- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-04-2022

- USD/CAD traders now await the Fed as the US dollar consolidates below 20-year highs.

- Bears have moved in and eye a significant correction towards 1.2720/50.

At the time of writing, USD/CAD is trading at 1.2805 and consolidated in resistance territories. The US dollar rose against most G10 currencies, tailing off towards the end of the day and offering some relief to the commodity complex. nevertheless, DXY, a measure of the greenback vs. a basket of currencies, rose to a 20-year high as investors price in a series of relatively bg interest rates from the Federal Reserve.

A bounce in risk appetite set in during the Wall Street session as investors observed evidence of strong consumer demand obscured by the unexpected decrease in Gross Domestic Product growth for the last quarter, the first since 2020. Nevertheless, the risk-off tones are well set and have sunk the S&P 500 more than 5% in April, on track to be the worst month since the 1987 bear market.

The worries over China's fight to curb COVID combined with the Ukraine crisis against a backdrop of hawkish central banks set on tightening monetary policy is feeding into recession concerns. Treasury Secretary Janet Yellen spoke up overnight and said that the global pandemic and Russia’s invasion of Ukraine highlight the possibility of big economic shocks in the future, adding that downturns are “likely to continue to challenge the economy.”

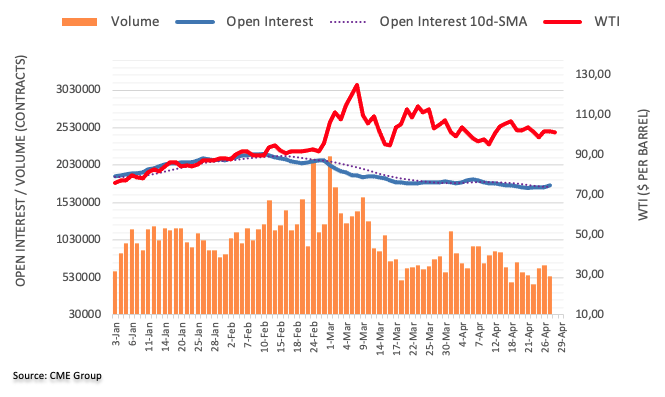

Meanwhile, supportive of CAD, the price of crude oil price has advanced to USD107/bbl amid the rising possibility of a European embargo on Russian oil. ''Germany is preparing to halt Russian oil imports in a phased manner, which would lead to a broader sanction by the region. Germany’s minister has already said that the country could manage without Russian oil,'' analysts at ANZ Bank explained.

''Investors are concerned about replacing the lost barrels due to the upcoming European sanctions. Oil product prices are rallying as well, lifting refiners’ margins. However, oil-product demand remains subdued in China due to rising COVID case numbers.''

All eyes on the Fed

All eyes will now turn to the Fed next week. Fed tightening expectations are robust. Markets are looking for at least a 50 bp hike at the May 3-4 meeting and again at the June 14-15 meeting. This is fully priced in, with nearly 25% odds of a possible 75 bp move in June. the surprise will come if there is anything short or above this consensus at next week's meeting.

''Looking ahead, swaps market is pricing in 275 bp of tightening over the next 12 months that would see the policy rate peak near 3.25%. While this almost meets our own call for a 3.5% terminal rate, we continue to see risks that the expected terminal rate moves even higher if inflation proves to be even more stubborn than expected,'' analysts at Brown Brothers Harriman said.

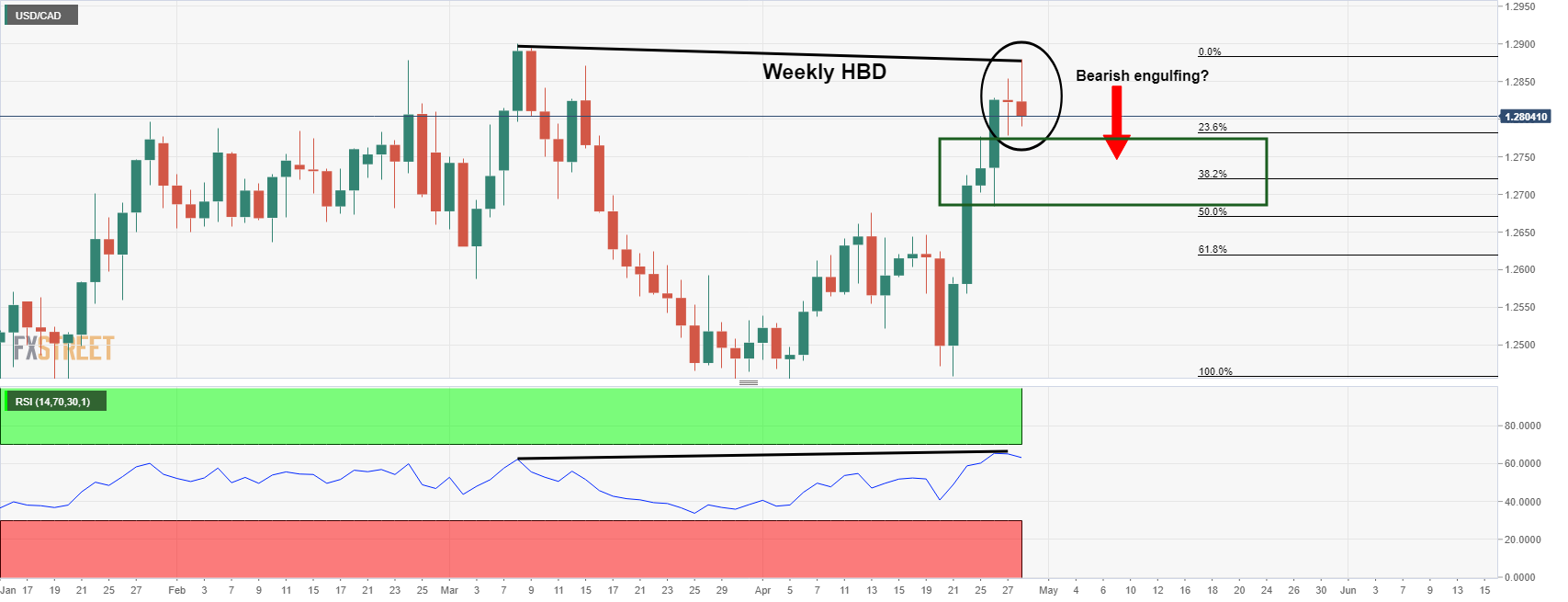

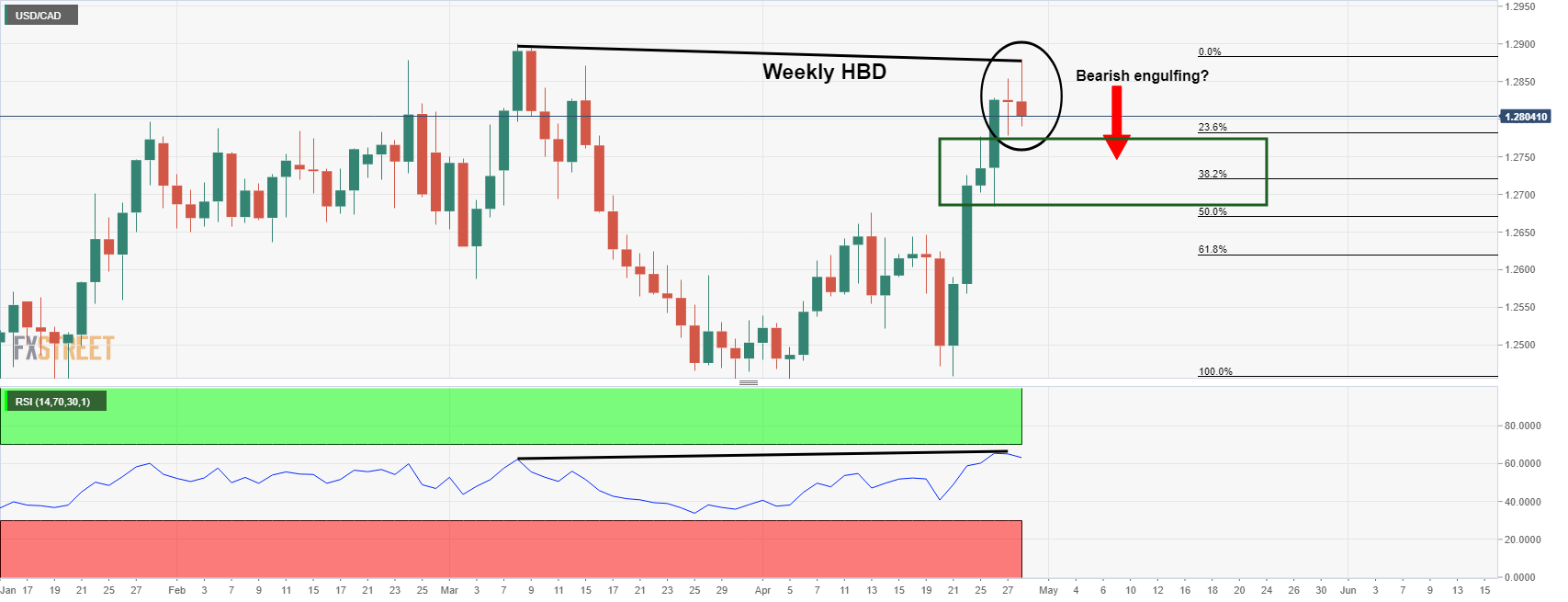

USD/CAD technical analysis

USD/CAD is consolidating in resistance territory and could be on the verge of a significant correction towards 1.2720/50 as per the following analysis:

-

Bears are growling back at the US dollar bulls

''The current price action is leaving the prospects of a bearish engulfing daily close following the prior day's doji. This is regarded as bearish and a prelude for the next days. There are expectations of a correction to test the 1.2770s, and then potentially as deep as a 38.2% Fibonacci retracement below 1.2750.''

''1.2650 comes thereafter but the point of control of where the majority of business was transacted for the month of April is much lower, down to the neckline of the W-formation at 1.2611.''

- The Aussie is set to finish the month with gains, up so far by 1.43%.

- The lack of New Zealand economic data and the hot Australian inflation report boosted the prospects of the AUD.

- AUD/NZD Price Forecast: Solid resistance around 1.0960-1.1000 might put a lid on the AUD/NZD upside.

The AUD/NZD seems poised to pare earlier week losses and is rising for the third consecutive day in the week, up a modest 0.13% as the Asian Pacific session begins. At the time of writing, the AUD/NZD is trading at 1.0943.

The week’s lack of New Zealand data left the AUD/NZD adrift to the Australian economic docket, which showed that inflation rose by 5.1% y/y, higher than the 4.6% estimations and smashing the 3.5% previous reading on the headline. Core inflation accelerated to its fastest pace since 2009, to 3.7%, from an earlier 2.6% reading.

Aside from this, sentiment improved throughout the day, and the Asian session carried on Wall Street’s mood. The coronavirus woes in China kept investors on their toes. Meanwhile, the Ukraine-Russian tussles alongside a weaker than expected US growth report were put aside by market players as appetite for riskier assets increased.

