- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 01-11-2013.

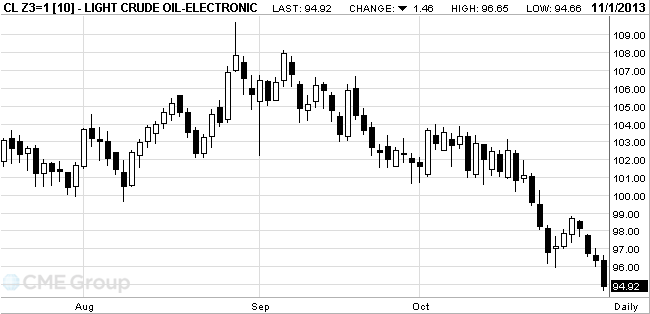

West Texas

Intermediate fell below $95 a barrel for the first time since June on surging

Futures

headed for a fourth straight weekly decline, the longest stretch of decreases

in more than a year. A

WTI for

December delivery decreased $1.50, or 1.6 percent, to $94.88 a barrel at 11:20

a.m. on the New York Mercantile Exchange. Futures touched $94.81, the lowest

intraday level since June 26. Prices are down 3 percent this week and fell 5.8

percent in October. The volume of all futures traded was about 22 percent below

the 100-day average.

Brent for

December settlement dropped $1.88, or 1.7 percent, to $106.96 a barrel on the

London-based ICE Futures Europe exchange. Volume was 18 percent higher than the

100-day average. The European benchmark crude traded at a $12.08 premium to

WTI, down from $12.46 yesterday.

The price of gold reached a two-week low after a sharp drop on Thursday caused by profit-taking at the end of the month , strong economic performance and the strengthening of the U.S. dollar.

Business activity in the U.S. Midwest in October exceeded forecasts by increasing the volume of new orders to the maximum level in 2004 , while the number of applications for unemployment benefits fell last week.

The published data on Friday Institute for Supply Management (ISM) showed that despite the suspension of the government , manufacturing activity in the U.S. in October remained at a high level as last month. Purchasing Managers Index (PMI) for the manufacturing sector in the U.S. October was 56.4 against 56.2 in September. The October index was the highest since April 2011 .

Investors fear that the improvement in the economy will force the Fed will soon begin to reduce the volume of buying bonds to $ 85 billion a month.

The outflow of funds from the world's largest secured gold ETF SPDR Gold Trust this year has exceeded $ 20 billion , and its reserves are close to a minimum of four years.

China in September, the fifth consecutive month, bought more than 100 tons of gold in Hong Kong due to the high demand for jewelry and bullion. This year, China could become the world's largest consumer of gold instead of India .

The cost of the December gold futures on COMEX today dropped to $ 1305.60 per ounce.

GOLD 1,323.50 -25.80 -1.91%

OIL (WTI) 96.25 -0.52 -0.54%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.