- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 05-10-2016.

(raw materials / closing price /% change)

Oil 49.70 -0.26%

Gold 1,269.00 +0.03%

Oil prices rose after data show an unexpected decline in US inventories.

Commercial oil reserves in US in the week 24 - 30 September unexpectedly fell and gasoline inventories rose moderately, according to the US Department of Energy

Crude oil inventories fell by 3 million barrels to 499.7 million barrels. It's close to the highs for this time of year. The average forecast of analysts anticipated growth of 2.1 million barrels.

Oil reserves in the terminal Cushing (Oklahoma), from which the oil traded on NYMEX, rose by 569,000 barrels to 62.7 million barrels.

Gasoline stocks rose by 222,000 barrels to 227.4 million barrels. Analysts had expected gasoline supplies to increase by 100,000 barrels.

Distillate stocks fell 2.4 million barrels to 160.7 million barrels. This rate is still above the upper limit of the average range for this time of the year. Analysts expected distillate stocks to decline 900,000 barrels.

The utilization of refining capacity fell by 1.8 percentage points to 88.3%.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 49.95 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 52.09 dollars a barrel on the London Stock Exchange ICE Futures Europe.

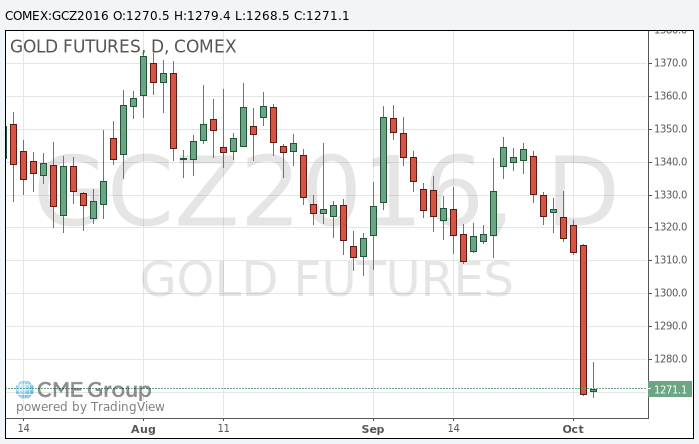

Gold price rose, rebounding from a 3.5 month low after ADP reported that the level of employment in the US private sector grew in September, less than expected, impacting the optimism about the US labor market.

On Tuesday, gold collapsed down to $ 43.00, or 3.28%, registering the biggest day drop since September 2013, as the US dollar jumped to a two-month high, while stocks increased significantly.

ADP reported that the level of employment in the private sector rose by a seasonally adjusted 154,000 last month, below forecasts of +169.000. Previos 175,000 jobs figure was revised downward from +177,000.

In the last hours the price of gold retreated from session highs as the dollar strengthened after the release of strong data on business activity in the US service sector.

Final data presented by Markit Economics, showed that the seasonally adjusted index of business activity in the US service sector grew in September to 52.3 points compared to 51.0 points in August. This value is the highest since April. Previously it was reported an increase to 51.9 index points. Economists had expected the index to reach 51.9 points. It is worth emphasizing, the index remains in the territory of expansion, ie, above 50 points for the seventh consecutive month. The average value of the index for the third quarter amounted to 51.5 points, which was slightly lower than in the 2nd quarter (51.8 points).

Currently the chances of a FED hike in November, up about 15%, and the probability of a rate hike at the meeting in December - almost 64%.

The cost of December futures for gold on COMEX rose to $ 1279.4 per ounce.

This morning, New York futures for Brent rose by 1.42% to $ 49.37 and crude oil futures for WTI rose 1.40% to $ 51.58 per barrel. Thus, the black gold is traded in the green zone on the background of an unexpected decline in US oil inventories. American Petroleum Institute data showed that the reserves of black gold in the US probably fell last week, showing a decline for fifth week in a row. Energy Information Administration will release official statistics today, but analysts expect that the agency will report a growth of reserves by 2.6 million barrels for the week ended September 30th.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.