- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-07-2016

(raw materials / closing price /% change)

Oil 41.13 -0.02%

Gold 1,333.40 +0.08%

(index / closing price / change items /% change)

Nikkei 22 16,476.84 -1.13%

Shanghai Composite 2,994.98 +0.10%

CAC 40 4,420.58 -0.59%

Xetra DAX 10,274.93 -0.43%

FTSE 100 6,721.06 -0.44%

S&P 500 2,170.06 +0.16%

Dow Jones 18,456.35 -0.09%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1076 +0,21%

GBP/USD $1,3159 -0,39%

USD/CHF Chf0,9804 -0,58%

USD/JPY Y105,27 -0,02%

EUR/JPY Y116,60 +0,18%

GBP/JPY Y138,54 -0,38%

AUD/USD $0,7504 +0,21%

NZD/USD $0,7075 +0,06%

USD/CAD C$1,3153 -0,17%

(time / country / index / period / previous value / forecast)

01:00 New Zealand ANZ Business Confidence July 20.2

01:30 Australia Private Sector Credit, m/m June 0.4% 0.5%

01:30 Australia Private Sector Credit, y/y June 6.5%

01:30 Australia Producer price index, q / q Quarter II -0.2% 0.2%

01:30 Australia Producer price index, y/y Quarter II 1.2%

03:00 Japan BoJ Interest Rate Decision -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275

05:00 Japan Housing Starts, y/y June 9.8% -3%

05:00 Japan Construction Orders, y/y June 34.5%

06:00 Germany Retail sales, real adjusted June 0.9% -0.1%

06:00 Germany Retail sales, real unadjusted, y/y June 2.6% 1.3%

06:30 Japan BOJ Press Conference

07:00 Switzerland KOF Leading Indicator July 102.4 101.3

08:30 United Kingdom Mortgage Approvals June 67.04 65.65

08:30 United Kingdom Net Lending to Individuals, bln June 4.3 4.2

08:30 United Kingdom Consumer credit, mln June 1503 1400

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) July 0.1% 0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) July 0.9% 0.8%

09:00 Eurozone Unemployment Rate June 10.1% 10.1%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II 0.6% 0.3%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II 1.7% 1.5%

12:30 Canada Industrial Product Price Index, m/m June 1.1% 0.5%

12:30 Canada Industrial Product Price Index, y/y June -1.1%

12:30 Canada GDP (m/m) May 0.1% -0.4%

12:30 U.S. PCE price index, q/q (Preliminary) Quarter II 0.2% 2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 2.0% 1.7%

12:30 U.S. GDP, q/q (Preliminary) Quarter II 1.1% 2.6%

13:45 U.S. Chicago Purchasing Managers' Index July 56.8 54

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) July 93.5 90.5

U.S. stocks rose, lifting the S&P 500 Index within striking distance of an all-time high, amid a mix of corporate results as investors await data Friday on the strength of the American economy. Stimulus bets influenced currency markets ahead of the Bank of Japan's policy meeting.

The S&P 500 staged an afternoon comeback to end five points below its record after falling as much as 0.4 percent. Earnings from Ford Motor Co. to Facebook Inc. tugged indexes in opposite directions. Google parent Alphabet Inc. surged almost 5 percent at 4:10 p.m. after its profit topped estimates. Amazon.com Inc. slipped 1 percent in late trading.

The dollar weakened on the Federal Reserve's assurance that it will raise rates gradually, while the yen erased gains before the BOJ stimulus decision. The pound slid on bets the Bank of England will lower rates next week. Oil slipped toward $41 a barrel, approaching a bear market.

While the prospects for additional central-bank support bolstered equities, better-than-forecast economic data and corporate earnings that broadly beat projections have also helped lift the S&P 500 this month. The gauge posted seven records in 10 days in a midmonth stretch, and it's rebounded 18 percent since its low in February. It's up 6 percent this year -- one of the best gains in developed-world equities.

Ford sank 8.2 percent after earnings missed estimates. General Motors Co. dropped 3.3 percent. Whole Foods Markets Inc. sank 9.5 percent on poor results. Facebook climbed to a record on sales that topped forecasts. MasterCard Inc., the second-largest U.S. payments network, advanced after saying profit rose 6.7 percent as customer card spending increased.

Major U.S. stock-indexes demonstrated moderate declines amid disappointing data from the U.S. Labor Department, as well as mixed earnings reports that are unlikely to help to clarify the strength of the economy. In addition, investors continued to assess the implications of the Federal Reserve's most recent statement.

U.S. Labor Department revealed that the number of people claiming unemployment benefits grew to to 266,000 for the week ended July 22. That was above analysts' expectations of 260,000.

Focus is on Facebook (FB) and Ford Motor (F). Facebook posted its financials after yesterday's session. The company's results significantly exceeded analysts' expectations. Facebook's shares rose 0.52%.

The quarterly results of Ford Motor (F) disappointed investors, as posted profit missed analysts' expectations. The Ford's shares plunged by 9.65%. The shares of other automakers were also under pressure, with General Motors (GM) tumbling by 3.76% and Fiat Chrysler (FCAU) falling by 5.45%.

Investors also expect the release of quarterly results of Amazon.com Inc. (AMZN) and Alphabet Inc. (GOOG), which are set to be published after the market's close today.

.

Most of Dow stocks in negative area (22 of 30). Top loser - The Boeing Company (BA, -2.46%). Top gainer - Apple Inc. (AAPL, +0.74%).

Most of S&P sectors in negative area. Top loser - Basic Materials (-0.65%). Top gainer - Conglomerates (+0.82%).

At the moment:

