- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 11-08-2015.

(raw materials / closing price /% change)

Oil 43.25 +0.39%

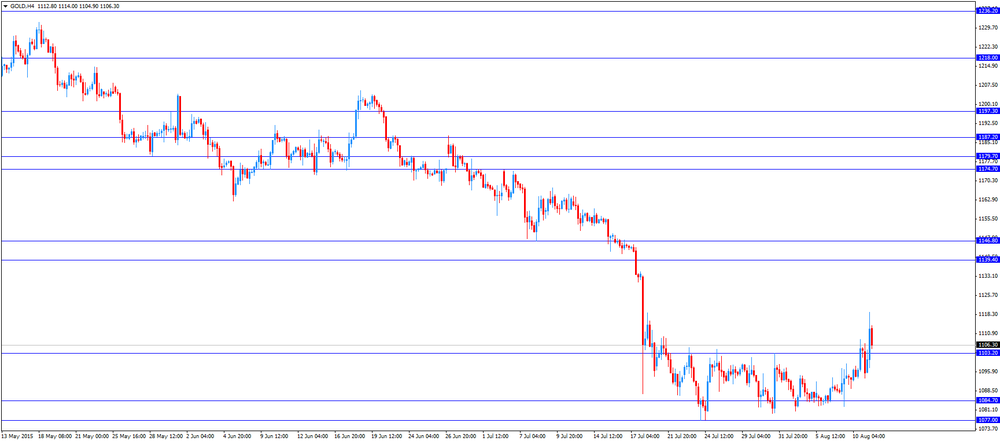

Gold 1,108.10 +0.04%

Oil prices dropped on the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Market participants are concerned that the oil demand from China could be weak.

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Tuesday. OPEC upgraded its forecast of 2015 oil supplies from non-member countries y 90,000 barrels per day.

"U.S. onshore production from unconventional sources is currently expected to decline marginally in the second half of 2015 through year-end, while U.S. offshore production is expected to grow due to project start-ups," OPEC noted.

OPEC also upgraded its forecast of 2015 world oil demand growth by 90,000 barrels per day, while the demand for OPEC crude oil remained unchanged at 29.23 million barrels per day.

OPEC oil production was 31.5 million barrels per day in July, the highest level since May 2012.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for September delivery declined to $43.19 a barrel on the New York Mercantile Exchange.

Brent crude oil for September fell to $48.75 a barrel on ICE Futures Europe.

Gold traded higher on the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Gold price was also supported be a deal on a third Greek bailout programme. The Greek government said on Tuesday that it reached a deal on the third bailout programme with its international lenders.

The European Commission has confirmed that a deal on a third Greek bailout programme has been reached.

"We have achieved an agreement in principle on a technical basis and talks are still ongoing on details… What we don't have at the moment is a political agreement and that's what we need," the European Commission spokeswoman Annika Breidthardt said on Tuesday.

She also said that deputy finance ministers from the 28 EU countries will hold a telephone conference today.

October futures for gold on the COMEX today rose to 1106.60 dollars per ounce.

The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Two OPEC officials said that there is no plans for an emergency meeting to discuss the decline in oil prices before a next scheduled meeting on December 04. OPEC kept its oil output unchanged at its last meeting held in June.

OPEC countries are discussing developments in the market.

"Consultations are ongoing to take a decision," Algerian Energy Minister Salah Khebri said.

West Texas Intermediate futures for September delivery declined to $44.61 (-0.78%), while Brent crude slid to $50.19 (-0.46%) retreating from yesterday's highs. Luckily for oil prices Xinhua agency reported on Monday that China (second-biggest consumer of oil after the U.S.) imported 30.71 million tonnes of crude in July, up 29% compared to last year. This information was based on data by general administration of customs.

Nevertheless this morning oil prices dropped after the Peolple's Bank of China devalued the yuan by nearly 2% in order to support the economy after a sequence of disappointing economic reports.

Gold is currently at $1,100.80 (-0.30%). On Monday the precious metal advanced significantly as comments from Federal Reserve officials questioned the likeliness of a rate hike in September. Federal Reserve Vice Chairman Stanley Fischer said on Monday that the labor market improved and got close to full employment. At the same time he noted that inflation remained weak. Both employment and inflation are closely watched by policymakers and progress in these spheres will determine the data-dependant rate increase.

This morning bullion slid as the People's Bank of China decided to devalue the yuan. Top consumer China accounts for nearly a third of global demand for the precious metal. A weaker yuan will make gold more expensive for Chinese importers.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.