- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 16-04-2013.

Brent crude

dropped below $100 a barrel for the first time since July on signs global

economic growth will slow, curbing fuel use. West Texas Intermediate oil

slipped to a four-month low on speculation

Brent futures touched $98 a barrel as the International Monetary Fund cut its global growth forecast and urged European policy makers to take action to bolster growth.

The global

economy will expand 3.3 percent this year, less than the 3.5 percent forecast

in January, after 3.2 percent growth in 2012, the Washington-based IMF said

today, cutting its 2013 prediction a fourth consecutive time. The IMF sees the

euro area shrinking 0.3 percent, compared with a 0.2 percent drop estimated in

January, with

The

Futures

tumbled yesterday after data showed

A

government report tomorrow will probably show that

Brent oil for June settlement fell $1.09, or 1.1 percent, to $99.54 on the London-based ICE Futures Europe exchange.

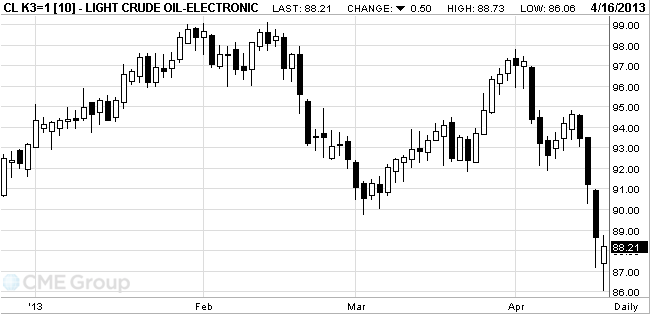

WTI crude for May delivery slipped 27 cents, or 0.3 percent, to $88.44 a barrel on the New York Mercantile Exchange. Prices fell as much as $2.65 to $86.06 earlier.

After yesterday's aggressive sell-gold began to return loss and went into positive territory for the first time in two days. Despite the fact that until full payment of yesterday's losses still far away, at auction in the U.S. spot gold prices fluctuate at a level of $ 1,387. Now the prices are still faced with obstacles and resistance testing $ 1,400 is unlikely to significantly strengthen the metal or the stability of prices will, at least in the short term.

Investor sentiment is supported by statistical data and the U.S.. Industrial production in March, adjusted for seasonal variations increased by 0.4% compared with February. Capacity utilization rose to 78.5% from 78.3%. The cold snap in the U.S. has led to a sharp increase in production in the communal area in March, which contributed to the increase in industrial production as a whole, despite the decline in the manufacturing industry. The data were better than expected. Economists had expected industrial production to grow by 0.3% and capacity utilization was 78.4%.

Construction of homes rose last month to the highest level since the pre-crisis times, that was a sign that the housing market recovery will continue to support economic growth. The total number of housing starts in March rose by 7.0% and adjusted for seasonal variation was 1.04 million homes. The reason for this increase was a jump in construction of multi-family homes, which is a volatile component of the industry. Construction of houses for at least five families increased by about 27%, and construction of single-family homes fell by 4.8% compared to the previous month. General index was the strongest since June 2008.

The cost of the June gold futures on COMEX today rose to 1404.02 dollars per ounce.

Change % Change Last

GOLD 1,361.10 -140.30 -9.3%

OIL 88.71 -2.58 -2.8%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.