- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 20-09-2012.

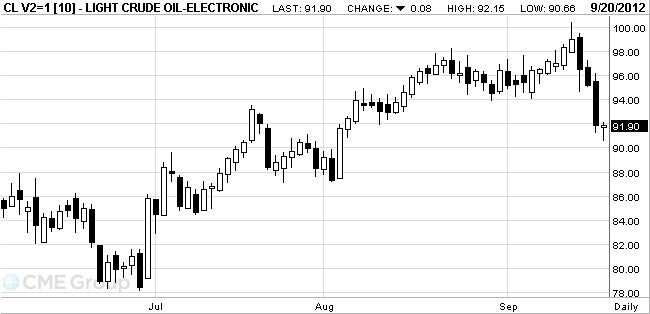

Oil traded near a six-week low after U.S. stockpiles climbed the most since March, Chinese manufacturing shrank and Japanese exports fell, signaling fuel demand may be slowing among the world’s biggest crude users.

Futures were little changed after declining as much as 1.4 percent. U.S. oil inventories surged 8.5 million barrels last week as Gulf of Mexico production resumed after Hurricane Isaac, Energy Department data showed yesterday. China’s manufacturing may contract an 11th month, according to a purchasing managers index by HSBC Holdings Plc and Markit Economics. Japan’s overseas sales fell a third month in August, the Finance Ministry said.

Oil for October delivery slid as much as $1.32 to $90.66 a barrel in electronic trading on the New York Mercantile Exchange, the lowest since Aug. 6.

Brent oil for November settlement rose 51 cents to $108.72 a barrel on the London-based ICE Futures Europe exchange. The front-month European benchmark grade’s premium to the corresponding West Texas Intermediate contract was at $16.68 a barrel. It narrowed to as little as $15.58, the lowest on an intraday basis since July 26.

Gold prices decline with the maximum reached on the eve of 6.5 months, as a stronger dollar and a decline in the stock markets and oil prompted investors to take profits.

The dollar rose after the release of a number of weak production reports in Europe and China, which are renewed concerns about global growth.

According to HSBC, a preliminary purchasing managers' index (PMI) for the manufacturing of China in September rose slightly by 0.2 points to 47.8, and this sector was the eleventh consecutive month of decline. This is a sign that the second-largest economy in the world slows down.

Meanwhile, the euro fell to its lowest level in a week after the release of weaker-than-expected manufacturing data in the eurozone. The preliminary purchasing managers' index (PMI) for the manufacturing eurozone in September rose by 0.9 points to 46.0. However, the index remained below the key level 50, separating the increased activity of its decline.

The number of initial claims for unemployment benefits in the U.S. in the week 9-15 September fell to 382,000 against 385,000 the previous week, and the data for the week September 2-8 were revised upward. However, this figure was lower than the forecast of economists.

Stocks of gold-ETFs on Wednesday declined to 607.000 ounces to a record high.

October futures price of gold on the COMEX is now 1763.4 dollars per ounce.

Change % Change Last

Gold 1,773 +2 +0.10%

Oil 91.70 -3.59 -3.77%© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.