Therefore, the AUD/NZD appreciated in the week on expectations that the Reserve Bank of Australia (RBA) would hike rates in May. Nevertheless, a Federal Election in Australia could deter the RBA from taking action despite a high inflationary reading.

AUD/NZD Price Forecast: Technical outlook

The AUD/NZD bias is tilted to the upside. The daily moving averages (DMAs) below the exchange rate depict the pair in an uptrend. However, Thursday’s price action encountered solid resistance around 1.0962, a zone clouded by resistance levels around the 1.0960-1.1000 area.

Upwards, the AUD/NZD’s first resistance would be April’s 28 daily high at 1.0962. Once cleared, the next supply zones would be 1.0975, followed by 1.0998.

On the other hand, the AUD/NZD first demand zone would be 1.0900. Break below would expose April’s 28 at 1.0880, followed by April’s 25 swings low at 1.0824.

Key Technical Levels

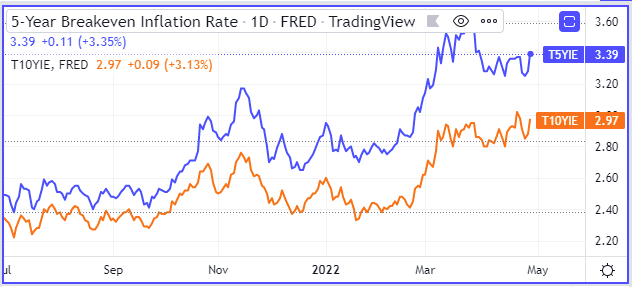

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose for the second consecutive day to 2.97% by the end of Thursday’s US session.

In doing so, the inflation gauge extends the mid-week recovery towards the record top marked on April 21, at 3.02%.

The following is the graphical representation of the 10-year and 5-year gauges of inflation expectations:

That being said, the same can bolster the odds of the Fed’s 0.50% rate hike on further upside moves, which in turn signals the US dollar’s additional north-run. It’s worth noting that the US Dollar Index (DXY) jumped to the highest level in 20 years while poking the 104.00 threshold.

Other than the FRED figures, today’s US Core Personal Consumption Expenditures Price Index for March also becomes important for the inflation view and the US dollar in turn, expected to ease to 5.3% YoY versus 5.4% prior.

Also read: USD/JPY dribbles around 20-year high near 131.00 with eyes on US PCE inflation

- EUR/JPY is consolidating in the 18-pips range as investors await EU GDP numbers.

- BOJ’s ultra-loose monetary policy has drifted the asset higher.

- EU is inching closer to embargoing Russian oil.

The EUR/JPY pair is oscillating in a narrow range of 137.32-137.50 in the Asian session as investors are awaiting the release of the Gross Domestic Product (GDP) numbers in the eurozone. The quarterly GDP numbers are seen at 0.3% in-line with the prior print while the annual GDP may outperform. A preliminary reading for the yearly GDP is 5% against the previous figure of 4.3%.

The cross is advancing firmly post dovish tone from the Bank of Japan (BOJ). A prudent monetary policy has been dictated by BOJ Governor Haruhiko Kuroda on Thursday. The BOJ kept interest rates unchanged but warns the impact of higher energy bills and commodity prices on the real income of the households in Japan. The central bank will continue to advocate more stimulus to ramp up the aggregate demand and inflation in the economy going forward. On the weakening yen front, the BOJ commented that corporate profits will remain solid but vulnerable domestic currency could have an adverse impact on the economy.

Meanwhile, the shared currency is expected to face a lot of heat amid its progressive moves towards an embargo on Russian oil imports. The majority of the criticism was coming from Germany in the last discussions but the automobile-maker nation is dropping its opposition as reported by its government officials, according to the WSJ. This will quicken the required paperwork and the prohibition of Russian oil on short notice will spurt the unemployment issues in the eurozone.

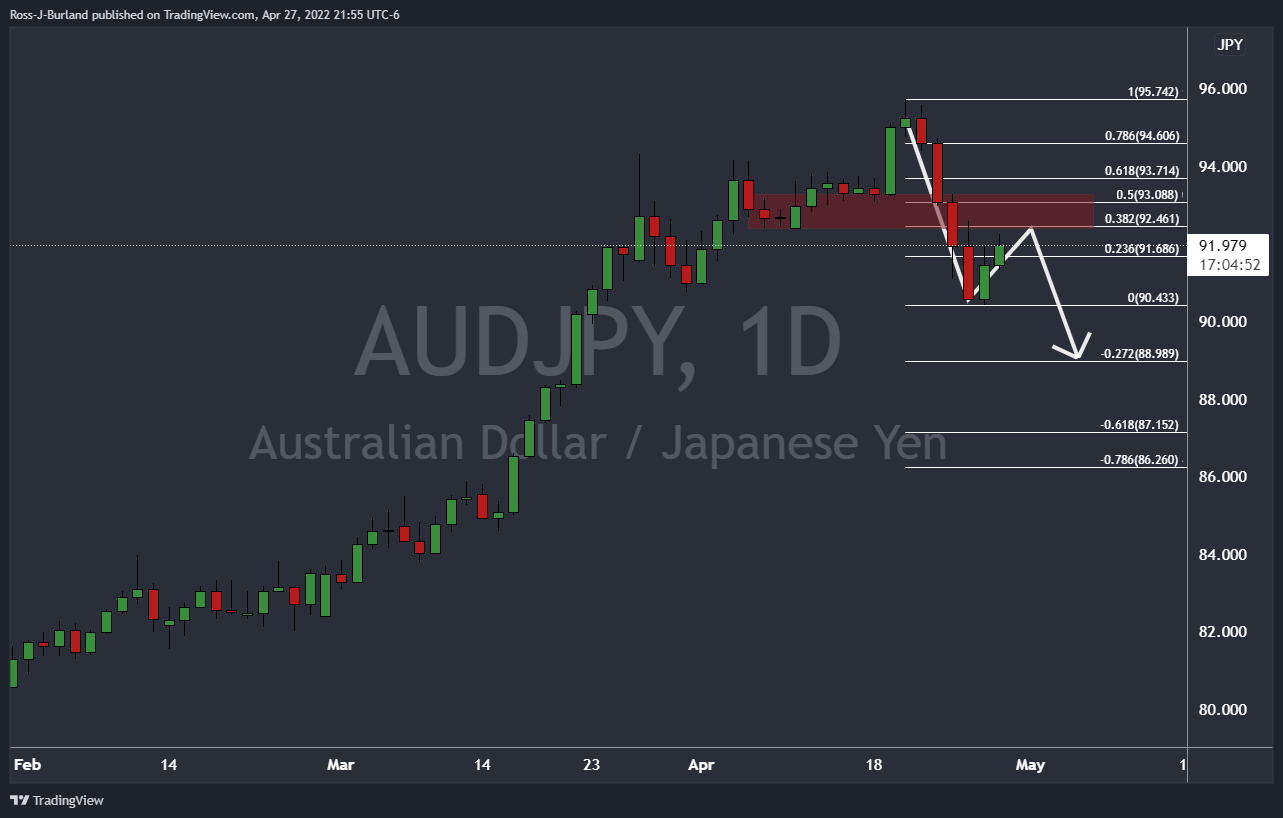

- AUD/JPY remains mildly bid above 200-SMA, up for the third consecutive day.

- Firmer RSI, bullish MACD signals also keep buyers hopeful.

- Monthly high, one-month-old resistance line lure bull ahead of 61.8% FE.

- Bears need to break five-week-long horizontal area for fresh entry.

AUD/JPY holds on to the mid-week rebound as buyers battle with the key moving average during Friday’s initial Asian session, up 0.10% near 93.00 by the press time. In doing so, the cross-currency pair pokes the 100-SMA hurdle, around 93.25 at the latest.

Given the bullish MACD signals and upbeat RSI line, not overbought, not to forget the pair’s rebound from a horizontal area comprising multiple levels marked since late March, AUD/JPY prices remain on the way to the monthly peak of 95.74.

However, multiple hurdles around 94.25 and an upward sloping trend line from March 28, close to 96.45, can test the short-term bulls.

In a case where the quote rises past-96.45, the 61.8% Fibonacci Expansion (FE) of March 15 to April 25 moves, near 97.50, will be in focus.

Alternatively, pullback moves may initially aim for the 200-SMA level of 91.90 before retesting the aforementioned horizontal support area near 90.70-60.

Following that, the 90.00 threshold will be crucial to watch as a clear break of which can direct prices towards the late March swing low near 87.30.

AUD/JPY: Four-hour chart

Trend: Further upside expected

- The momentum oscillator RSI (14) seems losing the downside momentum.

- Pound bulls have seen a minor pause after a six-day losing streak.

- A pullback towards 1.2500 will activate responsive sellers.

The GBP/USD pair is displaying a minor pause from 1.2411 after a sheer downside move. The cable is experiencing some signs of cushion after a six-day losing streak however, the overall context is still extremely bearish.

A bullish divergence formation on an hourly scale has made the pound bulls hopeful. The asset is continued with its lower high lower low formation, however, the momentum oscillator Relative Strength Index (RSI) shows a loss of downside momentum after forming higher lows and has raised the odds of a reversal.

It is critical to note that a bullish reversal is empowered with wider bullish ticks, which are not visible on the chart. Therefore, it’s too early to claim it a reversal but a pullback towards the psychological resistance of 1.2500 looks likely. The asset is expected to face barricades near the supply zone placed in a range of 1.2500-1.2600.

The 20- and 50-period Exponential Moving Averages (EMAs) at 1.2477 and 1.2534 respectively are scaling lower, which adds to the downside filters.

Should the asset test the supply zone in a range of 1.2500-1.2600, responsive sellers may attack the cable, which could drag the major towards Thursday’s low at 1.2411, followed by the 19 June 2020 low at 1.2342.

On the flip side, pound bulls could regain control if the asset oversteps the supply zone confidently. This will drive the asset towards the round level resistance and Tuesday’s high at 1.2700 and 1.2773 respectively.

GBP/USD hourly chart

-637867830942427252.png)

- The GBP/JPY is registering gains of 2.03% in April as the end of the month looms.

- Thursday’s Bank of Japan interest rate decision weighed on the JPY as the BoJ doubled down on stimulus, despite a worldwide high inflationary scenario.

- GBP/JPY Price Forecast: Bear’s failure to push the pair below 160.00 opened the door for further upside; further gains lie ahead.

The GBP/JPY stages a comeback but fails to reclaim 164.00 despite an upbeat market mood and a dovish Bank of Japan (BoJ), which kept rates unchanged and reiterated its accommodative stance on Thursday amidst a worldwide environment of elevated prices. At the time of writing, the GBP/JPY is trading at 163.01.

Asian equity futures have followed Wall Street’s mood, leading to a higher open. China’s coronavirus woes which tempered investors’ mood, appear to ease as Shanghai relaxed restrictions while the Russia-Ukraine conflict continues. Alongside global central bank tightening, those factors cloud an environment that could trigger a recession. On Thursday, the US Department of Commerce reported that the Q1’s GDP contracted by 1.4%.

