- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 17-06-2016.

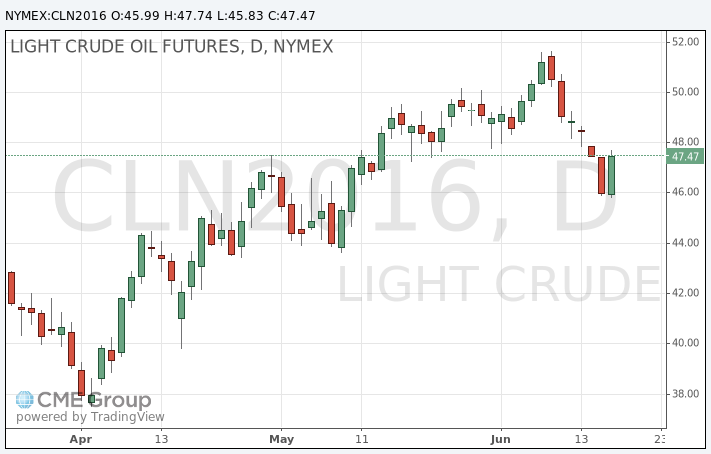

Oil prices rose on Friday for the first time in a week as the dollar fell and investors in global markets cautiously bought some riskier assets as anxiety eased about Britain's possible exit from the European Union.

Crude futures were still on track for a weekly loss after daily declines Monday through Thursday.

Brent crude futures' front-month contract were up $1.28, or 2.7 percent, at $48.47 a barrel .

The front-month in U.S. crude's West Texas Intermediate (WTI) futures rose $1.18, or 2.5 percent, to $47.39.

For the week, Brent was down 4 percent and WTI about 3 percent.

Investors will be on the lookout for a weekly reading on the U.S. oil rig count due from oil services firm Baker Hughes at 1700 GMT.

Last week, the rig count rose for a second week in a row, the first time since August, as oil drilling activity increased with crude trading over $50 a barrel.

On Thursday, Brent and WTI lost about 4 percent each as investors fretted that the global economy could be thrown into turmoil if the UK votes next week to ditch its EU membership.

On Friday, Britain mourned the death of UK member of parliament Jo Cox, a day after the vocal advocate for Britain remaining in the union was murdered. Her death threw next week's referendum on EU membership into limbo.

The dollar fell about a quarter percent, retreating from its 2-week high on Thursday that had weighed on demand for greenback-denominated oil from the holders of the euro and other currencies.

Some analysts cautioned that with UK's future EU still unknown until a vote next Thursday, oil could come under pressure again.

"It's mainly Brexit at the moment, at least until next Thursday, before people start to look at the more fundamental oil/commodity drivers again," ABN Amro's senior energy economist Hans van Cleef said.

Julian Jessop, chief economist and head of commodities research at Capital Economics, told Reuters Global Oil Forum that a Brexit situation could lead to a sharp oil selloff sending Brent to as low as $40.

In industry news, global oil majors Chevron and Royal Dutch Shell were putting up small refineries for auction as they looked to trim lower-margin assets amid rising crude prices.

Gold prices rose, as a softer dollar encouraged demand for the precious metal.

Gold rallied to its highest level since August 2014 at $1,315.61 an ounce on Thursday, as the U.S. Federal Reserve held interest rates and rising expectations that the U.K. could exit the European Union bolstered demand ahead of the referendum on June 23.

Gains tapered off, however, after the referendum campaign was paused later on Thursday following the killing of 41-year-old Labour Party lawmaker and Remain campaigner, Jo Cox, in northern England.

"Gold experienced an aggressive selloff during trading on Thursday with prices cutting below $1,285 following the suspension of the Brexit campaign which offered a foundation for bearish investors to pounce," said Lukman Otunuga, a research analyst at FXTM brokerage.

"It seems that gold prices have been dictated by Brexit expectations and with the suspension of the Brexit campaign bolstering speculation of a 'Bremain' victory, gold prices plummeted," he said.

The greenback softened Friday, which made dollar-denominated gold cheaper to buy for those holding other currencies. The Dollar Index, which tracks the dollar against a basket of 16 currencies, was recently down 0.23% at 86.22.

Looking ahead, prices may dip slightly as safe-haven demand stalls.

"A $108 rally in gold prices over 10 days may mean a lot of safe-haven buying has already happened and with the likely outcome of the Brexit vote far from clear, longs may well be tempted to take profits," said William Adams, head of research at Fastmarkets.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.