- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 05-09-2012.

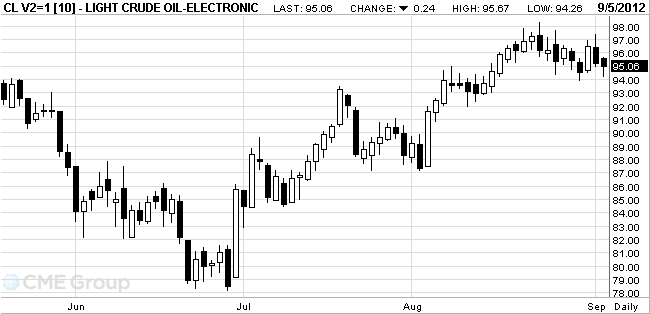

Oil fell before European Central Bank policy makers meet to discuss a plan involving unlimited purchases of government debt to ease the region’s debt crisis.

Futures dropped as much as 1.1 percent after two central bank officials said Germany’s Bundebank objected to the plan that involves sterilizing debt to assuage concerns about printing money. Prices initially rose on the proposal by ECB President Mario Draghi, who will announce a decision at a press conference tomorrow.

Oil also fell as euro-area services shrank more than initially estimated in August.

A gauge of euro-area service industries based on a survey of purchasing managers fell to 47.2 from 47.9 in July, London- based Markit Economics said today. That’s below an initial estimate of 47.5 published on Aug. 23. A composite index of both services and manufacturing fell to 46.3 from 46.5, also below an initial estimate.

An Energy Department report tomorrow will probably show U.S. crude supplies tumbled to a five-month low last week because of Hurricane Isaac.

Crude oil for October delivery dropped to $94.26 a barrel on the New York Mercantile Exchange. Prices rose as much as 37 cents to $95.67 earlier today. Futures have fallen 4.4 percent this year.

Brent oil for October settlement decreased 80 cents, or 0.7 percent, to $113.38 a barrel on the London-based ICE Futures Europe exchange.

Gold prices held near a six-month high, as the recent U.S. macroeconomic indicators and Europe can count on new stimulus central banks.

European data suggest the possibility of a recession in the euro zone in the current quarter: PMI composite index in August fell to 46.3 points from 46.5 points in July, compared with a preliminary value of 46.6 points.

Manufacturing activity in the U.S. in August declined at the fastest rate in three years, giving investors hope for new stimulus the Fed.

The price of gold has doubled in the past four years, the Fed has held two rounds of purchases of government bonds, known as "quantitative easing."

Stocks of gold-ETF funds by Tuesday hit records 71.889 million ounces (2.038 tons), while the stocks of the largest ETF SPDR Gold Trust GLD totaled 1.293 tonnes.

September futures price of gold on the COMEX is now 1693.00 an ounce.

Change % Change Last

Gold 1,698 +41 +2.49%

Oil 95.49 +0.87 +0.92%© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.