Elsewhere, on Thursday’s session, the GBP/JPY opened near the open at around 161.00 and rallied on fundamental news that weighed on the JPY, lifting the pair towards 164.25, the daily high for a 300-pip gain. However, the GBP/JPY retreated and settled around the 163.00 mark.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY remains upward biased after plummeting 800-pips in the week, though the 160.00 thresholds put a lid on the GBP/JPY fall. On Wednesday, the GBP/JPY bounced off those lows, helped by the Relative Strength Index (RSI) shift from bearish to the bullish territory. Along with a morning star pattern (a three-candlestick formation), those factors could pave the way for further GBP/JPY gains.

The GBP/JPY’s first resistance would be the 164.00 mark. A break above would expose March’s 28 daily high at 164.65, followed by the figure at 165.00. Once cleared, GBP/JPY’s bear’s next challenge would be 166.00.

Key Technical Levels

- USD/JPY bulls take a breather at the two-decade top in search of fresh clues, amid off in Japan.

- Strong yields, safe-haven demand and Fed v/s BOJ divergence propel the pair.

- US GDP details, BOJ’s double-down on easy money recently favored the bulls.

- Risk catalysts, US data to direct intraday traders amid Japan’s Showa Day Holiday.

USD/JPY seesaws around 131.00 during the early Friday morning in Asia, after rising to the highest levels since April 2002 the previous day. The pair’s latest inaction could be linked to the off in Japan, as well as a cautious sentiment ahead of the Fed’s preferred gauge of inflation.

The yen pair rallied the most since March 2020 the previous day after the Bank of Japan (BOJ) showed readiness for unlimited bond-buying to maintain the yield target. The Japanese central bank also cited the sustained inflation below the 2.0% target as the reason to support their dovish move. Furthermore, the BOJ also lacked economic optimism within the forecasts and added weakness to the JPY.

On the other hand, the US Q1 2022 GDP details and risk-aversion wave added to the USD/JPY pair’s north-run. Although the headline Annualized GDP marked the first contraction in two years with -1.4% figures versus 1.1% forecast and 6.9% prior, the details relating to the personal consumption, inventories and Net trade flashed positive signs.

Following the firmer data, CME’s FedWatch Tool showed around a 96% probability of a 0.50% rate hike during the May monthly meeting. Additionally favoring the odds of a faster Fed normalization was the rising inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data.

Elsewhere, the Russia-Ukraine crisis and the West versus Moscow tussles, due to the invasion of Kyiv, join China’s covid concerns to weigh on the risk appetite and support the US dollar’s safe-haven demand.

Amid these plays, Wall Street benchmarks rose for the second consecutive day, backed by upbeat earnings, whereas the US 10-year Treasury yields rose 1.5 basis points (bps) to 2.83%.

Looking forward, an absence of bond moves in Asia may challenge the USD/JPY buyers and can trigger the pair’s pullback. However, major attention will be given to the Fed’s preferred gauge of inflation, namely the US Core Personal Consumption Expenditures Price Index for March, expected to ease to 5.3% YoY versus 5.4% prior.

Technical analysis

The USD/JPY pair’s rebound from 127.00, followed by a clear upside break of the early-month high surrounding 129.40, enables the buyers to aim for the 100% Fibonacci Expansion (FE) of April 12-27 moves, near 131.60 by the press time.

Alternatively, the pullback can initially aim for the 130.00 round figure ahead of challenging the 129.40 and the 10-DMA support near 128.60.

- Gold Price is facing barricades near the $1,890.21-1,895.15 range and 20-EMA.

- The DXY is driving higher on an adrenaline rush from uncertainty over the rate decision by the Fed.

- Apart from the interest rate decision, balance sheet reduction and further guidance will be in focus.

Gold Price (XAU/USD) has rebounded sharply after hitting a low of $1,872.22 on Thursday. The rebound in the gold prices looks very confident, which claims the availability of responsive buyers who found the precious metal a value bet near the $1,870s area and paddle the bright metal prices to the upside. However, the precious metal is still inside the woods as it has not established above the psychological resistance of $1,900 yet and may get considered as a pullback, not a reversal as fundamentals are still unfavorable.

Meanwhile, the US dollar index (DXY) is witnessing a minor pause after hitting a high of 103.93 in the Asian session but the overall structure is still promising. The DXY has delivered a six-day winning streak and is likely to advance further despite weak US economic data. The annualized Gross Domestic Product (GDP) numbers have delivered a poor performance after printing at -1.4% against the forecasts of 1.1% and the prior print of 6.8%. Also, the Core Personal Consumption Expenditure (PCE) has landed at 5.2% in mid the expectations and the previous figure of 5.4% and 5% respectively.

Also read: Gold Price Forecast: XAUUSD to enjoy robust investment demand this year – Commerzbank

Well, the real catalyst which is driving the DXY and barricading the gold prices in a broader context is the interest rate decision by the Federal Reserve (Fed), which will be announced next week. An interest rate elevation by 50 basis points (bps) is expected to be announced by Fed chair Jerome Powell as signaled in his testimony at the International Monetary Fund (IMF) meeting. It would be interesting to see the dictation from Fed policymakers on the balance sheet reduction as liquidity contraction from the economy is the real agenda. Also, the roadmap dictating reversion to neutral rates will be keenly watched by the market participants.

In today’s session, investors will eye on the release of the Michigan Consumer Sentiment Index (CSI), which is likely to land at 62 against the prior print of 65.7.

Gold technical analysis

On a four-hour scale, XAU/USD is bid around the supply zone placed in a narrow range of $1,890.21-1,895.15. The asset is facing barricades near the 20-period Exponential Moving Average (EMA) at $1,898.10. While the downward trending 50-EMA at $1,917.90 is still advocating bears. The Relative Strength Index (RSI) (14) is attempting a range shift from 20.00-40.00 to 40.00-60.00, which could signal a short-lived reversal.

Gold four-hour chart

-637867808465475622.png)

- The US dollar rallied to the highest point in two decades on Thursday.

- NZD/USD shows a firm case for the upside for the session ahead.

NZD/USD has dropped to come close to meet the March 20 high of 0.6447, a long term key level. The low of the cycle was made today at 0.6451 after falling from a high of 0.6543. The US dollar rallied to the highest point in two decades on Thursday with the yen tumbling to its lowest since 2002 following after the Bank of Japan doubled down on its ultra-loose monetary policy. This transpired into a whitewash in commodities that sent the antipodeans lower.

''The Kiwi initially fell further versus the dollar, amid broad USD strength overnight. This was compelled by the US GDP number,'' analysts at ANZ Bank said. ''While the economy shrank in Q1, private domestic demand remains strong. This crystallised hawkish expectations for the Federal Reserve. In fact, pricing for Fed hikes increased, which underlay the USD strength. Any reversal in this trend will likely need to wait until the FOMC meeting next week, at least.''

Meanwhile, the focus will also be on New Zealand employment next week and what it will mean for the Reserve Bank of New Zealand. ''We’re picking that the Unemployment Rate fell slightly to 3.1%, versus 3.2% in the fourth quarter, Q4. But with Omicron peaking in the March quarter, uncertainty is high,'' analysts at ANZ Bank said.

''Whatever the headline numbers, we expect the details of the release will confirm what we saw in the Q1 QSBO – that the labour market is becoming increasingly stretched, and will be a key source of domestic inflationary pressure of 2022''

For the RBNZ, the analyst say that the data should affirm that another 50bp OCR hike is needed in May to get in front of domestic inflation. ''The strong labour market is the keystone for our forecast of a soft landing for the economy. With housing markets softening across the country, ongoing low unemployment and rising wages will be key.''

NZD/USD technical analysis

The price formed a W-formation that drew in the bears until the neckline that is so far rating as support. So long as this holds, then there is a firm case for the upside for the session ahead.