Dow 18321.00 -69.00 -0.38%

S&P 500 2156.25 -4.25 -0.20%

Nasdaq 100 4696.00 -11.75 -0.25%

Crude Oil 41.08 -0.84 -2.00%

Gold 1340.70 +6.20 +0.46%

U.S. 10yr 1.51 -0.01

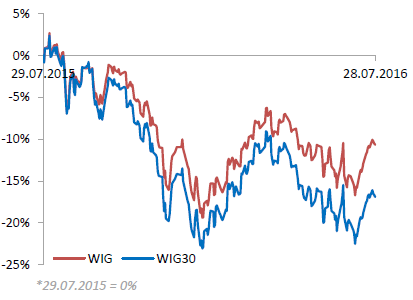

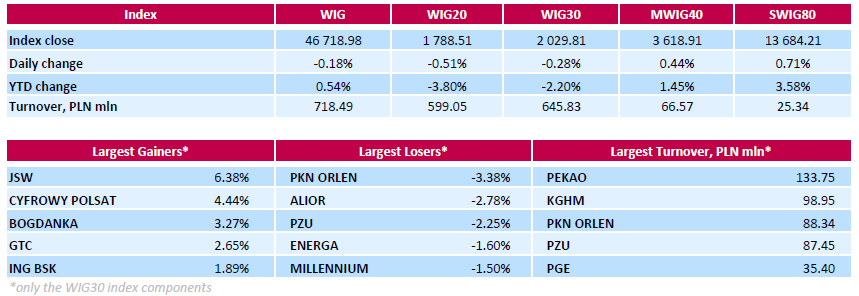

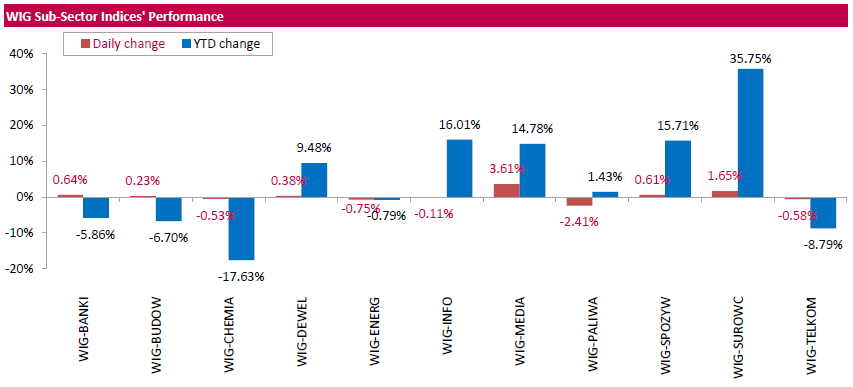

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, declined by 0.18%. Sector performance within the WIG Index was mixed. Media (+3.61%) outperformed, while oil and gas (-2.41%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.28%. In the index basket, the decliners were led by oil refiner PKN ORLEN (WSE: PKN), which tumbled by 3.38%. Other major laggards were bank ALIOR (WSE: ALR), insurer PZU (WSE: PZU) and genco ENERGA (WSE: ENG), which plunged by 2.78%, 2.25% and 1.60% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the gainers, jumping by 6.38%, partially supported by an analyst upgrade. It was followed by media group CYFROWY POLSAT (WSE: CPS), thermal coal miner BOGDANKA (WSE: LWB) and property developer GTC (WSE: GTC), which advanced by 4.44%, 3.27% and 2.65% respectively.

n today's trading, oil prices extended the losses of the previous session, falling to a new three-month low amid lingering concerns about surplus stocks of oil and petroleum products.

A day earlier, WTI crude oil fell to $ 41.68, the lowest level since April 20, after government data showed that crude oil inventories and gasoline in the US unexpectedly rose last week.

US Energy Information Administration (EIA) said in its weekly report that crude oil inventories rose by 1.7 million barrels in the week ended July 22 to 521.1 million barrels, the ministry called "historically high levels for this time of the year".

The report showed that gasoline inventories rose by 452,000 barrels. Despite the height of the summer driving season in the United States, gasoline reserves far exceed the limit of the average range, according to EIA.

In recent weeks, the US standard remains under pressure amid signs of recovery in the US drilling activity combined with higher fuel product inventory.

In the last session, Brent crude was under pressure as prospects for increasing exports from Libya and Iraq have raised concern that an excess of oil will reduce demand from refiners.

Oil prices have fallen nearly 18% from a peak of above $ 50 in early June, as the excess gasoline stocks overshadow prospects for oil demand.

The cost of the September futures on US light crude oil WTI fell to 41.29 dollars per barrel.

September futures price for Brent fell to 42.81 dollars a barrel on the London Stock Exchange ICE Futures Europe.

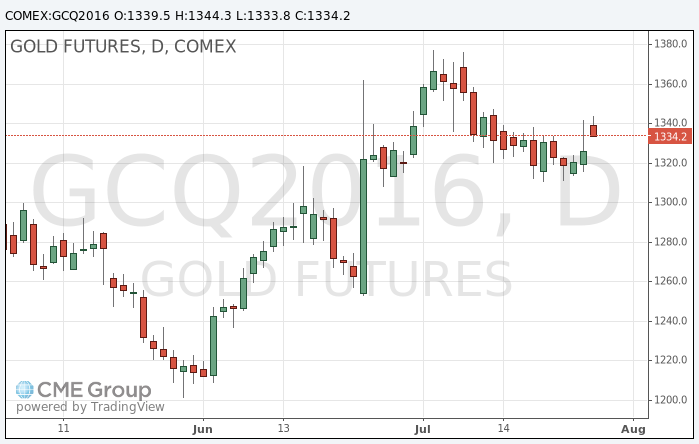

In the past few hours, the price of gold retreated from a two-week high reached after the Federal Reserve refrained from any hints of a rate hike at the next meeting in September.

On Wednesday, the Federal Reserve left interest rates unchanged and said that short-term risks to the US economic outlook declined. Nevertheless, the central bank did not give any indication regarding the rate increase in the near future.

Futures on the federal funds currently evaluating the likelihood of a rate hike in September to 18%, below 22% the day before. The probability of a hike in December is now 43% compared to 52% at the beginning of the week.

The precious metal is sensitive to higher interest rates in the United States. The gradual increase of the rate shall be less of a threat to the gold price than a series of sharp rises.

Daniel Brizeman, an analyst at Commerzbank, observes that the Fed decision not to change interest rates positively contributed to the rise in prices.

"The opportunity costs for gold remain low, - he said -. It is surprising that gold has not gone up even more."

"I think they (Fed) will wait a little longer to follow the events in Europe, before making a decision - says Bernard Dada, an analyst at Natixis -. If these events would be disastrous, then, I think they need more time to raise rates. "

Brizeman and Dada expect the next rate hike in December.

The Bank of Japan will announce its decision on monetary policy on Friday, with economists expecting further easing it. Softer monetary policy will mean that Japan's economic problems persist, prompting investors to buy safe-haven assets, including gold.

The cost of the August gold futures on COMEX fell to $ 1333.80 per ounce.

The shock of the recent results of the referendum led to a sharp deterioration in consumer confidence and a slowdown in activity in the construction sector. These are the results of the last survey conducted by YouGov and the Centre for Economics and Business Research (CEBR).

A month after the referendum, the data indicate a sharp deceleration of economic growth, which is likely to increase the chances of further measures by the Bank of England during the August meeting. Most economists predict that the Central Bank will lower interest rates, and may again start buying bonds.

The results of the survey show that in July consumer confidence index fell by almost 5 points to 106.6 points, recording the largest decline since October 2014, and reached its lowest level in the last three years.

