- Analytics

- News and Tools

- Market News

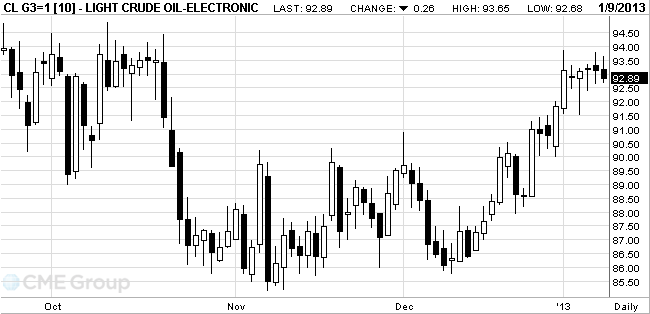

Analytics, News, and Forecasts for CFD Markets: raw news — 09-01-2013.

Oil

declined after a government report showed that

Futures

fell after the Department of Energy said crude stockpiles rose 1.31 million

barrels to 361.3 million last week. A 2 million-barrel gain was the median

estimate of analysts surveyed by Bloomberg. Gasoline and distillate inventories

also rose. Crude output climbed to 7 million barrels a day, the most since

1993. The

Increasing

output in the

Crude

imports rose 18 percent to 8.34 million barrels a day, the first gain in four

weeks. Fuel imports increased 7.8 percent to 2.09 million barrels a day last

week.

Gasoline

inventories climbed 7.41 million barrels to 233.1 million, versus an expected

gain of 2.5 million. Distillate inventories increased 6.78 million barrels to

130.7 million, versus a forecast advance of 1.9 million.

Refineries

operated at 89.1 percent of capacity last week, the report showed, down from

90.4 percent the previous week.

The Energy

Department raised its oil-price projections for 2013 yesterday and forecast

that global consumption will expand to a record. WTI will average $89.54 a

barrel, up 1.3 percent from the December estimate of $88.38, it said in the

monthly Short-Term Energy Outlook. The

Crude oil

for February delivery fell to $92.68 a barrel on the New York Mercantile Exchange.

The contract traded at $93.45 before the release of the inventory report at

10:30 a.m. in

Brent oil

for February settlement slipped 58 cents, or 0.5 percent, to $111.36 a barrel

on the London-based ICE Futures Europe exchange. The North Sea crude traded at

an $18.44 premium to the

Gold prices traded in a narrow range as investors await the outcome of the meetings of central banks of the euro area and Japan.

Last week, gold has fallen in price to a minimum of more than four months below $ 1.630 an ounce, as investors spooked minutes of the last meeting of the Federal Reserve, who showed concern about the side effects of "quantitative easing."

In 2012, gold has risen in price the 12th consecutive year by the central banks of the U.S. stimulus package and Europe. According to analysts, the Bank of Japan in January will consider further easing of policy, and the European Central Bank will not change interest rates at a meeting on Thursday.

Support prices may have increased demand in the physical market of Asia, especially in the largest consumer of gold - China and India. Premiums for delivery to India on Tuesday rose to its highest level in two months, as traders rush to place orders before the expected increase in import duties.

Yesterday, at the beginning of today's session, the price of gold prices rose amid signs that the buyers in China are increasing their investment in the precious metal on the eve of the Lunar New Year.

The amount of physical gold traded on the Shanghai gold market (Shanghai Gold Exchange), the main venue for trading this metal in China, jumped to record high this week. Trading volume on Monday exceeded 19,500 pounds, which is more than three times higher than the average of previous 30 sessions, according to the site SGE.

This was proof that the Chinese buyers took advantage has declined in recent years prices for gold purchases before the holidays. In addition, imports of gold to mainland China from Hong Kong reached a 7-month high in November, said the bank. This data is mostly considered an indicator of changes in demand for gold in the country. November data are the latest available at the moment.

Gold prices were down for the sixth session in a row, falling over this time by 6%. Growth of quotations of futures on Tuesday broke the 3-day price drop.

Buyers in China, tend to increase portfolios before the Lunar New Year, the celebration which will begin on February 10 and will continue for a week, during which markets will be closed.

February futures price of gold on COMEX today rose to 1666.00 dollars an ounce, and then decreased to the level of 1653.70 dollars per ounce.

Change % Change Last

Gold 1,659 +13 +0.77%

Oil 93.16 -0.03 -0.03%00:00Australia HIA New Home Sales, m/mNovember +3.4%+4.7%

00:30Australia Retail sales (MoM)November 0.0%+0.3%-0.1%

00:30Australia Retail Sales Y/YNovember +3.1%

02:00China Trade Balance, blnDecember 19.620.1

02:00China New LoansDecember 523550

09:30United Kingdom Trade in goodsNovember -9.5-9.0

10:00Eurozone GDP (QoQ)(finally)Quarter III -0.1%-0.1%

10:00Eurozone GDP (YoY)(finally)Quarter III -0.6%

11:00Germany Industrial Production s.a. (MoM)November -2.6%+1.1%

11:00Germany Industrial Production (YoY)November -3.7%-2.9%

13:15Canada Housing StartsDecember 196198

15:30U.S. Crude Oil Inventories- -11.1

18:00U.S. USA 10-y Bond Auction-

21:45New Zealand Trade BalanceNovember -718-670© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.