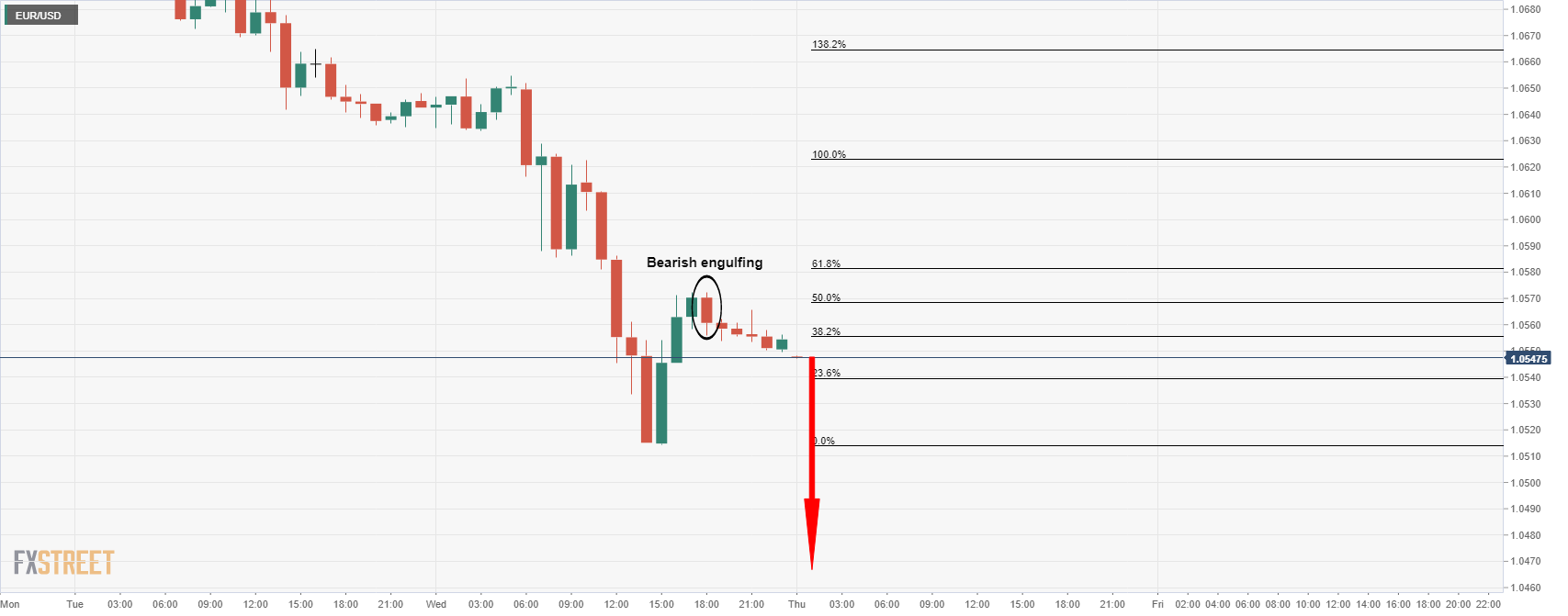

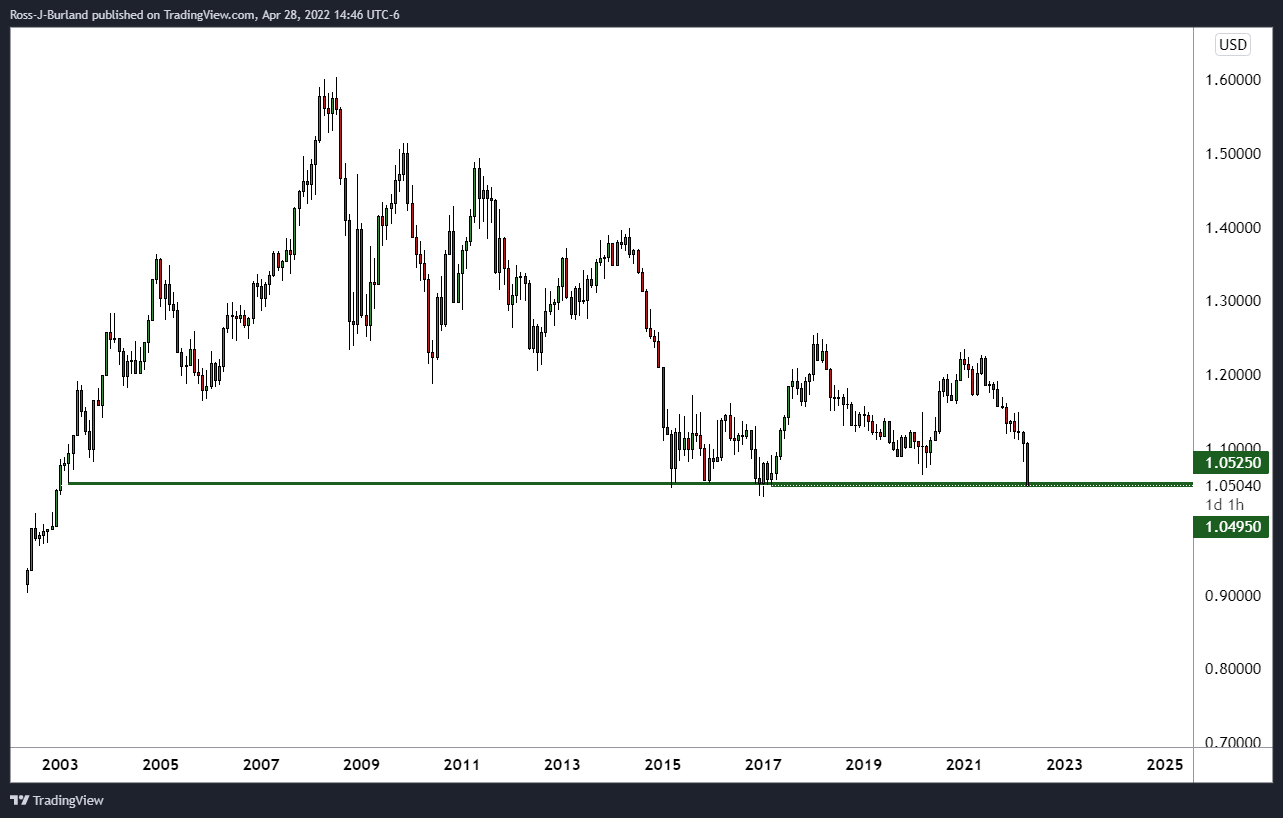

- EUR/USD is meeting a very key monthly area on the charts.

- The US dollar could be in for a correction into the Fed next week.

EUR/USD remains in the red despite a pick-up in global shares. The single currency is taking some of the brunt due to the volatility in the forex space following the Bank of Japan's dovish announcements and a subsequent dash for the US dollar.

At the time of writing, EUR/USD is trading off its cycle lows but is still down some 0.48% at 1.0505. The pair has travelled from a high of 1.0564 to a low of 1.0470 so far. Earlier, the US dollar touched its highest level since 2002 while Wall Street rose and European shares moved off six-week lows as strong earnings reports offset some of the gloomy US economic data. Additionally, US government bonds rose after signs of strength in the US job market that has superseded an expected decline in economic growth in the first quarter.

The advance estimate of Q1 Gross Domestic Product dropped 1.4% saar, versus consensus expectations for a 1.0% lift. However, traders cheered the details that were reasonably robust, with personal consumption up 2.7% saar, disposable income rising 4.8% and gross private investment up 2.3%.

''So underlying private demand growth remains firm,'' analysts at ANZ Bank argued. However, other components of GDP swamped those gains. Excessive domestic demand drove a 17% saar lift in imports, while exports contracted 5.9%. That meant net trade subtracted 3.2% from GDP.''

Nevertheless, the dollar stays firm along with the higher yields, which can be chalked up to the dollar smile theory that suggests the dollar will gain during periods of strong U.S. data and rising U.S. rates as well as bouts of risk-off sentiment, analysts at Brown Brothers Harriman said.

''Furthermore, we must stress that negative developments in the rest of the world (Russian gas supplies, dovish BOJ, etc.) are playing a big part in the dollar’s strength by highlighting relative fundamentals that favour the greenback.''

For next week, Fed tightening expectations have been robust leading into the meeting. Markets are looking for at least a 50 bp hike at the May 3-4 meeting and again at the June 14-15 meeting. This is fully priced in, with nearly 25% odds of a possible 75 bp move in June. the surprise will come if there is anything short or above this consensus at next week's meeting.

''Looking ahead, swaps market is pricing in 275 bp of tightening over the next 12 months that would see the policy rate peak near 3.25%. While this almost meets our own call for a 3.5% terminal rate, we continue to see risks that the expected terminal rate moves even higher if inflation proves to be even more stubborn than expected,'' analysts at BBH said.

As for the eurozone, German headline inflation is surging. The war in Ukraine and sent energy and commodity prices through the roof and inflationary pressure broadens. According to a first estimate based on the regional inflation data, German headline inflation arrived at 7.4% YoY in April, from 7.3% YoY in March. The HICP measure came in at 7.8% YoY, from 7.6% in March.

Observes are now calling for double-digit inflation in the summer. this will put pressure on the European Central Bank to act in order to normalise policy. However, will the sentiment be enough to prevent parity in EUR/USD for the first time since October 2002?

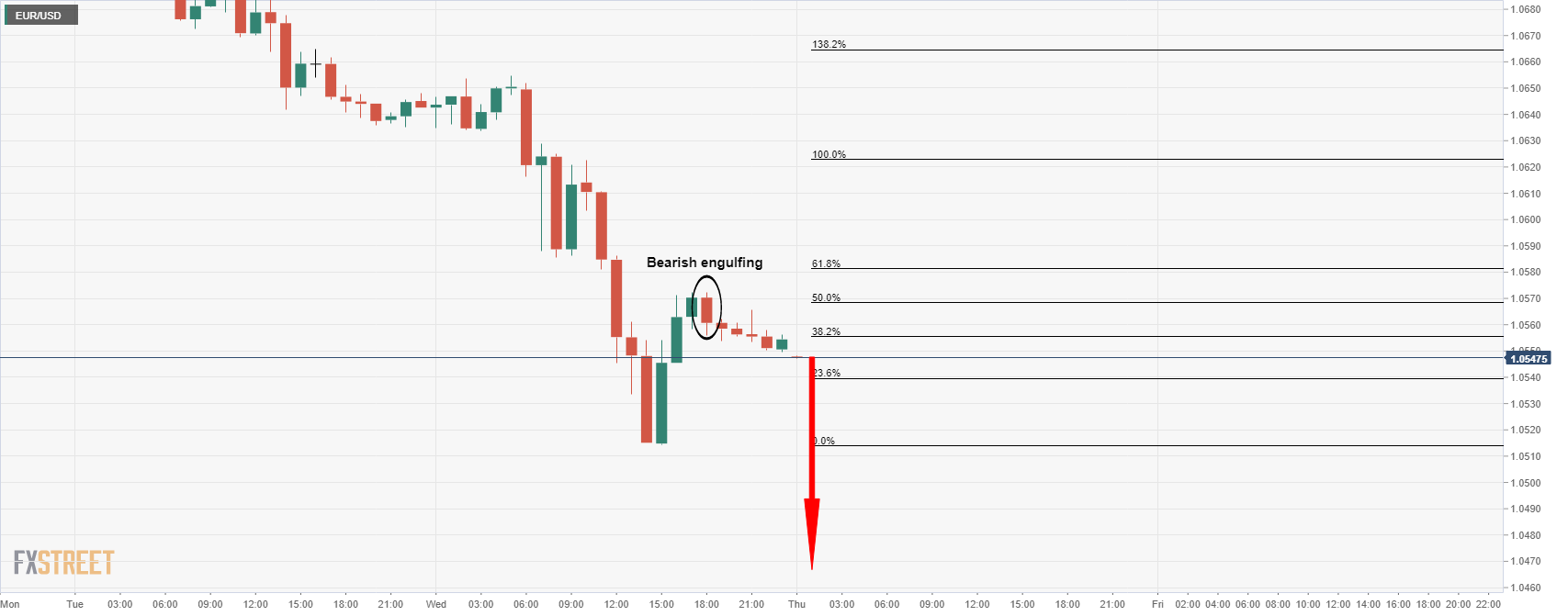

EUR/USD technical analysis

As per the prior sessions analysis, calling for further downside, EUR/USD bears refuelling from a 50% mean reversion, eye US GDP, the bears did indeed start up their engines and took the euro fir another ride even lower:

Prior analysis:

''From an hourly perspective, there is the potential for a downward continuation as per the correction meeting the 50% mean reversion mark, a bearish engulfing and drift to the downside again:''

Live market:

As seen, the price has melted some more, however, there is no bias and this could be the beginning to the end of the downside, at least for the meantime. After all, these are very key monthly levels that could protect parity, for now.

- In April, the AUD/USD is recording losses of 5.11%

- The US economy shrank in Q1, though it won’t stop the Fed from hiking rates.

- AUD/USD Price Forecast: A daily close under 0.7100 could send the pair tumbling towards 0.7000.

AUD/USD is losing some ground after on Wednesday, AUD/USD bears took a breather before pushing the pair beyond the 0.7100 mark, reaching a fresh two-month low around 0.7055, though late as the Wall Street close looms, the Aussie is back above the 0.7100 mark. At the time of writing, the AUD/USD is trading at 0.7100.

Sentiment improves, US economy contracts, but the USD stays resilient and rose

Global equities rallied for a second straight trading session amidst a positive market sentiment. China’s coronavirus outbreak seems to give a respite to investors, while the Ukraine-Russia conflict continues to escalate on Russia’s desire for victory. Aside from the macro environment, the US Gross Domestic Product for the first quarter showed that the US economy shrank 1.4% on an annualized pace, the first in nearly two years, though it’s unlikely to stop the Federal Reserve from hiking interest rates of 0.50 bps, as it attempts to tame inflation.

Stagflation talks began once the report hit the wires. Analysts of ING wrote in a note that domestic demand held up firmly when considering the hit to the economy momentum caused by the Omicron variant last year. Furthermore, they added that “consumer spending grew 2.7%, while non-residential investment expanded 9.2% and residential investment posted a 2.1% gain.” They attributed the negative figure to the drop in exports and imports surplus.