"The public still appreciates the EU referendum result, but it is clear that consumer confidence has deteriorated significantly within a month after voting for Brexit, - said Stephen Harmston, head of YouGov Reports -. Many people are particularly concerned about what will happen to the value of their homes and it can be very serious consequences for the housing sector and for the economy as a whole. "

Economists say consumer spending give hope that the UK will avoid a recession. But retailers said that sales fell sharply after the referendum. In the construction sector activity growth also slowed after the vote, and the companies revised plans for employment.

In the afternoon, we met weekly data from the US labor market. The number of applications for unemployment benefits in the US rose at the about 14 thousand, what is a result of slightly higher than forecast, but remains at a very low level, and 73 weeks in a row is below the critical limit of 300 thousand. From the point of view of investors is not important information because it does not lead to any changes.

The market in the United States opens in neutral and remains with a well-known consolidation. The Federal Reserve and the data from the labor market have not proved an important stimulus, and today it is difficult to expect changes as a result of the empty calendar.

EURUSD 1.0950 (EUR 380m) 1.1000 (1.7bln) 1.1100 (330m)

USDJPY 104.50 (USD 650m) 105.50 (415m)

GBPUSD 1.3050 (GBP 280m) 1.3200 (230m) 1.3530 (280m)

AUDUSD 0.7500 (AUD 2.9bln) 0.7590 (500m) 0.7600 (500m)

USDCAD 1.3020 (USD 260m) 1.3170 (260m) 1.3350 (520m)

AUDNZD 1.0800 ( AUD 807m)

"The FOMC upgraded its statement as our economists were expected and appear to be pathing the way to a September rate hike if US data remains firm. The statement said that "near-term risks to the outlook have diminished", likely referring to the market's calm reaction to Brexit, and upgraded language around the labour market. The confidence in our economists view for the Fed to raise rates in September has increased.

The surprise has been the reaction of the USD: we view that its softness overnight may be reflecting that short-term positioning was for a more direct signal of a September hike. Overall positioning, however, stands at only +6 (out of +/-50) according to our Positioning Analysis.

We do not expect USD weakness to persist and think Fed communication over the coming weeks will shift further in a hawkish direction, forcing the market to increase pricing for a September Fed hike. Two key events are likely to be the minutes of the July meeting (released 17 Aug) and Yellen's Jackson Hole speech (26 Aug).

We remain bullish on the USD accordingly and continue to recommend short GBPUSD* through cash and long USDJPY and short EURUSD via options". - efxnews.

U.S. index futures were little changed as investors assessed a mixed bag of corporate earnings and the Fed's yesterday statement.

Global Stocks:

Nikkei 16,476.84 -187.98 -1.13%

Hang Seng 22,174.34 -44.65 -0.20%

Shanghai 2,994.98 +2.98 +0.10%

FTSE 6,743.64 -6.79 -0.10%

CAC 4,452.35 +5.39 +0.12%

DAX 10,311.25 -8.300 -0.08%

Crude $42.01 (+0.21%)

Gold $1341.30 (+1.10%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 10.75 | 0.08(0.7498%) | 17962 |

| ALTRIA GROUP INC. | MO | 68.81 | 0.88(1.2954%) | 17960 |

| Amazon.com Inc., NASDAQ | AMZN | 739.63 | 4.04(0.5492%) | 9804 |

| Apple Inc. | AAPL | 104.31 | 7.64(7.9032%) | 4208997 |

| AT&T Inc | T | 42.38 | 0.00(0.00%) | 4474 |

| Barrick Gold Corporation, NYSE | ABX | 20.62 | 0.17(0.8313%) | 45981 |

| Boeing Co | BA | 137.5 | 2.65(1.9651%) | 172227 |

| Caterpillar Inc | CAT | 82.42 | -0.33(-0.3988%) | 5709 |

| Chevron Corp | CVX | 102.61 | -0.07(-0.0682%) | 770 |

| Cisco Systems Inc | CSCO | 30.91 | 0.03(0.0971%) | 16933 |

| Citigroup Inc., NYSE | C | 44.22 | 0.07(0.1586%) | 25189 |

| E. I. du Pont de Nemours and Co | DD | 69.53 | 0.37(0.535%) | 1872 |

| Exxon Mobil Corp | XOM | 91.5 | -0.03(-0.0328%) | 5074 |

| Facebook, Inc. | FB | 122.43 | 1.21(0.9982%) | 431905 |

| Ford Motor Co. | F | 13.83 | -0.03(-0.2165%) | 62069 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.71 | 0.03(0.2366%) | 103109 |

| General Electric Co | GE | 31.54 | 0.07(0.2224%) | 12787 |

| General Motors Company, NYSE | GM | 32.05 | -0.10(-0.311%) | 662 |

| Goldman Sachs | GS | 161.35 | 0.19(0.1179%) | 1490 |

| Google Inc. | GOOG | 739.94 | 1.52(0.2058%) | 3358 |

| Intel Corp | INTC | 35.09 | 0.00(0.00%) | 47843 |

| International Business Machines Co... | IBM | 162.45 | 0.33(0.2036%) | 1135 |

| Johnson & Johnson | JNJ | 125.3 | 0.15(0.1199%) | 655 |

| JPMorgan Chase and Co | JPM | 64.1 | -0.03(-0.0468%) | 5337 |

| McDonald's Corp | MCD | 121.8 | 0.09(0.0739%) | 6954 |

| Merck & Co Inc | MRK | 58.36 | 0.00(0.00%) | 600 |

| Microsoft Corp | MSFT | 56.74 | -0.02(-0.0352%) | 20181 |

| Pfizer Inc | PFE | 36.88 | 0.05(0.1358%) | 3385 |

| Procter & Gamble Co | PG | 85.31 | 0.04(0.0469%) | 1394 |

| Starbucks Corporation, NASDAQ | SBUX | 58.3 | -0.01(-0.0172%) | 2266 |

| Tesla Motors, Inc., NASDAQ | TSLA | 229.1 | -0.41(-0.1786%) | 8838 |

| The Coca-Cola Co | KO | 44.22 | -0.66(-1.4706%) | 227847 |

| Twitter, Inc., NYSE | TWTR | 16.42 | -2.03(-11.0027%) | 1347813 |

| United Technologies Corp | UTX | 108.5 | 0.61(0.5654%) | 3418 |

| UnitedHealth Group Inc | UNH | 141.5 | -0.20(-0.1411%) | 700 |

| Verizon Communications Inc | VZ | 54.84 | 0.03(0.0547%) | 3260 |

| Walt Disney Co | DIS | 96.96 | 0.27(0.2792%) | 4090 |

| Yahoo! Inc., NASDAQ | YHOO | 38.84 | 0.08(0.2064%) | 3117 |

| Yandex N.V., NASDAQ | YNDX | 21.2 | 0.07(0.3313%) | 1934 |

Upgrades:

