- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 21-01-2013.

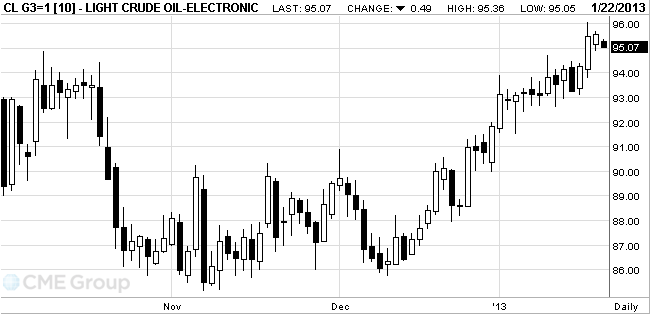

Oil dropped

from the highest level in four months in

West Texas

Intermediate futures slid as much as 0.5 percent, declining for the first time

in four days. House Republicans will use the planned Jan. 23 vote on a

debt-ceiling increase to try to force Senate Democrats to outline their

spending plans. Finance ministers in

Finance

ministers are debating whether the 500 billion euro ($666 billion) European

Stability Mechanism should take over earlier bank bailouts that were routed

through governments, and what to do with so-called legacy assets. A European

Union aide who briefed reporters defined those as loans already on a bank’s

balance sheet that could later cause difficulties.

WTI crude

for February delivery, which expires tomorrow, fell as much as 51 cents to

$95.05 a barrel in electronic trading on the New York Mercantile Exchange. The

more active March contract was down 46 cents at $95.58. Front-month futures

rose 7 cents on Jan. 18 to the highest close since Sept. 17.

With floor

trading closed today for the Martin Luther King Jr. holiday, the average volume

of all WTI contracts was 80 percent below the 100-day average.

Brent for March settlement on the London-based ICE Futures Europe exchange dropped as much as 48 cents, or 0.4 percent, to $111.41 a barrel.

The price of gold is kept in the range of the previous session in anticipation of further easing by the Bank of Japan.

Analysts suggest that the Bank of Japan on Tuesday announced the acquisition of the assets indefinitely as long as inflation does not reach 2 percent. In the past, gold has risen in price for 12 years in a row by the easing of many central banks.

In the past few years, Japan has sold more gold than to buy, but aggressive monetary policy can revive interest in buying precious metal, analysts said.

Demand in the physical market Asia is growing since the beginning of the year on the eve of the New Year according to the lunar calendar in China, which is struggling to India for leadership in the use of gold. Consumption growth will continue until February 10, to this day this year Chinese New Year falls.

On Monday, Citi analysts forecast lowered the price of gold this year, but at the same time raised forecasts for prices for platinum group metals. The bank now expects the average price of gold at the end 2013 at 1675 dollars per ounce, which is 4% lower than the previous forecast. The outlook for platinum price was increased by 1.5% to $ 1,700, and the outlook for palladium - by 4.2% to $ 775 per ounce.

February futures price of gold on COMEX today trading under 1684.80 - 1691.10 dollars per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.