- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 04-11-2016.

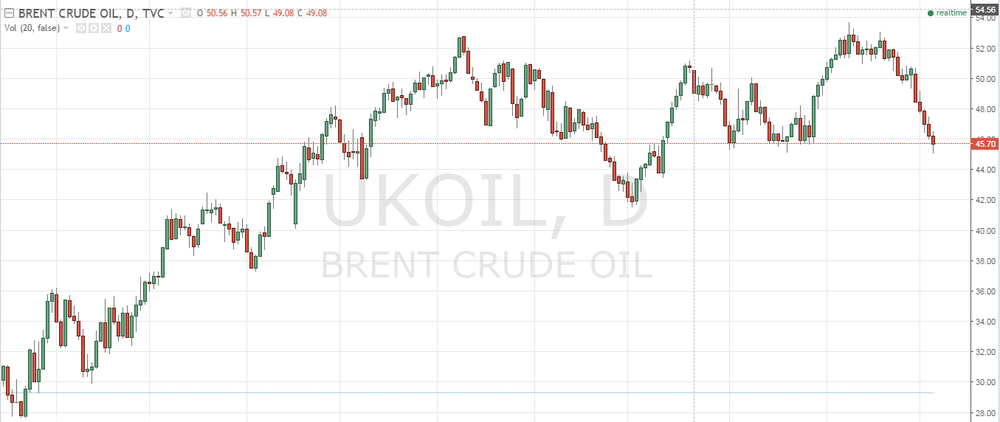

Crude oil futures lost value Friday after OPEC uncertainty to finalize plans for supply cuts that would help stabilize energy markets, rttnews says.

"We remain deeply optimistic about the possibility that the Algiers agreement will be complemented by precise, decisive action among all producers," said the commentary section of the cartel's monthly magazine, "OPEC Bulletin."

Certain cartel members such as Iran and Iraq have reportedly asked they be exempt from any quotas.

Brent was down to 45$ a barrel after the U.S. jobs report.

Oil fell sharply earlier in the week when the U.S. government said oil inventories skyrocketed by a whopping 14 million barrels.

Gold futures were little changed, clinging to this week's gains after a somewhat disappointing October jobs report.

The economy generated 161,000 jobs last month, slightly short of expectations, according to the Labor Department.

The unemployment rate fell to 4.9%, however, keeping the door open for a Federal Reserve rate hike in December.

Dec. gold was down 10 cents at $1,303.40 an ounce.

Prices rallied this week as Donald J. Trump closed the gap on Hillary R. Clinton just ahead of Tuesday's general election.

Markets have been spooked by the possibility of a protectionist president.

This morning, the New York futures for Brent rose by 0.18% to $ 44.74 and WTI rose by 0.22% to $ 46.45 per barrel. Thus, the black gold is trading in the green zone after Baker Hughes reported that the number of drilling rigs in the US decreased by 2 to 441 last week.

The US presidential candidates Hillary Clinton and D.Tramp have radically different views on energy policy, including the search for oil on federal territory and diplomatic relations with major oil producers.

Also, experts are skeptical about the implementation of OPEC's plans to limit the volume of oil production.

During the negotiations in Algeria, producers from 14 countries agreed to cut production to 32,5-33,0 million barrels/day, but OPEC said it would not make a final decision about this before the official summit in Vienna on November 30th.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.