Apple (AAPL) upgraded to Buy from Long-term Buy at Hilliard Lyons

Downgrades:

Facebook (FB) downgraded to Neutral from Buy at Monness Crespi & Hardt

Other:

Facebook (FB) target raised to $160 from $155 at Axiom Capital

Facebook (FB) target raised to $150 from $140 at Mizuho

Facebook (FB) target raised to $150 from $130 at Needham

Facebook (FB) target raised to $185 at Piper Jaffray

Facebook (FB) target raised to $150 at Cowen; Outperform

Facebook (FB) target raised to $170 from $165 at RBC Capital Mkts

Coca-Cola (KO) target lowered to $50 from $54 at Stifel

According to Bloomberg, jobless claims increased by 14,000 to 266,000 in the week ended July 23, a Labor Department report showed Thursday in Washington. The median forecast in a Bloomberg survey called for 262,000 applications. The less-volatile four-week average dropped to remain at the second-lowest level since 1973.

"The labor market's still firm, and really on a path of gradual improvement," Gennadiy Goldberg, an interest-rate strategist at TD Securities in New York, said before the report. "Companies aren't very keen to lay off workers -- it's a strong signal, and I think it stays that way assuming growth continues, even at its kind of meager pace."

Estimates in the Bloomberg survey ranged from 245,000 to 275,000. The Labor Department revised the prior week's reading to 252,000 from an initially reported 253,000.

The inflation rate in Germany as measured by the consumer price index is expected to be +0.4% in July 2016. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.3% on June 2016. The harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to be up 0.4% in July 2016 year on year. Compared with June 2016, the increase is expected to be 0.4%, too.

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 UK House Price Index from Nationwide, m / m in July 0.2% 0% 0.5%

6:00 UK House Price Index from Nationwide, y / y in July 5.1% 4.5% 5.2%

7:55 Germany Change in the number of unemployed in July -6 -3 -7

7:55 Germany Unemployment rate seasonally adjusted 6.1% in July 6.1% 6.1%

9:00 Eurozone index of sentiment in the economy in July 104.4 103.7 104.6

9:00 Eurozone consumer confidence index (final data) July -7.2 -7.9 -7.9

9:00 Eurozone Sentiment Index in the business community July 0.22 0.17 0.39

9:00 Eurozone business confidence index in industry in July -2.8 -3.4 -2.4

12:00 Germany Consumer Price Index m / m (preliminary data) July 0.1% 0.2% 0.3%

12:00 Germany Consumer Price Index y / y (preliminary data) July 0.3% 0.3% 0.4%

The euro retreated from a session high against the dollar, but still shows gains. The US currency remains under pressure against the background of the Fed meeting. Recall, the Fed left interest rates unchanged, but gave no clear signals about future plans. The Central Bank indicated that the labor market has strengthened, although six weeks ago it was reported that the pace of job growth has slowed. Fed officials also said that household spending is growing at strong pace and economic activity increased at a moderate pace. In general, the central bank's statement suggests that the economic outlook caused less concern compared with June. However, many investors expected a more explicit guidance on the timing of rate hikes. According to CME Group, FED futures point to 18% probability of a rate hike in September from 27% a day earlier.

Little support for the euro had statistical data for Germany and the euro zone. Germany Ministry of Labor said that the number of applications for unemployment benefits in July fell by 7,000 after a 6000 declining in June. Analysts had expected a drop to 3 000. The unemployment rate remained at around 6.1%, in line with expectations.

Meanwhile, the European Commission reported that the index of economic sentiment rose in July to 104.6 points compared with 104.4 points in June. Experts forecasted that the figure will drop to 103.7 points. The final index of sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Sentiment Index in the business community has improved to 0.39 points from 0.22 points in June. Analysts had forecast a drop to 0.17 points.

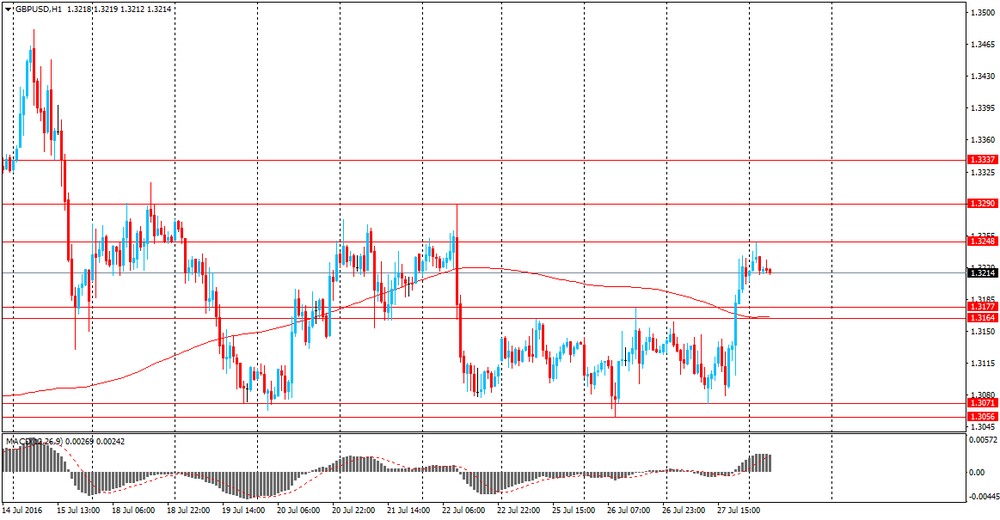

The pound depreciated moderately against the dollar, having lost all earned position. Most likely, the market participants have seen in the recent rally an opportunity to sell. Negligible impact had data from the Society of Motor Manufacturers and Traders (SMMT), which showed that the volume of car production in the UK continued to rise in June, and reached its highest level in 16 years. However, the SMMT warned that the prospects for further growth are unclear, given the expected negative consequences of Brexit. According to the data, at the end of June production of cars increased by 10.4 percent per year, reaching 158.641 units. This was the eleventh consecutive increase in production and the highest level for the month since 1998. 897,157 units were produced in the first half of the year, which is 13 percent more compared to the same period of 2015. It was the largest gain since mid-year 2000. Export demand has risen by 14.9 percent, and production for the domestic market increased by 7.1 percent.

Later this week, market participants will be watching the results of surveys of companies and consumers in Britain that will see just how much Brexit impacted on the economy. Recall preliminary PMI indices showed a reduction of the country's economy at the fastest pace since 2009.

