- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 01-02-2016.

(raw materials / closing price /% change)

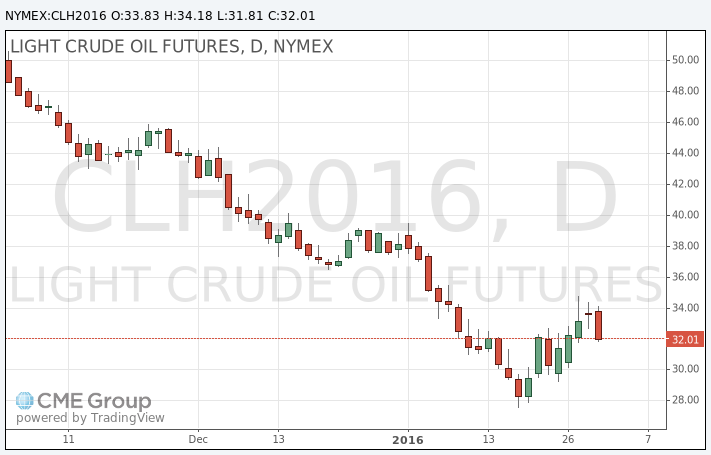

Oil 31.32 -0.95%

Gold 1,128.60 +0.05%

Oil prices declined on concerns over the global oil oversupply and on a weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

A senior OPEC delegate said on Monday that it was too early to talk about an OPEC emergency meeting to discuss the output cut.

WTI crude oil for March delivery fell to $31.81 a barrel on the New York Mercantile Exchange.

Brent crude oil for April declined to $35.72 a barrel on ICE Futures Europe.

Gold price rose as global stock markets declined and on the weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

A weaker U.S. dollar also supported gold. The U.S. dollar fell against other currencies after the release of the U.S. economic data. The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was flat in December, missing expectations for a 0.1% gain, after a 0.5% increase in November. November's figure was revised up from a 0.3% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

In 2015 as whole, the U.S. consumer spending climbed 3.4%, after a 4.2% growth in 2014.

April futures for gold on the COMEX today increased to 1129.40 dollars per ounce.

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was flat in December, missing expectations for a 0.1% gain, after a 0.5% increase in November. November's figure was revised up from a 0.3% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

In 2015 as whole, the U.S. consumer spending climbed 3.4%, after a 4.2% growth in 2014.

This data suggests that American consumers were cautious.

The saving rate climbed was 5.5% in December, up from 5.6% in November.

Personal income increased 0.3% in December, exceeding expectations for 0.2% rise, after a 0.3% gain in November.

In 2015 as whole, personal income rose 4.5%, after a 4.4% increase in 2014. It was the largest rise since 2012.

Wages and salaries were up 0.2% in December, after a 0.5% gain in November.

The personal consumption expenditures (PCE) price index excluding food and energy was flat in December, missing forecasts of a 0.1% increase, after a 0.1% gain in November. November's figure was revised up from a flat reading.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.4% in December. November's figure was revised up from a 1.3% gain.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

"Recent macroeconomic indicators show the economy is still in the process of bottoming out and efforts to trim excess capacity are just starting to show results. The pressure on economic growth remains intense in light of continued global volatility. The government needs to watch economic trends closely and proactively make fine adjustments to prevent a hard landing," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012.

Analysts had expected the index to decline to 49.6.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The services PMI decreased to 53.5 in January from 54.4 in December.

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 12 rigs to 498 last week. It was the lowest level since March 2010.

Combined oil and gas rigs declined by 18 to 619.

West Texas Intermediate futures for March delivery declined to $33.14 (-1.43%), while Brent crude fell to $35.44 (-1.53%) amid weak economic data from China. According to an official report released today, activity in China's manufacturing sector contracted at the fastest pace in nearly three-and-a-half years in January. Meanwhile expectations for oil producers to co-operate and reduce output deteriorated.

Analysts expect weakness of the Chinese economy and ample oil supplies to weigh on crude prices throughout 2016.

Gold climbed to $1,122.20 (+0.52%) amid uncertainty over the global economy and signs of weakness in the Chinese economy. China Federation of Logistics and Purchasing reported on Monday that the country's Manufacturing PMI declined to 49.4 in January compared to 49.7 reported previously and 49.6 expected.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund in the world, rose about 4% in January.

Nevertheless analysts don't expect gains to be sustained for a long time. Societe Generale forecasts gold price to average at $1,040 in the first quarter and $955 in the last quarter of the current year.

(raw materials / closing price /% change)

Oil 33.74 +0.36%

Gold 1,118.40 +0.18%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.