At the same time, the US Department of Labour released the Initial Jobless Claims for the week ending on April 22, which rose by 180K, lower than the 182K estimated.

The week ahead, the Australian economic docket will feature the Producer Price Index (PPI) for the first quarter, which is expected to rise by 1.6%. On a yearly basis is estimated to increase by 4%. On the US docket, the Fed’s favorite gauge of inflation, the Core Personal Consumption Expenditure (PCE), is estimated to downtick to 5.3%, while the headline is estimated to rose near the 7% threshold.

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains downward biased, as illustrated by its daily chart. Both MACD lines are heading south while its histogram is expanding to the downside, even though the AUD/USD jumped off monthly lows around 0.7050, shy of February’s 4 cycle lows around 0.7051.

The AUD/USD 1-hour chart depicts the pair is consolidating near the 0.7100 figure. The last three days’ AUD/USD price action formed a falling wedge, briefly broken downwards, though the major recovered and reclaimed the bottom-trendline. However, the hourly simple moving averages (SMAs) above the spot price could keep the pair downward pressured.

That said, the AUD/USD first support would be 0.7100. Break below would expose the confluence of February’s four daily low and the S2 daily pivot at 0.7051, followed by February’s 1 daily low at 0.7033, followed by the S3 daily pivot at the triple-zero figure at 0.7000.

What you need to know on Friday 29 April:

Despite a surprise decline in inflation-adjusted economic activity in the US in Q1 2022 according to the latest GDP release, the US dollar advanced across the board on Thursday. The Dollar Index (DXY), a trade-weighted basket of major USD currency pairs, surpassed its 2017 highs to come within a whisker of hitting 104.00, its highest level since December 2002. This was primarily a result of a steep sell-off in the yen that launched USD/JPY to fresh multi-decade highs of at one point above 131.00. At current levels around 130.90, the pair looks on course to post a gain of about 1.9%, its largest one-day move since March 2020.

The catalyst for the latest leg lower in the yen, which saw all major G10/JPY pairs surge, not just USD/JPY, was Thursday’s dovish BoJ policy announcement. As expected, the bank doubled down on its intent to stick with its ultra-dovish policies of negative interest rates and yield curve control for the foreseeable future given continued pessimism about its ability to meet its long-term inflation remit. Some market commentators said this served as a “green light” for traders to continue selling the yen.

Elsewhere, most other major G10 currencies also continued to depreciate versus the rampant US dollar. NZD/USD dropped another 0.8% to fresh lows in July 2020 under 0.6500, EUR/USD dropped a further 0.5% and briefly dipped under 1.0500 for the first time since March 2017, GBP/USD dropped a further 0.6% to the mid-1.2400s and AUD/USD fell another 0.4% to probe 0.7100. Expectations for the BoE and RBA to both lift interest rates by 25 and 15 bps each next week, with the RBA motivated by spicey Australian Q1 inflation data out earlier this week, have done little to stem the recent slide.

Indeed, both of these hikes pale in comparison to the 50 bps move expected from the Fed at not only next week’s meeting, but also the next few. CAD was the only major G10 currency not to succumb to the US dollar’s advances on Thursday. USD/CAD reversed back from earlier session highs near 1.2900 back to trading a tad lower on the day near 1.2800 amid a surge in crude oil prices to their highest levels in more than a week.

- The AUD/JPY to finish April with gains of 2.08%.

- A risk-on market sentiment boosted the prospects of the Aussie, while the BoJ kept the yen downward pressured.

- AUD/JPY Price Forecast: A daily close above 93.00 could rally the pair towards 94.00.

The Australian dollar advances vs. the Japanese yen as market sentiment leans risk-on, with US equities recording gains as 75% of the US companies’ earnings topped Wall Street. At 92.90, the AUD/JPY gains 1.61% and approaches, for the second time during the day, the 93.00 barrier.

Wednesday’s risk appetite carried on to Thursday as global equities rose. In the FX space, the Japanese yen depreciated after the Bank of Japan (BoJ) committed to its dovish stance keeping rates unchanged and offered to buy an unlimited amount of 10-year JGBs at a fixed 0.25% rate.

On Thursday, BoJ’s Governor Haruhiko Kuroda said currencies should move stably, reflecting fundamentals. He added that the 2% inflation target would not be sustained as energy prices fade and stated that he would watch FX moves carefully.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY bias remains upward, as the daily chart confirms. The daily moving averages (DMAs) reside below the exchange rate, aiming higher, and the MACD trending lower further confirms the aforementioned.

The AUD/JPY 1-hour chart depicts the pair as neutral-downward, opposite to the higher time-frame, though the 50-hour simple moving average (SMA) at 91.83 begins to aim higher, while the 200-hour SMA is horizontal above the exchange rate at 93.28.

The MACD is neutralizing, as shown by MACD-line/signal line and the histogram, which means the pair might be consolidating, just above the R2 daily pivot at 92.90.

Upwards, the AUD/JPY’s first resistance would be the 93.00 mark. A breach of the latter would expose the 200-hour SMA at 93.28, followed by the weekly high around 93.52, which, once cleared, would expose the 94.00 mark.

On the flip side, the AUD/JPY’s first support would be 92.58. Break below will send the pair tumbling towards the R1 daily pivot at 92.17, followed by April’s 27 daily high at 91.98.

Key Technical Levels

- US equities have enjoyed a strong tech-led rebound on Thursday after stronger than expected Meta Platforms earnings.

- The S&P 500 was last up nearly 3.0% and above 4,300 and the Nasdaq 100 was last up nearly 4.0%.

- But the major US indices remain on course to post hefty on-the-month losses and the macro backdrop remains difficult.

Stronger than expected earnings results from Facebook parent company Meta Platforms that saw FB shares last trading up by more than 18% on the session ignited a tech-led rally in US equity markets on Thursday. Tech behemoths Microsoft (+2.1%), Alphabet (+4.1%), Apple (+4.2%) and Amazon (+5.0%) all surge, with other large tech names also posting solid gains. As a result, the Information Technology index was last trading up around 4.0%, Communication Services gained 4.4% and Consumer Discretionary gained 2.9%.

Bullishness in the tech space was infectious and all eight of the remaining major sectors also gained at least 1.0% on the day, with Energy performing notably well with a 3.0% gain as crude oil prices rallied. In terms of the major US indices, the S&P 500 index was last trading higher by just shy of 3.0% having reclaimed the 4,300 level for the first time this week. Technicians said a break above this key level could open the door next week to a push towards resistance in the upper 4,300s in the form of mid-April lows (in the 4,380s) and the 50-Day Moving Average (near 4,390).

Amid the outperformance in big tech, the Nasdaq 100 was last trading just shy of 4.0% higher near 13,500, which would mark the indices best one-day performance of the year. The Dow, meanwhile, was last trading a respectable 2.0% higher near 34,000. US equities were unfazed by data that showed a surprise contraction in US GDP in Q1, which analysts explained away as a temporary weakness as a result of elevated imports and due to rampant Covid-19 infections at the time. Some cited month-end flows as supportive, with major asset managers and pension funds likely needing to up their exposure to equities to mitigate the impact of this month’s severe losses.

Indeed, while Thursday’s strong rebound does lighten the mood a little for US equity investors, its still been a torrid month. The S&P 500 is currently on course to post a more than 5.0% drop, similar in scale to January’s decline. The Nasdaq 100 index, meanwhile, is on course to post a slightly more than 9.0% decline, which would mark the worst one-month drop since 2008 and leaves the index flirting once again with “bear market” territory (i.e. more than 20% below recent highs). The Dow, meanwhile, is on course for a more modest 2.0% monthly loss.

A combination of bearish factors including nerves about aggressive monetary tightening from the Fed, a global growth slowdown, prolonged inflation, geopolitics (Russo-Ukraine war & sanctions) and China lockdown risk have all been cited as weighing on the market this month. Given recent developments on the latter two fronts, pessimism about prolonged elevation of inflation and slowing global growth likely arent going anywhere any time soon and the Fed seems to be on autopilot until it gets rates back to neutral.

May is likely to be another difficult month for investors. One reason for optimism would be if the earnings season continues to go well, which net-net, it has up until now. According to Reuters citing Refinitiv data, as of Thursday 81% of the 237 S&P 500 companies to report earnings had beaten analyst expectations, above the historical average beat rate of 66%.

- USD/CAD bears moving in for the kill as US dollar strength is faded into month-end.

- The bears are eyeing the downside market structures for the coming days/week.

As per the prior analysis, USD/CAD Price Analysis: The end of the rally is nigh according to market structure, despite a surge higher in the greenback to 20-year highs, the bears are growling back and a bearish outlook persists for the pair as follows:

The monthly outlook is bearish given the wicks and the weekly chart still shows hidden divergence despite the higher high printed since Wednesday's analysis.

USD/CAD weekly chart

With that being illustrated, there is still time to go for the weekly close, so, theoretically, that really needs to be discounted until the close but is worth some consideration nonetheless.

USD/CAD daily chart

The current price action is leaving the prospects of a bearish engulfing daily close following the prior day's doji. This is regarded as bearish and a prelude for the next days. There are expectations of a correction to test the 1.2770s, and then potentially as deep as a 38.2% Fibonacci retracement below 1.2750.

1.2650 comes thereafter but the point of control of where the majority of business was transacted for the month of April is much lower, down to the neckline of the W-formation at 1.2611.

- The USD/CHF advances In the week so far gain 1.50%.

- During the day, the US Dollar Index reached a 20-year high at around 103.928

- USD/CHF Price Forecast: Forming an inverted hammers

The USD/CHF surged some 100-pips and reached a fresh two-year high around 0.9759 during the day, though it has retraced but stays above the 0.9700 figure in the North American session. At the time of writing, the USD/CHF is trading at 0.9717, up some 0.27%.

The mood remains positive during the day, as European bourses closed with gains and US equities are set to finish in the green for the second consecutive day. China’s coronavirus outbreak seems to get under control, while geopolitics-wise, the Ukraine-Russia conflict continues to escalate.

On Thursday, the USD/CHF surged 90-pips and reached a two-year high. Late in the North American session, the pair retreated towards the 0.9710s area as traders booked profits as April’s about to end.

In the meantime, the US Dollar Index, a gauge of the greenback’s measure of value against other currencies, edges up some 0.61% sitting at 103.627. The US 10-year Treasury yield edges up and is gaining three basis points, sitting at 2.865%.

USD/CHF Price Forecast: Technical outlook

On Wednesday’s note, I wrote that the “USD/CHF uptrend appears to be overextended,” and despite that conditions, alongside the Relative Strength Index (RSI) showing that the pair is overbought with readings around 81.00, the pair recorded another leg-up reaching a fresh two-year high. Nevertheless, Thursday’s price action of the USD/CHF appears to form an inverted hammer in an uptrend, usually, a sign of exhaustion and possible consolidation of the USD/CHF near the 0.9660s-9750 area.

If the USD/CHF extends its rally, the next resistance would be April’s 28 daily high at 0.9759. A breach of the latter would expose April’s 2020 swing high at 0.9802, followed by March’s 23, 2020 daily high at 0.9900.