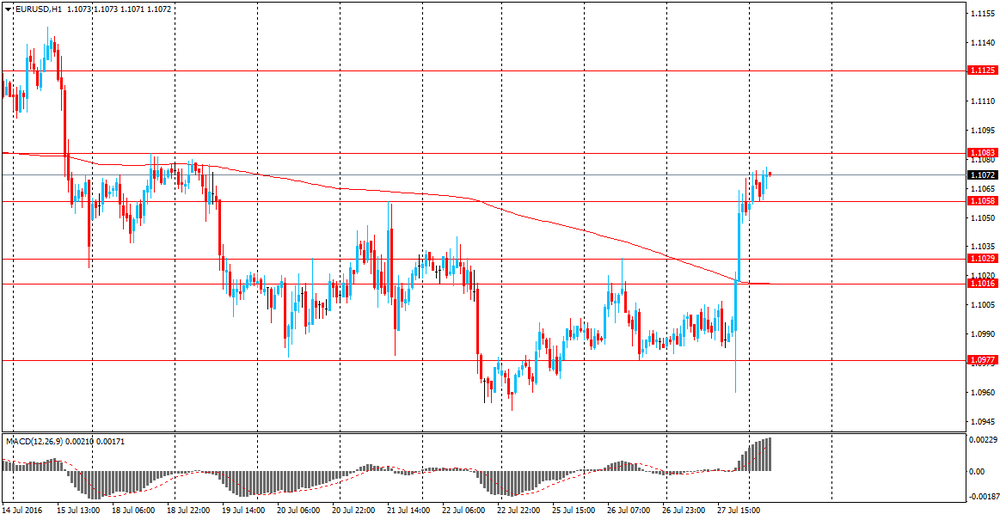

EUR / USD: during the European session, the pair rose to $ 1.1119, but then went back up to $ 1.1080

GBP / USD: during the European session, the pair fell to $ 1.3136

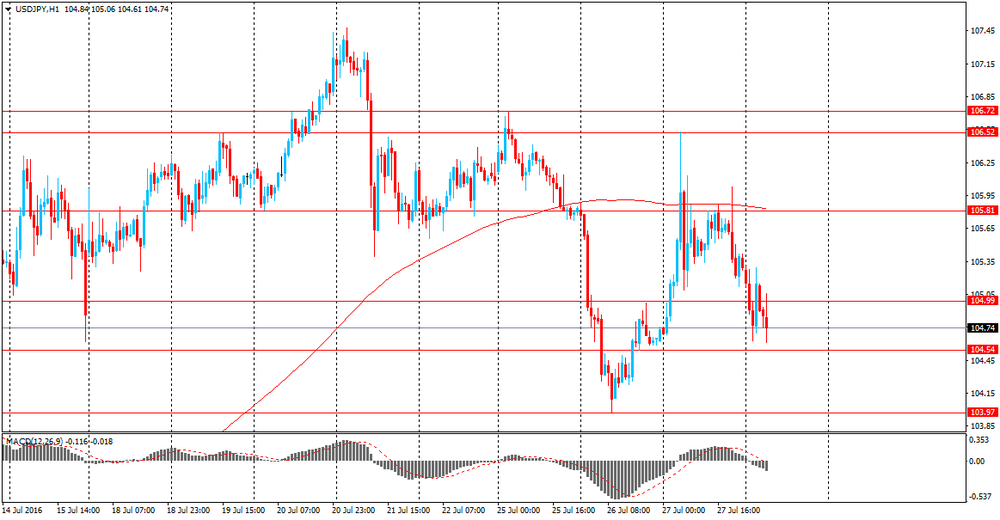

USD / JPY: during the European session, the pair fell to Y104.47

Intl Paper reported Q2 FY 2016 earnings of $0.92 per share (versus $0.97 in Q2 FY 2015), beating analysts' consensus estimate of $0.84.

The company's quarterly revenues amounted to $5.322 bln (-6.9% y/y), generally in-line with analysts' consensus estimate of $5.314 bln.

IP closed Wednesday's trading session at $45.59 (-0.02%).

EUR/USD

Offers 1.1125-30 1.1150 1.1165 1.1180 1.1200 1.1230 1.1250

Bids 1.1085 1.1050 1.1035 1.1020 1.1000 1.0980 1.0950 1.0930 1.0900

GBP/USD

Offers 1.3250 1.3270 1.3285 1.3300 1.3320 1.3350

Bids 1.3170 1.3150 1.3130 1.3100 1.3085 1.3050 1.3020 1.3000

EUR/GBP

Offers 0.8425-30 0.8450 0.8470 0.8485 0.8500 0.8525 0.8550

Bids 0.8380 0.8350 0.8330 0.8300 0.8285 0.8255-60 0.8235 0.8200

EUR/JPY

Offers 116.80 117.00 117.50 117.80 118.00

Bids 115.50 115.00 114.60 114.30 114.00 113.75 113.50 113.00

USD/JPY

Offers 105.00 105.25 105.50 105.80 106.00 106.20-25 106.50

Bids 104.60-65 104.30 104.00 103.75-85 103.40-50 103.00

AUD/USD

Offers 0.7550 0.7565 0.7580 0.7600 0.7620 O.7635 0.7650-55 0.7700

Bids 0.7520 0.7500 0.7485 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350

-

two of the attackers in Germany were refugees, and that mocks Germany and other refugees

-

attacks in recent days in Germany and elsewhere are shocking

-

will decide on what additional measures are required

-

must undertake a comprehensive analysis before taking any steps in response attacks

-

these attacks show we need a better early warning system to alert us to radicalization

-

the repatriation of migrants process must be improved

Ford Motor reported Q2 FY 2016 earnings of $0.52 per share (versus $0.47 in Q2 FY 2015), missing analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $37.000 bln (+5.4% y/y), beating analysts' consensus estimate of $36.279 bln.

F fell to $12.88 (-6.94%) in pre-market trading.

The first half of today's session showed clearly that the Warsaw Stock Exchange remains true to its independence, especially when located near resistance. The round level of 1,800 points well act as a barrier for demand. While the blue chips sector caught short of breath and is on the verge of breaking, generating a signal that could be an invitation to expand profit taking, the second and third line are doing much better. The mWIG40 increases (+0,12%) and even more stable behaves the sWIG80 (+0,25%), so the sentiment among these companies is still good

At the halfway point of listing the WIG20 index was at the level of 1,786 points (-0,61%).

European stocks traded slightly downward. Investors analyzed a mixed corporate reporting, as well as waiting for the results of stress tests in the euro zone, which will be published tomorrow.

