the Bank of England Governor Mark Carney said that the regulator together with the Ministry of Finance have prepared an emergency action plan. This was reported in banks's press release.

The US Treasury has expressed willingness to support Britain and the EU after Brexit

The United States is ready to cooperate with London and Brussels to ensure financial stability in Europe, from the statement of US Treasury Secretary Jacob Lew, posted on the official website of the department.

• The annual growth rate of the broad monetary aggregate M3 increased to 4.9% in May 2016, from 4.6% in April.

• The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, decreased to 9.1% in May, from 9.7% in April.

• The annual growth rate of loans to households stood at 1.6% in May, compared with 1.5% in April.

• The annual growth rate of loans to non-financial corporations increased to 1.4% in May, from 1.2% in April.

eFXnews quoting a very clear Credit Agricole recommendation. Take it with a pinch of salt

We expect the single currency to remain subject to downside risks. This is especially true as the latest UK-related development is likely to increase political uncertainty in the EU further and as more muted growth prospects should keep the ECB in a position to consider additional policy action if needed. As reiterated by ECB President Draghi this week, downside risks to growth and inflation remain significant and uncertainty high. At the same time he stressed that more can be done if needed. Although it remains too early to expect the central bank to consider further policy measures, there is no scope of rising rate expectations anytime soon. In an environment of EU specific risk aversion, we believe too that the EUR should remain positively correlated with risk aversion.

As a result of the above outlined conditions we advise against buying the EUR, especially against currencies such as the USD. It may be true that increased global growth uncertainty should prevent the Fed from tightening monetary policy anytime soon.

However, at the same time the USD is behaving more as a safe haven currency in the current environment. In terms of data next week's main focus will be on preliminary June CPI, which is unlikely to confirm improving price developments.

The futures market started the new week from decrease of 0.17% to 1,756 points, means in the area close to Friday's end. So we start a little more interesting period, when the dust settles and we may look at the situation calmly.

WIG20 index opened at 1759.88 points (-0.55%)*

WIG 44662.18 -0.25%

WIG30 1962.15 -0.43%

mWIG40 3356.62 0.28%

*/ - change to previous close

The cash market opens from a decrease of 0.58% to 1,759 points at relatively modest turnover. The German DAX lost on a similar scale, what after the huge volatility on Friday may be called a quiet and relatively neutral opening.

Usually after such sessions of a solstice (low beginning, growth and above-average rotation) market likes to test later the credibility of return, which will may happen on the market today.

In addition to the economic data mentioned in the economic calendar, other events of which importance is more or less significant to the global markets:

- at 17:30 GMT the ECB president Mario Draghi will deliver a speech.

- for pound traders, on the next few days there will be plenty informations about Brexit and speeches from UK's officials.

Friday's session on Wall Street was one of the worst sessions since 2011. All indexes lost and almost the entire 3-month hardship of climb indices in the vicinity of 2,100 points on the S&P500 was offset by one session. It turned out that Thursday's breakout above this level was false, which usually is a sign of trouble. Declines on US stock exchanges were led by the banking sector - the same that for the last 3 sessions was the strongest one. It is worth to note almost 10% plunge in Citigroup. Heavily lost also companies from the biotechnology and transport sectors. There was no positive impact on the stock prices from weak data on orders for durable goods. In May, they declined by 2.2%. There was no help also from consumer confidence index which finally fell to 93.5 points. The main reason was to look on the other side of the ocean - in the UK. The strong rise in prices of US bonds, gold (+ 4.99%), and the yen shows that investors are beginning to buy so-called "safe" instruments. Ultimately, the S&P500 lost 3.59% and the technological Nasdaq fell by 4.13%.

In Asia the Nikkei and Shanghai indices reflect, what should gently support Europe, but we must remember that the Old Continent together with the Warsaw Stock Exchange on Friday quite clearly caught his breath after the first shock. In the morning, it seems that political uncertainty will be at the most hit in Britain and other markets should be quieter and the same opening may be close to neutral. A positive factor may be the result of Sunday's elections in Spain, where the ruling conservatives have increased their participation in Parliament, however, it still looks like it will be hard to build a coalition there.

Today's macro calendar is virtually empty, and from this site we should not expect an impulse to trade.

According to a Goldman Sachs client note the most significant change is a sharp cut in our UK GDP forecast by a cumulative 2¾% over the next 18 months, which implies that the UK economy enters a mild recession by early 2017.

"We have also reduced our Euro area GDP forecast by a cumulative ½%, which implies an average growth rate of 1¼% instead of 1½% for the next two years, and have shaved our US GDP forecast for the second half of 2016 by ¼pp to 2%.

There are three economic transmission mechanisms for the Brexit shock.