On the flip side, the USD/CHF first support would be the 0.9700 mark. Once cleated, the next support would be the April 26 daily high at 0.9626. Break below would expose the April 26 daily low at 0.9564, followed by the June 30, 2020 cycle high-turned-support at 0.9533.

Key Technical Levels

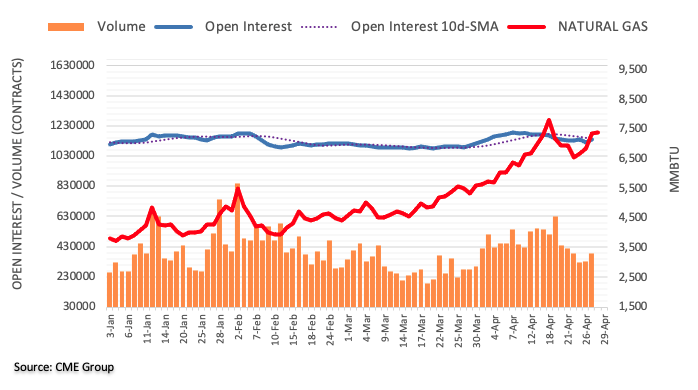

- WTI rallied to its highest level since last Tuesday above $105.00 and eyes a retest of recent near $110 highs.

- Traders cited a WSJ report alleging that the EU nearing agreement on a Russian oil import embargo as supporting prices.

Oil prices hit their highest levels since last Tuesday, with front-month WTI futures rallying to the north of the $105.00 per barrel mark, with traders citing a report from the WSJ alleging that the EU is on the cusp of agreeing to implement a blanket ban on Russian oil imports. At current levels in the mid-$105.00s, WTI is trading higher by nearly $3.40 on the day, with tailwinds also coming from a decent rebound in US equity markets amid earnings optimism.

Regarding the latest reports of an EU embargo on Russian crude, the WSJ reported that Germany has dropped its opposition to an embargo on Russian oil imports. According to the WSJ, this "clears the way" for a wider EU ban on oil imports from Russia, given that Berlin had been one of the main opponents on an embargo up until now. The change in stance comes after Russia earlier in the week cut off gas flows to Poland and Bulgaria after the two countries refused to pay for the gas in roubles, as has been Russia's demand. EU officials accused Moscow of using fossil fuels to blackmail Europe over its support of Ukraine.

Fears about the impact of an EU embargo on Russian oil are, for now, helping to negate fears about demand weakness as a result of lockdowns in China as restrictions in Beijing spread and after the latest weaker than expected US Q1 2022 GDP numbers. The WTI bulls will be eyeing a retest of last week’s highs near $110 and oil may well get a helping hand this way if EU/Russia tensions continue to escalate.

Elsewhere, focus will shift back to OPEC+ next week, with the cartel set to meet on 5 May and likely to agree on another 400K barrel per day output hike in June. Analysts note that OPEC+’s sluggish output hiking policy, which many nations have been struggling to keep up with anyway, doesn’t come close to making up for the loss of as much as 3M BPD in Russian output expected from May due to sanctions.

Analysts at Danske Bank continue to expect the Federal Reserve will hike interest rates by 50bp three meetings in a row (May -next week-, June and July) and 25bp on each of the last three meetings (September, November and December). They are still of the view that risks are skewed toward faster and more rate hikes.

Key Quotes:

“We expect the Federal Reserve to hike the target range by 50bp, a view shared by consensus and market pricing. We expect the Fed to signal that more 50bp rate hikes are likely in coming months in order to get quicker back to neutral.”

“We expect the Fed to announce the balance sheet runoff to start in mid-May. We expect the cap to be set at USD95bn as outlined in the minutes.”

“Our current Fed call is that the Fed will hike by 50bp in May, June and July and 25bp in September, November and December (a total of 225bp). We still see risks skewed towards faster rate hikes, as monetary policy remains too accommodative.”

“We do not expect a substantial USD strengthening on the announcement of a 50bp hike - but rather view the USD strength as continuous; as it has been over the last one and a half year.”

- Better risk appetite and more favourable commodity market conditions is helping the risk/commodity-sensitive Aussie resist the buck’s latest advances.

- AUD/USD pared earlier losses and is back to trading above 0.7100, though still a tad lower on the day.

- Ahead of next week’s Fed and RBA meetings, bears are eyeing annual lows just under 0.7000.

Better risk appetite in US equity markets and stabilisation in the broader commodity complex is helping the risk and commodity-sensitive Aussie resist the US dollar’s latest advances and is outperforming the likes of the euro, pound and yen. AUD/USD was last trading just above the 0.7100 level, down about 0.3% on the day, having pared earlier losses that saw the pair hit its lowest levels since early February in the 0.7060s.

FX volatility remains elevated with the US dollar the clear winner and, though better on Thursday, the general tone to risk appetite in recent weeks has been weak as investors fret about weakening global growth, central bank tightening, geopolitics and China lockdown risks. Regarding growth fears, US Q1 GDP numbers released earlier in the session weren't pretty and showed a surprise drop in output, though analysts put this down to surging imports and a slowing of inventory building.

Nonetheless, against this backdrop, many AUD/USD bears will continue to target a test of sub-0.7000 annual lows in the coming weeks. The Fed will likely hike interest rates by 50 bps next week, will likely signal that further 50 bps moves are coming and will announce plans on monetary tightening. This could easily keep the USD rally going, analysts suspect.

But one fact that might make a breakout below 0.7000 a little more difficult to muster is the fact that the RBA might also be raising interest rates next week, more than one month earlier than expected by most analysts just one week ago. Wednesday’s spicey Q1 2022 Australian Consumer Price Inflation numbers are the reason for the hawkish shift in policy expectations.

A 15 bps rate hike to 0.25% is now fully priced in and rates seen ending the year at 2.5%, roughly in line with where the Fed has interest rates. Should the RBA live up to or even exceed the hawkish hype, this lessens the argument for AUD/USD to head lower in the near term, suggesting 0.7000 could become a key area of support.

The US economy contracted at an annualized rate of 1.4% during the first quarter, data showed on Thursday. According to analysts from TD Securities, GDP growth was impacted by large setbacks in net exports and inventories. They point out that the details of the report were actually much stronger than the headline suggests.

Key Quotes:

“Real GDP fell by a notable 1.4% q/q AR in Q1, below the +1.0% consensus and our 0.0% estimate. This is the economy's first contraction since COVID first impacted output in Q2 2020 and follows a robust, inventory-led 6.9% q/q AR expansion in Q4.”

“GDP contracted in Q1, but the details were actually much stronger than the headline suggests. Final sales to private domestic purchasers (a better gauge for domestic demand) actually rose to a robust 3.7% q/q AR pace after rising 2.6% and 1.4% in Q4 and Q3 2021, respectively. This supports our view of a rebound in Q2 output as inventory rebuilding normalizes and imports become less of a drag amid still strong domestic demand.”

“We forecast a 1.9% Q4/Q4 pace in 2022, down from 5.5% in 2021, with 3% in Q2, 1.9% in Q3 and 2% in Q4. We expect core PCE inflation to slow as well, with the y/y change in core PCE prices down to 4.1% in 22Q4.”

- The EUR/JPY is about to close in April with gains of 2.25% in the month.

- An upbeat market mood weighed on the JPY, alongside a “dovish” Bank of Japan (BoJ).

- The BoJ would remain dovish, despite further JPY weakness and looks forward to overshooting the 2% inflation target.

- EUR/JPY Price Forecast: Remains bullish biased, about to form a morning-star pattern.

The shared currency is rallying against the Japanese yen after the Bank of Japan (BoJ) committed to its dovish stance, despite expressions of the Japanese Minister of Finance that FX volatility is undesirable and calling recent moves “extremely worrying.” At 137.68, the EUR/JPY is up 1.55% in the day, up almost 200-pips in the trading session.

Global equities remain trading with gains after China’s recent Covid-19 outbreak seems to be controlled. The Ukraine-Russia tussles have taken the backseat so far, as hostilities would continue amidst Russia’s appetite for victory.

Meanwhile, in the Asian session, the Bank of Japan held rates unchanged and doubled down to the Yield Curve Control (YCC), offering to buy an unlimited amount of 10-year JGBs at a fixed 0.25% rate. The BoJ’s expressed that they will ease policy without hesitations as needed with an eye on pandemic impact.

The BoJ Governor Haruhiko Kuroda, in his press conference, said that it is appropriate for Western central banks to tighten given higher inflation and their relatively quick recovery from the pandemic. Kuroda added that there is nothing wrong with diverging monetary policy between Japan and Western nations.

Also read: Breaking: Bank of Japan keeps policy steady, tweaks forward guidance, yen at fresh session lows, 129.52+

On the Eurozone side, inflation in Germany surprisingly rose to its fastest pace since the early 1990s, as shown by the Consumer Price Index at 7.8% y/y, beating the 7.6% forecasts by analysts.

Elsewhere, the European Central Bank (ECB) Vice-President Luis de Guindos said that he had not seen any signs of wage dynamics, adding that wage increases are quite prudent and are compatible with the ECB’s target. In the meantime, ECB’s Visco expressed that a rate hike in the third quarter could happen, as reported by CNBC.

EUR/JPY Price Forecast: Technical outlook

On Wednesday’s note, I wrote, “As long as the EUR/JPY sits above 134.29,” the EUR/JPY “would stay bullish.” The Bank of Japan helped in fulfilling the aforementioned, being the only bank without tightening monetary policy. The EUR/JPY, on its way north, broke all the resistance levels mentioned on Wednesday’s vote, opening the door for further upside.

With that said, the EUR/JPY’s first resistance would be 138.00. Break above would expose 139, followed by April’s 25 daily high at 139.23, which, once cleared, will push the EUR/JPY towards the YTD high at 140.00.

Key Technical Levels

- US dollar holds onto daily gains, trading at the highest level in years.

- NZD/USD finds support at 0.6450, holds a negative bias.

- AUD/NZD approaches 1.1000 and retreats.

The NZD/USD dropped further after the beginning of the American session and bottomed at 0.6450, the lowest level since June 2020. Then it rebounded, unable to rise back above 0.6500, showing the bearish momentum is still high.

Dollar keeps running

The key driver in NZD/USD continues to be the stronger greenback. Economic data released on Thursday showed an unexpected contraction in the US economy during the first quarter. The numbers weakened the dollar only for a few minutes.

The DXY hit the highest level since 2002 at 103.92 and then pulled back modestly; is it hovering around 103.65. US yields are up on, even after the negative GDP reading. The US 10-year stands at 2.87% and the 30-year at 2.94%.

The Kiwi is also down versus the Australian dollar, although it trimmed losses during the last hours. The AUD/NZD is up for the third day and peaked at 1.0962, near the multi-year high it hit last week below 1.1000. The move off highs could show the Aussie is not ready to break 1.1000. If it manages to do, the kiwi will likely weaken across the board.

