- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 09-01-2014.

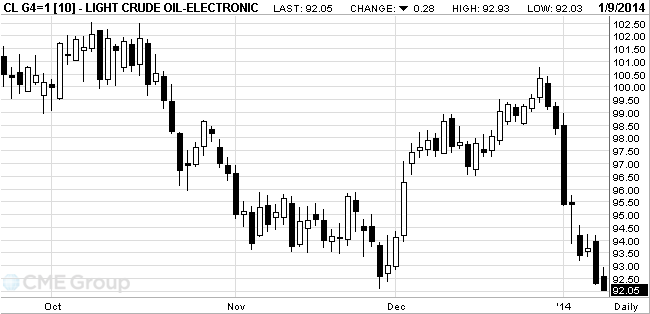

West Texas Intermediate crude tumbled to the lowest level in more than six weeks, erasing an earlier advance of 0.7 percent.

Pressure on

oil futures continue to provide data to the government report , pointed out the

restrained demand for petroleum products .

According

to data released on Wednesday the U.S. Department of Energy , the oil reserves

in the country last week fell by 2.7 million barrels, while they expected a

decline of 600,000 barrels. Reducing oil reserves observed the sixth

consecutive week . However , news about the growth of stocks of petroleum

products have overshadowed reports of the high demand for oil .

According

to the Ministry of Energy , gasoline inventories in the week December 27 -

January 3, increased by 6.2 million barrels, while expected to rise by 2

million barrels. Distillate stocks , which include diesel and heating oil, rose

by 5.8 million barrels, while the projected growth of 1.5 million barrels .

Futures on

crude oil prices continued to decline after the December meeting of the

protocols of the Federal Reserve , according to which most of the leaders of

the central bank supported the folding of bond-buying program . The program

supported oil prices, weakening the dollar, which , in turn, makes oil more

attractive to foreign investors.

WTI for

February delivery slid 32 cents, or 0.3 percent, to $92.01 a barrel at 10:12

a.m. on the New York Mercantile Exchange. Earlier, it touched $91.94, the

lowest intraday price since Nov. 27. The volume of all futures traded was 8.9

percent below the 100-day average. Prices have fallen 5.9 percent since the

start of the year.

Brent for

February settlement increased 1 cent to $107.16 a barrel on the London-based

ICE Futures Europe exchange. The European benchmark crude was at a premium of

$15.15 to WTI, compared with $14.82 at yesterday’s close.

Gold prices consolidated after declining in the previous two sessions . On the eve of gold fell after the publication of minutes of the last meeting of the U.S. Federal Reserve , during which it was decided to start to minimize the program to stimulate the economy .

Many investors in recent years to invest in gold, considering it as a hedge against inflation risks , which could be the result of the Fed's ongoing program to stimulate the economy . However, despite the trillions of dollars poured in by the central bank in the financial system by buying bonds , U.S. inflation remained muted .

According to analysts, now , when the Fed begins to reduce the monthly purchase of assets, inflation risks seem more restrained , which reduces the attractiveness of gold in the eyes of investors. In 2013, gold futures fell 28% , while investors expect the Fed will eventually announce the beginning of collapse of asset purchases , which happened in December and passed on rapidly rising stock markets .

Decline in gold prices was observed after eve was better than expected report on the U.S. labor market . These data have raised expectations about what the Fed will continue its program of folding to stimulate the economy this year.

According to published data ADP, the number of jobs in the private sector in the U.S. in December rose more sharply than economists expected. In addition, data released on Tuesday , reporting the more serious than expected , reducing the trade deficit the U.S. in November .

Today we have published data on the number of initial applications for unemployment benefits , which also came out better than expected. Gold traders closely monitor data on the U.S. labor market in search of signals about how far can the Fed in its rolling program to stimulate the economy .

Cost February gold futures on the COMEX today rose to $ 1230.90 per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.