Focus was also are the results of the July meeting of the Fed. Recall, as expected the Fed left interest rates unchanged, but gave no clear signals about future plans. Investors slightly reduced the likelihood of a rate hike in September, although the Central Bank has improved the economic outlook and said that short-term risks to the economy declined.

According to CME Group, futures on interest rates Fed point to 18% probability of a rate hike in September.

Some support the market have the latest data on Germany and the euro zone. Germany Ministry of Labor said that the number of applications for unemployment benefits in July fell by 7,000 after declining in June 6000. The unemployment rate in July remained at the level of 6.1%, in line with expectations.

Meanwhile, the European Commission reported that the index of economic sentiment rose in July to 104.6 points compared with 104.4 points in June. Experts expect that figure will drop to 103.7 points. Sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Sentiment Index in the business community has improved to 0.39 points versus 0.22 points in June. Analysts predicted that the rate will fall to 0.17 points. Sentiment index for the retail sector rose to 1.8 from 0.8, and the confidence index for construction reached a level of -16.3 versus -18.2 in June.

The composite index of Europe's largest enterprises Stoxx 600 lost 0.4%.

Shares of the banking sector shows the largest decline among the 19 industry groups in anticipation of the stress tests outcomes "Markets are now digest all previous successes after a decline due to Brexit, - said Philippe Gijsels BNP Paribas -. Corporate profits were generally good, except for a few companies. Investors can exercise some caution on the eve of the meeting of the Bank of Japan and after a strong rally, which may indicate some overbought ".

Shares of Royal Dutch Shell Plc fell 2.5 percent after the company reported that the amount of profit was less than half the average analysts' estimates

Quotes of Lloyds Banking Group Plc fell 3.7 percent amid falling outlook for capital formation in 2016 that increased concerns about rising dividends.

The cost of Dialog Semiconductor Plc sank 7.1 percent as the company cut its forecast for full-year sales

Capitalization of JCDecaux SA decreased by 7 percent after the company's statement that the expected slowdown in the UK will influence the local advertising market

Saipem SpA shares fell 9 percent after lowering profit and sales forecasts for 2016.

At the moment:

FTSE 100 6731.58 -18.85 -0.28%

DAX -5.45 10314.10 -0.05%

CAC -8.35 4438.61 -0.19%

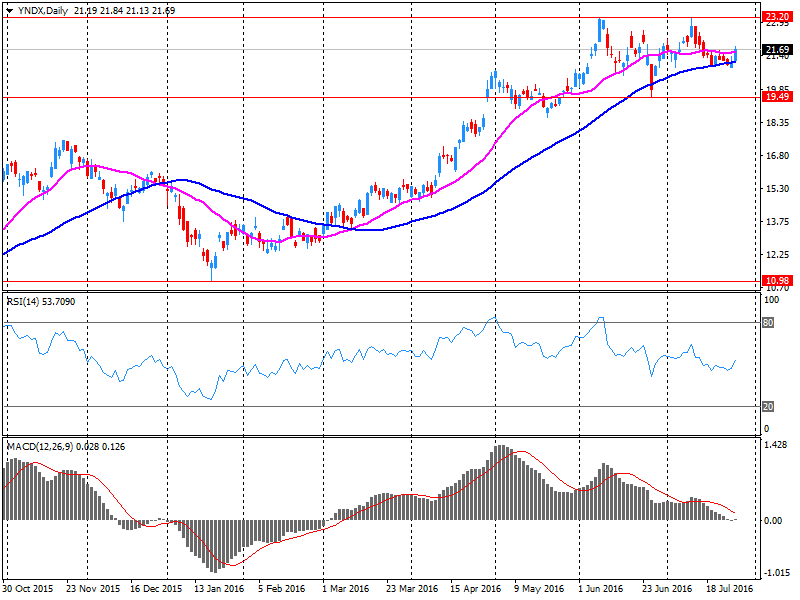

Yandex N.V.reported Q2 FY 2016 earnings of RUB 12.05 per share (versus RUB 8.63 in Q2 FY 2015), beating analysts' consensus estimate of RUB 9.26.

The company's quarterly revenues amounted to RUB 18.040 bln (+29.6% y/y), beating analysts' consensus estimate of RUB 17.611 bln.

YNDX rose to $22.38 (+3.09%) in pre-market trading.

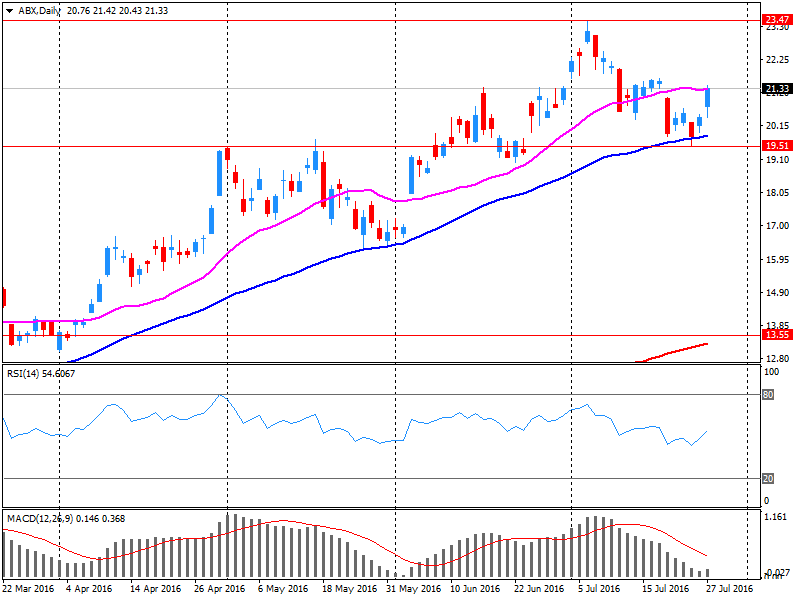

Barrick Gold reported Q2 FY 2016 earnings of $0.14 per share (versus loss of $0.01 in Q2 FY 2015), missing analysts' consensus estimate of $0.15.

The company's quarterly revenues amounted to $2.012 bln (-9.8% y/y), missing analysts' consensus estimate of $2.073 bln.

ABX fell to $21.24 (-0.52%) in pre-market trading.

The results of the research, published by the European Commission showed that economic confidence in the euro area increased slightly in June, contrary to expectations of a moderate decline.

According to the data, the index of economic sentiment, which is a gauge of consumer and business confidence rose in July to 104.6 points compared with 104.4 points in June.

In addition, it was announced that the final index of sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. The decline reflects the more negative assessment of the future general economic situation, unemployment and the future anticipated savings consumers.

Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. The increase was due to positive expectations of demand. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Improved confidence was associated with a more optimistic assessment of the current stock of orders and stocks of finished products. Sentiment Index in the business community has improved to 0.39 points versus 0.22 points in June. Analysts predicted that the rate will fall to 0.17 points. sentiment index for the retail sector rose to 1.8 from 0.8 in June, which was associated with more positive views on the current and expected business situation. confidence index for construction reached -16.3 vs. -18.2 in June.

Futures price for Brent crude oil delivery in September 2016 on the ICE exchange in London fell compared to the previous closing level of by 2.18% - to 42.99 dollars per barrel. Thus, oil prices fell below 43 dollars a barrel for the first time since 20 April.

Reduced oil continues against the backdrop of US Department of Energy data that show a increase in commercial oil reserves in the country. In particular from 15 to 22 July they rose by 3.2%, or 1.64 million barrels to 521.1 million barrels. At the same time, analysts had expected a decline of stocks by 2.26 million barrels, shows the Bloomberg survey.

A weaker GBP remains the clearest trend in markets. Policy easing, political uncertainty, and a twin deficit will all keep the pressure on.

The mix of slowing economic growth, looser monetary policy, and a large twin deficit are negatives for sterling.

The appointment of a new PM and cabinet has stabilised sentiment for now, but the uncertain political climate is far from over.

The UK will not trigger Article 50 until next year. The long drawn-out nature of the process is bad for the economy and sterling.

ANZ targets GBP/USD at 1.25 by the end of the Q3 - efxnews.

EUR/USD 1.0950 (EUR 380m) 1.1000 (1.7bln) 1.1100 (330m)

USD/JPY 104.50 (USD 650m) 105.50 (415m)

GBP/USD 1.3050 (GBP 280m) 1.3200 (230m) 1.3530 (280m)

AUD/USD 0.7500 (AUD 2.9bln) 0.7590 (500m) 0.7600 (500m)

USD/CAD 1.3020 (USD 260m) 1.3170 (260m) 1.3350 (520m)

AUD/NZD 1.0800 ( AUD 807m)

"The labor market developed positively in July," said Frank-Juergen Weise, president of Germany's labor agency. Demand for workers continues to be high, according to the statement.

The number of people out of work fell by some 4,000 each in western Germany and the eastern part of the country, the labor agency said.

German unemployment extended its decline in July, in a sign that Europe's largest economy is showing resilience to uncertainty unleashed by Britain's vote to leave the European Union.

The number of people out of work fell by a seasonally adjusted 7,000 to 2.682 million in July, data from the Federal Labor Agency in Nuremberg showed on Thursday. Economists in a Bloomberg survey forecast a drop of 4,000. The jobless rate remained at a record low of 6.1 percent.

The number of employed people increased by 271,400 in the second quarter of 2016 compared to the previous quarter (1.51%) and stood at 18,301,000. In Seasonally adjusted quarterly variation is 0.29%. Employment has grown by 434,400 people in the last 12 months. The annual rate is 2.43%. - The low occupancy this quarter in 23,200 people in the public sector and increases in 294,600 private. In the past 12 months, employment has increased in 395,700 people in the private sector and 38,700 in the public. - The total wage increases in the second quarter 252,700 (425,500 over the previous year).

At 09:00 GMT Italy will hold an auction of 10-year bonds

At 18:00 GMT the ECB board member Benoit Coeure will deliver a speech

This morning, New York crude oil futures WTI rose 0.12% to $ 41.97 and Brent oil futures were down -0.07% to $ 43.88 per barrel. Thus, the black gold is trading mixed but with little activity after the recent collapse. Forecasts for oil remain weak, refinery continue to supply more than the market can consume. Also, stocks grew by 1.7 million barrels contrary of an expected reduction of 2.3 million barrels. Oil production in the US has also increased.

WIG20 index opened at 1791.55 points (-0.34%)*

WIG 46780.65 -0.05%

WIG30 2033.44 -0.10%

mWIG40 3600.11 -0.08%

*/ - change to previous close

On the Warsaw market contracts started from cosmetic minus (-0.22%). The same FOMC message has not changed much and the market remains in consolidation.

The WIG20 index started today's session with downward move by 0.34% to 1,791 points. At the same time, the German DAX opened with a loss of less than half. The little gains on Pekao may be a good news in the context of yesterday discounts. The market itself is moving on well-known yesterday levels and its image remains neutral.

-

Japanese government to fund about JPY 7 trln of its 28 trln + package via driect/local govt spending

-

no time period specified over which spending would be made

-

the money will be part of the JPY 13 trln fiscal measures - via forexlive.

"The FOMC kept rates unchanged at its 26-27 July meeting, as widely expected. The statement evolved in the way we had expected and if anything, went a little further in preparation for a hike. We think the statement sent a clear warning sign that a hike could be on the horizon as "near-term risks to the outlook have diminished." The odds of a September hike look better than even, and it seems as though the Fed is preparing for one as long as the data fall in line. We expect Fed communication to shift further over the coming weeks, with data releases doing most of the work. Upcoming Fed speeches, the minutes of the July FOMC meeting, and Yellen's Jackson Hole speech will all be important.

The Fed just lowered the bar jobs need to achieve to motivate the next hike. Overall, this increases our confidence in our change in view last week from no change in Fed funds to forecasting a hike in September. Upcoming speeches and the minutes will likely shift market expectations in our direction. Payrolls are also expected to be supportive - we expect 175k in the next report, which is comfortably above the level we now think is the threshold for a hike - around 130k.

We continue to see a good odds of a September hike with a second being partially priced in for December.

We do not expect a December hike to be delivered as a September hike will likely tighten financial conditions and we expect a medium-term outlook which is more pessimistic than the Fed's".

During the Asian session, the euro holds its positions against the dollar trading near yesterday's high, after the announcement of the US Federal Reserve on monetary policy. Yesterday, the US dollar initially rose after the FOMC announcement but for quick handed its positions, as the Fed's statement, issued after a two-day meeting, led investors to revise their expectations of rising interest rates before the end of the year.

The US Federal Reserve, following the meeting, raised its assessment of the situation in the economy, saying that the short-term risks to the outlook have decreased. The leaders of the central bank left the door open for a rate hike later this year, possibly as early as September. Nine out of ten members of the committe voted to keep the key interest rate range unchanged at 0.25% -0.5%, but more optimistic assess the situation on the labor market and in other sectors of the economy.

Some investors expect the Fed clearer signals regarding the rate hikes in the coming months. CME Group recently pointed out that investors see a 24% probability of a rate hike in September compared to 27% probability earlier on Wednesday.