NZD/USD with support at 0.6450

The pair found support on Thursday at the 0.6450 area which is a relevant barrier; the next considerable resistance might be seen at 0.6375 (interim support at 0.6400). The kiwi needs to rise and hold above 0.6530 to alleviate the bearish pressure. Above the following resistance stands at 0.6585.

Technical levels

- The GBP/USD is recording its worst monthly losses since March 2020, down some 5.43%.

- The US economy contracted by 1.4% and missed economists’ 1% expansion foreseen.

- GBP/USD Price Forecast: To remain downward pressured unless bulls reclaim 1.2700

The British pound keeps plunging, extending its April monthly fall to 5.43%, and it is approaching the 1.2400 figure on Thursday amidst an upbeat tilted mood, despite that some US and European indices record losses. At the time of writing, the GBP/USD is trading at 1.2440

US economy contracts for the first time in two years, sentiment improves

Sentiment improved as China’s Covid-19 outbreak got under some control while the Russia-Ukraine conflict continued. Aside from this, recent US economic data crossed the wires, as the Gross Domestic Product for the first quarter showed a contraction of 1.4% on an annualized pace, the first in nearly two years, though it’s unlikely to deter the Federal Reserve from hiking interest rates as it attempts to tackle inflation.

Stagflation talks began once the report hit the wires. However, analysts at ING wrote that domestic demand held up firmly when considering the hit to the economy momentum caused by the Omicron variant last year.

They added that “consumer spending grew 2.7%, while non-residential investment expanded 9.2% and residential investment posted a 2.1% gain.” They attributed the negative figure to the drop in exports and imports surplus.

Also in the US docket, the Department of Labour released the Initial Jobless Claims for the week ending on April 22, which rose by 180K, lower than the 182K estimated.

Meanwhile, back to geopolitics, Russia’s Foreign Ministry said that Russia had not received a response from Ukraine on a potential agreement and also informed that Russia will hold an informal UN Security Council meeting on May 6th regarding the situation in Ukraine.

Due to the market sentiment, the GBP/USD should rise as the GBP is considered a risk-sensitive currency, opposite the safe-haven US dollar. Nevertheless, the Fed’s pace of tightening appears more aggressive than the Bank of England’s, and with both banks having interest rates decision in the next week, it would be prudent to wait and see before opening fresh bets.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is bearish biased and seems poised to extend to lower price levels. The Relative Strength Index (RSI) is at 18.61, well within the oversold territory, but its slope remains headed south, meaning that the GBP/USD might continue sliding.

That said, the GBP/USD first support would be 1.2411. A breach of the latter would expose the 1.2400 figure, followed by 1.2300, and then June’s 29, 2020, daily low at 1.2251.

- GBP/JPY is trading around 163.00, just under its 21DMA and more than 100 pips below earlier session highs.

- Sterling bulls remain hard to find as pessimism about the UK economic and BoE tightening outlooks build.

- But the pair still trades with gains of well over 1.0% on the day with the yen battered post-dovish BoJ.

Though the pair still trades more than 1.0% higher on the day as the yen continues to suffer in wake of the BoJ latest just as dovish as anticipated policy announcement during Thursday’s Asia Pacific session, GBP/JPY has reversed more than 100 pips lower from earlier session highs to the north of the 164.00 level and now trades back to the south of its 21-Day Moving Average at 163.25 near the 163.00 level.

Pound sterling has seen substantial weakness in recent trade, despite a lack of any definitive trigger of fundamental catalyst. Seemingly, the market remains very much in the mood to sell sterling in wake of a run of concerning data releases including last week’s dour March Retail Sales report and this week’s shocking UK government borrowing figures.

Hand and hand with UK growth concerns as the country suffer through its worst cost-of-living squeeze in decades is a growing sense that beyond a few more 25 bps rate hikes at upcoming meetings, there likely won’t be much more by way of monetary tightening from the BoE. As a result, it probably shouldn’t come as too much of a shock to see GBP/JPY’s bullish momentum fade.

Failure to reconquer the 21DMA might prove a bearish sign going forward, with some bears perhaps betting on an eventual retracement back lower to this week’s sub-160.00 lows and even a test of the 50DMA at 158.98 just below it. Of course, much will depend on whether the yen continues to crater. If the recent leg lower is the start of another larger bearish push, then GBP/JPY might find itself gradually moving higher towards last week’s highs above 168.00.

- EUR/USD drops further and breaks below 1.0500.

- Extra losses could now extend to the 1.0340 area.

EUR/USD remains well into the negative territory and tests lows in the 1.0470 zone, an area last traded back in January 2017.

The downside momentum in the pair remains well and sound and now the door looks wide open to a potential visit to the 2017 low at 1.0340 (April 3) sooner rather than later.

While below the 2-month line around 1.1000, extra losses remain well on the cards for the pair.

EUR/USD daily chart

Germany has dropped its opposition to an embargo on Russian oil imports, government officials reportedly said according to the WSJ. According to the WSJ, this "clears the way" for a wider EU ban on oil imports from Russia, given that Berlin had been one of the main opponents on an embargo up until now.

The change in stance comes after Russia earlier in the week cut off gas flows to Poland and Bulgaria after the two countries refused to pay for the gas in roubles, as has been Russia's demand. EU officials accused Moscow of using fossil fuels to blackmail Europe over its support of Ukraine.

Germany recently made a U-turn on its policy of military support for Ukraine and will now send heavy weaponry to the country as it seeks to hold off Russian aggression that is primarily concentrated in its East and South.

- DXY prints tops in levels last seen 19 years ago.

- Further gains in the dollar could see 104.00 revisited.

There are no changes to the bullish stance in the greenback, while DXY’s upside faltered just below the 104.00 yardstick on Thursday, an area last seen in January 2002.

The intense move higher in the dollar remains in the overbought territory – as per the daily RSI around 80 - and this could be a prologue to a potential near-term technical correction. Against that, initial contention emerges at the weekly low in the 99.80 zone (April 21).

The current bullish stance in the index remains supported by the 7-month line near 96.70, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.65.

DXY daily chart

- USD/JPY continues to trade close to session highs just under 131.00 as the buck remains resilient and yen weak post-BoJ.

- The buck seems to be the preferred currency safe-haven at the moment, thanks to Fed/BoJ divergence.

- January 2002 highs just above 135.00 look there for the taking.

The yen continues to reel in wake of the latest dovish BoJ policy announcement, that saw the bank double down on its dovish policy pledge to maintain negative interest rates and yield curve control for the foreseeable future. Traders seemingly took this as a green light to resume selling the yen, which, combined with continued broad US dollar strength, has launched USD/JPY to the north of the psychologically important 130.00 level for the first time in over two decades.

In more recent trade, the pair has even managed to break to the north of the 131.00 mark, despite fresh jawboning about yen weakness from officials at Japan’s Ministry of Finance in wake of the BoJ meeting, and despite the latest weaker than expected US Q1 2022 GDP growth figures. At current levels around 131.10, USD/JPY trades with on-the-day gains of about 2.1%, the largest single day gain since March 2020.

Meanwhile, USD/JPY now trades more than 3.0% higher versus Wednesday’s sub-127.00 lows, and looks on course to close out April with a 7.5% gain, the best one-month performance since November 2016. April’s historic rally comes on the heels of a nearly as impressive 5.8% gain in March, marking the strongest two-month run of gains since 1995.

And against the current macro backdrop, the highs of this century from January 2002 just above 135.00 look there for the taking. The BoJ’s insistence that it not move towards tighter monetary policy in tandem with its global peers (most notably, the Fed) suggests the yen may continue to suffer from unfavourable moves in rate differentials. This has seemingly robbed the yen of its status as the market’s preffered safe-haven asset, with the buck instead seemingly in vogue.

Risk appetite remains ropey with major US equity indices continuing to trade near multi-week lows as the month-end approaches, with investors citing fears about global growth and central bank tightening, with the latest US GDP figures only likely to exacerbate the former. Given the USD’s status as the top currency safe-haven, this might only add further tailwinds to USD/JPY in the coming weeks.

- EUR/JPY adds to Wednesday’s advance and reaches 138.00.

- Further gains could see the 2022 high around 140.00 retested.

EUR/JPY pushes further up and reaches the key 138.00 region on Thursday.

The continuation of the upside momentum looks likely in the very near term, with the immediate hurdle at the 2022 peak around 140.00 (April 21). In case the cross clears this level, it should then refocus on the June 2015 high at 141.05. Beyond this level, there are no hurdles of note until the 2014 top at 149.78 (December 2014).

In the meantime, while above the 200-day SMA at 130.66, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- The relentless USD buying pushed USD/CAD to a fresh multi-week high on Thursday.

- The disappointing release of the US GDP capped the upside for the USD and spot prices.

- Softer crude oil prices, aggressive Fed rate hike bets support prospects for further gains.

The USD/CAD pair trimmed a part of its intraday gains during the early North American session and was last seen trading around the 1.2855-1.2860 region, just a few pips below the highest level since March 9.

The pair attracted fresh buying near the 1.2800 mark on Thursday and prolonged its recent strong rally witnessed over the past one week or so amid the relentless US dollar buying. Investors seem convinced that the Fed would adopt a more aggressive policy response to combat stubbornly high inflation and have been pricing in a 50 bps rate hike at the upcoming meeting on May 3-4.

The markets also expect the US central bank to continue tightening its monetary policy when it meets again in June and July and ultimately lift rates to around 3.0% by the end of the year. The USD, however, eased a bit from the five-year peak following the disappointing release of the US GDP report, which showed that the economy unexpectedly contracted by 1.4% during the first quarter.

That said, additional details revealed that the GDP Price Index accelerated to 8% in Q1 and reaffirmed the prospects of rapid Fed rate hikes. This, along with a fresh leg up in the US Treasury bond yields, acted as a tailwind for the buck. On the other hand, a softer tone around crude oil prices undermined the commodity-linked loonie and offered additional support to the USD/CAD pair.

This, in turn, favours intraday bulls and supports prospects for a move back towards testing the YTD high, around the 1.2900 mark touched in March. Some follow-through buying will mark a fresh bullish breakout and set the stage for a further near-term appreciating move for the USD/CAD pair. This, in turn, suggests that any meaningful pullback might still be seen as a buying opportunity.

Technical levels to watch

GBP/USD has dropped under 1.25. Economists at Scotiabank expect the cable to lose another two or three cents if next week’s Bank of England (BoE) policy decision is dovish.

BoE to signal a much narrower path for hikes than markets are anticipating

“Sterling one-week risk reversals show the largest downside risk for the GBP over the following week since the initial days of the Russian invasion of Ukraine.”

“A BoE rate hold cannot be ruled out – though it is far from being our base case. The BoE will likely signal a much narrower path for hikes than markets are anticipating, which presents the main GBP downside risk.”

“The pound may still hold around 1.25 over the coming days, but a dovish BoE and weak macro figures over the coming weeks could see the GBP fall another two or three cents; with the broad dollar tone an important unknown.”

EUR’s drop under 1.05 this morning was followed by a solid recovery to 1.0565, the daily high, that then triggered steady selling to the low 1.05s where it stands. Economists at Scotiabank expect to see an eventual break below 1.05 to open up the 2017 low of 1.0341.

