- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 12-11-2012.

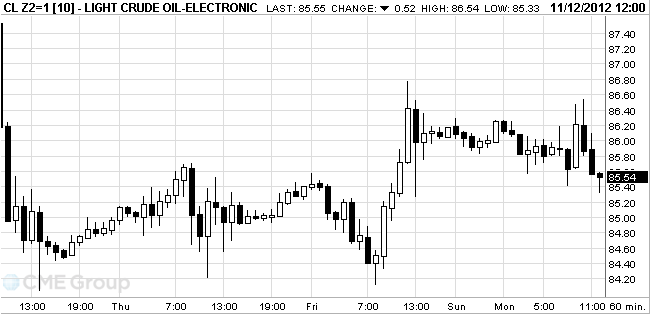

Oil fluctuated in New York as rising Chinese crude imports countered concern that an economic contraction in Japan will reduce fuel consumption.

Futures traded in a $1.05-a-barrel range after China’s net crude purchases rose to the highest level in five months in October. Price retreated after Japan said its economy shrank last quarter as overseas sales and consumer spending slumped.

China’s net crude imports rose to 5.52 million barrels a day in October, also the highest level since May, the General Administration of Customs said Nov. 10 in Beijing. Industrial production was up 9.6 percent in October from a year earlier, the National Bureau of Statistics said Nov. 9.

Japan’s gross domestic product fell an annualized 3.5 percent in the three months through September, after a revised 0.3 percent gain the previous quarter, the Cabinet Office said in Tokyo. A drop of 3.4 percent was the median estimate of economists.

The U.S., China and Japan are the world’s biggest oil- consuming countries, accounting for a combined 37 percent of world demand, according to BP’s Statistical Review of World Energy. The 27 members of the EU were responsible for 16 percent of global oil use in 2011, BP said.

Crude oil for December delivery traded in a range of $85,42 – $86,54 a barrel on the New York Mercantile Exchange. Prices are down 13 percent this year.

Brent oil for December settlement climbed 48 cents, or 0.4 percent, to $109.88 a barrel on the London-based ICE Futures Europe exchange.

Gold continues to go after the most successful week in late August because of concerns that the U.S. recession may begin, if Congress does not agree on reducing the budget deficit.

Precious metal rising in price while the dollar is under pressure from fears about threatening the U.S. financial crisis. If the White House and Congress agree, at the beginning of next year, will come into force automatically spending cuts and tax increases, estimated at $ 600 billion, which could push the U.S. economy into recession.

Euro holds above a two-month low against the dollar as Greece's ruling coalition won enough votes in parliament to approve the budget for 2013.

Today, the euro zone finance ministers meet in Brussels to discuss Greece's selection of a new portion of loans. According to German Finance Minister Wolfgang Schaeuble, the "troika" of international creditors are unlikely to present a full report on Monday on Greece.

On the physical market, jewelers reduced purchases, speculators and investors are waiting for the new price increase. Importers in India also stopped buying, because due to the weakening rupee, local prices increased to a maximum of seven weeks. The festive season, with rising demand for gold will culminate this week during festivals Dhanteras and Diwali, but the wedding season will last until December.

December futures price of gold on COMEX today rose to 1738.30 dollars per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.