- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 17-08-2015.

(raw materials / closing price /% change)

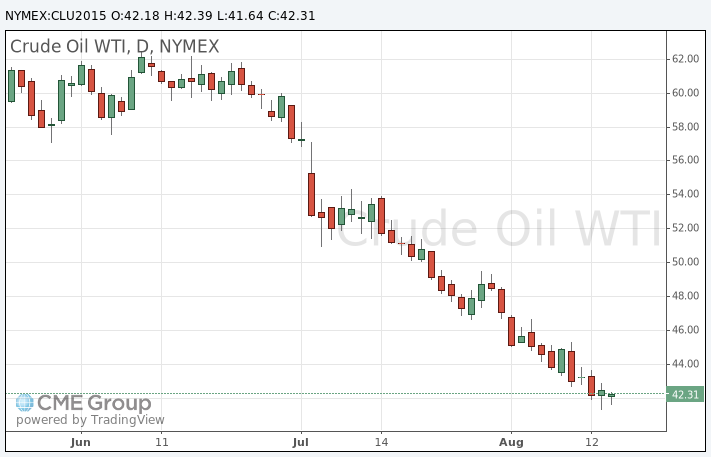

Oil 41.88 +0.02%

Gold 1,116.90 -0.13%

Oil prices stabilised after declining earlier. Oil prices dropped on the weak GDP data from Japan and on concerns over the global oil glut. Japan's GDP declined by 0.4% in the second quarter, beating expectations for a 0.5% fall, after a 1.1% rise in the first quarter.

Business spending fell 0.1% in the second quarter, while private consumption dropped 0.8%.

Exports dropped at an annual rate of 16.5% in the second quarter.

On a yearly basis, Japan's economy shrank 1.6% in the second quarter, beating forecasts of 1.9% decline, after a 3.9% rise in the first quarter.

Concerns over the global oil glut grew as the number of U.S. active oil rigs rose last week. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 2 rigs to 672 last week. It was the fourth consecutive increase.

Combined oil and gas rigs remained unchanged at 884.

WTI crude oil for September delivery was trading in the range between $41.64 - 42.57 a barrel on the New York Mercantile Exchange.

Brent crude oil for September decreased to $49.15 a barrel on ICE Futures Europe.

Gold rose after the weaker-than-expected U.S. economic data. The NY Fed Empire State manufacturing index plunged to -14.92 in August from 3.86 in July, missing expectations for an increase to 5.0. It was the lowest level since April 2009.

News that China increased its gold reserve in July also supported gold price. China's gold reserve climbed 1.16% to 1,677.3 tonnes in July from 1,658 tonnes in June, according to data from the People's Bank of China (PBoC).

The channels were domestic scrap gold, production storage and trade in domestic and overseas markets.

October futures for gold on the COMEX today increased to 1121.80 dollars per ounce.

China's gold reserve climbed 1.16% to 1,677.3 tonnes in July from 1,658 tonnes in June, according to data from the People's Bank of China (PBoC).

The channels were domestic scrap gold, production storage and trade in domestic and overseas markets.

China has the fifth largest gold reserve worldwide, according to the World Gold Council.

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Sunday. Japan's GDP declined by 0.4% in the second quarter, beating expectations for a 0.5% fall, after a 1.1% rise in the first quarter. The first quarter figure was revised up from a 1.0% increase.

Business spending fell 0.1% in the second quarter, while private consumption dropped 0.8%.

Exports dropped at an annual rate of 16.5% in the second quarter.

On a yearly basis, Japan's economy shrank 1.6% in the second quarter, beating forecasts of 1.9% decline, after a 3.9% rise in the first quarter.

The International Monetary Fund (IMF) said on Friday that it expects the Chinese economy to expand 6.8% this year and 6.3% in 2016.

"China is transitioning to a new normal, with slower yet safer and more sustainable growth," the IMF noted.

China's economy grew 7.4% last year.

The IMF pointed out that China should prepare for slower growth in the medium term.

The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 2 rigs to 672 last week. It was the fourth consecutive increase.

Combined oil and gas rigs remained unchanged at 884.

West Texas Intermediate futures for September delivery dropped to $41.97 (-1.25%), while Brent crude fell to $48.60 (-1.20%) after the latest data had shown the number of drilling rigs in the U.S. increased last week.

In addition to oversupply issues the devaluation of the yuan by China's central bank led to the weakening of other emerging market currencies thus making imports of oil more expensive for corresponding economies.

Citigroup Inc lowered its crude oil price outlook citing such negative factors as robust supply from OPEC and doubtful demand growth in Asia as China's economic growth slows and Japan GDP contracts.

Gold climbed to $1,117.70 (+0.45%) as contraction of Japanese economy renewed demand for safe haven even after the yuan stopped falling. Last week the metal climbed 1.9% amid China's surprise yuan devaluation.

Nevertheless Fed interest rates remain key fundamentals for bullion. Minutes of the Fed's July 28-29 meeting due on Wednesday should shed some light on the bank's plan to raise rates for the first time in nearly a decade. Recent data on employment and retail sales argue for a rate hike in September.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.