Oversold conditions may stall the drop

“The EUR is clearly still under downward pressure, and while the first decline under 1.05 didn’t hold, the trend favours an eventual break under the figure that leaves limited support markers until the 2017 low of 1.0341.”

“The mid-figure and figure zone may stand as a floor and oversold conditions (which could still go a bit lower) may stall its drop.”

“After the daily high at 1.0565, the 1.06 area stands as resistance followed by ~1.0625 and the mid-1.06s.”

USD/CHF has broken above the resistance level at 0.9672 with ease. Analysts at Credit Suisse maintain a tactically bullish outlook for the pair and see scope for a move to 0.9800/03 next and eventually 0.9900/21 over the medium-term.

USD/CHF continues to show sustained strength

“We expect the advance to be maintained in the medium-term, with resistance seen at 0.9720/37 initially, then at 0.9760 and eventually at the April 2021 highs at 0.9800/03. Whilst a short corrective pause is likely given the steepness of the current climb, above 0.9800/03 would see scope to reach the 2020 high at 0.9902 in due course, which we expect to act as a key medium-term indicator to define the market’s further course.”

Supports remain located at the cluster of intraday lows at 0.9665/9526, which ideally hold “any sharp near-term correction. Only a quick fall back all the way to 0.9473/54 though would negate the upside and signal further weakness, first to 0.9417/13 and then potentially to 0.9383/69.”

- Silver only saw a very modest bounce from their lowest levels since mid-February under $23.00 after weak US GDP data.

- As US yields move higher and USD remains resilient, XAG/USD remains at risk of t4esting earlier 2022 lows at $22.00.

Spot silver (XAG/USD) prices only saw a very modest bounce from their lowest levels since mid-February under $23.00 in wake of data showing a surprise drop in US GDP in Q1, with the US dollar having pulled back from highs. But any more meaningful rebound does not appear to be forthcoming, with XAG/USD for now still only trading just above the $23.00 mark and still nursing on the day losses of about 1.0%.

The US dollar has been on a rampage higher in recent days with the US Dollar Index (DXY) hitting five-year highs above 103.00 this week and nearing 104.00 earlier on Thursday amid worries about geopolitics, global growth and expectations for aggressive Fed tightening. This has weighed heavily on the precious metal complex, with both silver and gold being battered.

Indeed, at current levels near $23.00, XAG/USD trades with on-the-week losses of nearly 5.0% and trades nearly 12% below last week’s highs above $26.00. Some analysts might interpret the latest US GDP numbers as lessening the likelihood that the Fed in the coming months signals a further hawkish shift in its rate guidance towards outright restrictive interest rates (i.e. above the 2.5% neutral level).

But, for now, markets do not appear to be reading things this way. US yields continue to press higher and the buck looks likely to remain buoyant, perhaps given the latest inflation readings for Q1 that came out alongside the GDP growth figures showed another rise. XAG/USD remains vulnerable to retesting annual lows around $22.00 and returning to Q4 2021 lows in the mid-$21.00s.

- EUR/USD reclaims the area above the 1.0500 level.

- German flash CPI seen at 7.4% YoY in April.

- US GDP expected to have contracted 1.4% YoY in Q1.

The single currency abandons the area of recent lows and encourages EUR/USD to advance past 1.0500 following unexpected results in the US calendar.

EUR/USD bounces off lows on US data

EUR/USD now attempts some tepid bounce after the first revision of US GDP showed the economy is expected to have contracted 1.4% on an annualized view during the January-March period.

However, the negative performance of the pair appears unchanged against the backdrop of a stronger dollar, while yields on both sides of the ocean now left behind the initial pessimism and returned to the positive territory.

In the domestic calendar, preliminary inflation figures in Germany noted the CPI is seen rising 7.4% in the year to April and 0.8% vs. the previous month.

What to look for around EUR

EUR/USD’s price action shows further deterioration and revisits the sub-1.0500 area for the first time since January 2017. The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point around June/July, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: ECB 2021 Annual Report, Consumer Confidence, Economic Sentiment, Germany Flash Inflation Rate (Thursday) – Germany, EMU Flash Q1 GDP Growth Rate, EMU Flash Inflation Rate (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is down 0.48% at 1.0504 and a break below 1.0480 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017). On the upside, the next hurdle appears at 1.0936 (weekly high April 21) seconded by 1.1000 (round level) and finally 1.1005 (55-day SMA).

- Weekly initial claims and continued claims were broadly in line with expectations according to the latest report.

- The US dollar weakened as a result of weak US GDP data and ignored the latest jobless claims figures.

There were 180,000 initial claims in the US economy in the week ending on 23 April, in line with consensus estimates and a slight decline from last week's 185,000 reading which was revised up from 184,000, according to data released by the US Department of Labour on Thursday. That meant that the four-week average of initial claims rose to 179,750 from 177,500 a week prior.

Continued claims in the week ending on 16 April saw a slight fall to 1.408M from 1.409M a week prior, a little above the expected drop to 1.403M. The insured unemployment rate thus came in at 1.0% in the week ending on 16 April, unchanged from a week earlier.

Market Reaction

FX markets did not react to the latest broadly as expected jobless claims report but rather reacted to weak US growth numbers, with the US dollar weakening slightly.

- AUD/USD dropped to over a two-month low on Thursday amid the relentless USD buying.

- The prospects for more aggressive Fed rate hikes continued acting as a tailwind for the buck.

- The USD bulls seemed rather unaffected by the disappointing release of the US Q1 GDP.

The AUD/USD pair witnessed an intraday turnaround from the 0.7160 area and dropped to its lowest level since February 7 during the early North American session. The pair, however, managed to rebound a few pips in reaction to the dismal US GDP print and was last seen trading just below the 0.7100 mark, down over 0.40% for the day.

Broad-based US dollar strength remains a key theme in the FX market on Thursday and growing acceptance that the Fed would tighten its monetary policy at a faster pace to curb soaring inflation. The bets were reaffirmed by hawkish remarks from influential FOMC members last week, including Fed Chair Jerome Powell.

The Fed is expected to hike interest rates by 50 bps when it meets on May 3-4, and again in June and July, and ultimately lift rates to around 3.0% by the end of the year. The USD buying remained unabated after the Advance US GDP report showed that the economy unexpectedly contracted by 1.4% in the first quarter of 2022.

This, along with the risk-on impulse in the markets, acted as a headwind for the safe-haven USD and extended some support to the perceived riskier aussie. The disappointment, however, was largely offset by a sharp rise in the GDP Price Index, which jumped to 8% in Q1 and reaffirmed the prospects of rapid Fed rate hikes.

The fundamental backdrop seems tilted firmly in favour of the USD bulls and supports prospects for a further near-term depreciating move for the AUD/USD pair. The emergence of fresh selling on Thursday adds credence to the negative outlook, suggesting that any attempted recovery is more likely to be short-lived.

Technical levels to watch

- The US economy unexpectedly shrank at an annualised pace of 1.4% in Q1 2022 versus expectations for a 1.1% growth rate.

- The downbeat growth data triggered weakness in the US dollar, with the DXY dropping back from the upper 103.00s to around 103.50.

The annualised pace of US real GDP growth in Q1 2022 came in at negative 1.4%, according to data released by the US Bureau of Economic Analysis on Thursday. That was a big miss on expectations that the economy had grown at an annualised pace of 1.4% in Q1 and marked a significant turnaround in fortunes from Q4 2021's robust 6.9% annualised growth rate.

Meanwhile, the GDP Price Index for Q1 saw a bigger than expected jump to 8.0% from 7.1% in Q4 versus an expected rise to 7.3%, though Core PCE Prices saw a slightly smaller than expected rise to 5.2% from 5.0%, versus forecasts for a 5.4% rise.

Market Reaction

The US Dollar Index (DX) immediately dropped back from the upper 103.00s and is now trading just above 103.50 in wake of the massive miss on growth expectations for last quarter. Some might argue that the data might deter the Fed from raising interest rates quite so aggressively in the coming quarters. At the very least, it diminishes the argument for the Fed to take interest rates back into outright restrictive territory (i.e. above 2.5%).

The Riksbank completed its shift towards the hawkish side of the spectrum by delivering a surprise 25bp rate hike today. EUR/SEK fell from the 10.40 area to slightly below 10.30 after the Riksbank’s statement was released. A series of gradual hikes are set to come, providing support to the krona, economists at ING report.

Riksbank will start QT from July

“Sweden’s central bank surprised with a 25bp rate hike today after a U-turn in the inflation assessment. Rate projections signal two to three more hikes this year and a terminal rate slightly below 2% by 2025; balance sheet reduction in 2H22 was also announced. All of this means more support to the krona in the medium-term”

“The recent instability in global risk sentiment and lingering geopolitical concerns in Europe are keeping a lid on the high-beta krona. This may not change in the near term, and we still struggle to see EUR/SEK trade sustainably below 10.20 in the coming weeks.”

“In the longer run, the Riksbank’s policy shift is set to offer sustained support to the krona, and periods of stabilised market sentiment (especially in Europe) could see the widening EUR/SEK rate differential push the pair materially lower. We now expect a move below 10.00 in EUR/SEK in the second half of the year.”

EUR/USD has broken below the 2020 low at 1.0635. However, analysts at Credit Suisse see scope for a short-term rebound from channel support at 1.0485.

EUR/USD to find a floor at first in the 1.0485/1.0341 zone

“Our bias remains to try and look for a better floor to be found the lower end of the potential broad downtrend channel from 2016 and price support at 1.0496/85 at first and for a consolidation/recovery phase to emerge to unwind the oversold condition. Should weakness directly extend though, this would be seen to expose the 1.0341 low of 2017.”

“Big picture, we suspect the decline ultimately extends to the 78.6% retracement of the entire 2000/2008 bull trend and psychological floor at 1.00/0.99.”

“Resistance is seen initially at 1.0573, with 1.0623/33 ideally capping to keep the immediate risk lower. Above 1.0656 though is needed to mark a near-term exhaustion point and a deeper recovery to 1.0739/60.”

- Annual HICP inflation in Germany was 7.8% in April, a tad above expected.

- FX markets did not react to the latest figures, which didn't deviate to much from expectations.

Inflation in Germany according to the Harmonised Index of Consumer Prices (HICP) rose at a YoY pace of 7.8% in April, according to a preliminary data release from the Destatis, the Statistical Office of the EU, on Thursday. That was higher than median economist forecasts for the YoY rate of inflation to have stayed unchanged at 7.6%. The MoM gain in HICP in April was 0.7%, a little above expectations for a 0.4% gain but marking a deceleration after March's 2.5% jump.

Inflation in Germany according to the Consumer Price Index came in at 7.4% in April, above the expected drop to 7.2% from 7.3% in March. MoM, the CPI rose 0.8%, above expectations for a 0.6% rise, but also marking a deceleration after prices rose at a MoM pace of 2.5% in March.

Market Reaction

FX markets were unreactive to the latest national German inflation numbers, which were only slightly higher than expected, but will nonetheless keep the pressure on the ECB to start lifting interest rates in Q3.

US Q1 GDP Overview