First, the UK terms of trade are likely to deteriorate, especially if it becomes harder to export high-value added services (including financial services) to the European Union. This is probably the most important shock from a long-run perspective, although its size is highly uncertain because we do not yet know how much access the UK will ultimately have to the Common Market.

Second, the uncertainty about the long term is likely to weigh on UK growth in the short term as firms hold off on investment. There is a substantial body of economic research showing that uncertainty shocks have large negative macroeconomic effects. Our European economics team views the uncertainty shock as the main near-term drag on UK growth.

Third, outside the UK the main transmission channels are weaker UK demand for imports and-much more importantly-a tightening of financial conditions via a stronger exchange rate and lower risk asset prices.

Taking as given the hit to UK GDP projected by our European economics team and the changes in financial conditions seen on Friday, we use the model to estimate the impact of the Brexit shock on growth in the major economies over the next two years. We then feed the GDP hit into an inflation hit via a Phillips curve relationship that also has a role for exchange rate pass-through.

And finally, we feed both the GDP hit and the inflation hit into a change in the warranted short-term interest rate via simple Taylor rule relationships.[3] The upshot is that the assumed hit to the UK and the moves seen in financial markets so far imply only moderate economic spillovers. The GDP effects are consistent with the forecast adjustments in the Euro area and the US already announced, although they suggest that Japan is at risk of even weaker growth than our Japan team's ½-1% forecast for 2016-2017 if Friday's FCI tightening does not reverse. The inflation effects are generally very small; only Japan sees a hit of more than 0.1pp because of the size of Friday's trade-weighted yen appreciation. And finally, the monetary policy effects are moderate, with a reduction in the warranted policy rate relative to the baseline of between 20bp in the US and 50bp in Japan".

As reported today by the State Statistical Bureau of China, the profits of large industrial enterprises increased by 3.7% year on year, after rising 4.2% in April. In the five months of this year, profit increased compared to the same period of last year by 6.4% and amounted to $ 356 billion.

The report said that since the beginning of this year, profits of China's industrial enterprises are steadily growing, with the main source of profit for companies is their main occupation. The highest growth is observed among the producers of coal, steel and non-ferrous metals. Reduction in recorded profits is seen in the chemical and petrochemical industries, as well as among electronics manufacturers.

The report of the department also reported that in May, the total debt of industrial enterprises increased by + 4.9% y/y.

- UK' s exit from the EU has added new factors of uncertainty to the the global economy, its impact is already being felt.

- there is a need to promote the restoration of global growth, together overcoming all the problems.

- China will continue to maintain relations with the EU and the UK as an important partner.

- China's economy is not threatened by a hard landing. We have every opportunity to achieve the main goals of socio-economic development in the current year.

- China's development is facing a number of challenges, including the weakening of external demand, the financial risks and uncertainties, however, expressed confidence that the country will cope with these difficulties.

- the basic situation in China's economic development is that the reason for the long-term devaluation of the RMB is not there.

- we have the ability to maintain the RMB exchange rate at a reasonable and balanced level.

The pound remained under pressure on Monday, falling to a 31-year low, reflecting the strong bearish sentiment of investors after the UK decided to withdraw from the European Union. The euro was also under pressure as Brexit clouded the future of the European Union.

The market continues to be in a state of shock after the results of the referendum indicated the willingness of the British to leave the EU. Scotland and London by an overwhelming majority voted in favor of EU membership, but Wales and the rest of the country outside of London voted in favor of Brexit. In connection with the results of the referendum, Prime Minister Cameron said that he was resigning. During the campaign he supported the remain in the EU. The prime minister said that the country needs "fresh leadership." "Britain needs a new prime minister and that he will decide when to begin the withdrawal from the EU, but I'll be on the post three months." - Said Cameron. In addition, the head of the Bank of England Governor Mark Carney said that the central bank is ready to provide additional funds in the amount of 250 billion pounds to support the financial markets after the voting. He also said that in the coming weeks, the regulator will consider the possibility of adopting additional measures of support.

Most economists agree that Brexit will affect the economy of Great Britain, Europe, and possibly other countries. Some of them believe that the short-term damage can be limited, if the authorities in Britain and other countries willmanage the consequences.

At the same time, the Prime Minister of Scotland Nicola Sturgeon did not rule out the possibility of holding a second referendum on independence from the UK. "A referendum on independence is now quite possible", - said Sturgeon. She said that Scotland should start preparing for a new referendum on independence from the UK so the region could be in the European Union.

Impact of Brexit - which also caused a lot of turmoil in world stock, commodity and bond markets - are expected to increase due to the potential negative impact in the European economic and political landscape.