The Australian dollar strengthened against the background of the widespread weakening of the US dollar. Also today the Australian Bureau of Statistics said that export prices in the second quarter increased by 1.4% after a decline of -4.7% in the first quarter. Agricultural products and minerals account for over 60% of the exports of manufactured goods Australia. Thus, changes in raw material price movements affect the Australian economy and leads to volatility for the Australian currency. The rise in prices is a medium-term risk as the price increase is accompanied by a fall in demand.

Import Price Index in the second quarter decreased by 1%. The decline has been less than in the first quarter, when the import price index weakened to -3%. The higher the price of imported goods, the greater the effect will be on inflation.

The combination of higher export prices and lower import prices trade gain 2.7% for the quarter. This value can be added in the calculation of GDP for the second quarter.

The yen traded mixed on the eve Bank of Japan meeting. It is expected that BoJ will carry out an easing of monetary policy to support the economy.

"Large-scale measures of fiscal stimulus may cause the Bank of Japan to go to more drastic steps - said Marc Chandler of Brown Brothers Harriman -. It seems that market participants remain skeptical."

Yesterday, Prime Minister of Japan Shinzo Abe has made it clear that the government is preparing a stimulus package totaling 28 trillion yen.

"If the Government of Japan intends to revive inflation expectations, it is not enough to repeat the previous incentives should include in the program budget spending to stimulate consumption and capital investment." - SMBC Friend Securities.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1050-65 range.

GBP / USD: during the Asian session, the pair was trading in the $ 1.3170-85 range.

USD / JPY: during the Asian session, the pair was trading in Y104.60-80 range.

The highlight of the last hours of the financial markets was the end of the Fed meeting. Nothing special has been passed in the message and the Fed left its key interest rate in the range of 0.25-0.5%, while stating that the short-term risk to the US economic growth weakened.

The probability of increases after yesterday's meeting did not change significantly, where possible deadline for such a move is now estimated on December (approx. 40%) after the US presidential election. After this message, the price of gold rose and the dollar weakened.

In the morning, most Asian parquet on the little lost, led by the Nikkei falling by 1,0%. Contracts in the US are stable, but the expectations indicate the possibility of light falls on the opening in Europe.

From the point of view of the Warsaw Stock Exchange it is a neutral picture of the situation. There is no strong impulse to snatch the market from around 1,800 points. Investors will continue to focus its attention on the banking sector, we are still waiting for the results of stress tests of European banks (Friday) and the law on foreign currency loans in Poland (by the end of the week).

Export prices in Australia were up 1.4 percent on quarter in the second quarter of 2016, the Australian Bureau of Statistics said on Thursday.

That was shy of forecasts for 3.0 percent following the 4.7 percent contraction in the previous three months.

Import prices slipped 1.0 percent on quarter versus expectations for an increase of 1.5 percent following the 3.0 percent fall in the three months prior.

On a yearly basis, export prices plummeted 8.7 percent, while import prices slipped 2.8 percent.

During the Asian session, the euro holds its positions against the dollar trading near yesterday's high, after the announcement of the US Federal Reserve on monetary policy. Yesterday, the US dollar initially rose after the FOMC announcement but for quick handed its positions, as the Fed's statement, issued after a two-day meeting, led investors to revise their expectations of rising interest rates before the end of the year.

The US Federal Reserve, following the meeting, raised its assessment of the situation in the economy, saying that the short-term risks to the outlook have decreased. The leaders of the central bank left the door open for a rate hike later this year, possibly as early as September. Nine out of ten members of the committe voted to keep the key interest rate range unchanged at 0.25% -0.5%, but more optimistic assess the situation on the labor market and in other sectors of the economy.

Some investors expect the Fed clearer signals regarding the rate hikes in the coming months. CME Group recently pointed out that investors see a 24% probability of a rate hike in September compared to 27% probability earlier on Wednesday.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1303 (3662)

$1.1210 (3825)

$1.1129 (2020)

Price at time of writing this review: $1.1088

Support levels (open interest**, contracts):

$1.0982 (2965)

$1.0940 (4641)

$1.0874 (7389)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40555 contracts, with the maximum number of contracts with strike price $1,1200 (3825);

- Overall open interest on the PUT options with the expiration date August, 5 is 49972 contracts, with the maximum number of contracts with strike price $1,0900 (7389);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from July, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3503 (1819)

$1.3405 (1938)

$1.3307 (1106)

Price at time of writing this review: $1.3177

Support levels (open interest**, contracts):

$1.3088 (1943)

$1.2992 (1823)

$1.2895 (852)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 26704 contracts, with the maximum number of contracts with strike price $1,3400 (1938);

- Overall open interest on the PUT options with the expiration date August, 5 is 25419 contracts, with the maximum number of contracts with strike price $1,2950 (2786);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from July, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

UK house prices increased by 0.5% in July and, as a result, the annual rate of house price growth was little changed at 5.2%, compared with 5.1% in June. "This is the first month's data following the EU referendum. However, it is important to note that, in constructing the index, we use data at the mortgage offer stage - this means any impact from the vote may not be fully evident in July's figures, as there is a short lag between a buyer making the decision to purchase a property and applying for a mortgage.

European stocks finished higher Wednesday, with surges in shares of French firms LVMH Moët Hennessy Louis Vuitton and Peugeot SA helping to offset a drop in Deutsche Bank AG shares after the German lender's profit plunged.

The Stoxx Europe 600 SXXP, +0.43% rose 0.4% to end at 342.74.

U.S. stocks ended slightly lower Wednesday after the Federal Reserve said improving economic conditions could justify an interest-rate hike as soon as September. The S&P 500 SPX, -0.12% shed 3 points, or 0.1% to 2,166, as declines in utilities and consumer-staples shares weighed on the index. The Dow industrials DJIA, -0.01% finished flat at 18,472, despite a strong performance by Apple Inc. AAPL, +6.50% which reported stronger-than-expected quarterly earnings late Tuesday. The Nasdaq Composite gained 30 points, or 0.6%, to 5,139. Economic data released Wednesday seemed to contradict the Fed's sanguine outlook. Durable-goods orders sank in June at the fastest clip in nearly two years.

Asian stocks edged up on Thursday after the Federal Reserve provided an positive assessment of the world's largest economy and lifted risk sentiment.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.2 percent after briefly climbing to its highest level since August 2015.

Australian shares rose 0.4 percent and Shanghai .SSEC gained 0.3 percent, trimming some of the heavy 1.9 percent loss suffered the previous day.

News that Chinese regulators are planning a tough clampdown on wealth management products to curb risks to the country's banking system had weighed heavily on Chinese stocks, but investors are still wading through the details.

Japan's Nikkei fell 0.7 percent, hurt by a stronger yen and nerves before the Bank of Japan's monetary policy decision on Friday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.