- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 11-05-2015.

(raw materials / closing price /% change)

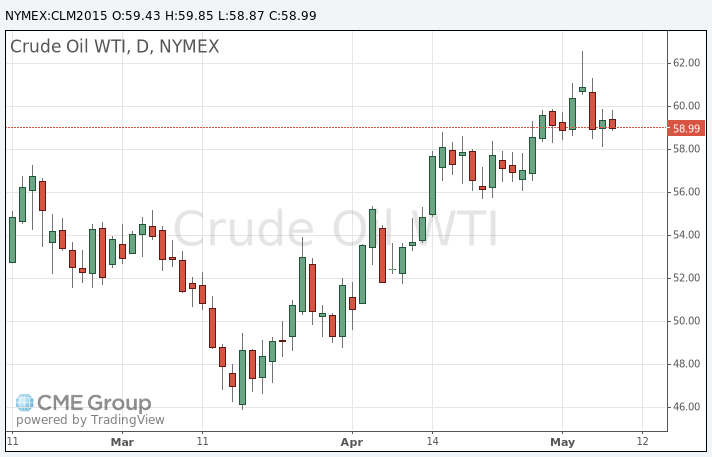

Oil 59.25 -0.24%

Gold 1,183.00 0.50%

Oil prices traded lower on concerns about the global glut of oil. Investors are focusing on the release of the number of oil rigs in the U.S. The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 11 rigs to 668 last week, the lowest weekly level since September 2010.

Combined oil and gas rigs fell by 11 to 894, the lowest level since June 2009.

Investors are also cautious that U.S. oil producers could increase its oil production due to higher oil prices.

The Wall Street Journal reported today that the Organization of the Petroleum Exporting Countries (OPEC) forecasts that oil prices will be about $76 a barrel in 2025. OPEC doesn't see oil prices trading at $100 a barrel in the next decade, according to its latest strategy report, seen by The Wall Street Journal.

The Wall Street Journal also said that the report recommends that OPEC reintroduce the production quota system it abandoned in 2011.

WTI crude oil for June delivery fell to $58.87 a barrel on the New York Mercantile Exchange. Brent crude oil for June declined to $64.83 a barrel on ICE Futures Europe.

Gold price traded lower despite further stimulus measures from China. The People's Bank of China (PBOC) cut its one-year lending rate by 25 basis points to 5.1% on Sunday. It lowered the benchmark deposit rate by 25 basis points to 2.25%. It was third interest rate cut in six months.

China's central bank noted that the country's economy is still facing "relatively big downward pressure".

"At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average," the central bank added.

The Greek debt crisis remains in focus. The Eurogroup meeting is scheduled to be today. It is unlikely that the €7.2 billion tranche of loans will be unlocked at this meeting because there are still differences despite the progress of negotiations.

German Finance Minister Wolfgang Schaeuble said on Monday that a referendum on the Greek bailout in Greece may be helpful. "If the Greek government thinks it should have a referendum, then it should organize a referendum," he noted.

Schaeuble ruled out any deal between Greece and its creditors at today's Eurogroup meeting as "there is not sufficient progress".

Greece must repay the IMF €750 million loan on May 12. Athens said that it has enough money to pay the IMF this week.

June futures for gold on the COMEX today fell to 1183.10 dollars per ounce.

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 11 rigs to 668 last week, the lowest weekly level since September 2010.

Combined oil and gas rigs fell by 11 to 894, the lowest level since June 2009.

The People's Bank of China (PBOC) cut its one-year lending rate by 25 basis points to 5.1% on Sunday. It lowered the benchmark deposit rate by 25 basis points to 2.25%. It was third interest rate cut in six months.

China's central bank noted that the country's economy is still facing "relatively big downward pressure".

"At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average," the central bank added.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.