- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 06-03-2013.

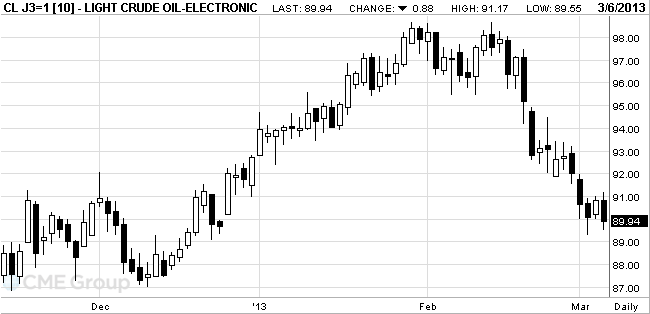

West Texas Intermediate oil fell for the fourth time in five days as a government report showed U.S. inventories increased more than expected last week.

Prices dropped as much as 1.3 percent after the Energy Information Administration, the Energy Department’s statistical arm, said supplies rose 3.83 million barrels in the week ended March 1. Analysts expected a gain of 788,000 barrels.

Oil stockpiles rose to 381.4 million barrels last week, the most since June 29, the EIA reported. Supplies at Cushing, Oklahoma, the delivery point for WTI, gained 257,000 barrels to 50.8 million.

Venezuelan President Hugo Chavez died yesterday, and an election must be held within 30 days. U.S. crude imports from Venezuela, OPEC’s fourth-largest producer, totaled 549,000 barrels in the week ended Feb. 22, down 44 percent from a year earlier, EIA data showed. U.S. domestic output rose to as much as 7.12 million barrels a day in February, the most since 1992.

Venezuela pumped 2.86 million barrels of oil a day last month, behind Saudi Arabia, Iraq and Kuwait in the 12-member Organization of Petroleum Exporting Countries, according to a survey of oil companies, producers and analysts.

WTI for April delivery declined to $89.55 a barrel on the New York Mercantile Exchange.

Brent for April settlement fell 94 cents, or 0.8 percent, to $110.67 on the London-based ICE Futures Europe exchange.

The price of gold has stabilized on hopes for the continuation of the ultrasoft policies of central banks and the increased interest in higher yielding assets.

Investors' attention turned to the stock market, when on the eve of the U.S., the Dow Jones reached a historic high, while European shares rose to its highest level since 2008.

According to analysts, the European Central Bank, the Bank of England and Bank of Japan this week the supersoft policy after assuring the Fed to continue the program of buying bonds.

South Korea's central bank bought 20 tonnes of gold in February, making the fifth purchase in less than two years, bringing the inventories to 104.4 tonnes. At the same time, the world's largest reserves of gold-exchange-traded fund (ETF) SPDR Gold Trust on Tuesday dropped to a 16-month low of 1.244,855 tons, indicating the sale of gold by investors.

April futures price of gold on COMEX today rose to 1584.30 dollars per ounce.

Change % Change Last

Oil 90.64 -0.18 -0.20%

Gold $1,574.80 -0.10 -0.01%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.