- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 05-07-2012.

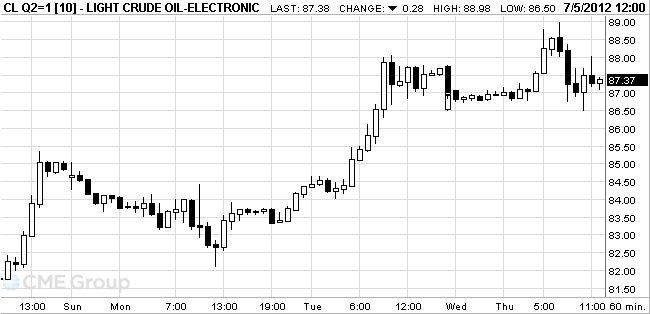

Crude fluctuated after a U.S. Energy Department report showed that stockpiles dropped and as the dollar rose against the euro on the European Central Bank’s reduction of interest rates to a record low.

Supplies fell 4.27 million barrels to 382.9 million last week, the biggest decrease since December, the report showed. Inventories were forecast to decline 2.3 million barrels, according to a Bloomberg survey. Oil decreased as much as 1.3 percent earlier after ECB President Mario Draghi said economic risks remain after the bank cut rates and the dollar gained.

Crude for August delivery surged to $88.98 earlier, the highest level since May 30. Prices are down 11 percent this year.

Brent oil in London rose as Statoil ASA (STL), Norway’s largest crude producer, prepared to halt output. The Norwegian Oil Industry Association, which represents employers, will ban all members of three labor unions who are covered by offshore pay agreements from midnight on July 9, Statoil said.

The planned lockout of oil workers in Norway will halt the nation’s entire offshore production, which totals about 2 million barrels a day of oil equivalent, Bard Glad Pedersen, a spokesman for Statoil ASA, said by phone today from Oslo.

Brent oil for August settlement advanced $1.60, or 1.6 percent, to $101.37 a barrel on the London-based ICE Futures Europe exchange. It touched $102.34 during the session, the highest level since June 7.

In the morning, gold prices were close to a maximum of two weeks at a time, as investors awaited the European Central Bank decision on interest rates.

After the announcement of the ECB's decision to reduce the key refinancing rate by 25 basis points and Mario Draghi pessimistic comments about the state of the economy the dollar rose sharply and took the gold price down.

Bank of England on Thursday launched the third round of "quantitative easing" by announcing that buys the assets for a further 50 billion pounds, and kept the key interest rate at 0.5 percent per annum, as expected.

On Friday, the U.S. employment report released in June, which could prompt the Fed to new measures to stimulate economic growth. According to the forecasts of economists, the number of jobs in June rose by 90,000, while unemployment remained at 8.2 percent.

Low interest rates are beneficial for gold, not bearing interest, because it reduces the loss of profit from investments in precious metals.

Investment demand for gold has declined in recent months due to economic uncertainty, as investors prefer the U.S. dollar as a safe asset.

The physical demand in India - the world's largest consumer of gold - fell because of the depreciation of the rupee and seasonal downturn.

August gold futures on the COMEX today, went up to 1624.5 dollars per ounce, then fell to 1597.5, and the dollar is currently trading at around 1608.8 dollars per ounce.

Resistance 3: 1660 (MA (200) for D1)

The resistance of 2:1640 (high of June, MA (100) for D1)

Resistance 1:1619 / 24 (resistance line from Jun 6, session high, Jul 3 high)

Current Price: 1608.70

Support 1:1595 (session low, Jul 3 low)

Support 3: 1587 (Jul 2 low)

Support 3: 1550 (low of June, resistance line from May 16)

Resistance 3: 95,00 (61.8% FIBO $ 106 - $ 77)

Resistance 2:91,60 / 90 (50.0% FIBO $ 106 - $ 77, Jun 29 high)

Resistance 1:88,70 (session high)

Current Price: 87.68

Support 1:86,20 (session low, Jul 4 low)

Support 2:82,00 (Jun 2 low, MA (200) for H1)

Support 3:77,50 (low of June)

Change % Change Last

Gold 1,615 -7 -0.41%

Oil 87.01 -0.65 -0.74%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.