- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 02-03-2016.

(raw materials / closing price /% change)

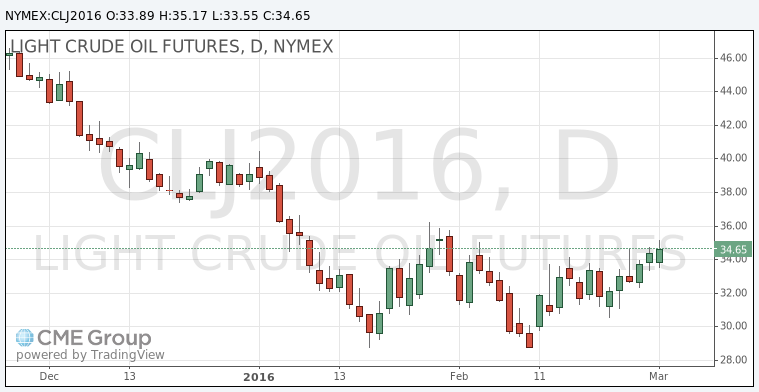

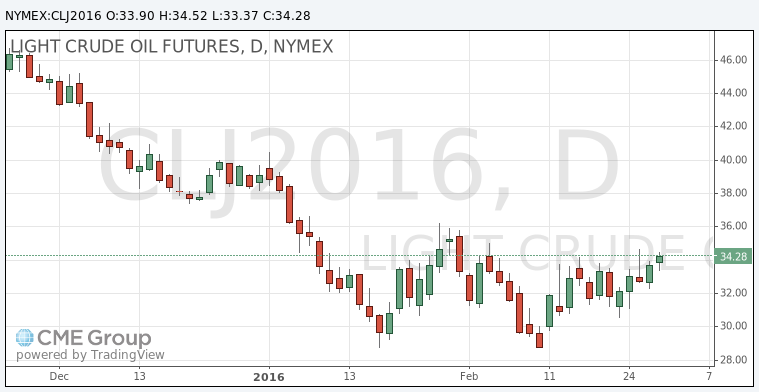

Oil 34.73 +0.20%

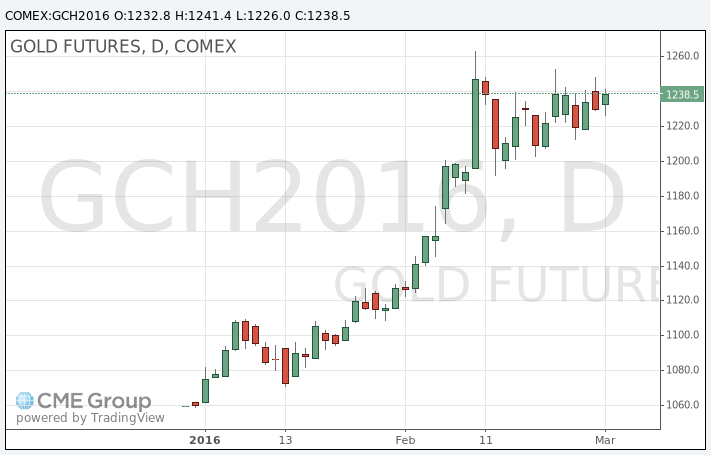

Gold 1,240.50 -0.10%

Oil prices rose despite an increase in U.S. crude inventories. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories rose by 10.37 million barrels to 518.0 million in the week to February 26.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories decreased by 1.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.2 million barrels.

U.S. crude oil imports increased by 502,000 barrels per day.

Refineries in the U.S. were running at 88.3% of capacity, up from 87.3% the previous week.

WTI crude oil for April delivery increased to $34.69 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $36.99 a barrel on ICE Futures Europe.

Gold price rose as global stocks declined. Global stocks fell on decreasing demand for risky assets.

Gains were limited as the U.S. dollar increased after the release of the better-than-expected U.S. economic data. Private sector in the U.S. added 214,000 jobs in February, according the ADP report on Wednesday. January's figure was revised up to 193,000 jobs from a previous reading of 205,000 jobs. Analysts expected the private sector to add 190,000 jobs. Services sector added 208,000 jobs in February, while goods-producing sector added 5,000.

April futures for gold on the COMEX today increased to 1241.40 dollars per ounce.

Gold rebounded on Wednesday as global shares turned lower after a fall in oil prices, shrugging off a steadier dollar following better-than-expected U.S. economic data.

Bullion, seen as a shelter for risk-averse investors, has rallied about 16 percent this year in the face of tumbling equities and fears of a global economic slowdown.

"We are still in the phase of investors filling their boots and that means the retracement we are seeing in gold is likely to be used as a buying opportunity," Saxo Bank senior manager Ole Hansen said.

On Wednesday, gold had started the day on the back foot along with other assets perceived as safer, including the Japanese yen, due to a rally in stock markets.

But a retreat in stocks after oil prices slipped generated renewed demand for the metal.

Gold rebounded even as the dollar gained 0.1 percent against a basket of currencies, after data showed the U.S. private employers added 214,000 jobs in February, above economists' expectations.

Investors will be watching more U.S. data to gauge the impact on stocks and the Federal Reserve's monetary policy, with the most important release being non-farm payrolls on Friday.

Gold futures for March delivery rose to $1241,40 per ounce.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories rose by 10.37 million barrels to 518.0 million in the week to February 26.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories decreased by 1.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.2 million barrels.

U.S. crude oil imports increased by 502,000 barrels per day.

Refineries in the U.S. were running at 88.3% of capacity, up from 87.3% the previous week.

Private sector in the U.S. added 214,000 jobs in February, according the ADP report on Wednesday. January's figure was revised up to 193,000 jobs from a previous reading of 205,000 jobs.

Analysts expected the private sector to add 190,000 jobs.

Services sector added 208,000 jobs in February, while goods-producing sector added 5,000.

"Despite the turmoil in the global financial markets, the American job machine remains in high gear. Energy and manufacturing remain blemishes on the job market, but other sectors continue to add strongly to payrolls. Full-employment is fast approaching," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in February. The U.S. economy is expected to add 190,000 jobs in February, after adding 151,000 jobs in January.

Moody's Investors Service cut China's outlook to 'negative' from 'stable' on the country's government credit ratings on Wednesday. The agency said that the downward revision was driven by the weak fiscal metrics, a decline in reserve buffers and the uncertainty about the government' capacity to implement reforms.

Moody's affirmed China's Aa3 rating.

The agency noted that the country's climbed to 40.6% of GDP at the end of 2015 from 32.5% in 2012, and expected to rise to 43.0% by 2017.

China's foreign exchange reserves dropped to $3.2 trillion in January 2016, down by $762 billion from June 2014.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.