"The focus now is Europe, where Brexit can cause a domino effect among the states that wish to withdraw from the EU. Although it has long been said, the main problem for the foreign exchange market is the European political uncertainty, which may lead to the monetary paralysis, "- said Junichi Ishikawa, FX analyst at IG Securities in Tokyo.

Today, the yen is trading in a narrow range. On Friday, the Japanese yen has risen 6.7% against the US dollar for the first time breaking the mark of 100. The sharp increase in demand for the Japanese currency, which is considered a safe haven, was associated with an increase in fear because of Brexit.

Today, Japanese Prime Minister Shinzo Abe at the emergency meeting of top cabinet members with the management of the Bank of Japan said that it is necessary to take additional measures to overcome the instability of the market.

"The market has a sense of uncertainty and increased risks, important steps to calm the situation are needed.", - Said the prime minister. He stressed the particular importance of the protection of the real sector of the Japanese economy, especially small and medium-sized businesses. In particular, at the meeting of the government has asked the central bank to saturate the market liquidity and credit.

During the discussion, the Japanese Deputy Prime Minister Taro Aso said that the finance ministers and the central banks of the G7 were able to bring down the panic. "In general, the measures gave the result," - he said.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1322 (2158)

$1.1272 (745)

$1.1221 (118)

Price at time of writing this review: $1.1016

Support levels (open interest**, contracts):

$1.0935 (7243)

$1.0857 (15973)

$1.0772 (6468)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 36583 contracts, with the maximum number of contracts with strike price $1,1500 (4307);

- Overall open interest on the PUT options with the expiration date July, 8 is 89877 contracts, with the maximum number of contracts with strike price $1,0900 (15973);

- The ratio of PUT/CALL was 2.46 versus 2.45 from the previous trading day according to data from June, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.3723 (7)

$1.3628 (174)

$1.3535 (56)

Price at time of writing this review: $1.3392

Support levels (open interest**, contracts):

$1.3288 (722)

$1.3190 (3049)

$1.3092 (339)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 22924 contracts, with the maximum number of contracts with strike price $1,5000 (4027);

- Overall open interest on the PUT options with the expiration date July, 8 is 42823 contracts, with the maximum number of contracts with strike price $1,3500 (3689);

- The ratio of PUT/CALL was 1.87 versus 1.87 from the previous trading day according to data from June, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

European stocks posted their worst daily drop in nearly eight years Friday, after investors dumped risk assets following the U.K.'s historic referendum that left the country on course to leave the European Union.

The Stoxx Europe 600 SXXP, -7.03% tumbled 7% to 321.98, marking its worst session since October 2008 in fallout of Lehman Brothers bankruptcy, according to FactSet data. The stock gauge had been on pace for its largest daily drop since October 1987, but pared losses.

In London, the FTSE 100 UKX, -3.15% slid 3.2% to 6,138.69, bouncing back from steeper early losses.

U.S. stocks plunged Friday, posting largest drops in 10 months after U.K. citizens voted to end the country's membership in the European Union. The main indexes ended with weekly losses for a third straight week.

The S&P 500 SPX, -3.59% plummeted 75.92 points, or 3.6%, to 2,037.40, its largest one-day percentage decline since Aug 24, 2015. For the week, the benchmark index lost 1.6%, the largest one-week drop since February.

The Dow Jones Industrial Average DJIA, -3.39% suffered its largest one-day drop in 10 months, plunging 611.21 points, or 3.4%, to 17,399.86. The blue-chip index lost 1.6% over the week.

Meanwhile, the Nasdaq Composite COMP, -4.12% was hit the hardest, as investors dumped technology and biotech stocks. The index lost 202.06 points, or 4.1%, to 4,707.98 and declined 1.9% over the week.

Asian stocks fell and the British pound tumbled more than 2 percent on Monday as markets struggled to shake off deep uncertainty sparked by Britain's decision to leave the European Union.

Sentiment remained weak even though the worst of the turmoil seen on Friday, when global stock markets suffered their biggest decline in nearly five years, had eased.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS shrank losses to 0.6% as companies with UK exposure in particular came under more pressure.

Financials led declines in Australia and Hong Kong with the sector seen the among worst hit by Brexit and the prospect of London losing its prized "EU passport".

June 27 Japan's Nikkei share average rebounded on Monday as government officials stepped up warnings that they may intervene in currency markets to stabilise the yen after Britain voted to leave the European Union.

Prime Minister Shinzo Abe said on Monday he has instructed Finance Minister Taro Aso to watch currency markets "ever more closely" and take steps if necessary.

Abe summoned Aso and Bank of Japan Deputy Governor Hiroshi Nakaso to discuss how to deal with the market turbulence caused by Brexit.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.